Най-добрите трейдинг платформи в България за 2026

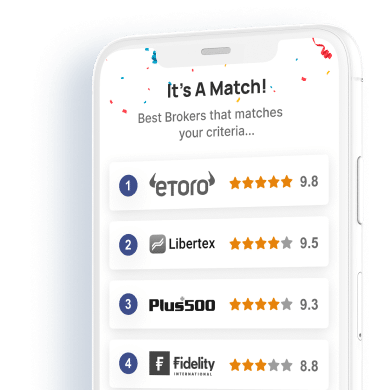

Използвайте нашият интерактивен търсач за най-добри платформи за социална и дневна търговия с български акции, валута, договори за разлика и крипто, които съвпадат с вашите желания.

- Ние предлагаме само регулирани брокери

- Ние разкриваме скрити разходи, комисионни и спредове

- Вижте брокери, които са оценени с най- добра поддръжка на клиента

Напълно регулиран

Експертно прегледани

Сигурен и надежден

Прозрачни такси

Мобилни

Different online stock trading platforms form an important bridge between you and your chosen financial market. Therefore, it is important that if you are interested in trading stocks, forex, commodities or cryptocurrencies, you find a suitable free trading platform that meets your requirements and needs.

At TradingPlatforms.com, we present you with the best trading platforms for 2026. This includes cryptocurrency trading platforms that offer the best fees and commissions, a wide variety of asset classes to trade, and, of course, are strictly regulated.

The best trading platforms for 2026

Below is a list of the best trading platforms for 2026. You can read more about each of the providers of these free online trading platforms below!

[stocks_table id=”15″]

There are thousands of providers of solutions for trading securities and other market instruments operating in the online space, and choosing the right free trading platform to fit your needs and requirements is difficult. In addition to having a good reputation and supporting your chosen market, the trading platform should offer competitive fees and excellent customer service. It is also important to pay attention to the reports offered, trading tools and functionality, educational resources, charts and other indicators. To help you choose, we offer you a selection of the best trading platforms in 2026.Overview of the best trading platforms

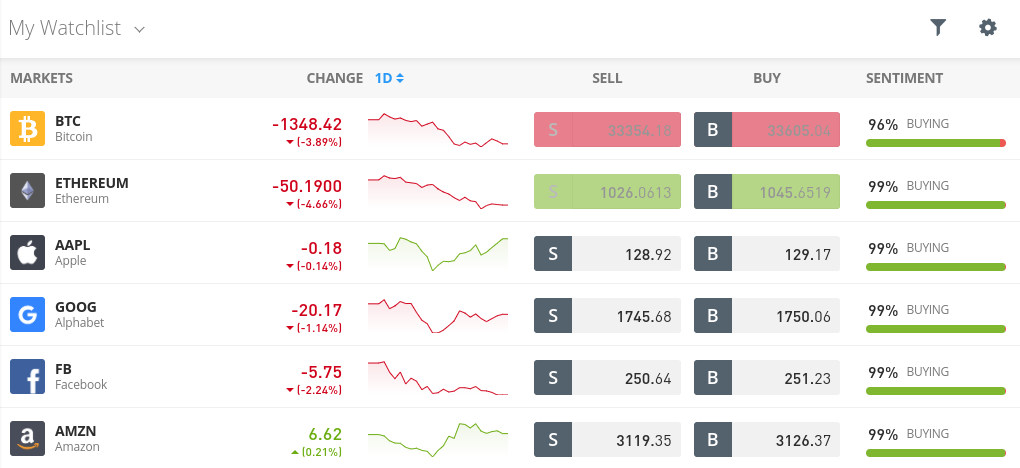

1. eToro – The best platform for trading financial markets for 2026

After researching hundreds of online trading solution providers, we found eToro to be the best stock trading platform for 2026. First of all, the broker is perfect if you are new to online stock trading. This is because the platform is easy and simple to use and supports small trades.

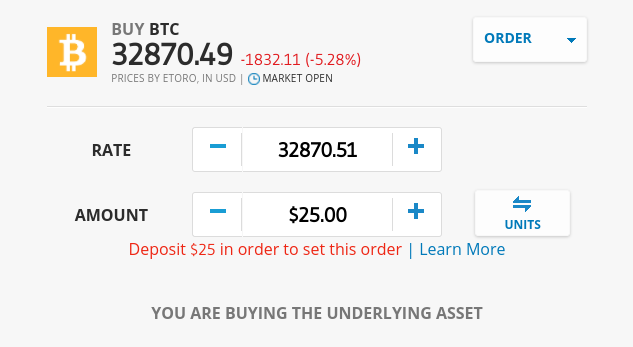

The minimum deposit required by the financial instruments trading platform is $200, and trading starts at $25. When it comes to the tradable assets offered, eToro supports several classes. You can choose from 2,400 stocks from 17 different markets.

You can buy shares of companies based in the US, Canada, UK, Hong Kong and a number of European exchanges.

eToro also offers access to 250 ETFs and over 80 cryptocurrencies . The platform supports trading in all kinds of commodities – from gold and silver to oil and natural gas.

eToro also offers a serious resource for forex trading

Among the important advantages of this online trading platform is that every financial market can be traded through eToro. There are also no ongoing fees, making eToro a great online platform for trading stocks and financial instruments for anyone looking for a low-cost provider.

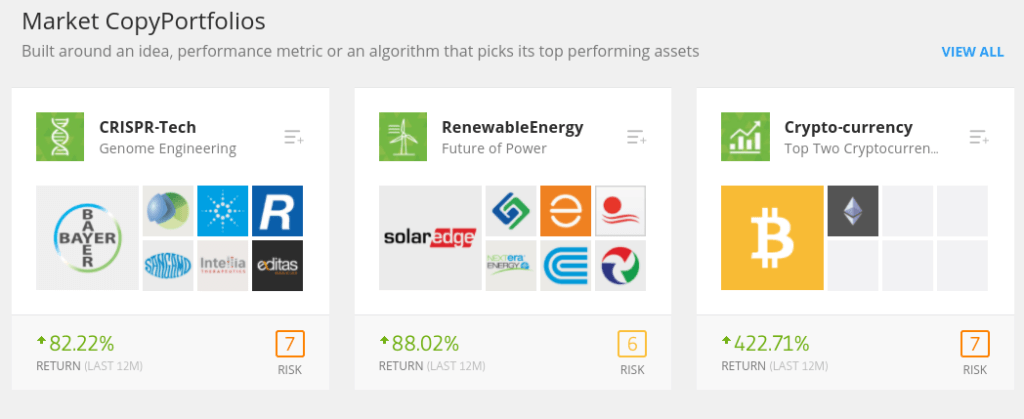

Another reason why eToro is number 1 on our list is that it is the best trading platform for beginner traders, as it offers passive investment tools. One such feature is CopyPortfolio, through which you can benefit from a professionally managed investment strategy.

This means that an eToro team will buy and sell assets on your behalf.

Why choose to trade with eToro?

There is a wide range of strategies to choose from, with a focus on technology stocks, cryptocurrencies and renewable energy, for example. Another feature of eToro is the Copy Trading tool. With it, you can choose a trader whose strategy you like and then copy their trades.

For example, if your chosen trader holds 3% of his portfolio in Apple shares and 2% in IBM shares, your portfolio will be the same.

eToro allows you to deposit using a debit card, credit card, bank transfer or e-wallet such as Paypal and Skrill. The trading platform is regulated by the UK regulators CySEC (Cyprus) and ASIC (Australia), which shows that the app takes its customers seriously. For US customers, eToro is a FINRA registered app.

Benefits:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

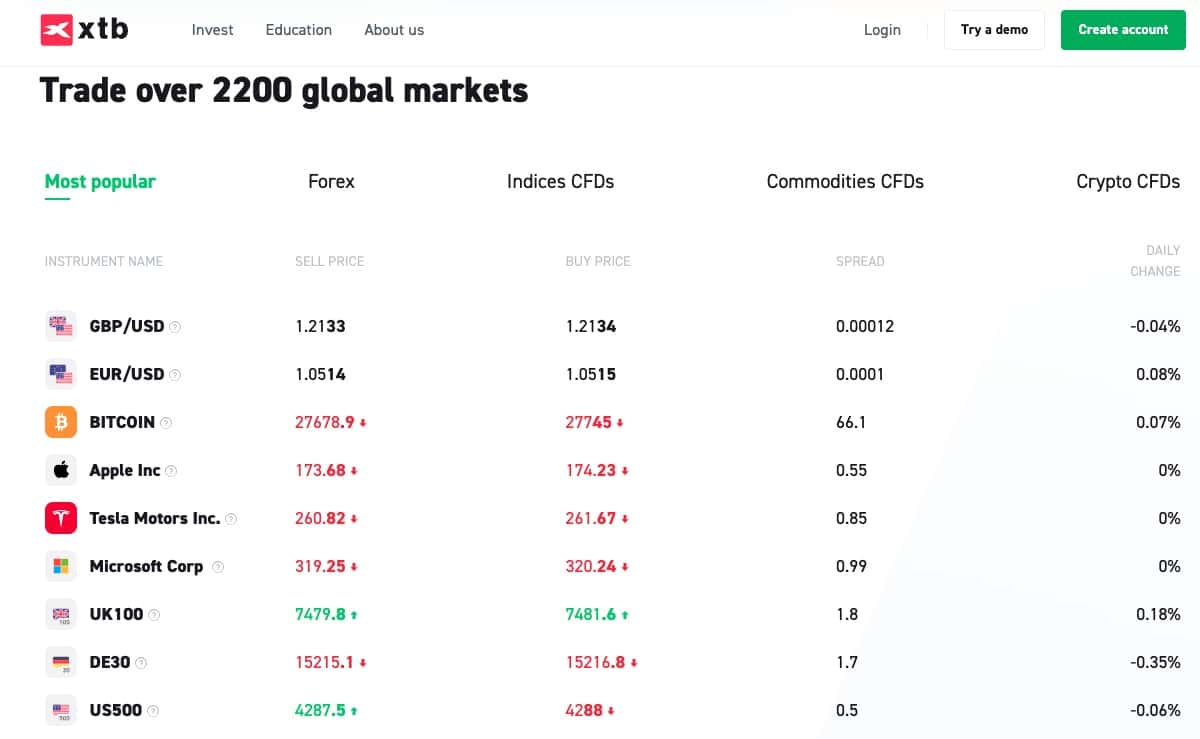

2. XTB – Platform with low fees and flexible leverage options

XTB is one of the leading forex brokers in the world, providing platforms and services for trading in the financial markets. With nearly 20 years of experience in the industry, XTB has established itself as a trusted and reliable partner for investors.

The company has licenses from various regulatory authorities in multiple countries, including the UK, Cyprus and many others.

XTB offers a variety of investment instruments (over 2,000!) - stocks, currency pairs, cryptocurrencies and commodities.

Additionally, XTB is committed to educating its new traders. They provide a wide selection of educational materials, webinars, and seminars that are ideal for both beginners and experienced traders.

XTB stands out with competitive spreads, low commissions, and flexible leverage. They also offer demo accounts, allowing users to test strategies without real risk.

Benefits:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

3. Skilling – Licensed broker offering hundreds of global trading assets

Skilling is a modern online broker that provides its clients with the opportunity to invest in a wide range of global financial instruments (over 1200).

Skilling is constantly expanding its portfolio, providing the opportunity to trade stocks from major global markets such as FTSE, NYSE & NASDAQ. They are licensed by some of the most stringent regulatory authorities in the world.

One of the advantages of Skilling is that there are no fees for deposits and withdrawals. The minimum deposit is $100, and the minimum transaction is $10.

You can use MT4 & MT5, which is a big plus for those who use this interface. If you are a newbie, you can take advantage of the copy trading options, although we always advise you to go your own way.

As a disadvantage, we can mention the somewhat slow order fulfillment times.

Benefits:

Disadvantages:

56% от сметките на инвеститорите на дребно губят пари, когато търгуват CFD с този доставчик.

4. Pepperstone – A top-notch and highly rated broker by traders

Pepperstone is one of the leading forex brokers on the global stage.

With 1200+ instruments on the platform, Pepperstone provides its clients with a wide selection of trading options, including currency pairs, commodities, indices, and more.

One of the main advantages of Pepperstone is the provision of extremely low spreads, especially for professional traders. Starting spreads start from 0.0 pips, making trading extremely competitive and cost-effective.

For those who prefer using popular trading platforms, Pepperstone supports both MetaTrader 4 and MetaTrader 5.

The minimum deposit to open an account at Pepperstone is $100, making the broker accessible to traders with different financial capabilities.

With regulations on four continents, Pepperstone emphasizes its commitment to protecting its clients and providing a safe and regulated trading environment.

Benefits:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

5. Admiral Markets – Extremely reliable broker for Forex and CFD trading

The minimum deposit is $100 (or euros), offering its clients 20 to 1 leverage and an exceptional selection of investment assets - over 8,000 CFDs, ETFs, stocks, bonds, commodities and raw materials, as well as forex pairs.

You can invest in cryptocurrencies, and the platform is ideal for scalpers due to its fast order execution, and it also supports many deposit and withdrawal methods. The huge pluses come in the low fees, and the support of MetaTrader 4 & 5 is another good news for investors.

There are no deposit and withdrawal fees, and demo accounts are also available for those who are still getting to know the platform. As a minus, we can say that there is no 2FA and no trading signals.

Benefits:

Disadvantages:

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)

6. Avatrade - Broker with an impressive range of trading platforms

AvaTrade is an excellent broker that has over 400,000 users and is regulated by many reputable jurisdictions.

AvaTrade has many convenient features for novice traders, offering risk management tools and over 1,200 trading assets. Users can trade S&P500 stocks, cryptocurrencies, and forex pairs.

The broker uses MetaTrader 4 & 5 to provide familiar charting and technical analysis to its global clients. The company is licensed to operate in Australia, Japan, South Africa and the entire European Union, including Bulgaria.

Benefits:

Disadvantages:

7. Libertex – Low-cost, zero-spread CFD trading platform

Libertex is an online CFD trading platform popular with UK traders, with low fees and commissions. This online trading platform also offers zero spreads. This means that when you choose an asset to trade, there will be no difference between the bid and ask price.

This allows you to benefit from the best quotes in the industry. Libertex collects a commission from each party to the trades, but it is usually low. The amount of commissions is most often 0.1% per order.

And an example with the popular currency pair NZD/USD, which can be traded with a commission of 0.012%. As for the supported market instruments, Libertex offers CFDs on stocks, commodities and currencies. You can trade with leverage on every trade.

Opening an account with Libertex takes minutes. The minimum deposit is £100 and you can use a debit/credit card, bank transfer or e-wallet. After the initial account funding, subsequent deposits are a minimum of £10.

As for safety, Libertex is regulated by CySEC. Libertex has a long history and has been offering trading in financial instruments and financial services since 1997.

Benefits:

Disadvantages:

How to choose the best online stock and financial instruments trading platform for you

There are so many trading platforms available on the market that finding a suitable provider takes a long time.

Ultimately, you will be investing your hard-earned money, so you need to be 100% confident that you are choosing the right online trading platform for you and your financial goals.

Here are some features of stock and financial instrument trading platforms to consider:

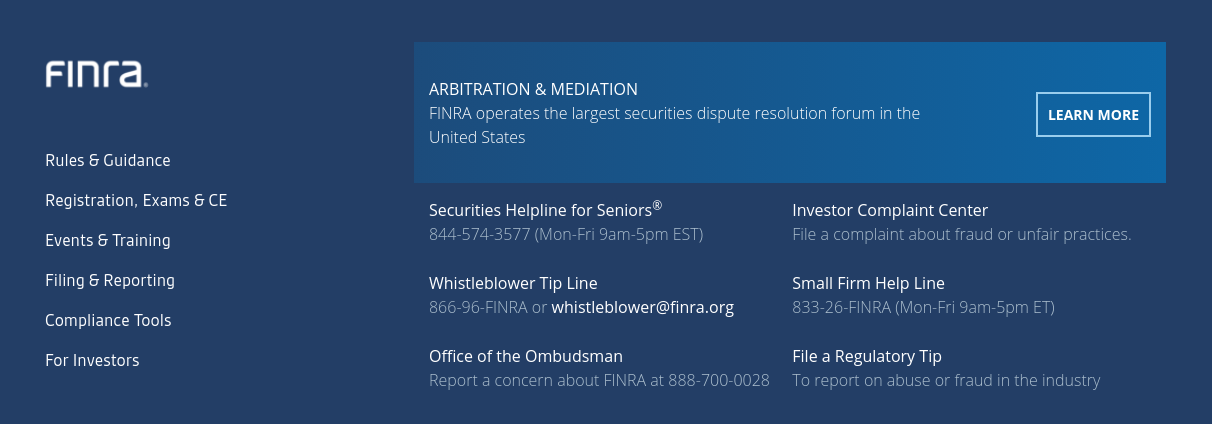

Regulation

You may be tempted to choose a trading platform based on fees and supported markets, but your first thought should be whether your money is safe.

Check which financial regulators have issued a license to your chosen platform.

The best platforms for online trading of stocks, currencies, and financial instruments are regulated by FINRA and the SEC in the US, as well as ASIC in the UK and Australia, respectively.

If you are wondering why you need an online trading platform that is authorized and regulated, here are the advantages:

- Your funds will be held in separate bank accounts. This means that the stock and financial instruments trading platform will not use your money to finance its own operations and cover its debts.

- Regulated brokers comply with anti-money laundering legislation. Traders must verify their identity, which limits criminal capital.

- The trading platform will be audited by licensed auditors. This ensures a fair and transparent trading environment.

By choosing an online trading platform that is unregulated or licensed in a shady, offshore location, it means that your funds are at risk.

Assets

Online trading attracts investors of all sizes. While some investors want to trade stocks, others are interested in futures or options, or something else. So check if the broker you choose supports the markets and instruments you are targeting.

The best online trading platforms (trading for beginners) offer the following key assets:

- Shares and units

- ETFs , index funds and mutual funds

- Bonds

- Forex and commodities

- Bitcoin and other cryptocurrencies

It is easy to check whether your chosen trading platform supports your preferred markets and assets and instruments.

Taxis

We can't forget that the best trading platforms in the online space offer competitive fees. In some cases, the platforms offer a simple and transparent pricing structure. In others, the fee system is complex and confusing, making it difficult to estimate exactly how much you will pay for your operations.

The main fees that stock and financial instruments trading platforms charge are:

Trading commissions

The most important fee to check for is the trading commission. It can come in two different forms. Some trading platforms charge a flat fee. This means that you may have to pay, for example, $15 to buy a stock, and another $15 when you withdraw your profits.

In other cases, fees vary. Some trading platforms charge 1% of buy and sell positions. For example, if you buy a stock for $500, you will pay a commission of $5. When you close your position, if it is for $600, you will pay a commission of $6.

If you carefully review the list of the best online trading platforms for beginners, you will see that most of them do not charge commissions. You can buy stocks, ETFs, and other assets without paying fees or commissions.

Spreads

If you are experienced in investing and are investing for the long term, the spread will not impress you. However, if you are trading short-term and want to buy and sell forex, commodities, cryptocurrencies and more quickly, then the spread is key.

The spread is the difference between the buy and sell price of your chosen asset. In some cases, it is calculated as a percentage. If you are trading forex, the spread is stated in 'pips'.

Transaction fees

You may be surprised to learn that many online brokers charge transaction fees for deposits and withdrawals. The amounts vary by platform and can be a fixed amount or a percentage of the amount.

Other fees

In addition to commissions, spreads, and transaction fees, there are some other fees that trading platforms charge.

Among them are:

- Inactivity Fee: Some trading platforms will charge you a monthly fee if your account is inactive. An account is marked inactive usually after 12 months of inactivity, but some systems have a shorter period. Always check that you have funds in your account.

- Margin fees: If you plan on margin trading, you should also research the broker's fees. These are usually set as a percentage of the amount for each day you keep the position open.

- Account fees: It is important to check whether the trading platform you choose charges account fees. Typically, the fee is paid on a monthly basis.

Understanding the fee policies of stock, forex, and other trading platforms can be complicated and sometimes daunting, but it is extremely important.

Demo accounts

Demo accounts allow you to trade with virtual money, allowing you to get to know the platform and get used to the interface.

When is it worth using demo accounts:

- You are changing your broker - every interface is different and sometimes it can take some time to get used to the new forex broker.

- You want to test strategies - if you want to check whether a trader is successful at copy trading, or you just want to try a different strategy, you can test the profitability of this approach with a demo account.

- If you are a newbie - there is no point in commenting here. We always advise new users to see how the markets work before testing them with real money.

Trading tools and features

It is extremely important to learn what features your chosen online platform for trading stocks and other assets offers. There are many useful trading tools that should not be overlooked.

Among them are:

Partial shares

Being able to buy fractional shares is very important if you are a small investor with a limited budget. After all, you may not want to pay more than $3,000 for a single share of Amazon or $1,700 for a single share of Google. Fractional shares allow you to buy a portion of a single share.

For example, our top-rated trading platform eToro allows you to invest in any of its 2,400+ stocks for just $50. This means you can invest $50 in a stock that’s worth $500, giving you 10% ownership. This is great not only for investors on a tight budget, but also for diversifying your portfolio.

Types of orders

Regardless of which online trading platform you decide to sign up with, you will need to place an “order” to execute a trade. However, the broker needs to know what you want to achieve from your trade. Although all trading platforms will offer “buy” and “sell” orders, there are other types of orders that may be useful to you.

The best online trading platforms offer stop-loss and take-profit orders. Both are crucial for trading in a risk-free manner.

Another important order is a “trailing stop loss.” It is offered by trading platforms like eToro and allows you to keep a profitable position open until it decreases by a certain percentage.

Copy Trading

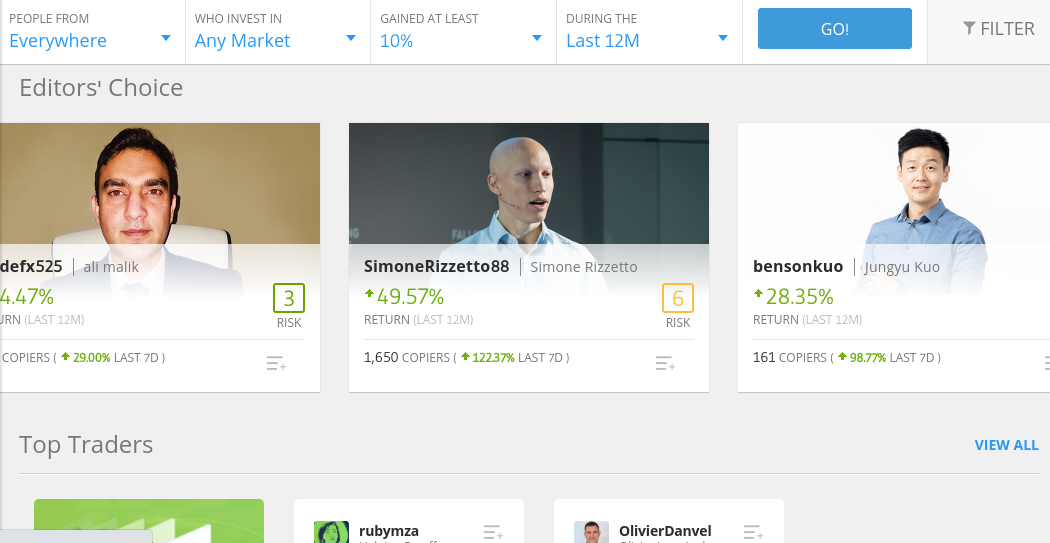

If you want to actively trade in the financial markets but lack the experience and know-how, it’s worth trying out the Copy Trading feature. In its most basic form, it allows you to passively copy the trades of a trader of your choice. According to The Insight Partners, copy trading will reach a market share of $3.77 billion by 2028.

Thousands of verified investors trade with eToro using the Copy Trading feature. You can view each trader's profile, looking at key metrics such as past performance, average monthly return, risk rating, preferred asset class, and average trade duration.

When you find a trader whose trades you want to copy, you should start with a minimum of $200. Once confirmed, all positions of this trader will be reflected in your trading account. You can stop copying the trader at any time.

MT4/MT5

If you are an experienced trader then you will know that the MetaTrader (MT) series is extremely popular. For those who don’t know, both MT4 and MT5 are third-party trading platforms that sit between you and your chosen broker.

Many traders choose a broker that offers access to these online trading platforms as they come equipped with advanced tools.

Both MT4 and MT5 offer:

- Multiple technical indicators

- Charts and various tools

- Real-time quotes

- Mirror trading

- Automated trading option

- Mobile functionality

Not all trading platforms support MT4 and/or MT5, so you should check in advance if you want to use them.

Signals

Financial markets move dynamically, so you need to know every little detail that could affect their movement. Therefore, consider a trading platform that allows you to set up alerts. The best online trading platforms allow you to set up price notifications that are sent via email or through the trading application itself.

This is important because it lets you see when an asset has reached a certain price. For example, if you want to manually trade GBP/USD when it reaches 1.36, the best trading platforms will allow you to set up volatility price alerts. This will let you receive notifications if any of your chosen assets exhibit volatile price movements.

Training, research and analysis

The best online trading platforms take things to the next level by offering comprehensive training, meaning you can learn the basics of buying and selling financial instruments without having to use an external provider.

The most useful educational resources offered by the top-rated trading platforms are:

- Guides and blogs on key topics

- Webinars

- Podcast

- E-books

- Courses

In addition to educational resources, the best online trading platforms also offer a variety of research and analysis tools. This can include real-time news, trading and market sentiment information, chart reading tools, and technical indicators.

User experience

If you are trading online for the first time, choose a provider that guarantees a perfect user experience. A broker may have a perfect desktop interface, but its trading app may not offer the same experience.

If you prefer mobile investing, keep in mind that you will be entering positions on a small screen. Therefore, navigation is crucial. It should be easy to discover assets, research, enter orders, check portfolio values, and deposit/withdraw funds.

In most cases, the best trading platforms create apps for both iOS and Android devices. The app will be optimized for a specific operating system. If the trading platform offers demo accounts, you will be able to test it out without risking losing any funds.

Payment methods

To start buying and selling assets from the comfort of your own home, you will need to fund your trading account. Check what payment methods your chosen provider accepts.

In most cases, you will be able to transfer funds from your bank account. Some platforms allow this to happen quickly, while others take 1-2 days to process. Consider whether trading platforms that offer debit/credit card payments as an option are a good option for your purposes.

If you use the top-rated trading platform eToro, you will be able to deposit funds via Visa and MasterCard, as well as e-wallets such as Paypal, Neteller, and Skrill.

Customer service

There can be huge differences in the level of customer service between platforms. Some brokers only support email or online support. These online trading platforms should be avoided as it can often take days to get a response. According to statistics from 123Builders, 61% of users change their service provider after a single unresolved issue.

Choose a stock and other asset trading platform that offers real-time customer service. The best way to contact them is via live chat or phone support.

Check the working hours of the customer service teams. Most platforms do not offer service during the times when most markets are closed. Usually, service is 24/5.

How to trade with the best online trading platform

So far, we've discussed the best online trading platforms. We've also explained the important features you should look for when choosing a provider.

Now we'll look at how to get started with arguably the best trading platform.

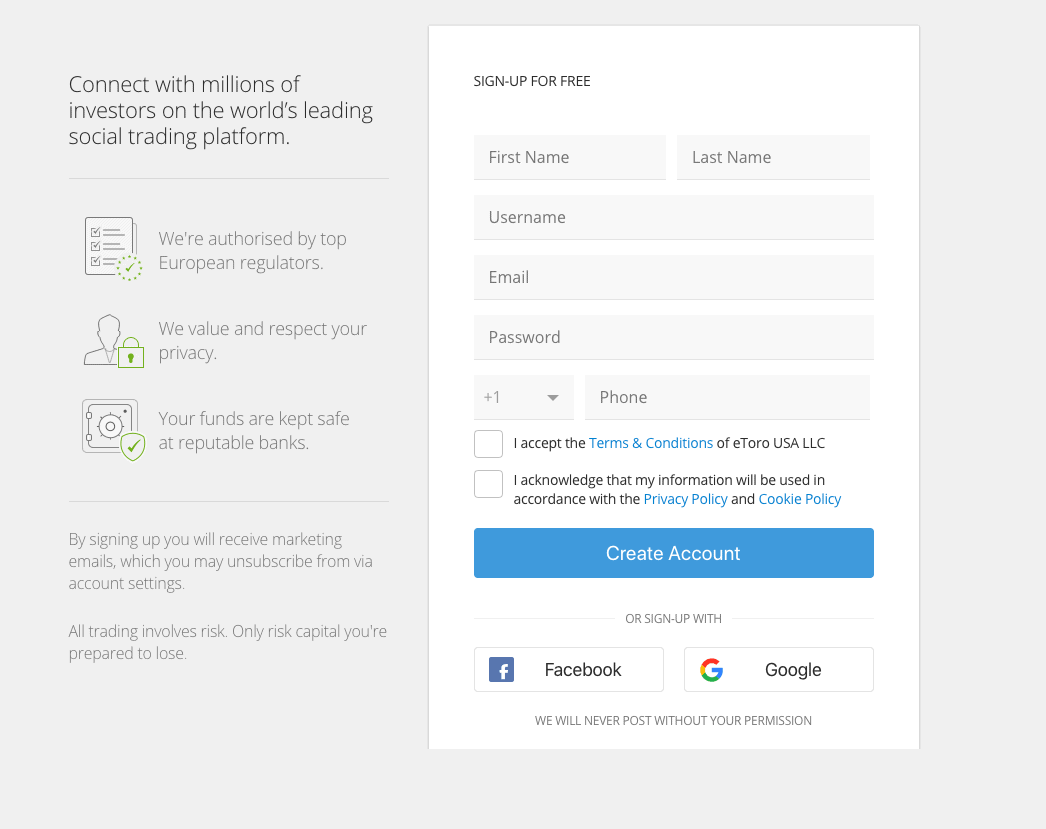

Step 1: Open an account and upload your ID

Regardless of which trading platform you decide to join, you will need to start the process by opening an account. With eToro, this can be done in minutes.

Open the eToro website and click the 'Join' button. Enter your personal details – full name, nationality, exact address, date of birth. The trading platform will also ask for an email address and phone number.

Step 2: Verify identity

eToro is regulated by the UK Financial Conduct Authority, which means you must prove your identity in order to make deposits and withdrawals.

You must attach a copy of the following two documents:

- Valid ID or driver's license

- Utility bill or bank statement (issued within the last 3 months)

In most cases, eToro will automatically validate the documents and your account will be verified immediately.

Step 3: Deposit funds

The next step is to fund your trading account with eToro.

You can choose from several convenient translation methods:

- Debit card

- Credit card

- E-wallets (Paypal, Skrill or Neteller)

- Bank transfer

The minimum deposit is 20 EUR/USD/GBP for all payment methods except bank transfer which requires 250 EUR. There are no deposit fees.

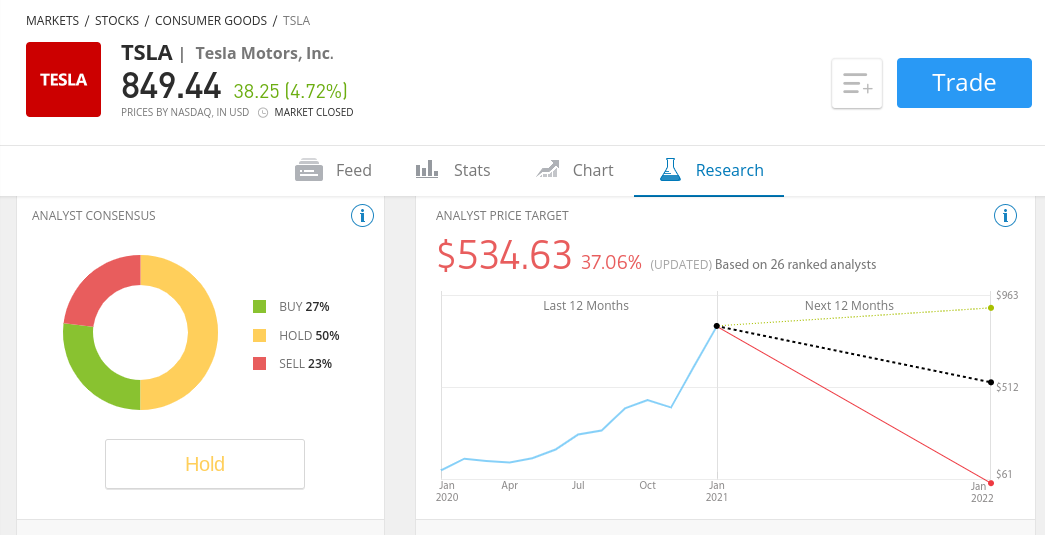

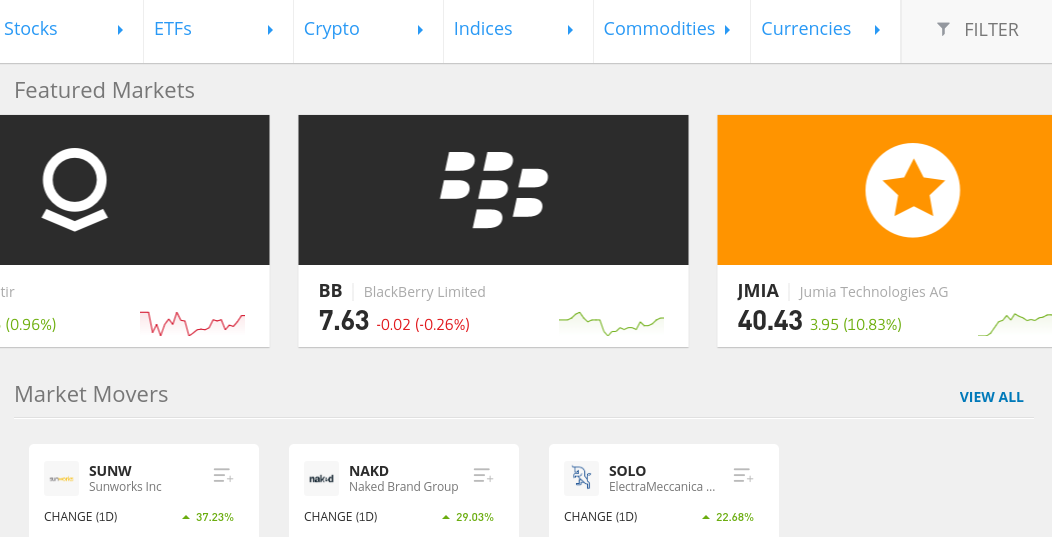

Step 4: Explore supported trading markets

Once you have funded your eToro account, you can start looking for assets to trade. Search for the markets that interest you.

If you want to see the supported assets, click on the 'Trade Markets' button. There you will see the tradable asset classes, such as stocks, cryptocurrencies, ETFs, forex and commodities. You will also find information about the instruments with the strongest growth, the strongest decline and the most volatile markets.

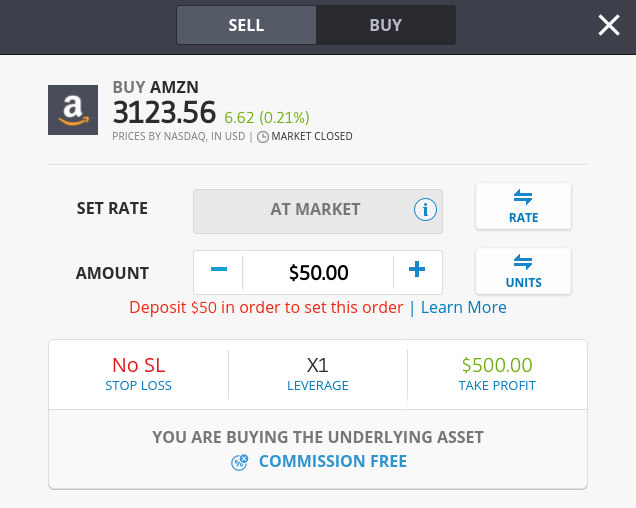

Step 5: Start trading

When you have selected an asset to trade, place an order. In the example below, we show an order for Bitcoin .

You can trade the markets in real time and place stop-loss or take-profit orders.

Overall, there are hundreds of stock and asset trading platforms to choose from. You need to spend a lot of time researching to ensure that you are working with a provider that will meet all of your requirements and needs. Some traders, for example, look for low trading costs, while others focus on access to a specific market or asset.

{etoroCFDrisk} % от сметките на инвеститорите на дребно губят пари при търговия с CFD (догвори за разлика)Conclusion

Frequently Asked Questions

Sources:What is the best trading platform?

Which cryptocurrency trading platforms are available from Bulgaria?

Do online trading platforms require ID verification?

What is the best trading platform in Bulgaria?

What are the best stock brokers?