Как да търгувам с борсови индекси в България – ръководство стъпка по стъпка 2026

In this guide, we’ll explain the most important things you need to know about investing in stock indices and why they’re a great way to get quick, low-cost exposure to a large basket of companies.

We’ll also show you how they can be used to target specific regions to take advantage of the unique structure of each stock exchange.

Finally, we’ll pick the best index trading platforms for new investors and show you how to get started and execute your first session.

How to start trading stock indices

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

[stocks_table id=”15″]

How to trade stock indices in Bulgaria – a step-by-step guide 2026

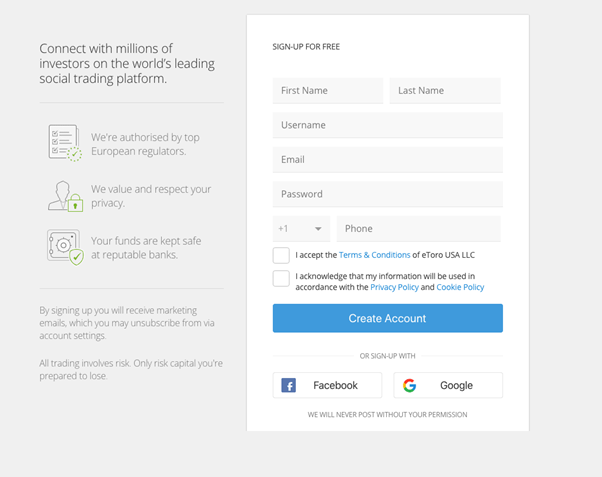

Step 1: Open an account and upload an ID

Download the mobile app or go to www.etoro.com . This guide is based on the platform’s product website. All regulated trading platforms are required to collect personal information from their potential clients. Click on the link labeled “Join Now” and fill in all the required details.

In addition to your full name, home address, date of birth, you will also need to provide your personal identification number and, of course, enter a username and create a strong password.

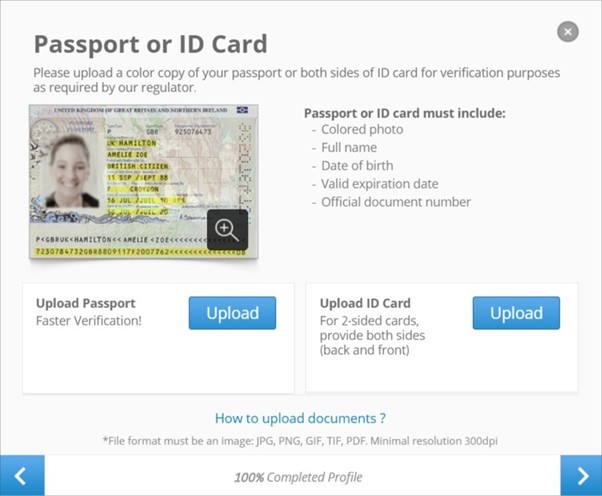

Step 2: Identity Verification

As part of the KYC process, you will need to verify your identity by uploading a copy of an official photo ID, as well as a copy of a utility bill or bank statement:

- Valid passport/ID card or driver’s license

- Utility bill or bank statement

Once you submit these documents, eToro verifies them almost immediately.

Note: If you do not have access to the documents listed above and want to start trading on eToro right away, you can upload them later. However, you will need to do so if you want to deposit more than $2,250 and request a withdrawal.

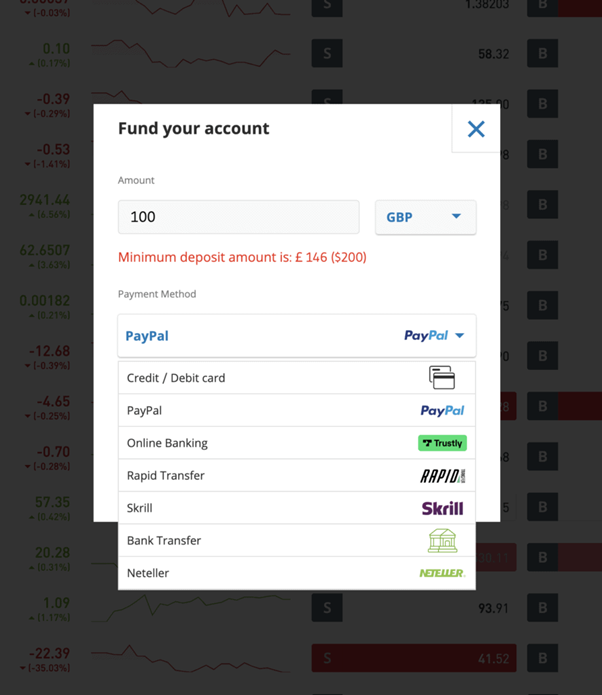

Step 3: Deposit funds into your trading account

Once you have completed your identity verification, it is time to make a deposit. The minimum deposit is $200, as shown in the screenshot below.

You can deposit funds instantly with your debit/credit card. Another option is to use an e-wallet like Paypal, Skrill or Neteller or make a bank transfer, but it can take days to process.

Note: Your eToro deposit is subject to a small forex fee of 0.5% – as all transactions are converted into US dollars. There are no additional forex fees for accessing foreign markets.

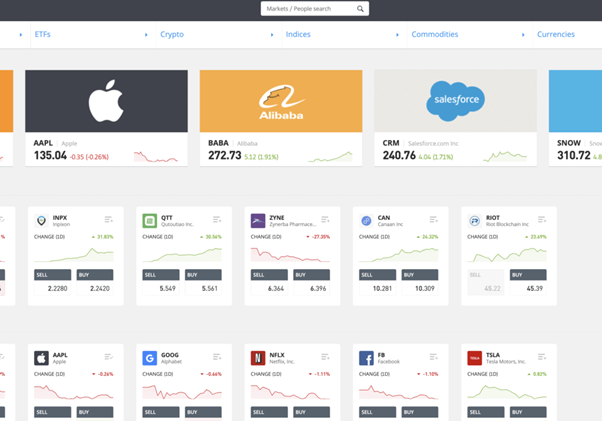

Step 4: Trading Stock Indices

Once you have funded your eToro account, all that remains is to choose the stock index you want to trade.

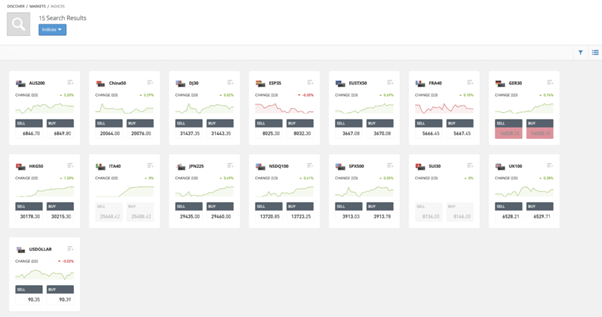

Click on “trade markets” in the vertical grey menu bar (on the left, under “Discover”), then click on “Indices” in the horizontal navigation bar below the search box at the top of the page, from where you will see a list of indices you can trade, as shown in the two screenshots below:

You can trade a total of 15 indices – from the FTSE 100 (UK100) index of the 100 largest companies to the American technology index Nasdaq (NSDQ100).

What are indices?

A stock market index is a set of publicly traded companies that aggregates their value and expresses it as an index number starting from a given base year. For example, the FTSE 100 was created on January 3, 1984, with an initial value of 1000.

Leading stock market indices such as the FTSE 100, FTSE 250 and S&P 500 were born out of investors’ need to make better comparisons between different stocks and different stock markets.

Although it has not always been the case, today it is easy for individual investors to gain exposure to the value of a given stock index and benefit from the direction in which it moves – up or down.

Who creates the indices and what is their methodology?

Индексите често се създават от доставчици на данни и рейтингови агенции, ето защо те имат имена като FTSE, където FT обозначава “Financial Times” и S&P 500, където S&P обозначава рейтинговата агенция Standard & Poor’s.

Индексите имат строги методологии и правила, които определят начините, по които се включват компаниите в тях и ситуациите, при които те се изключват. Например, FTSE 100 включва 100-те най-големи публични компании на Лондонската фондова борса, а S&P 500 – 500-те най-големи публични компании на Нюйоркската фондова борса. Освен пазарната капитализация обаче, има и други правила, на които компаниите трябва да отговарят – като например ликвидност и периода, в който са се търгували при нужния размер. По отношение на размера, например, няма смисъл в дадено тримесечие да се включи дадена акция, ако през следващото тримесечие стойността ѝ падне толкова много, че тя вече не отговаря на изискването за размер на пазарната капитализация.

Не всички индекси обаче се претеглят на базата на пазарната капитализация. DJIA се претегля на базата на цените, което означава, че съставните му компании се избират на базата на цената на акциите им. FTSE 100 и германският DAX 30 са пример за индекси, базирани на претегляне на пазарната капитализация.

Видове търговия и инвестиции в индекси

Има няколко начина да получите експозиция към индекси в зависимост от финансовите инструменти, които предпочитате и нивото на риска, което сте готови да поемете.

Индексни фондове

Индексните фондове могат да бъдат взаимни или да включват борсово търгувани фондове. Взаимните фондове са колективни инвестиционни дружества, в които средствата на инвеститорите се събират с цел инвестиция във всички компании от даден индекс.

Този вид взаимни фондове по-рано бяха известни като тракери, но днес са по-познати като индексни фондове. Те не се ограничават единствено до борсови индекси, но в този наръчник ще се съсредоточим върху акциите.

Взаимният фонд проследяват борсовия индекс като купува директно акциите на всяка компания от индекса или, ако борсовият индекс съдържа твърде много компании, като например американските борсови индекси за компании с малка капитализация Russel 2000 или Russel 3000, той може да инвестира в извадка от индекса. В този случай взаимният фонд купува извадка от акциите, които в исторически план отразяват общото представяне на индекса.

Индексните фондове обикновено начисляват такси за инвеститорите, които варират от 0.25% до 0.85%. Това може и да ви изглежда като малка сума – и със сигурност тя е доста под сумите, които бихте платили за активно управляван взаимен фонд, но въпреки това тя може да се отрази на възвръщаемостта от инвестициите ви поради ефекта на съчетаването. Американската инвестиционна компания Vanguard има репутацията на пионер в индексните фондове и осигурява едни от най-евтините и най-популярни продукти в сферата на индексните фондове.

Индексните фондове от типа взаимни фондове емитират нови дялове, когато в тях влязат инвеститори. Те не търгуват на фондовия пазар така, както вие бихте купували акции. Вместо това, те ценообразуват само веднъж дневно. Когато искате да излезете от инвестицията си в даден взаимен фонд, ще трябва да изкупите дяловете си, което означава, че фондовият мениджър ще унищожи вашите дялове и ще върне пари на инвеститора в размер, равен на стойността на притежаваните дялове.

Борсово търгувани фондове

Борсово търгуваните фондове са подобни на взаимните фондове по това, че те следят цената на базовия актив или кошница от активи, които често са представени под формата на индекс, но за разлика от взаимните фондове, борсово търгуваните фондове се търгуват на фондовия пазар като обикновени акции – така че имат цена на акциите, която се движи постоянно в реално време спрямо предлагането и търсенето на дяловете от страна на купувачите и продавачите.

Борсово търгуваните фондове или ETFs са особено популярни сред индивидуалните инвеститори, защото те с евтин и гъвкав начин за достъп до борсовите индекси в допълнение на огромното разнообразие от други класове активи и ниши на финансовите пазари, които по-рано бяха труднодостъпни.

Борсово търгуваните фондове са още по-евтини от индексните фондове, като таксите при тях варират от 3% до 4,5%.

Договори за разлика

Договорите за разлика (CFDs) са деривативен продукт, създаден от дадена финансова институция, където страните в договора се съгласяват да платят разликата между цената при откриването и цената при закриването на дадена търговия

Тези деривативни продукти и CFD брокерите, които ги осигуряват, са популярни сред българските инвеститори и има много брокери, които са специализирани в предлагането им. Те могат да се използват с цел експозиция към всякакви класове финансови активи – не само борсови индекси.

Те са по-високо рискови от, да речем, борсово търгуваните фондове или взаимните фондове, поради начина, по който са конструирани, което означава, че е скъпо да ги държите за дълъг период от време, тъй като емитентът начислява такси за прехвърляне на следващия ден, ако искате собственикът на договора да задържи позициите отворени.

Те обаче може да са идеален вариант за дневна търговия, тъй като предлагат бърз достъп до експозиция към даден борсов индекс – повече по тази тема може да намерите по-долу в секцията за стратегии за търговия с индекси. Договорите за разлика ви позволяват както да купувате, така и да продавате даден индекс. Т.е., ако цената се повиши, печелите, но можете и да предприемете къса продажба – в който случай печелите, ако индексът падне.

Опции и фючърси

Договорът за опции дава на собственика права,но не и задължение, да закупи даден актив на определена цена. Тези деривативни продукти по-рано бяха запазена територия за професионалните и институционалните търговци, но днес са много по-масово използвани, особено в САЩ.

To trade options in Bulgaria, you will probably need to answer a questionnaire correctly to show that you understand how they work and the risks involved. Futures are similar to options, but there is one difference – instead of giving the right, but not the obligation, to buy or sell an asset, in futures the owner of the contract commits to deliver the product (unless it is cash-settled) unless the contract is closed before its expiration. Options are the more popular instrument, so let’s take a look at how options work.

There are two types of options contracts – a call option (an option to buy) and a put option (an option to sell). If you expect the price of a stock to rise, you enter into a call option, and if the opposite is true, you enter into a put option.

What is In The Money (ITM), Out of The Money (OTM) and At The Money (ATM)?

A call option has a final expiration date and a strike price or exercise price, which is the price at which the seller can sell the contract at expiration.

If the price has exceeded the strike price, the call option is In The Money (ITM), and if not, the strike price is Out of the Money (OTM) and is worth nothing. If the contract strike price is equal to the spot price, the contract is At The Money (ATM).

An option is usually denominated in lots of 100, so one contract might give you the right to buy or sell 100 shares of a security. This means that even small movements in the price of the stock or index are multiplied many times over for the option owner. Add in the ability to trade with leverage (using borrowed money to increase your position) and the size of the profit from a relatively small investment can be very large, but so can the losses.

Trading on margin can expose the trader to a margin call, in which you must deposit more funds with the broker to cover possible losses if the position goes against you.

Spread Betting

Spread betting is another way to get involved in index trading. With this instrument, the trader bets a certain amount per point of the movement in the underlying index. Just like with options and CFDs (and some of the so-called inverse exchange-traded funds and index funds – see more in the strategies section), you can choose to go short.

Spread betting is considered to be even riskier than options or CFDs. A small amount per point can quickly increase if the index enters a period of wild volatility. The index could fall by 200 points – if you had bet £5 per point, your position would be in the red by £1000. You can limit your risk by using stop-loss levels. See more about stop-loss levels below.

Advantages of index trading

Fast, easy and cheap

The main advantage of index trading is exposure to the entire index, which can be achieved quickly and relatively easily and inexpensively, depending on the instrument you choose to use.

Imagine how much you would pay in transaction fees to buy each individual share of the FTSE 100. Instead of doing that, you can buy the index with one click if you choose to trade an index.

Diversification

Depending on the specific index, it provides the investor with immediate exposure to a diversified basket of stocks, which is a key way to minimize risk in an investment portfolio. Because there are companies from different sectors in the index, you get exposure to stocks that can be relatively uncorrelated, meaning that if one falls, the other may rise due to the different attributes of the economic sectors and industries in which they operate.

Risks of index trading

Low risk as a long-term investment

Investing in an index and leaving it alone as part of a possible long-term investment strategy is a low-risk approach, as any losses from the index can be compensated for over time. It is true that stocks are the best-performing asset class over the long term.

Short-term trading is riskier

However, trading is different from medium- and long-term investments and is usually carried out over short periods of time. Therefore, the risk in short-term investments may be higher, especially if you are unable to keep your position open until it enters a profitable position, or you are unable to respond to a margin call, or your position does not have a stop-loss level set and the index falls sharply, exposing you to large losses.

Again, risk calibration depends in part on the type of instrument you choose to trade stock indices with.

Many moving parts: weighting, regions, and macro environment

An index can rise or fall for many reasons and to some extent it can be more difficult to make the right decision than with individual stocks.

Each index has unique characteristics. For example, if you want to invest in the S&P 500, there are a lot of technology stocks in it (28%), but if you want to invest in the FTSE 100, there are very few (only 1.2% in weighted value). The FTSE 100 includes many international companies that generate most of their revenue in dollars, which means that if the lev falls against the dollar, the value of investments made by investors in Bulgaria in the FTSE 100 index will increase (the index will rise).

Since stock indices are country-specific, the macro environment in the country in question (and globally) also affects the index’s returns – for example, an increase in unemployment or inflation may cause index investors to sell.

What indices can you trade in Bulgaria?

Below you will find a list of the major stock market indices in alphabetical order that you can trade in Bulgaria. Most trading platforms stick to the short form of their names. The FTSE 100 is usually displayed as the UK 100, and the Dow Jones Industrial Average as the Wall Street.

| Short name | Full name |

| Australia 200 | S&P/ASX 200 |

| China A50 | FTSE China A50 |

| EU Stocks 50 | EURO STOXX 50 |

| France 40 | CAC 40 |

| Germany 30 | DAX 30 |

| Hong Kong 50 | Hang Seng China 50 |

| Italy 40 | FTSE MIB |

| Japan 225 | Nikkei 225 |

| Netherlands 25 | AEX 25 |

| Spain 35 | IBEX 35 |

| Switzerland 20 | SMI 20 |

| UK 100 | FTSE 100 – colloquially known as Footsie |

| US Small Cap 2000 | Russell 2000 |

| US SP 500 | S&P 500 |

| US Tech 100 | NASDAQ 100 |

| Wall Street | Dow Jones Industrial Average (DJIA, Dow 30) – known colloquially as the Dow |

Index Trading Strategies

When learning how to trade stock indices, it is important to master index trading strategies so that you can make informed decisions about your investments.

1. Get to know correlations

The index may be strongly correlated with certain sectors and industries due to the weighting (relative prevalence) of these sectors in the index. If interest rates are going up, an index with a strong presence of companies from the financial industry will gain.

In the case of the NASDAQ, which is focused on the technology sector, the movement of Big Tech stocks like Apple heavily influences the index. Apple is also one of the few and best technology ETFs listed on the Dow, so it will have an impact there as well.

As mentioned earlier in this guide, foreign currency movements can also affect the performance of indices, so this is another related factor to consider. Many FTSE 100 companies generate their revenues in US dollars, so a possible strengthening of the US dollar against the leva often leads to an increase in the FTSE 100.

Similarly, any weakness in the dollar could improve the earnings of U.S. companies that have strong operations abroad as their goods and services become more competitive in local currencies.

2. Economic events are extremely important

Economic events can be a very strong driver of index performance. Having an economic calendar for the country where an index is based is of paramount importance. Leading economic news such as employment, purchasing power, business and consumer sentiment, unemployment, etc. can have an immediate and direct impact on the movement of an index and should be closely monitored for profitable (or not) trading opportunities as events that could cause fluctuations.

3. Day Trading or Position Trading

You need to decide whether you want to focus on day trading or whether you prefer to open a position and hold it for a long period of time – sometimes years. This choice will help you decide what tools to use in executing your strategy.

Both types of traders need to master technical analysis in order to understand price charts. This is perhaps even more important for day traders, where traders are looking for opportunities on a minute-by-minute and hourly basis. Regardless of your choice, trend trading is a useful rule of thumb and can be a good option for a short-term strategy, where if a stock is going up, it is likely to continue to go up, and if it is going down, it is likely to continue to go down. Knowing when these trends might reverse is also extremely important.

4. How to manage risk

For all sessions, you should set “take profit” and “stop-loss” positions . They will help you control your risk.

It is especially important to get used to setting “stop-loss” levels. Their exact value depends on your assessment of the market, your risk tolerance, which in turn can be influenced by the amount of investment you have available, or your investment goals.

It’s also important to take your profits. We’re all susceptible to psychological biases in trading, such as getting greedy and not closing out a winning position in the hope of making even more. The problem with this in indices – especially day trading – is that said winning position can very quickly turn against you.

Best Indices Trading Platforms

We’ve already shown you how to invest in stock indices, and now it’s time to choose a top index trading platform.

Our favorites are listed below:

1. eToro

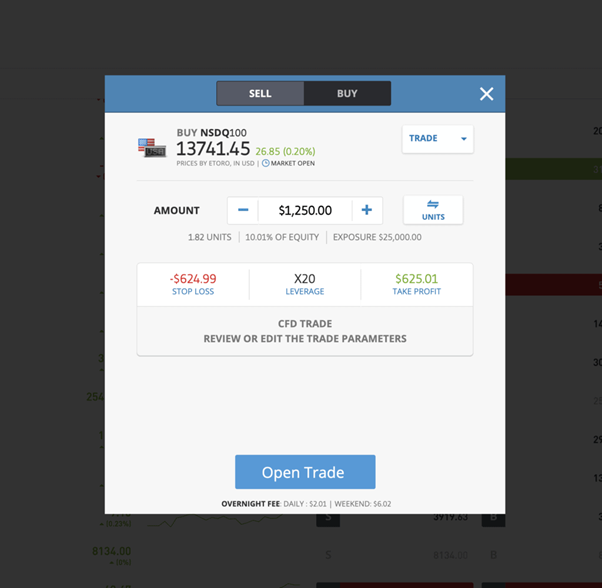

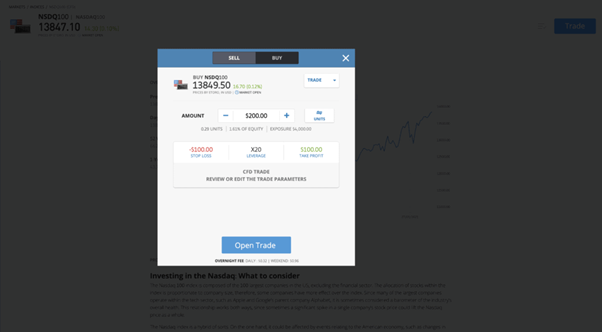

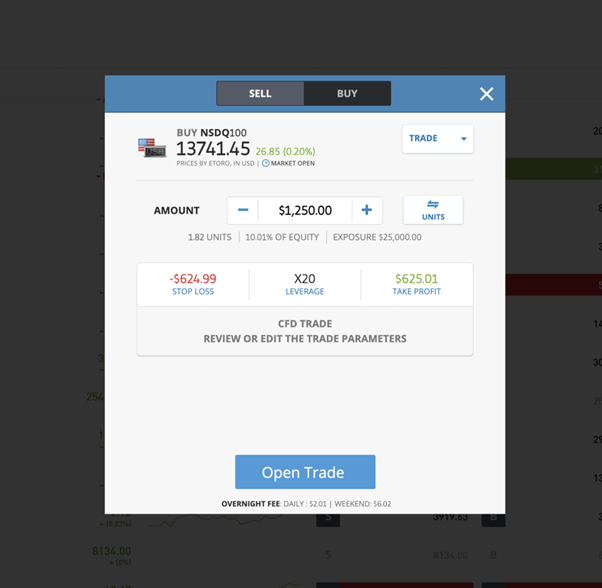

The indices are accessed via CFDs and this is clearly visible in the order screen (see below), as are the rollover fees for the next day’s sessions. CFDs allow you to predict whether the market will go up or down, allowing you to potentially profit from that direction, as seen in the screenshot below. Important information such as leverage levels is also displayed.

eToro is regulated by the UK Financial Conduct Authority, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). If you want to trade via your mobile device, eToro offers a great app for iPhone and Android.

eToro Fees:

| Commission | 1$ |

| Deposit fee | Free |

| Withdrawal fee | $5 |

| Inactivity fee | $10 per month after 12 months of inactivity |

Pros:

Cons:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. Libertex

<

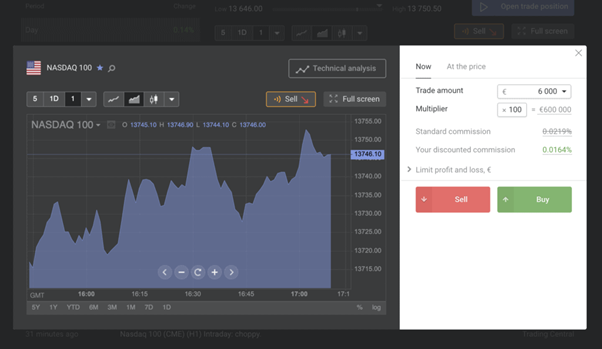

Commissions vary for each individual index. For the S&P 500, for example, the standard commission without discount is 0.0148%. The Nasdaq (see screenshot below) is more expensive - 0.0219%.

You can trade with leverage up to 100x, but be sure to change it before you start if you do not intend to use leverage or if you want to reduce the leverage to apply for the specific session.

The minimum deposit required by Libertex is just $10, which is ideal for novice investors who want to take a cautious approach, although with this minimum amount you won't have to trade stock indices.

The platform accepts various payment methods - including debit/credit cards and e-wallets. It is licensed by the Cyprus Securities and Exchange Commission (CySEC). Cyprus is a member of the EU, so your money is safe in case the company goes bankrupt.

Libertex fees:

| Commission | See the discount table below |

| Deposit fee | Free |

| Withdrawal fee | 1 EUR for debit/credit cards, 1% for Neteller, free for Skrill |

| Inactivity fee | 10 EUR after 180 days |

Users can use commissions depending on the amount deposited

| GOLD level

Total deposit of €250 |

GOLD+ level

Total deposit of €1450 |

PLATINUM level

Total deposit of €1500 |

VIP level

Total deposit of €5000 |

| Discount – 3% | Discount – 4% | Discount – 20% | Discount – 30% |

Pros:

Cons:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

3. AvaTrade

AvaTrade is a broker that is regulated in six different jurisdictions around the world. This provides a high level of security for your funds and peace of mind when you deposit or withdraw money, for which you do not pay any fees.

With AvaTrade, you can trade a full range of global stock indices, as well as 1,250+ other markets, including stocks, commodities, currencies, exchange-traded funds (ETFs) and cryptocurrencies. This can be done through a variety of account types such as CFD trading, options trading, spread betting and swap-free accounts.

Even better, with AvaTrade you can trade without any commission! The broker also provides a range of trading platforms such as MetaTrader 4 and MetaTrader 5. There is also an easy-to-use web platform.

Pros:

Cons:

Вашия капитал е в риск.

How to trade stock indices today

Hopefully, you have followed the instructions at the beginning of this guide and already have an eToro account. Now we will show you how to buy indices with eToro via the desktop version of the platform.

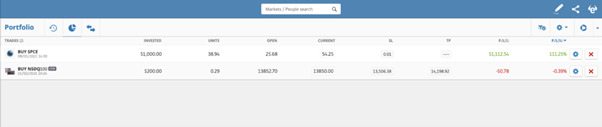

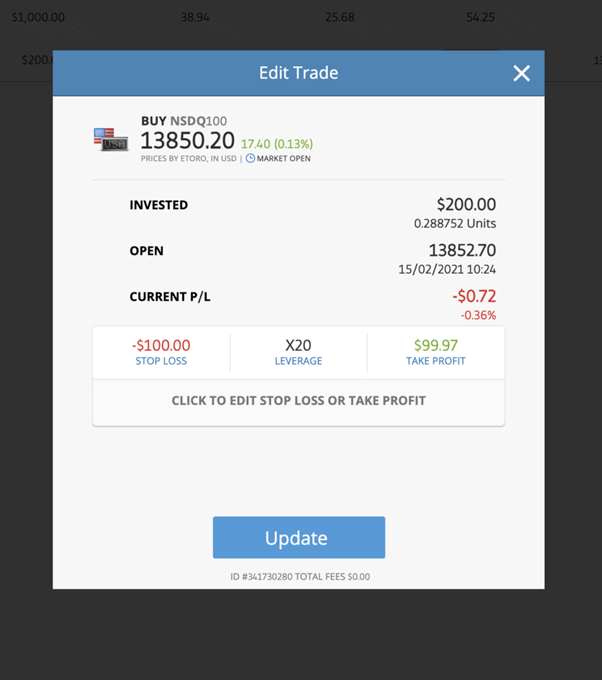

We will trade the NSDQ100 index by opening a “buy” position. Click on the “NSDQ100” market in the list of index markets. You will be taken to the instrument page, where you will find more information about the NASDAQ index market under “feed”, “stats” and “chart”. The feed displays posts from other users that you can like, comment on or share – this is a great place to find trading ideas, but it is always essential to do your own research. The statistics (see screenshot below) give you a useful overview of the characteristics of the market you have chosen. Click on the blue “trade” button on the right side to open the order screen: The minimum amount you can trade is $200. In our example, we are using x20 leverage. eToro automatically sets a stop-loss of -$100 and a take profit of $100, but you can change them depending on your own preferences and requirements. At the top of the trading ticket there is a “trade” dropdown menu, which you can change to “order” if you want to place a “limit” order. This means that instead of taking the market price as shown in the default screen, you can decide what price you want to trade at. “Units” or shares need a little explanation. Basically, this is the size of the position you are taking. In the screenshot you can see the amount ($200), but below it in gray, note that the equivalent shares are 0.29. In addition, to the right of the amount there is a “units” button, which, if you click on it, will show the equivalent of the trade in shares instead of dollars – see the screenshot below: The share size for indices is calculated by eToro using the following formula: Invested amount x leverage / rate when opening the position So in the example above: 200 x 20 (= 4,000) / 13848 = 0.2888 (rounded to 0.29) The exposure and total equity for the session are clearly displayed. In addition, the fees for rolling over the position to the next day are clearly indicated at the bottom of the ticket. To start the session, simply click on the blue “open trade” button (see screenshot above). To view your trades, go to the portfolio page , where all the instruments you hold are listed. Click on the “settings cog” icon (see the above screenshot, right column) and you will open a drop-down menu where you can choose to open a new trade, write a new post, view a chart, and set a price alert for NSDQ100. While on the portfolio page, the down arrow in the far right corner of the horizontal menu (see screenshot below) allows you to switch to the “ manual trades view ”. This is useful for editing trades in one place, for example if you want to close more than one position quickly: Click on the cog icon in the manual view and the various functionalities will open, such as the trade ticket, where you can directly edit your trade by setting stop loss and take profit positions.1. Trading the NASDAQ 100

2.Setting the trading amount, stop-loss and take-profit

3. Trade Execution

4. Go to the wallet page to see the completed order

In summary, index trading can be done using a wide range of investment platforms in Bulgaria, but in our opinion it is extremely important for beginners to have access to easy-to-understand and easily accessible functionalities and tools. In our opinion, eToro is an extremely useful platform because of its ease of use, the guidelines it provides for risk control, the easy-to-access user interface, with which placing and editing orders and changing important elements such as leverage and stop loss is extremely easy. eToro is a great platform for both beginners and advanced investors. Although we wish it had more indices, it wouldn’t have stopped us. We especially like the ability to copy trade with eToro and the community of investors that the broker has built. It is also one of the cheapest platforms on the market. Therefore, this popular and regulated by the British Financial Conduct Authority (FAC) trading platform is gaining momentum and now has over 13 million investors from 140 countries around the world. The investment application is also extremely good, and can be downloaded from both the Apple and Google app stores. eToro – The best index trading platform in Bulgaria

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)How to trade stock indices in Bulgaria – conclusion

Index Trading - Frequently Asked Questions

What is the best index trading platform in Bulgaria?

Which index trading platform is best for beginner traders in Bulgaria?

How much money do I need to trade stock indices in Bulgaria?