Как да закупите Биткойн с цел инвестиция през 2026 – Наръчник за начинаещи

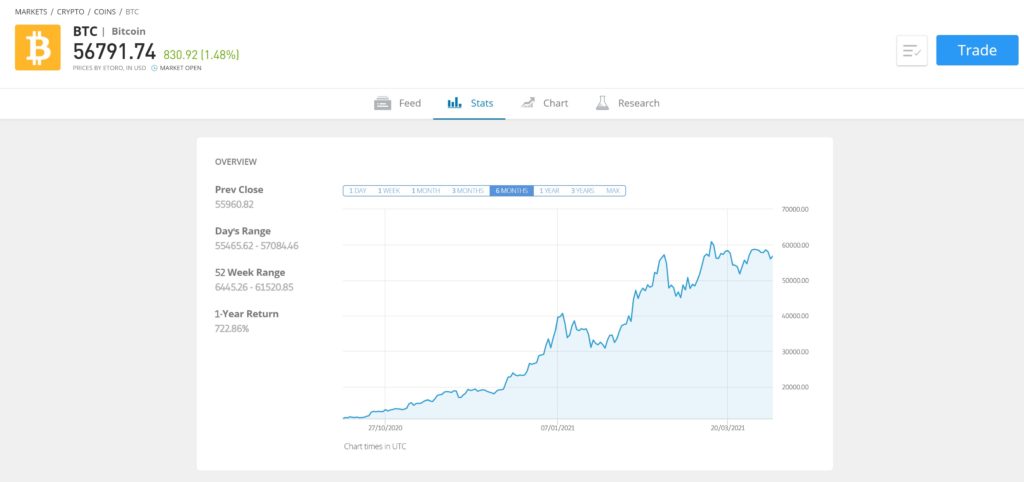

In the 11 months prior to the writing of this guide, Bitcoin rose from $3,800 to over $60,000. This is an increase of over 1,000% in less than a year.

If you had invested in the S&P 500 index, you would have realized a growth of about 80% over the same period. Thus, Bitcoin is shaping up to be the most profitable asset class in this pandemic-dominated era.

If you want to join the trend, this guide on how to invest in Bitcoin in Bulgaria will walk you through the process step by step.

Here you will find details about the process of choosing a trusted Bitcoin broker, the possible risks and benefits you should consider, and what strategies you can take.

How to buy Bitcoin for investment purposes – quick steps 2026

To start buying Bitcoin, you need to follow the steps below:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

[fin_table id=”16″]

How to invest in Bitcoin from Bulgaria – a short guide

- Choosing a Bitcoin Broker: First, you’ll need to choose a trusted Bitcoin broker. We recommend eToro , which is regulated by the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC) and allows you to invest in Bitcoin for as little as $25.

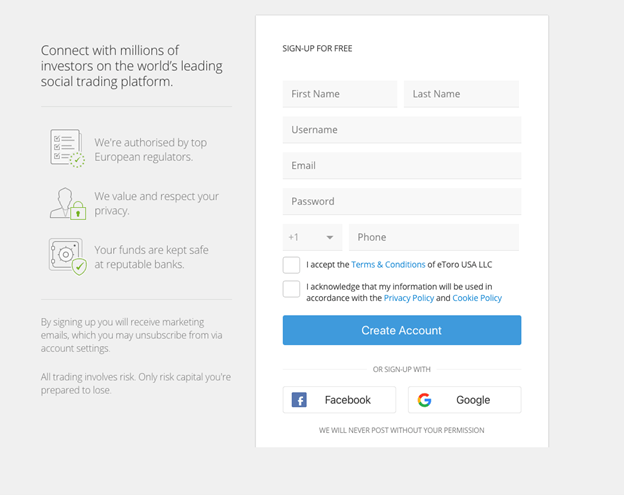

- Opening an account: you will then need to open an account with eToro – for this you simply need to fill in a set of personal data and contact details.

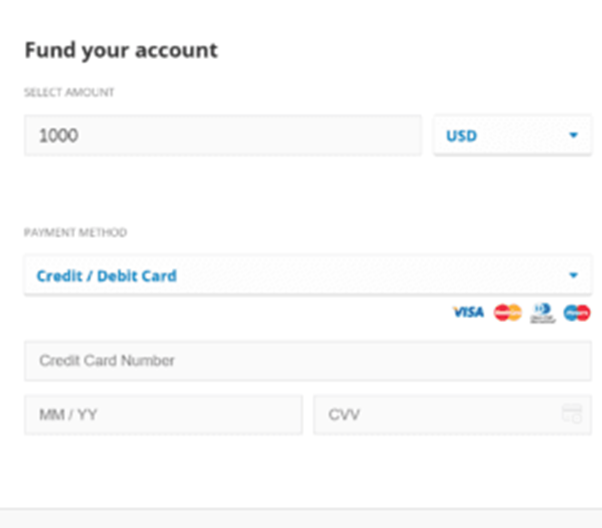

- Depositing funds: It is time to deposit an amount with a Bulgarian debit/credit card, e-wallet or bank transfer.

- Investing in Bitcoin: Finally, you need to select Bitcoin from the list of supported cryptocurrencies and enter the amount you want to buy. The minimum is only $25.

Choosing an investment platform to buy Bitcoin

As we noted above, the most important part of the Bitcoin investment process is the careful selection of an appropriate online platform.

It will allow you to make a Bitcoin investment from the comfort of your own home and you will be able to use a convenient payment method from Bulgaria to make the purchase. However, you should research whether the platform is secure, what fees are charged, and what the minimum Bitcoin investment is.

To help you choose a suitable Bitcoin trading platform, we will take a look at some of the best providers below.

1. eToro – best platform for investing in Bitcoin overall (globally regulated)

There are several reasons to believe that eToro is the best broker for investing in Bitcoin from Bulgaria. First of all, in terms of security, eToro is a strictly regulated legal entity. It holds three licenses – including from the British Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

This means that you can invest in bitcoin without paying any fees. The process of investing in bitcoin through eToro is very easy. Registration only takes a few minutes and you can deposit funds with a debit/credit card, e-wallet or bank transfer. You may decide that bitcoin is the best asset to invest £500 in, or even a larger amount if you are wondering how to invest 40k.

Additionally, the minimum Bitcoin investment with eToro is just $25. This means you can get access to the world of Bitcoin trading without having to risk large sums of money. As soon as you complete your purchase, your Bitcoins will be stored securely at eToro. This means you won’t have to worry about your cryptocurrency wallets.

Instead, your cryptocurrency will stay with eToro until you decide to sell it back. In addition, eToro also offers a full-fledged Bitcoin wallet. It is available via a dedicated iOS/Android mobile app that you can download for free. The eToro digital wallet also allows you to buy, trade, and convert digital currencies.

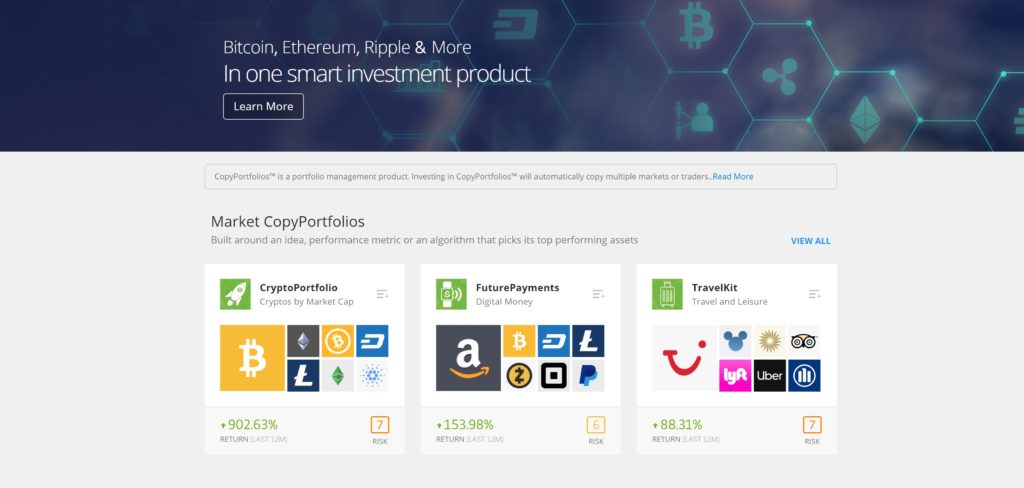

The icing on the cake is that with eToro you can invest in cryptocurrencies completely passively. You can do this through this copy trading tool, with which you can “copy” an experienced crypto investor who uses eToro to trade.

Or invest in a cryptocurrency portfolio managed by the eToro team. This is a diversified basket that, in addition to Bitcoin, contains a bunch of other cryptocurrencies with different weights. The portfolio is rebalanced regularly, allowing you to invest completely passively.

Pros:

Cons:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

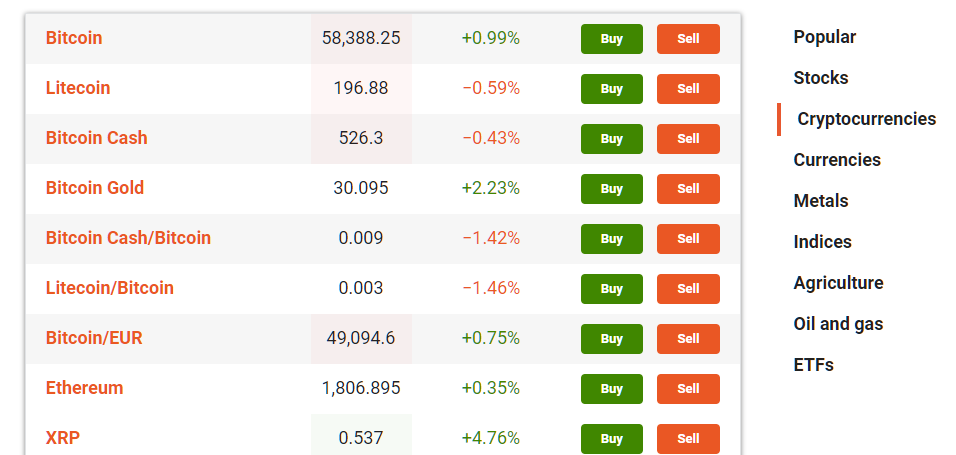

2. Libertex - Investing in Bitcoin with zero spreads

<

In the case of Libertex, the broker charges a small commission, which is currently 50% off for cryptocurrencies due to their popularity. There is also a huge list of cryptocurrencies you can trade, including Bitcoin, Bitcoin Cash, Bitcoin Gold, Bitcoin/EUR, Monero/Bitcoin, Zcash/Bitcoin and many more!

Opening an account with Libertex is really easy and can be done in minutes. What’s even better is that you can open accounts with a minimum deposit of EUR 100.

Since the broker provides contracts for difference (CFDs) on cryptocurrencies, you can trade both long and short positions, meaning you can profit from falling and rising markets.

Pros:

Cons:

73,77% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

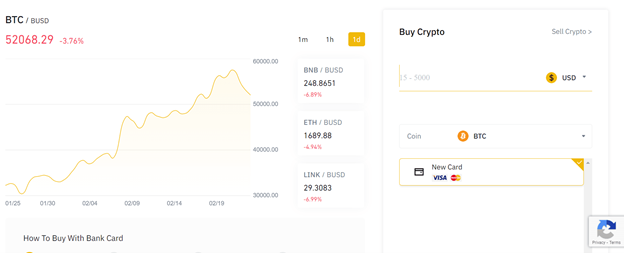

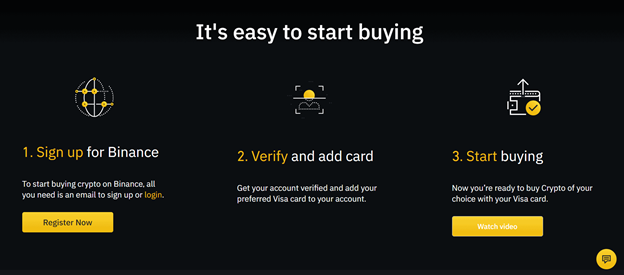

3. Binance – the largest cryptocurrency exchange by volume and liquidity

Notably, Binance is the largest cryptocurrency exchange by trading volume. In the last 24 hours alone, the platform processed over $114 billion in trades - more than even traditional brokerages could dream of.

In terms of investing in Bitcoin from the comfort of your own home, Binance allows you to do so with a Bulgarian debit or credit card. However, the fees are a bit high - 3% for each Bitcoin purchase. From time to time, Binance runs promotions on the commission, and the last time the fee was reduced to 1%.

If you want to fund a trade via bank transfer, you will avoid this fee. However, this will slow down the process by at least 2 days. Once you have funded your account, Binance charges a small trading fee of 0.1%.

In terms of storage, Binance allows you to store your cryptocurrencies in a web wallet. While it is less secure than downloading them to a private cryptocurrency wallet, Binance offers several security mechanisms. For example, you have access to two-factor authentication, as well as adding the IP and wallet address to the so-called whitelists.

In addition, the vast majority of client funds are stored in a so-called "Cold Wallet" and you have a Safe Asset Fund for Users (SAFU) to rely on. This is an increasingly popular insurance tool that is funded by transaction fees and serves to compensate users in the event of a hacker attack.

Like eToro, Binance gives you the option to use the broker's own crypto wallet. The so-called "Trust Wallet" can be downloaded and installed on a mobile device. The wallet is easy to use and has various internal control features that ensure the security of your money.

Pros:

Cons:

Криптоактивите са силно волатилни, нерегулирани инвестиционни продукти. Няма защита на инвеститорите от ЕС.

Bitcoin Investment Research

Once you have chosen your Bitcoin broker, it is time to take a step back. By this we mean that you need to learn how to invest in Bitcoin from Bulgaria properly, taking into account the high risks and possible profits. However, Bitcoin and all cryptocurrencies are not only speculative, but also super volatile.

To ensure you make an informed investment in Bitcoin, take a moment to read the sections below.

What is Bitcoin?

Many people in Bulgaria know how quickly Bitcoin has risen in price, but they don't really know what it is. In its simplest form, Bitcoin is a digital currency, meaning it doesn't physically exist. Instead, Bitcoin is based on blockchain technology - a kind of public ledger that can be accessed online.

- Blockchain technology ensures that Bitcoin is not controlled or owned by a single party.

- The technology is not backed by any government, state, or central bank. Instead, Bitcoin is decentralized, meaning there is no centralized authority, such as a bank.

- Bitcoin itself was created to replace the global financial system - namely fiat currencies such as the US dollar, the euro, and the British pound.

- In turn, you can send, receive, and transfer Bitcoin from wallet to wallet without having to go through a third party. You can do this via a web wallet, mobile wallet, desktop wallet, or hardware wallet.

Not only are Bitcoin transactions always anonymous, but they also only take 10 minutes to confirm the transfer. Plus, no matter how many Bitcoins you transfer, the fees are usually less than a pound. When you factor in Bitcoin’s highly secure and confidential framework, it’s no wonder the technology is often referred to as “the next internet.”

Note: To really understand the ways Bitcoin works - read the book "'Mastering Bitcoin: Unlocking Digital Cryptocurrencies" by Andreas Antonopoulos

Ways to invest in Bitcoin

In this part of our guide on how to invest in Bitcoin from Bulgaria, we will look at some of the different ways you can enter this market.

Direct purchase of Bitcoin

The easiest, safest and most cost-effective way to invest in bitcoin in Bulgaria is to use a regulated broker like eToro. This way you can buy bitcoin with your Bulgarian debit/credit card and even an e-wallet like PayPal.

Perhaps most importantly, the minimum investment in Bitcoin is only $25. Simply put, this means that you can invest in Bitcoin with small amounts, rather than putting up amounts that you probably can’t afford to lose.

This small minimum bet also allows you to adopt a so-called "dollar-cost averaging" strategy, where you buy at regular intervals with approximately equal amounts. We will explain this strategy in more detail later in this guide on how to invest in Bitcoin in Bulgaria.

Investing in a crypto wallet

Another way to invest in bitcoin is to diversify your cryptocurrency portfolio. Again, eToro stands out here, as it offers CryptoPortfolios that are professionally managed by its team.

This allows you to invest in a basket of different digital currencies. In turn, you have the opportunity to diversify with a single investment. Below we will look at Bitcoin diversification in more detail.

Using a Bitcoin ATM

According to CoinATMRadar, the number of Bitcoin ATMs is growing very rapidly.

- Simply put, if there is a Bitcoin ATM near where you live, you can immediately make an investment by inserting money into the terminal.

- You can choose what amount you want to purchase on the screen - such as £50

- After you enter the required amount in paper banknotes, a QR code appears

- Then you need to scan this QR code with your mobile Bitcoin wallet

- Bitcoins arrive in your personal wallet in 10-20 minutes

There are both pros and cons to this option of investing in Bitcoin. The pros are that you don't need to open a brokerage account - you can just go to an ATM and make the purchase in minutes.

However, the average transaction fee that a Bitcoin ATM will charge is 10%. This means that if you invest £100, you will only receive £90 worth of Bitcoin.

Secondly, you need to have a Bitcoin wallet to receive the currency. If you are a beginner and don’t know how to use cryptocurrency wallets, this can be a problem.

Bitcoin stocks

There are no "Bitcoin stocks" in the literal sense of the word, as the digital currency is an asset class in its own right. However, you can invest in stocks that are indirectly linked to Bitcoin's success.

For example:

- FinTech Square shares – they rose by triple-digit percentages in 2020 and have a strong presence in the Bitcoin scene.

- This is due to the fact that the company allows Americans to buy and sell Bitcoin through a mobile app.

- In turn, as more people invest in Bitcoin, this should have a positive impact on Square's stock price.

There are also a few other stocks that have some correlation to Bitcoin's success, such as Riot Blockchain and MicroStrategy. However, there is no guarantee that the value of your chosen cryptocurrency-related stocks will be tied to the price of Bitcoin, as there are many variables to consider.

How much should I invest in Bitcoin?

At the time of writing this guide, one Bitcoin was worth over £34,000, so you may be wondering how much money to invest and whether you can afford it.

The good news is that you don't have to buy entire Bitcoins at once. Bitcoins can be broken down into smaller pieces, allowing for smaller transactions. For example, one satoshi is equal to 1/100-millionth of a Bitcoin and is the smallest unit of Bitcoin.

Platforms like eToro allow you to invest in bitcoin from as little as $25, so there’s no need to go broke. Of course, you can invest tens of thousands if you want, but just make sure you do your research and understand the risks.

Is Bitcoin a good investment?

In this part of our guide on how to invest in Bitcoin in Bulgaria, we will look at the long-term viability of this innovative digital asset.

The best-performing asset of the last decade

No other asset class, even in emerging markets, can match Bitcoin’s financial returns over the past decade. If we turn back the clock to 2009, when this technology was born, Bitcoin had no value at all.

- Even a few years later, one bitcoin would be worth a tiny fraction of a penny. At the time of writing in February 2026, bitcoin was worth over $57,000.

- Simply put, if you had invested in this digital asset in its early days, you would have now made a profit of millions of percentage points.

- On the other hand, it's easy to view such serious gains with hindsight, as Bitcoin was virtually unknown for many years.

- In any case, it is important to remember that not long ago, in March 2020, you could buy one Bitcoin for around $5,000.

Based on the $57,000 price we mentioned above, this means the digital currency has delivered a return of over 1,000% in less than a year.

Limitless possibilities

It's hard to say exactly how much Bitcoin could be worth in the future, but many prominent commentators in the sector are quite optimistic.

Bitcoin has many of the characteristics of gold (store of value, limited supply, fractionalization, etc.) - some argue that the feasible long-term prospect for Bitcoin is to overtake the precious metal in market capitalization.

At the time of writing this article in February 2026:

- Bitcoin had a total market capitalization of $937 billion

- Gold had an estimated total market capitalization of $9-10 trillion

With the above in mind, if Bitcoin were to overtake gold in terms of circulating value, it would require a tenfold increase.

Some Bitcoin fans are even more optimistic, claiming that in the long term, Bitcoin could replace the US dollar as the world's reserve currency. If these wild predictions come true one day, the possibilities are truly endless.

Leading companies and institutions

Perhaps the biggest sign that Bitcoin has solid prospects is the recognition it has received from some of the most influential players on a global scale.

- In first place is Tesla - the world's largest car manufacturer with a market valuation of over $680 billion. The company, which is led by Elon Musk (a fan of cryptocurrencies), recently announced that it has invested over $1.5 billion of its cash reserves in Bitcoin.

- This also includes PayPal, which recently began mediating the purchase of Bitcoin through its platform.

- The broker Coinbase, which we mentioned earlier, is expected to go public this year, with predictions that it will attract a market valuation of $100 billion.

There are many, many more examples of large companies entering the Bitcoin space, which is a good thing from an investment perspective.

Risks of investing in Bitcoin

There is no doubt that Bitcoin has generated huge returns in recent years. However, it is important to note that investing in this digital asset is very risky.

Speculative and variable

Bitcoin is subject to huge volatility. This is due to the fact that Bitcoin is a highly speculative and volatile asset class. Although it has enjoyed huge success over the past year, after previously falling to $5,000, there is no guarantee that this success will last forever.

To illustrate this, it is worth remembering what happened in 2017.

- Bitcoin started 2017 with a price of around $1,000

- By the end of the year, the digital currency hit a record $20,000.

- That's a 1900% increase in 12 months.

- However, Bitcoin then plummeted and just 12 months later it was worth $3,000.

- This means that people who bought Bitcoin at its peak in 2017 lost over 85% of their investment.

Ultimately, it wasn't until December 2020 that Bitcoin crossed the $20,000 mark again - a full three years later. The idea is that Bitcoin is too volatile and super unpredictable - so there's no guarantee you'll make money.

Hacking and fraud

Another risk that should be taken seriously when investing in Bitcoin is that the industry is still rife with hacking and fraud. There have been countless examples of attacks on Bitcoin exchange servers - resulting in customers losing money.

- In many cases, hacking attacks cost tens of millions of pounds. As you may know, if your Bitcoin is hacked or stolen, it is gone forever.

- In other words, there is no third party you can turn to to get your money back.

- Additionally, Bitcoin seems to be the currency of choice for scammers, due to the anonymity of blockchain technology.

- Popular scams include malicious attacks on desktop devices, SIM card swapping, and the old pyramid schemes.

If you are wondering how to invest in Bitcoin in Bulgaria in the safest possible way, it is best to choose a regulated brokerage company like eToro. This will guarantee you investing in Bitcoin and safe storage of your digital assets until you are ready to cash out your investment.

Bitcoin Investment Strategies

In this part of our guide to investing in Bitcoin in Bulgaria, we will look at some of the best strategies worth considering.

However, it is very important to have an entry and exit plan when investing - regardless of the asset class or financial market.

Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy used in a number of financial market segments. In its simplest form, this strategy involves investing modest amounts of money in Bitcoin – but periodically.

For example, you could decide to invest £20 a week for the foreseeable future. If you do this, you can forget about the volatile nature of the market - as you have decided to bet for the long term.

Specifically, each time you make your weekly/monthly investment, you will receive a different price. Of course, the value of Bitcoin may continue to rise and fall, but for you, this will simply average the price over time.

For example:

- Week 1: You invest £100 in Bitcoin at a price of $50,000

- Week 2: You invest £100 in Bitcoin at a price of $35,000

- Week 3: You invest £100 in Bitcoin at a price of $40,000

- Week 4: You invest £100 in Bitcoin at a price of $55,000

As above, you made one purchase of £100 worth of Bitcoin at the end of each week, paying a different price each time. In turn, your dollar-cost averaging strategy results in an average price of $45,000.

Diversification

In addition to a dollar-cost averaging strategy, it is also important to diversify.

For example, instead of putting all your money into investing in cryptocurrency Bitcoin, you could spread your capital across several different digital asset classes.

- In theory, this will limit long-term risks, as you don't have overexposure to a single cryptocurrency.

- The main problem with this approach is that you will need to store all purchased cryptocurrencies in a private wallet.

- This can be confusing, as some wallets only support specific currencies.

- So you may need to acquire a collection of private portfolios where you can hold your diversified investments.

The simple solution to this problem is to choose a crypto wallet on eToro. As we briefly wrote above, this will give you access to a fully diversified portfolio of digital currencies.

The eToro team takes care of rebalancing and weighting the portfolio, so your investment is not only fully diversified, but also passive.

Buy on the dip

In the 24 hours prior to the creation of this guide on how to invest in Bitcoin in Bulgaria, the digital currency fell by over 10%. It is still unclear whether this is a short-term decline or a sign of a longer-term market correction.

However, if you firmly believe that Bitcoin will perform well in the long term, such market dips are an excellent buying opportunity. This is not just true for Bitcoin, but for all assets.

- As for how to implement such a strategy, it depends on you and your financial goals.

- Some investors religiously buy Bitcoin every time it ends the day at a predefined loss - for example, 5% or more.

- So you are practically investing in Bitcoin at a discount with every purchase.

In many ways, this is a dollar-cost averaging strategy in itself - as long as you keep your bets consistent.

How to invest in Bitcoin on eToro

In this section, we will walk you through the process of investing in Bitcoin in Bulgaria. We chose to show the steps with the regulated broker eToro because the minimum Bitcoin investment is only $25 .

As we revealed in this guide, eToro is a broker regulated by the UK Financial Conduct Authority (FCA) – so you will have to go through a standard account opening process with them. However, it only takes a few minutes. Simply go to the eToro website and select open an account. You will then need to provide the broker with some personal information, contact details and your national insurance number. Another requirement when using this secure cryptocurrency trading platform is to provide a copy of your passport/ID card or driver’s license. You will also need to provide a copy of a bank statement or utility bill issued within the previous three months. While the eToro team is reviewing the documents (which usually takes a few minutes), you can make a deposit of up to $2,250. If you are wondering how to invest in Bitcoin in Bulgaria immediately, you will need to deposit funds with a debit/credit card or e-wallet. The payment will be reflected immediately so that you can start buying Bitcoin. If you choose to transfer funds from your bank account in Bulgaria, you will have to wait for days for them to arrive in the account. You can use the search box at the top of the screen to go directly to the Bitcoin purchase page. As you can see from the image above, simply type “bitcoin” into the box and click the “Trade” button. As seen in the image above, an order box will appear on your screen. The only thing you need to do is enter the amount of Bitcoin you want to buy. As we noted earlier, the minimum investment is $25. To complete your Bitcoin investment on eToro, click the “Open Trade” button. Most people who use eToro to invest in Bitcoin leave their funds for safekeeping in their wallet until they decide to cash them out. However, the platform also gives you the option to transfer your Bitcoins to eToro’s own crypto wallet. This gives you more control over how you store and use your Bitcoins – for example, you can convert them to other cryptocurrencies. If you want this, follow these quick steps below: Once you complete the above steps, the Bitcoin will appear in your eToro wallet.Step 1: Register with eToro

Step 2: Quick ID upload

Step 3: Deposit funds

Step 4: Search for Bitcoin

Step 5: Order

Step 6: Transfer Bitcoin to an eToro crypto wallet (optional)

With returns of over 1000% in the past year alone, more and more people in Bulgaria are looking for ways to invest in Bitcoin. It is important to make modest bets, not least because Bitcoin is very volatile and highly speculative. It is also wise to mitigate your risks by using a dollar-cost averaging strategy and diversifying your investment. Of course, it is also necessary to find a suitable broker to help you invest in Bitcoin. We found eToro to be the broker for this purpose, as it allows you to invest in Bitcoin with a minimum investment of just $25. And most importantly, eToro is a regulated broker, so there’s no need to use shady and unlicensed crypto exchanges.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)Conclusion

eToro – the best broker for investing in Bitcoin

Frequently Asked Questions

How do I invest in Bitcoin?

Is it too late to invest in Bitcoin?

Should I invest in Bitcoin - is it safe?

What is the minimum to invest in Bitcoin?

Can I trade Bitcoin derivatives?

Can I buy Bitcoin with Paypal?