Актуални мнения за eToro България за 2026 и ревю на такси, функции, предимства и недостатъци

If you live in Bulgaria and want to buy stocks and shares freely, at any time, the eToro broker is right for you. This platform for trading stocks and other asset classes is popular among novice investors because it is easy to open a trading account, convenient to make a deposit, and buying shares takes minutes. But is eToro the right platform for you? Read this eToro review to find out.

In this eToro review , we’ll cover everything you could want to know about eToro: what stocks you can buy, fees and commissions, trading tools, payment methods, using the app, licensing and regulation, and more. This way, you’ll know if eToro is the right broker for you.

If you choose eToro and want to start trading stocks, you can read about the necessary steps:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) With eToro, users can buy stocks, ETFs, and cryptocurrencies , as well as CFDs on stocks, indices, bonds, metals, energy, and more. One of the most attractive aspects of eToro is its industry-leading pricing structure, as it is one of the few platforms in the online space that allows you to buy stocks . This also applies to cryptocurrencies like Bitcoin, as well as over 150 ETFs. As a stock trading platform aimed at novice investors, eToro is suitable for those of you who will encounter investing in financial instruments online for the first time. Opening an eToro trading account takes minutes, depositing with a debit/credit card, e-wallet or bank account is extremely easy. Then you simply choose what instruments you want to buy, how much you want to invest and confirm the transaction. We should also note the social trading and copy trading features that the eToro stock trading platform offers. They also contribute to eToro’s rapid growth in popularity. These features allow you to interact with other investors in a Facebook-like format and even copy other traders’ trades, which adds a new dimension to traditional trading.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) Advantages:

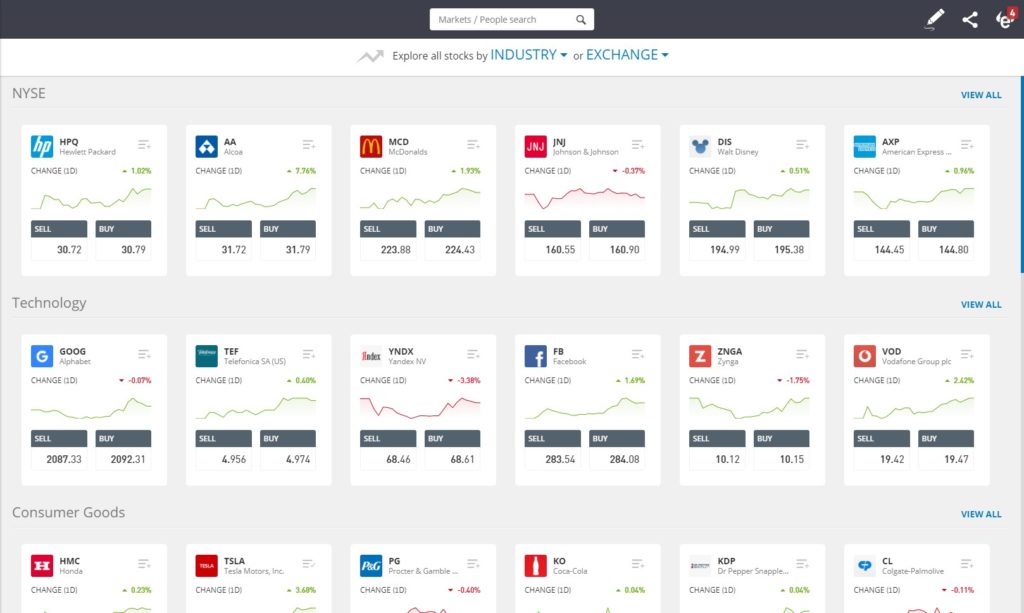

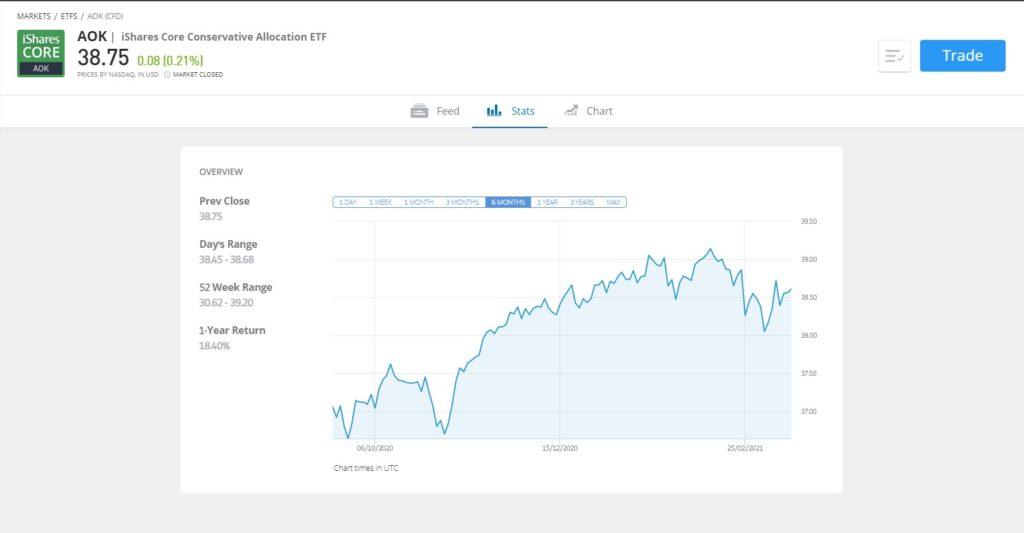

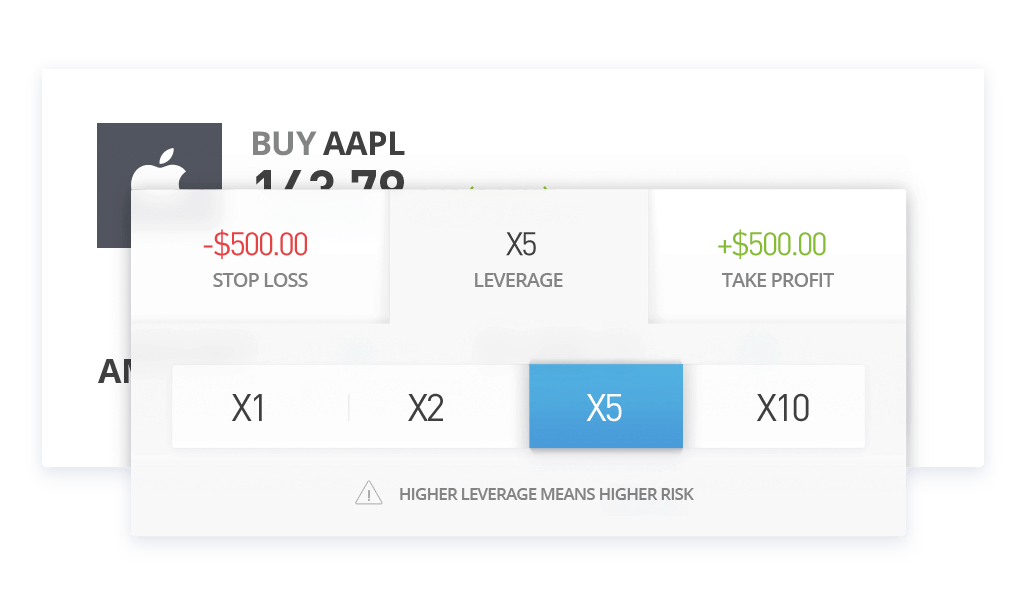

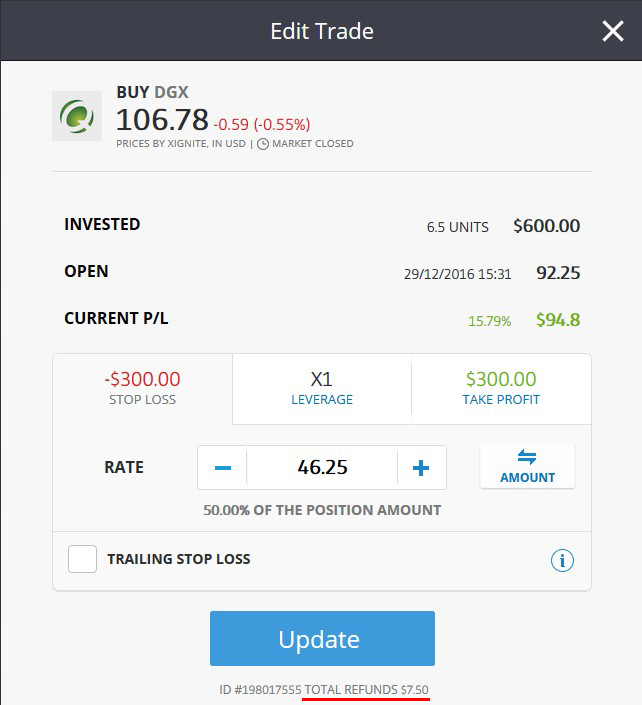

Disadvantages: eToro offers stocks from over 3,000 companies listed on various exchanges. While the number is smaller than IG or Hargreaves Lansdown, you still have a wide selection, including many of the best stocks for 2021. For example, if you want to invest in British stocks, such as BP, Royal Mail, Tesco or HSBC, you can easily do so with eToro. Additionally, if you want to add international stocks to your portfolio, eToro gives you a wide range of options. At the forefront are the US markets. eToro gives you access to hundreds of well-known US companies listed on the New York Stock Exchange (NYSE) and NASDAQ. The international stock exchanges that eToro gives you access to are: From the big and well-known companies, you can choose from stocks of Apple, Amazon, Facebook, IBM, Ford Motors, Nike, Disney, and others. As for the specific types of stocks you can buy, eToro offers access to technology stocks, retailer stocks, bank stocks, food stocks, even cannabis stocks! You can choose from a very good selection of dividend stocks if you are looking for passive income or keep track of your favorite stocks through eToro's personalized watchlists. eToro is one of the brokers in Bulgaria that allows investments in the so-called 'fractional ownership'. As the name suggests, fractional ownership allows you to acquire a 'part' of a stock. This type of investment is extremely suitable in many cases, especially if you want to include expensive stocks on the US markets in your eToro portfolio. Unlike the London Stock Exchange, where stock prices are in pennies, in American markets they are dominated by dollars, and some of the most traded companies on the NYSE and NASDAQ are chasing prices of hundreds and even thousands of dollars. One such example is Amazon. At the time of writing this eToro review, the retail giant’s share price is at $3,184, or roughly £2,400. For many people, spending that much on a single stock is not justified. Not only does this hinder your ability to build a diversified portfolio of stocks, but it could be much more than you planned to invest. However, if you want to buy Amazon shares through eToro, you can do so for a minimum of $50, or around £40. With that amount, you can acquire 1.6% of a single share. eToro offers such fractional ownership for all 5,000+ instruments offered by the trading platform. If you are interested in investing in global stock markets with eToro but are not quite sure which companies to choose, ETFs may be an option worth considering. This allows you to invest in a basket of different stocks in a single transaction. Once you allocate your funds to ETFs with eToro, you won’t need to do anything else until you decide to cash out your investment. This is because the ETF provider will buy and sell stocks on your behalf. eToro offers 153 ETFs across a variety of sectors. In particular, eToro offers ETFs from three of the largest providers in this segment of the financial scene - Vanguard, iShares and SDPR. This allows you to invest money in some of the most popular ETFs worldwide. For example, all three of the aforementioned providers offer ETFs that track the S&P 500 index . It is the most traded stock market index in the world, tracking 500 large-cap companies listed in the U.S. In other words, by making a single investment in the S&P 500 ETF on eToro, you are buying shares in 500 different companies. If you want to take your diversification strategy to the next level, eToro also offers ETFs that give you access to bonds. For example, the Vanguard Total International Bond ETF contains over 6,000 bond instruments from different markets. Once again, you can invest in an entire basket of assets with just one trade. at eToro you can buy ETFs with a minimum deposit of $50. This is great news for investors from Bulgaria, as most online brokers require significantly larger amounts. Vanguard and similar providers require a minimum investment of £500. If you want to diversify your portfolio with different asset classes, eToro offers a wide selection. Here's what else you can trade on the platform: It is important to note that apart from stocks, ETFs and crypto assets, all other asset classes on eToro are traded via CFDs (Contracts for Difference). This means that you can trade the future value of the asset in question without having to store or own it. This gives you easy exposure to hard assets like gold, silver or oil. Although you won't own the underlying asset, investing in CFDs with eToro provides you with two key advantages that you won't find when investing in the traditional sense - leverage and short selling. Remember that CFDs are complex instruments with a high level of risk, especially if you use leverage, so research how CFDs work well before trading with real money. Leverage allows you to trade with more money than you actually have. The eToro broker complies with the regulatory requirements of the European Securities and Markets Authority (ESMA), which means that investors based in Bulgaria and throughout continental Europe will be limited by the amount of leverage they can apply. Leverage at eToro is 1:5 for stocks, 1:20 for gold, and 1:30 for major currency pairs. You can also get 1:2 for trading cryptocurrencies and 1:10 for commodities other than gold. If you are not sure how leverage works at Toro, you are essentially multiplying your stake by your chosen factor. For example, let’s say you have staked the equivalent of £100 on gold. If the price of gold increases by 10% and you apply the maximum leverage of 1:20 – then your £10 profit will be increased to £200. One of eToro's most popular features is "short selling." It allows you to speculate on the value of an asset whose price is falling. And one example. If you have done in-depth research on HSBC shares and believe they are overvalued, most Bulgarian investors would avoid them, but you can sell the company's shares short and profit from falling prices. If you placed an order to sell HSBC shares for £500 and the shares fall by 20%, your profit will be £100. To do this, you will need to trade the selected asset via CFD.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) One of the most common questions investors ask is whether or not eToro pays dividends. The answer is yes. When you invest in stocks and ETFs with eToro, you will be entitled to dividends when they are distributed by the relevant organization. When investing in stocks, the company that owns the shares will transfer the dividend to eToro. The broker will then add the funds to your account balance. You can then withdraw the money or reinvest it. This will give you the best possible chance of taking advantage of compound interest. If you're invested in ETFs, providers like Vanguard and iShares typically make payments every three months. This is because the underlying basket of assets will attract dividends paid out throughout the month and it's unviable to make individual payments consistently. The quarterly payment covers all dividends received from the ETF provider during the relevant period. It will be reflected in your eToro account and will be available for immediate withdrawal or reinvestment. One of the most important things to consider before choosing a broker is their fee policy. This doesn’t just include fees for stock trading, there are many other fees that could come as a surprise. We offer a full breakdown of the fees you will pay when trading stocks with eToro. This fee policy is in stark contrast to some of the larger stock trading sites , which is one of the main reasons the broker has quickly amassed a client base of over 30 million investors. For example, the popular British broker Hargreaves Lansdown has an entry fee of £11.95. This is paid when you buy your chosen shares, as well as when you sell them. For example, if you wanted to buy £50 worth of Royal Mail shares with a fee of £11.95, you would end up paying a nominal rate of 23.9%. However, fees at eToro are not due when you meet the following conditions: Any of the above actions would mean that you are trading CFDs on shares, which means that you are trading the asset rather than investing in it. If you want to buy £1,000 worth of shares with eToro, IG or a traditional broker like Hargreaves Lansdown, here are the fees you’ll pay. If you want to take a long position in a £1,000 share CFD with eToro or MarketsX, here are the fees you will pay. There are some fees to watch out for when using eToro. The spread is the difference between the “buy” and “sell” price. It is an indirect trading fee that should be included in your return on investment. eToro does not have a specific spread structure as they change depending on market conditions. In other words, if you trade during standard market hours, then you will benefit from the most competitive spreads. For example, the “bid” and “ask” prices for Royal Mail shares during standard trading hours in the UK are 174.24p and 174.80p. This represents a spread of approximately 0.32%. This is a reasonable price assuming no other trading fees are paid. eToro applies an inactivity fee of $10 per month after 1 year of inactivity. eToro does not charge fees for depositing funds into your trading account. There is a currency conversion fee that you should consider because eToro account balances are denominated in US dollars. When you fund your eToro trading account with a debit/credit card, e-wallet or bank account, a 0.5% currency conversion fee will be charged. This means that a deposit of £1,000 will cost you £5. For withdrawals, eToro applies a flat fee of $5 or around £4.

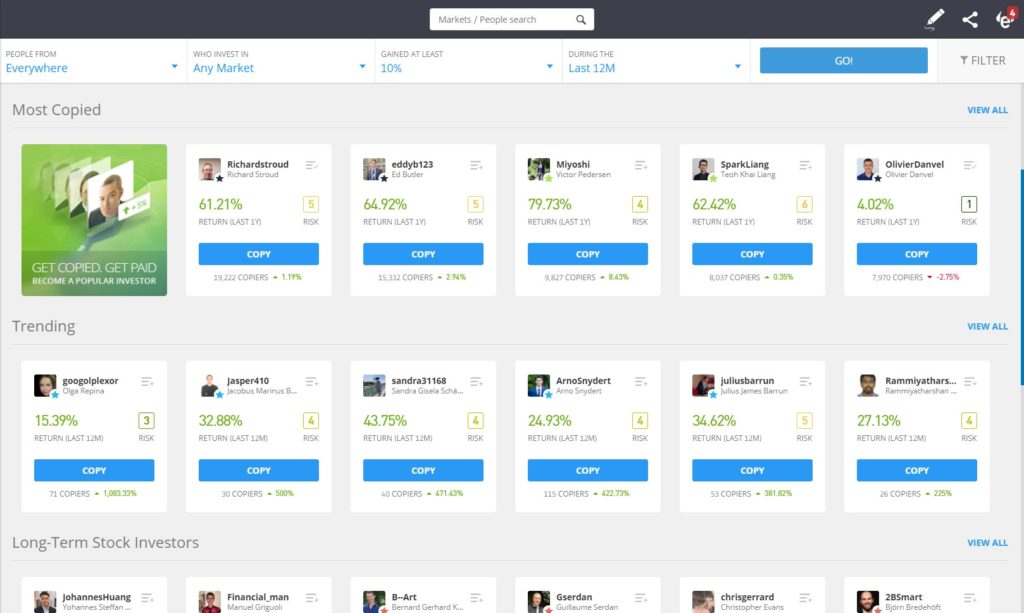

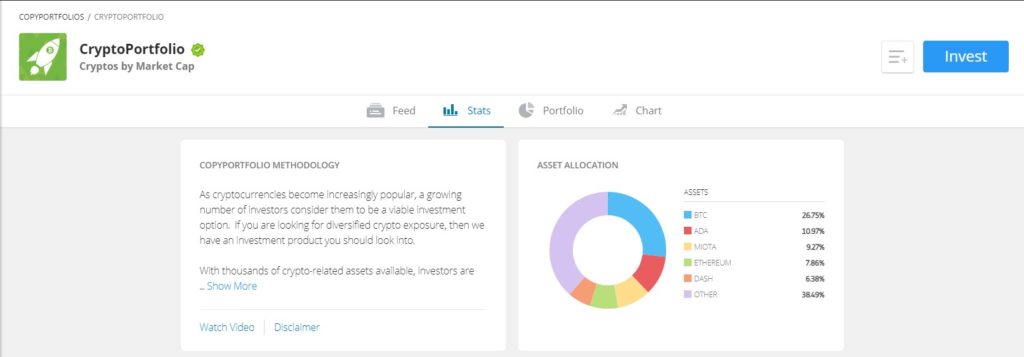

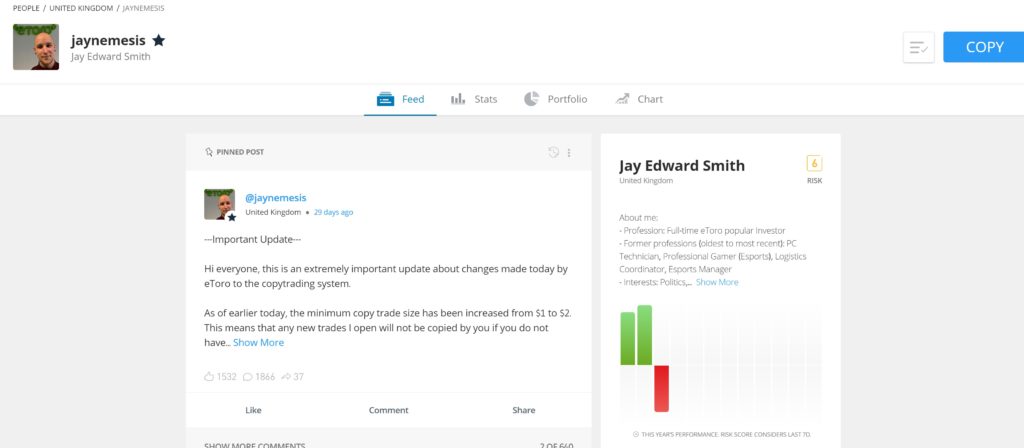

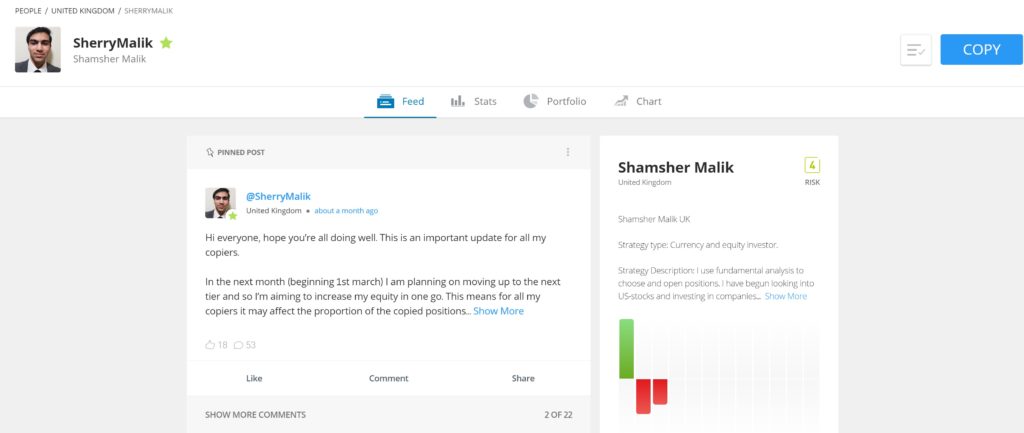

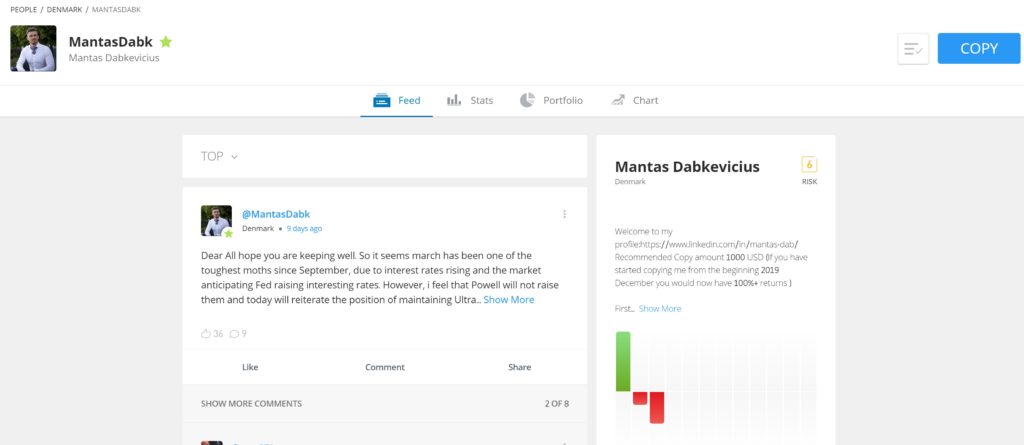

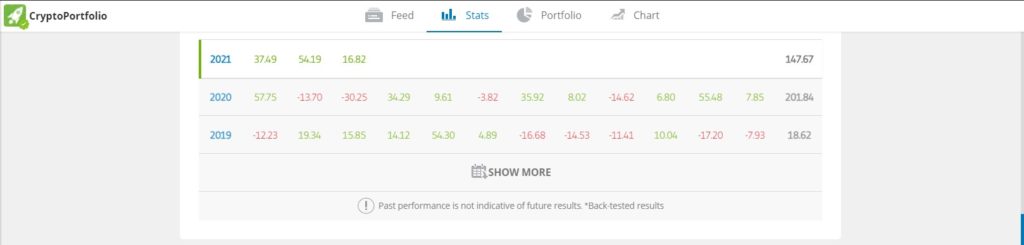

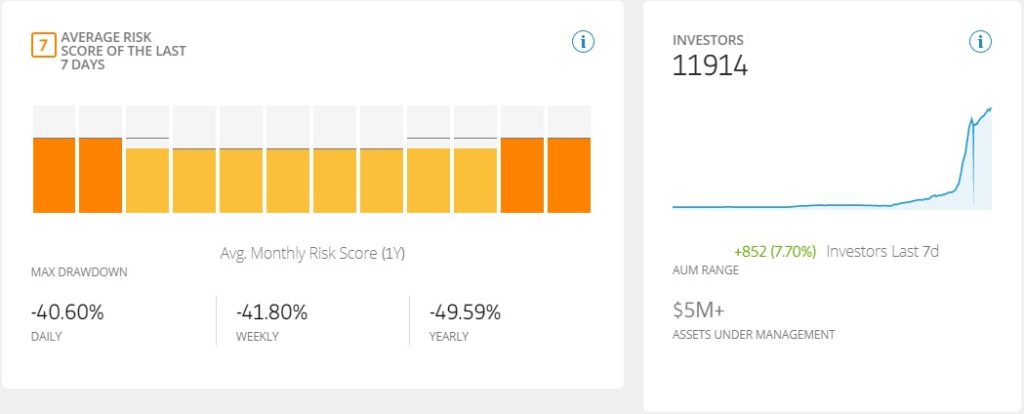

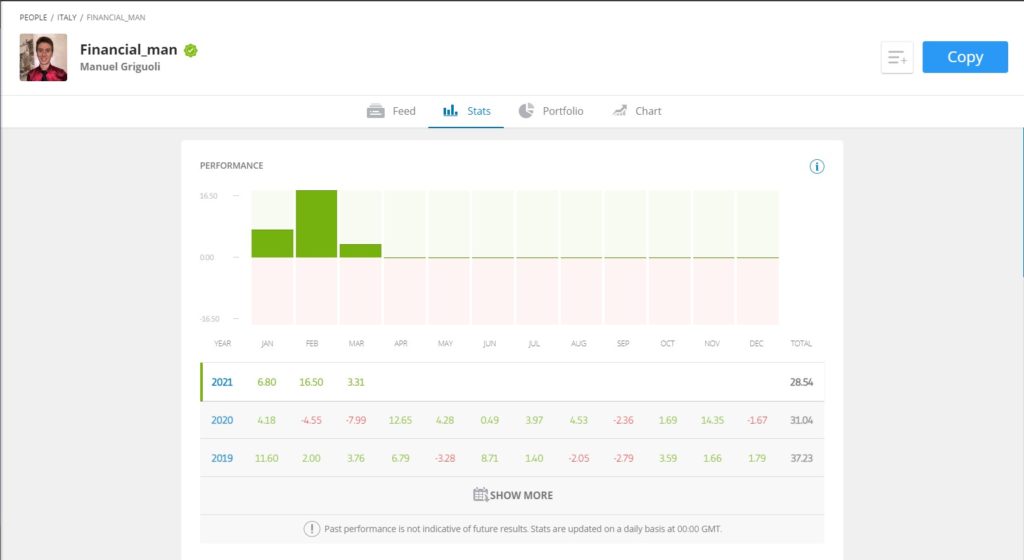

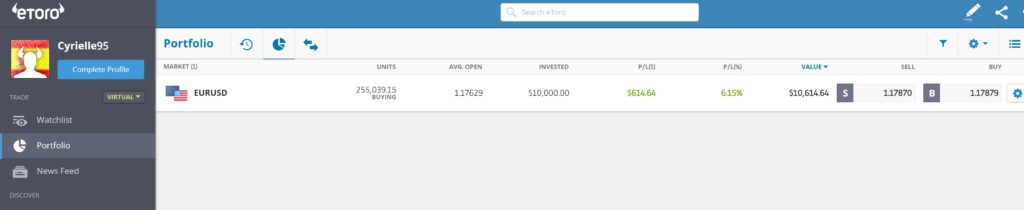

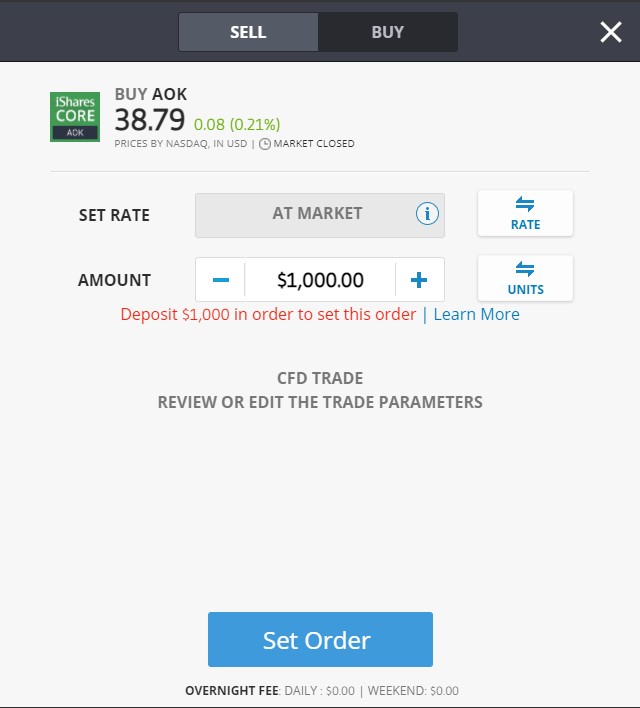

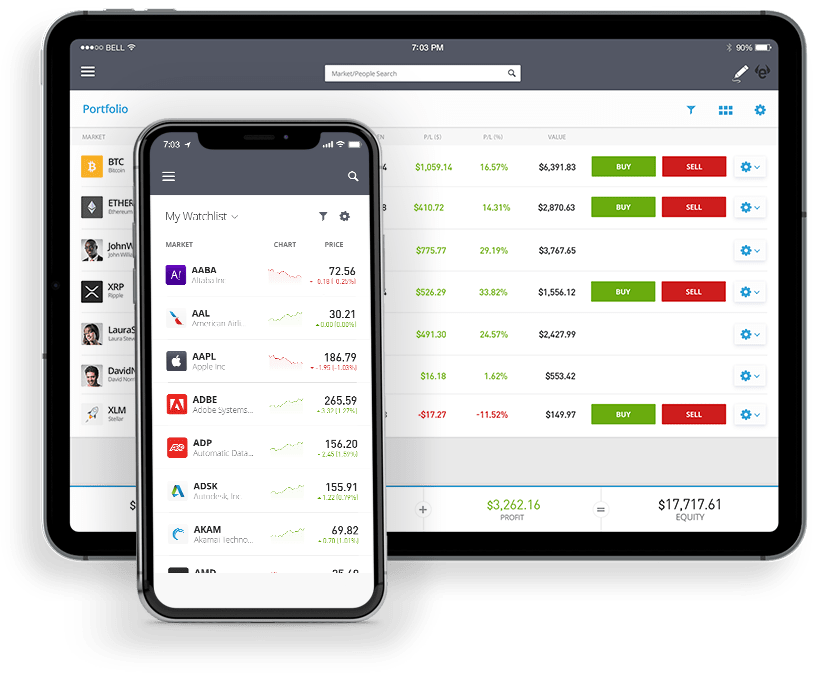

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) The process of buying and selling stocks on eToro is extremely simple. To make an investment, you can. You have access to several types of orders: If you want to buy stocks with eToro and hold them for a long period of time, a market order is perfectly sufficient. eToro is often described as a “social trading platform” – and for good reason. For those unfamiliar with the social trading phenomenon – it’s a bit like a social media platform, but for the investment space, where you can discuss and share stock trading ideas, as well as receive investment advice from other eToro investors. If an experienced investor on eToro posts some trading ideas for the upcoming week, you will be able to see the post as well as post a response. Of course, the platform is available after you have created an account with the broker. This is very useful if you are new to the investment arena and want to gain knowledge and insights. You can add selected eToro members to your “friends list” to follow their activity on the stock trading platform. The copy trading feature on eToro is unique. As the name suggests, it allows you to choose a popular investor on eToro and then copy their trades. You can copy the entire portfolio of the trader you choose, including their future trades. This means you can essentially invest in stocks and forex pairs without doing any prior research. It is perfect for beginners. We have seen many positive eToro opinions and reviews on Trustpilot When copying trading, you need to make a minimum investment of $200. There are no additional fees for using the copy trading feature on eToro and you can exit your position at any time. You can manually cancel individual orders from a given portfolio, giving you 100% control over your money. At the time of writing this eToro review, there are just under 710,000 traders whose portfolios you can copy on eToro. The stock trading platform offers a full range of filters that ensure you can find a highly rated trader who will meet your long-term financial goals and provide you with consistent profits. Here's what you should look for when choosing traders on eToro to copy: Finding a trader to copy on eToro can take time, but you have thousands of traders to choose from. We offer you an overview of three of the best copy traders on eToro. Jay Edward Smith with the username Jaynemesis is one of the best copy traders on eToro for 2021 given the achieved return of 68% (according to data as of mid-October 2020). This is an unprecedented achievement given the volatility in the markets due to the COVID-19 pandemic and the fact that many stocks have fallen sharply and their prices are still below pre-pandemic levels. In September alone, J. Edward Smith reported a minimal loss of 0.57%. In the previous 14 consecutive months, he made a profit. For 2018, he reported a 52% return, which is also an impressive result. If we look at his portfolio, he has a well-diversified stock portfolio, having invested in stocks from Microsoft and Etsy, through UPS, Canadian Solar, and all the way to Beyond Meat. In total, 95% of his portfolio is in stocks, with small investments in Bitcoin and ETFs. Previously, Jay Edward Smith invested in indices and commodities. His risk rating is 5/10, up from 2/10 in April. Currently, this top-rated copy trader has over 26,000 followers and over $5 million in assets under management. If you don't feel confident copying the trades of a riskier trader like Jay Edward Smith (5/10), Shamsher Malik's portfolio is a good option. This UK-based investor specializes in fundamental analysis and has a low-risk approach to investing. His focus is primarily on stocks and forex. On average, Malik keeps his positions open for a period of 2 weeks. This shows that he prefers to follow short-term trends. Although his profile is low risk - 3/10, the achieved returns to date are impressive. Shamsher Malik has posted a 12.32% return in the first 10 months of 2020. It is actually less than what J. Edward Smith has achieved. However, one should not forget about the risk/reward ratio. If you are interested in short-term swing trading, you will be interested in the portfolio of Mantas Dabkevicius. Based in Denmark and using the username “Mantasdabk”, this trader likes to buy and sell assets regularly - the average duration of his trades is 1.5 weeks. Mantasdabk averages just under 20 trades per week, so he's super active. A total of 60% of his portfolio is concentrated in stocks, while the remaining 40% is invested in practically everything - commodities, currencies, cryptocurrencies, and ETFs. By copying his portfolio, you can trade around the clock on multiple markets and multiple assets 100% passively. Mantas Dabkevicius joined the stock and financial assets trading platform eToro in December 2019. He realized a return of 4.85% in his first month, and for 2020 he achieved a return of 55.62%. This represents 58.70% winning weeks since he joined eToro. Such a return gives the impression of a high-risk trade, but his rating is only 4/10. This is lower than the average score of 6/10 that he achieved in March 2020. eToro also offers more advanced copy trading tools - CopyPortfolios, i.e. copying portfolios. These are professionally managed portfolios that use artificial intelligence and algorithmic trading. Two types of portfolios are available. The first, Top Trader Portfolios, consists of the best-performing traders on eToro, while Market Portfolios combine a number of assets according to a chosen market strategy. One of the most popular top portfolios available on the stock trading platform is that of “GainerQtr.” It is currently up just under 20% in 2020. The previous year, the return was 14%. The portfolio is well diversified, with 5 traders making up just over 25% of its weight. The remainder is divided among a large number of traders from different target markets. Copy Portfolios is a tool for more advanced traders and requires an investment of at least $5,000 in CopyPortfolio. However, this is the most passive investment option on eToro, as everything is managed for you. There is no requirement to personally choose which investors to copy and no need to worry about constantly rebalancing your portfolio. The Market Portfolios feature allows you to target specific sectors of the financial markets. An example of this is the “RemoteWork” portfolio. As the name suggests, this portfolio gives you exposure to companies related to the work-from-home space. This includes Twilio, Zoom, Shopify, Adobe, Salesforce, and the like. This eToro feature has performed exceptionally well since its inception on the platform in 2018. Over the past three years, it has achieved returns of 82% (2020), 41% (2019), and 49% (2018). Other niche sectors that are covered by the eToro Market Portfolios feature are renewable energy, autonomous vehicles, mobile payments, food, technology, and gaming. Unlike the Top Trader Portfolios feature, which requires a minimum investment of $5,000, some market portfolios are available with an investment of $1,000. The specific amount depends on the portfolio selected. eToro has some gaps in terms of research and analysis. eToro’s web platform has integrated its stock research page with TipRanks , but it doesn’t provide a wealth of data. For example, you can’t view reports, balance sheets, or in-depth expert analysis. However, you can view some analytical data for your chosen stocks. This includes multiple charts and graphs of the stock's historical prices, as well as what the general consensus is from leading hedge funds. eToro also lacks a main news feed. Only users of the platform share news there. Therefore, it is best to look for research materials in external sources, such as Yahoo Finance or Morningstar . Both the stock trading app and the mobile browser version provide the same functionality as the desktop version. Whether you’re buying and selling stocks, checking your portfolio value, or depositing/withdrawing funds, eToro is an ideal choice for anyone looking to trade from their mobile devices. You can check the value of your positions with just one click, no matter where you are. You can also make last-minute investments from anywhere, as well as immediately close a losing position. After all, having to wait hours on end while you access your desktop device can be extremely expensive. If you want to practice without losing any money, you can take advantage of an eToro demo account. It provides a $100,000 stock trading budget and offers the full functionality of the eToro trading platform, including copy trading tools. This is a great way to learn more about the platform and practice if you are not a very confident investor.

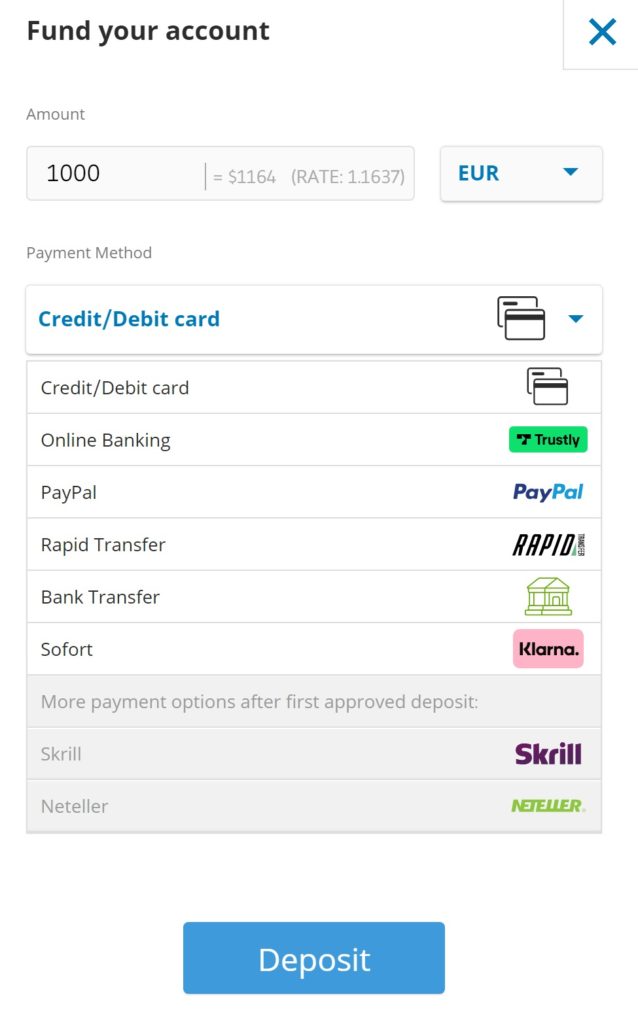

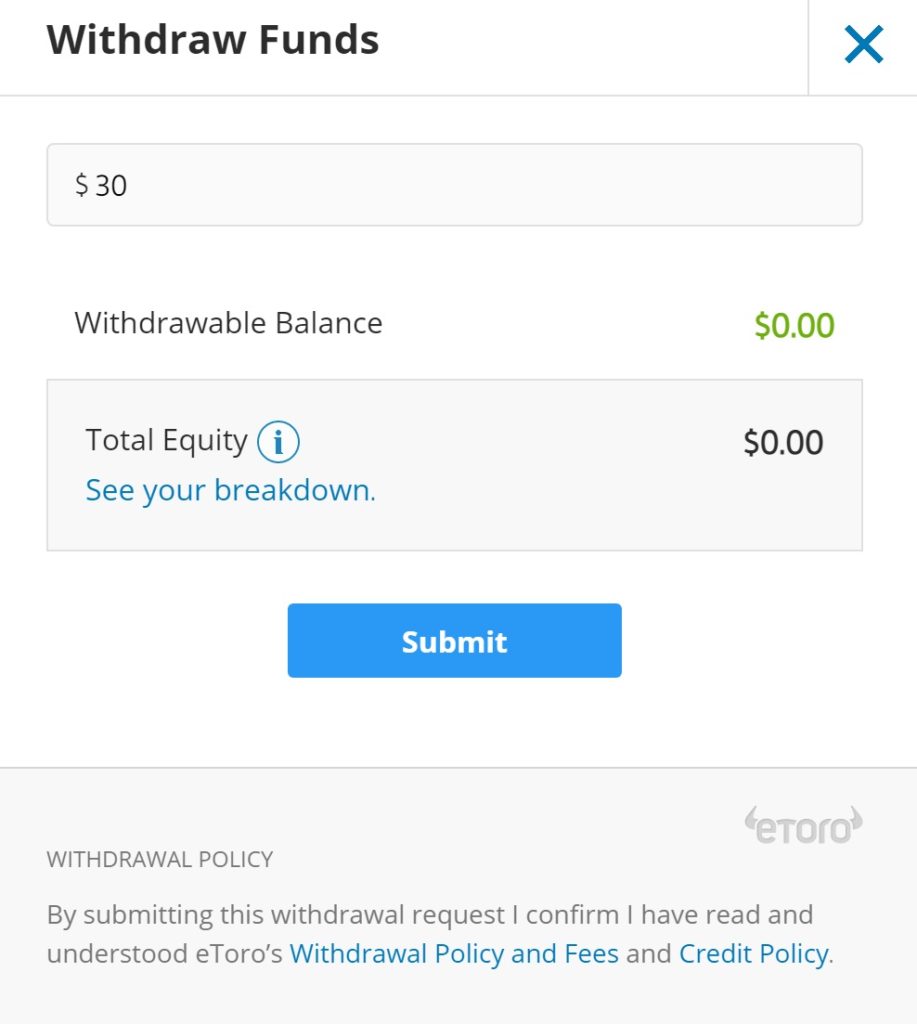

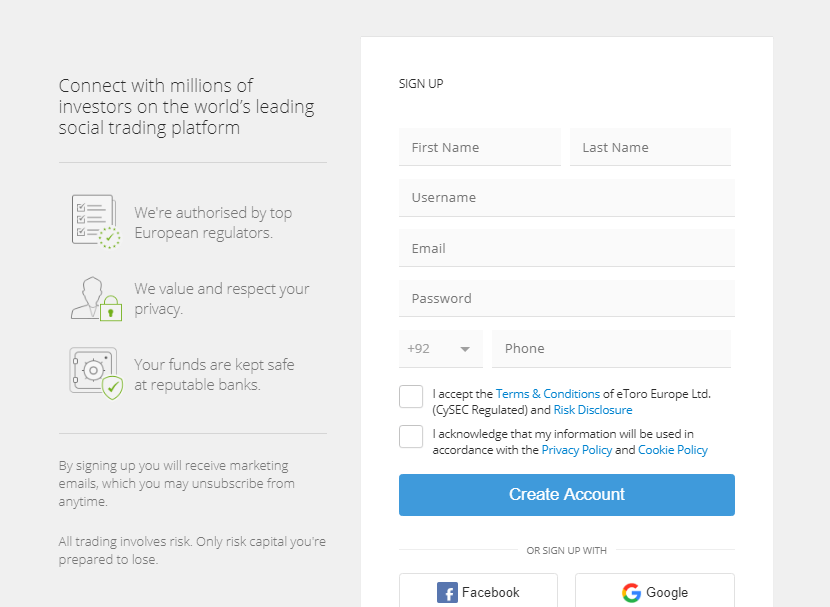

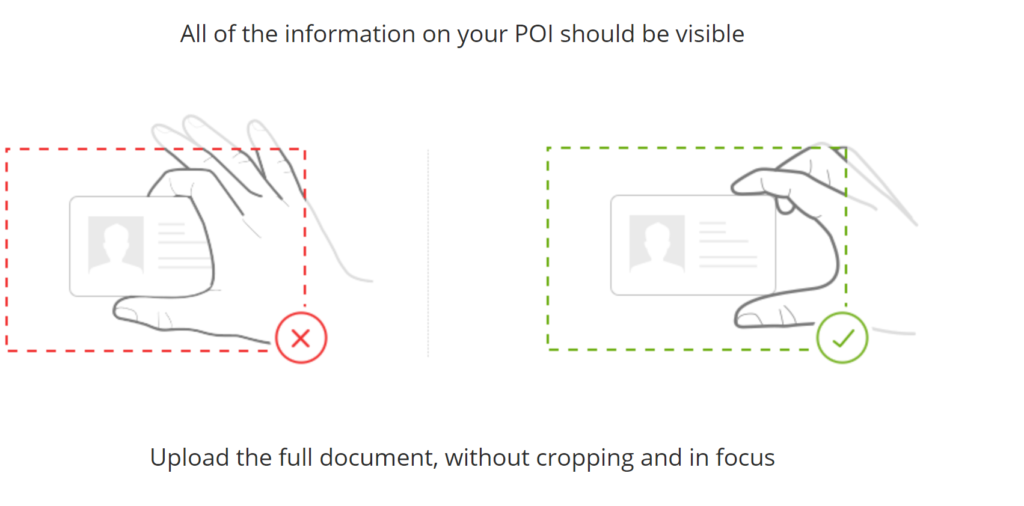

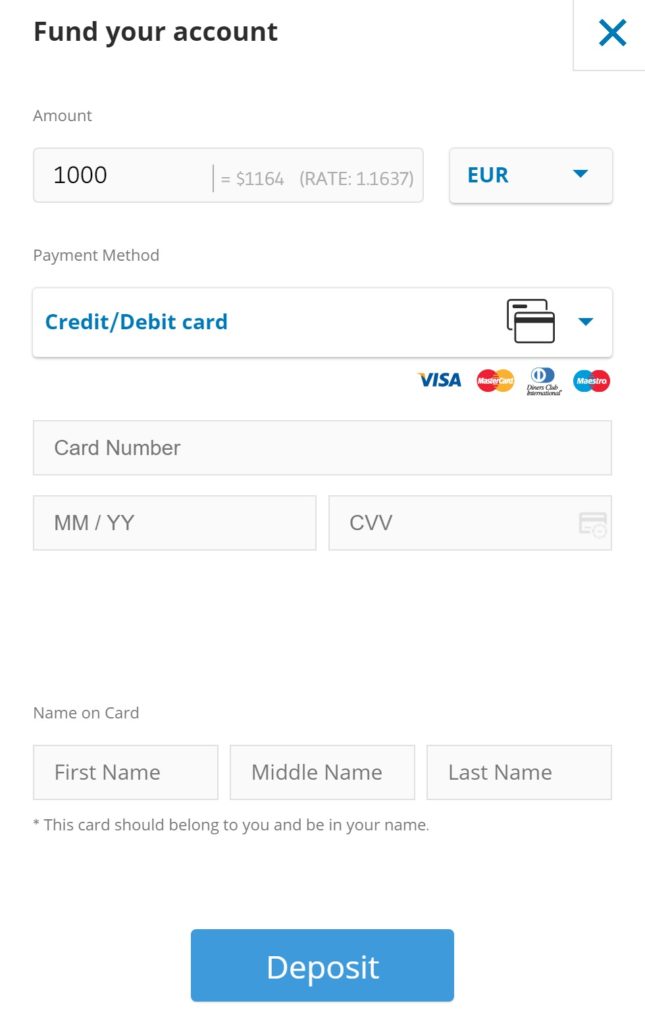

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) The eToro stock trading platform offers a variety of payment methods: This offers flexibility compared to traditional brokers, most of which only accept payments via bank transfer. Degiro is a good example of this – the deposit process takes several days. This is quite annoying and frustrating, especially if you want to buy shares immediately. At eToro, if you use a debit/credit card or e-wallet to deposit funds, the money will be credited to your account immediately and you can start trading stocks and financial instruments immediately. eToro requires a minimum deposit of $200, or around £160. Prices on eToro are denominated in US dollars because the trading platform offers over 1,700 stocks across 17 international markets. By sticking to one currency, you don’t have to worry about constant currency fluctuations. There is a 0.5% currency conversion fee for depositing funds into your eToro account. If you deposit funds in a currency other than the US dollar, you will pay a fee. For example, for a deposit of $1,000, the fee will be $5. The process of withdrawing money from eToro is also easy. From your trading account dashboard, you select the withdrawal option, then specify the amount you want to withdraw. According to the anti-money laundering laws in Bulgaria, you will have to withdraw at least the amount of the deposit to the same account from which you made it. For example, if you made a $500 deposit with your debit card and withdraw $600, at least $500 of your withdrawal request must be sent to the same debit card you used to deposit. The remaining $100 can be sent to another account. The minimum amount you can withdraw from the stock trading platform is $30. There is a flat fee of $5 for all withdrawal requests, regardless of the amount. eToro also charges a 0.5% foreign exchange fee on withdrawals. This is calculated based on the current exchange rate at the time of withdrawal. The number of shares traded and the transaction fees are extremely important indicators to pay attention to when choosing a broker. However, it is imperative to also check the regulatory reputation of the stock and financial instruments trading platform. This will ensure that you are using a reputable and trusted broker who will keep your funds safe. The eToro stock trading platform has three regulatory licenses: In addition to regulatory licenses, it is important to note that eToro has been operating in the online stock trading space since 2007. This is a total of 14 years of experience, for which it has accumulated a client base of over 30 million people. Therefore, overall, there is no room for concern about eToro client funds. The customer service department at eToro works extremely well, which is also evident in the ratings and opinions for the platform on Trustpilot. 4.4/5 stars is a pretty solid achievement, which is difficult to achieve for many other brokers. If you would like to contact the support team, you can do so via: We advise you to use the live chat as it is the best option to get timely assistance. You can also check out and seek help on the site's social profiles on Twitter (@etoro), Facebook (@eToro) & Instagram (@etoro_official). You will need to visit the eToro website to open an account for trading stocks and financial instruments. As with any FCA-regulated stock trading platform, this requires you to provide personal details - your full name, home address, date of birth and contact details. eToro will need to verify that you are the real owner of your account. Therefore, you will need to upload digital copies of some documents to prove/verify your identity. The documents are: eToro usually verifies documents within 1 hour. During this time, you can fund your account. Depositing funds to eToro is easy. You need to choose a payment method (we have described the options above) and decide how much you want to deposit. The minimum deposit is $200 (around £160). The deposit becomes active immediately, unless you fund your account with a bank transfer. In that case, the process takes a few days. Once you have funded your eToro account, you can start trading stocks. If you have researched and know which company you want to invest in, you can find it directly from the search box at the top of the page. If you want to browse the eToro stock library, click on the 'Trading Markets' option and then 'Stocks'. You can filter stocks by exchange or economic sector. We give an example of buying Nike shares, so we type the company name in the search field and click the 'Trade' button. Next, we determine how much we want to invest. As you can see, the amount is in US dollars. The minimum investment is $50 or about £40. To complete your order, click on the 'Open Trade' button during normal trading hours or 'Order' if the relevant exchange is closed at the time of submission of the request. You can find countless reviews about eToro. As one of the most popular stock brokers in Bulgaria, information about eToro can be found in multiple sources. You can also check out others like this eToro review so that you can compare who is saying what about the stock trading platform and make sure that eToro is really a quality investment and trading system. It's easy to see why eToro has amassed a client base of over 30 million investors. Not only is the platform super easy to use, but you can also buy ETFs without fees or commissions. There's no annual fee, and a wide range of deposit and withdrawal methods are supported. For advanced investors looking for more of a challenge and wanting to execute more complex trades, eToro supports leverage and short selling options available across all of the 5,000+ stocks, indices, cryptocurrencies, bonds, currencies and commodities it offers. Overall, eToro is an ideal stock trading app if you want to invest in the stock markets in a simple, safe and profitable way.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) Sources Yes! You can definitely make money with eToro if you have good strategies for trading stocks and financial instruments /or by choosing the right traders for copy trading. The fees for trading stocks on eToro depend on the type of assets traded. The commission for trading and ETFs is 0%, and for trading CFDs on stocks and other assets, a spread and overnight fee is paid if you hold the assets for a longer period. eToro charges an inactivity fee after 1 year of inactivity, as well as a $5 fee when withdrawing funds from the account. Yes - the eToro stock trading app is legal. The broker is regulated by three regulatory authorities - FCA (UK), ASIC (Australia) and CySEC (Cyprus). Yes, eToro is made extremely user-friendly for beginners. eToro offers access to over 3,000 stocks in 17 international markets, including the UK, US, Germany, France, Spain, Sweden, Saudi Arabia, etc. eToro is constantly expanding its library of stocks available on the platform. The minimum deposit required by eToro is $200. The process of withdrawing funds from eToro takes a few seconds. You need to log in to your account, select the withdrawal option, and enter the amount you want to withdraw. Depending on the payment method you choose, you will receive the money within a few days. Yes - eToro accepts Paypal. The platform also supports several other e-wallets - such as Skrill and Neteller. Yes, you can register and invest in stocks from Bulgaria through eToro. Sources Георги Стоянов е опитен анализатор в областта на икономиката, бизнеса и личните финанси. В допълнение вече над 10 години активно търгува на финансовите пазари, инвестира дългосрочно и споделя своя опит, като пише за различни онлайн медии. След като успешно завършва следването си в УНСС, също добива и магистърска степен по журналистика, Георги активно започва да се интересува и да пише по теми свързани с финанси, технологии и криптовалути. Статии на Георги са публикувани в най-популярните български новинарски портали, включително Капитал и Bloomberg. Като вече доказал се специалист, той бързо бива привлечен към развиващия се екип от журналисти и редактори на TradingPlatforms.com. Днес Георги споделя с аудиторията особеностите на търговията, предоставя ценна информация за непрекъснато променящата се икономическа и бизнес среда. Мисията на Георги е да разсее съмненията относно финансовия свят и да даде възможност на читателя да взема уверени и обмислени финансови решения. Неговата изключителна способност да предава ясно информация е многократно оценена от аудиторията на нашия уебсайт и е полезна както за начинаещи, така и за опитни трейдъри. В допълнение към основните дейности на журналист, редактор и активен трейдър, ежедневието на Георги е свързано и с постоянно лично самоусъвършенстване. Сам казва, че успешните хора се учат и развиват нови качества през целия си живот. 61% от сметките на дребни клиенти с CFD губят пари. Вашият капитал е изложен на риск. 61% от сметките на дребни клиенти с CFD губят пари. Вашият капитал е изложен на риск. ПРЕДУПРЕЖДЕНИЕ: Съдържанието на този сайт не трябва да се счита за инвестиционен съвет и ние не сме упълномощени да предоставяме инвестиционни съвети. Нищо в този уебсайт не е одобрение за определен продукт или препоръка на определена търговска стратегия или инвестиционно решение. Информацията на този уебсайт е от общ характер, така че трябва да вземете предвид информацията в светлината на вашите цели, финансово състояние и нужди. Инвестирането винаги крие риск. Когато инвестирате вашия капитал е изложен на риск. Този сайт не е предназначен за използване в юрисдикции, в които описаните търговия или инвестиции са забранени и трябва да се използва само от такива лица и по начини, които са разрешени от закона. Вашата инвестиция може да не отговаря на изискванията за защита на инвеститорите във вашата страна или държава на пребиваване, така че, моля, направете своя собствена надлежна проверка или потърсете съвет, когато е необходимо. Този уебсайт е безплатен за използване, но може да получим комисионна от компаниите, които представяме на този сайт. Продължавайки да използвате този уебсайт, вие се съгласявате с нашите условия и правила за поверителност. Регистриран фирмен номер: 103525 © tradingplatforms.com Всички права запазени 2024 г.

How to start trading with eToro in a few quick steps?

What is eToro?

eToro is an online trading platform founded in 2007 in Israel by a group of fintech entrepreneurs. The platform offers trading in a variety of assets, traditional investments, and the ability to trade contracts for difference (CFDs).

eToro is an online trading platform founded in 2007 in Israel by a group of fintech entrepreneurs. The platform offers trading in a variety of assets, traditional investments, and the ability to trade contracts for difference (CFDs).Advantages and disadvantages of eToro

What stocks can you buy with Toro?

Fractional Share Investments with eToro

ETFs

Other assets on eToro

eToro leverage

Short positions on eToro

Dividends with eToro

eToro Fees and Commissions

No fees for selling shares

Buying shares for £1,000 with eToro vs another UK broker

eToro

IG

Hargreaves Lansdown

International stocks

£1

£0 or £10

£11.95 or 1% (min £20 / max £50)

Holding a £1,000 share CFD with eToro for 1 week vs other UK brokers

eToro

MarketsX

S&P 500

£1.20

£1.30

Europe 50

£1.35

£1.25

Apple

£3.15

£3.20

Other fees

Spread

Inactivity fee

Deposit and withdrawal fees

eToro Stock Trading Platforms

Stock orders

Social and copy trading on the eToro stock trading platform

Copy trading

The best traders on eToro Traders to copy

Jay Edward Smith (Jaynemesis) – extremely highly rated trader with 68% return for 2020.

Shamsher Malik – ShamsherMalik – Trades stocks and forex with low risk (55% growth in 2020)

Mantas Dabkevicius – Mantasdabk – Swing trader (55% return for 2020)

Copying wallets

Top Trader Portfolio

Market portfolios

Charts, research and analysis at eToro

eToro mobile app

eToro demo account

Payments on eToro

Withdrawing funds from eToro

Is eToro a safe stock trading platform?

Customer Service at eToro

How to start trading with eToro?

Step 1: Opening an account

Step 2: Prove your identity

Step 3: Deposit funds

Step 4: Purchase of shares

Our opinion on eToro

Frequently asked questions:

Do you really make money with eToro?

What are the fees of eToro in Bulgaria?

Is the eToro stock trading app legal?

Is the eToro stock trading app suitable for beginners?

What stocks can be bought with eToro?

What is the minimum deposit with eToro?

How do I withdraw money from eToro?

Does eToro accept Paypal?

Can I use eToro in Bulgaria?

Георги Стоянов

Главен редактор, трейдър и финансов анализатор

eToro: Най-добрата платформа за търговия - 0% комисионна за търговия с ETF