Ръководство за търговия с фючърси България 2026

Futures allow access to trading markets that would otherwise be difficult for retail clients to access. This includes hard metals such as gold and silver, natural gas, oil and wheat. You can also trade futures contracts on stocks, indices and currencies.

One of the main attractions of futures trading in Bulgaria is that you have the opportunity to bet on long and short positions and apply leverage up to 1:30 when trading futures online.

Futures trading is much more complicated than simply buying or selling assets, which is why we created this guide to futures trading in Bulgaria. In it, we explain the details of how futures work, what risks and profit opportunities exist, and how to start trading futures today.

How to start trading futures

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

[stocks_table id=”15″]

What is futures trading?

Futures contracts are extremely popular among experienced investors because they allow you to trade on the future value of an asset without actually owning it. The basic premise is that you have to predict whether the value of an asset will increase or decrease on or before the expiration of the futures contract.

Futures contracts are extremely popular among experienced investors because they allow you to trade on the future value of an asset without actually owning it. The basic premise is that you have to predict whether the value of an asset will increase or decrease on or before the expiration of the futures contract.

For example, you can try your hand at the 3-month oil futures market. If the contract price is $50 per barrel, you have to determine whether you think oil will be worth more or less than that in 3 months. If you speculate correctly, you will win.

There is no requirement to hold your futures contract until it expires. On the contrary, you can usually sell the contract at any time. This allows you to withdraw your profits early or mitigate your losses. In terms of tradable markets, futures can be available for virtually any asset class.

This includes everything from stocks to oil, natural gas, currencies, wheat and gold. In Bulgaria, most futures brokers allow you to buy and sell futures contracts with leverage. For currencies it is up to 1:30, for gold and major indices – 1:20, and for other asset classes – between 1:2 and 1:10.

How are futures traded in Bulgaria?

There is a lot to learn before you start trading futures in Bulgaria, as this particular segment of the financial markets is quite complex. You need to be aware of what trading and risk management options are available to you before you start betting.

Below you will read more about the key conditions you must meet to trade futures in Bulgaria.

All futures contracts expire

When you invest in a traditional asset like stocks, you can hold onto them for as long as you want. Whether it’s 10 weeks, 10 months, or 10 years, the underlying asset can remain in your stock portfolio indefinitely. However, this is not the case with futures trading.

Futures contracts always have an expiration date. In most cases, each contract lasts for a period of 3 months and expires on the third Friday of the respective month. When futures contracts expire, they must be settled. In simple terms, this means that there is a legal requirement for the holder of the futures contract to buy or sell the underlying asset.

For example:

- Suppose you hold futures contracts on Ford Motors stock.

- The futures contract consists of 100 individual shares at a price of $6 each.

- If you still own the futures contracts when they expire, you are legally required to purchase 100 shares of Ford Motors at $6 each.

- This would result in a total cost of $600.

Whether you make a profit depends on the market value of Ford Motors stock at the time the contracts expire. If the value of Ford Motors stock was more than $6 per share at the expiration date of the futures contract, you will make a profit.

All futures contracts have a price.

In the example above, we explained that you purchased a Ford Motors futures contract at a price of $6 per share. This means that you can buy the shares at the aforementioned price when the contract expires.

However, this will not reflect the current market value of the underlying asset. This means that at the time you purchased the 3-month futures contract, Ford stock may have been priced at $5.50.

In terms of the $6 stock price that is attached to your futures contract, that is what the markets believe Ford Motors stock will be worth in three months.

Therefore, your job is to determine whether the stock will be worth more or less than the price of the futures contract on its expiration date.

Minimum futures contract

When you buy or sell a futures contract, you are committing to a basket of assets. In the case of stock trading, a futures contract typically consists of 100 individual shares. In other asset classes, the number may be higher or lower.

For example:

- In the WTI crude oil market, 1 futures contract is equal to 1,000 barrels of oil.

- At $40 per barrel, this typically requires a cost of $40,000.

The good news, however, is that most traders use leverage when accessing the futures market. In futures trading in Bulgaria, retail clients are limited to a maximum leverage ratio of 1:30.

With that in mind, unless you want to risk thousands of dollars to access your chosen market, it is much more cost-effective to trade futures via CFDs. However, you will read more about this below.

Long or short positions

Once you have assessed the fundamentals of your chosen futures market, you need to decide whether you want to take a long or short position. This means you need to determine whether you expect the price of the asset to rise or fall on or before the date the futures contract expires.

For example:

- Let’s say a 3-month gold futures contract is priced at $1,800 per troy ounce.

- If you believe that the value of gold will surpass this price in the next 3 months, you will take a long position

- If you are of the opposite opinion, you will take a short position

This is a major advantage of trading futures over traditional assets, as you have the opportunity to profit from both rising and falling markets. In other words, if you believe that an asset is likely to decline in price, futures allow you to take advantage of that prediction.

How to profit from trading futures contracts

So, now that you understand how futures trading works in Bulgaria, we now need to explain how experienced investors make money.

Below you will find a few simple examples of how futures trading would lead to profit.

Example 1: Long position on Disney stock

As we explained earlier, going long on a futures contract means that you believe the value of the underlying asset will increase on or before the contracts expire.

- Disney’s stock price is $130

- You purchase 1 futures contract on Disney stocks, which consists of 100 shares.

- The futures contract is valid for 3 months and the contract price is $140

- A few weeks before the contract expires, Disney shares are priced at $150 on the NYSE.

- This is $140 more than the contract price, which is $140 per share.

- You decide to withdraw your profits by selling the futures contract to your chosen broker.

- Since your futures contract consists of 100 shares of Disney stock, you realize a total profit of $1,000 ($10 x 100)

As illustrated in the example above, most traders would sell the futures contract before its expiration date. This not only allows you to withdraw profits, but also minimizes losses if the market moves against your predictions.

Example 2: Short position with oil futures trading

Now let’s look at an example of a short futures position, which means you believe the value of the asset will decrease.

- The price of oil is $30 per barrel.

- You purchase 1 oil futures contract, which consists of 1,000 barrels.

- The futures have a 3-month expiration and a contract price of $27

A few weeks later, OPEC announced that it intended to increase oil production, which would lead to greater supply on the market.

- Oil price reacts to open market

- A few days before the contract expires, the price of oil drops to $20 per barrel

- That’s $7 per barrel below the futures contract price of $27.

- You can withdraw your profits by selling the futures contract.

- Your futures contract consists of 1,000 barrels of oil, so your total profit amounts to $7,000 ($7 x 1,000)

The above example illustrates how futures trading in Bulgaria allows you to profit from falling markets.

Futures Trading in Bulgaria: Asset Classes

Futures trading gives you access to multiple financial markets.

Among them are:

Stock futures

Stock futures offer investors an easier way to trade stocks. You can take long and short positions in your chosen market, as well as take advantage of leverage.

In most cases, financial institutions only offer futures on major stocks, such as the leading companies in indices such as the FTSE 100, such as BP, Unilever and Diageo.

If you are interested in trading US stock futures, this will also include technology leaders Facebook, IBM, Amazon, and Apple.

Commodity futures

Commodity futures trading is common because assets like gold and oil are difficult to store in the traditional sense.

This means you would have to go through the hassle of purchasing and physically storing the asset, which would not be viable. Instead, traders buy and sell futures contracts without having to take ownership of the asset.

Popular commodity trading markets where futures trading is also possible are:

- Gold

- Silver

- Platinum

- Brent crude oil

- US Light Crude Oil

- Natural gas

- Wheat

- Sugar

- Soybeans

If the holder of the futures contract sells it before the expiration date, there is no obligation to take delivery of the relevant commodity.

Forex futures

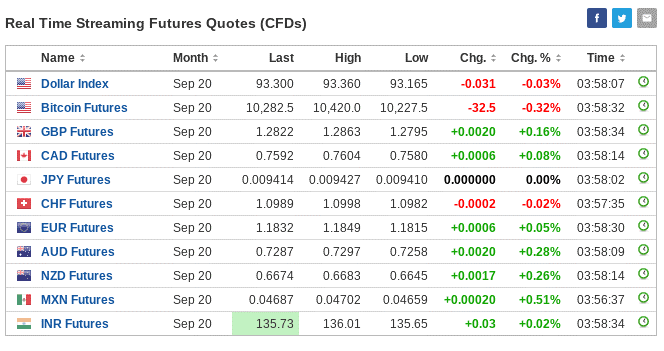

Futures are ideal for currency traders who want to speculate for the longer term. Conventional forex markets are based on leveraged financial products. Forex is typically traded in currency lots of 100,000 and investors will take full advantage of the leverage.

If they don’t, traders have to invest an obscenely large amount of money just to access the desired currency pair. While forex trading with leverage is useful for bankroll management, the main disadvantage is that you will have to pay an overnight fee for each day you keep the position open.

This is a kind of interest that you pay to the broker for trading with more money than you have in your account. That is why classic forex trading is best suited for day trading, but not for long-term strategies. This is where forex futures come in. Since each contract usually has a validity period of 3 months, this allows you to keep your position open for a much longer time without having to pay overnight fees.

Cryptocurrency futures

CME Group, home to one of the world’s largest derivatives markets, allows institutional investors to participate in trading bitcoin futures. However, there is a significant minimum requirement regarding the value of the contract.

One contract covers 5 Bitcoins, so at current prices of just over $10,000/BTC you would need to spend at least $50,000. Of course, there is leverage, but CME Group is specifically an exchange for larger investors. With that in mind, your best bet is to trade cryptocurrency futures in the form of contracts for difference (CFDs).

CFDs as an instrument track the value of Bitcoin, meaning you can access the market without taking ownership of the underlying contract. This also avoids the costly stake.

What are the advantages of futures trading in Bulgaria?

If you are still not sure if futures trading is for you, below we outline some of the main advantages that this particular market offers.

Long-term deals

Futures are a great alternative to leveraged CFD trading instruments. You can keep your position open – typically up to 3 months – without worrying about overnight fees. However, you should consider the fees for trading leveraged futures – this cannot be avoided.

Profit from rising and falling markets

If you buy stocks in the traditional sense, the only way (apart from dividends) you can profit from is if the price of the company’s stock goes up.

This leaves you in a somewhat limited position if you predict that the stock will fall. With futures trading, you can profit from both rising and falling markets. This gives you much more flexibility to take advantage of your market research.

Leverage opportunities

Most futures trading platforms in Bulgaria allow the use of leverage. However, this means that not only can you trade with more money than you have in your account, but your potential profits (and losses) will also increase.

In terms of restrictions, trading platforms in Bulgaria are required to comply with ESMA regulations. This means that the leverage you will be able to apply to trade CFD futures will depend on the specific asset class to which the futures are linked.

- 1:30: Major currency pairs

- 1:20: Minor currency pairs, gold and major indices

- 1:10: Commodities other than gold, exotic currency pairs

- 1:5: CFD on shares

- 1:2 Cryptocurrencies

Simply put, if you have £500 in your account and are trading futures with 1:10 leverage, this means you are effectively trading £5,000. Your profits and losses will also be magnified by a factor of 10.

Access to hard-to-reach markets

In the days before financial derivatives, trading the future value of assets like oil, wheat and gold would have been virtually impossible – especially for retail clients. The evolution of futures trading means you can now do this with the click of a mouse button. You can trade anything – soybeans, sugar, platinum and natural gas – without ever having to own or store the underlying asset!

What are the risks of futures trading in Bulgaria?

As is the case with all financial instruments, futures trading carries risks that must be taken into account.

For example:

- You can lose money: Like any other investment transaction, you can lose money when trading futures. You must correctly predict which way the markets will move in order to win. If you don’t, you will lose.

- Leverage Risk: Leverage gives you the ability to trade with more money than you have in your account, but it also carries risk. If your futures position falls in price by more than your margin balance, you will have to liquidate.

- Complexity: Futures contracts can be complex to trade. You will need to have a clear understanding of contract duration, pricing, minimum volume, and more.

- Settlement: When you buy a futures contract, you are legally obligated to buy or sell the asset on an agreed-upon date in the future. Most traders would sell their futures contracts before they expire, but there is no guarantee that you will be able to do so.

Considering the above risks, you should make sure you fully understand how futures trading works in Bulgaria before investing.

Futures Trading Strategy

Because futures contracts allow you to make complex trades, there are a bunch of potential strategies you can consider.

This includes:

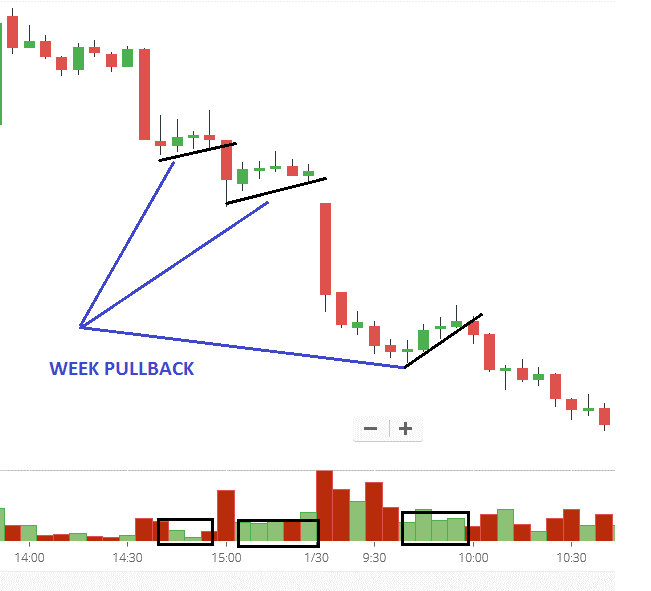

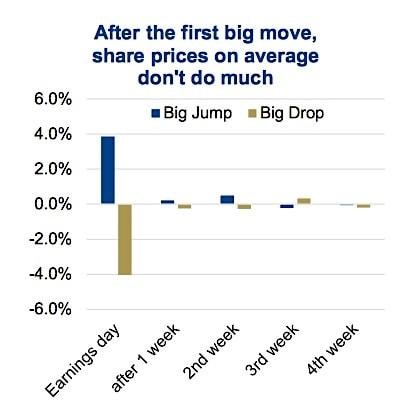

Market corrections

Every asset goes through a market correction. This happens when investors exit their positions to take profits. For example, let’s say Apple shares rise 7% over a 7-day period.

Some investors will be looking to cash in on their profits, which could see Apple’s stock price fall by 2%. However, that doesn’t mean the uptrend is over.

This is a short-term market correction. If this is the case, a savvy investor might try to buy long-term Apple stock futures contracts. This effectively enters the market at a 2% discount. If and when the uptrend resumes, the investor will sell their contracts for a profit.

Hedging

Hedging refers to the process of reducing the risks of an open position. For example, let’s say you have invested £20,000 in an ETF that tracks the FTSE 100 index. With the uncertainty surrounding Brexit, you will want to protect your investment. At the same time, you do not want to cash out your investment in the ETF.

A sensible solution would be to short some FTSE 100 futures. This would buy you 3 months to decide whether to keep your ETF position open or sell it. In theory, you have hedged your risk no matter where the FTSE 100 goes while the futures contract is open.

Fundamental trading

Fundamental analysis is the process of making trading decisions based on news. For example, suppose Amazon announces in its earnings report that it has exceeded market expectations for revenue and operating profit. In turn, the value of Amazon’s stock is likely to increase in the short term.

By going long on futures contracts at the time of the announcement, you will have the chance to profit from the expected rise in the company’s stock price. By keeping up with financial news, you have the best possible chance of predicting which way the relevant futures market is likely to move.

What is algorithmic futures trading?

Futures trading can be a challenge if you are a novice investor. That is why it is worth considering the option of an algorithmic futures trading strategy. In other words, you will rely on an algorithmic tool designed to trade futures on your behalf.

The software will scan the financial markets 24/7, constantly looking for trends that could affect the value of the asset in question. If and when a profit opportunity arises, the algorithm will enter a long or short position.

However, the software does not have the ability to evaluate fundamental news, it is focused entirely on technicals. If you are interested in an algorithmic futures trading strategy, you will need to do some research on the provider you choose.

This includes historical trading results and risk management tools. After purchasing and downloading the software, you will need to install it on a third-party trading platform, such as MT4.

The best futures trading platforms in Bulgaria

If you want to trade futures in Bulgaria, you will need to find an online broker that suits your needs. Compared to stocks, bonds, and other traditional assets, there are very few platforms that allow retail clients to trade futures.

However, more and more brokers are offering futures trading via CFDs. We offer you several regulated futures trading platforms in 2021 that serve Bulgarian investors.

1.eToro

This broker also stands out for offering an integrated social trading network with its trading platform. You can follow other traders and see what they are buying and selling. You can also take advantage of the portfolio copy feature, which allows you to automatically imitate the trades of professional traders.

eToro’s proprietary graphical interface isn’t the most sophisticated we’ve seen, but it’s easy to use and comes with over a hundred built-in indicators and drawing tools. The main limitation is that you can’t create your own technical studies.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. AvaTrade

AvaTrade is an online futures trading platform regulated in multiple jurisdictions. It specializes in CFD trading – with thousands of tradable markets available at the click of a button. This includes stocks, commodities, currencies and cryptocurrencies.

When it comes to futures trading, AvaTrade offers several asset classes. This includes indices like the FTSE 100 and Dow Jones, as well as hard metals like gold. You can also trade futures on government bonds and agricultural commodities like corn, sugar, and wheat.

AvaTrade is a popular option for traders from Bulgaria who are looking to access the futures market without being pressured by high fees. The platform does not charge commissions, but earns on spreads. An additional benefit of choosing AvaTrade as a futures trading platform is that it supports MT4 and is one of the best MT5 brokers. It also offers social trading through the Zulutrade platform.

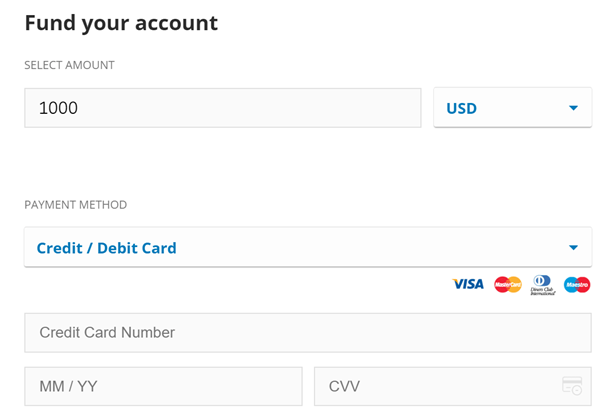

This gives you the option to incorporate an algorithmic trading robot. You can trade online or via mobile. Minimum deposits start at £100, which you can fund instantly with a debit or credit card. Bank transfers are also available, but take a few days to process.

Advantages:

Disadvantages:

Вашия капитал е в риск.

3. Libertex

The spread is the difference between the buy and sell price for an asset and is determined by the broker. With Libertex you pay a small commission on buy and sell. You can also get 50% commission discounts on certain account types.

You can trade CFDs as well as other markets including currencies, stocks and an extensive list of cryptocurrencies. The broker's trading platform is web-based and easy to use.

Advantages:

Disadvantages:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

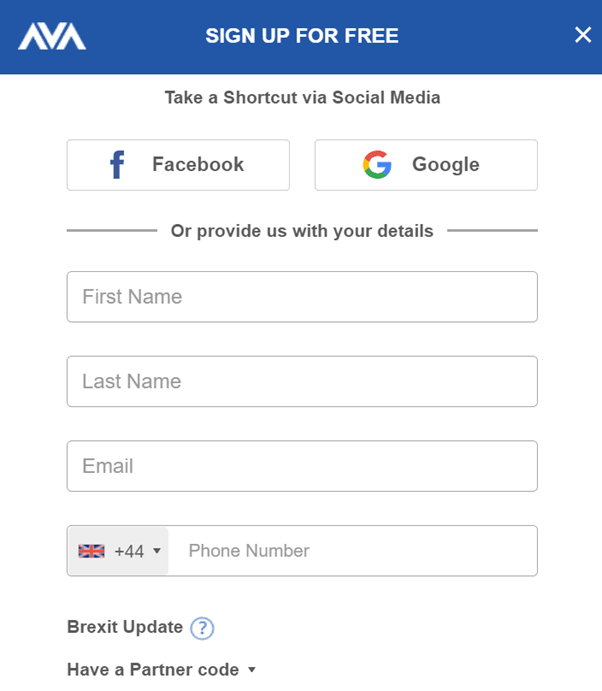

How to Start Trading Futures with AvaTrade – Step-by-Step Guide

Now that you have gained knowledge about futures trading so that you can minimize your risks, we will guide you through the process of opening a trading account. The step-by-step guide is based on our top-rated futures broker, AvaTrade.

Of course, you can also choose to use another trading platform. Start by opening an account with AvaTrade. You will need to answer some questions about your identity and trading experience. This will take no more than 5 minutes. You must provide a copy of your passport or driver’s license. This is to ensure that the broker is able to verify your identity. Make your first deposit using one of the accepted payment methods. The minimum deposit is $100. Once you have funded your AvaTrade account, you can explore the futures trading section. Once you have chosen a futures market to trade, you will need to choose a buy or sell position. You will need to fill out an order form. There you will enter the bet size and the required leverage ratio. Once you confirm the order, the position will be matched at the next available market price.Step 1: Open a futures trading account

Step 2: Verify your identity

Step 3: Deposit funds

Step 4: Explore the futures markets

Step 5: Place a futures order

How to start trading futures with eToro – a step-by-step guide

If you're ready to start trading futures CFDs in Bulgaria, see how to do it with eToro.

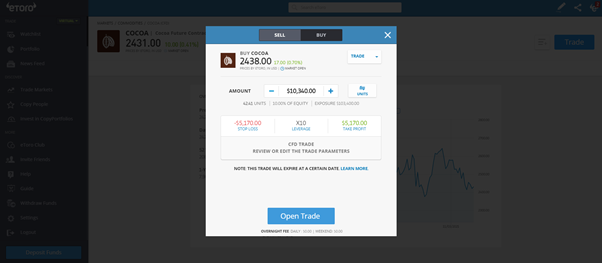

Open a new trading account with eToro. On the broker’s website, click the ‘Join Now’ button and enter a username, password, as well as your names and email. eToro requires you to verify your identity to comply with legal requirements. You can complete this step online by uploading a copy of your passport or driver’s license, along with a copy of a recent bank statement or utility bill. Fund your account using a debit or credit card, an e-wallet like Neteller or Skrill, or a bank transfer. eToro requires a minimum deposit of $200 when opening a new account. Head to the eToro dashboard to explore the different markets. Commodity markets like cocoa, oil, and others are typically traded through futures. For example, trading cocoa on eToro is done through a cocoa futures contract. By clicking on Trade, you can open a form as shown below. Step 1: Open a trading account

Step 2: Fund your account

Step 3: Place your first order to trade futures CFDs

Futures contracts can be complicated for beginners. This market is not just about buying and selling assets. With the right knowledge of how this market works, you have the ability to make much more complex trades. This includes the ability to choose between long and short positions and access your chosen market with leverage. You can also exit your position at any time before the futures contract expires. If you want to start trading futures in Bulgaria right now, eToro offers a choice of markets and low fees. If this sounds good to you, click the link below to register an account today!

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)In conclusion

eToro – the best futures CFD trading platform in Bulgaria

Frequently Asked Questions

What is the difference between futures and options?

What are futures CFDs?

What leverage can you get when trading futures in Bulgaria?

How long do futures contracts last?

When do futures contracts expire?