Най-добрите Робо-съветници в България

Robo-advisors are the latest craze in the online investing space. Simply put, the phenomenon, powered by artificial intelligence, allows you to invest in a somewhat passive way. This guide to the best Robo-advisors in Bulgaria will tell you everything you need to know. In addition to

discussing the best Robo-advisors available to investors from Bulgaria, we will also explain how the process works and what you need to do to get started.

List of the best Robo-advisors in Bulgaria for 2026

Here is a snapshot of our top Robo-Advisor platforms in Bulgaria that we believe excel in this particular investment space. You can scroll down to read our full review of each broker!

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

[stocks_table id=”15″]

Overview of the best Robo-advisors in Bulgaria

Finding the best Robo-Advisor in Bulgaria for your financial goals is not an easy task. This is because you need to consider two key metrics. First, you need to look at the Robo-Advisor’s trading platform itself. For example, how much does the broker charge for buying and selling assets and what instruments can you invest in?

Secondly – and perhaps most importantly – you should spend some time researching the Robo-Advisor technology itself. After all, the Robo-Advisor will be investing on your behalf, so you should feel confident that it won’t wipe out your entire balance in a week of trading.

To save you countless hours of research, below we will look at the best Robo-Advisors currently on the market in Bulgaria.

1 – eToro – The best all-round Robo-Advisor in Bulgaria

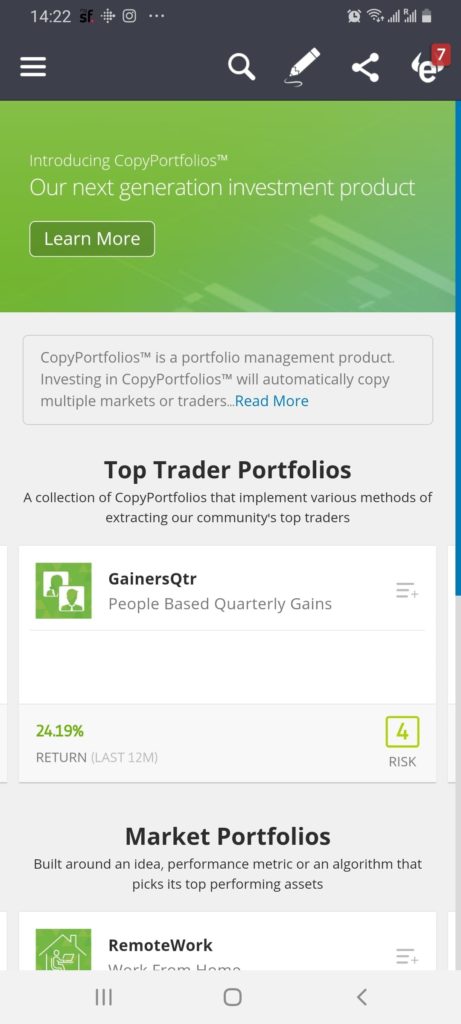

eToro is not your typical robo-advisor, as it is primarily an online broker, but it does offer robo-advisory services. This comes in the form of professionally managed CopyPortfolios. They are designed to help investors minimize risk, promote growth opportunities, and create diversified portfolios.

eToro is not your typical robo-advisor, as it is primarily an online broker, but it does offer robo-advisory services. This comes in the form of professionally managed CopyPortfolios. They are designed to help investors minimize risk, promote growth opportunities, and create diversified portfolios.

CopyPortfolios are a more advanced form of eToro’s popular copy tool, which essentially allows users to copy the portfolios of any of the over 12 million investors and traders on the eToro platform.

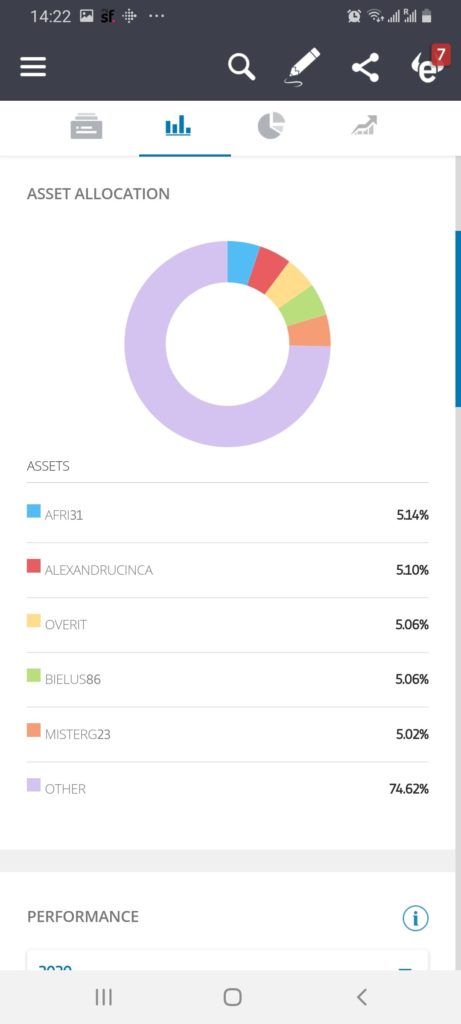

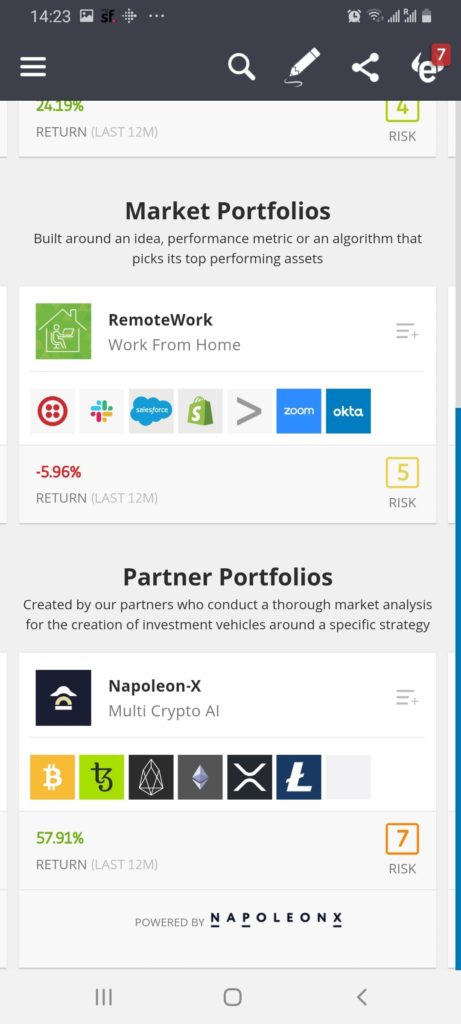

eToro CopyPortfolios are professionally managed investment portfolios that use AI (artificial intelligence) and machine learning technology. There are two types of portfolios you can invest in: Top Trader Portfolios and Market Portfolios.

Top Trader Portfolios feature the best performing and most resilient traders on eToro, while Market Portfolios combine CFDs on stocks, ETFs or commodities under a chosen market investment strategy. There are various thematic portfolio options, such as technology investing and green investing.

You need to invest at least $5,000 in CopyPortfolio, but it’s the perfect combination of expert human and AI management and provides access to many of the best stocks and other financial instruments. Plus, the fact that there are no management fees is a huge plus and makes it a cost-effective platform.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. Learn 2 Trade – Automated Robo-Advisor providing forex signals

The algorithm uses a combination of artificial intelligence (AI) and machine learning with a number of different technical trading indicators. Once the algorithm identifies an investment opportunity, it sends the signal directly to its membership base so you can receive it in real time.

Ultimately, it’s up to you whether you want to take advantage of the investment opportunity or not, but it offers an interesting take on robo-advice. Learn 2 Trade has a free package where you get 3 signals per week with entry levels, stop loss and take profit levels.

You can then choose to upgrade your service to receive 3 – 5 alerts per day! All premium plans also come with a 30-day money-back guarantee!

Advantages:

Disadvantages:

Няма гаранция, че ще спечелите с този провайдър.

3. AvaSocial – FCA-regulated social and copy trading app

The AvaSocial Trading app is another unique approach to a robo-advisor. With the app, you can see the performance of other traders’ portfolios and then copy the exact same trades and investments into your own portfolio. This allows you to choose the best style, execution, and risk profile for yourself.

Your portfolio is held with AvaTrade, a broker regulated in six different jurisdictions around the world. The AvaSocial app is actually a partnership between AvaTrade and FCA-regulated company Pelican Trading.

In the app, you can also copy the investments of different traders across different markets. This includes stocks, indices, commodities, Forex and more, which can be traded 100% commission-free with AvaTrade.

Advantages:

Disadvantages:

Вашия капитал е в риск.

4. Libertex MT4 Signals – Automated MT4 Copy Trading Signals

This provides a more passive way to invest. The platform provides detailed statistics on the trader’s performance with various risk management indicators. What is really great is the fact that you can first start copying trades with a demo account to see the effectiveness before copying the trades to your real account.

Some signal brokers charge for their services, while others provide them for free. Libertex itself does not charge any spreads, but does have a small commission on buying and selling. There is currently a 50% discount on cryptocurrencies if you copy a crypto trader.

Advantages:

Disadvantages:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

What is a Robo-Advisor?

Now that we have discussed the best robo-advisors in Bulgaria that are currently offering their services – we need to explain how the investment process actually works. In short, robo-advisors allow you to invest in a passive manner. This is because the underlying technology, which is usually backed by artificial intelligence, will determine what assets to invest in. In addition to this, the robo-advisor will balance your portfolio for you.

This means that it will determine which stocks to buy and sell – and when. Crucially, the majority of robo-advisors in Bulgaria use a risk-based approach to investing. That is, when you first open an account, you will be asked a series of questions about your financial goals and risk appetite. This way, the robo-advisor technology will build a portfolio based on your answers.

In terms of what you will invest in, most robo-advisors in Bulgaria stick to ETFs and index funds. This means that each individual fund will contain dozens, hundreds, or in some cases, thousands of assets. This could include stocks, bonds, government securities, or cash.

The specific weighting of your portfolio – along with the markets and economies it targets – will depend on your risk profile. Either way, once you invest in your chosen robo-advisor in Bulgaria, you won’t have to lift a finger. This makes the process ideal if you want to invest but have no experience – or simply don’t have the time to research the markets yourself.

Advantages of Robo-Advisor

Still not sure if robo-advisors are the right investment vehicle for you? If so, below we will discuss some of the main advantages of choosing a robo-advisor platform in Bulgaria.

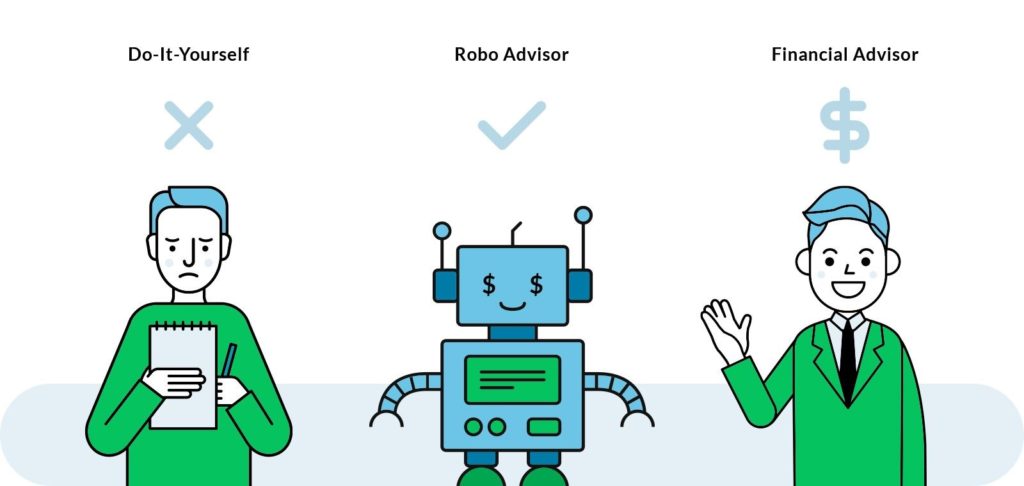

Perfect for beginners

Most investors in Bulgaria will choose a DIY (“Do It Yourself”) trading account. This simply means that you will be required to choose which stocks to invest in – and when. While this adds a “thrill” to the investment process, it means that you are 100% responsible for the assets you buy and sell.

It is crucial that knowing which companies or bonds to invest in is a challenging process that requires years of prior experience. This includes requiring an understanding of fundamental research – such as the ability to interpret a company’s earnings reports.

All things considered, robo-advisors are a great option if you want to invest in the financial markets but are a complete beginner. This is because the robo-advisor will make all the investment decisions for you.

100% Passive

Once you invest money in a robo-advisor, you can sit back and let the technology do its thing. As noted above, this is because the robo-advisor makes all the investment decisions on your behalf.

Thus, the process is 100% passive. This reduces the need to do any research and ultimately – reduces the need to keep up with the financial markets. Instead, the underlying algorithm will buy and sell assets based on market conditions. In addition to this, we should note that by using a robo-advisor, you don’t have to worry about the emotional side of trading.

That is, the robo-advisor does not make reckless investment decisions and does not suffer from fatigue! This means that it can analyze the markets around the clock, without risk.

Investing based on your risk appetite

The core concept of robo-advisor platforms in Bulgaria is to invest in markets that reflect your risk appetite. This is crucial as each portfolio will have its own risk/reward ratio.

For example, if your risk tolerance is super low, then your money will likely be invested in high-quality bonds and stocks – along with government securities and cash.

At the other end of the spectrum, a higher-risk portfolio will likely give you exposure to emerging markets and small-cap stocks. Ultimately, the level of risk you take is your decision.

Liquid investment

In most cases, the best robo-advisors in Bulgaria will give you immediate access to your money. That is, as soon as you want to withdraw money, there is rarely a lock-up period. This can be beneficial if you need access to money quickly.

Disadvantages of Robo-Advisors

While there are many advantages to investing in robo-advisors, there are also a few disadvantages to consider.

Limited flexibility

One of the main disadvantages of using investment robo-advisors in Bulgaria is that you are given limited flexibility. This is because the robo-advisor will determine which assets to invest in on your behalf.

So, you won’t be able to add individual stocks or bonds to your portfolio. This can be problematic if you’ve taken a liking to a particular investment. If that’s the case, you’ll need to set up an account with a stock trading platform that allows you to invest on a DIY basis.

More expensive than the means

On the one hand, when you invest with a robo-advisor, it’s almost certain that your portfolio will be loaded with ETFs and index funds. It’s worth noting that the costs of accessing these funds are higher when you invest through a robo-advisor. In fact, you’ll often pay on the order of 0.75% above the corresponding fee charged by the ETF broker.

If, for example, you were to invest in an ETF on eToro, you would not pay any transaction fees at all. On the other hand, it is important to remember that robo-advisors in Bulgaria will rebalance your portfolio automatically. This is not a privilege you will receive when investing in an ETF or index fund yourself.

There is no guarantee that you will make money.

As with any investment instrument, there is no guarantee that you will make money by investing in a robo-advisor in Bulgaria. On the contrary, there is every chance that you will get back less than you initially invested.

Specifically, you will be entrusting your money to an algorithm that will make investment decisions for you. Even if the algorithm has a proven track record, past performance is never a 100% indicator of future results.

Robo-Advisor Fee Comparison

Before signing up with a robo-advisor in Bulgaria, it is imperative that you have a clear understanding of what fees you will pay. Before we review our comparison table, let’s briefly explain the main fees you will face when investing in a robo-advisor in Bulgaria.

- Platform fee: This is the fee charged by your chosen robo-advisor for access to its platform. This is almost always expressed as an annual percentage fee and is charged on the amount you invest. For example, if you are going to invest 1,000 Bulgarian leva and the robo-advisor charges 0.70%, you will pay 7 leva per year.

- Fund Fee: This is the fee that the ETF or index fund broker charges. This is then passed on to you, the investor, if any. The specific fee can vary wildly when sent to the fund, though it rarely exceeds 0.5% per year.

As always, fees can change all the time – so always check for yourself before opening an account.

How to choose the best Robo-Advisor for you in Bulgaria

Although we have already found the best robo-advisors in Bulgaria available on the market, this does not mean that the brokers we have selected are right for you . So there may come a time when you need to do some independent research before choosing a platform to sign up with.

With this in mind, below we have listed a number of important metrics to consider before signing up.

Regulation

Your first stop should be to check whether your chosen platform meets the necessary regulatory requirements to offer robo-advisor services in Bulgaria. At a minimum, this should include a full license with a well-known regulator such as the Financial Services Commission, CySEC, ASIC, FINRA, etc.

Minimum investment

It goes without saying that you should make sure that the minimum investment amount falls within your personal budget. As we found in our list of the best robo-advisors, they can vary quite a bit.

Taxis

Fees are also an important component to evaluate before choosing a robo-advisor in Bulgaria. As we discussed above, this is usually broken down into platform fees and fund fees. Some brokers will combine the two fees into one percentage.

In general, you’ll likely find that the best robo-advisors charge a fee in the region of 0.75% per year. While most brokers don’t charge anything for deposits or withdrawals, it’s best to check just in case.

User experience

If you’ve turned to robo-advisors because you want to invest in the financial markets but have little or no experience, then you’ll want to make sure the platform is beginner-friendly.

In other words, you will want the process of signing up, depositing funds, and choosing a portfolio to be seamless. All of the robo-advisors in Bulgaria listed on this page offer a comprehensive, easy-to-use service.

Accessible markets

Of course, you also need to consider where the robo-advisor should put your money. As we’ve discussed throughout the guide, the standard procedure is to invest purely in funds.

That said, while some platforms give you access to thousands of markets, some are much more limited. For example, with eToro you can invest in the stock market, ETFs, or commodities.

Past performance

As we also say, past performance is no guarantee of future results. However, past performance is still an important metric to consider before making an investment. This is especially true when choosing a robo-advisor platform and the right portfolio for your risk tolerance. In an ideal world, you would want to choose a robo-advisor that has a consistent track record of making profits for at least three years.

In summary, robo-advisors are great if you want to grow your money over time but don’t quite understand how the financial markets work. They are also great if you want to invest on a passive basis. Either way, there are a lot of robo-advisors in Bulgaria active in the space – so competition is getting fierce among brokers. With that said, we would argue that eToro is an established market leader in the robo-advisor arena in Bulgaria. With over 12 million clients – the platform offers a great combination of low fees and diverse markets. Just click the link below to get started!

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)Summary

eToro – The best Robo-Advisor in Bulgaria with no management fees

Frequently Asked Questions

Do robo-advisor algorithms offer wealth management and financial advice?

How much does a robo-advisor investment service cost in Bulgaria?

Who is the best robo-advisor in Bulgaria?

Are robo-advisors regulated in Bulgaria?