Какво е търговията с копия? Как да инвестирате в портфолио за търговия с копия?

If you’re a novice investor who has no idea how the stock and bond world works, you might be considering ETFs or mutual funds. That’s because the dealer will buy and sell shares on your behalf. However, recently, a somewhat new phenomenon has entered the space that you might find appealing: copy trading.

In short, copy trading allows you to copy the trades of other investors from the stock trading platform you are using. As such, you have the chance to make money in the stock markets without having to do any research on which companies to invest in. Instead, the entire process is passive.

In this guide, we explain the details of what copy trading is, how it works, and whether or not it is suitable for your long-term investment goals.

How does copy trading work?

As is the case with most online investment streams these days, the copy trading process is actually relatively straightforward:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

What is copy trading?

In its most basic form, copy trading does exactly what the name suggests. This means that you will copy the trades of another investor – like-for-like. This in turn allows you to actively trade the stock markets without having to have any knowledge of how they work.

It also means that you will benefit from the expertise of the respective copy trader, as he will make any and all decisions on your behalf. The best part is that the copy trader will invest his own capital – so effectively, it reduces the threats of recklessness.

It is important to note that the copy trading phenomenon is typically offered by a number of niche stock brokers. For example, it is generally accepted that FCA-regulated platform eToro is the market leader in this particular segment.

However, there are some other brokers that are also leaders in copy trading, such as AvaSocial and its partnership with FCA-regulated Pelican Trading and Libertex with its MetaTrader 4 offering.

Top 3 Copy Trading Platforms

When it comes to copying trades from other traders, you want to make sure you have a top-notch broker that helps you find the best ones! The level of performance analysis provided is essential for making the right decision on who to copy.

You also want to make sure that the copy trading platform itself is easy to use and the fees are transparent. To save yourself some time, here are the top three copy trading platforms to get started with:

- eToro – The best overall copy trading platform

- Libertex – Access to MetaTrader 4 Signals

- AvaSocial – FCA-regulated copy trading app

We will discuss each of them in detail below.

1. eToro – The best overall copy trading platform

The level of analytical detail is truly impressive. You can see detailed statistics of all copy traders and analyze their historical performance, total profits and losses, and more importantly, feedback from other people who copy them.

Deposits are also free and you can access copy trading services for multiple asset classes including currencies, cryptocurrencies, stocks, commodities and more. If you are serious about copy trading, eToro is the RIGHT place.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. Libertex – Access to MetaTrader Signals

The platform is not as user-friendly as eToro or AvaSocial, but it does allow for algorithmic trading. Fortunately, there is good quality performance data for traders to review and analyze before choosing who to copy.

Advantages:

Disadvantages:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

How does copy trading work?

3. AvaSocial - Copy Trading App Regulated by FCA

The AvaSocial copy trading app is a partnership between globally regulated broker AvaTrade and FCA regulated Pelican Trading. Together, they provide a copy trading app that is available on Android and iOS devices.

Through the app, you can interact, follow and copy other traders with the click of a button. The performance statistics are also great, helping you find the right trader to copy. It details monthly results, trading activity, total profit and traded markets.

Advantages:

Disadvantages:

Вашия капитал е в риск.

As is the case with most online investment streams these days, the copy trading process is actually relatively straightforward.

Below we have listed the general process you will need to follow - along with some handy screenshots from leading copy trading platform eToro. However, the process remains largely the same regardless of the platform you decide to use.

Step 1: Choose a copy dealer

The first, and perhaps most important, part of the copy trading process is choosing an investor to “back.” That is, you will need to carefully choose an experienced investor that you want to copy like-for-like. Ultimately, your profits and losses will be dictated 100% by the investor’s trading results.

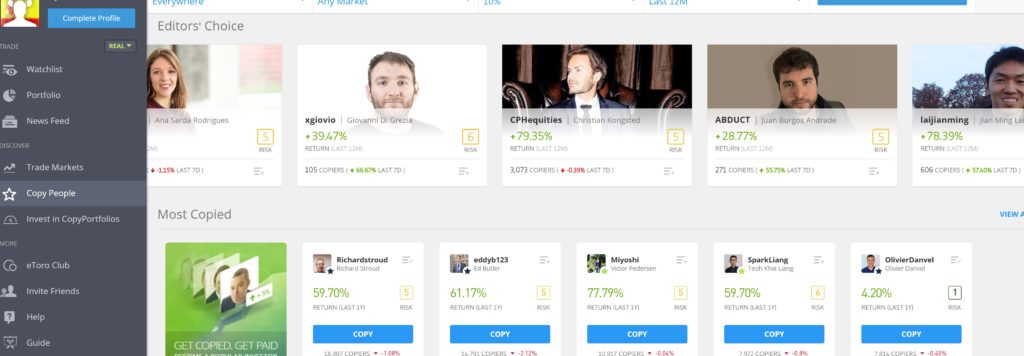

eToro Copy Trading

If you are going to use eToro to engage in copy trading, you will essentially have access to over 12 million investors. It goes without saying that the majority of these traders will not have the skill set or proven track record that would be copy worthy. As a result, it is imperative that you make full use of the filtering facilities.

You can use various filters such as location, the market you want to copy trades from, the amount the copy trader has earned in the last twelve months and more. Once you set the filters and hit “GO!”, you will be presented with an extensive list of potential copy traders to copy!

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

AvaSocial copy trading

AvaTrade has a unique copy trading offering from its partnership with FCA-regulated Pelican Trading. With the AvaSocial app, you can interact, follow and copy the trades of other traders, known as signal providers.

You can see detailed statistics for each of the providers by clicking on their profiles. This will detail their historical results, trading frequency, and how many followers and copycats they have.

Вашия капитал е в риск.

Libertex copy trading

With Libertex, you can access copy trading features through the popular MetaTrader 4 trading platform and the MetaTrader Signals tab. This allows you to see the performance of other traders using the MetaTrader platform.

The platform is a bit more complicated to use than eToro, which is super easy. Also, you may have to pay for some of the signals to copy into your trading account, while eToro is free!

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

Step 2: Analyze copy trading performance

This is where things get interesting, not least because you will have a significant amount of information at your fingertips once you click on a specific merchant profile.

For example, you will have the opportunity to explore:

Execution

Some would argue that this is the most important metric to analyze. Most importantly, it gives you a complete breakdown of how the trader has performed on the platform since joining. This is where you need to tread with caution, especially when it comes to the timeframe.

For example, while a trader may be 40% in the green, this may only be based on 3 months of trading. This would mean that the trader is taking significant risks. Instead, it is best to stick to copy traders who have at least 12 months of experience.

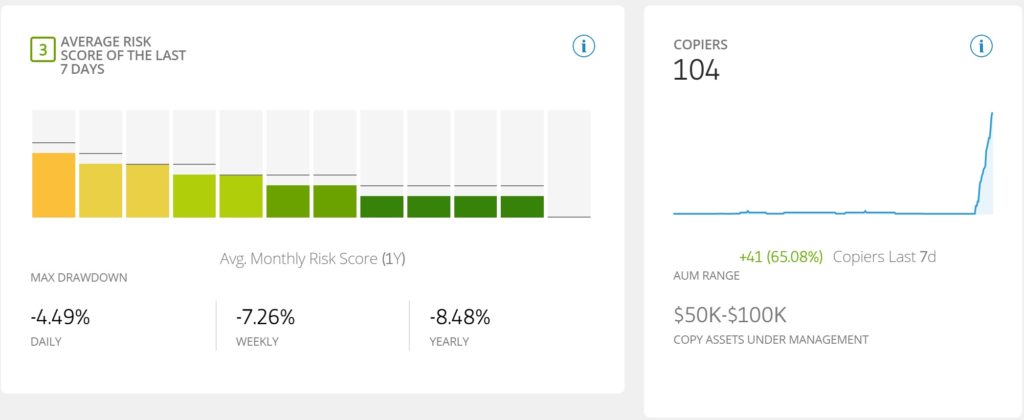

Copycats and AUM

You can see how many people are currently copying the investor in question. If an investor has a large number of followers, this is usually a good sign.

You can also look at the investor's AUM (assets under management). This figure won't play a significant role in the selection process, but it's interesting nonetheless.

Trading statistics

This particular set of statistics is useful because you can see the investor’s mindset. For example, you get a full breakdown of what assets the trader likes to buy and sell. If you want to stick exclusively to stocks and bonds, you’ll need to evaluate this particular statistic before parting with your money.

You can also see the average profit and loss for each trade. This number is also useful as it gives you an idea of what the trader is typically looking for in terms of profit. It also highlights how much the trader is willing to go into the red before exiting their position.

Average values

At the bottom of the trader’s profile, you can see some interesting averages. For example, you can see how many trades the investor typically makes each week. The higher the number, the more active the trader is. Similarly, if this is a low number, the investor is likely to favor a long-term “buy and hold” strategy.

You can also see the average number of days an investor keeps a position open. Once again, this will give you a clearer indication of whether the investor prefers a more short-term or long-term strategy.

Risk rating

eToro will also assign the investor a risk rating, which is updated frequently. The risk meter goes from 1 -10. The lower the number, the less risk the trader is taking. The level of risk you are comfortable with will ultimately be up to you .

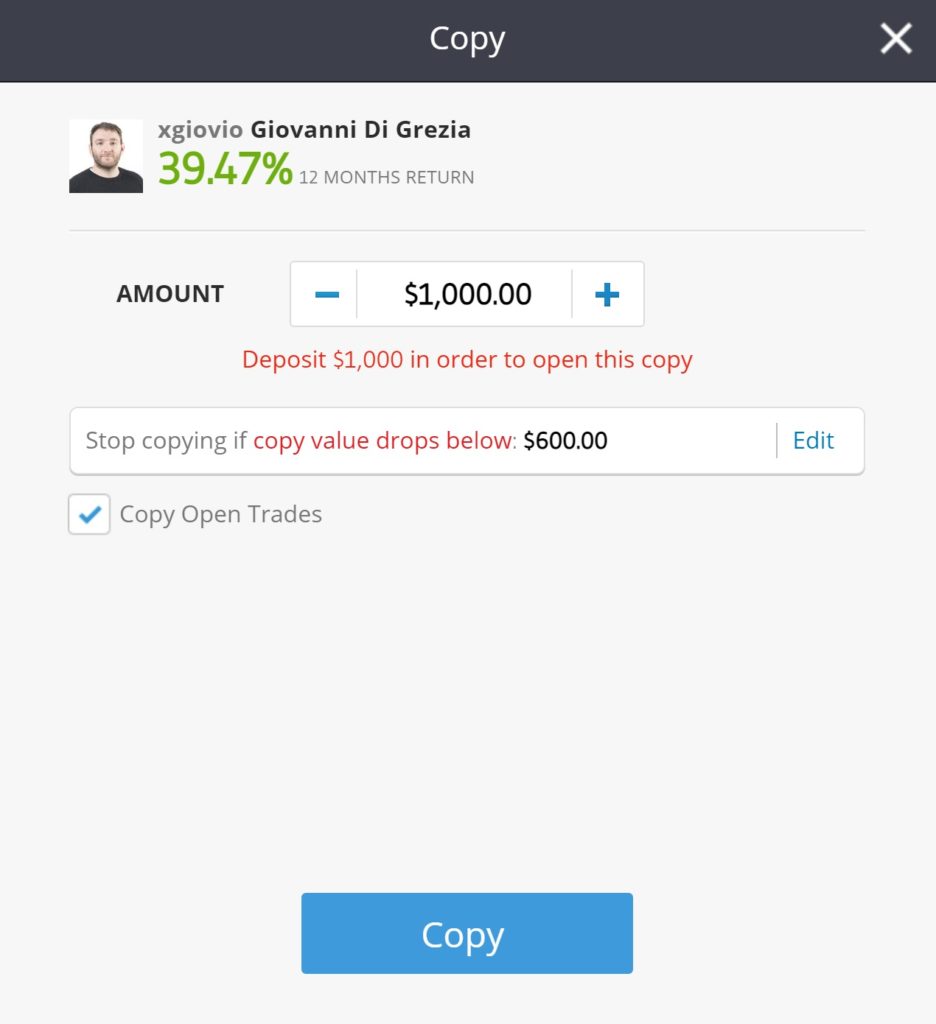

Step 3: Decide how much you want to invest

Once you have chosen a trader you like, you will need to determine how much you want to invest. There will always be a minimum investment threshold, which will vary depending on the platform you choose. In the case of eToro, this is a minimum of $200 (£160) per copy trader portfolio.

As soon as you confirm the investment - the funds will be taken from your brokerage account balance and allocated to the trader's wallet.

Step 4: Copy the Like-for-Like Portfolio

Once you make an investment, your personal portfolio of stocks and bonds will be updated accordingly. To illustrate how this works in the easiest way possible, it's best to give you a basic example.

To make things easier, let's assume that the copy trader has the following portfolio:

- £10,000 worth of shares in Tesco (20%)

- £20,000 worth of shares in HSBC (40%)

- £20,000 worth of shares in Royal Mail (40%)

While it is clear to see that the total value of the portfolio is £50,000 - this number is actually irrelevant. Instead, for the purposes of copy trading, we are more concerned with the 'weighting' of the portfolio. In layman's terms, this means how much each individual stock contributes to the wider portfolio. This is because your personal portfolio of shares will reflect this weighting on a like-for-like basis.

For example:

- Let's say you decide to invest £2,000 in the copy trading portfolio.

- 20% of the portfolio will be in Tesco shares worth a total of £400

- 40% of the portfolio will be in HSBC shares worth a total of £800

- 40% of the portfolio will be in Royal Mail shares worth a total of £800

As you can see from the above, your portfolio now reflects that of your chosen investor - but in an amount proportional to what you invested!

Step 5: Copy Current Like-for-Like Deals

Once your personal portfolio mirrors that of your chosen copy trader, there is no need to do anything else. However, it is important to remember that the investor will be actively buying and selling stocks while they are on the stock trading platform.

In other words, if the investor decides to sell all of their BP shares, then your BP shares will also be sold. Similarly, if the investor decides to add Facebook shares to their portfolio, your portfolio will also contain Facebook shares.

This is where things get a little confusing, as eToro copy traders will often deposit additional funds so they can add more stocks to their portfolio. In this case, you have two options:

Add more funds

When the investor deposits more funds, you will receive a notification. In most cases, the investor will publicly announce that they intend to add more funds, which gives you time to prepare. Either way, if you want to truly reflect the investor as like-for-like, you will need to deposit more funds - in a proportional amount.

- For example, if an investor initially had a portfolio worth £50,000 and they add £10,000 - then they increase their position by 20%.

- So if your portfolio is worth £2000, you will need to add another £4000 (20% of £2000).

Automatic retuning

If you decide not to add more funds to your copy portfolio, your position will be adjusted automatically. In other words, eToro will have to sell some of the shares you currently hold to make room for the new purchase. In this sense, you will still reflect the investor, but the weighting will not be 100% accurate.

How do you make money from copy trading?

If you’ve read our in-depth guide to ETFs and mutual funds, then you should already have a solid understanding of how you make money with a copy trading portfolio. If not, you’ll make money the same way you would if you bought the stocks on a DIY basis. As such, you can make money in the form of capital gains and dividends.

- Capital Gains: Let’s say you invest £5,000 in a copy trading portfolio that contains 25 different stocks. At the end of the first year, the total value of the stocks has increased by 10%. As such, the value of your copy trading portfolio is now £5,500. If you were to exit your position, your capital gains would be £500.

- Dividends: If your copy trading portfolio contains dividend stocks, then you will be entitled to your share. Unlike an ETF or mutual fund, your dividends will be paid out as soon as they are distributed by the company. This is great news if you want to take advantage of compound interest. In terms of how much you will receive, it will be proportional to the amount you have invested in the particular dividend-paying stock.

Top Tip: To reduce the risk of overexposure to a single copy trader, it can be worth diversifying across several different investors. However, you should make sure you meet the $200 minimum investment in each copy trader – if you use eToro .

What copy trading fees should I know about?

The fees you pay when using the copy trading feature will depend on the platform you choose.

Overall, copy trading portfolios are an interesting alternative to other passive income streams like ETFs and mutual funds. This is because you will be able to personally choose an experienced trader that you like by analyzing their profile. In addition, and perhaps most importantly, you get much more control over the copy trading portfolio. This is because you can adjust your portfolio whenever and however you see fit. For example, while you may agree with 90% of a trader’s stock purchases, you may not want to be exposed to the technology sector. If that’s the case, you can manually exit those positions and keep the rest of your portfolio active! Similarly, you can buy shares in any company of your choice. Just make sure you understand the risks of copy trading. After all, just because your chosen investor has impeccable track record in stocks and bonds doesn’t mean it will be endless.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)Conclusion

eToro – Number 1 Stock Trading Broker in Bulgaria

FAQs

Can you make money from copy trading?

Can I tell the copy trader what stocks to invest in?

How much does copy trading cost?

How long is my money locked in a copy trading portfolio?