Ръководство за търговия с ETF в България 2026 – Търгувайте ETF с 0% такси!

Exchange-traded funds (ETFs) are becoming increasingly popular among investors in Bulgaria. But ETFs are also tempting targets for active trading.

So, what is ETF trading? With ETF trading, you can speculate on an entire industry or market sector in one position. ETF trading in Bulgaria is an excellent alternative to trading individual stocks, currencies or commodities.

Want to dive into ETF trading in Bulgaria? In this guide, we’ll explain how ETF trading works and highlight some of the best ETF trading strategies. We’ll also look at three of the best brokers you can use to start trading ETFs in Bulgaria today.

How to start trading ETFs

Are you ready to move into ETF trading in Bulgaria? We’ll show you how to get started with eToro, which offers open-end or CFD trading on more than 450 popular ETFs:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

[stocks_table id=”15″]

What are ETFs?

ETFs are baskets of assets that trade on the stock market. An ETF can give you financial exposure to, say, hundreds of different stocks or more than a dozen different commodities. ETFs have become very popular alternatives to mutual funds and investment trusts because they trade just like stocks and can be purchased through most stockbrokers in Bulgaria.

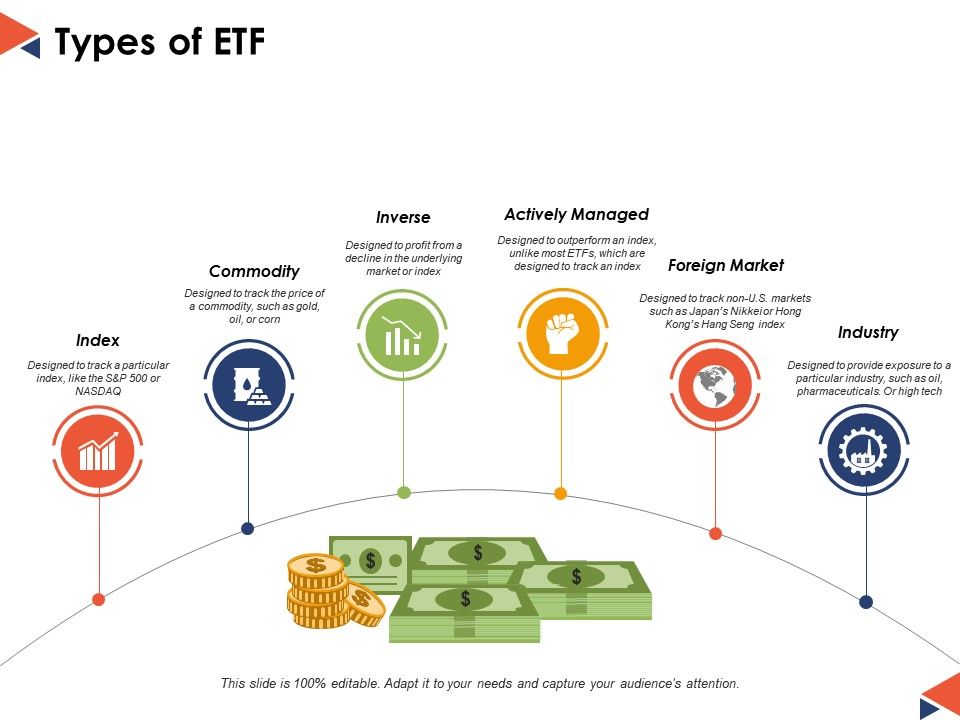

Different types of ETFs

An ETF can hold many different types of assets, in a wide variety of combinations. Let’s take a closer look at some of the most popular types of ETFs in Bulgaria.

ETF stocks

ETFs, as the name suggests, are baskets of stocks. When you buy ETFs, it’s pretty much the same as buying stocks – except you’re buying a lot of different stocks at once.

There are several different styles of ETF stocks.

Index ETFs are designed to mirror major stock market indices, such as the FTSE 100 or AIM 50. They contain the same blue chip stocks, so this changes the value of the ETF to mirror changes in the broader market.

Dividend ETFs invest primarily in dividend-paying stocks. The value of these ETFs may not change much over time, but you can realize returns from dividends paid by all the companies held by the fund.

Industrial ETFs give you exposure to a selection of stocks from a specific market sector. For example, you can use industrial ETFs to trade pharmaceutical stocks, oil stocks, or cannabis stocks.

There are many other styles of ETFs. Some focus on growth stocks, while others look for undervalued stocks. If you want to trade penny stocks, there are ETFs for that too.

ETF bonds

Bond ETFs are packages of bonds. These ETFs often offer returns through the distribution of the bonds they contain. However, the value of bond ETFs can rise or fall as interest rates and bond prices change.

Commodity ETFs

Commodity ETFs give you exposure to a wide variety of commodities – such as sugar, coffee and butter – all at once. Trading commodity ETFs is a good way to transition into commodity trading if you want to speculate broadly on agriculture or energy rather than the price of a specific product.

Forex ETFs

Forex ETFs typically contain currency futures contracts, giving you exposure to a basket of different currency pairs. Trading these ETFs is one way to get into forex trading while avoiding expensive currency conversion fees.

What is ETF trading and how does it work?

ETF trading in Bulgaria is a form of trading that focuses on buying and selling ETFs for profit. This is different from ETF investing, where it is much more typical to buy a fund and hold it for months or years. Many ETF traders engage in day trading or weekly swing trading.

ETF trading relies on the fact that ETF prices change throughout the trading day. The way ETF prices move is a little different than the way stock prices move.

While stock prices are determined primarily by buying and selling activity, ETF prices are determined primarily by price changes in the assets they hold. Let’s look at an example of a technology ETF that holds shares of Amazon, Apple, and Facebook. If the stock prices of all three companies increase by 5%, then the value of the ETF will also increase by 5.

Importantly, because ETFs hold multiple assets, the change in the value of the ETF reflects the average change in the price of the underlying assets. So, if Amazon rises 5%, Apple falls 2%, and Facebook rises 1%, the value of the ETF will only rise 1.33%. So, when trading ETFs in Bulgaria, it is extremely important to consider how market news or events will affect all of the assets that the ETF holds.

ETF trading fees

Since ETFs trade on major exchanges just like stocks, ETF trading in Bulgaria is typically commissions free . Many Bulgarian brokers offer commission-free ETF trading, although some charge a fee of a few leva each time you buy and sell. If you trade ETFs using contracts for difference (CFDs), you can pay a spread of around 0.1% per trade or more.

Trading ETFs comes with additional costs that stock traders don’t bear. ETFs typically have management fees that can range from as little as 0.01% of your investment annually to 0.5% or more. ETF traders typically don’t have to worry about these fees, as they are very small when you only hold the ETF for a few days at a time.

Advantages of ETF trading in Bulgaria

Wondering why you should trade ETFs? There are several advantages of ETFs that have helped ETF trading explode in popularity in Bulgaria.

ETF reduces risk

Perhaps the number one reason to trade ETFs is that they give you financial exposure to a wide range of assets in a single trade. This is a big deal because it dramatically reduces the risk on any single trade. For example, if you were trading shares of AstraZeneca, your trade could be a roller coaster ride in response to news surrounding the company. However, if you were trading a biotechnology ETF instead, any bad news about AstraZeneca would have only a limited effect on the value of your trade.

Of course, this goes both ways. Good news about the company could send AstraZeneca’s stock up a few percent. But a biotech ETF, in which AstraZeneca is just one of dozens of companies, could move very slightly in response to the news. Trading ETFs allows you to significantly reduce your risk, in exchange for potentially limiting your gains.

Wide exposure

Another important advantage of ETF trading in Bulgaria is that by giving you exposure to a wide range of assets, you can speculate on entire industries or markets at once. For example, with ETF trading you can speculate on the energy market as a whole, without making multiple, potentially expensive trades on multiple commodities.

Easy access

Unlike mutual funds or investment trusts, you don’t need a specific broker or money management relationship to trade ETFs. ETFs are traded on the stock market and don’t require a minimum investment. Additionally, some ETF trading platforms allow you to buy fractional shares of an ETF, so the amount you need to start trading is very low.

High liquidity

Because ETFs trade on exchanges like the London Stock Exchange, they tend to have very high liquidity. This is important for ETF trading in Bulgaria as it means you won’t have a problem buying and selling ETFs quickly. Even for some less popular ETFs, it’s easy for your broker to match your trade with someone else who is buying or selling that fund.

Risks of ETF trading

ETF trading may be relatively less risky than other types of trading, but that doesn’t mean it’s risk-free. As with any type of trading, there’s always a chance that the value of your position will fall. In that case, you may have to close your trade at a loss.

Keep in mind that if you buy and sell ETFs through leveraged CFD trading , your risk is greater. Leveraged trading multiplies your losses as well as your profits.

ETF Trading Strategies

It is important to approach ETF trading in Bulgaria with a clear strategy. The better your ETF trading strategy, the more likely you are to return consistent profits from your trading. Let’s take a look at three of the most popular ETF trading strategies that you can start using today:

Momentum ETF Trading Strategy

Momentum trading with ETFs involves buying and selling ETFs that are moving strongly in one direction. ETFs often gain momentum due to excitement about (or disappointment with) the market sectors they represent. For example, if the technology sector is flying high, technology ETFs can see a huge price spike over the course of a few days.

The goal of momentum trading is simply to ride the wave. Instead of trying to time the market perfectly, exit your position as soon as the momentum shows signs of fading. These signs can be in the form of lower trading volume or a trade signal from a momentum indicator such as the moving average convergence divergence (MACD).

Overbought and oversold ETF trading

The key to this type of trading is timing. Don’t buy an ETF as soon as it’s oversold. Rather, wait until it shows a strong reversal to open a bullish position. It’s better to miss a small increase than to risk the ETF continuing to fall without a reversal.

ETF range trading

ETFs will sometimes bounce back and forth between support and resistance price levels. This offers an opportunity to trade ETFs as you can buy and sell the moves between these price levels. Be cautious when trading around support and resistance levels as a breakout is likely to occur eventually. When this happens, the price movement can be rapid and powerful.

Tips for ETF trading in Bulgaria

Getting started with ETF trading in Bulgaria is easy, but mastering it takes time and practice. To help you improve, here are five of our favorite tips:

#1. Take an ETF Trading Course

This guide is a great place to start learning about ETF trading in Bulgaria. But if you want practical help and advice on ETF trading strategy, we recommend taking an ETF trading course. There are tons of online courses offered by professional ETF traders and even some of the best ETF brokers.

#2. Get a book about ETFs

Reading an ETF trading book is another way to learn more about the ins and outs of ETF trading in Bulgaria. Two of our favorites are “ETF Trading: Gaining the Edge with Technical Analysis” by Darren Wagner and “A Practical Guide to ETF Trading Systems” by Anthony Garner.

#3. Study a specific industry

When you are just starting out with ETF trading, it is a good idea to focus on a specific industry or market sector. The more you know about that market, the better you will be able to create an ETF trading strategy and understand how prices move in that market. Only after you have mastered that market should you move on to trading in another industry.

#4. Learn to use Stop Losses

Stop losses play a key role in ETF trading. They prevent your losses from growing when a trade goes bad, protecting your hard-earned profits from other trades. We recommend placing a stop loss on every ETF trade.

#5. Be patient.

ETF trading requires considerable patience. When there is no good trading opportunity that fits your strategy, don’t force one. It is better to take a day off from trading than to rush into a trade and lose money.

The best ETF trading platforms

Choosing the best ETF trading platform plays a big role in your trading. Your ETF broker determines what ETFs you can trade and how much each trade will cost you. Additionally, your ETF trading platform is your primary source for analysis and research tools to help guide your trades.

So, let’s take a closer look at three of the best ETF brokers in Bulgaria that you can start trading with today:

1. eToro – Partial ETF Trading with 0% Commission

This broker also stands out for offering an integrated social trading network with its ETF trading platform. You can follow other ETF traders and see what funds they are buying and selling. You can also take advantage of the portfolio copy feature, which allows you to automatically mimic the trades of professional ETF traders.

eToro’s proprietary software interface isn’t the most advanced we’ve seen, but it’s easy to use and comes with over a hundred built-in indicators and drawing tools. The main limitation is that you can’t create your own technical studies.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. AvaTrade - Large range of ETF trading platforms

AvaTrade offers users a wide range of different ETF trading platforms and account types such as CFD trading, spread betting, options trading, and Islamic swap free accounts. All of these accounts also offer commission-free trading.

With AvaTrade, you can trade a full range of different ETFs, as well as over 1250+ other markets covering stocks, currencies, indices, commodities and more. All of this can be done from the popular MetaTrader 4 and MetaTrader 5 trading platforms, as well as the broker's feature-rich web platform.

Opening an account is a simple process and can be done within minutes. You can also deposit and withdraw funds with zero fees. The broker offers great peace of mind as they are regulated in six different jurisdictions around the world.

Advantages:

Disadvantages:

Вашия капитал е в риск.

3. Libertex – Zero Spread ETF CFD Provider

The spread is the difference between the buy and sell price and is often quoted by the broker. With Libertex you simply pay a small commission on buy and sell. You can also get 50% commission discounts on certain account types.

You can also trade CFDs on ETFs, as well as a range of other markets, including currencies, stocks and an extensive list of cryptocurrencies. The broker's trading platform is web-based and easy to use.

Advantages:

Disadvantages:

Вашия капитал е в риск.

ETF Trading Advantages & Disadvantages

Advantages:

Disadvantages:

How to start trading ETFs

Are you ready to move into ETF trading in Bulgaria? We'll show you how to get started with eToro, which offers open trading or CFD trading on more than 450 popular ETFs.

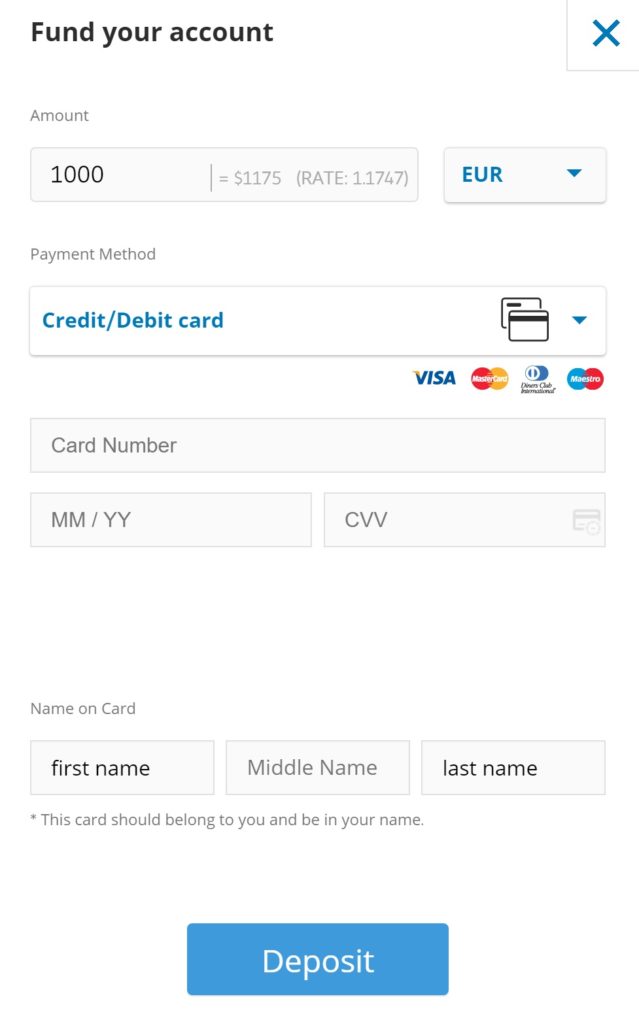

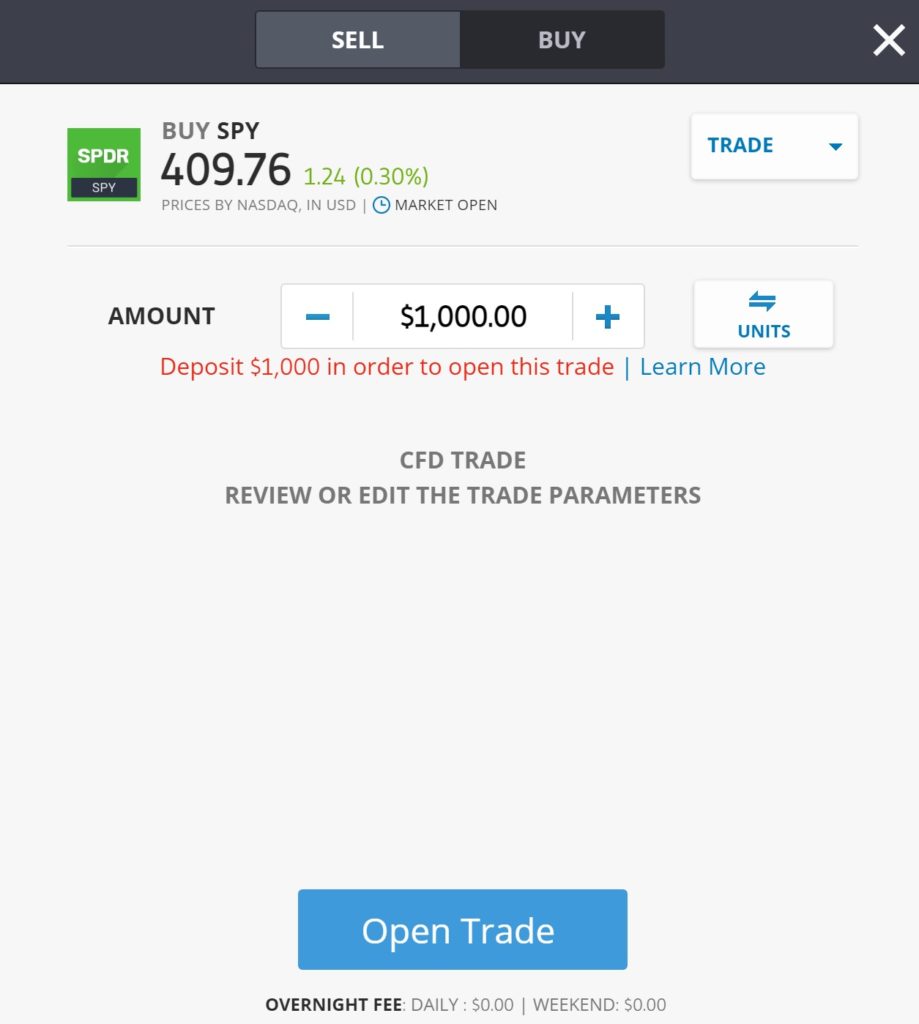

Get started with eToro by opening a new trading account. On the broker’s website, click “Join Now” and then enter a new username and password, along with your name and email. eToro requires you to verify your identity to comply with Bulgarian government regulations. You can complete this step online by uploading a copy of your passport/ID card or driver’s license, along with a copy of a recent financial statement or utility bill. Add funds to your eToro trading account using a debit or credit card, an e-wallet like Neteller or Skrill, or a bank transfer. Note that eToro requires a minimum deposit of £140 when opening a new account. Head to the eToro ETF dashboard to browse the top ETFs or search for a specific fund by name. When you find an ETF to trade, click the “Trade” button to open a new order form. In the order form, specify how much money you want to trade and how much leverage to apply, if any. You can also enter a stop loss level or take profit level, in line with your ETF trading strategy. When you are ready, click “Trade” to open your first ETF trade.Step 1: Create an ETF Trading Account

Step 2: Fund your account

Step 3: Make your first ETF trade

ETF trading allows you to speculate on entire market sectors or industries in a single trade. By giving you exposure to a wide range of assets, ETF trading in Bulgaria can partially reduce the risk of trading compared to trading individual assets. Plus, ETFs are easy to enter and exit and don’t require a large amount of money to trade. Are you ready to start ETF trading in Bulgaria? Sign up for an eToro account to make your first ETF trade today!

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)Conclusion

eToro – The best ETF trading platform in Bulgaria

Frequently Asked Questions

What is ETF options trading?

What are the rules for ETF trading?

Can I trade international stocks through ETFs?

Does ETF trading require a minimum investment?