أفضل صناديق الاستثمار (Best Investment Funds) في الدول العربية لعام 2026

If you are keen on investing in the financial markets but lack the know-how to place trades yourself, you can consider mutual funds.

When used, your chosen fund will determine which assets to buy and sell, meaning you can enjoy a stream of income without any effort on your part. Investment funds come in various forms, ranging from exchange-traded funds and mutual funds to credit funds and index funds.

In this guide, we discuss the best investment funds available to residents of Arab countries for 2026. We’ll explain a variety of fund types, as well as how to invest from the comfort of your home.

Top 8 Investment Funds in Arab Countries

Below is a quick overview of the best investment funds in Arab countries that we’ve selected for you. You’ll find more information about each fund by browsing the list below.

- iShares Russell 1000 ETF — Invest in over 800 undervalued US stocks — Invest now

- SPDR Gold ETF — Invest in gold without commissions and without worrying about storage space — Invest now

- MI Chelverton UK Equity Growth Fund — Best UK Small Cap Equity Fund — Invest Now

- S&P 500 Index — The Real Long-Term Wealth-Building Investment Fund — Invest Now

- iShares MSCI Hong Kong ETF — Invest in a portfolio of Hong Kong companies — Invest Now

- iShares FTSE China 25 Index ETF — Invest in the best Chinese stocks — Invest now

- BMO Responsible UK Income 2 Inc — The best ethical fund to invest in UK companies — Invest now

- Vanguard Retirement Investment Fund — Choose Your Target Retirement Date — Invest Now

73.81% of CFD accounts lose money.

Best Comprehensive Investment Funds in Arab Countries

It’s great that investors in Arab countries have thousands of top investment funds to choose from. Ultimately, this ensures there are funds to suit all types of investors. However, this can make it extremely difficult to differentiate the good ones from the bad ones.

With this in mind, below you will find our best comprehensive investment funds available in Arab countries.

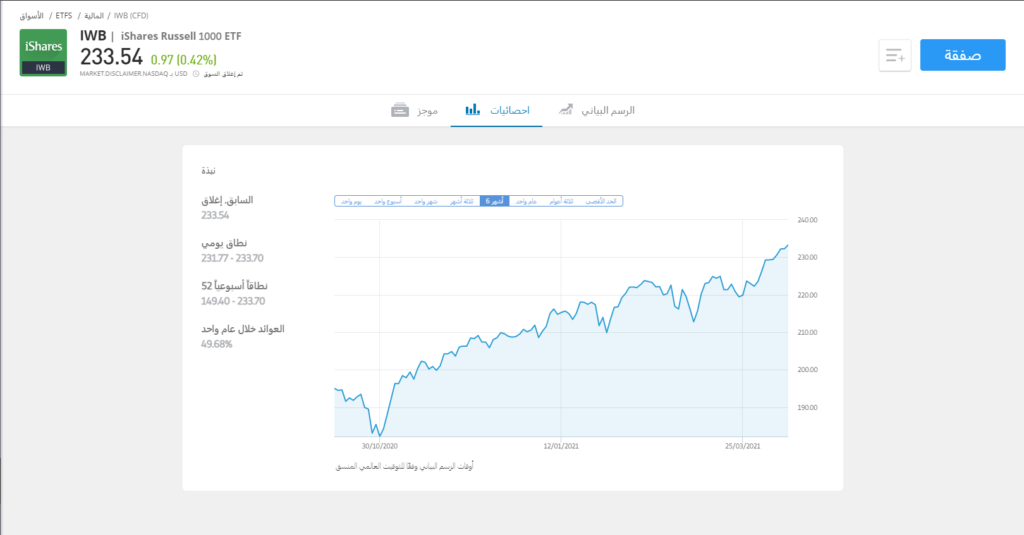

iShares Russell 1000 ETF — Invest in over 800 undervalued US stocks

The iShares Russell 1000 ETF is a great option if you want to invest in the US economy. In fact, this particular ETF gives you instant access to 843 stocks. This means you’ll have a huge stock portfolio with just one investment.

The iShares fund manager seeks to select US companies that he believes are undervalued. This includes both large- and mid-cap stocks across all sectors. For major companies, the fund currently holds 2.76% in Berkshire Hathaway and 2.27% in Johnson and Johnson. Other companies include Walt Disney, Intel, Verizon, and JPMorgan Chase & Co.

.Although this particular investment fund is based in the United States and focuses entirely on American companies, investing in it from Arab countries is extremely easy.

73.81% of CFD accounts lose money.

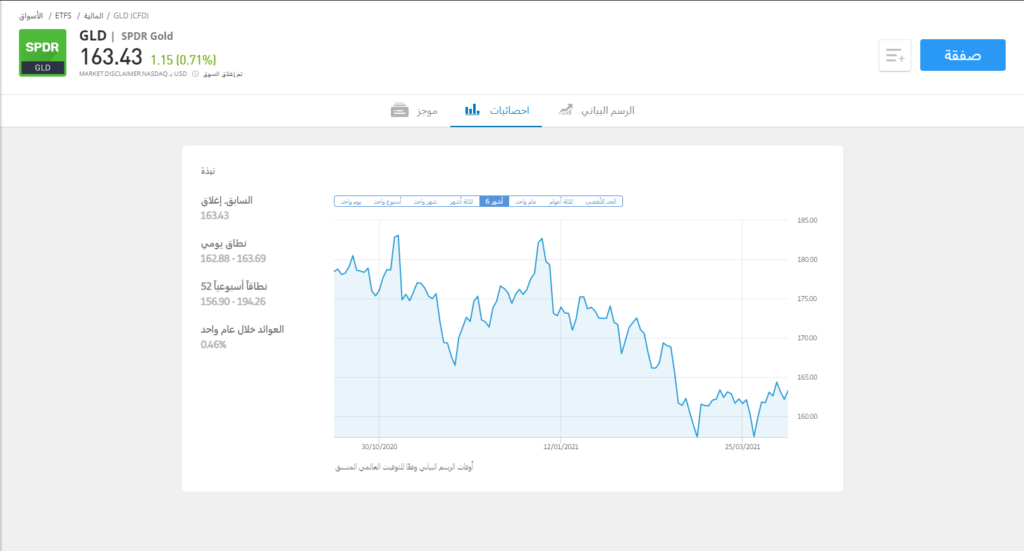

SPDR Gold ETF — Invest in gold without commissions and without worrying about storage space

As the name suggests, this investment fund focuses exclusively on gold. This store of value metal can be extremely beneficial to invest in if you anticipate challenging economic conditions in the future. After all, investors turn to assets like gold when market uncertainty increases. This is evident in gold’s performance this year.

In fact, the SPDR Gold ETF has risen 25.99% over the 12 months prior to this writing. This ETF is also easy to invest in—you simply need to invest a minimum of $20 on eToro. By doing so, you’ll be investing in the future value of gold without having to worry about storage or delivery.

The SPDR ETF provider is also physically backed by the underlying assets, so you can invest easily. Investing in an ETF also features minimal fees. Again, you won’t pay any commissions or ongoing fees on ETFs when using a broker like eToro, and you can exit your trade at any time.

73.81% of CFD accounts lose money.

The best investment funds in Arab countries

Both of the top-rated funds on the above list are exchange-traded funds (ETFs). This means the provider is tasked with tracking a specific market, such as the Russell 1000 or gold. Mutual funds, on the other hand, are slightly different. This is because the fund manager decides which assets to buy and sell and when to do so.

In other words, although it may focus on FTSE 100 stocks, it may decide to omit a number of companies if it deems they do not add value to investors. This is something that ETFs cannot do. However, below, you will find the mutual funds in Arab countries that we have rated highest.

MI Chelverton UK Equity Growth Fund — Best UK Small Cap Equity Fund

While most investors focus on large-cap stocks listed on the London Stock Exchange, some look to invest in emerging companies. Such companies are typically found on the Alternative Investment Market (AIM), the UK’s secondary stock exchange.

This particular market has a much higher risk/reward ratio compared to established blue-chip stocks, as many AIM-listed companies have yet to prove their business model. Or they may be established but have a small market valuation. In either case, if you want to allocate some of your capital to smaller companies, your best option is a mutual fund like MI Chelverton UK Equity Growth.

Ultimately, the relevant investment fund will determine which UK stocks are worth investing in. An experienced fund manager will also determine the right time to buy or sell. The MI Chelverton UK Equity Growth fund was first launched in 2014 and had just over £722 million in assets as of August 2020.

Managed by James Baker and Edward Booth, its portfolio contains 127 stocks. It spans a diverse range of sectors, with a strong focus on technology, healthcare, support services, and consumer goods. Its top holdings include Future, Clingen, SDL, Premier Foods, Gamesys, and dotDigital.

There are other leading UK investment funds you can invest in, such as:

- Blackrock UK Fund — This mutual fund focuses on large-cap UK stocks. This may be convenient if you want to take on less risk—the fund consists of established companies with strong market valuations.

- ASI Global Smaller Companies Fund: This fund is another mutual fund targeting upcoming UK equities. The fund has performed well since inception, so it may be worth diversifying between this fund and the MI Chelverton UK Equity Growth Fund to balance risk levels.

73.81% of CFD accounts lose money.

Best Investment Funds for Beginners

All UK investment funds are suitable for beginners, as you won’t be required to do anything. You can leave the buying and selling of assets to the fund provider.

However, some mutual funds are more suitable for beginners because they contain assets that are easy to understand. These funds typically focus on major stocks with a long track record and represent brands you’re likely familiar with.

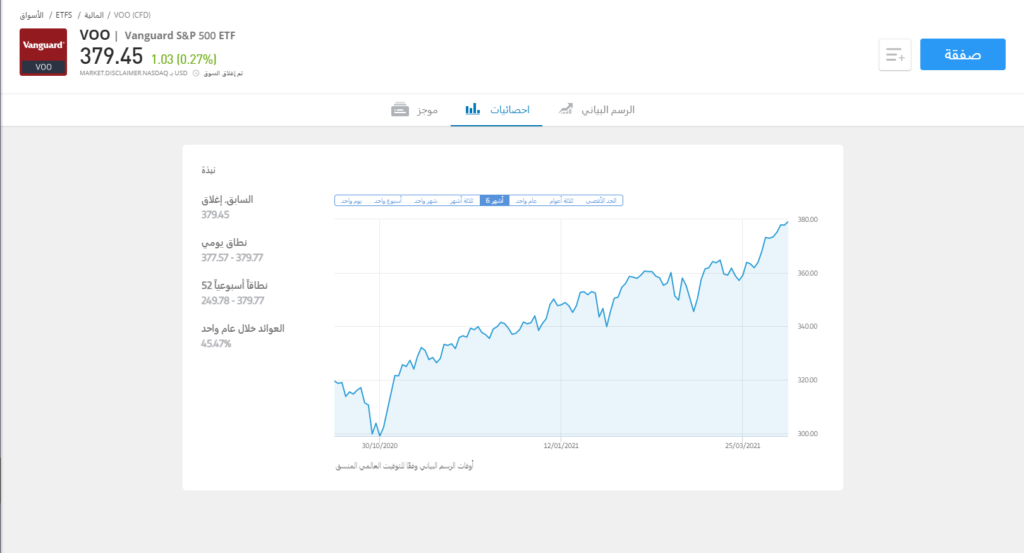

S&P 500 Index — The Real Long-Term Wealth Building Investment Fund

Even if you’ve never placed a trade before, there’s a good chance you’ve heard of the S&P 500. For those unfamiliar, the S&P 500 is a stock market index focused on the United States. It tracks the performance of 500 large American companies—from both the New York Stock Exchange (NYSE) and the Nasdaq (NASDAQ). This includes companies like IBM, Google, Twitter, Disney, Berkshire Hathaway, Verizon, Apple, Amazon, and many more.

Since its launch in 1926, the S&P 500 has averaged returns of just over 10% annually—measured over time. So, for the best investments for beginners, you may want to consider how to invest in the S&P 500 in Arab countries. The key point is that the index is regularly rebalanced to ensure it reflects the major U.S. stock markets. To do this, the S&P 500 focuses on market capitalization.

This means that the largest US stocks by market capitalization will contribute a larger percentage to the index. In terms of investment volume, there are many mutual funds that track the S&P 500. In our opinion, the easiest and most cost-effective way to do this is through exchange-traded funds (ETFs). Vanguard funds are at the forefront of these funds. !

It’s also worth noting that, like most other ETFs, Vanguard allows you to earn dividends. In fact, these dividends are distributed quarterly to your brokerage account. By reinvesting these dividends back into the S&P 500, you have the opportunity to invest your money faster.

To ensure you can find an S&P 500 ETF that meets your needs, here are some other options:

- iShares Core S&P 500 ETF

- SPDY S&P 500 ETF

- Portfolio Plus S&P 500 ETF

73.81% of CFD accounts lose money.

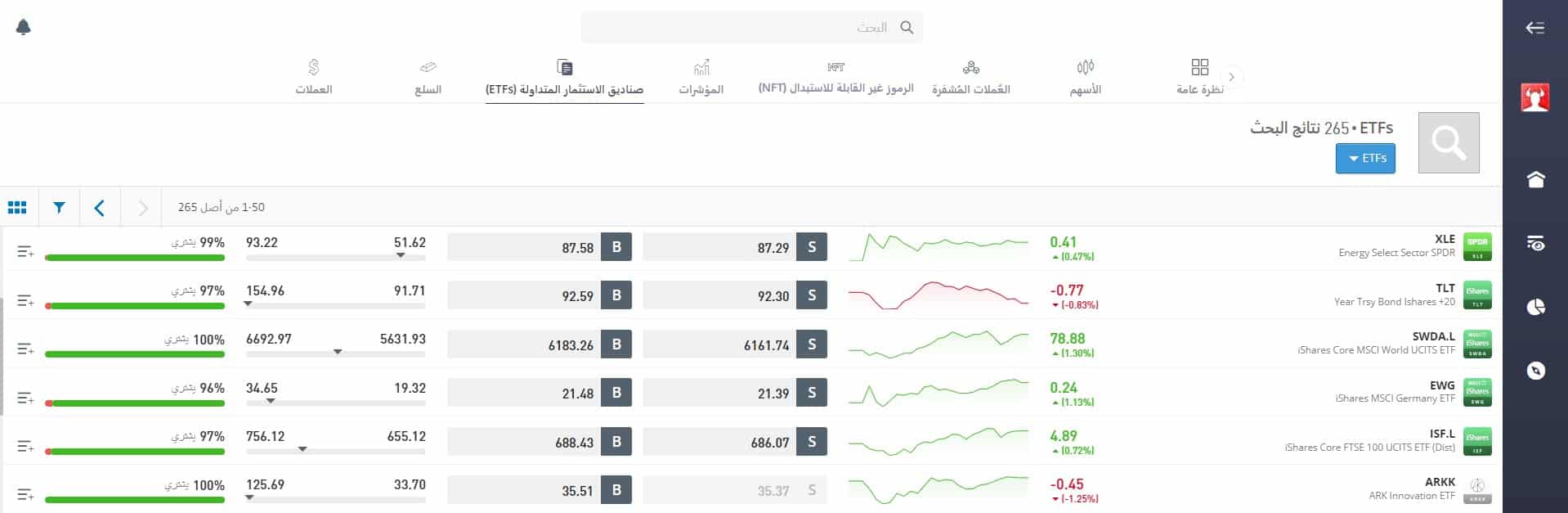

Best Exchange Traded Funds

We’ve already discussed some of the best investment funds available in the form of exchange-traded funds (ETFs). We’ve talked about the Vanguard S&P 500 Index, the SPDR Gold ETF, and the iShares Russell 1000 ETF. However, there are many other ETFs worth considering.

like:

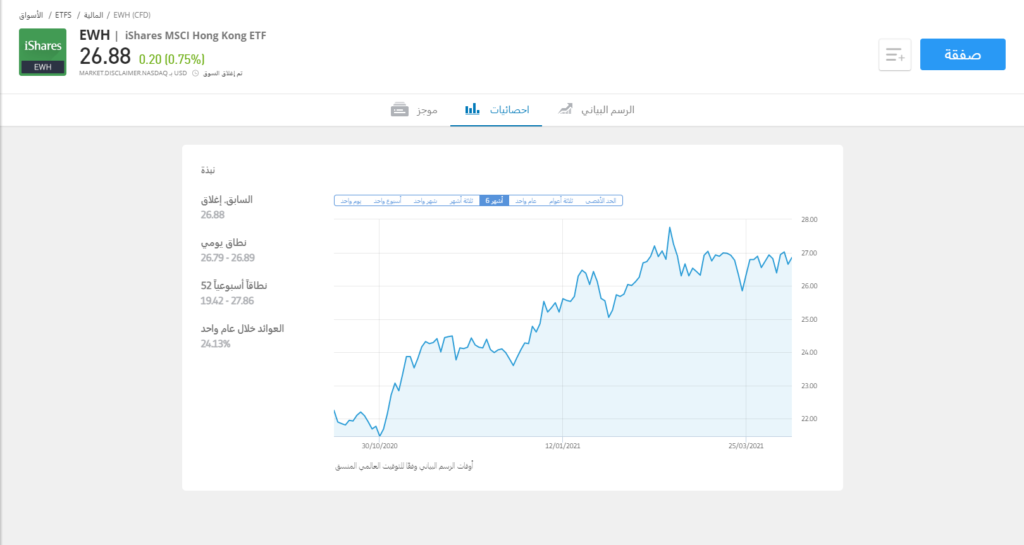

iShares MSCI Hong Kong ETF — Invest in a portfolio of Hong Kong companies

If you’re an investor looking to gain exposure to the ever-growing Asian economies, you might consider the iShares MSCI Hong Kong ETF. As the name suggests, this ETF focuses on the Hong Kong markets. Specifically, the fund includes 41 individual stocks listed on the Hong Kong Stock Exchange.

Although the portfolio is reasonably well-weighted, two companies together account for just over 36% of the fund: AIA Group with 23.95% and Hong Kong Exchanges and Clearing with 12.14%.

Next come companies like Sun Hung Kai Properties, Techtronic Industries, and CK Hutchinson. Most importantly, this ETF focuses on the ease of investing in international companies from the comfort of your home. Furthermore, eToro is completely free to use and very easy to get started.

73.81% of CFD accounts lose money.

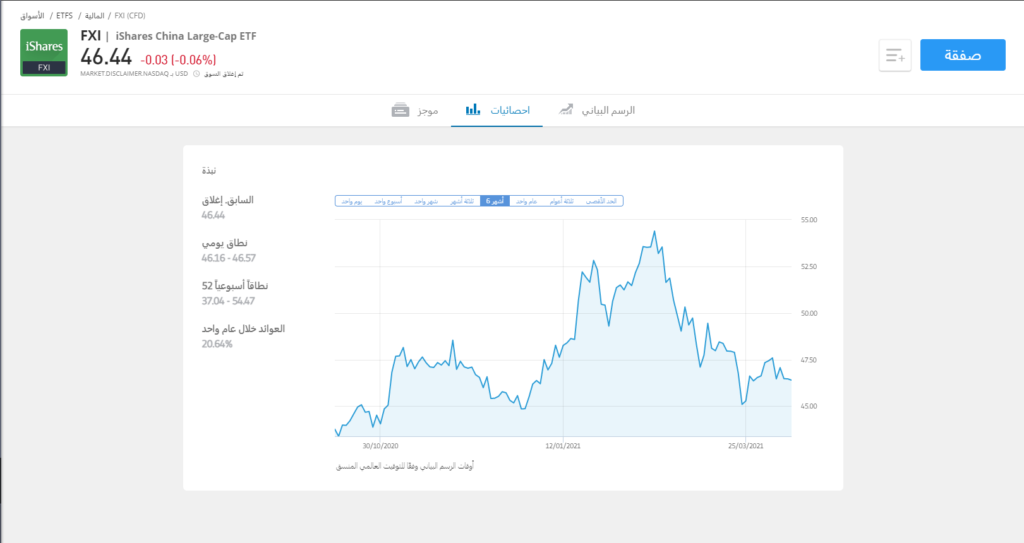

iShares FTSE China 25 Index ETF — Invest in top Chinese stocks

There’s an additional ETF you can consider, the China 25 Index. Backed by established fund provider iShares, it gives you access to 25 major Chinese companies.

It includes companies such as Tencent Holdings, Meituan Dianping, China Construction Bank, Alibaba, and China Mobile. Considered one of the fastest and strongest economies in the world, this investment fund is worth watching.

73.81% of CFD accounts lose money.

The best ethical investment funds in Arab countries

When investing in this type of investment fund, certain ethical rules will be applied. The end result is that these funds avoid certain industries and sectors such as gambling, alcohol, tobacco, or weapons.

In some cases, an ethical investment fund focuses only on companies involved in socially beneficial areas. For example, this might include companies that produce clean energy.

But, below you will find our top-rated ethical investment funds in Arab countries.

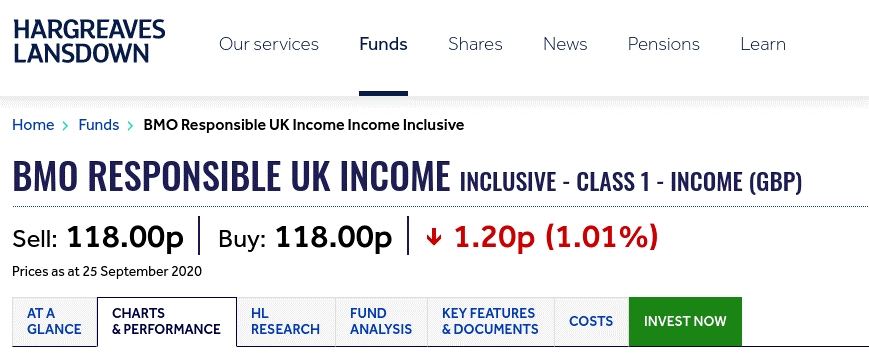

BMO Responsible UK Income 2 Inc — The best ethical fund to invest in UK SMEs

This ethical investment fund is UK-based and focuses on the UK. The key to this fund is that each stock must not only meet a set of ethical criteria but also have a small- to mid-cap market capitalization. In terms of performance, the fund has outperformed the FTSE Comprehensive Index in four of the past five years.

When going directly to the provider of this fund, you’ll need to invest at least £500,000. Therefore, we recommend entering through an external broker. For example, Hargreaves Lansdown requires only £100, or a minimum direct deposit of £25 per month. In terms of fees, this fund will cost you 0.91% per year.

Jupiter Responsible Income — Invest in UK blue-chip stocks that consistently manage social responsibilities

This investment fund focuses on companies that actively address social and environmental issues. The portfolio contains 45 stocks, including leading companies such as GlaxoSmithKline, RELX, Vodaphone, Teso, and Aviva.

Again, entry via Hargreaves Lansdown requires a minimum lump sum of just £100 or £25 per month. The ongoing fee is 0.93% with no upfront payment.

What are the investment funds in Arab countries?

Mutual funds allow you to invest effortlessly in the financial markets. You don’t need any experience or knowledge of how markets work—the fund manager will handle all investment decisions. That is, your chosen mutual fund will buy and sell stocks, bonds, and other assets on your behalf.

This investment form actually encompasses several asset classes. For example, investment funds may include exchange-traded funds (ETFs), such as real estate investment trusts (REITs), credit investment funds, mutual funds (such as property investment trusts), money market funds, or index funds. The key point is that each of the above fund types allows you to invest in a full range of assets in a single transaction.

For example, suppose you invest in an income fund that focuses on small companies in the UK. With an investment of just a few hundred pounds, your portfolio could include more than 200 small companies listed on the AIM. Similarly, by investing in a fund that tracks the FTSE 100 index, you would purchase a portfolio of 100 large-cap UK stocks.

Basically, investment funds are managed by large financial institutions. The most important and largest are iShares, SDPR, and Vanguard. Your money is placed with thousands of other investors—which means the fund often has billions of pounds under management.

How do mutual funds work?

Whether you choose an ETF, mutual fund, or trust fund, the investment process is largely the same. To illustrate, let’s look at a quick example of how the best investment funds work.

- Invest £10,000 in a mutual fund

- The fund manager focuses on major UK stocks.

- In total, the investment fund buys stakes in 150 companies listed on the London Stock Exchange.

- In theory, you will own a small percentage of each share the fund purchases, based on the amount you invested.

- For example, if the fund has 4% of its portfolio in HSBC, your £10,000 investment invests £400 in HSBC shares.

In terms of making money, most UK investment funds pay dividends. This is a share of any stock dividends or bond coupon payments the fund receives on behalf of its investors. Dividends are typically distributed every three months, but some funds may be paid every six or 12 months.

In addition to regular dividends, you can also increase your investment if the fund’s net asset value (NAV) rises. This will occur if the assets the fund holds on the open market increase. For example, if you invest in a FTSE 100 fund and the index value increases by 10%, you can expect your investment to increase by a similar margin.

Types of investment funds

As we discussed above, there are many types of mutual funds. Most work in the same way: you invest in a pool of assets without any hassle from your side. The fund will purchase the assets on behalf of its investors and determine the appropriate time to sell.

However, there are some slight differences between each type of investment fund, which we will explain below:

- Mutual Funds : This type of investment fund specifies which assets to purchase and when. The fund manager has the flexibility to choose which assets to invest in, as it is not tied to a specific market. Since this type of fund is actively managed, fees are slightly higher than those of exchange-traded funds.

- Exchange-traded funds (ETFs): This type of investment fund tracks a specific market. For example, if an ETF aims to track the NASDAQ 100 Index, it will aim to keep up with and mimic the NASDAQ. ETFs are often the least expensive option because they are effortless to manage.

- Trust funds: These are similar to mutual funds. This is because the fund manages your capital and makes all investment decisions on your behalf. Trust funds are not tied to a specific market, so they offer greater flexibility.

- Index Funds: As the name suggests, index funds track a specific stock market index, such as the FTSE 100 or Dow Jones. The fund purchases shares in all the companies that make up the index, using the same weighting system used by the index itself.

Some of the best types of investment funds for investors in Arab countries can be explored below:

- Index Funds

- Mutual funds

- Tracking funds

- Vanguard Funds

- Money market funds

- Income funds

- Ethical investment funds

- Credit investment funds

- Property funds

- Real Estate Investment Funds

- gold boxes

- Technology funds

- Absolute Return Funds

Mutual funds vs. funds

Investment funds are a branch of the broader investment fund system. They are popular in Arab countries, where funds have generally outperformed mutual funds over the past decade.

One of the key differences between trust funds and regular funds is that trust funds have the ability to borrow money. This is known as leverage, and it gives the fund significantly greater purchasing power. In turn, they can trade for much more than they have in working capital.

Advantages of investing in the best investment funds

There are many advantages to choosing an investment fund over traditional stocks or bonds.

These benefits include:

- No experience required: Selecting stocks or bonds can be challenging. Ultimately, you need a solid understanding of technical and fundamental research, and the ability to read and interpret company reports. This is why many beginners choose mutual funds in Arab countries, as they don’t require any knowledge of how financial markets work.

- Effortless Income: Once you invest money in an investment fund, you can sit back and let the provider buy and sell assets on your behalf. This is great for earning income without the hassle, as you’ll likely receive dividend payments every quarter.

- Low Investment Amount: You can now invest in funds with a small capital. In most cases, you can start with a few hundred pounds. Some platforms allow you to invest in ETFs with as little as $50 (around £40), while Hargreaves Lansdown requires £100. Even if your chosen ETF requires a large capital requirement, you can simply bypass this by investing through a broker.

- Low Fees : Most of the best investment funds of 2026 charge ongoing fees of less than 1% per year. Some are closer to 0%, especially ETFs and index funds. Even at the highest, this gives you good value because you invest without the hassle.

- Diversification: Diversification allows you to reduce your overall exposure to risk by investing in a range of assets across multiple sectors and markets. Achieving this goal as a self-funded investor can be costly and time-consuming. This is not the case with mutual funds, where you can often invest in hundreds (if not thousands) of assets with a single investment.

- Difficulty accessing markets: Some financial markets can be difficult for the everyday investor in Arab countries to access. One example is stocks listed in emerging markets. On the other hand, investment funds often have billions under management. This means they can access any market. As such, investment funds give you a backdoor into a specific asset or sector you’ve been trying to invest in.

How to Choose the Best Investment Funds [ cur_year]

With so many good mutual funds to choose from, knowing where to start can be difficult. The most important thing is that the fund meets your long-term investment goals. For example, are you looking to grow your money over many decades to save for retirement, or are you looking to enter a specific market, such as foreign bonds or US securities?

Either way, below you’ll find a list of metrics you should look for to find the mutual fund that meets your needs.

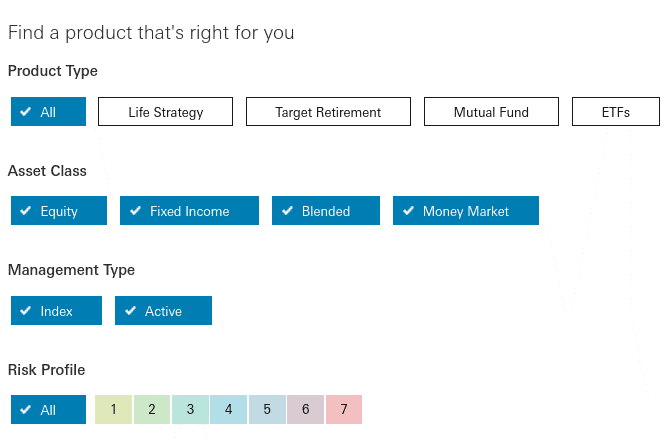

- Fund Type: You first need to know what type of investment fund the service provider offers. It could be an exchange-traded fund, mutual fund, trust fund, or index fund.

- Objectives: What assets or markets does the fund focus on? This could be anything from large US stocks to emerging market bonds.

- Past Returns: Review the returns the fund has achieved over the past few years. Compare these returns to its competitors in the sector and the market as a whole.

- Ongoing Fees: Most funds charge ongoing fees—expressed as a percentage. While most funds charge less than 1% annually, some can be significantly more expensive. Also, look for performance and upfront fees.

- Minimum Investment: Find out how much the fund provider requires in total as a minimum. If the amount is too much, you’ll likely find a broker with a lower minimum requirement.

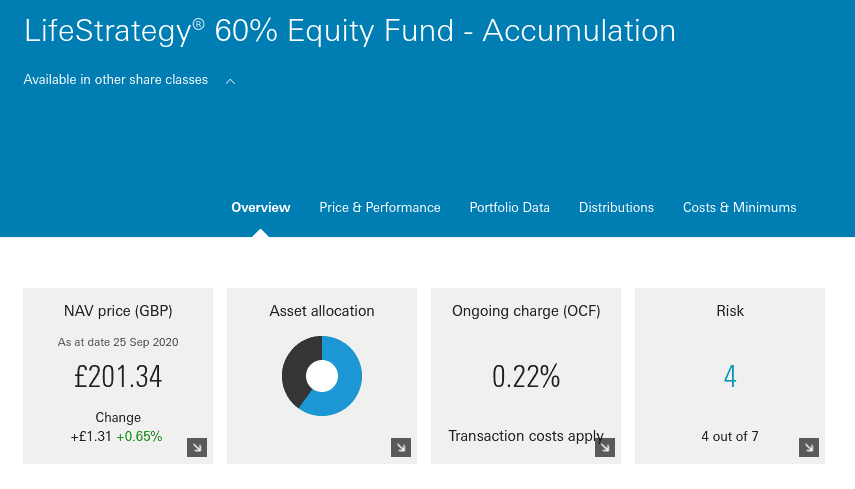

- Risk : Leading mutual fund providers like Vanguard provide a risk rating for each of their products. This allows you to gauge the amount of risk you’re likely to be exposed to when investing in the fund.

- Dividend Distribution Frequency: Make sure you know how often the mutual fund distributes your dividends. This is usually quarterly, but it can be every two years or even annually.

As you can see above, there are many metrics to consider before choosing an investment fund. Therefore, it’s important to study the highly rated funds we’ve discussed on this page—all of which are available to investors in Arab countries.

Best Mutual Fund Brokers in Arab Countries

If you want to invest in an investment fund, you need to find a reliable online broker registered and authorized by the Financial Conduct Authority. While some fund providers allow you to invest directly through their website, you’ll often find that fees and account minimums are high. Therefore, we recommend using an external platform.

Here are the best mutual fund brokers available to residents of Arab countries.

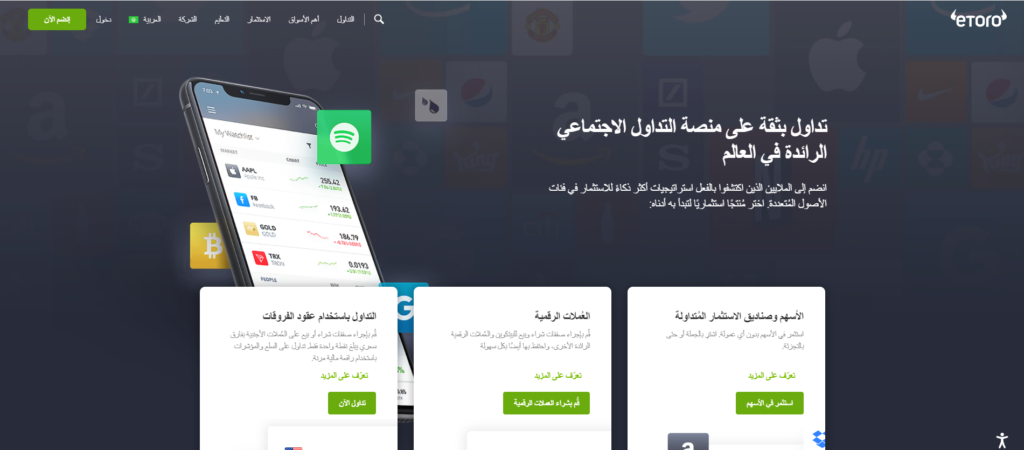

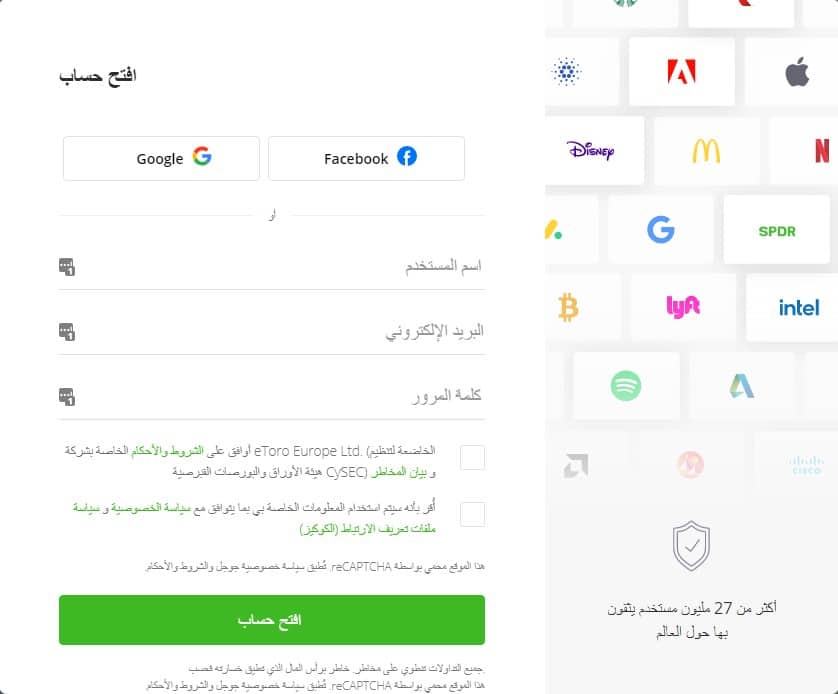

1. eToro — A good and reliable broker for investment funds in Arab countries

eToro is the best option if you’re looking to invest in ETFs. This is

In total, the platform gives you access to over 150 funds. This includes a wide range of markets such as UK and US stocks, bonds, gold, and many more. Additionally, eToro allows you to invest in over 1,700 stocks across 17 exchanges. This can be useful if you want to add specific stocks to your portfolio that aren’t included in the fund.

In terms of payments, eToro allows you to deposit funds instantly using a debit or credit card, as well as e-wallets like PayPal, Skrill, and Neteller. You can also deposit via bank transfer, but it’s best to avoid this as it can take several days for funds to arrive. The minimum deposit on eToro is $200, although you can invest as little as $50 in your chosen fund. The broker is regulated by the Financial Conduct Authority, and your funds are protected by the FSCS (up to the first £85,000).

eToro also offers an excellent investment app, which is the perfect way to invest in mutual funds from your mobile phone.

eToro fees :

| Commission | 0% on ETFs |

| Deposit Fee | Free |

| Withdrawal fees | $5 |

| Inactivity Fee | $10 after 12 months of inactivity |

Advantages:

- Easy-to-use online trading platform

- Buy ETFs without paying any commission or trading fees.

- Trade CFDs on stocks, indices, commodities, forex and more.

- Over 800 stocks listed on UK and international markets

- Deposit funds using a debit/credit card, e-wallet, or bank account in Arab countries.

- Ability to copy other users' trades

- FCA and FSCS Protection

Disadvantages:

- Not suitable for advanced traders who like to perform technical analysis.

67% of retail investors lose money when trading CFDs on this site.

2. Alvexo — The best investment funds in Arab countries

Founded in 2014 by a team of market veterans, Alvexo offers a choice of intuitive trading platforms that stream live buy and sell quotes on over 450 different assets. The platforms are flexible and easy to use, including a range of trading tools to aid market analysis.

Alfxo clients can benefit from a comprehensive suite of daily signals, market analysis, economic news, seminars, and webinars. They focus on providing personalized and reliable service while implementing the latest advanced innovative technologies to ensure a safe and robust trading environment.

Alvexo has designed five accounts that offer investment options tailored to each account's requirements and configurations. The range of trading tools offered by Alvexo includes CFDs, stocks, indices, commodities, and currencies, along with the newly launched Alvexo cryptocurrency trading feature.

Customer feedback from testimonials shared on the Alvexo website is overwhelmingly positive, with clients highlighting the importance of dedicated account managers and educational resources that have helped them become more confident traders.

Advantages:

- An organized and reliable platform

- Negative balance protection

- Commission-free trading

- Additional trading tools

Disadvantages:

76.57% of CFD accounts lose money.

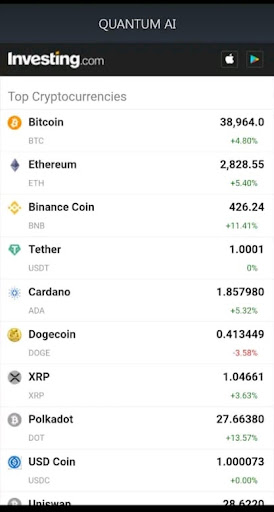

3. Quantum AI — Get investment advice from the world's first quantum computer

Quantum AI is a software that uses quantum computing technology to provide you with recommendations on what to buy, what to sell, and when. The platform has partnered with several MT4 platforms, as well as other brokerage firms. All investments are executed directly on the Quantum AI website or app.

Quantum AI can provide advice on many different financial assets, such as ETFs, funds, cryptocurrencies, forex, and stocks.

The automated investment bot guarantees up to 60% returns every day, which is impressive. Although we couldn't find any prior history on performance, the Quantum AI platform ranks highly on places like Trustpilot and CoinInsider.

Opening an account is very easy and only takes a few minutes. The minimum deposit you need to start with is €220, which you can also withdraw at any time. Quantum AI charges absolutely no fees. You don't pay for deposits, withdrawals, or any other transaction fees. It's also a commission-free platform. Great, right?

Quantum AI is unregulated, but a number of its bots are highly disciplined and organized. If you have any questions or need assistance with a service, their customer service is available via email 24/7.

Let's take a look at some of the pros and cons of Quantum AI. You'll see that the pros far outweigh the cons.

Advantages:

- Customer reviews about it are good on trustworthy sites.

- You pay no fees to use Quantum AI.

- The world's first quantum computer for automated trading.

- 24/7 customer support.

- Fast transactions.

- The robot gives advice on what to buy and what to sell - you can choose what you like.

- Available on mobile as well as on desktop.

Disadvantages:

- Difficulty finding performance date.

- Large minimum.

- It’s a very new product, which means it’s still in its early stages.

Your capital is at risk.

4. AvaTrade Invest in funds from the global market

AvaTrade is a globally licensed broker that is strongly regulated by the Central Bank of Ireland, the Australian Securities and Investments Commission, the Japanese Financial Services Agency, and many others.

The broker offers trading on more than 1,250 global markets, including forex, stocks, bonds, indices, ETFs, commodities, and cryptocurrencies. This includes investment funds from various regions around the world.

With AvaTrade, users can trade from a variety of different trading accounts. These include spread betting, CFD trading, options trading, and swap-free Islamic accounts. The broker also offers access to professional trading accounts for experienced traders.

The broker provides access to services from the trading center, which provides immediately actionable trading ideas and research. This can greatly assist in generating sound investment ideas.

Advantages:

Disadvantages:

71% of retail investors lose money when trading CFDs on this site.

5. Libertex Invest in funds in an easy and well-organized way.

Libertex is one of the world's leading CFD brokers with 23 years of experience and

The Libertex trading platform is unique in that it offers investors access to trade over 213 CFD instruments, including currencies, stocks, commodities, indices, and cryptocurrencies.

The broker also offers traders a range of different platforms, including the world's most popular MetaTrader 4. It also offers access to its own custom-designed trading platform, complete with useful trading features such as sentiment indicators, news, and live analytics.

Opening an account with Libertext is easy and can be done in just a few minutes. The minimum deposit is just €100 and can be made via wire transfer, credit/debit cards, and e-wallets such as Neteller and Skrill.

Advantages:

Disadvantages:

83% of retail investors lose money when trading CFDs on this site.

How to invest in the best investment funds today in Arab countries

Are you looking to invest in a mutual fund today but aren't sure where to start? Follow the step-by-step instructions below to invest in a fund from the comfort of your home.

The instructions below are explained using the top-rated fund broker eToro, which allows you to invest. You can, of course, use any broker of your choice .

Step 1: Open an account on eToro

Visit the eToro website to begin the account opening process. You’ll need to provide some personal information, such as your email address and a password of your choice.

You can also create an account by downloading the eToro app directly to your mobile phone. This can be done through the App Store if you have an iPhone or Google Play if you have an Android phone .

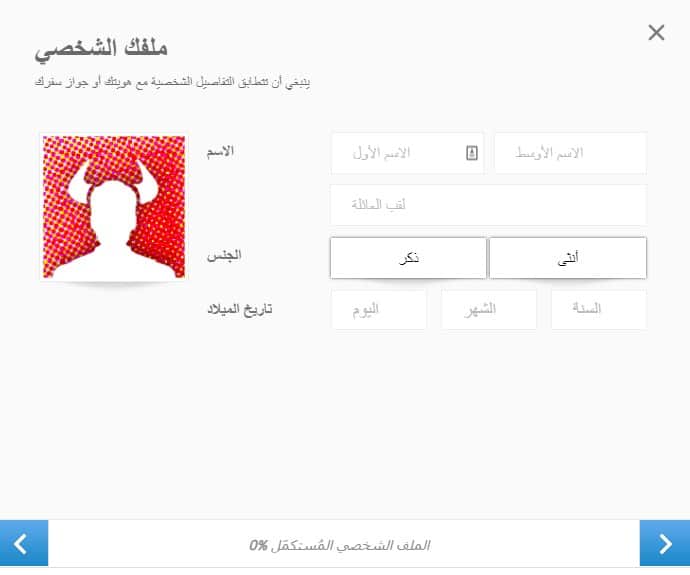

Step 2: Fill out the profile

Here, as shown below, you will have to enter this information.

- Your country of residence.

- Your nationality.

- Place and date of birth.

- Your address and phone number.

- The currency you want to trade.

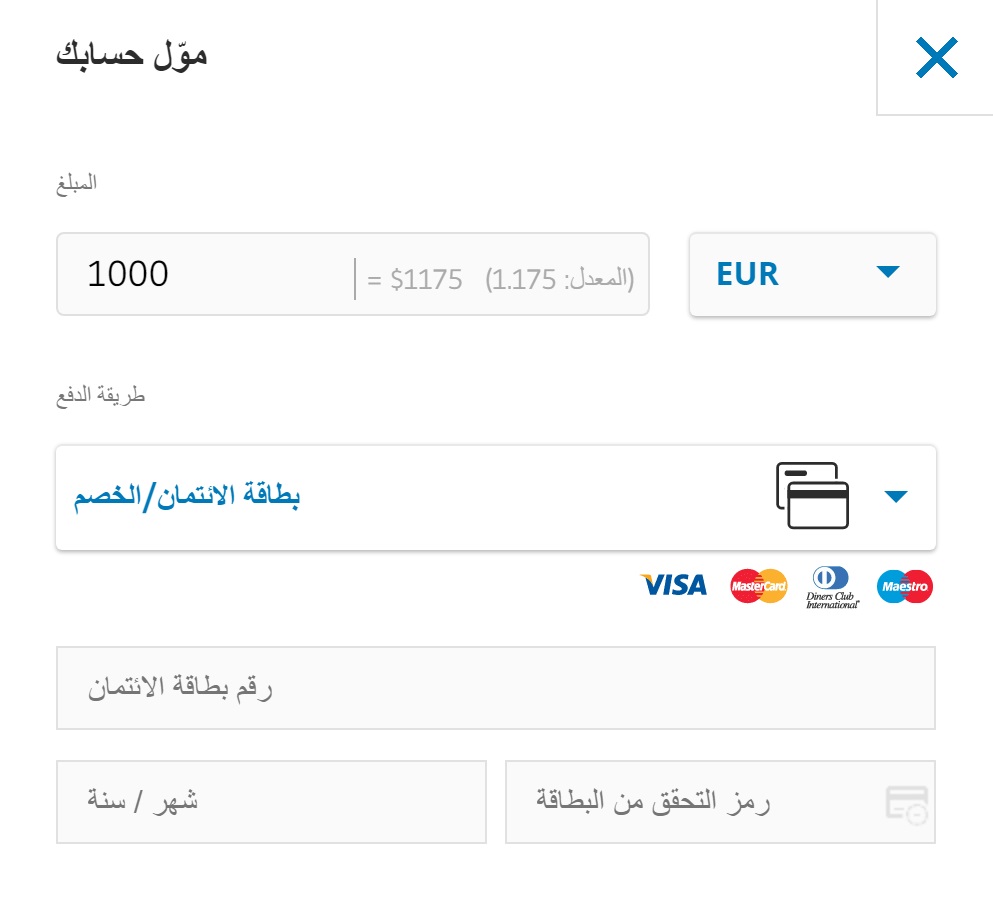

Step 3: Deposit funds

You will now be asked to deposit some funds into the investment account you created.

eToro accepts payment methods from the following Arab countries:

- Direct debit card

- Credit Card

- Bank transfer

- E-wallets such as Neteller, Skrill, and PayPal.

The minimum deposit amount is between $50 and $200, and all payments are made without any fees ! After making your deposit, all that’s left is to click “Deposit.”

Step 4: Start investing in funds through the best broker

After registering with eToro, you’ll be able to invest in funds easily and simply. All you have to do is search for the fund you want to invest in in the designated box, and all relevant information will appear. All you have to do is select the fund you want to trade, such as the gold SPDR, and click “Buy.”

Don’t forget to take advantage of some of the special features, such as the stop loss feature, to avoid negative balance.

Mutual funds are becoming increasingly popular among traders in Arab countries, as the process takes place from start to finish without your intervention. All you have to do is choose a fund, set the minimum investment amount, and that’s it—you don’t have to do anything else. In addition to increasing your capital as the fund’s net asset value increases, you can also earn dividends—your share of stock dividends or bond coupon payments—typically distributed quarterly. If you’d like to start investing in an investment fund today, the process rarely takes more than 10 minutes with eToro. You can deposit funds instantly with no fees on ETFs and start investing in a fund with as little as $20.

CFDs are complex instruments and come with a high risk of losing money rapidly Conclusion

eToro – Invest with the best platform in the Arab countries

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.

Frequently Asked Questions

What is an investment fund?

Do investment funds pay dividends?

How much do mutual funds cost?