Libertex Преглед – Такси, Функции, Предимства и Недостатъци

If you want to trade contracts for difference (CFDs) online – perhaps because you want access to more complex markets or plan to use leverage, consider Libertex.

The CySEC-regulated trading platform offers a wide selection of CFDs on various asset classes – stocks, indices, cryptocurrencies, ETFs and commodities. One of the main advantages of Libertex is trading without any spreads.

But is Libertex the right CFD trading platform for you? We will find out in this Libertex review. We will take a look at the basics of the platform, including tradable assets, fees, payment methods, tools, functionality and security.

Start Trading with Libertex in 4 Simple Steps!

If you already know that you want to trade with this particular broker, follow these steps to get started:

If you want to learn more about Libertex and the features it offers, keep reading!

85% of retail investor accounts lose money when trading CFDs with this provider.

What is Libertex?

Founded in 1997, Libertex is an online CFD trading platform with a solid reputation and over two decades of history. The provider operates in 110 countries and has over 2.2 million clients. This ensures a good volume of daily transactions, as well as professional traders.

Unlike its competitors, Libertex doesn’t offer an exclusive service that is packed with thousands of financial instruments. The platform specializes in niche asset classes and covers only 213 markets. It offers a good selection of stocks, ETFs, forex, cryptocurrencies, commodities, and more.

Every financial market covered by Libertex can be traded with leverage. The limit depends on the location and type of traders. If you have the powers of a professional trader, you can benefit from leverage of up to 1:600. This means that with a 100 euro account balance you get access to 60,000 euro of trading capital.

As for the account itself – LIbertex offers two options. Those of you who are more interested in a user-friendly experience without having to use advanced tools, you are probably better off using the web-based Libertex platform. However, if you are experienced in trading the markets and want to use technical indicators, drawing tools, custom screens and automated robots, you can trade with MT4.

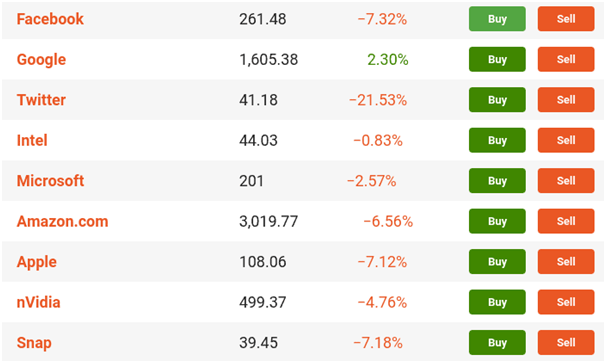

What Stocks Can You Buy with Libertex?

It is extremely important to understand that you will not be buying shares with Libertex. With this broker you will be trading CFDs on shares. This means that you will be trying to predict whether the price of a share will go up or down in the short term.

The CFD instrument you trade at Libertex is not backed by the actual shares, so you have no legal right to the shares. You benefit from price dynamics, low trading fees, the ability to take short and long positions, and access to leverage.

In total, Libertex offers 50 markets for CFDs on stocks. They mainly focus on the major “blue chips” of the New York Stock Exchange and NASDAQ. You can trade CFDs on stocks such as Tesla, Facebook, Amazon and Apple. Some UK stocks are also available, as well as other European and Latin American markets.

When it comes to the sectors supported by Libertex in the CFDs on shares department, everything from cannabis-related stocks to technology, pharmaceutical stocks and commercial stocks is offered.

Forex Trading

Libertex is a well-known forex trading company. The platform mainly offers major and minor pairs – for example EUR/USD, GBP/USD, USD/JPY and USD/CAD. Although it is an industry standard, a forex broker offers the most popular tradable currency pairs, what we like about Libertex is that you can also trade a variety of exotic currency pairs.

These are currency pairs that contain at least one emerging currency. These include the Mexican peso, Singapore dollar, Turkish lira, South African rand, and others. These exotic currencies can be traded against major currencies such as the USD, EUR, or GBP.

Trade in Goods

In addition to forex, you can trade commodities with Libertex. The three main categories of energies, hard metals and agricultural products are also represented.

Here are the specific commodities you can trade with Libertex.

- Metals: Gold, silver, copper, platinum, incl. ETFs on platinum, palladium

- Energy: Brent crude, US light crude, natural gas, heating oil

- Agricultural commodities: Coffee, cocoa, soybeans, wheat, corn, sugar.

Most commodity brokers are focused on the major oil, gas and gold markets, but as you can see Libertex is one step ahead of them.

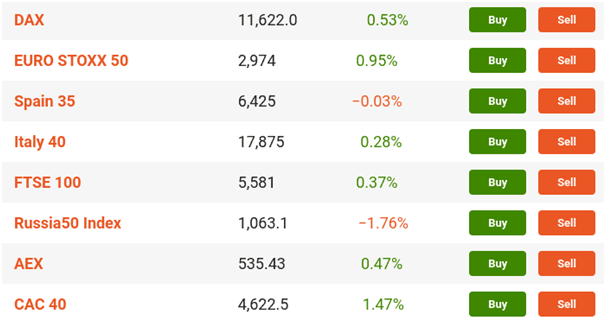

Indices Trading

If you are interested in index trading, you will be pleased to know that Libertex offers access to exclusive markets.

Among the main indices are:

- NASDAQ 100

- DOW JONES 30

- SP 500

- RUSSELL 2000

- FTSE 100

- CHINA 50

- HANG SEN

- NIKKEI 225

You will also get access to less liquid indices, for example:

- SPAIN 35

- ITALY 40

- RUSSIA 50

- ISRAEL 35

- CHILE INDEX

Trading ETFs

Libertex gives you access to 10 ETF trading markets. Compared to other CFD brokers, this is not a lot. Most of the ETFs are backed by iShares, and there is also a market offered by the Vanguard SPDR group.

Libertex Fees and Commissions

Libertex claims to offer an industry-leading pricing structure, so we have researched in detail what fees you can expect to be charged if you use this trading platform. Be sure to review the following sections to make sure you are aware of what fees you will pay if you use Libertex.

Zero Spreads

This broker stands out with its zero spread. This is something we have not seen before in CFD trading, as spreads are charged by platforms of all sizes. For those who are not aware, the spread charged by brokers is the difference between the buy and sell prices.

For example, if the spread is 0.4%, this means that you need to make at least 0.4% profit to break even. In other words, when trading online, the spread ensures that you always start the trade with a small loss. The fact that Libertex allows you to trade in a zero spread environment is good news for your potential profits from your trading operation.

Trading Commissions

One of the main issues with Libertex is that the broker is not completely transparent about what commissions they charge, as we had to dig around a lot to find the information we needed. We don’t like this as the best online trading sites are usually crystal clear about what commissions you will pay.

Here’s what we found:

- The specific commission you will pay depends on the asset and market you will be trading.

- The most profitable market is the major currency pairs market, where an average of 0.03% is paid.

- Higher-risk markets, such as digital currencies, can reach commissions of up to 2.5%, which is quite high.

- However, more liquid pairs, such as BTC/USD, remain below the 0.5% mark.

- If you are going to trade CFDs on stocks, you will pay in the range of 0.1%-0.2%.

Although there are some CFD brokers that serve Bulgarian traders without commission, it is important to understand that with them you will definitely pay a spread. With Libertex you do not pay a spread, but commissions. You should consider both cost options to clarify for yourself whether the particular platform is competitive enough for you.

Other fees

Spreads and commissions have the biggest impact on your portfolio. However, there are other fees that Libertex charges.

This includes:

- Overnight Fee: Like any trading site available to clients from Bulgaria, this broker also charges overnight fees. These are also called ‘swap fees’, which is a fee you pay for each day you keep your position open. This is because CFDs are leveraged financial products and thus attract interest.

- Inactivity Fee : If your account balance is below $10,000 and you do not place an order for 180 days, you will be charged an inactivity fee. It starts at €10 per month and will be deducted from your account each month until you start trading again or withdraw your funds.

Libertex does not charge any fees for depositing funds into the account.

The Libertex Platform and Trading Tools

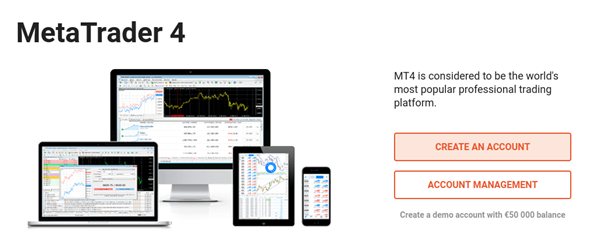

As we mentioned, Libertex offers two trading platforms – MT4 (this is the best MT4 broker in our opinion) and its own trading platform.

MetaTrader 4 (MT4)

If you are an experienced trader, you will be well acquainted with MT4 and the many features and tools it offers. For those who don’t know, it is a third-party trading platform. With it, you get access to many technical indicators and charting tools.

You can fully customize your trading screen and install an automated forex robot. MT4 can be accessed directly from the Libertex website, and you can also download MT4 for Mac. It is better to download the platform to your own device.

Libertex Web Trader

MT4 is a complex platform for novice traders due to the size and depth of the software’s features and tools. In this case, we recommend using the Libertex web-based platform. This is the online platform designed and maintained by Libertex.

There is no requirement to install any software as everything can be accessed through your standard web browser. The Libertex web trading platform offers a smooth and seamless experience that is ideal for traders with little experience in the markets. You can easily find your chosen market by using the filters or search engine.

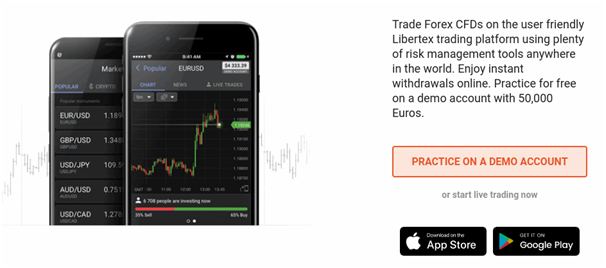

Libertex application

Like most of the top rated CFD brokers active in the online space, Libertex offers a full-fledged mobile app for stock trading. The app is available for both Android and iOS devices, ensuring you have a premium trading experience at your fingertips.

You can access the Libertex secure trading app via the broker’s website. You will then be redirected to the relevant Google Play or Apple Store to complete the download. You can also have permanent access to your Libertex account via the MT4 app. All you need to do is install the MT4 app and log in with your Libertex details.

Demo Account with Libertex

One of the best features available at Libertex is that you will have access to a demo account whenever you see fit. This is great if you are a beginner in trading. The demo account is pre-loaded with a paper trading balance of €50,000 and allows you to trade in a 100% risk-free environment.

The demo account reflects real market conditions. This way you can learn exactly how the markets work before investing your own money.

The Libertex demo account is also useful for experienced traders. This is because you have the chance to try out new trading strategies and systems, new forex or CFD robots for MT4 without risking your trading capital.

Research and Analysis with Libertex

If you are looking for an online trading platform that offers a large selection of in-house research materials, then Libertex is not for you. Although there is no main news section on the site, articles are published infrequently.

There is also no financial commentary on the site. An economic calendar is offered, but almost nothing else.

When it comes to technical analysis, Libertex provides all the necessary tools you need. This includes a huge number of technical indicators that are available on the Libertex web trading platform and MT4.

Leverage with Libertex

Like most CFD trading sites, Libertex offers leverage options on all of its markets. While you might be attracted to the platform’s 1:600 leverage offer, this is only available to professional traders. If you are a day trader from Europe, you will be subject to the restrictions imposed by ESMA.

This means that the maximum leverage you can get is 1:30 when trading major currency pairs. Minor and exotic currency pairs and gold can be traded with leverage up to 1:20. For stocks, leverage is limited to 1:5, and for cryptocurrencies it is 1:2.

Payments with Libertex

For deposits and withdrawals, you have access to a variety of different payment methods.

This includes:

- Debit cards

- Credit cards

- Skrill

- Neteller

- SOFORT

- Giro Pay

- Trustly

- Bank transfer

- Neosurf

- Tele Ingreso

- Others

There are no fees for depositing funds with Libertex, no matter which payment method you choose. Apart from traditional bank transfer, all of the payment methods listed above are processed instantly. This ensures that you can start trading immediately and without delay.

When withdrawing funds from Libertex, the processing time of the transaction depends on the payment method chosen. For example, e-wallets such as Skrill and Neteller are the fastest and Libertex usually processes them in less than 24 hours. Immediately after processing, the funds will be credited to the respective e-wallet within a few seconds.

All e-wallet withdrawals are free. If you choose to withdraw by debit/credit card, the processing time can take 1-5 days and a small fee of 1-5 euros will be applied. Bank transfers take 3-5 days to process and a fee of 0.5% is charged (minimum 2 euros, maximum 10 euros).

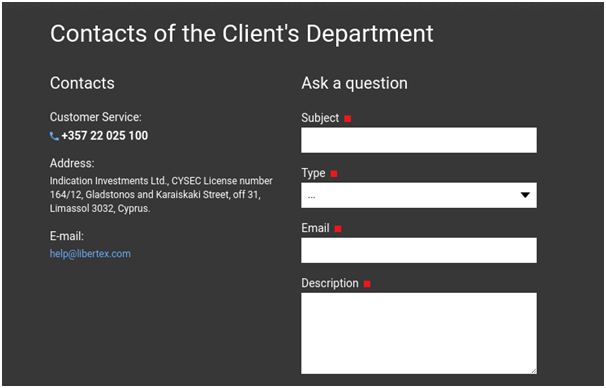

Libertex Customer Service

Libertex offers support through several channels. The easiest way to speak to a customer service representative is via live chat. There is also a Whatsapp number and a Facebook Messenger option that you can use.

If you would like to speak to a Libertex representative over the phone, you can call +357 22 025 100 (Cyprus number).

If you want to send an email to Libertex, use [email protected].

The help and service section also offers a fairly comprehensive FAQ section where you can find the answer to your query without having to contact the company.

Is Libertex safe?

Libertex is a licensed broker by the Cyprus Securities and Exchange Commission (CySEC). This in itself ensures that Libertex must follow a set of strict regulatory requirements. For example, all new account holders must have their identity verified before making a withdrawal.

This ensures that you can trade in a safe and secure environment. In addition, brokers supervised by CySEC must keep client funds in separate bank accounts from their own. You will also benefit from an investor protection scheme when using Libertex. According to CySEC, this is €20,000 or 90% of the claim amount – whichever is lower.

Advantages and Disadvantages of Libertex

Advantages:

Disadvantages:

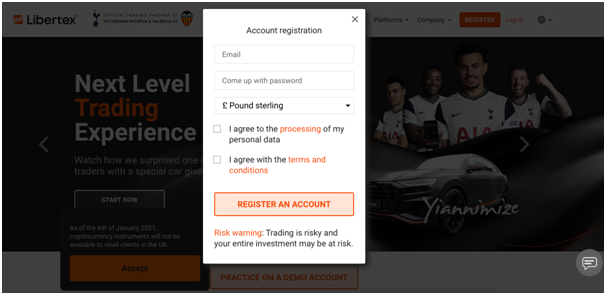

Join Libertex Today – Step by Step Guide

If you are ready to trade with the CySEC-regulated broker Libertex with zero spreads for CFDs on stocks, cryptocurrencies, indices, forex and more, follow our step-by-step guide below.

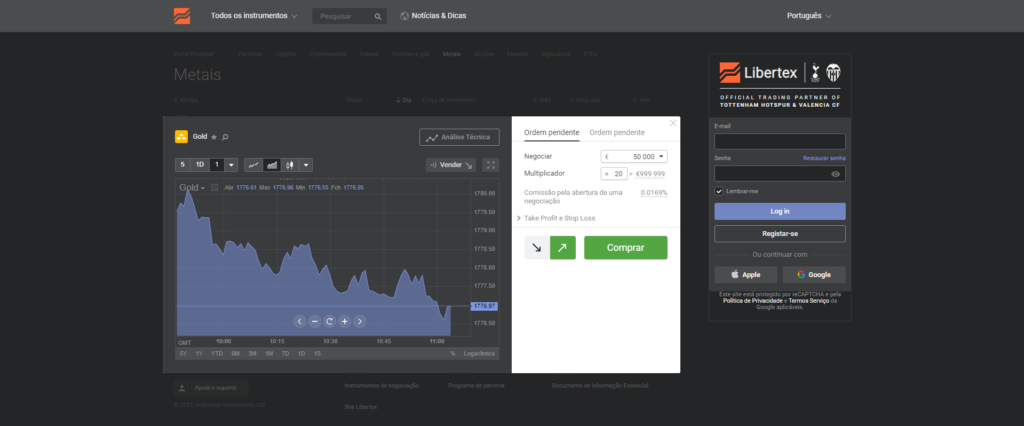

Opening an account with Libertex is easy. Click the “Register” button on the broker’s homepage and enter the requested personal details. The broker will want to know more about you, so you will need to fill out a short questionnaire. This includes your job, trading experience, etc. Since Libertex is regulated by CySEC, the company must meet anti-money laundering requirements and must verify your identity. You must upload documents in this regard in the client area. The following is required: Verification is an easy process and takes a few minutes! The minimum deposit with Libertex is only €100. Funding the account is fee-free and you can use several payment methods: With Libertex you can trade CFDs on a wide range of markets, which includes stocks, cryptocurrencies, indices, forex, commodities and more. The Libertex trading platform is easy to use and has interesting functionality. Once you have chosen a market to trade, you can easily place a buy or sell order. From here you can also choose leverage, add a stop-loss or take-profit level, and view charts for the market you are trading. Here, the broker indicates the trading commission along with the zero spread offer.Step 1: Opening an Account

Step 2: Verify Identity

Step 3: Deposit Funds

Step 4: Select Market

Step 5: Trade!

Launched in 1997, Libertex currently focuses on CFD trading. The broker offers a relatively small number of markets – 213, but the most traded asset classes are supported. You can instantly deposit funds with the broker without any fees and you will trade with zero spreads on all markets. You can choose to trade with MT4 or the broker’s own web-based platform Libertex. You also get access to your account via a mobile app. 85% of retail investor accounts lose money when trading CFDs with this provider.Conclusion

Libertex – Exclusive CFD Broker with Low Fees

Frequently Asked Questions

Is Libertex a scam?

Does Libertex offer leverage?

What is the minimum deposit with Libertex?

Does Libertex support MT4?

What fees does Libertex charge?