Ръководство за търговия с опции в България 2026 г

Options trading in Bulgaria is a sophisticated yet extremely flexible way to enter the market. With options, you can speculate on the timing of price changes for stocks, currencies, commodities, and more. Options trading allows you to create customized strategies that limit risk or that allow you to profit when the market moves against you.

If you are interested in options trading in Bulgaria, this guide will teach you what options trading is, as well as what binary options trading is, which is also extremely popular in Bulgaria. We will also offer you some strategies and tips for trading binary options, as well as an overview of the best options trading brokers in Bulgaria.

How to start trading options in Bulgaria

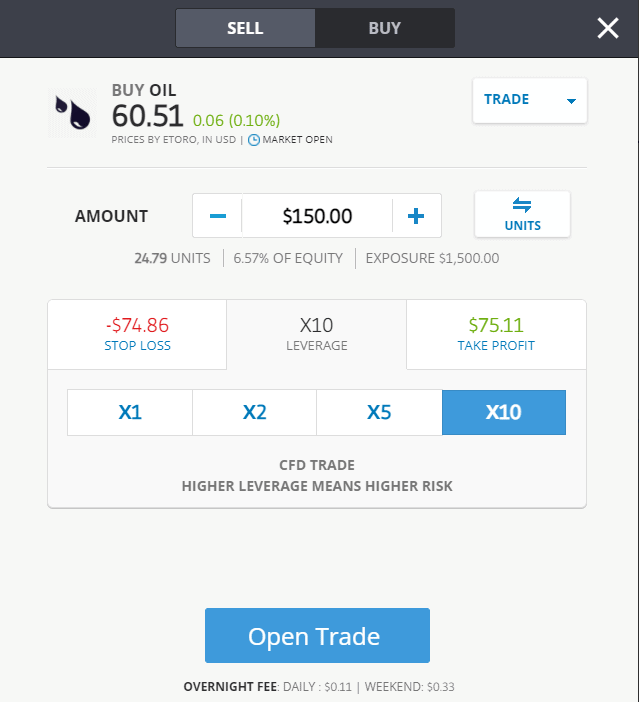

We will guide you through the process of trading options in Bulgaria step by step. Our chosen broker is eToro, which provides access to trading CFDs, futures and real stocks. The broker is about to launch options trading as well, so be one step ahead, start using the world’s largest social trading platform now:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

What is options trading?

Options trading in Bulgaria is the purchase of a contract that gives you the right to purchase an underlying asset at a predetermined price on a specified date.

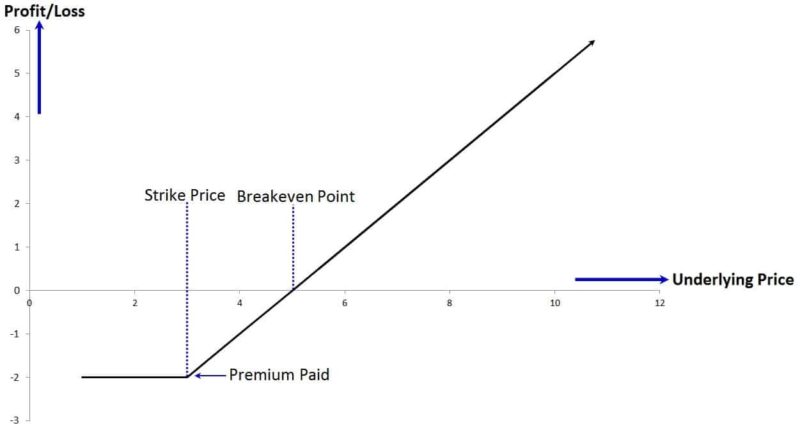

There are three key components to an options contract: the premium, the strike price, and the expiration date. The premium is the price of the contract itself that you pay to enter each option. The strike price is the price at which you agree to purchase the underlying asset if you decide to exercise your option. The expiration date of the option is the date by which you have the right to exercise your contract. After this date, the option contract expires and becomes worthless.

The easiest way to understand how options trading works is with an example. Let’s say you want to buy options to buy shares in AstraZeneca, which are trading at £84. If you think the price of AstraZeneca will rise in the future, you might pay a premium of £10 for an options contract that gives you the right – but not the obligation – to buy shares in AstraZeneca for £86 per share in the future (the strike price).

If the price of AstraZeneca remains below £86, you can simply let your options contract expire. You only lose the £10 per contract that you paid as premium. If the price rises above £86 per share, you now have the opportunity to buy AstraZeneca shares for less than they are worth on the open market. You may not make a profit initially because you still have to get your £10 per contract back. However, if the price rises significantly above £86 per share, you could make enough money to cover the premium you paid, plus some additional profit.

It is important to emphasize that options traders are advised not to hold their contracts until expiration. You can sell your options contracts to another trader at the current premium. This allows you to exit your trade and realize a profit or loss depending on whether the options contract has increased or decreased in value since you purchased it.

Binary Options Trading

Binary options trading is similar to traditional options trading, but it works on an “all or nothing” basis. When you trade binary options, you pay a premium and agree to a strike price and an expiration date. Importantly, you also agree to a potential profit if your trade is successful – say 70% of the value of your premium payment.

If the price of the underlying asset is above the strike price at the expiration of the binary options contract, you will win. You get your premium back, plus the agreed-upon return of 70%. However, if the price of the underlying asset is below the strike price, you lose all the premiums you paid. In this case, you lose 100% of your initial investment.

There are different types of binary options, including those that only require the underlying asset to reach its strike price at any time before expiration. Binary options trading is a little easier to understand than traditional options trading in Bulgaria, but can be significantly riskier.

What asset classes can you trade as options?

Options trading in Bulgaria covers a wide variety of assets, including stocks, currencies, commodities, etc. Stock trading and forex trading through options are particularly popular, as these assets are relatively volatile and prices can move quickly in one direction. Options can also be used to trade other types of assets, such as ETFs, bonds, and cryptocurrencies.

It is important to note that oil trading, gold trading, and other commodity trading are traditionally done with futures, not options. Futures trading and options trading in Bulgaria are similar, except that you are required to exercise your futures contract on the expiration date.

Advantages of options trading in Bulgaria

Options trading offers a number of key advantages over other types of trading, such as direct stock trading or CFD trading (contracts for difference). Let’s take a look at some of the reasons why you might prefer options trading in Bulgaria:

Cost-effectiveness

The main reason why many traders in Bulgaria prefer options is that they are cost-effective. If you want to take a £1,000 position in, say, Tesco shares, you will need to commit £1,000 to buy those shares outright. However, to take a £1,000 position through options, you may only pay £50 in option premiums. The options contracts you buy at that price could give you the right to buy £1,000 worth of Tesco shares.

Cost efficiency may not sound like a big deal, but it is important. The less money you have to commit to a trade, the more trades you can make with a small amount in your trading account.

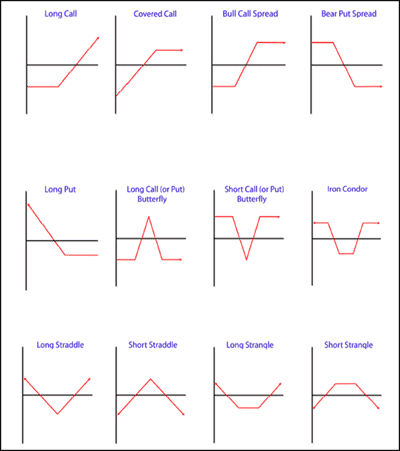

Flexible trading strategies

These types of complex trading strategies are difficult to achieve when purchasing assets directly or through CFDs.

Clear risk

When trading options in Bulgaria, the maximum amount you can lose on any one trade is very clearly defined. Typically, the loss is limited to the amount you paid in premiums to open your trade.

Since you are not obliged to exercise your options contract, you can simply let it expire if you see that the trade is not going in your favor. This also applies to binary options trading – the amount you lose on a losing trade is the amount you paid in premiums.

Opportunity for higher returns

Options trading in Bulgaria allows for leverage on every position. So you put down a small amount – the premium – and open a position. However, your return is still based on the difference between the asset price at expiration and the strike price in your contract. The high potential return from cheap trades is one of the main reasons traders like options.

Binary options trading can bring even higher returns due to the higher risk. Be sure to check your binary options contract as different brokers offer different potential returns.

Is options trading profitable?

When successful, options trading in Bulgaria can be very profitable. To show you how you can make money from options trading, let’s take a look at how to trade options on BT shares.

Let’s say you pay £50 premium for an option to buy 1,000 shares of BT at a strike price of £1.12. If BT shares only rise to £1.12, you will lose the £50 premium, but if the shares rise to, say, £1.20, you make a profit of £0.08 per share, making a total of £80. After accounting for the £50 you paid as premium, you make a profit of £30 – a return of 60%.

There are some other things to consider when trading options, however. If you are trading stock options, it is important to consider dividends. You will not be eligible for a payout if you only own options contracts, but dividends can cause the stock price to move up or down temporarily. This can have a big impact on the price of an options contract or the value of an existing position.

Options trading also has tax implications. Traders pay capital gains tax on any profit at the end of the year.

Risk in options trading

Options trading can be more profitable than other types of trading, but it also carries some significant risks. First, while your maximum loss is limited to the premiums you paid for your options contracts, you can easily lose your entire investment.

Using the example above, let’s say the value of BT shares falls from £1.10 to £1.08. If you owned 1,000 BT shares directly, you would lose £20. Since your options contracts are worthless at £1.08, you lose the £50 premium.

Binary options trading multiplies the risk. You cannot recover any of your premiums if the trade goes against you because it is all or nothing.

It is also important to keep in mind that options trading is time-bound – the expiration date of your contract. It is not enough to be right about the direction or magnitude of the price movement of an asset. You also need to be right about when this will happen, and it is difficult to predict. This is why it is riskier to trade binary options and traditional options.

Options Trading Strategies

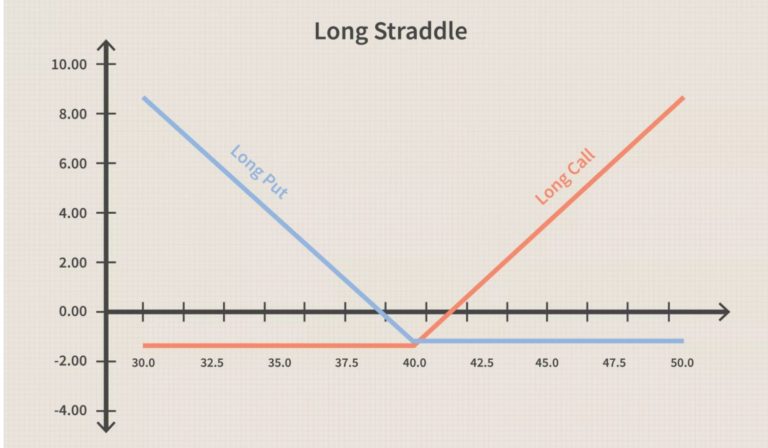

Approaching options trading in Bulgaria with a clear strategy is essential to your success. Options trading allows you to adapt to any market conditions, but it is important to know what market conditions you are expecting in order to formulate an appropriate trade.

Let’s take a look at some of the best options and binary options trading strategies:

Options trading in a stable market

This binary options trading strategy involves buying binary options that will pay off if the price of the underlying asset does not change between the opening and expiration of the position.

These contracts usually carry high premiums. However, these premiums are worth it if you believe the market will continue to register weak movements.

Options trading in a volatile market

Another binary options trading strategy revolves around the high volatility of the market. If the market experiences sharp up and down movements, binary options trading can reduce the risk compared to traditional options trading.

To trade volatility with binary options, buy binary options with a short expiration and a strike price that is slightly above the current one. The premium for these options should be cheap, so the amount you risk relative to the potential payoff is low.

The binary options trading strategy is often applied to day trading in volatile markets. Just keep in mind that volatility is essentially gambling, so don’t make huge bets when using this strategy.

Impulsive Options Trading

If the price of an asset is moving in a strong dynamic, it may be a good candidate for options trading. Evaluate the time frame of the price movement to choose your contract expiration date and strike price. However, keep in mind that premiums can be high, as options look profitable if the trend continues.

Once your position is open, keep a close eye on the asset’s momentum. If it starts to fluctuate, you can make a profit by selling your options contracts instead of holding them until expiration. Don’t wait too long, as the market value of your contracts can drop quickly if the trend reverses or slows down dramatically.

Options Trading Tips

Mastering options trading takes time, practice, and dedication. Here are five tips for trading options in Bulgaria so you can give this market a try.

1. Take an options trading course

This guide is a great starting point to learn more about options trading in Bulgaria. However, if you really want to understand the ins and outs of options trading, take a specialized course. These online courses are taught by professional traders with extensive experience in the market. Many of them will help you build your own options trading strategy so that you can succeed in this market.

2. Read books on options trading

There are many good books explaining how to trade options, with very detailed strategies and examples. Two books on options trading that we recommend are ‘Options Trading: QuickStart Guide – The Simplified Beginner’s Guide to Options Trading’ by Clydebank Finance and ‘Option Volatility and Pricing: Advanced Trading Strategies and Techniques’ by Sheldon Netenberg.

3. Use a demo account for options trading

Most of the best options trading brokers in Bulgaria offer free demo accounts where you can practice options trading risk-free. Using a demo account can help you try out new strategies or see how you do in the options market before risking your own funds.

4. use options trading signals

Trading signals can play an important role in helping you identify options trading opportunities. With options trading signals, you will receive alerts when a specific parameter is reached, or you can automatically set entry and exit points for trades. Trading signals help remove some of the emotion from trading, which is key to successful options trading.

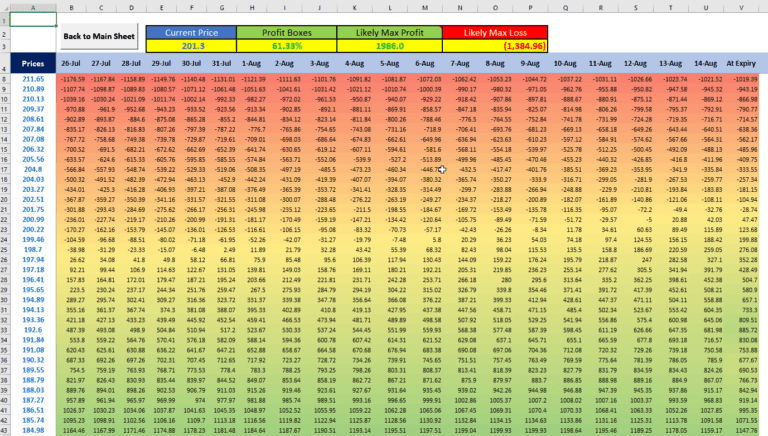

5. Use an options trading calculator

Determining your potential profit and loss from trading options can be difficult. However, there are online options calculators that do most of the work for you. Enter the details of your options contract and the current price of the asset, and the calculator will do the rest.

The best options trading platforms

Choosing the right options trading platform in Bulgaria is extremely important. Your broker determines what options you can trade and whether you can participate in binary options trading. Your trading platform will also be your primary source for research and analysis.

There is a wide choice of options trading brokers in Bulgaria. Here are our favorites:

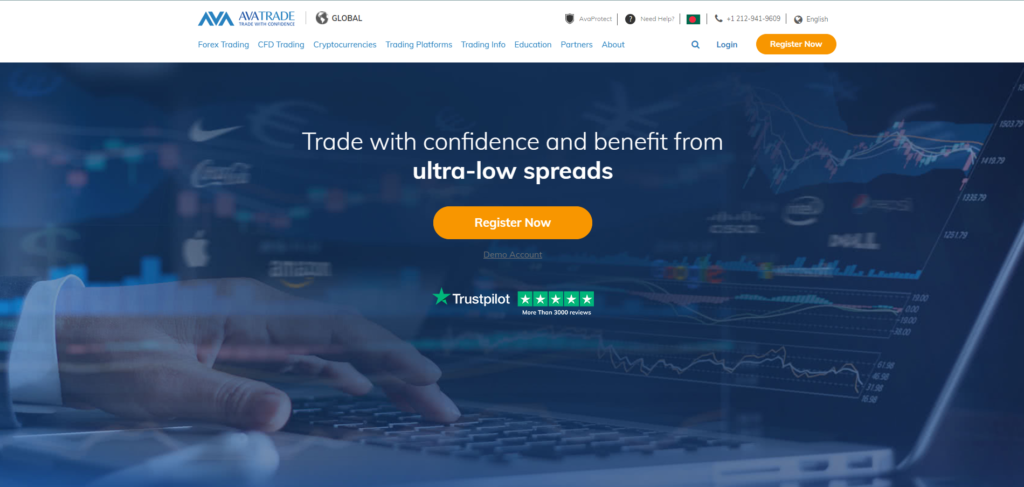

1. AvaTrade – A dedicated platform for trading forex options

AvaTrade is the best forex options broker in Bulgaria. This broker offers options trading on more than 40 currency pairs. For most asset types, AvaTrade offers contracts for difference (CFD) trading, but it also allows you to buy and sell options contracts directly, so you have the opportunity to exercise your contract, not just speculate on premiums.

AvaTrade offers a dedicated options trading platform – AvaOptions. You can quickly evaluate different options trading strategies using the platform, as well as calculate your profit, loss and break-even price. AvaOptions also offers professional risk management tools, including stop-loss orders for options trading.

AvaOptions is available for desktop, web, and mobile. All options trades through AvaTrade are 100% commission-free. However, be careful with the spreads, as they can be a bit steep if you plan to sell your positions instead of exercising the contract.

Advantages:

Disadvantages:

Вашия капитал е в риск.

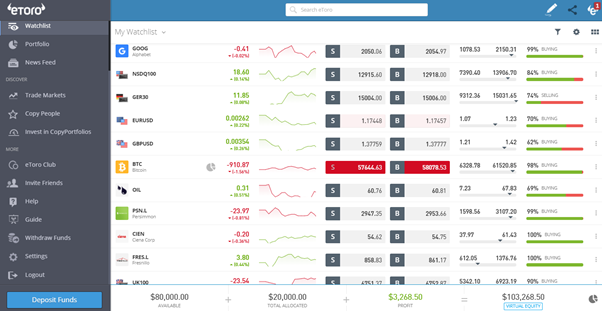

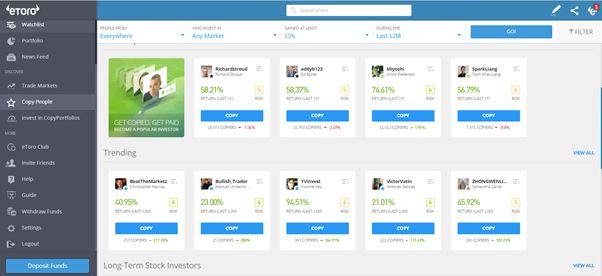

2. eToro - The best alternative broker for options trading

Although it does not yet offer options, the platform offers the ability to buy actual stocks and ETFs, as well as trade CFDs on more than 2,400 markets, including stocks, commodities, indices, currencies, and cryptocurrencies.

One of the reasons the eToro platform is so popular with investors around the world is that it allows you to copy other successful traders and investors with the click of a button. The CopyPeople feature allows you to view the historical performance of other traders and if you like their results, you can copy their trades to your own account.

For long-term investors, eToro also offers an internally managed investment portfolio called CopyPortfolio. These are ready-made investment funds that you can invest in. They cover a wide range of topics, such as precious metals and energy, cloud technology, drone technology, medical marijuana, and more.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

Options Trading in Bulgaria: Advantages & Disadvantages

Advantages:

Disadvantages:

How to start trading options in Bulgaria

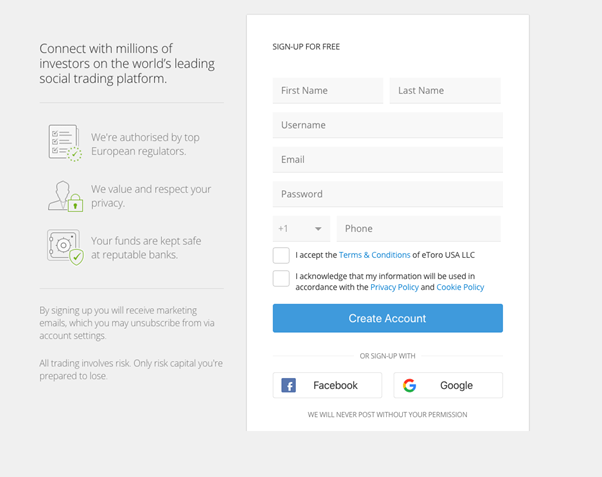

We will guide you through the process of trading options in Bulgaria step by step. Our chosen broker is eToro, which provides access to trading CFDs, futures and real stocks. The broker is about to launch options trading as well, so be one step ahead, start using the world's largest social trading platform now.

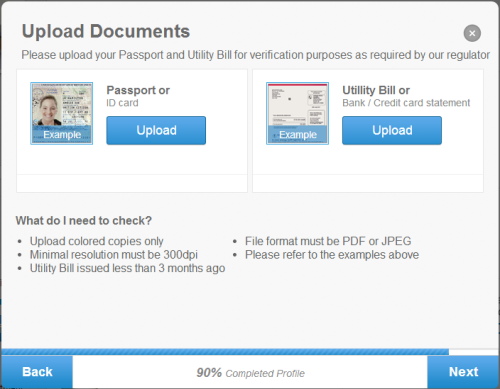

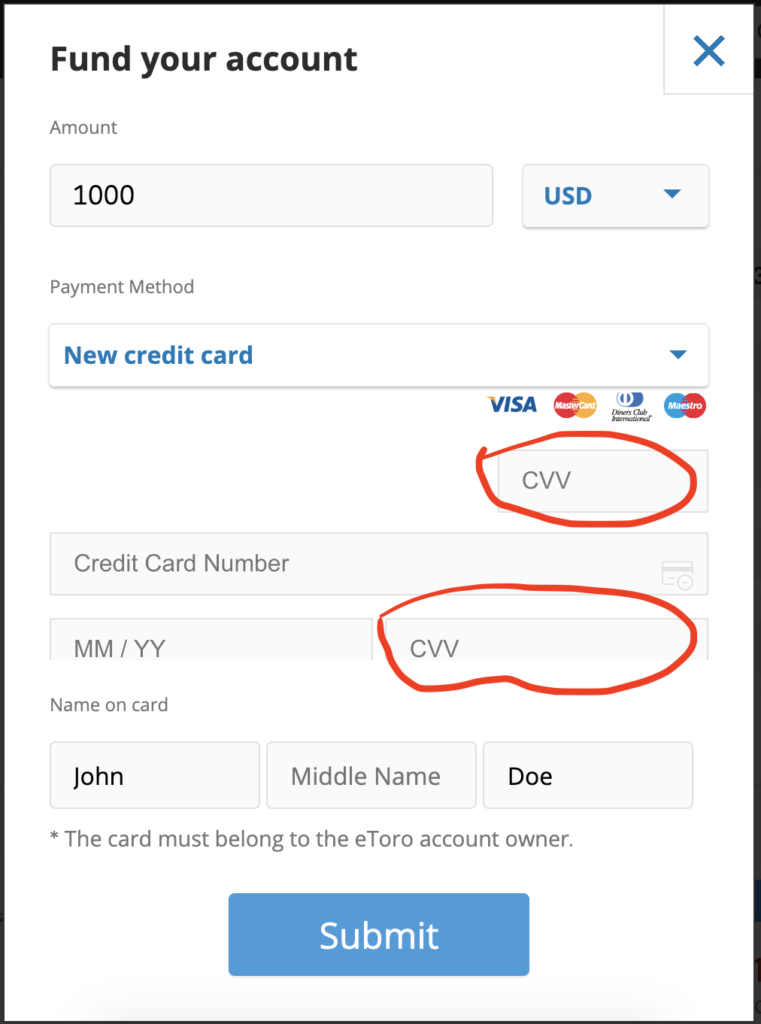

You can open an account with eToro in just a few minutes. To create an account, fill in your personal details and accept the Terms and Conditions. Once this is complete, you will be redirected to the eToro platform. To start depositing funds and trading, you will need to fill out an application form so that the broker can learn more about you and your experience in the financial markets. As a globally regulated broker, eToro will need to verify your identity and address. Documents can be uploaded to the platform. You need to upload: You can easily deposit funds by clicking the Deposit Now button in the bottom left corner of the platform. You can also create an eToro Wallet, where you can send and receive crypto assets from other wallets and transfer crypto assets to the platform. Deposit methods include: From the eToro platform, you can search for the asset classes you want to trade. Once you have selected your market, simply click on the trade button. In the trade form, you specify the amount you want to invest and whether you want to place a stop-loss or take-profit order. Any fees for your position, such as overnight fees, are also outlined. Click Open Trade to complete your transaction!Step 1: Opening an account

Step 2: Verify your identity

Step 3: Deposit funds into your eToro wallet

Step 4: Choose your investment and invest!

Options trading is an advanced form of trading that gives you the right to buy an asset at an agreed price on a future date. Options trading in Bulgaria is popular among traders as it is cost-effective and offers opportunities for large profits.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)In conclusion

eToro – The best broker

Frequently Asked Questions

How much money can be made from options trading?

What is the difference between options and futures?

How can I get approved to trade options?

What is CFD options trading?

Can I bet against an underlying asset using options?