كيفية شراء أسهم أبل في الدول العربية

Apple stock is listed on the NASDAQ stock exchange, and the company’s value now exceeds $1 trillion, so it’s no surprise that many investors are interested in purchasing Apple shares. If you want to buy some Apple shares, you’ll need to use a stock broker in the Arab countries who gives you access to the US markets.

In this guide, we’ll explain how to buy Apple stocks online in Arab countries. We won’t explain what you need to consider before investing in Apple, but we’ll review the best stock brokers in Arab countries and provide a step-by-step overview of how to buy stocks today.

How to Buy Apple Stock Today – A Step-by-Step Guide

If you don’t have time to read our entire guide, don’t worry. You can follow the quick steps below to buy Apple stock in less than 10 minutes!

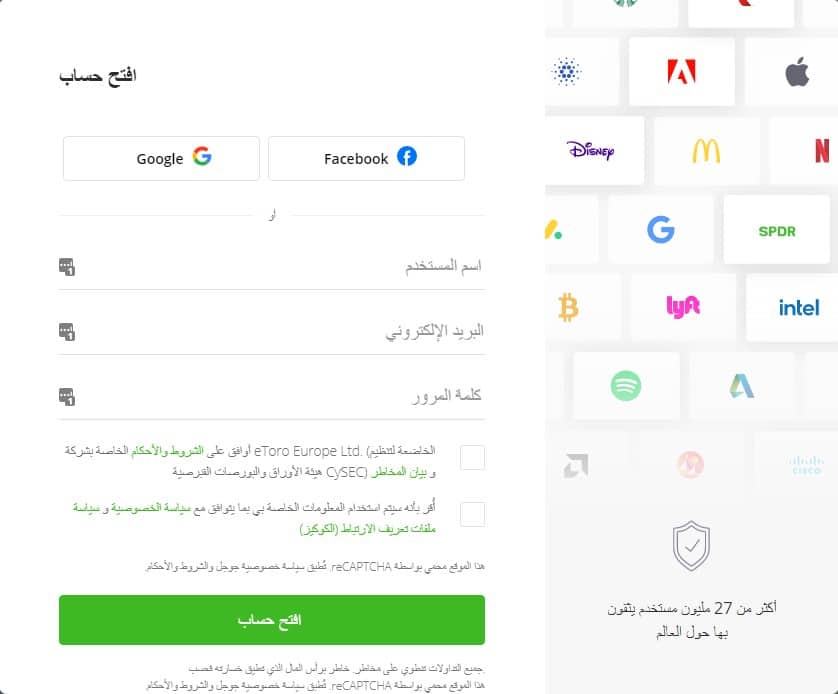

- 1 – Open an account with eToro — Open an account in minutes with our recommended eToro broker

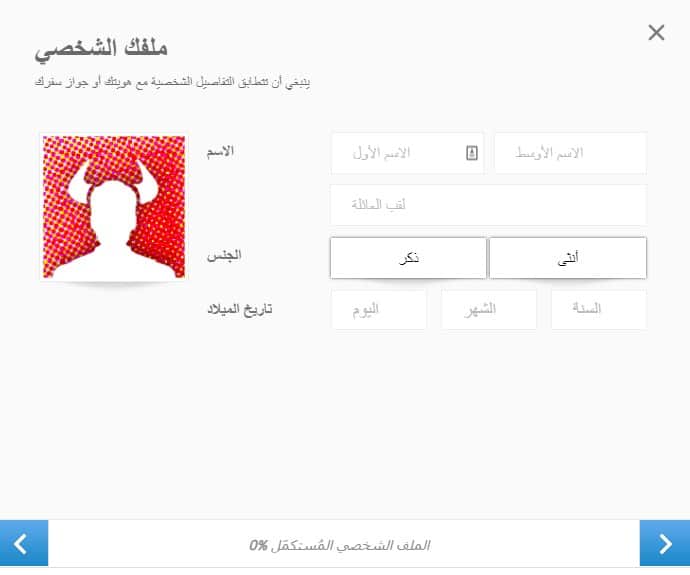

- 2 – Upload identity documents – Upload a copy of your passport or driver’s license to verify your identity.

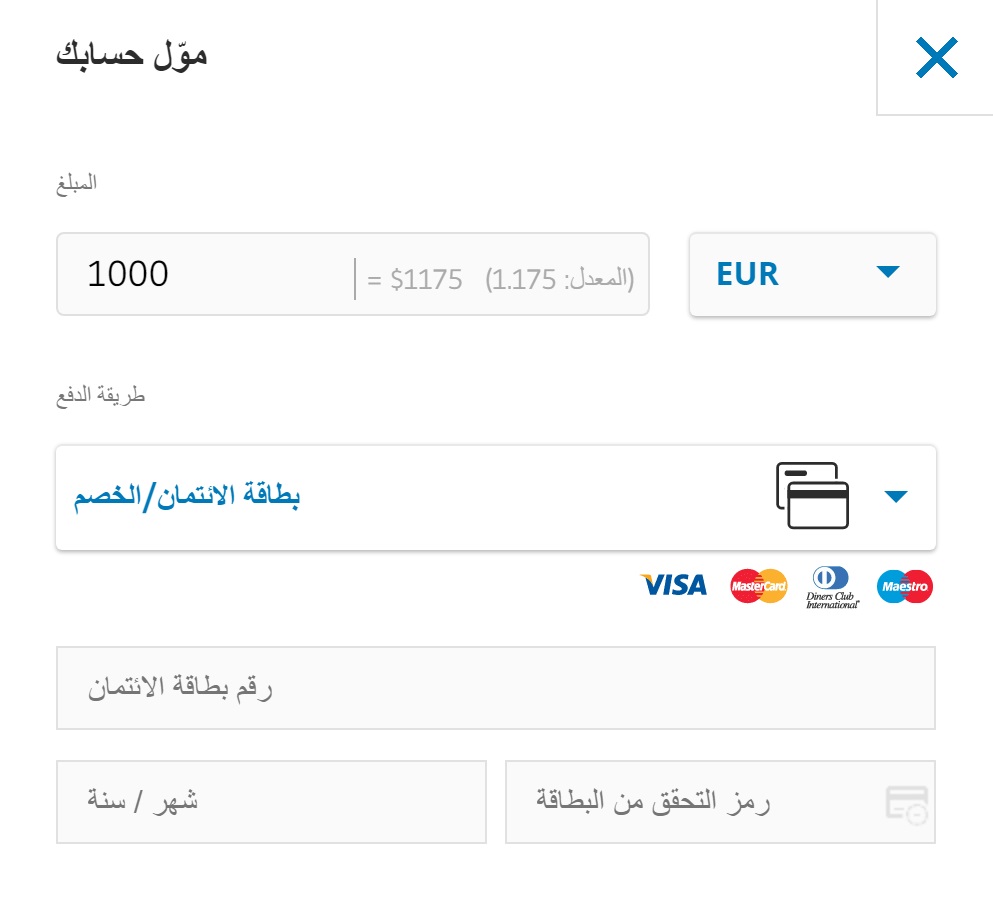

- 3 – Deposit – Deposit funds using a debit/credit card in Arab countries or bank transfer

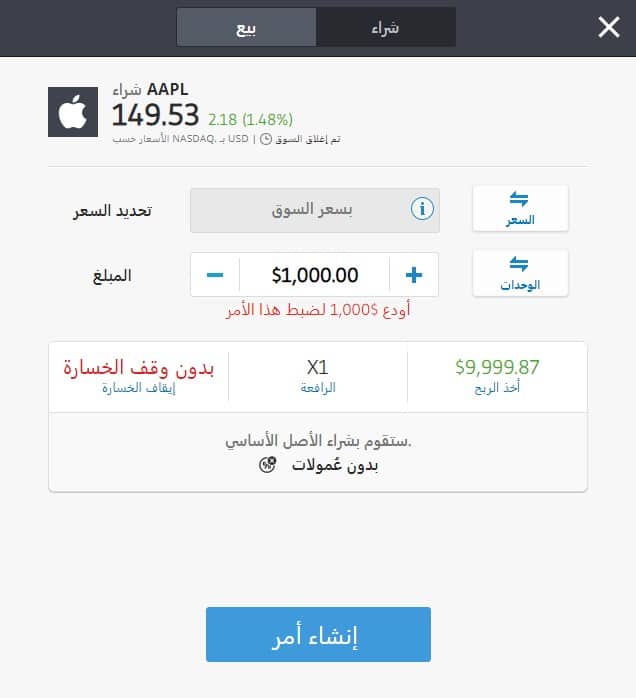

- 4 – Buy Apple! — Buy Apple stocks with 1$ commission with eToro

As you can see above, buying Apple stocks on eToro is not only safe and commission-free, but it also takes only a few minutes.

73.81% of CFD accounts lose money.

Step 1: Find a stock broker in the Arab world that offers Apple stocks.

Although Apple is listed in the United States, buying its shares from Arab countries is very easy. All

However, you will need to ensure that the broker you choose is licensed and offers competitive fees.

To help you do this, below are our picks for the best stock brokers in the Arab world for buying Apple stock.

1. eToro — The leading social trading broker

If you’re an investor in the Arab world and want to buy Apple stocks quickly and cheaply, eToro

eToro is one of the few online brokers that charges 1$ commissions. Therefore, you can buy Apple stocks. eToro is also popular with those looking to start with small amounts.

This is because there is no requirement to purchase a full Apple stock ($135 at the time of writing). Instead, eToro allows you to invest as little as $50, as it allows fractional investing.

In addition to allowing you to buy stocks, eToro also offers stock CFD trading and is considered one of the best CFD brokers. This means you can sell and speculate on Apple’s stock price when it declines, and you can also use leverage of up to 1:5 to amplify your trades.

eToro is known for its social trading and copy trading tools, which truly set it apart from most standard trading platforms. As a social broker, eToro allows you to interact with other users, and you can even use the CopyTrader tool to copy the entire portfolios of top investors!

To deposit, you can use a bank card, bank transfer, or an e-wallet such as PayPal. You’ll need a minimum deposit of $200. Since eToro converts all deposits to US dollars, you’ll pay a 0.5% conversion fee. However, this allows you to easily invest in UK and international companies.

In terms of safety, eToro is regulated by the UK Financial Conduct Authority. It is also licensed by ASIC and CySEC. If you’re an investor who likes to buy and sell stocks on the go, eToro offers a fully functional investment app.

- Easy-to-use online stock broker

- Over 800 stocks listed on UK and international markets

- Ability to buy stocks or trade CFDs

- Social Trading and Copy Trading Tools

- PayPal accepted

- Mobile Trading App

- FCA licensed

- Not suitable for advanced traders who like to perform technical analysis.

67% of retail investor accounts lose money when trading CFDs with this provider.

2. Alvexo – Buy Apple stocks with a broker with rich educational tools

Alvexo is an online trading broker founded in 2014. For seven years, it has been providing everything you need to make

With the platform, you’ll be able to trade Apple or any stock of your choice without paying any commissions, deposit or withdrawal fees. Additionally, you’ll be able to invest in over 450 investment instruments, ranging from stocks and commodities to forex and other categories. Let’s point out an important point you should never overlook: practice your Apple trade first by opening a demo account, which is available for free.

These and many other features you’ll benefit from with Alvexo, starting with the broker’s app, which you can download in less than a minute, regardless of your phone type. There’s no difference between the services provided by the platform and the app. However, naturally, using your phone to trade will be simpler than using a computer, as you can trade anywhere, anytime.

The platform’s unique feature, which places a great deal of emphasis on its clients, is its strong focus on guidance and education. You’ll have access to a range of learning academies and financial channels, all designed to guide you toward smarter trades and more informed decisions regarding your investments.

Getting started with the platform or app is very simple and seamless, and takes just minutes. It requires a minimum deposit of at least $500. Payment options are numerous and varied, including e-wallets.

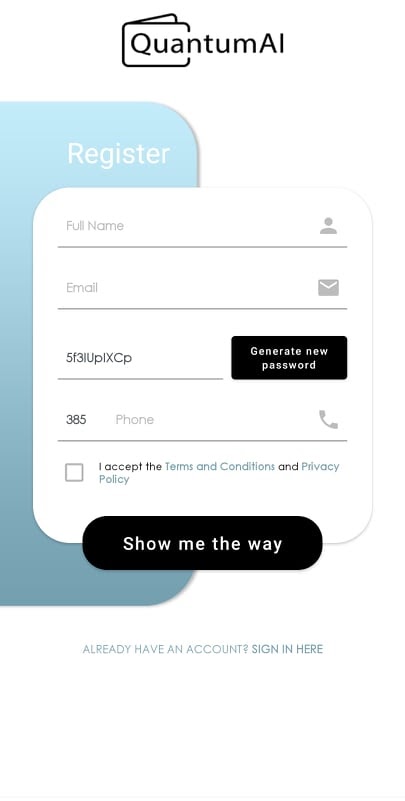

76.57% of CFD accounts lose money. Quantum AI is a software that works with multiple regulated brokers to provide you with recommendations on the best investment opportunities. Although it’s considered a software program, The advanced Quantum AI software scans the market and performs in-depth analysis similar to that of experts, but much faster, to extract the best investment opportunities that are considered the most ideal and likely to be profitable and present them to you. The software claims it can guarantee up to 60% daily profit because it works to search for favorable conditions for you to invest. Among these conditions, we find the right time. Let us all recall the story of Apple traders using Quantum AI last year at the height of the global pandemic, when Apple’s stock value reached its lowest level. The platform’s advanced robot provided them with its intelligent recommendations, urging them to buy Apple shares at that precise time, subsequently making significant profits after the stock’s value rose again. Quantum AI can be configured to operate fully automatically. The platform’s bot buys or sells Apple stocks in your place, and all you have to do is follow the platform’s instructions. You can also configure it to operate semi-automated, allowing you to make decisions and investments based on your own personal analysis, research on Apple stocks, or the strategies and advice of experts and financial advisors you follow. Furthermore, you won’t be charged any commissions or fees with Quantum AI. If you encounter any difficulty in making your investment or need any additional information related to your investments or related to the field of markets and trading in general, all you have to do is contact the Quantum AI platform’s customer support service. Unlike other platforms, this service is available 24/7 via live chat, the platform’s phone numbers, or email. You can ask any question at any time and receive a prompt and professional response, in addition to their effectiveness in resolving any problem. It’s indeed very useful to set up the Quantum AI platform to operate 100% automatically, allowing it to make any Apple purchases for you without any prior research or study. However, it’s essential to conduct some research and analysis yourself to understand how your investments align with expert guidance. Therefore, we recommend following all the training and guidance lessons provided by Quantum AI. Also, don’t forget that you can open a demo account on the platform and the app to practice and learn from mistakes you might make during your direct investments due to haste or lack of sufficient knowledge of how the platform works. With Quantum AI, you can start trading Apple stocks with an initial deposit of €220, either via bank transfer or one of the major cards such as credit and debit. AvaTrade is a licensed CFD broker in six different jurisdictions worldwide. The broker also offers a wide range of different trading accounts, including CFD trading, spread betting, options trading, and swap-free Islamic accounts. There are also professional accounts for serious traders. With AvaTrade, you can also trade on a variety of different platforms, including the popular MetaTrader 4 and MetaTrader 5. There’s also a wide range of research and educational materials.

71% of individual investors lose money when trading CFDs on this site. Libertex is another stockbroker that offers CFD trading on a wide range of markets. Not Since CFDs are a derivative product that you never actually own, you are merely speculating on its price direction. This means that you can not only trade on margin, but you can also trade long or short! Additionally, with Libertex, you can trade Apple stock CFDs with zero spreads! This is typically the difference between the buy and sell price, and is one of the ways the broker makes money. However, Libertex charges a small fee for buying and selling, currently only 0.207%. Adjustments for dividends are also made when using CFDs. Opening an account with Libertex is easy and can be done in minutes. Its trading platform is simple to use and operates on the web.

83% of individual investors lose money when trading CFDs on this site. While you may want to buy Apple stock right now, we suggest conducting some independent research first. This will ensure you fully understand the risks and benefits of owning Apple stock. To help guide you in the right direction, we’ll outline some key facts about this tech giant below. Although Apple is often viewed as a modern-day technology innovator, the company actually went public in 1980. Apple chose the technology-oriented NASDAQ exchange over the New York Stock Exchange, and its stock was initially priced at $22 per share. At the time of writing in April 2021, that same stock was worth more than $134. This puts Apple’s stock in “all-time high territory,” meaning the company has reached an all-time high value. However, it’s important to note that Apple has had four stock splits since its IPO in 1980. This makes a significant difference when determining the company’s growth. This includes a 7-for-1 split in 2014, and 2-for-1 splits in 1987, 2000, and 2005. In simple terms, if you had purchased 1,000 Apple shares in 1980, you would now own 56,000 shares. Initially, this would have cost you $22,000 (22 x 1,000 shares). However, it’s also important to look at the short-term picture. Savvy investors likely bought some Apple shares in March 2020, selling at a significant discount. This was due to the impact of the coronavirus pandemic. For example, while Apple shares were priced at $82 in January 2020, just two months later, the same shares were worth only $53. That represents a significant two-month decline. However, the stock not only recovered those losses in early June 2020, but has since continued to move upward. Therefore, if you had invested in Apple stock in March 2020, at today’s prices, you would have gained over 150%! Unlike other large tech companies listed on the NASDAQ stock exchange (Amazon, Google, Facebook, and Netflix), Apple pays dividends. This allows it to combine a consistently rising stock price with regular income payments. Although this occurs four times a year, the dividend yield on Apple stock is relatively low. In fact, it’s holding steady at less than 1% at the time of writing. However, as we discussed in the section above, this is offset by the unprecedented capital gains investors have enjoyed over the past few decades. Now that you have some basic information about Apple’s stock price history, we need to assess what Opponents of Apple as a viable long-term investment will argue that its core revenue growth from the iPhone is slowing somewhat. However, let’s not forget that Apple has some of the largest cash reserves not only in the United States, but globally. In fact, that sum is $192 billion. The likes of Amazon and Facebook hold a tiny fraction of that sum, around $49 billion and $60 billion, respectively, which doesn’t diminish their significance. Crucially, having such a large free cash flow position is beneficial for two main reasons. First, the company will have no problem weathering a potential COVID-19 storm. Whether sales decline or supply chain disruptions, Apple shareholders have nothing to fear. Second, Apple’s nearly $200 billion war chest allows it to continue its diversification efforts. This includes launching new and innovative products and services, as well as acquisitions. For acquisitions, this includes its recent purchase of NextVR, a virtual reality company specializing in sporting events. When novice investors think of Apple, they often focus on the core iPhone lineup. While this remains Apple’s primary revenue generator, the company is devoting more resources to its services division. In 2019 alone, Apple launched four new services for global markets that boast strong growth potential in 2021. This includes its TV streaming service, game streaming, news subscriptions, and even its credit card. Most importantly, Apple’s services revenue increased by 16% in 2019—equivalent to just under one-fifth of its total revenue. As mentioned above, such a strong free cash flow position will allow Apple to continue increasing its investment in services. Very few companies avoided the massive stock market crash that occurred in March 2020. Due to investor concerns about the impact of COVID-19, many major companies lost anywhere from 20% to 50% in just a few weeks. As mentioned above, Apple shares lost about 30% during that period. However, by early June 2020, Apple had recovered all of these losses. This was a huge positive for shareholders. In fact, not only did Apple’s stock return to its pre-March 2020 levels within just two and a half months, but it was on an unstoppable upward trajectory. Once you’ve conducted independent research on Apple stocks, the next step is to open an account with your chosen stockbroker in the Arab world. Regardless of which platform you decide to subscribe to, the process remains largely the same. For example, you’ll need to provide some personal information, deposit funds, and purchase Apple shares. To show you how seamless the process is, below we show you how to invest in stocks using our recommended broker in the Arab countries, eToro.

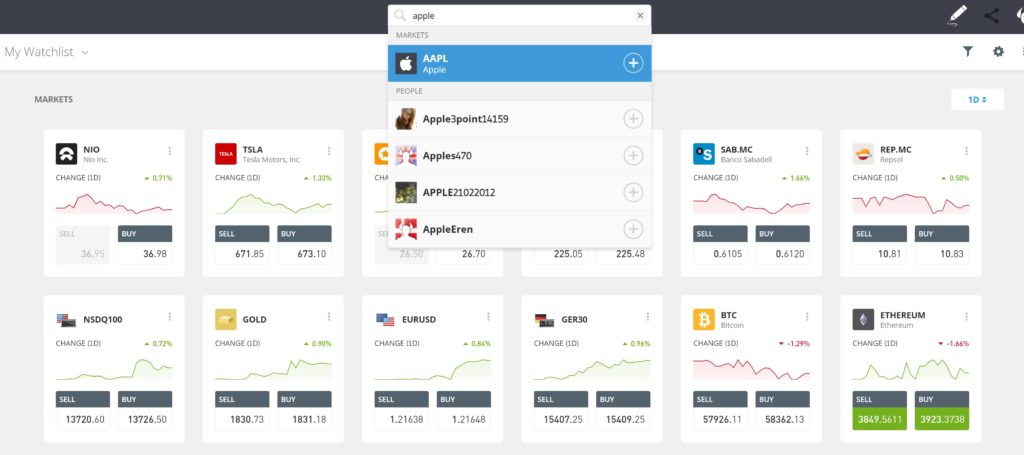

73.81% of CFD accounts lose money. So, you’ll first need to visit the eToro website and choose to register an account. You’ll then be asked to provide the following personal information: Although eToro allows you to make an immediate initial deposit, it’s best to verify your identity first. This will ensure that deposit restrictions are lifted and that you can withdraw funds without delay. Therefore, you will need to upload a copy of: After uploading the above documents, you will be asked to add funds to your account. You will need to make a minimum deposit of only $50–$200, depending on the country. The payment methods available on eToro are: Except for bank account transfers, funds for all other deposit methods are added instantly. Once you’ve funded your eToro account , you can buy Apple stock. First, enter “Apple” in the search box at the top of the page. Once the result appears, click on it. Next, click the green button that displays the stock price during the purchase, which also signifies “buy,” as shown below.

You’ll then see an order box. If you like Apple’s current market price, all you have to do is enter the amount you want to invest and buy Apple stock. The Apple stock purchase process will then be completed when you select the amount of shares you wish to purchase. It’s no surprise to learn that Apple is often considered one of the best stocks to buy in 2021. With a market cap of over $1.6 trillion, no one knows how big this tech giant will become. Considering its cash reserves of just under $200 billion, Apple has all the tools it needs to pursue its diversification and acquisition goals. This is crucial for Apple shareholders, as it reduces the risk of overinvesting in the iPhone. Consequently, Apple services—such as streaming TV and gaming subscriptions—continue to grow throughout the year. If you’re looking to invest today, the popular CySec and FCA-regulated broker eToro lets you buy Apple stocks for as little as $20. It charges 1$ fees for stock trading, and you can also take advantage of eToro ‘s innovative stop-loss trading tools . Just click the link below to get started! CFDs are complex instruments and come with a high risk of losing money rapidly

Advantages:

العيوب

3. Quantum AI – Get investment advice from the world’s first quantum machine

Advantages:

العيوب

71% of retail investors lose money trading CFDs on this site4. AvaTrade — Buy Apple Stock Commission-Free

You can not only buy Apple stock CFDs, but also trade over 1,250 other markets, including stocks, cryptocurrencies, indices, forex, and more, commission-free.

المزايا:

العيوب

5. Libertex — Buy Apple stocks with zero spread

المزايا:

العيوب

Step 2: Research Apple stocks

Apple stock price history

Information about Apple’s dividends

Should I buy Apple stock?

mountain of cash reserves

The Services division remains the foundation for Apple shareholders.

Rapid recovery of COVID-19 losses

Step 3: Open an account and deposit funds

Step 4: Buy Apple shares

Final Opinion

eToro — Buy Apple stocks with the best broker in the Arab world

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.Frequently Asked Questions

How much were Apple shares worth when the company first went public?

How much does it cost to buy Apple stock in Arab countries?

Does Apple pay dividends?

What is the minimum number of Apple shares I can buy?