Най-добри инвестиционни фондове в България 2026

If you want to invest in the financial markets, but don’t have the know-how to do it yourself – it might be worth considering the option of using an investment fund.

This way, the fund you choose will determine which assets to buy and sell, meaning you will enjoy a passive income stream. There are different types of investment funds – from exchange-traded funds (ETFs) and mutual funds to investment trusts and index funds.

In this guide, we’ll look at the best investment funds for Bulgarian residents in 2026. We’ll cover different types of funds – and walk you through the investing process from the comfort and convenience of your own home.

Top 8 investment funds in Bulgaria

Below you will find a quick overview of the best investment funds in Bulgaria that we have selected. You will find more information about each of them by scrolling down.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

[stocks_table id=”15″]

Best investment funds in Bulgaria – overview

On the one hand, it is great that Bulgarian investors have thousands of investment funds to choose from. However, this ensures that there is a suitable fund for all types of investors. However, this can make it difficult for you to choose the best among them.

That’s why below you will find a list of the best investment funds in general that you can access from Bulgaria.

iShares Russell 1000 ETF – invest in over 800+ undervalued US stocks

The iShares Russell 1000 ETF is a great option if you want to gain exposure to the US economy. In fact, this mutual fund will give you instant access to 843 individual stocks. This means you’ll have a huge portfolio of stocks for a single investment.

The iShares investment fund selects US companies that it believes are undervalued. This includes both large- and mid-cap stocks from all possible sectors. Of the big players, the investment fund currently holds 2.76% of Berkshire Hathaway and 2.27% of Johnson and Johnson. It also has stakes in Walt Disney, Intel, Verizon and JPMorgan Chase & Co.

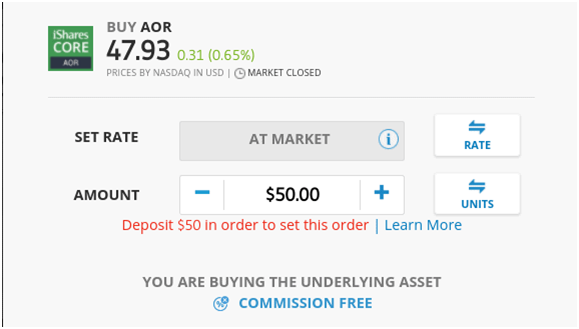

Although this investment fund is based in the US and focuses entirely on US companies, it is more than easy to invest in it from the UK. Furthermore, this platform requires a minimum investment of just $50.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

SPDR Gold ETF – Invest in gold without worrying about storing it

As the name suggests, this investment fund focuses exclusively on gold. It is worth considering such an investment if you expect difficult economic circumstances to occur. However, investors often rush to buy assets such as gold during periods of increased uncertainty in the market. Proof of this is the good performance of gold this year.

In fact, the SPDR Gold ETF is up 25.99% in the 12 months prior to the creation of this page. This mutual fund is also super easy to access – all you need to do is meet the $50 minimum deposit requirement on eToro. This way, you can invest in the future value of gold without worrying about storing or delivering this asset.

Instead, the ETF provider SPDR is physically backed by the asset – so you can invest seamlessly and easily. If you invest in an ETF, the fees are quite reasonable.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

Best mutual funds for investment in Bulgaria

Both of the funds mentioned above are ETFs. This means that the provider is tasked with tracking a specific market – such as the Russell 1000 or gold. Mutual funds, on the other hand, are a little different. This is because the fund manager personally decides which assets to buy and sell – and when to do so.

In other words, although the manager may be focused on FTSE 100 stocks, he may decide to remove some of them if he believes that the company is not adding value to investors. This is something that ETFs cannot do. Below you will find the best mutual funds in Bulgaria – in our opinion.

MI Chelverton UK Equity Growth Fund – best investment fund for investing in small British stocks

While most investors are focused on large-cap stocks listed on the London Stock Exchange, some are looking for exposure to new companies with high growth potential. These can usually be found on the Alternative Investment Market (AIM), the UK’s secondary stock market.

There, the risk-reward ratio is much higher than in established blue-chip stocks, as many companies listed on AIM have yet to really showcase their business models. Or they may be established but simply have a small market valuation. Whatever the case, if you want to allocate some of your capital to small UK companies, it is best to choose a mutual fund such as the MI Chelverton UK Equity Growth Fund.

However, the investment fund in question will personally decide which UK stocks are worth supporting and which are not. The experienced fund manager will also decide when the right time is to buy or sell. MI Chelverton UK Equity Growth Fund was established in 2014 and as of August 2020 has assets worth just over £722 million.

The fund is managed by James Baker and Edward Booth and its portfolio consists of 127 individual stocks. They are from a variety of sectors, with a strong focus on technology, healthcare, support services and consumer goods. The fund has investments in Future, Clingen, SDL, Premier Foods, Gamesys, and dotDigital.

Other leading UK mutual funds worth considering include:

- Blackrock UK Fund: This mutual fund focuses on large-cap UK stocks. Generally, they are better suited if you want to take on less risk – as the fund consists of established companies with larger market caps.

- ASI Global Smaller Companies: This is another mutual fund that focuses on smaller UK stocks with growth potential. The fund has performed well since its inception, so it may be worth diversifying your investments by allocating them between it and MI Chelverton UK Equity Growth to balance out your risk level.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

Best investment funds for beginners

In principle, all investment brokers in Bulgaria are suitable for investors, as you are not expected to do the “black” work. Instead, the process of buying and selling assets is driven by the fund itself.

However, some mutual funds are more suitable for beginners than others because the assets they hold are easy to understand. They are usually focused on large-cap stocks and shares that have a long history and represent large, well-known brands.

S&P 500 Index – The de facto investment fund for long-term wealth accumulation

Even if you’ve never traded before, chances are you’ve heard of the S&P 500. For those who don’t know, the S&P 500 is a U.S.-focused market index. It tracks the performance of 500 large U.S. companies from the NYSE and NASDAQ. These include companies like IBM, Google, Twitter, Disney, Berkshire Hathaway, Verizon, Apple, Amazon, and many more.

Since its inception in 1926, the S&P 500 index has posted an average return on investment of over 10% – weighted over time. So when it comes to the best investments for beginners, it’s a good idea to take a look at the article on how to invest in the S&P 500 in Bulgaria. The main thing is that the index is rebalanced regularly to make sure it reflects the broader U.S. stock market. To achieve this, the S&P 500 is focused on market capitalization.

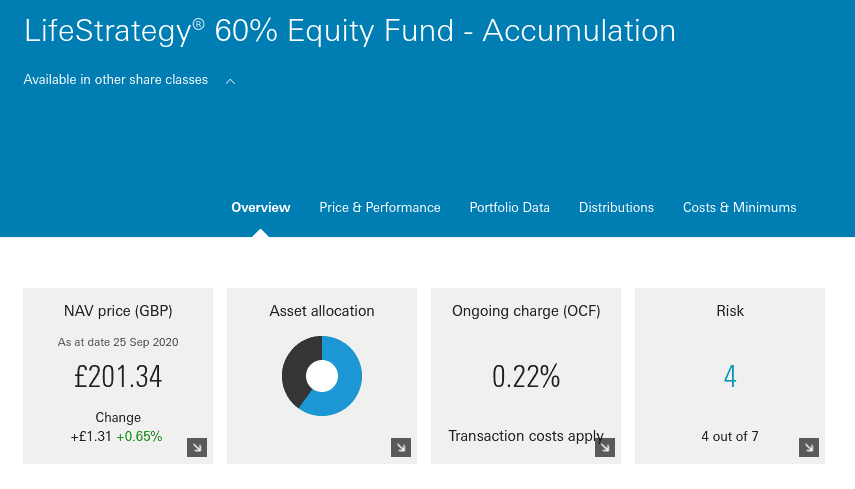

This means that the largest U.S. stocks by market value represent a larger percentage of the index. When it comes to gaining exposure, there are many mutual funds in Bulgaria that track the S&P 500. In our opinion, the easiest and most effective way to do this is through ETFs. Leading the way in this regard is Vanguard, which has its own S&P 500 ETF hosted on eToro.

This means you can invest as little as $50 without paying any fees or commissions. It’s also worth noting that, like most exchange-traded funds (ETFs), Vanguard also allows you to receive dividends. In fact, they are distributed quarterly directly to your brokerage account. By reinvesting these dividends back into the S&P 500 index, you have a chance to grow your money faster.

To help you find a mutual fund that tracks the S&P 500 and meets your needs, below are some more options:

- iShares Core S&P 500 ETF

- SPDY S&P 500 ETF

- Portfolio Plus S&P 500 ETF

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

Best exchange-traded investment funds

We’ve already covered some of the best ETFs. In summary, they include the Vanguard S&P 500 Index, the SPDR Gold ETF, and the iShares Russell 1000 ETF. However, there are other public ETFs worth considering.

Among them are:

iShares MSCI Hong Kong ETF – Invest in a basket of Hong Kong companies

If you’re the type of investor who wants to gain exposure to the ever-growing economies of Asia, you might want to consider the iShares MSCI Hong Kong ETF. As the name suggests, this mutual fund focuses on the markets of Hong Kong. Specifically, it holds 41 stocks listed on the Hong Kong Stock Exchange.

Although the portfolio is reasonably balanced, there are two companies that occupy just over 36% of it. They are AIA Group (23.95%) and Hong Kong Exchanges and Clearing (12.14%).

There are also companies like Sun Hung Kai Properties, Techtronic Industries and CK Hutchinson. It is important to note that this public fund once again shows how easy it is to invest in international companies from the comfort of your own home. All you need to do is make a minimum deposit of $50 and that’s it – you will have a basket of 41 Hong Kong companies.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

iShares FTSE China 25 Index ETF – Invest in the best Chinese stocks and shares

Another public fund worth considering is the China 25 Index. Backed by the giant iShares, it gives you access to 25 large Chinese companies.

These include Tencent Holdings, Meituan Dianping, China Construction Bank, Alibaba, and China Mobile. China is one of the fastest growing and most powerful economies in the world, so it’s worth keeping an eye on this fund.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

Best ethical investment funds Bulgaria

If you invest in this type of investment fund, you will be subject to certain ethical codes. These may include avoiding certain industries and sectors, such as gambling, alcohol, tobacco, or defense.

In some cases, ethical investment funds focus solely on companies that work in areas that benefit society. For example, a company that is looking for ways to produce environmentally friendly energy.

Below you will find a list of the best ethical investment funds in Bulgaria – in our opinion.

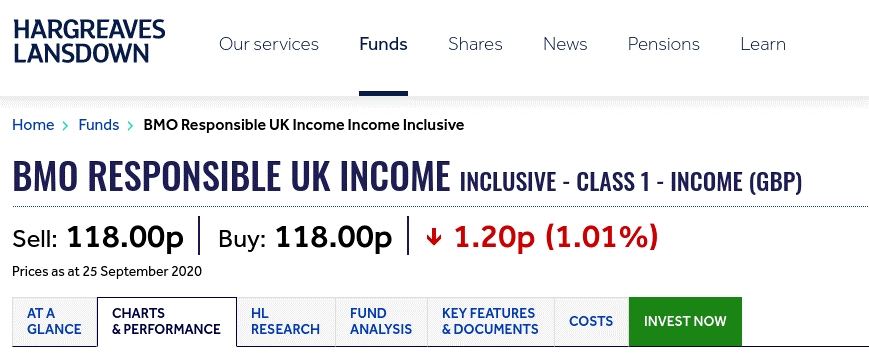

BMO Responsible UK Income 2 Inc – best ethical fund for investing in small to medium-sized British companies

This ethical investment fund is based in the UK and focuses on UK options. The key thing about it is that each stock must not only meet a series of ethical standards, but also be small to mid-cap. In terms of performance, the fund has outperformed the broader FTSE All-Share index in 4 of the last 5 years.

If you decide to invest in this fund directly, you need to have at least £500,000 ready. That’s why it’s best to go through a third-party provider. For example, Hargreaves Lansdown only requires a £100 minimum direct debit or £25 per month. As for fees, the fund will cost you 0.91% per annum.

Jupiter Responsible Income – invest in large British stocks that actively manage social responsibilities

This investment fund focuses on companies that actively manage their social and environmental affairs. The portfolio consists of a total of 45 stocks, with leading companies including GlaxoSmithKline, RELX, Vodaphone, Teso and Aviva.

Again, if you decide to go through Hargreaves Lansdown, you will need a minimum balance of just £100 or £25 per month. The current fee is 0.93% with no upfront fee.

What are the investment funds in Bulgaria?

Mutual funds allow you to invest money in the financial markets passively. You don’t need to have any experience or knowledge of how the markets work – the fund manager will take care of all your investment decisions. The mutual fund you choose will buy and sell stocks, bonds and other assets for you.

There are actually several asset classes that fall into this investment realm. For example, investment funds can be public, such as REITs (real estate investment trusts), mutual funds, including real estate, investment trusts, money market funds, or index funds. The main thing is that each of the aforementioned types of funds allows you to gain exposure to a full basket of assets through a single trade.

For example, let’s say you invest in a fund that focuses on small UK companies. If you invest just a few hundred pounds, your portfolio could include over 200+ small AIM listed companies. Similarly, if you invest in a fund that tracks the FTSE 100, you will buy a basket of 100 large cap UK stocks.

Mutual funds are managed and supervised by large financial institutions. Some of the biggest players in the sector include iShares, SDPR, and Vanguard. Your money is pooled with thousands of other investors, meaning the fund often manages billions of dollars in assets.

How do investment funds work?

Whether you choose a public fund, a mutual fund, or a trust, the investment process is largely the same. To help you understand, let’s look at a quick example of how the best mutual funds work.

- You invest £10,000 in a mutual fund

- The fund manager is focused on large British stocks

- In total, the investment fund buys shares in 150 companies listed on the London Stock Exchange.

- In theory, you will own a small share of each share purchased by the fund – based on the amount invested

- For example, if the fund holds 4% of its portfolio in HSBC, your £10,000 investment would consist of £400 worth of HSBC shares

When it comes to making money, most mutual funds that you can access from Bulgaria pay dividends. They are a portion of each share’s dividend or bond coupon payments that the fund has received on behalf of its investors. Your share is usually distributed every three months, although some funds pay dividends every 6 or 12 months.

In addition to regular dividends, you can grow your money if the net asset value (NAV) of the investment fund increases. For example, if you invest in the FTSE 100 fund and the value of the index increases by 10%, you can expect your investment in the fund to increase by a similar margin.

Types of investment funds

As we explained above, there are many types of mutual funds. Most work in the same way – you invest in a basket of assets passively. The fund makes purchases of assets on behalf of its investors and determines the right time to sell.

However, there are some small differences between the different types of investment funds, which we will list below:

- Mutual Funds: These types of investment funds determine which assets to buy and when . The fund manager has the flexibility to choose which assets to invest in, as they are not tied to a specific market. Since these types of funds are actively managed, fees are slightly higher than with public funds.

- ETFs: These types of mutual funds track a specific market. For example, if the fund’s objective is to track the NASDAQ 100, it replicates the NASDAQ stock market one-for-one. Public funds are often the least expensive option because they are passively managed.

- Investment Trusts: Trusts are similar to mutual funds. This is because your capital is actively managed by the fund – they make all the investment decisions. Trusts are not tied to a specific market, which brings great flexibility.

- Index Funds: As the name suggests, index funds track a specific stock market index, such as the FTSE 100 or Dow Jones. The fund buys shares of all the companies in the index using the same weighting system.

Some of the best types of investment funds for Bulgarian investments are:

- Index funds

- Mutual funds

- Trackers

- Vanguard funds

- Money market funds

- Income funds

- Ethical investment funds

- Investment trusts

- Real estate investment funds

- Real estate investment trusts (REITs)

- Gold investment funds

- Funds for investments in technology companies

- Absolute return funds

Investment trusts versus investment funds

Investment trusts are a type of investment fund. They are popular in Bulgaria, as over the past decade or so, trusts have generally performed better than funds.

One of the main differences between trusts and funds is that trusts can borrow money. This practice is known as gearing and gives trusts much greater purchasing power. In turn, they can trade with amounts much larger than their working capital.

Benefits of investing in leading investment funds

Choosing an investment fund over traditional stocks or bonds brings many advantages.

Among them are:

- No experience required: The process of choosing stocks or bonds can be quite difficult. However, you do need to have a good understanding of technical and fundamental analysis and be able to read and interpret company reports. This is why many beginners choose mutual funds, as they do not require you to know how the financial markets work.

- Passive Income Stream: Once you put money into a mutual fund, you can simply sit back and let the provider buy and sell assets on your behalf. This is a great way to earn passive income, as you will likely receive a dividend every three months.

- Low investment size: You can currently invest in funds with small amounts. In most cases, you can start with just a few hundred euros. With eToro, the amount is even smaller – there you can invest in public funds with amounts as low as $50, and with Hargreaves Lansdown the minimum investment is £100. Even if the investment fund you choose requires a larger capital, you can simply bypass this requirement by using a broker.

- Low fees: Most of the best mutual funds for 2026 charge a flat fee of less than 1% per year. Some are much closer to 0% – especially public and index funds. Even with the more expensive ones, this offers good value because you’re investing passively.

- Diversification: Diversification allows you to limit your overall exposure to risk by investing in a variety of assets across industries and markets. Achieving this goal on your own can be an expensive and time-consuming endeavor. This is not the case with mutual funds, as they allow you to gain exposure to hundreds (if not thousands) of assets with a single injection of capital.

- Hard-to-reach markets: Accessing some financial markets for Bulgarian investors can be quite difficult. For example, stocks and shares listed in emerging markets. Investment funds, on the other hand, manage billions. This means that there is no inaccessible market for them. Thus, they offer a gateway to a given asset or sector to which you are trying to gain exposure.

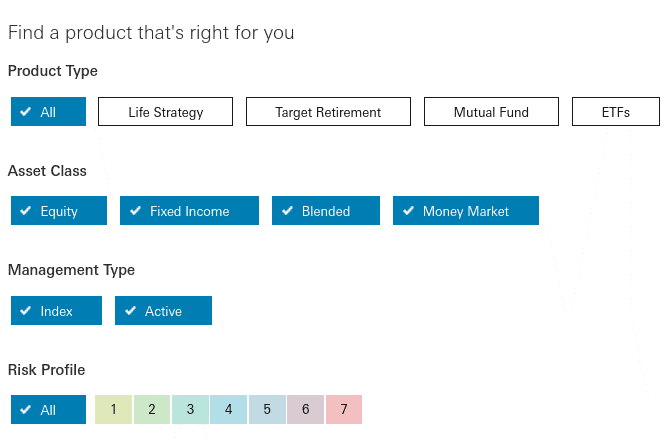

How to choose the best investment funds 2026

With so many mutual funds to choose from, it can be hard to know where to start. The most important thing is that the fund meets your long-term investment goals. For example, do you want to grow your money over decades to save for retirement, or do you want access to a specific market, such as foreign bonds or US stocks?

Whatever your goal, there is a list of metrics to consider when looking for an investment fund suitable for your needs.

- Fund Type: First, you need to look at the types of investment funds the provider offers. These can be a public fund, a mutual fund, a trust, or an index fund.

- Objectives: What asset or market is the fund focused on? They can vary from stocks of large-cap US companies to stocks issued in emerging markets.

- Past performance: See what kind of investment returns the fund has generated over the past few years. Compare these returns not only to other players in the industry, but also to the market as a whole.

- Ongoing fees: Most funds charge an ongoing fee – expressed as a percentage. While most are less than 1% per year, there are some funds that can be significantly more expensive. Also look for upfront fees and performance fees.

- Minimum investment: Check what the minimum investment the fund requires. If it is too high, you may be able to find a lower minimum investment with a third-party broker.

- Risk: Leading mutual funds like Vanguard offer a risk rating for each of the products they offer. This allows you to assess the risk you are taking on by investing in the fund.

- Dividend frequency: Make sure you are aware of the frequency of periods in which the investment fund distributes dividends. This is usually every three months, but it can also be every six months or even once a year.

As you can see, there are many factors to consider before choosing an investment fund. That’s why it’s worth taking a look at some of the leading funds we’ve discussed on this page – all of which are available to investors in Bulgaria.

Best investment fund brokers in Bulgaria

If you want to invest in a mutual fund, you will need to find a reputable online broker that is regulated by the UK Financial Conduct Authority (FCA). While some funds allow you to invest directly through their website, their fees and minimum account opening requirements are often higher. That is why we recommend that you choose a third-party platform.

Here are the leading investment fund brokers for residents of Bulgaria – in our opinion.

1. eToro – best investment fund broker in Bulgaria overall

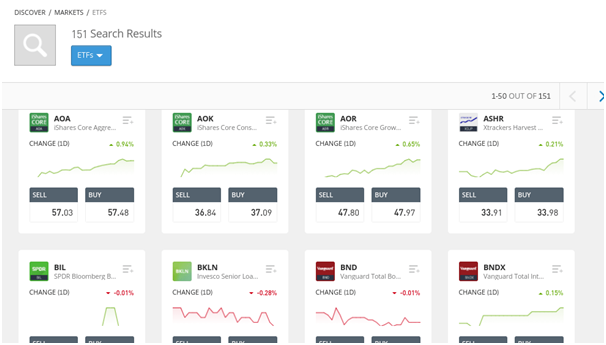

The platform gives you access to over 150 funds across a variety of markets – US and UK stocks, bonds, gold and more. In addition, eToro allows you to invest in over 1,700 stocks across 17 stock exchanges. This can be useful if you want to add specific stocks to your portfolio that the fund doesn’t cover.

When it comes to payments, eToro allows you to instantly deposit funds using a debit or credit card, as well as e-wallets such as Paypal, Skrill and Neteller. Bank transfers are also an option, but we don’t recommend them as they take a few days to transfer funds. The minimum deposit with eToro is $200, although you can invest as little as $50 in your chosen fund. The broker is licensed by the UK Financial Conduct Authority (FCA), and your money is protected by the FSCS (up to the first £85,000).

eToro also offers an excellent investment app, which is an ideal way to invest in mutual funds via your mobile phone.

eToro Fees:

| Commission | 1$ |

| Deposit fee | Free |

| Withdrawal fee | $5 |

| Inactivity fee | $10 per month after 12 months of inactivity |

Pros:

Cons:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

2. AvaTrade

AvaTrade is a globally regulated broker that offers strong oversight from the Central Bank of Ireland, the Australian Securities and Investments Commission, the Japanese Financial Services Agency, and more.

The broker provides trading opportunities in over 1250+ global markets, covering forex, stocks, bonds, indices, mutual funds, commodities, and cryptocurrencies. These include investment funds from different regions around the world.

With AvaTrade, users can trade from a variety of trading accounts, including spread betting, CFD trading, options trading, and swap-free Islamic accounts. The broker also offers access to professional trading accounts for serious traders.

The broker provides access to services from Trading Central, which provide actionable real-time trading ideas and useful research. They can be very useful for finding high-quality investment ideas.

Pros:

Cons:

Вашия капитал е в риск.

3. Libertex

The Libertex trading platform is unique in that it offers investors the opportunity to trade over 213+ financial CFD instruments, including currencies, stocks, commodities, indices and cryptocurrencies.

The broker also provides traders with a range of different platforms, including the world’s most popular platform, MetaTrader 4. However, it also provides access to its own trading platform, which has useful functionalities such as market sentiment indicators, real-time news, and analytics.

Opening an account with Libertex is easy and only takes a few minutes. The minimum deposit is just €100 and can be made via bank transfer, credit/debit card and e-wallets such as Neteller and Skrill.

Pros:

Cons:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

How to invest in the best investment funds in Bulgaria today

Want to invest in a mutual fund today, but don’t know where to start? Follow our step-by-step instructions to make a purchase in a fund from the comfort of your home.

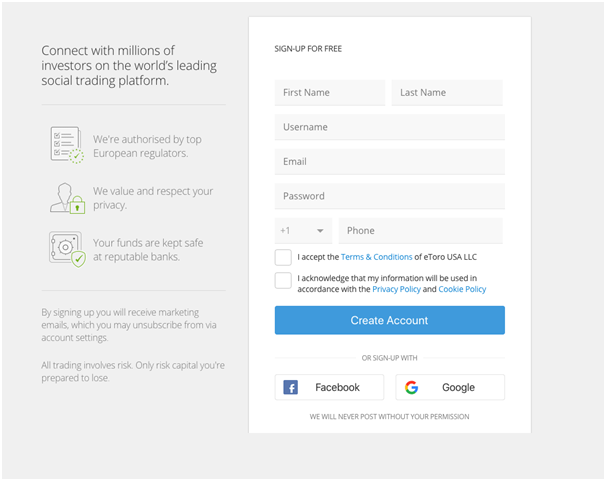

Visit the eToro website to begin the account opening process. You will need to enter a few details about yourself – your full name, date of birth, address, and personal identification number. You will also need to enter an email address and mobile number, as well as choose a username and password. Once you open your account, eToro will ask you to upload identification documents – a passport/ID card or driver’s license and proof of address. Proof of address can be a recent bank statement or utility bill. If you don’t have time to upload these documents right now, you can make a deposit, but it should not exceed $2,250. You will then need to deposit a certain amount into your newly opened investment account. eToro accepts the following payment methods: The minimum deposit is $200, and all payments are processed instantly unless you choose a bank transfer. eToro offers over 150 leading mutual funds in the form of public funds. When you click on the “Trade Markets” button, then “ETFs”, you will see what is available. If you already know which public fund you want to invest in, you can enter its name in the search box at the top of the page. Once you have chosen an investment fund, all that remains is to enter the amount you wish to bet. It must be at least $50. Once you confirm your order, the investment fund will be added to your eToro wallet. It will remain there until you decide to cash out your investment. In the meantime, you will likely receive quarterly dividends.Step 1: Open an online trading account

Step 2: Deposit funds

Step 3: Choosing a fund

Step 4: Choose investment amount and confirm order

The world of investment funds is gaining more and more popularity among investors in Bulgaria, as the process is passive – end to end. You only need to choose a fund, meet the minimum investment requirement and that’s it – you don’t need to do anything else. In addition to growing your capital as the fund’s net asset value grows, you can also earn dividends. This is your share of the dividends from stocks or coupons from bonds. It is usually distributed every three months. If you want to start investing in mutual funds today, the process rarely takes more than 10 minutes when you use eToro. You can instantly deposit funds with this FCA-regulated broker and invest in a fund with amounts as low as $50.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)Conclusion

eToro – Invest in the best investment funds

Frequently asked questions:

”What

”Do

”How

”How