Най-добрите CFD брокери в България за 2026 г.

If you want to actively trade stocks to take advantage of tight spreads, low commissions, leverage options and short selling opportunities – you may be suited to specialist CFD brokers.

In this guide, we will discuss the best CFD brokers for trading stock CFDs. It is crucial that each broker meets a set of minimum requirements to ensure that you can trade stocks in a safe, convenient and profitable way.

Comparison of the best CFD brokers in Bulgaria

We review the best CFD brokers in more detail further down the page, but if you’re just looking for a quick summary, here’s a list of the best CFD brokers for 2026.

- eToro – Best all-round CFD broker

- Libertex – The MT4 (Meta Trader 4) Built CFD Broker

- AvaTrade – Popular online trading platform with tight spreads

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

[stocks_table id=”15″]

What is CFD?

Before we continue, it’s important to quickly establish what we mean by “CFDs” – not least because you’ll be trading more complex financial products. In their most basic form, CFDs – or contracts for differences, are designed to track the actual price of an asset.

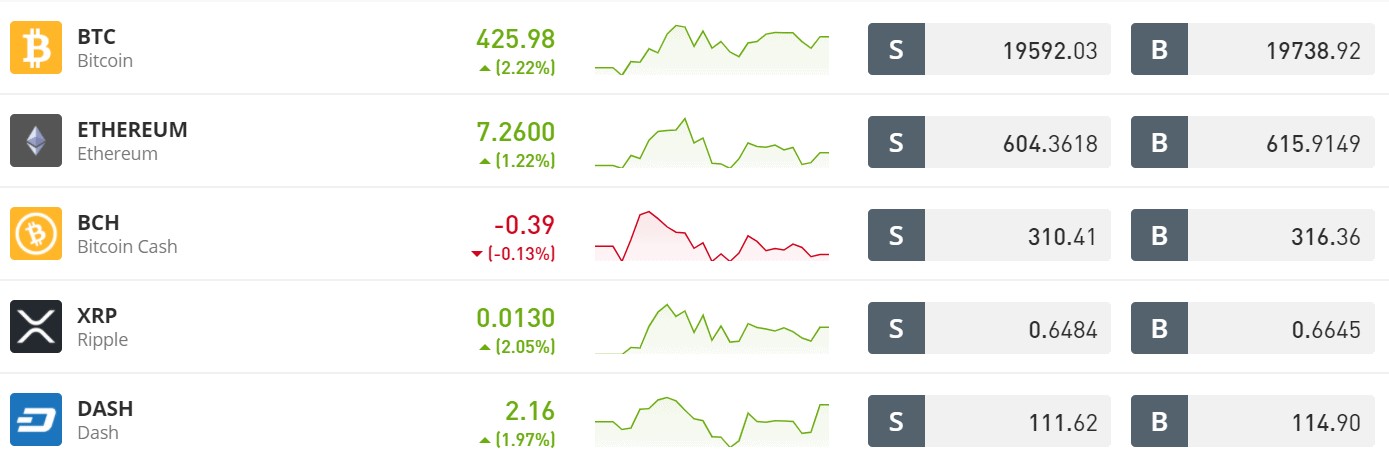

This includes not only stocks and shares, but practically every investment class imaginable. Whether it’s gold, oil, natural gas, bonds, indices or cryptocurrencies – if there is a market, there will be a CFD instrument.

The ease with which CFDs can track the movement of a stock price second by second offers numerous advantages for the day trader. For example, you will often find that the best CFD brokers allow trading, as well as highly competitive spreads.

Additionally – and perhaps most relevantly – CFDs on shares can be traded with leverage and you will also be short selling the relevant company. This means you can speculate on the value of the shares going down – which would otherwise not be possible using traditional stock brokers.

The best CFD brokers in Bulgaria for 2026

Choosing the right CFD broker for your trading needs is essential. For example, are you looking to trade stocks from a specific exchange or market, or are you more concerned with low commissions and tight spreads?

Similarly, you may be looking to deposit and withdraw funds with a specific payment method or want access to an advanced trading platform like MetaTrader4.

Either way, these are some of the questions that a CFD broker should ask you before you sign up. To help you out, below we have listed the best CFD brokers currently serving clients from Bulgaria.

1. eToro – The best CFD broker in Bulgaria for beginners

However, this is provided that you do not keep your position open overnight, as this will incur funding fees. However, this is standard in the industry.

In terms of tradable markets, the stock CFD library at eToro covers the London Stock Exchange, as well as exchanges in the US, Germany, France, Japan and many more. You can place both long and short positions in your stock CFD trade, as well as apply leverage.

According to ESMA restrictions – this is capped at a ratio of 1:5. The trading platform itself is original to eToro and was built with the “beginner investor” in mind. While this is ideal if you are just starting out, it probably won’t be enough if you are an experienced trader.

Outside of its stock library, you can also trade CFDs in the form of indices, cryptocurrencies, bonds, and commodities. An additional option to consider as a beginner is the platform’s copy trading feature.

Next steps with eToro

Once you have chosen an experienced trader that you like, you can mirror their trades as similar ones. When it comes to safety, eToro is licensed by the FSC, CySEC and ASIC – so you have regulatory oversight on three fronts.

Getting started with an account takes minutes – which you can do online or via the eToro app. Minimum deposits start at $200 (around 323 BGN), which you can do with a debit/credit card, e-wallet or bank account.

Regardless of the payment method, all deposits come with a 0.5% conversion fee – as eToro is denominated in US dollars. Finally, eToro has a minimum withdrawal of $50 – with all withdrawals costing a $5 fee.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. Libertex – The best among all CFD brokers for trading via MT4

Instead, you will pay a small trading commission - which is charged against the value of your order. The platform now boasts over 2.2 million clients worldwide and is regulated by CySEC.

This particular regulator is a tier-one licensing authority based in Cyprus, so you should have no issues regarding the safety of your funds.

In terms of leverage, this is limited to 1:30 for retail clients and 1:600 if you are considered a professional trader. As for the trading arena, Libertex offers full support for MetaTrade4 (MT4).

This means you can automate your CFD trades via an autonomous robot or EA (Expert Advisor). You will also have access to a wide range of technical indicators and you will customize your trading screen to reflect your personal requirements.

Advantages:

Disadvantages:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

3. AvaTrade – Popular online trading platform with tight spreads

AvaTrade is a good option for those of you looking to trade CFD assets using a day trading strategy. This is because the platform offers some of the tightest spreads in the industry.

For example, most major forex pairs offered at AvaTrade can be traded at spreads as low as 1 pip. In addition to this super-competitive spread structure, AvaTrade allows you to buy and sell CFD instruments commission-free.

When it comes to tradable markets, AvaTrade offers thousands of financial assets. In addition to forex, this includes bonds, stocks, indices, commodities, cryptocurrencies, options, and futures. So if there’s a market you’re interested in, chances are you’ll find it on AvaTrade.

What we also like about AvaTrade is that it offers multiple trading platforms. For example, you can use the AvaTrade platform via your web browser or via a mobile app for Android/iOS.

Additionally, the platform also supports MT4 and MT5, which is great for advanced chart analysis and implementing automated robots, making it the best MT5 broker in Bulgaria. We should also note that AvaTrade offers spread betting. If you are in Bulgaria, this means that all profits are capital gains tax free.

If you like the sound of AvaTrade but want to test the platform first, the CFD broker offers a demo account option. You don’t need to deposit any funds to use this, which is great for getting to know the platform before taking the financial plunge.

Minimum deposits on the platform are $100 – which you can do via debit/credit card or bank transfer. Finally, AvaTrade is highly regulated and holds licenses in several countries.

Advantages:

Disadvantages:

Вашия капитал е в риск.

How to find the best CFD brokers in Bulgaria?

Regardless of which CFD broker in Bulgaria you choose, the end-to-end investment process works largely the same way. In other words, you will always be required to create an account, upload some form of identification, deposit funds, and then place buy and sell orders on a do-it-yourself basis.

With this in mind, your focus should be on key metrics such as fees, commissions, payment methods, security and customer support. Below, we will discuss these key factors in more detail to ensure you choose a CFD broker that is closely aligned with your needs.

Regulation of CBD brokers

You will be depositing and trading real funds - so it is extremely important that your money is protected. That is why you should only consider a CFD broker in Bulgaria if it is authorized and regulated.

Some of the most well-known financial regulators for the CFD industry include the Bulgarian Financial Services Commission, CySEC, and ASIC. These regulators provide regulations that ensure that retail clients are protected with segregated accounts and negative balance policies.

Deposits, Withdrawals and Payments

You should also visit the CFD broker’s website to assess what payment methods they support. This is crucial as you will be depositing and withdrawing real money.

Although the typical payment methods available to you will vary depending on the broker, this may include:

- Debit cards

- Credit cards

- Bank transfers

- PayPal

- Skrill

- Neteller

Once you have decided which payment method you want to use, check whether transaction fees apply. You should also research how long it takes for the CFD broker in Bulgaria to process withdrawals and whether there is a minimum withdrawal threshold.

Fees, Commissions and Spreads

You will have to pay a fee for online CFD trading, so this should also be part of the due diligence process.

In particular, watch out for:

- Spread : The spread is the difference between the bid and ask price of a CFD. The best CFD brokers will usually display this as the ‘bid’ and ‘ask’ price respectively. Either way, you’ll want to make sure that the platform you choose offers competitive spreads, not least because this will contribute to your end-to-end trading costs. If you can get your CFD spreads below 1 pip, you’re doing well.

- Trading Commissions : Some, but not all, CFD brokers will charge you a trading commission. For example, IG charges 0.10% when trading CFDs on shares in Bulgaria - with a minimum of 10 BGN. In other cases, eToro does not charge any commissions.

- Overnight funding : If you plan to trade leveraged CFDs on shares, you may have to pay an overnight funding fee. As the name suggests, this is if you leave your CFD position open overnight. CFD brokers base this on an annual percentage rate that is spread out each day. In most cases, you can see the specific fee before you make your trade.

Tradeable markets at CBD brokers

The best CFD brokers will give you unlimited access to a wide range of stock exchanges. While some of you may want to focus on Bulgarian companies, others may prefer to take a more diversified approach.

See what markets the CFD broker offers. Similar to eToro and IG, they trade exchanges from the USA, Canada, Germany, France, South Africa, Saudi Arabia, Finland and more!

Features and tools of CBD brokers

On top of the basics - we would also suggest researching what trading features and tools the CFD broker offers.

This may include:

- Technical Indicators : If you want to be successful in your CFD trading ventures on stocks, you will need to learn the ins and outs of how technical indicators work. This will ensure that you have the ability to read and interpret price trends. The best CFD brokers usually provide dozens of technical indicators - however, be sure to check.

- Mobile Trading : CFD trading is typically done on a short-term basis. That is, experienced investors often hold a position open for a few minutes or hours - so they need to be "on the alert" when a new trend takes hold. So the best CFD brokers will offer a free stock trading app.

- Educational resources: If you have little or no experience trading CFDs, it’s best to stick with a broker that offers educational resources. This could be anything from a set of how-to guides, video explanations, and even live webinars.

- Leverage : If you have a bit more risk tolerance, the best CFD brokers usually offer leverage of up to 1:30. This is reduced to 1:5 when trading stock CFDs.

- Negative Balance Protection : Although it is now the norm for CFD brokers, it is best to make sure that the provider has negative balance protection. This means that a failed leveraged trade will not push your account balance into negative territory. Instead, your position will be closed when your balance reaches zero.

Getting started with Bulgarian CFD brokers today – Quick guide

Are you based in Bulgaria and want to start trading CFDs today?

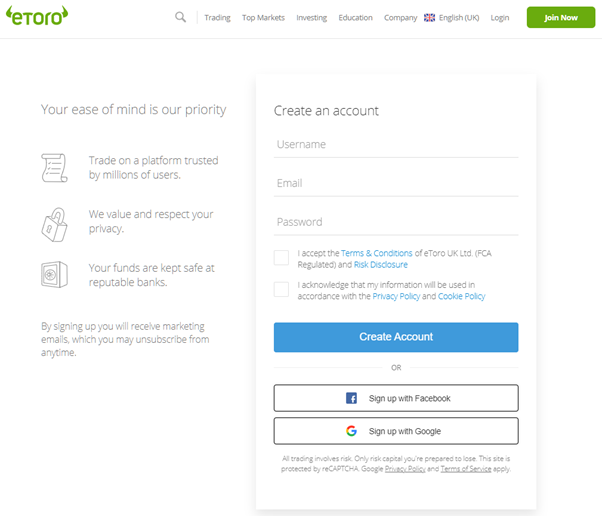

If so, below you will find a quick step-by-step guide to get you started in minutes. We based our demo on the popular CFD broker eToro - but feel free to use any platform of your choice!

First and foremost, go to the eToro website and choose to create an account. As is the case with all CFD brokers regulated by the FSC, you will be required to provide personal information.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) This includes: You will also need to upload some identification documents – in accordance with Bulgarian anti-money laundering laws. This includes a passport or driver’s license and a recent utility bill or bank statement. eToro accepts several payment methods in Bulgaria. To deposit funds, you can choose from a debit/credit card, e-wallet, or bank account. Minimum deposits start at $200. All deposits at eToro are credited instantly (except for bank transfers, which take 1-3 business days). Once your account is verified and funded, you can start trading CFDs immediately. You will then be asked to place an order. In our example, we are looking to trade CFDs on Apple shares.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика) Once your CFD trade is executed on eToro, it will remain active until you close the position manually or your take profit/stop loss order is triggered.Step 1: Create an account and upload an ID

Step 2: Deposit funds

Step 3: Place a CFD trade

Finding the best CFD broker for your individual trading needs is imperative. Not only should you make sure your research covers the broker’s regulatory status and reputation, but also other metrics such as tradable assets, fees, commissions, spreads and payouts. If you want to get started today, eToro is popular with investors in Bulgaria. You can open an account in minutes, instantly deposit funds with a debit/credit card, and then trade CFDs with the click of a button.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)Conclusion

eToro – Comparison of the best CFD brokers in Bulgaria

Frequently Asked Questions

Is CFD trading legal in Bulgaria?

Do I own the asset when I trade a CFD?

How can I get higher leverage limits when trading CFDs?

Can I transfer a CFD position to another broker?

Do CFD brokers in Bulgaria accept PayPal?