Най-добрите мобилни трейдинг приложения (Trading App) за 2026– Приложения за търговия

The best online brokers offer their own trading app. They are usually compatible with both iOS and Android devices. The best trading apps allow you to buy and sell financial instruments with a single click. However, it is important to do your homework before choosing a trading app that suits your needs.

To help you get started in the right direction, this review looks at the best trading apps worth considering in 2026.

Start trading with the eToro app in 4 easy steps

Getting started with the eToro app is easy. Follow these 4 easy steps and start trading today!

Want to download the best trading app right now? If so, below you will find the top trading platform apps that we think you should pay attention to. You can learn more about each provider by scrolling down!

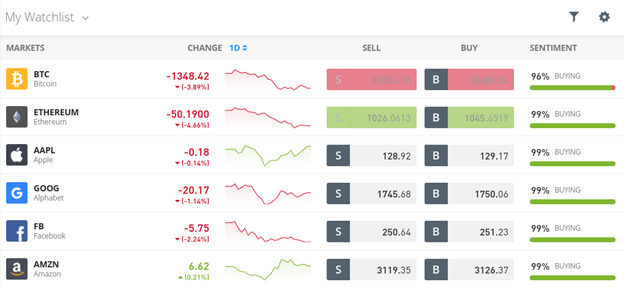

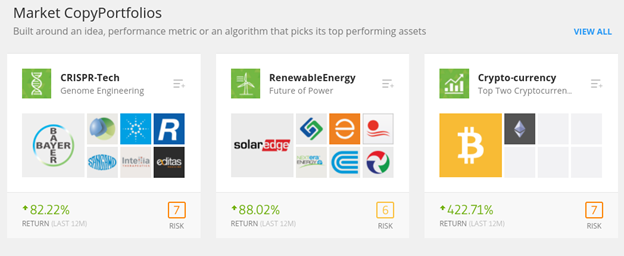

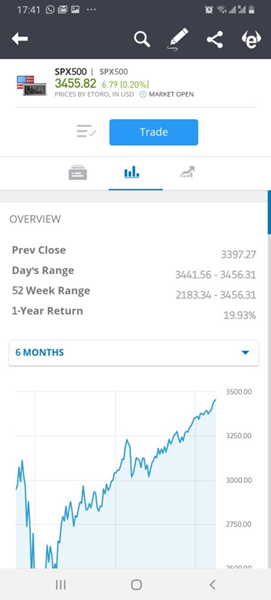

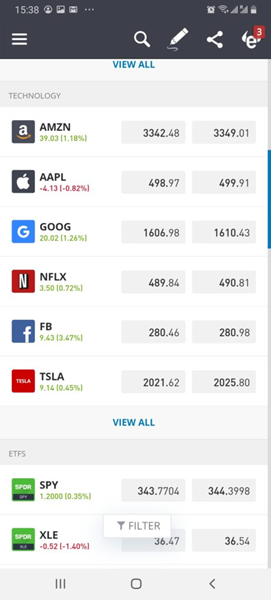

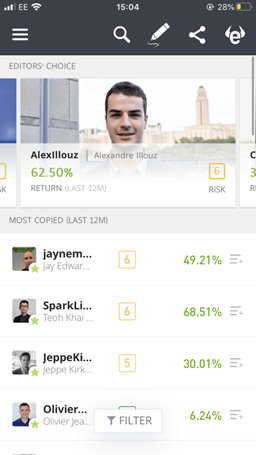

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) There are currently hundreds of trading apps in the world of mobile investing. This is great because you are sure to find a trading app provider that will help you achieve your investment goals. However, in the search for the best trading app, it is important to focus on certain metrics, such as tradable markets, commissions, how easy the app is to use, and regulations. We’ve done the hard work for you by reviewing the best trading apps on the market right now! You don’t owe anything to open a brokerage account; there are no ongoing fees to use the platform. Once you’ve completed the 10-minute registration process, you’ll gain access to thousands of tradable markets. There you will find 2,400 stocks from over 17 international markets, 250+ publicly traded funds, 16 cryptocurrencies and tons of CFDs. These include everything from gold, silver and oil to natural gas, wheat and honey. You can also trade forex, as the investment app supports over 55+ currency pairs. In terms of core features, the eToro trading app allows you to invest socially passively. For example, with the Copy Trading tool, you can choose from thousands of verified investors and then copy their current positions. The trading app also allows you to invest in diversified portfolios that are managed by the eToro team. We like this social trading platform app provider for another reason – it offers a fully-featured demo account that comes pre-loaded with $100,000 worth of virtual money. Unlike many trading apps you can find on Google Play or Apple Stores, eToro is heavily regulated, including by the FCA, ASIC, and CySEC. The provider of this app is also registered with the US FINRA. If you want to opt for the eToro trading app, you need to make a minimum deposit of just $200. You can add money to your account directly from the app using supported payment methods, including debit/credit card and e-wallets like PayPal. eToro Fees

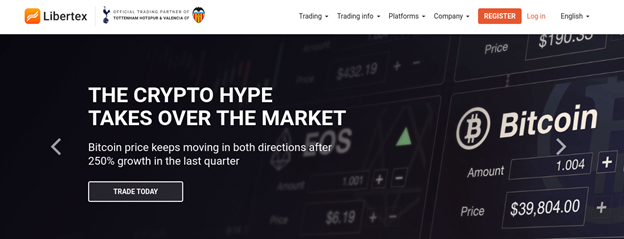

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) < However, this does come with some benefits when you use the Libertex trading app. For example, Libertex allows you to buy and sell financial instruments without paying any spreads. The commissions are super low, with the main assets costing less than 0.1% per slide. Libertex also offers leverage of up to 1:600 for professional clients and lower if you are an individual trader. In terms of instruments you can trade, this leading trading app supports everything from forex, cryptocurrencies and commodities to stocks and indices. If you are looking for more sophisticated sessions, Libertex is also compatible with MT4. Simply download the MT4 trading platform app and log in with your Libertex login details. Getting started with Libertex is very easy, as opening an account only takes a few minutes. You can then use the Libertex demo functionality or deposit a minimum of $100 if you want to trade with real money. Supported payment methods are debit/credit card, bank transfer and e-wallets. Libertex has a great reputation. The online trading platform has been operating since 1997. It is authorized and regulated by CySEC. Libertex fees

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик. The Avatrade app is designed for traders looking for a smooth and seamless experience. You can browse the various tools and menus via the home dashboard. There are also various management tools and other useful functionalities. One of them helps you follow social trends to see how the markets are developing in real time. Another feature is AvaProtect. It allows you to get your money back if you lose trades up to $1 million. It allows you to protect a specific session against losses for a given period of time. The platform offers 24/7 customer service in several different languages, so you're sure to get help if you need it. There are also a variety of payment methods, including debit and credit cards, bank transfers, and e-wallets. Avatrade Fees

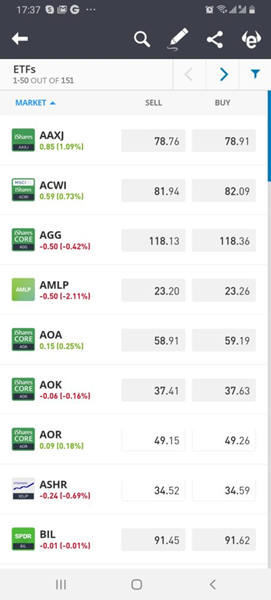

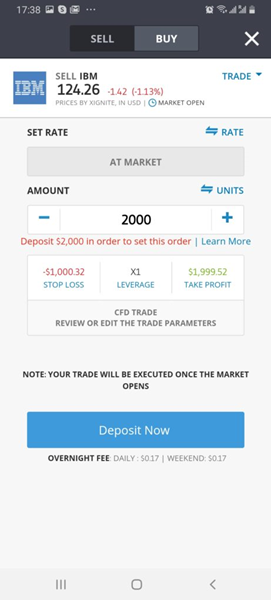

Вашия капитал е в риск. We've looked at 10 of the best trading apps for 2026 and beyond. Since they're all different, each one is suitable for a specific type of investor. For example, some apps are great for long-term investments, while others are better suited for short-term CFD trading. With this in mind, below we discuss some of the most important metrics that need to be considered in your search for the best trading app. Therefore, below we will discuss some of the most important metrics that should be considered while looking for the best trading app. Whichever trading app you choose, you should make sure it is authorized and regulated by a reputable financial authority. This regulator does not necessarily have to be based in the country you are in, as many of the trading apps listed on this page have a global presence. By choosing a regulated trading app, you can rest assured that your funds are safe. You can also be sure that the provider of the app in question offers transparent fees and fair market conditions for all clients. There are often big differences between the types of assets you can trade or invest in when choosing an app provider. First, you need to decide whether you want to invest in traditional assets like stocks and mutual funds, or whether you are a day trader. If you are a day trader, you will probably prefer to use a CFD trading platform . This will allow you to trade assets over your phone without having to own them. Not only will this result in low trading fees and spreads, but you will also have access to thousands of assets, including forex, metals, bonds, interest rates, stocks, indices and more. On the other hand, if you want to create a long-term investment plan, check if your chosen trading app offers traditional asset ownership. This means that when you invest in stocks, publicly traded funds, and mutual funds, you will be entitled to your share of the dividends paid. The same is true for bonds, although with these you will receive fixed coupon payments. The eToro trading app actually covers both long-term and short-term strategies. This is because it covers thousands of traditional stocks and publicly traded funds, as well as CFD instruments. Once you've figured out whether your chosen trading app supports your preferred financial markets and strategies, it's time to see what fees you'll pay. Again, the type and amount of fees you owe varies greatly between applications, so we've decided to provide a breakdown of the main fees below. Trading fees are associated with long-term traditional assets, such as stocks, publicly traded funds, and mutual funds. Typically, the best trading apps charge a flat trading fee - for example, $10 per session. This means that no matter how many shares you buy, you always pay $10. You owe $10 again when you decide to sell your shares. While the flat fee sounds tempting at first glance, it's not the case if you trade frequently or want to invest small amounts. For example, if you bought a stock for $40 with a $10 trading fee, that means you're paying a 25% commission just to get into the market. If you use a CFD trading app, you will likely be charged a variable commission. This means that you will be charged based on the size of the bet you place. The best trading apps listed on this page, such as eToro, do not charge any commission when buying and selling CFD instruments. Regardless of whether your chosen trading app charges a commission, if you trade CFD markets you should always consider the overnight rollover fee. As the name suggests, this fee is charged by the trading app for each night you keep your position open. The reason for this is that CFDs are leveraged financial products - this means that you are required to stake a small percentage of the value of the asset. In turn, this means that you are effectively borrowing the remaining capital from the trading app provider, which is why daily interest is charged. Spreads are charged by all trading apps except Libertex. The spread is the difference between the buy and sell price of an asset and is how trading app providers make a profit. The bigger the difference between the two prices, the more you are indirectly paying. The best trading app providers listed on this page offer very competitive spreads - especially in highly liquid markets. However, it can be difficult to know what spreads you are actually paying if the app does not provide this information. If it is missing, you should calculate the spread yourself to ensure you are not paying too much to access your chosen market. With many trading apps currently offering zero commissions and competitive spreads, providers are looking to differentiate themselves from the rest by offering features that offer a better experience. Some of the best functionalities are: If you plan to trade over the phone but don't have access to large capital, it might be worth considering an app that offers leveraged trading. As we briefly discussed above, leverage allows you to trade with more money than you have in your account. Most leading trading apps that offer access to CFD markets also offer leverage. The specific amount you can receive varies depending on the app provider, your location, and the relevant asset class. But to give you an idea: Some of the best trading apps on the market also offer margin trading for stock investments. This is similar to leverage, but without CFDs or forex trading. Most individual investors wouldn't invest $3,000 in buying a single share of Amazon. The good news is that you don't have to anymore - the best trading apps support fractional ownership.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) This means you can invest smaller amounts and own a fraction of a stock. eToro allows fractional ownership from just $25 for cryptocurrencies and $50 for stocks. The best trading app providers offer automated trading tools. eToro, for example, allows you to copy another trader one-to-one. For example, you might decide to copy a successful stock trader with an impeccable reputation and experience on the platform. If the trader risks 10% of their balance on Square stocks, you will do the same. Ultimately, this way you can invest and trade without doing anything. eToro's Copy Trading tool is also ideal for traders who have no experience or knowledge in researching financial instruments. Best of all, this tool does not come with any additional fees, so you can invest without any commission. Trading app providers realize that many investors are inexperienced in the field, which is why the best apps are packed with educational tools. Some of them are: If you already have some knowledge of how the world of trading works, you'll probably want access to research and analysis tools as well. The best trading app providers listed on this page offer everything from technical indicators and charting tools to real-time financial news and data. The user experience offered by different trading apps can vary greatly. It is important that the app is easy to use and that your investment goals and desires are not limited by the smaller screen. This is especially true if you are looking for short-term trading opportunities rather than long-term investments. By this we mean buying and selling assets as a day trader or swing trader. However, you will need to be able to enter and exit the market with the click of a button - so it is important to choose an application that is fast and easy to use. Similarly, if you are a short-term trader, you will be doing technical analysis and researching price trends, so a good user experience is extremely important.

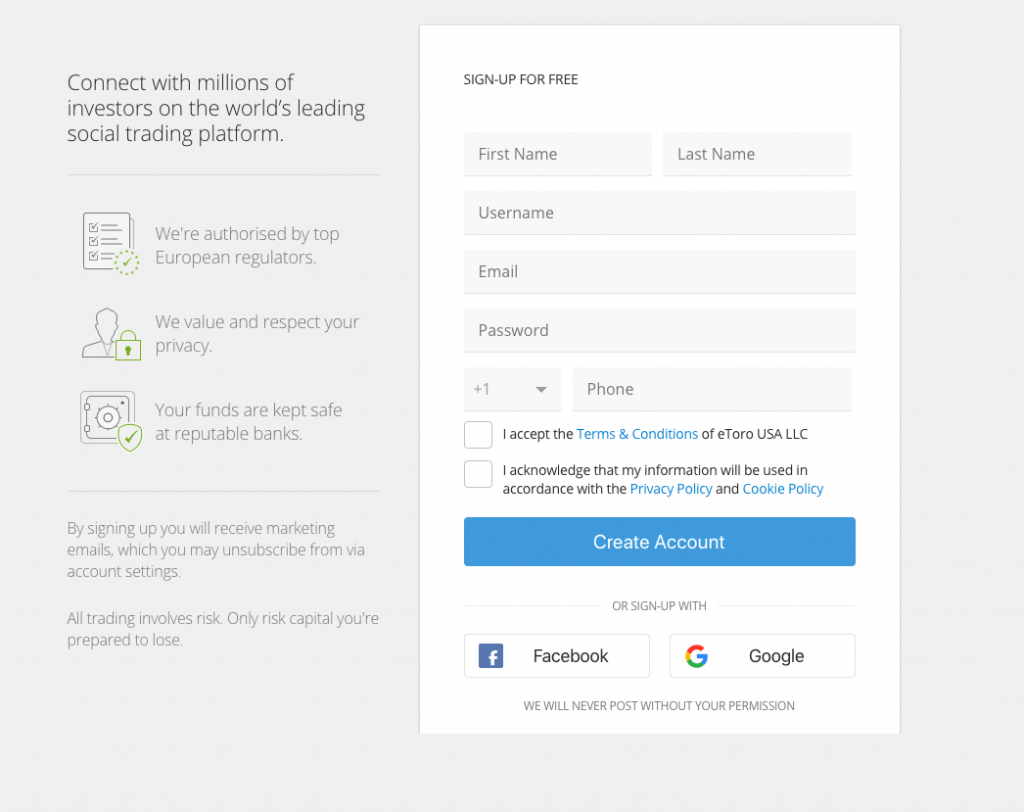

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) Even if you just want to add a few stocks or mutual funds to your portfolio, a trading app should provide a seamless process. For example, the app should have clean and accurate search functionality, and placing an order should be easy and simple. Once you have gone through the account opening process on your chosen trading app, you will need to make a deposit. The best trading app providers allow you to do this instantly and most importantly, through the app itself. For example, eToro's trading app allows you to deposit funds instantly via debit/credit card, PayPal, Neteller, Skrill, etc. Some other app providers, such as International Brokers, only support traditional bank transfers. This means you will need to log into your online or mobile banking account and manually transfer the amount. If there comes a time when you need help with your account, you should be able to easily reach a member of the customer service team. The best trading app providers offer their own live chat functionality, meaning you can speak to a staff member in real time. You should check what the team's opening hours are. Most trading app providers offer customer service Monday through Friday during standard market hours. eToro offers customer service 5 days a week, 24 hours a day. If you're planning to use a trading app for the first time, we'll show you how to get started. Even if you want to start with a demo account on eToro, you need to open an account. The process only takes a few minutes and requires you to simply enter a few personal details.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) After you go to the eToro website and click on the "Join Now" button, you will need to enter the following information: Once you have registered with eToro, the platform will redirect you to the official app download page depending on the operating system you are using. To be clear, the app is available for both iOS and Android. After you download and install the eToro trading app, open it. You can log in to your eToro account through the app. You will need to use the username and password you created when you registered. Once you're logged into the app, you can trade for free with the eToro demo account. If you want to invest or trade with real money, you can deposit funds directly from the app. The methods for instant depositing funds are: The minimum deposit for US citizens is $50, and for all other nationalities - $200. Once you have made a deposit with one of the selected payment methods listed above, you can start trading instantly. To find the asset you're looking for, use the search engine at the top of the app screen. Or, you can browse the asset library by clicking on the relevant financial instrument - such as crypto or publicly traded funds. All that's left to do is place an order. Simply click the "Trade" button next to the asset and enter your stake in USD. To place your order, click the "Open Trade" button.

BEST TRADING APPS FOR 2026

OVERVIEW OF THE BEST ONLINE TRADING APPS TRADING APP

1. eToro – Best Trading App for 2026 overall

Fee

Size

Stock trading fee

1$

Forex trading fees

Spread, 2.1 pips for GBP/USD

Crypto trading fees

spread, 0.75% for Bitcoin

Inactivity fee

$10 per month after 1 year

Withdrawal fee

$5

Pros :

Cons :

2. Libertex – CFD Trading App with low costs and ZERO spreads

Fee

Size

Stock trading fee

Commission: 0.034% for Amazon.

Forex trading fees

Commission: 0.008% for GBP/USD.

Crypto trading fees

Commission: 1.23% for Bitcoin.

Inactivity fee

$5 per month after 180 days

Withdrawal fee

Free

Pros:

Cons :

3. Avatrade – Best Forex Trading App according to the Global Forex Awards

Avatrade has an app called AvatradeGo. Here you can choose and trade over 1000 instruments including leading forex pairs, stocks, cryptocurrencies, commodities and many other instruments.

Fee

Size

Stock trading fee

From5%

Forex trading fees

Spread 0.9 pips for EUR/USD

Crypto trading fees

From 0.25% above market

Inactivity fee

$50 per quarter after 3 months of inactivity + $100 after 1 year of inactivity

Withdrawal fee

Free

Pros :

Cons :

HOW TO CHOOSE THE BEST TRADING APP FOR YOU

Regulation

Assets

Taxis

Trading fees

Commissions

Next day rollover fees

Spreads

Trading tools and functionalities

Leverage and margin trading

Partial shares

Copy trading

Education, research and analysis

User experience

Payment methods

Customer service

HOW TO START TRADING WITH THE BEST FREE TRADING APP

Step 1: Visit the eToro website and open an account

Step 2: Download the eToro trading app

Step 3: Login

Step 4: Deposit funds

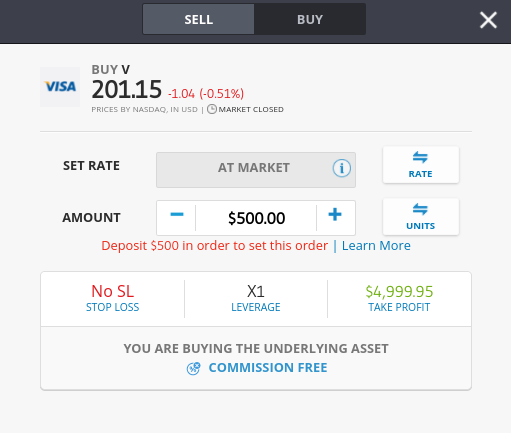

Step 5: Invest or trade

In summary, choosing a top trading app can be a challenge as there are many factors to consider. For example, the app should not only have a great reputation and offer competitive fees, but also support your chosen financial market. And of course, you should pay attention to the features and tools offered, as well as whether the trading app provides a good user experience. Taking all these important factors into account, we found that the best mobile trading app provider for 2026 is eToro. This regulated broker’s app lets you invest in traditional assets and trade CFDs. The app is easy to use and takes just 10 minutes to get started. We also like the Copy Trading features, which allow you to trade actively in a completely passive way.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)BEST TRADING APPS FOR 2026 – CONCLUSION

eTORO – BEST TRADING APP

FREQUENTLY ASKED QUESTIONS:

What is the best trading app for beginners?

Are there any free trading apps?

What are the best mobile trading apps for stocks?

Are the best trading apps safe?

How much do the best brokerage apps charge?