Търговия онлайн на форекс: Най-добрата форекс платформа 2026 г. коя е най-евтина?

If you are considering buying and selling currencies online, you will need a top-rated forex trading platform. A simple Google search will reveal thousands of potential platforms. Finding the best forex platform for you can be a lengthy process. You will need to research a number of things, such as supported currency pairs, commissions, minimum trading account balances, and regulation.

In this guide, we review the best forex trading platforms in 2026 . We will also walk you through the necessary steps so that you can start buying and selling currencies on a highly rated forex trading platform online.

Top forex trading platforms in 2026

We present you with a list of the best forex trading platforms that we have found to offer a great overall user experience. You can find a full review of each provider below.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

Best Forex Trading Platforms & Fees Comparison 2026:

To find the best forex trading platform online, you need to check and compare multiple indicators.

For example, what currency pairs the provider allows you to trade and under what conditions (fees and commissions). You should also consider the supported payment types, ease of use and security.

To save you hours of research, we have selected the best forex trading platforms in 2026.

1. eToro – The best forex platform 2026

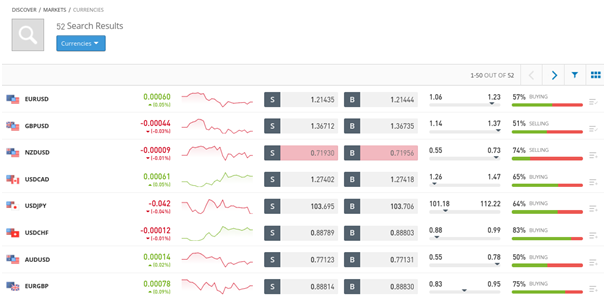

The platform allows forex trading, with profits made from the spread. eToro supports over 50 currency pairs for you to trade.

These include a significant number of major and minor currency pairs, as well as a selection of exotic currencies, such as the South African Rand and the Hungarian Forint. You can trade all supported currency pairs with leverage on eToro. For most users, the leverage is 1:30 for major currency pairs and 1:20 for minor and exotic pairs.

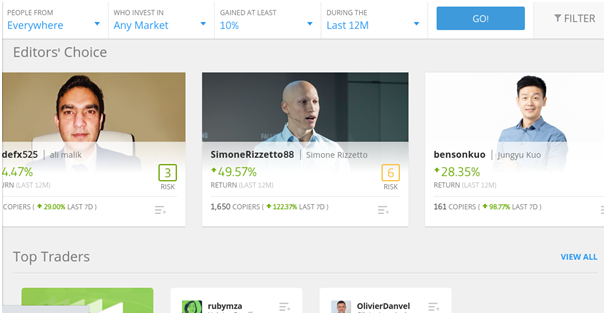

What we really like about eToro is that it is also suitable for novice forex traders. With the platform, you can choose to “copy” an experienced forex trader one-on-one.

There is no additional charge for this, and the minimum investment is $200. eToro is regulated by the FCA, CySEC, and ASIC. The company holds client funds in segregated bank accounts and verifies the identities of all investors, ensuring a safe and healthy environment.

The platform supports debit/credit card payments, e-wallets, and bank transfers, so you can easily fund your trading account. In addition to forex, with eToro you can trade commission-free ETFs.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

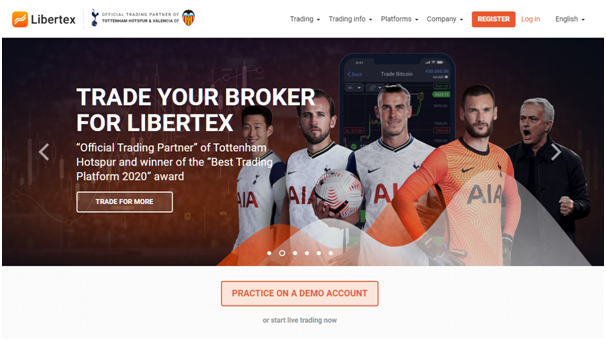

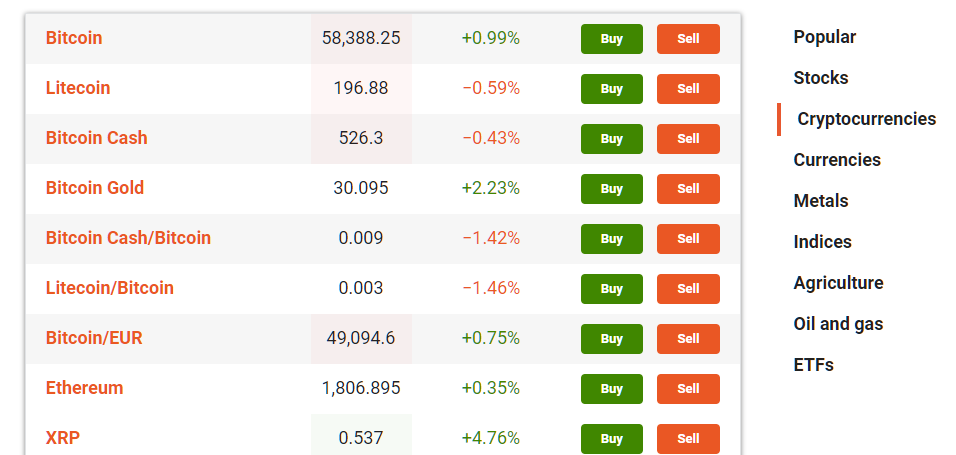

2. Libertex - The best forex platform with zero spreads

<

Libertex has a small commission on buying and selling and maintains zero spreads. Currency trading is done via CFDs, which means you can profit from both rising and falling markets.

There are multiple account types, and the VIP+ account gives a 50% commission discount along with many other additional trading features. The broker also provides its own feature-rich web platform that provides sentiment indicators, live news, and other features.

Advantages:

Disadvantages:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

3. AvaTrade - The best online forex trading platform with access to multiple trading tools

AvaTrade is a forex broker that offers a wide range of different account types, including CFD trading, options trading, and swap-free trading accounts. Using a broker that offers such variety allows for flexibility in different market conditions.

The broker also offers a full range of forex trading platforms, which include MetaTrader 4, MetaTrader 5, AvaOptions, AvaSocial, and AvaTradeGO. With these platforms, you can perform algorithmic trading, options trading, social trading, and copy trading on desktop, web, and mobile platforms.

You can trade over 1,250 global markets, including all major, minor and exotic currency pairs, commission-free. AvaTrade is regulated in six jurisdictions, including the CBI, ASIC, FSA, FSCA, FRSE and BVI FSC.

Advantages:

Disadvantages:

Вашия капитал е в риск.

How to choose the best forex trading platform for you

Having reviewed the best forex trading platforms for 2026, we will now explain how you can find a provider yourself. After all, not all brokers are created equal, so you need to make sure that the platform is conducive to your forex trading needs.

Below you will find a list of important factors to consider when searching for the best forex brokers.

Regulation

Trillions of dollars of currency are traded daily in the global forex market. In most parts of the world, this online forex trading scene is highly regulated. Not all forex trading sites have the necessary license or permit to operate in the countries they serve.

In other cases, although the platform may hold a license, it may be from shady offshore financial authorities. Therefore, only open trading accounts with platforms that are regulated by reputable regulators.

Such are:

- FCA (United Kingdom)

- ASIC (Australia)

- FINRA (USA)

- SEC (USA)

- CySEC (Cyprus)

- MAS (Singapore)

- IIROC (Canada)

By choosing a forex trading platform that is regulated by one or more of the above authorities, you can be sure that it is safe.

For example, our top-rated forex trading platform, eToro, is regulated by the FCA, CySEC, and ASIC. It is also registered with FINRA in the US. Overall, these bodies have strict requirements for the forex brokers they oversee, all of which focus on fairness, transparency, and investor protection.

Forex currency pairs

There are many forex pairs that you can trade from home. Most online forex trading sites offer most major and minor forex pairs.

These are the most sought-after pairs as they carry the highest trading volume and liquidity. They also have the tightest spreads.

The best forex trading platforms also offer many exotic currency pairs. eToro, for example, allows you to trade many emerging currencies against the US dollar and the euro. Although more volatile, this trading is interesting for experienced forex traders.

Taxis

All forex trading platforms are in business to make a profit. How they do this varies from platform to platform. It is essential to check what fees are charged by your chosen forex trading site.

The main fees charged by the best forex trading platforms are:

Forex trading commission

Some forex trading platforms charge a commission on every buy and sell order you place. It is usually in the form of a variable percentage, with the exception of a few platforms.

For example:

- Let's say you are trading EUR/GBP and your chosen broker charges a commission of 0.1%.

- You place a buy order for $500

- This means that to enter the trade, you will pay a commission of $0.50 (0.1% of $500)

- When you get to closing your deal, it is worth $600

- Closing the deal will result in the payment of a new commission, this time of $0.60 (0.1% of $600).

The best forex platforms for 2026 allow you to place buy and sell orders without commission. In this scenario, you will pay a fee in the form of a spread.

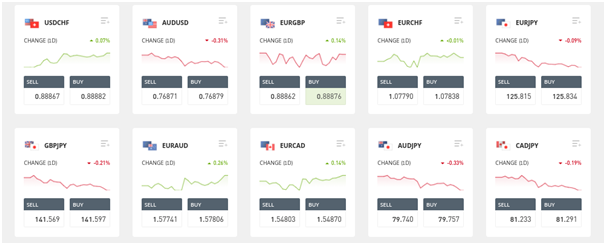

Spreads in forex trading

All forex trading platforms make money from the spread. This is the difference between the buying and selling price of a currency pair.

Unlike traditional financial markets, forex spreads are calculated in pips. In terms of what is considered competitive, the best forex trading platforms offer spreads for major currency pairs that are less than 1 pip.

If you are not familiar with the spread, it is an indirect cost that you must cover to get back to the break-even point in your forex trading.

For example:

- If you trade GBP/USD

- The spread offered during your activity is 0.8 pips

- This means that when you enter the trade, you will be 0.8 pips in the red

- This means that your position needs to increase in value by 0.8 pips to break even.

- All gains above 0.8 pips are pure profit.

It is important to note that most forex trading platforms offer variable spreads. This means that the spread can change throughout the day depending on market conditions. The more volatile the currency pair, the wider the spread will be.

Leverage fees

Unless you have a significant amount of capital in your forex trading account, you will likely need to use leverage. When trading leveraged products, this also requires overnight funding fees.

The overnight fee is paid to your chosen platform for keeping your position open overnight. This fee will be deducted from your account balance and charged daily for as many nights as your position remains open.

You should check the overnight fee of your chosen platform. It is usually expressed as a percentage and multiplied by your stake. The more you stake and the higher the leverage you apply, the more you will pay.

Other fees

The best forex trading platforms may also apply some other fees.

Such are:

- Inactivity Fee: Even the best forex trading platforms charge a fee if your account is inactive for a certain period of time. This period is usually 12 months, but it can be shorter.

- Transaction fees: You may be charged a fee when depositing and withdrawing funds.

- Currency Conversion Fees: Some forex trading platforms charge a fee when you trade a currency other than your base currency. For example, if your account is denominated in dollars and you trade EUR/GBP, a currency conversion fee will be charged.

Trading tools and features

Being able to trade forex online and make consistent profits is a daunting task, especially if you are a novice trader. Check to see if your chosen forex platform offers a selection of tools and features that can take your currency trading efforts to the next level.

This includes:

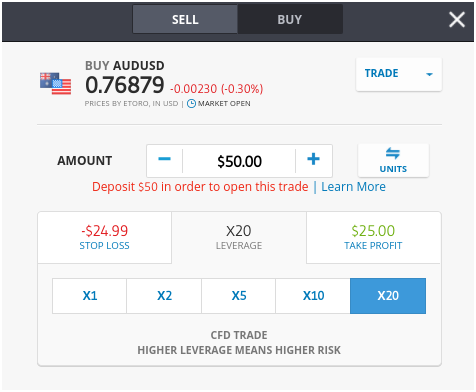

Leverage

As we said, being able to make a living trading forex without investing a huge amount of capital can be challenging. This is because you will be targeting very small profit margins - especially when day trading.

Затова се нуждаете от ливъридж, така че не забравяйте да проверите дали избраната от вас платформа предлага и при какви условия. Лимитът ви за ливъридж се определя от държавата ви на пребиваване - за Обединеното кралство, Европа и няколко други региони ливъриджът е ограничен до 1:30.

Видове поръчки

Най-добрите платформи за форекс търговия ви дават достъп до много видове поръчки. Освен купува/продала и пазар/лимит поръчки, хубаво е да има и стоп-загуба или тейк-профит поръчки. Това ще ви позволи да търгувате форекс с минимален риск.

Други видове поръчки, които най-добрите платформи за форекс търговия предлагат, са:

- Последваща стоп-загуба

- Гарантирана стоп-загуба

- Поръчка за деня (GFD)

- Поръчка “до отмяна” (GTC)

- Поръчка “едната отменя другата” (OCO)

Автоматизирана търговия

Най-добрите форекс брокери предлагат инструменти за автоматизирана. eToro например предлага инструмент за копиране на търговия, който ви позволява да копирате поръчките на друг опитен инвеститор.

С тази функция всеки път, когато избраният от вас инвеститор постави поръчка, точната позиция ще бъде отразена във вашата собствена сметка. Ключовият момент е, че размерът на вашия залог ще бъде пропорционален на това колко сте решили да инвестирате с eToro.

Ето как работи тази функция:

- Инвестирате $ 500 в популярен форекс инвеститор чрез функцията за копи търговия на eToro

- Трейдърът рискува 5% от портфейла си, като ги влага в поръчка купува GBP/USD с ливъридж 1:25

- Поставяте същата поръчка, като делът ви е 25% (5% от вашите $ 500 инвестиция)

- Трейдърът затваря позицията след ръст от 10%

- Вие печелите 10% от $ 25 – $ 2.50. Приложили сте обаче и ливъридж 1:25, така че вашата обща печалба от тази сделка би била $ 62.50

Както е посочено по-горе, инструментът за копи търговия на eToro ви позволява активно да купувате и продавате валути без да си мръднете пръста. Това е чудесно за начинаещи или за инвеститорите, които нямат много време за проучвания на пазара.

EA във форекс

Друг начин за автоматизирана търговия онлайн на форекс е EA (Expert Advisor). Наричан още и форекс робот, EA е софтуер, който има възможност да търгува от ваше име.

За разлика от инструмента за копиране на търговия в eToro, EA се основава на предварително програмирани алгоритми. Това означава, че той има капацитета да сканира валутните пазари 24 часа в денонощието, 7 дни в седмицата.

За да се възползвате от EA, трябва да се регистрирате с платформа за търговия, която поддържа MT4. Много от най-добрите платформи за форекс търговия, които разгледахме, предлагат тази платформа. След това трябва да инсталирате ЕА на МТ4 и да активирате софтуера.

Сигнали

За да сте сигурни, че ще следите пазара по всяко време, най-добре е да изберете платформа за форекс търговия, която има възможност за настройка на сигнали. Още по-добре е ако сигналите могат да се доставят до мобилния ви телефон в реално време.

For example, you might receive a notification if a major currency pair you are trading breaks a key level you are targeting. Or the platform might notify you when news breaks that could affect the future price of a currency pair.

The best forex trading platforms ensure that you never miss important fundamental and technical events.

Training, research and analysis

If you're new to online forex trading, it's best to choose a platform that can help you improve your knowledge. eToro, for example, offers everything from forex trading guides and videos to weekly webinars.

When it comes to research, the best forex trading platforms offer financial news and market information. This helps you stay up to date with key market trends and supports you in making trading decisions.

In terms of technical data, the best forex trading platforms offer advanced chart reading tools. This should include customizable screens, technical indicators, and chart drawing capabilities.

User experience

The forex industry is extremely dynamic and exchange rates change in seconds. That’s why it’s important that the forex trading platform you choose offers a great end-to-end user experience. For example, how easy is it to find your chosen forex market and are there any difficulties in placing orders?

In our research, we found that there is often a huge difference in how user-friendly a forex trading platform is. For example, the likes of eToro are really easy to use - both the desktop version and the mobile app.

Demo account

We briefly mentioned forex trading demo accounts. They allow you to practice forex trading in a safe environment, without the risk of loss. The best forex trading platforms offer demo accounts that reflect real trading conditions.

This way, you will learn everything about the market and practice until you feel ready to enter this field with your own funds. Note that some forex trading platforms place a limit on the time you can use a demo account, for example, 30 days.

Payment methods

The best forex platforms support a huge selection of payment methods. This makes the process of withdrawing and depositing funds easier. eToro, for example, supports payments with debit and credit cards, as well as e-wallets.

Some of the forex trading platforms we reviewed only accept bank transfers. If you use a platform based in your country of residence, you will also be able to take advantage of instant deposits. In many cases, it can take a few days for bank transfers to arrive and be reflected in your forex trading account.

Customer service

The best forex trading platforms offer live chat that is available at least 24/5. This means you can speak to a customer service agent in real time without having to call.

Some platforms only offer customer service via email, which means you may have to wait a few hours to get a response.

How to do forex trading

If you've read this guide so far, then you know what it takes to find a forex trading platform that suits your needs. All that's left to do now is place your first forex trading order.

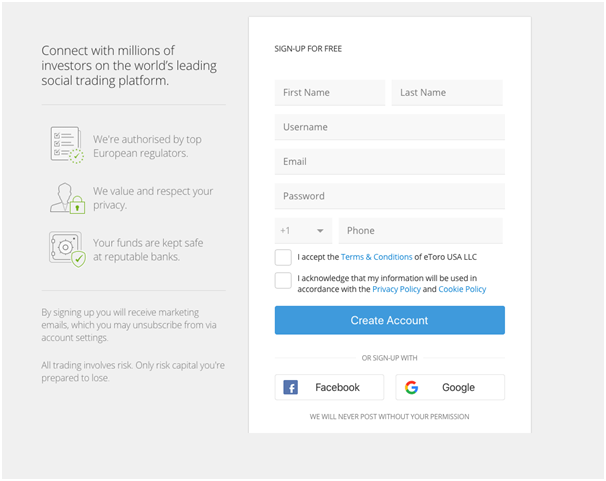

To make sure you know what this involves, we'll walk you through the process on the eToro platform, where you'll trade commission-free.

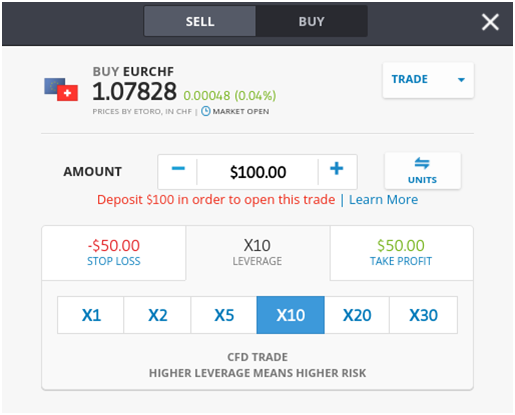

Even if you want to use eToro for demo trading, you will still need to open an account. This only takes a few minutes. Visit the eToro website, click the ‘Join Now’ button and follow the instructions. Fill in the personal and contact details that are requested. As a regulated forex trading platform, eToro is required to verify all new account holders. This will also only take a few minutes and requires: eToro will ask you to make a deposit into your newly created forex trading account. You can choose the following payment methods: Unless you choose bank transfer, all deposits at eToro are processed instantly. Once your deposit has been processed, you can search for the desired currency pair to trade. In our example, we are showing trading (EUR) against Swiss Franc (CHF). We enter ‘EURCHF’ in the search box and click on the result that appears. Then you press the ‘Trade’ button. Now you will need to place a forex trading order. The main fields you need to fill in are: You can also choose the exact price at which you want your forex trade to be executed. To do this, click on the “Trade” button in the top right of the box and select “Order.” Then enter your desired entry price. You can also enter a stop-loss or take-profit order by clicking the corresponding button and entering your chosen exit price. Click ‘Open Trade’ to place your forex trading order with eToro.Step 1: Open an account and upload identification documents

Step 2: Verify your identity

Step 3: Deposit funds

Step 4: Search for a currency pair to trade

Step 5: Place an order

One of the most important decisions you need to make when trading forex online is which platform to sign up for. However, forex trading means you will be risking your own money, so you will want to make sure that the provider is strictly regulated. You should also check whether the platform offers trading in your preferred currency pairs and whether it allows you to open positions in a profitable manner. The best forex platform on the market right now is eToro. It is heavily regulated and offers 50+ currency pairs, all of which can be traded with low spreads. Getting started with eToro is easy and takes minutes. The platform is easy to use and allows instant deposit with debit/credit card or e-wallet!

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)In conclusion

eToro – The best forex platform

Frequently Asked Questions

Which forex trading platform has the lowest fees?

Which forex trading platform offers the most currency pairs?

What is the best forex trading platform for beginners?