Как да инвестираме в петрол в България – Ръководство за начинаещи

Did you know that crude oil prices have increased by nearly 500% since the pandemic?

This market volatility is rare and has attracted institutional mutual funds, which have helped drive gains across the energy sector, including oil stocks and oil ETFs.

If you want to join the market rally, this beginner’s guide on how to invest in oil in Bulgaria will be useful to you!

In a step-by-step process, we present how to invest in oil with the best brokers, the best strategies for navigating volatile market conditions, the best oil companies to invest in, and more, and more.

How to invest in oil with eToro

The section below walks you through the process of how to invest in oil step by step on the eToro trading platform. This is the platform we chose because it is regulated by the FCA, CySEC and ASIA and offers oil trading:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

How to invest in oil in Bulgaria

If you want to know how to invest in oil in Bulgaria with a small investment, follow these steps:

- Choose an oil broker. We recommend eToro , which is licensed and regulated by the FCA and offers a good range of oil-related products, including crude oil, oil stocks, ETFs.

- Open a trading account . Opening a trading account with eToro is easy and takes minutes. You only need to provide a set of personal details.

- Depositing funds. The minimum initial deposit is $200, which can be made by bank transfer, debit/credit card or e-wallets.

- Investing in oil! You’re ready to invest in oil. Take action!

You can invest in oil through the largest social trading platform with over 17 million users.

Step 1: Choose an oil investment platform

One of the most important things to keep in mind when investing in oil is that you use the right trading platform.

Your trading platform is your gateway to investing in the oil market, so it needs to be safe, secure, and easy to use.

Below we discuss some of the best oil investment platform providers you can choose from.

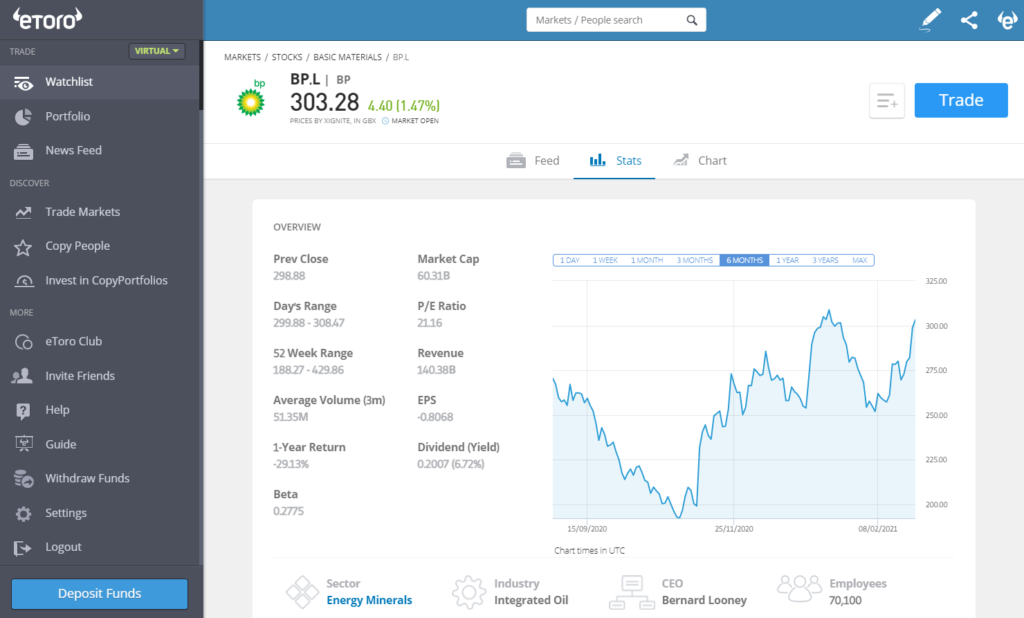

1. eToro – An exceptional platform for investing in oil

eToro is the largest social trading platform in the world with more than 17 million users, licensed and regulated by the FCA, CySEC and ASIC.

eToro is the largest social trading platform in the world with more than 17 million users, licensed and regulated by the FCA, CySEC and ASIC.

With eToro you get access to over 2,400 global markets, including crude oil, oil stocks, oil ETFs and other asset classes such as currencies, indices and commodities.

However, there are some other fees to consider. One is the spread – the difference between the buy and sell price of an asset. If you keep a trade open overnight, there is also a small overnight fee.

However, both the spread and overnight fees on eToro are low and competitive in the industry. If you decide to invest in oil stocks, there are no overnight fees.

One of the best features of the eToro platform is that you can find other profitable traders and copy their trades with the click of a button. Using the Copy People option, you can view the performance of different traders and copy their trades to your own account.

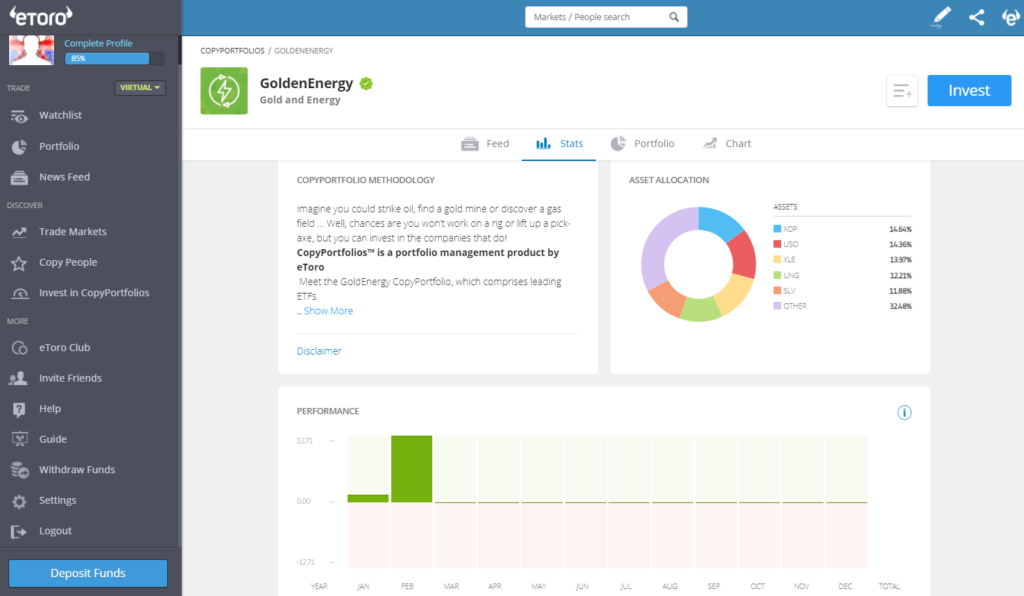

Another interesting feature is CopyPortfolio. These are ready-made portfolios designed by experts so you can invest and benefit from major market trends. Some portfolios include oil, others – drone development technologies, others cover the 5G revolution, mobile payments and more.

With so many markets and different product offerings, the platform provides a variety of ways to diversify your portfolio by investing in the oil market. Opening an account is easy, in a matter of minutes.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. AvaTrade - Best Oil Broker for Different Account Types

AvaTrade is a globally regulated broker with strong regulatory oversight from the Central Bank of Ireland, the Australian Securities and Investments Commission, the Financial Services Agency of Japan, and many others, providing peace of mind when depositing and withdrawing funds.

With AvaTrade, you can trade 1,250+ global markets and various asset classes, such as commodities like oil, as well as currencies, indices, stocks, and cryptocurrencies.

AvaTrade users can trade from a variety of trading accounts, which include CFD trading, options trading, spread betting, and swap-free Islamic accounts. The broker also offers access to professional accounts for serious traders.

The broker also offers a range of educational and research tools, including videos, articles, and a blog. Users can also access services from Trading Central, which provides real-time trading ideas and research on thousands of markets.

Customer service is available in more than 14 different languages Monday through Friday via live chat, phone, and email. Users have access to a wide range of features when trading with MetaTrader 4, such as access to the MetaTrader marketplace and signal services.

Advantages:

Disadvantages:

Вашия капитал е в риск.

3. Libertex - Best Oil Trading Platform with Zero Spreads

<

The platform offered by Libertex is unique because the broker does not charge any spreads. The spread is the difference between the purchase price and the sale price of a particular asset. With Libertex you can trade more than 200 financial CFD instruments covering commodities such as oil, as well as stocks, indices, currencies with zero spreads and low commissions.

Libertex allows margin trading of oil CFDs. This allows you to control a larger position with a smaller deposit. Margin requirements vary depending on whether you are a retail investor or a professional trader.

The Libertex trading platform is web-based and feature-rich. The broker also offers access to the world's most popular MetaTrader 4 platform. A Libertex account can be opened easily and in just a few minutes.

The minimum deposit is just € and can be made via bank transfer, credit/debit cards and e-wallets such as Neteller and Skrill. Customer service is available Monday to Friday from 8am to 8pm CET via live chat, WhatsApp or Telegram.

Advantages:

- Zero spreads!

- Regulation by CySEC

- Real-time analytics and news on the platform

- 213+ global markets

- Easy to use trading platform

- Low minimum deposit

Disadvantages:

- CFD trading only

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

Step 2: Choose an oil investment

Once you have chosen the most suitable oil investment platform for you, it is now time to decide which oil investment you want to make. There are quite a few options to choose from!

CFDs on oil, futures & options

As mentioned above, there are different ways to speculate on the price of oil. Some methods are relatively easy, while others are quite complex, as you will learn more about in the following lines.

CFDs on oil

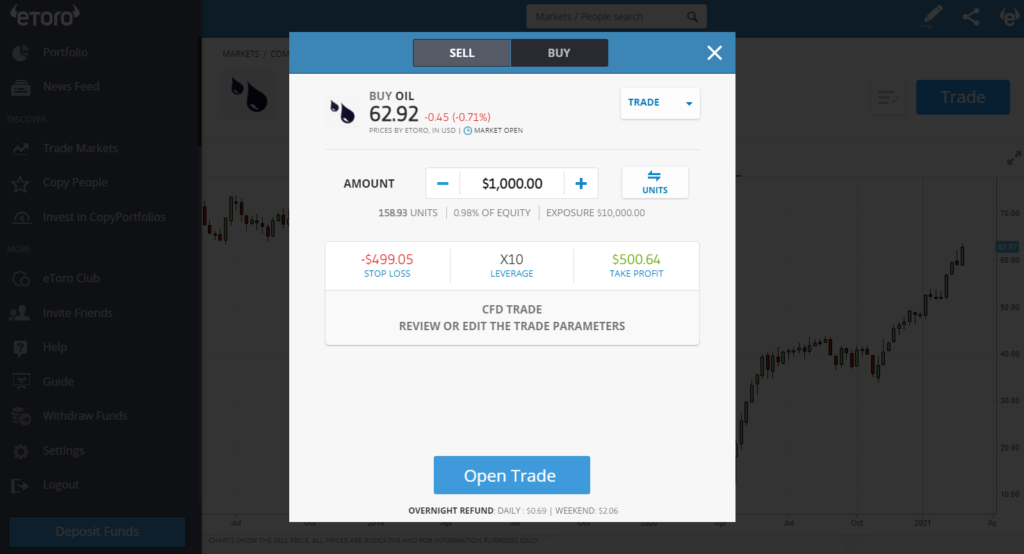

One of the easiest ways to trade oil is through a CFD broker like eToro. With a CFD, you speculate on the market price going up or down, but without owning the underlying asset.

All you have to do is press the buy button if you think the market will rise or sell if you expect it to fall. This is just one of the advantages of CFDs - you can trade long or short and profit from rising and falling markets.

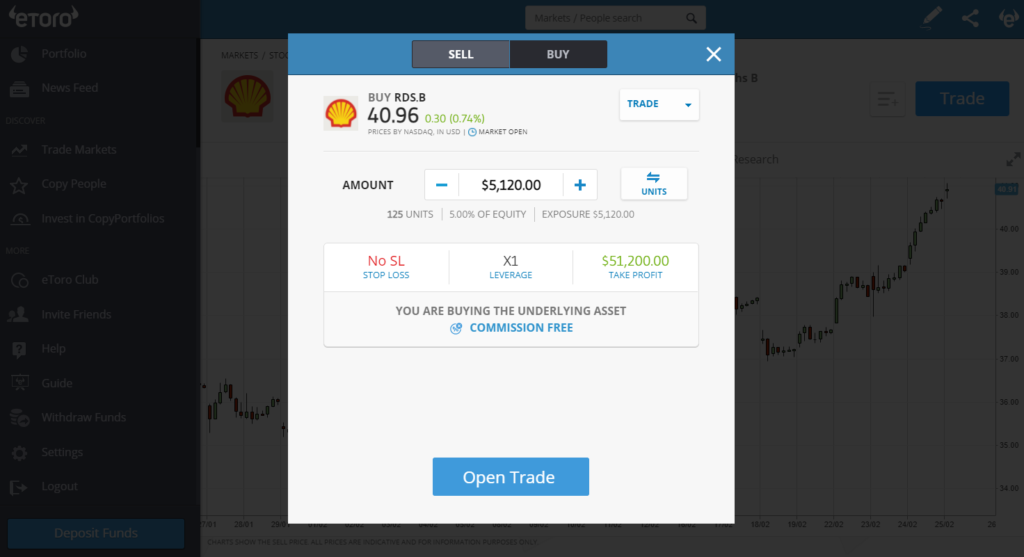

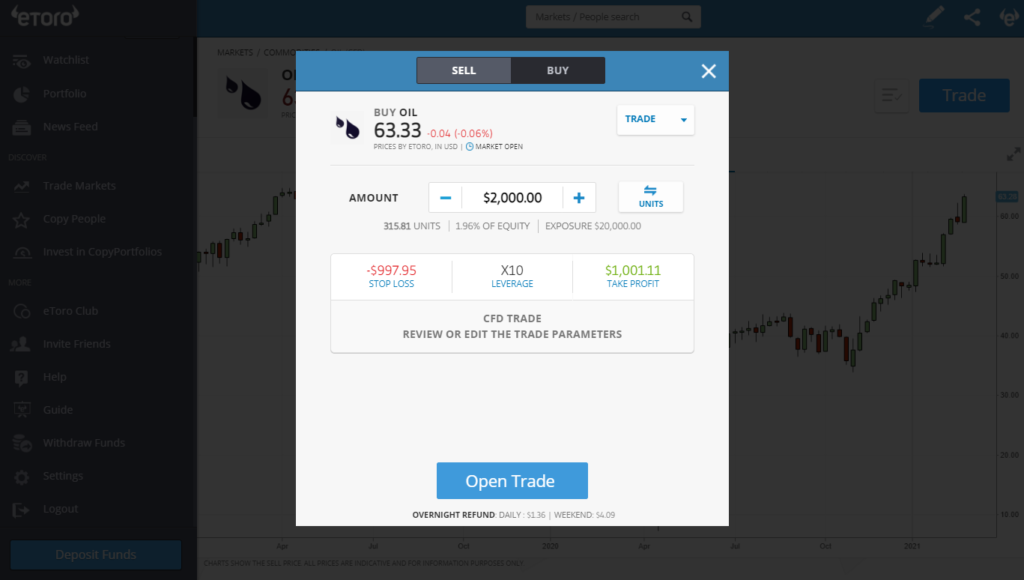

Another benefit of trading oil CFDs is that you can use leverage to control a larger position using a small deposit. The screenshot above, taken from the eToro platform, shows that a $1,000 investment in oil gives you $10,000 exposure.

With a CFD broker, you can also set stop-loss orders to minimize any losses if the market moves against you, as well as take-profit orders to withdraw your profits if the market moves in your favor.

Oil futures

Oil futures are contracts to exchange a specified number of barrels of oil at a fixed price on a specified date in the future. When trading oil futures, each contract has an expiration date, which is usually one month, but can be as long as three months.

These contracts are typically traded on a futures exchange such as the New York Mercantile Exchange (NYMEX) and are primarily used by trading companies to lock in the price of the barrels of oil they want to buy. However, the leverage is not as high as that offered by CFD brokers.

Oil options

An oil options contract gives you the right, but not the obligation, to buy or sell a fixed quantity of oil at a fixed price on a specified date in the future. The two types of options available are called “calls” and “puts.”

If you expect the price of oil to rise, you buy a call option. If you expect the price to fall, you buy a put option. Oil options contracts are also affected by time lags and volatility, making options trading one of the most complex ways to invest in oil.

Oil Stocks & ETFs

Some investors choose to invest in oil directly, through CFDs, futures or options, while others prefer oil stocks, oil ETFs or mutual funds. However, companies that explore for oil are likely to do well when oil prices rise.

Energy companies offer investors direct exposure to the oil market and other benefits. Some of the big energy giants like Exxon Mobil, BP, and Shell pay very good dividends on shares purchased.

This means that the investor can potentially benefit from capital gains in the share price, as well as from the dividend payments from the stock, which are usually made quarterly.

Oil ETFs are another way to gain exposure to the oil market or the energy sector as a whole. For example, the US Oil Fund is one of the most popular oil ETFs available. This fund provides exposure to the US oil market without having to purchase futures contracts.

There are other oil ETFs that act more like mutual funds, investing in a basket of different oil stocks. For example, the Energy Select Sector SPDR offers investors exposure to the major companies in the U.S. energy market. The fund's largest holdings are Exxon Mobil, Chevron, ConocoPhillips, and 23 other energy companies.

The eToro trading platform offers you a full range of oil companies to invest in.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

Step 3: Oil Studies

Now that you know more about the variety of ways you can get started trading oil, it's wise to delve deeper into your knowledge. This is important to identify where the opportunities lie, but also what the risks are when trading oil.

Be sure to read the sections below to upgrade your knowledge on all things related to investing in oil!

Different types of oil

When learning how to invest in crude oil, it is important to also know the different varieties and blends that exist. The two most commonly traded types are U.S. light crude and Brent.

WTI (Light US Crude) is a blend that is refined in the United States and traded on the New York Mercantile Exchange (NYMEX). This type of oil is extracted from oil fields in the states of Texas, Louisiana, and North Dakota and then transported to Oklahoma.

Brent crude oil is extracted from the North Sea and transported by pipeline to Scotland. It is traded on the Intercontinental Exchange (ICE) and is used as a benchmark for oil prices in Europe, Africa and the Middle East.

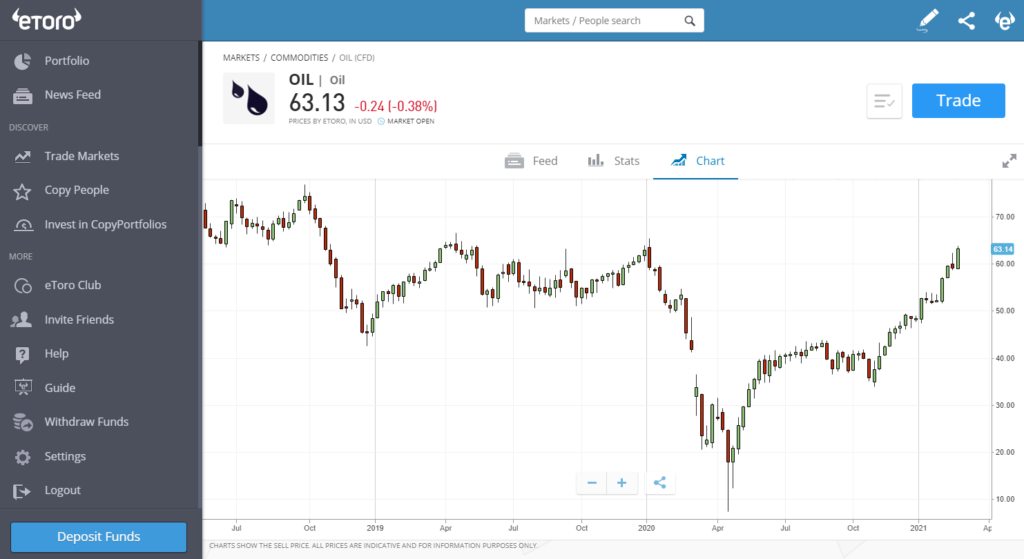

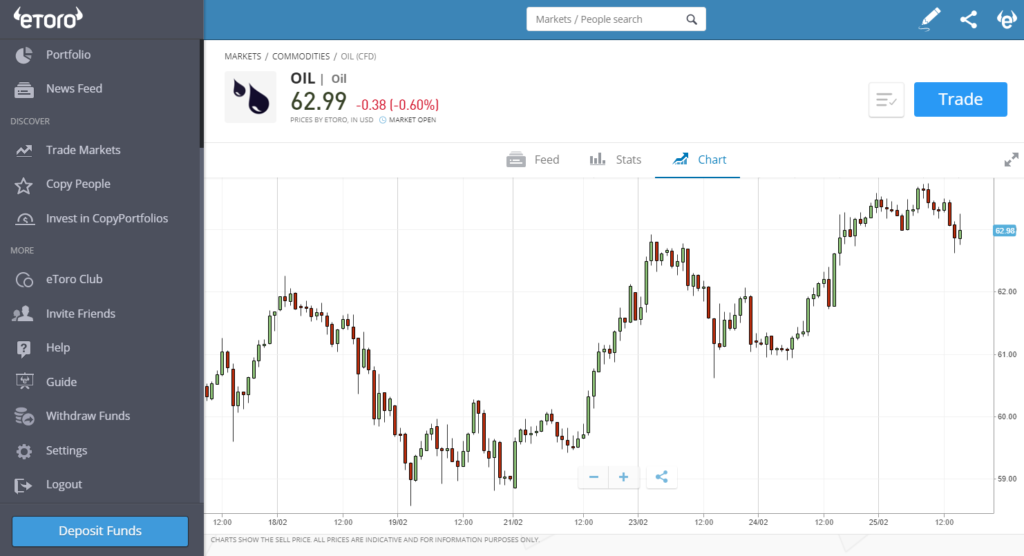

Oil prices

Oil blends like WTI and Brent are priced in US dollars. When you look at the price of oil, you are essentially looking at the price of a barrel of oil in US dollars. At the time of writing, the price of US light crude is $63.10 per barrel.

When learning how to invest in crude oil, being able to predict future price movements will be helpful. The price of oil is affected by many different factors, such as:

- OPEC Production . The Organization of the Petroleum Exporting Countries (OPEC) is made up of 14 oil-rich countries, led by Saudi Arabia. They meet every month to discuss how much oil they will produce and sell on the open market. If they reduce supply, prices usually rise, and vice versa.

- Geopolitics. The oil market is highly politicized due to the tensions that could flare up in the Middle East. Even the coronavirus pandemic has caused problems for the price of oil, as barrels of oil sat unused in the continental United States during the lockdown, leading to a rise in inventories and a collapse in prices.

- The US dollar. Since WTI and Brent are priced in US dollars, any major currency movement can have an impact on the price per barrel of oil.

Is oil a good investment? Analysis of oil investments

Many investors are wondering whether oil is a good investment after its price collapsed by almost 90% after the start of the pandemic, followed by a sharp recovery.

JP Morgan analysts say commodities have entered a new supercycle as prices surge in agriculture, metals and energy. Only four supercycles have developed in the past 100 years, with the last peaking in 2008.

Many analysts predict higher oil prices in the long term, citing various reasons, including an increase in oil demand due to several reasons:

- Successful vaccination against the coronavirus will increase global travel and mobility.

- Central bank stimulus will boost infrastructure spending and production.

- Energy companies trying to become more environmentally friendly will reduce oil drilling overall, which will raise prices for current supplies.

If oil prices can approach the 2018 highs of approximately $77, that would be a 60% increase from prices since the beginning of 2026. A move to the previous 2018 highs of approximately $113 would mean a 130% increase in prices.

Oil is an asset with high volatility, as it is affected by global demand and geopolitical factors, so it is important to be aware of some of the risks of oil investments.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

Risks of investing in oil

When considering how to invest in oil in Bulgaria, it is important to consider the risks, as the oil market is highly volatile. Some of them are:

- Economic risk. Oil markets can be affected by supply or demand shocks, which can be due to weather conditions, geopolitical tensions and extraordinary events. For example, when oil demand suddenly stopped during the pandemic, oil prices crashed to 30-year lows.

- Company risk. If you are choosing oil companies to invest in, then consider announcements and news that could hurt the price of the company's stock. A scandal, accounting mismanagement, or losses could cause many investors to sell, which will put pressure on stock prices.

- Political risks. Geopolitical tensions can cause major fluctuations in oil prices. Much oil comes from the Middle East, where tensions can easily flare between different countries, leading to supply disruptions.

- Climate risks. More and more oil companies are trying to move away from oil drilling in favor of more climate-friendly energy sources. Many companies are also losing big investors as mutual funds move away from energy companies that leave a large carbon footprint.

Oil investment strategies

There are a variety of strategies that investors can use to take advantage of the volatility in the oil market. Many of the strategies will depend on your chosen investing style, such as whether you prefer short-term or long-term investing. Let's take a look at a few:

Investing in oil based on fundamentals

Longer-term investors tend to analyze the fundamental picture of what might happen over many months or years. This type of investor is more likely to focus on oil companies to invest in rather than buying oil directly.

Since companies in the energy sector tend to pay high dividends, this is a strategy that combines different streams of income - share price appreciation and dividend income paid quarterly.

Oil trading with technical analysis

Short-term investors, such as day traders, may choose to speculate on the price of oil through CFDs, which allow for profit from both rising and falling markets, with leverage also applied.

In this case, most traders will study price charts and technical analysis indicators to identify short-term turning points in the market. Although a highly specialized skill, day trading oil is popular due to market volatility.

Oil Investments with CopyPortfolios

A much newer way to capitalize on the oil market is to use eToro’s CopyPortfolio feature. These are ready-made investment portfolios managed in-house by eToro’s investment team. They are also super easy to access and can provide a good level of diversification.

For example, the eToro platform has the GoldenEnergy CopyPortfolio. This is a portfolio that includes investments in the energy, oil, gold, and mining sectors.

You can easily browse the different investments in the portfolio and choose whether to invest with a click of a button.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

Step 4: How to invest in oil with eToro

The section below walks you through the process of how to invest in oil step by step on the eToro trading platform.

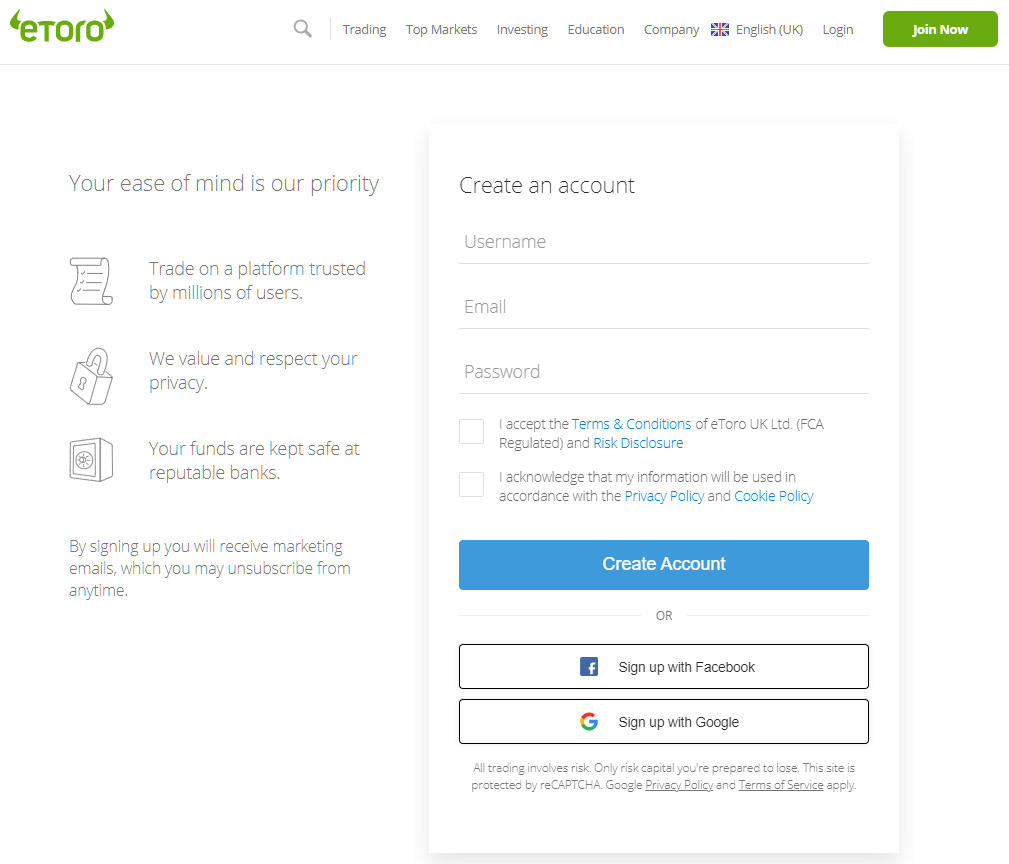

1. Opening an account

Opening a trading account with the eToro platform takes minutes. To open an account, you need to fill in your personal details and accept the Terms and Conditions. You will then be redirected to the platform. To deposit an account and start trading, you will need to fill out a form in which you reveal more about yourself and your experience in the financial markets.

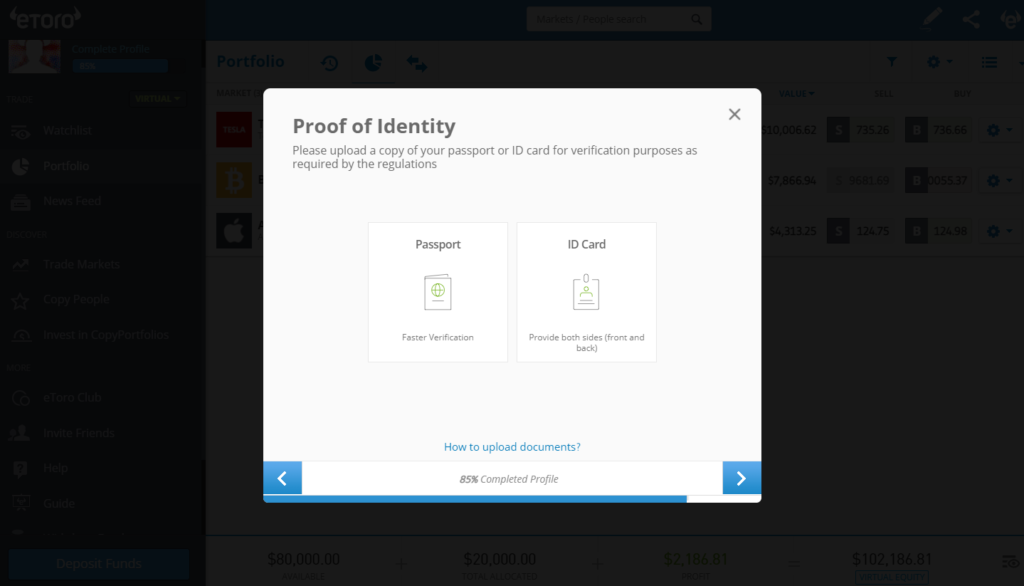

2. Identity verification

As a globally regulated broker, eToro must verify your identity and address.

Documents can be uploaded to the platform. The following are required:

- Valid passport or driver’s license

- Bank statement or utility bill no older than 6 months

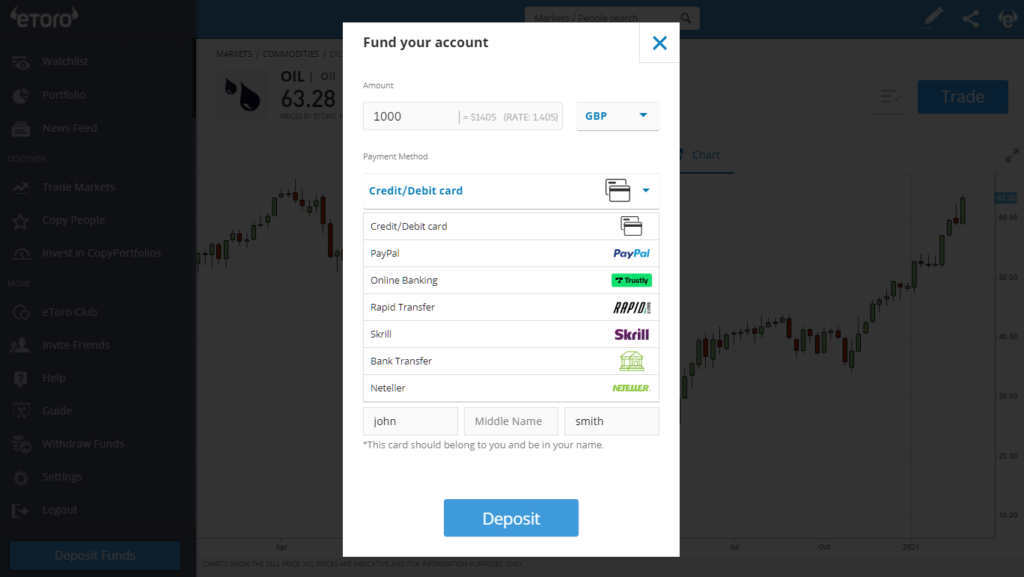

3. Depositing funds into the eToro oil portfolio

You can easily deposit funds by clicking the Deposit Now button in the bottom left corner of the platform. You can also create an eToro Wallet, where you can send and receive crypto assets from other wallets and transfer crypto assets to the platform.

A deposit can be made with:

- Bank transfer

- Debit/credit card

- Neteller

- Skrill

- PayPal

4. Choose how to invest in oil and invest!

From the eToro platform, search for the asset class you want to trade. This could be oil stocks, an oil ETF, or WTI via CFD.

Once you have selected your market, simply click on the “Trade” button.

The oil trading form allows you to enter the amount you want to invest and whether you want to place a stop loss or take profit order. It also outlines any fees for the position, such as overnight fees. By clicking “Start Trade,” you complete your transaction.

How to invest in oil in Bulgaria – In conclusion

In this beginner’s guide to investing in oil in Bulgaria, we’ve looked at some of the best oil investment platforms, the different products available for investment, and how to invest.

Whether you trade oil directly via CFDs, stocks or ETFs, many analysts are optimistic about the future of the oil market. JP Morgan predicts that we are now in a commodities trading supercycle – only the fifth in the last 100 years.

To be able to take advantage of this trend, it is essential to have access to the right broker and platform. eToro is one such broker because it is highly regulated and offers trading. An account can be opened in minutes and you can see for yourself how easy the system is to use.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)Translation results

eToro – The best broker for oil investments in Bulgaria

Frequently Asked Questions

Is oil a good investment?

How do I decide which companies to invest in?

How do I invest in oil with little money?

What are the risks of investing in crude oil without training?

Can you profit from a drop in oil prices?