Как да купите акции на Amazon от България през 2026 – с 0% комисиона

Most major stocks saw double-digit percentage price declines during the first COVID-19 lockdown, but Amazon shares were not among the losers. On the contrary, the online retailer continues to post gains. If you want to buy Amazon shares, you will need a stock trading account that gives you access to the US NASDAQ.

In this guide, we explain how to buy Amazon shares online in Bulgaria . This includes the steps required to buy Amazon shares in the fastest, cheapest and safest way, as well as the best broker in Bulgaria to make your trades with.

How to buy Amazon shares – a step-by-step guide 2026

To start buying Amazon shares , you need to follow the steps below:

- Find a broker in Bulgaria that offers Amazon shares (we recommend either eToro )

- Explore Amazon Stocks

- Opening an account and depositing funds

- Buying Amazon shares

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

[stocks_table id=”15″]

Step 1: Find a broker in Bulgaria that offers Amazon shares

Amazon is one of the largest companies by market capitalization in the world, and it’s no surprise that many UK brokers now allow trading in the company’s shares. However, that doesn’t mean that all brokers offer the perfect Amazon share deal.

It is imperative to research the types of fees and commissions that platforms charge, what payment methods for Bulgaria are supported, and – crucially – whether the broker is regulated or not.

We offer you some popular stock brokers in Bulgaria that allow you to buy Amazon shares online.

1. eToro – Leading Broker for Social Trading

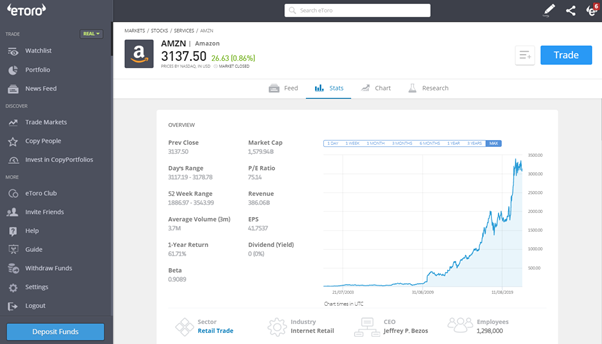

One of the unique features of eToro is that the broker allows you to trade traditional stocks as well as CFDs. With CFD trading, you can also speculate on falling stock prices, as well as apply 1:5 leverage for larger volumes.

eToro is known as a social trading platform, meaning you have the opportunity to interact with other traders in a community. The broker also offers copy trading tools, meaning you can copy trades and portfolios of top-performing investors!

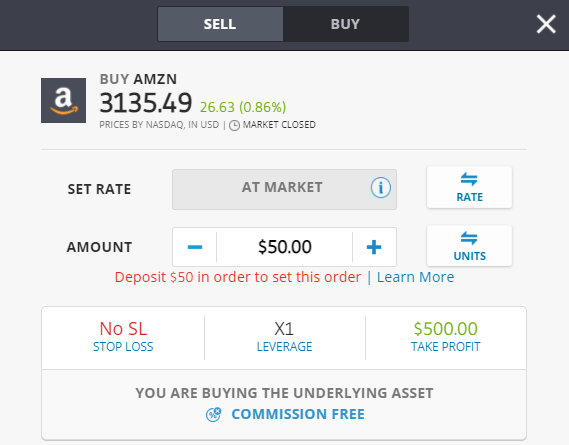

The minimum deposit is $200. eToro allows you to buy fractions of Amazon shares, as the price of one share exceeds $1,000. You can invest even just $50, i.e. buy a fraction of an Amazon share.

When it comes to the security of your funds, eToro is regulated by the FCA, ASIC (Australia) and CySEC (Cyprus), so your money is protected. Another advantage of eToro is its excellent stock trading app, from which you can buy Amazon shares from a mobile device.

Advantages:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. Libertex – Zero Spread Stock CFD Broker

In addition to trading CFDs on Amazon, Libertex also allows you to trade other stocks, currencies, indices and cryptocurrencies. The cryptocurrency offering is impressive.

Key stocks in hot sectors are also available, such as cannabis stocks that other brokers don't offer. Stock trading commissions range from 0% to 0.5%, and with some account types you can get a 50% discount.

The Libertex trading platform is feature-rich and easy to use, with exceptional training and research materials. In addition, Libertex guarantees peace of mind thanks to its CySEC regulation.

Libertex fees:

| Commission | 0%-0.5% for stocks |

| Deposit fee | None |

| Withdrawal fee | 1 EUR for credit/debit card, 1% for Neteller, free for Skrill |

| Inactivity fee | 10 EUR after 180 days |

Advantages:

Disadvantages:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

3. AvaTrade - Large selection of trading platforms

With AvaTrade, users get access to a wide range of trading platforms and account types - for spread betting, options trading, CFD trading, and swap-free Islamic accounts for the MetaTrader 4 and MetaTrader 5 trading platforms.

In addition to being able to trade CFDs on Amazon stocks through AvaTrade, you also have access to over 1,250 global markets and stocks, indices, commodities, currencies, and cryptocurrencies.

You trade 100% commission-free with a broker that is regulated in six different jurisdictions!

AvaTrade Fees:

| Commission | 0% |

| Deposit fee | None |

| Withdrawal fee | None |

| Inactivity fee | Yes, $50 after 3 consecutive months of account inactivity |

Advantages:

Disadvantages:

Вашия капитал е в риск.

Step 2: Research Amazon stocks

Amazon has been rewarding its shareholders handsomely over the past decade, but it's still important to do your own research. In this part of our guide, we explore some of the most important factors to consider before buying Amazon stock.

Amazon stock price history

Founded in 1994 by Jeff Bezos, Amazon began as an online bookstore. The company then expanded to include other aspects of commerce, selling DVDs, CDs, and other consumer goods. Just three years after its founding, Amazon decided it would go public. It listed on the technology-focused NASDAQ, with Amazon shares initially trading at $18. This valued the company at just under $500 million.

In the following years, Amazon grew rapidly and benefited greatly from the dot-com boom. However, like the rest of the industry, Amazon suffered serious consequences from the bursting of the dot-com bubble. It took almost 14 years for the company's stock to recover to pre-dot-com levels.

Оттогава за акционерите на Amazon траекторията е само възходяща. В началото на 2021 г. цената на акциите на Amazon достига малко над $ 3 100. Това представлява ръст от 16 000% спрямо цената при първичното публично предлагане. Трябва обаче да вземете предвид и това, че са правени няколко сплита, което означава, че възвръщаемостта на инвестицията ви ще бъде още по-висока.

Ако сте инвестирали £1 000 в акции на Amazon през 1997 г., стойността на вашата инвестиция сега щеше да е £1.2 милиона. Amazon вече има пазарна капитализация над $ 1.44 трилиона. Личното състояние на основателя и главен изпълнителен директор на компанията Джеф Безос се оценява на $ 177 милиарда.

Дивиденти от Amazon

Като вземем предвид всичко изброено по-горе - че Amazon сега е един от най-големите, най-успешните и най-печелившите бизнеси в света, може да се изненадате да научите, че компанията не е изплатила и 1 цент за дивиденти. Това е малко странно предвид колко е силна фирмата чисто финансово.

Компанията подчертава, че планира да реинвестира дивидентите си, за да поддържа растежа на бизнеса. Тя се диверсифицира в различни, модерни сектори, за да поддържа силен паричен поток, например изкуствен интелект, облачни изчисления и дигитален стрийминг.

Да купя ли акции на Amazon?

Recorder

Swing traders love Amazon because the company's stock continues to rise. Amazon shares have been hitting record highs since August 2020.

This is especially interesting given the impact of the pandemic on the broader stock markets. Some public companies have lost 30-50% of their value. Ultimately, there is no reason to believe that Amazon's rally will end anytime soon, so it will be interesting to see how high the price can go over the next 6-12 months.

The main trading business is booming

Looking at the stock market growth that Amazon has achieved in recent years, it is very reminiscent of a new company, such as Tesla. However, it is important to remember that Amazon and its core business model - online retail - has been around since 1994.

Amazon's retail sales are still growing at an exponential rate. In 2020, the growth was 19% compared to the previous year, and in 2021, almost the same growth is expected.

Amazon brand loyalty

Customer loyalty is key for Amazon to maintain its position in the online marketplace, as evidenced by data on its Prime service. It was recently found that 24% of people with Prime subscriptions plan to increase their spending on Amazon this year.

Another Bank of America survey found that 67% of Prime members would not or are very unlikely to cancel their subscription. Only 6% of Prime subscribers said they would cancel, down 2 percentage points from the same survey a year earlier.

Unprecedented diversification

Amazon's online retail business is booming, but let's not forget the company's innovative projects. The company recently entered the online grocery space. To capitalize on the sector, Amazon is expanding its super-fast 30-minute delivery service. The company has also eliminated the $15 monthly fee for most Prime subscribers. This is expected to attract more subscriptions to the service.

Another example is Amazon Web Services (AWS), which is expected to generate over $45 billion in sales in 2021. That’s more than Google and Microsoft combined in the cloud computing sector. Amazon is also ramping up its efforts in artificial intelligence and drone delivery, sectors to watch in the coming years.

Step 3: Open an account and deposit funds

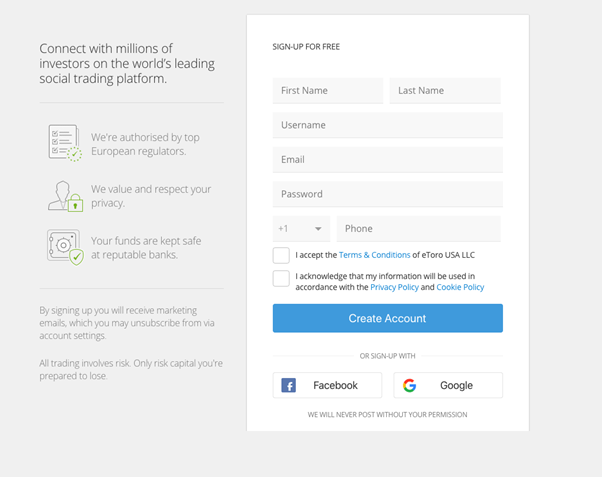

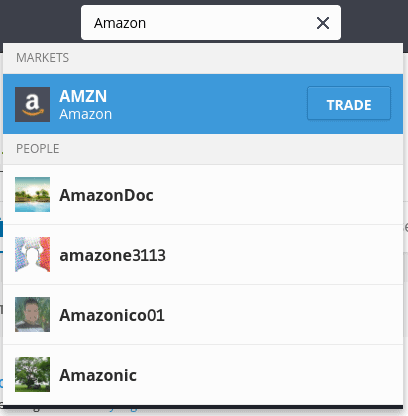

Now that you have the essential information about Amazon, you are ready to take the next step. We will guide you through the process of buying Amazon shares from Bulgaria. You can choose from many brokers, we will show you how to invest in the stock with eToro. First, log in to the eToro website and open an account. You must choose a username and password and provide some personal information – name, home address, date of birth and contact details. You will also need to verify your identity. You can do this at a later stage, unless you are planning a deposit of more than €2,000. However, identity verification must be completed before you can withdraw funds, so it is best to do it right away. This requires: A minimum deposit of $200 is required when opening an account with eToro. You don’t have to invest the entire amount, you can invest as little as $50 in Amazon shares. eToro accepts payments with: After the deposit is confirmed, the funds will be reflected in your account immediately (unless you fund it with a bank transfer). Once you have made a deposit into your account, you can now buy Amazon shares. With eToro, this can be done by searching for ‘Amazon’ in the search box at the top of the page and then clicking on the results as shown below. Then press the ‘Trade’ button. To complete the investment process, you need to enter the value of your investment in USD, then click ‘Place Order’ to complete the Amazon stock transaction! Note: If you are buying Amazon stock outside of standard market hours (9:30 AM to 5 PM Eastern Standard Time), you must click ‘Place Order.’ Your trade will be executed when the market reopens.

Step 4: Purchase Amazon shares

In short, those who backed Amazon early in its corporate journey are now seeing huge gains. While it’s disappointing that you missed out, it’s not too late to get on board. The company’s stock has increased in value by 70% in 2020 alone. Amazon appears to be holding onto its momentum in 2021, so the company’s stock is considered one of the best investments by many analysts. If you want to profit from Amazon shares as quickly, safely and cost-effectively as possible, use eToro. With innovative copy trading tools and a license from eToro, it is an excellent choice of broker for trading Amazon shares. Click the link below to start trading! button url=”https://tradingplatforms.com/bg/visit/etoro” style=”3d” background=”#0191C4″ size=”8″ center=”yes” radius=”0″]Visit eToro now[/button]

In conclusion

eToro – Buying Amazon shares

Frequently Asked Questions

How much did Amazon stock cost when it went public?

How much does it cost to buy Amazon shares in Bulgaria?

Does Amazon pay dividends?

Is there a currency conversion fee when trading shares with eToro in Bulgaria?

What is the minimum number of Amazon shares I can buy?