Инвестиране в акции през 2026: Наръчник за закупуване на акции в България

Thinking about investing in stocks in 2026? If you’re looking for a way to make your first stock investment, you’ve come to the right place.

In this beginner’s guide, we’ll give you all the tips you need to understand how to trade stocks in Bulgaria. We’ll discuss how to choose an authorized and regulated stock broker, what fees you can expect, how to place your first stock purchase order, and give you tips on how to choose the right stocks.

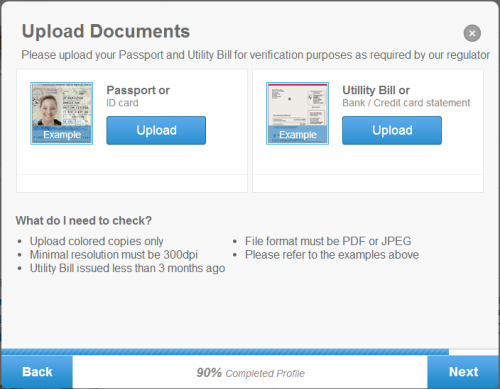

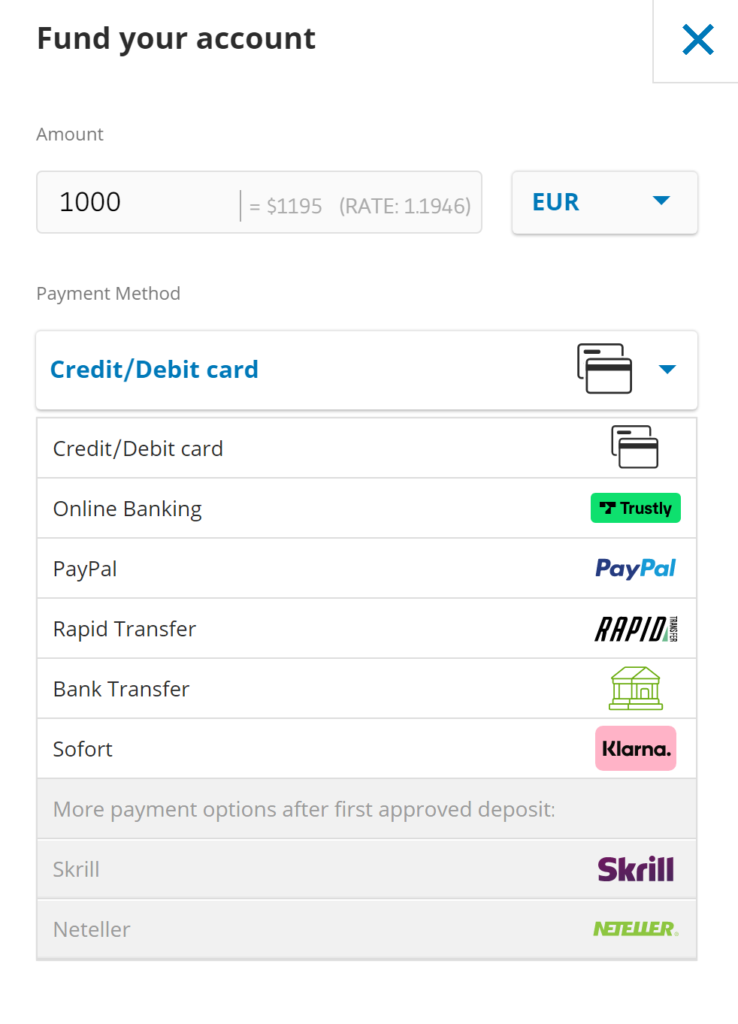

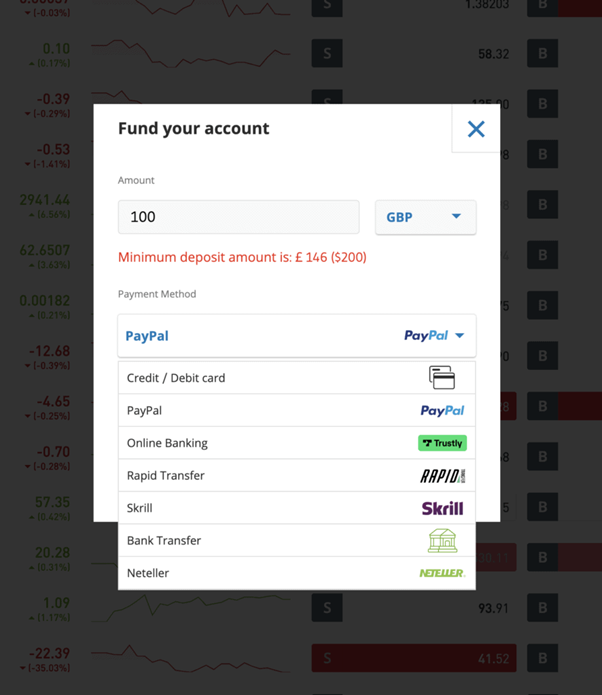

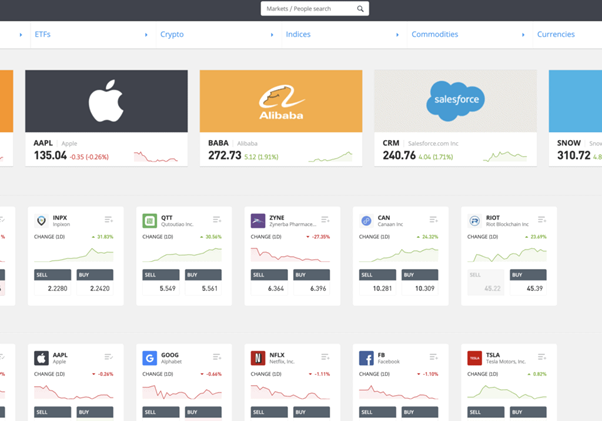

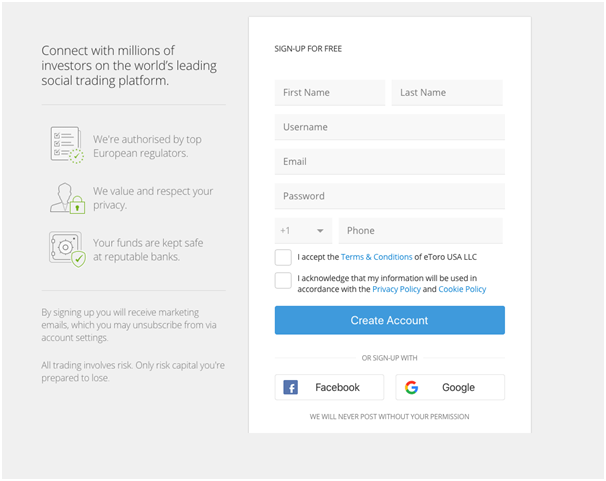

Before you start your stock investing journey, you need to choose a top stock broker . To help you out, we’ve put together a list of the best brokers in Bulgaria, along with a full breakdown of their fees and features. You can even enter the amount you plan to invest and the number of sessions you plan to have to find out how much each broker will cost you. [stocks_table id=”15″] This guide will show you how to buy shares and is based on our recommended regulated stock broker eToro , although the process is similar for most brokers. You can register using the form below once you have read all the information on this page. To create an account, eToro will ask you to enter certain personal details, such as your: You will also need to choose a username and a strong password. With eToro you can make a deposit of up to $2000 without having to attach a photo of your ID or passport, but if you want to deposit a larger amount, you will need to verify your account, as eToro is regulated by the UK Financial Conduct Authority. You just need to upload a copy of your passport/ID card/driving license and proof of address. As proof of address, you can use a recent bank statement or utility bill. As soon as you upload the documents, eToro will be able to validate them within minutes. eToro requires a minimum deposit of $200. Supported payment methods are debit/credit card, bank transfer, and e-wallets such as PayPal, Neteller, and Skrill . As we briefly noted earlier, all deposits with eToro are converted into US dollars, which incurs a 0.5% fee. This gives you instant access to over ten international financial markets. Once your eToro account is funded, you can buy your first share. In our example, we are buying shares of BP. To do this, type “BP” in the search box at the top of the screen, then click “TRADE.” If you haven’t decided which stocks you want to buy yet, click the “TRADE MARKETS” button and browse eToro’s stock library. Before we can buy shares in our chosen company, we need to create a “buy order”. As you can see from the screenshot below, the market price of BP is currently 305.60p – and it changes almost every second. However, we need to enter the amount we want to invest in US dollars. In our example, we are buying BP shares for $500. Note – we are buying the underlying asset, unlike cases where we choose leverage and trade the shares as a contract for difference. To complete the investment process, we simply need to click on “OPEN TRADE”. In a few seconds, our order will be executed – meaning that we have just bought BP shares. And that’s it – you now know how to invest in Bulgarian stocks in a few easy steps!

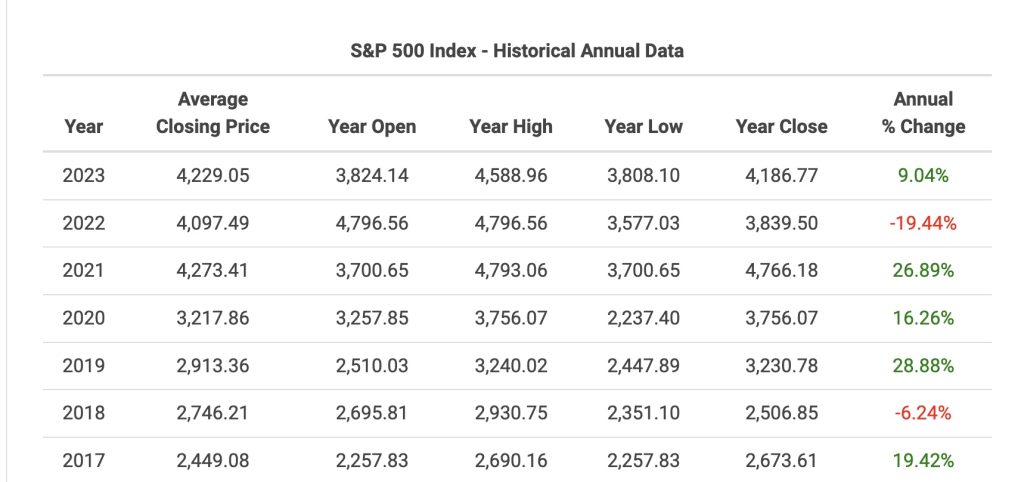

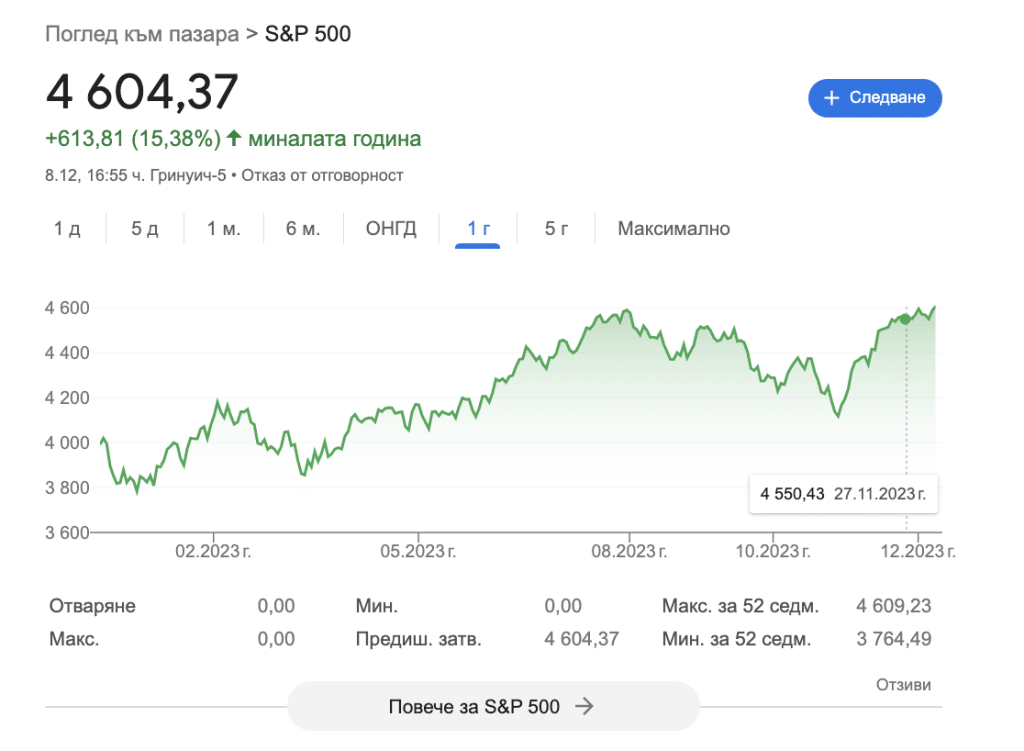

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) A stock is a security that gives you the right to own a “share” of a particular company. If the company has 1,000 shares outstanding and you own 300, then you have a 30% stake in the company and its dividends. Depending on the type of share, you may be entitled to a dividend, and some shares give voting rights at the general meeting or the right to a liquidation share. Stocks vary in type, so it’s important to know what type of stock you’re buying when you buy it. These are the main types, and Investopedia also describes other types of stocks , which you will hardly need at the beginning of your journey as an investor. The value of stocks is determined by market forces. If there are more buyers than sellers, the price of the stock will rise. When this happens, the value of your investment will also increase. If there are more sellers than buyers, the effect is exactly the opposite – the value of your shares will fall. As a shareholder in the company, you will be entitled to certain benefits. Chief among these advantages is the right to dividends and the ability to vote at the annual general meetings of the companies you hold shares in. You can sell your shares at any time during standard market hours. The amount you will receive in cash will be based on the number of shares you hold, relative to the company’s current share price. We recommend that you refer to our stock terminology page while purchasing your first share. If you want to start trading stocks, it is perfectly normal to wonder how much to invest from the start. Unfortunately, we cannot provide you with a specific answer, but the information in the following lines can be used as a good guide: Once you’ve answered the question of how much to start your “investment adventure” with, it’s time to know how to choose which assets to invest in. That’s why you need to know how to position yourself correctly. Most investors invest in successful companies with the goal of selling the company’s shares at a higher price. Broadly speaking, there are two strategies: In this way, capital gains are generated. If you are a fan of long-term investments and want to benefit from annual returns, then investing in dividend stocks is a very good option. За целта ще трябва да направите подробно проучване на акциите, които изплащат най-големи дивиденти, или пък направо да “стреляте” към S&P 500, чиято доходност може да гравитира между различни стойности, но в дългосрочен план винаги е добра идея. Трейдърите могат да спекулират с цената на акциите, като по този начин могат да печелят от движението на цената, без значение от посоката. При пазарни спекулации можете да използвате ливъридж, който ви дава шанс да отворите по-голяма позиция, както и да продавате акции, без да ги притежавате посредством договор за разлика (CFD). Пример 1 : Отваряте дълга позиция за $500 в акции на Microsoft, като очаквате да се повишат. Акциите се повишават и затваряте позицията си на $600. Генерирате печалба от $100. Пример 2: Забелязвате трус в корпоративните структура на Netflix. Решавате, че цената ще падне и затова отваряте къса позиция за $500. Цената пада и вие печелите $100, когато купувате “обратно” акциите на по-ниска цена. Има много стратегии за инвестиране в акции в България и по света. Хубаво обаче е да слушаме и опитните инвеститори като легендата Уорън Бъфет, който казва че “Рискът идва от липсата на знание за това, което правиш“. Основните инвестиционни стратегии са три – дългосрочна, средносрочна и краткосрочна, като всяка от тях има своите плюсове и минуси. Стратегиите е най-добре да ги изготвите индивидуално. Не ви съветваме да слушате “експерти”, които ви обясняват кое работи най-добре. Фундаментите на дългосрочната инвестиция в акции включват избор на активи с потенциал за растеж или стабилност през годините, като акции на големи компании и фондове като S&P 500, FTSE100 и други. Средносрочната инвестиция в акции е нелоша опция за начинаещи инвеститори, тъй като предлага баланс между потенциал за растеж и управляем риск. Този вид инвестиция обикновено обхваща период от няколко месеца до няколко години и е подходящ за тези, които търсят по-голяма възвращаемост от краткосрочните инвестиции, но не са готови за рисковете на дългосрочните ангажименти. Основната идея за търговията с акции на краткосрочна основа е да се възползваме от временни ценови колебания, като се реагира бързо на пазарни новини или анализи. Една от причините да инвестираме в акции краткосрочно е потенциалът за бърза печалба, особено във волатилни или бързо променящи се пазари. Като цяло обаче не ви съветваме да се впускате в бързите сделки, поне не в началото. Когато търгувате с финансови инструменти, е важно да знаете основните разлики между реалните акции и договорите за разлика (така наречените CFD-та). И двете имат своите предимства и недостатъци, като вашата стратегия е определяща за това в какво да инвестирате. Investing in stocks is considered lower risk because it gives you the chance to own a share of a company. In addition, real stocks pay dividends that can compound over the years. Most index investors (S&P 500, NASDAQ, FTSE 100, etc.) are known to hold their positions for over 10 years. If you like to think about the future and focus on long-term strategies, then investing in real stocks is a better choice. However, in this case, you should know that you will not be able to take advantage of many useful features of stock brokers – such as leverage and opening short positions. CFD trading is very popular among scalpers and people who have extensive knowledge of stock trading. When we imagine “The Wolf of Wall Street”, we should imagine the life of such an investor. Those who invest in CFDs do not actually own the assets and cannot receive dividends. However, they can trade stocks with leverage (eToro, for example, is one of the best CFD brokers and offers leverage of up to 5X the actual position). CFD trading also opens up opportunities for so-called “short positions” – or situations in which traders are certain that a company will collapse. You already know how to trade stocks, but do you have a reliable broker that suits your investment preferences? There are many online brokers and they all differ in terms of the assets traded, the fees and the functionalities they offer, so you should take some time to research the different platforms before signing up. Among the most important factors to consider are: The first and most important factor you should check before joining any broker is whether it is regulated by the UK Financial Conduct Authority (FCA) or another regulator such as the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), etc. This will ensure that your stock investments are safe and someone is “looking after” you. For example : There are high risks associated with fraud in the world of finance and stock investing. That’s why you should never sign up for a stock trading platform unless it is licensed by a regulator. Once you have assessed the broker’s regulatory status, you should also look at the payment methods they accept that are convenient for you. In most cases, stock trading platforms available in Bulgaria accept debit/credit cards and bank transfers. Bank transfers are best suited for larger deposits of over £10,000. Depending on the broker, the bank transfer to your account can take from 3 to 5 business days, but if you make an express transfer, this period can be two hours. Stock brokers like eToro also accept e-wallets: Skrill, Neteller, and the most convenient of all – Paypal. As we briefly noted above, there are tens of thousands of public companies on dozens of exchanges. The specific markets you will have access to depend on the broker you sign up with. For example, on eToro, XTB & Admiral Markets you will be able to buy, sell and trade the shares of over 10,000 different companies. Among them are companies listed on: It is best to choose a stock broker that covers various international markets as this will give you the best possible chance of investing in suitable securities in the market. eToro, for example, allows you to buy stocks from 17 different markets. When looking for a stock broker, you should pay attention to the various fees and commissions that are charged, including dealer commissions, annual account maintenance fees, and withdrawal fees. The good news is that some platforms allow you to buy stocks without paying any dealer fees or annual fees. Instead, they make money from the “spread” – a one-time currency exchange fee when you make your first deposit (some of the top brokers, like eToro, charge a 0.5% commission). Finding the time to research everything about an online stock broker can be quite difficult. Below you will find a list of the best stock trading accounts that meet a few minimum requirements and can manage your stock investments. Among these minimum requirements are the all-important license from a regulatory authority, support for payments with Bulgarian debit/credit cards and bank accounts, as well as the ability to buy and sell shares of international companies. In terms of security and safety, eToro is regulated by the UK Financial Conduct Authority (FCA) and is very popular with the millennial generation who are new investors. With a minimum deposit of $200 to start, opening an account is super quick and very easy. With eToro you can invest in British blue-chip stocks like Tesco, BT and Rolls Royce, as well as the best tech public funds and trending tech stocks like Amazon and Tesla . If you want to trade CFDs on stocks – where leverage of up to 1:5 is available – you will have to pay a small fee known as a spread. You can find out more about the difference between buying physical shares and trading CFDs on stocks here. eToro is fully licensed by the UK Financial Conduct Authority (FCA) and is also licensed in Australia (ASIC) and Cyprus (CySEC) – so you are protected regulatory-wise on all fronts. Opening an account takes minutes. The platform allows you to deposit funds with a Bulgarian debit/credit card, bank transfer or e-wallet. The minimum deposit is $200. Once your deposit is processed by the broker, it will be converted into US dollars for a small fee of 0.5%. This will give you access to international markets without having to worry about exchange rates. If you want to deposit more than £2000, eToro requires you to verify your identity. The platform supports large investments – up to £40,000 per card transaction and no limit on bank transfers. With such deposits, you can get a VIP account manager and a chance to meet him face to face at the company’s headquarters in London. Another advantage of eToro is its copy trading feature, which gives you the chance to copy successful stock investors and create portfolios like theirs. However, this feature comes with additional fees. For more details, check out our eToro review . Pros:

Cons:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) Buying stocks for investment offers the potential for significant returns, dividend income, and portfolio diversification. However, all of this comes with its own risks, including market volatility and taxation. It also takes time to learn the ropes and gain experience in profitable stock trading strategies. Pros

Cons The process of buying shares in Bulgaria has changed dramatically over the past decade or so. The conditions are no longer the same. In 2026, you no longer need to speak to a traditional broker over the phone to place a buy or sell order. Instead, all you have to do is choose a regulated online stock trading platform, deposit some money from your debit/credit card, and choose which stocks you want to buy.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) A stock represents a share of ownership in a company. It may or may not pay dividends to its investors. A stock exchange is a market where stocks, bonds, and other securities are traded. It is the place where companies issue their stocks for the first time (primary market) and where investors trade these stocks with each other (secondary market). To buy stocks of large companies, you must first open an investment account with a broker. Then you can use the platform to buy/sell stocks. There is no best or worst strategy for investing in stocks. Each strategy depends on your experience as well as your investor profile. As of 2026, the best options for investors are NVidia, Tesla, and Apple. To buy shares on eToro, you need to open an account, find the company's stock in your dashboard, and open a trade. Sources: Георги Стоянов е опитен анализатор в областта на икономиката, бизнеса и личните финанси. В допълнение вече над 10 години активно търгува на финансовите пазари, инвестира дългосрочно и споделя своя опит, като пише за различни онлайн медии. След като успешно завършва следването си в УНСС, също добива и магистърска степен по журналистика, Георги активно започва да се интересува и да пише по теми свързани с финанси, технологии и криптовалути. Статии на Георги са публикувани в най-популярните български новинарски портали, включително Капитал и Bloomberg. Като вече доказал се специалист, той бързо бива привлечен към развиващия се екип от журналисти и редактори на TradingPlatforms.com. Днес Георги споделя с аудиторията особеностите на търговията, предоставя ценна информация за непрекъснато променящата се икономическа и бизнес среда. Мисията на Георги е да разсее съмненията относно финансовия свят и да даде възможност на читателя да взема уверени и обмислени финансови решения. Неговата изключителна способност да предава ясно информация е многократно оценена от аудиторията на нашия уебсайт и е полезна както за начинаещи, така и за опитни трейдъри. В допълнение към основните дейности на журналист, редактор и активен трейдър, ежедневието на Георги е свързано и с постоянно лично самоусъвършенстване. Сам казва, че успешните хора се учат и развиват нови качества през целия си живот. 61% от сметките на дребни клиенти с CFD губят пари. Вашият капитал е изложен на риск. 61% от сметките на дребни клиенти с CFD губят пари. Вашият капитал е изложен на риск. ПРЕДУПРЕЖДЕНИЕ: Съдържанието на този сайт не трябва да се счита за инвестиционен съвет и ние не сме упълномощени да предоставяме инвестиционни съвети. Нищо в този уебсайт не е одобрение за определен продукт или препоръка на определена търговска стратегия или инвестиционно решение. Информацията на този уебсайт е от общ характер, така че трябва да вземете предвид информацията в светлината на вашите цели, финансово състояние и нужди. Инвестирането винаги крие риск. Когато инвестирате вашия капитал е изложен на риск. Този сайт не е предназначен за използване в юрисдикции, в които описаните търговия или инвестиции са забранени и трябва да се използва само от такива лица и по начини, които са разрешени от закона. Вашата инвестиция може да не отговаря на изискванията за защита на инвеститорите във вашата страна или държава на пребиваване, така че, моля, направете своя собствена надлежна проверка или потърсете съвет, когато е необходимо. Този уебсайт е безплатен за използване, но може да получим комисионна от компаниите, които представяме на този сайт. Продължавайки да използвате този уебсайт, вие се съгласявате с нашите условия и правила за поверителност. Регистриран фирмен номер: 103525 © tradingplatforms.com Всички права запазени 2024 г.

Stock trading for beginners and how to choose the right broker

A guide to investing in Bulgarian stocks in 2026

1. Open an eToro account and buy stocks

3. Depositing funds

4. Buying shares of companies

5. Complete your order

What is a share?

Types of shares

How is the price of a share determined?

Sale of shares

How much capital should you allocate for an investment in stocks?

What do stock investors profit from?

1. Price growth

2. Dividends

3. Спекулации за хода на цената на акциите

Инвестиционни стратегии при купуване на акции в България

Инвестиция в реални акции или CFD е по-добрият вариант?

Защо да инвестираме в акции?

Why invest in CFDs?

How to choose a broker in Bulgaria for investing in stocks?

Regulation

Payment methods

What stocks can you buy from Bulgaria?

Fees and commissions

Where to buy stocks – the best stock trading platforms in Bulgaria for 2026

eToro – best stock broker in Bulgaria overall

eToro Leverage and License

How quickly can I open an account and what is the minimum deposit for stock trading?

What are the pros and cons of investing in stocks?

Conclusion

Frequently Asked Questions

What is a stock?

What is a stock exchange?

How do I buy stocks of large companies?

What is the best strategy for investing in stocks?

What are the best stocks to buy in 2026?

How do I buy shares on eToro?

Георги Стоянов

Главен редактор, трейдър и финансов анализатор

eToro: Най-добрата платформа за търговия - 0% комисионна за търговия с ETF