أفضل وسطاء الرافعة المالية العالية في الدول العربية — مراجعة لأرخص الوسطاء

If you’re looking to trade online but don’t have the capital to make it profitable, it may be worth choosing a broker with high leverage. Typically, the maximum leverage available to traders in Arab countries is 1:30, so if you’re a professional client or using a platform based abroad, you can get even higher leverage. In this guide, we review the best high-leverage brokers available to traders in Arab countries in 2021.

Open an eToro account in 4 simple steps

Start trading with leverage on eToro , one of the best brokers with high leverage across the board, in 4 simple steps.

Are you looking for a quick list of the best high-leverage brokers in Arab countries right now? If so, check out the list below!

Top 4 High Leverage Brokers in Arab Countries for 2026

73.81% of CFD accounts lose money.

Review of the best high-leverage brokers in Arab countries

While your primary priority may be finding the best trading platforms in Arab countries that offer high leverage, you may also need to consider other key factors.

This should include in particular the assets and markets the broker supports, the fees and commissions they charge, and whether the platform is easy to use.

We’ve done the hard work for you and selected four of the best high-leverage brokers in the Arab world right now.

1. eToro — The best all-around high-leverage broker in the Arab world

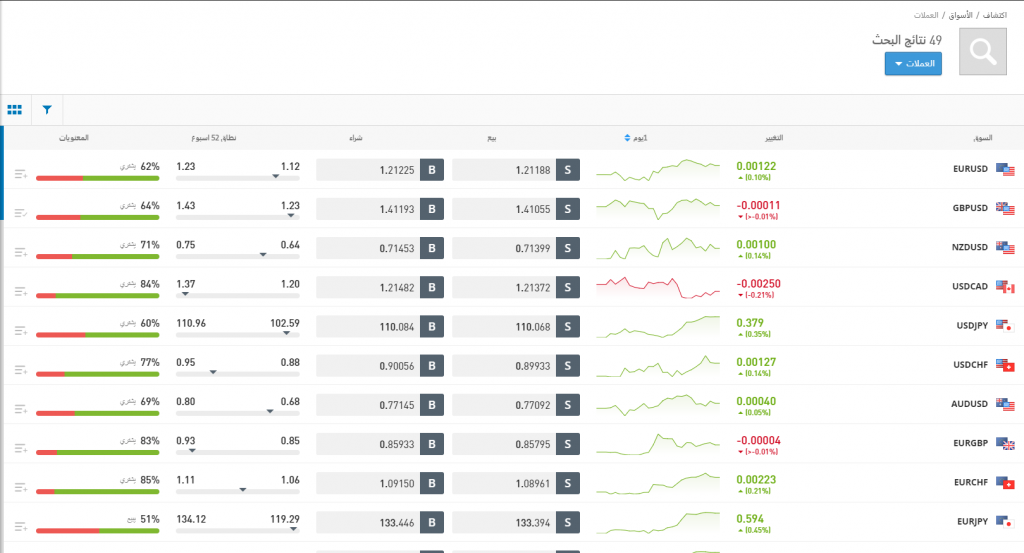

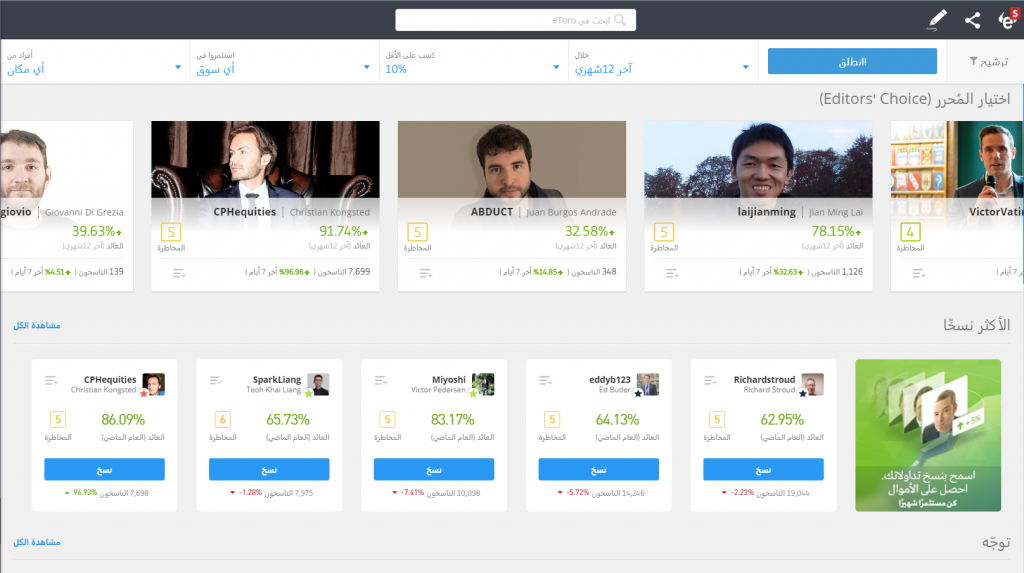

eToro is an easy-to-use online broker and trading platform that now has over 17million active users. This popular broker lets you trade everything from stocks, ETFs, and cryptocurrencies to forex, indices, and hard metals.

Although this broker charges low spreads that allow for traditional investments, every financial instrument on the platform can also be traded as a CFD. This, in turn, means you have the ability to use leverage.

In terms of leverage limits, these limits comply with FCA regulations. This means that unless you are a professional client, the maximum leverage you will be able to obtain is 1:30. This is available when trading major forex pairs such as GBP/USD and EUR/USD, meaning eToro offers lower limits on other asset classes.

For example, if you want to trade minor/exotic forex pairs or gold, you’ll receive leverage of 1:20. If you want to trade commodities such as silver, copper, wheat, corn, and sugar, you can trade these instruments on eToro with leverage of 1:10. You can also trade over 2,400 stocks across 17 UK and international markets with this top-rated broker, which offers high leverage.

eToro offers you leverage of 1:5 — meaning you can trade stocks with five times the amount you have in your account. However, if you can prove you’re a professional client, eToro will upgrade your account accordingly. This, in turn, means you’ll have much higher leverage limits.

In terms of trading fees and commissions, this is where eToro truly stands out. This is because the broker charges no commissions when trading ETFs. There are also no monthly fees on the platform, and no stamp duty on traditional stock purchases in Arab countries.

If you like this high-leverage broker, eToro accounts take minutes to open. You only need a small minimum deposit of $200, although the platform’s minimum trade size starts at $25 for cryptocurrencies, $50 for stocks, and $200 for ETFs.

Depositing and withdrawing funds on eToro is also a simple process. You can deposit funds using a debit card in Arab countries, a credit card, an e-wallet, or a bank account transfer. Of course, eToro is fully regulated in Arab countries. This includes being licensed by the Financial Conduct Authority and protecting your funds with the usual FSCS protection.

Advantages: Disadvantages:

67% of individual investors lose money when trading CFDs on this site.

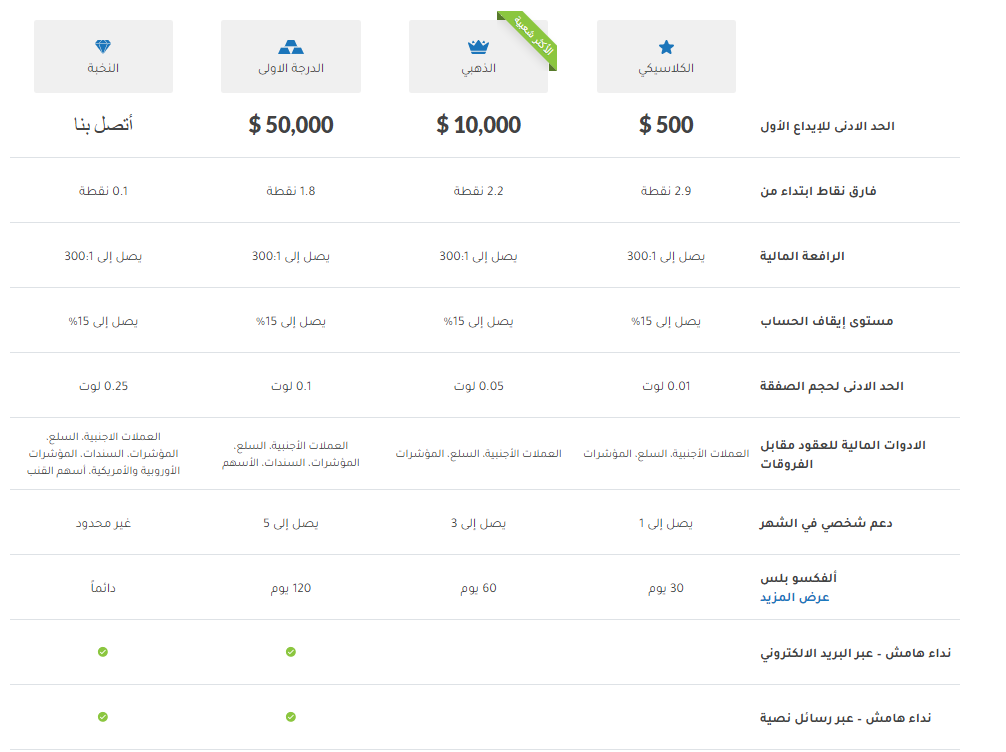

2. Alvexo – A good and safe trading broker with leverage up to 300:1

Founded in 2014, it stands out among other good and effective platforms thanks to its educational, guiding, and directive nature. Alvexo, this platform, has always ensured that

We’ve already talked about its advisory nature, but this wise, sound, and beneficial approach, which the platform provides and which it considers its first foundation, cannot be summarized in a single, fleeting sentence. Here are the details of its educational tools: trading signals, a learning academy, educational seminars, e-books, an economic agenda, blogs, and many more tools that you’ll be able to access once you register with the platform.

If you’re looking to trade with a platform that offers high leverage, Alvexo offers leverage of up to 300:1 on all its assets, regardless of your chosen account. These assets include a wide range of stocks, cryptocurrencies, forex pairs, commodities, and more, bringing the total number of investment instruments available to over 450. To date, the platform has processed more than 900,000 transactions, with over one million clients.

This was just a brief overview of the many features Alvexo offers , including its mobile app and demo account, not to mention that both its app and platform are extremely easy to use. There are also multiple payment options, but before we move on to the pros and cons, we must inform you that the minimum deposit is $500. This is a high number compared to the low minimum deposits suggested by other brokers. Advantages: Disadvantages:

76.57% of CFD accounts lose money.

3. Avatrade — Enjoy leverage of up to 400:1 on MetaTrader4 and MetaTrader5

AvaTrade is licensed by the CBoI, ASIC, and FSB, making it one of the oldest platforms on the market. It has a strong reputation and is highly respected in the industry. Avatrade is a CFD platform that allows you to trade forex, cryptocurrencies, indices, stocks, and ETFs.

Because it’s a CFD platform, you can trade commission-free, with very low spreads, starting from as little as 1 pip for major forex pairs. However, since you trade financial instruments as CFDs, you can gain leverage. The maximum leverage is 30:1 – 2:1.

It also allows the use of MetaTrader 4 and MetaTrader 5 with higher leverage of up to 400:1. MT5 is a modern, multi-functional platform featuring advanced technical tools. It is designed to facilitate advanced trading. Compared to MT4, it offers a wider range of asset classes.

You can easily get started on Avatrade today, with a deposit of as little as $100. If you have a question or need assistance, customer service is available 24 hours a day, 7 days a week.

Advantages: Disadvantages:

Your capital is at risk

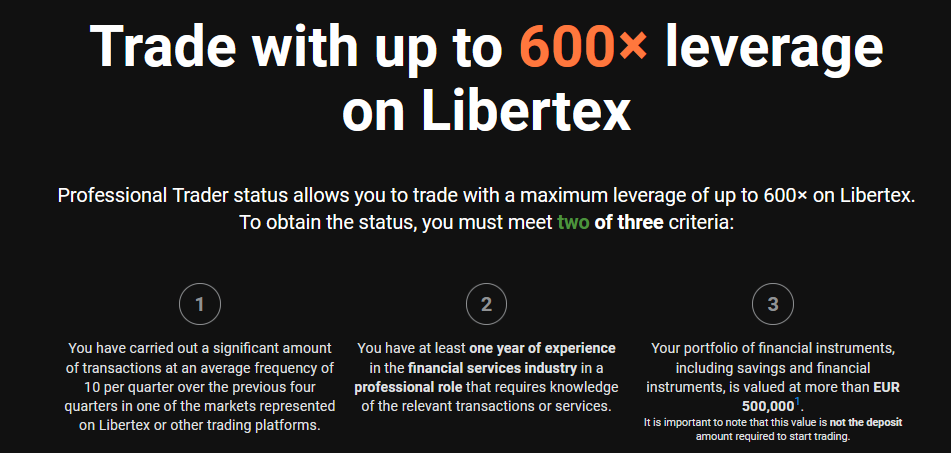

4. Libertex — A broker with zero spreads and 1:600 leverage for professional clients

Libertex is a highly reputable, high-leverage broker. What appeals most to traders about this platform is that it charges no spread. Instead, there is no gap between the bid and ask prices across all of Libertex’s available markets.

This means that in some ways, Libertex isn’t much different from an ECN broker. In terms of what you can trade, Libertex specializes in CFDs. This includes everything from hard metals, energies, stocks, indices, and forex.

As a top-rated CFD broker, it allows you to use leverage. The limits of this leverage depend on whether you are an individual trader or a professional client. If you are a professional client, you will be able to trade with leverage of up to 1:600.

This means that an account balance of £1,000 would allow you to open a trade worth £600,000. However, if you are not classified as a professional client, you will be bound by the same limits mentioned in the eToro review. This means that the most you can get is 1:30 on major currency pairs and less on other financial instruments.

In terms of fees, we mentioned that Libertex is a spread-free broker. However, you will need to pay a trading commission when opening and closing trades. Often, this commission is only a small amount above the 0% rate offered, so overall, trading fees are considered quite competitive with this broker.

If you want to get started with Libertex today, the platform requires an initial deposit of £100. However, you can deposit as little as £10 from your second deposit onward. This can be done via debit/credit card, bank transfer, and various e-wallets. Finally, this two-decade-old broker is licensed by CySEC.

Advantages: Disadvantages:

83% of retail investors lose money when trading CFDs on this site.

Comparison of leverage and fees of high-leverage brokers

If you’re looking for an overview of the limits offered by the best high-leverage forex brokers we’ve discussed on this page — see the table below.

| Maximum Leverage (Individuals) | Maximum Leverage (Professional) | Commission | Minimum Deposit | |

| eToro | 1:30 | It varies from one case to another. | on ETFs 0% | $200 |

| Alvexo | 1:30 | 1:500 | 0% | $500 |

| Avatrade | 1:30 | 1:400 | 0% | $100 |

| Libertex | 1:30 | 1:600 | 0%-0.5% | £100 |

High-Rise Crane Explained — What You Need to Know

The online trading arena in Arab countries is highly regulated. In contrast, the Financial Conduct Authority provides certain protections for individual clients regarding leverage.

To ensure you’re aware of the rules and regulations that online brokers need to adhere to, this section will explain everything you need to know about high leverage in Arab countries.

What is leverage?

While most of you reading this guide already understand what leverage is, some of you may be a complete beginner. In its simplest form, leverage allows you to trade with more money than you have in your brokerage account. In effect, you are borrowing additional capital from your chosen trading platform.

Brokers express leverage in the form of multipliers (such as x2 and x3) or ratios (such as 1:2 and 1:3), but most brokers choose the latter. For example, suppose you invest £100 in a forex trade with a leverage of 1:10. This means you are trading 10 times your investment. So, in this example, you have turned your £100 investment into £1,000.

Here’s a quick example of how this trade works when using the best brokers with high leverage.

- You invest £100 in the GBP/USD pair by choosing a buy order because you believe the exchange rate will rise.

- You can use a leverage of 1:10.

- After a few hours, your GBP/USD trade is worth 4% more.

- You like your profits and decide to close the trade with a sell order.

- Without leverage, your 4% gain on a £100 trade would only give you £4.

- However, when using a leverage of 1:10, this £4 profit doubles to £40.

As you can see above, the best high leverage Forex brokers allow you to maximize your potential profits — making it ideal if you don’t have a large amount of capital at your disposal.

Leverage limits in Arab countries

As we’ve noted in this guide, the FCA is very strict in setting leverage limits for retail clients. For those who don’t know, being classified as a retail client simply means you’re not a professional trader. Instead, it means you’re an amateur trader investing modest amounts from the comfort of your home.

If this is the case for you, the maximum amount of leverage you will be able to obtain with your chosen FCA regulated broker is as follows:

- 30:1 for major currency pairs

- 20:1 for minor currency pairs, gold, and major indices

- 10:1 for commodities other than gold and non-major stock indices

- 5:1 for individual stocks and other benchmarks

You may notice that cryptocurrencies like Bitcoin are missing from the list above. Prior to January 2021, retail clients in Arab countries could trade digital assets with leverage of 1:2. However, the Financial Conduct Authority has since banned cryptocurrency derivatives for retail clients in Arab countries.

Again, if you are an individual client and want higher limits, you have only two options, which we discuss in the sections below.

Option 1: Open a Professional Client Trading Account

The best way to increase your leverage with high-leverage brokers is to open an account as a professional client. Regardless of which broker you decide to use, the requirements for doing so remain the same.

73.81% of CFD accounts lose money.

That is, you need to meet at least two of the following three criteria:

- You have at least one year of experience in the financial services sector. This is a very broad requirement, but you will likely need to demonstrate to the broker, with high leverage, that you have worked professionally in trading/investing.

- Over the past four years, you must have placed at least 10 trades every three months. This doesn’t have to be with the highly leveraged broker you intend to join. For example, if you previously traded with IG but now want to open a professional account with eToro, this is possible. Importantly, this is the easiest criterion to achieve, as 10 trades every three months isn’t a lot. In reality, it only means five completed trades, with each trade requiring a buy and sell order to open and close the trade.

- You currently hold a portfolio of assets worth at least €500,000 (approximately £441,000). This can include investments, savings, and other financial instruments, but not real estate.

As you can see above, it can be difficult to obtain professional client status. If you don’t have assets of €500,000, you will need to prove that you have worked in the financial services sector in a professional capacity and traded semi-regularly over the past four years.

If you can do this, any of the best high-leverage brokers in the Arab countries will ask you to provide the documents so they can review your application.

Option 2: Use an external intermediary

If you cannot meet the professional client requirements and are still seeking higher leverage than FCA regulations allow, your only other option is to use an offshore broker.

In simple terms, this means the platform will not be regulated by the Financial Conduct Authority (FCA) and will not be covered by the FSCS Protection Scheme. This protection protects you in the event of a broker’s bankruptcy — up to £85,000.

Benefits of Overnight Trading on Leverage

Before embarking on a leveraged trading strategy, it’s important to understand that there are some fees involved. More specifically, you’ll need to pay “overnight interest” for each day you keep a leveraged trade open.

Ultimately, you’re trading with more money than you have in your account—that means you’re borrowing money from the broker. In turn, the broker wants a financial return on the capital they lend you, which comes in the form of interest.

There is no uniform interest rate on leveraged financial products, as this can vary from broker to broker and from asset to asset. The bottom line is that leveraged trading is not suitable for long-term investments, as overnight interest will continually eat into your potential gains.

Knowing what you’ll pay to a highly leveraged broker as overnight interest is crucial. Even if you’re trading short-term, a high interest rate can make a trade a losing one.

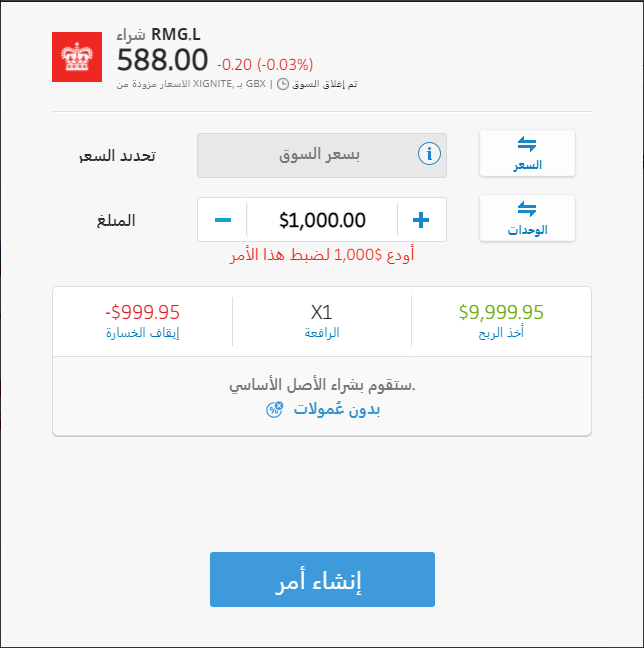

The good news is that eToro clearly displays the overnight interest rate before you open a trade. In fact, the daily fees—shown in dollars—are updated as the ticks in the order boxes change.

for example:

- If you trade $50 worth of Royal Mail shares with 1:30 leverage on eToro.

- If we increase the above investment from $50 to $500, the daily rollover interest and weekend fees become $0.44 and $1.32 respectively.

Ultimately, when you use a reputable FCA broker like eToro for leveraged trading, you have a full understanding of the overnight interest you will be required to pay.

The difference between margin and leverage

When searching for the best high-leverage brokers in Arab countries, you can be sure you’ll come across the term “margin.” The terms leverage and margin are often used interchangeably, but they differ slightly.

In simple terms:

- Leverage refers to the amount you want to increase your investment by. For example, a leverage of 1:5 will turn a £100 investment into £500.

- Margin refers to the amount of capital you need to use to obtain the required leverage. In the example above, the margin is £100, which is required to obtain £500 for a 1:5 equity trade.

Understanding how margin requirements work is really important when using the best high leverage forex brokers — because this will determine the point at which a trade is liquidated.

A high-leverage broker liquidates your trade, meaning the platform will automatically close your trade when it drops by a certain amount.

- Applying this to the example above, a trade with 1:5 leverage requires a margin of £100 — that’s 20% of a £500 trade.

- Therefore, if your trade loses more than 20%, it will be liquidated.

- So, your chosen forex broker will hold a £100 margin — meaning you lose your entire investment.

This is why you should tread carefully when using high levels of leverage on your trades. More importantly, this is why the FCA has strict limits for individual clients.

Other considerations when choosing a broker with high leverage

It’s important to note that you should never sign up with an online broker simply because they offer high leverage limits. On the contrary, there are many other key metrics you need to consider, such as:

- What assets does the broker offer with high leverage?

- How much does a high leverage forex broker charge in fees and commissions?

- Is the high leverage broker licensed by the FCA or another tier-one financial authority?

- What payment methods does a high leverage forex broker accept?

- Is a broker with high leverage suitable for beginners?

As you can see, there are plenty of high-leverage brokers to suit your needs. So, if you don’t have time to research dozens of providers yourself, we found that eToro ticks all the boxes in terms of ease of use, trading markets, and licensing.

How to get started with a high-leverage broker

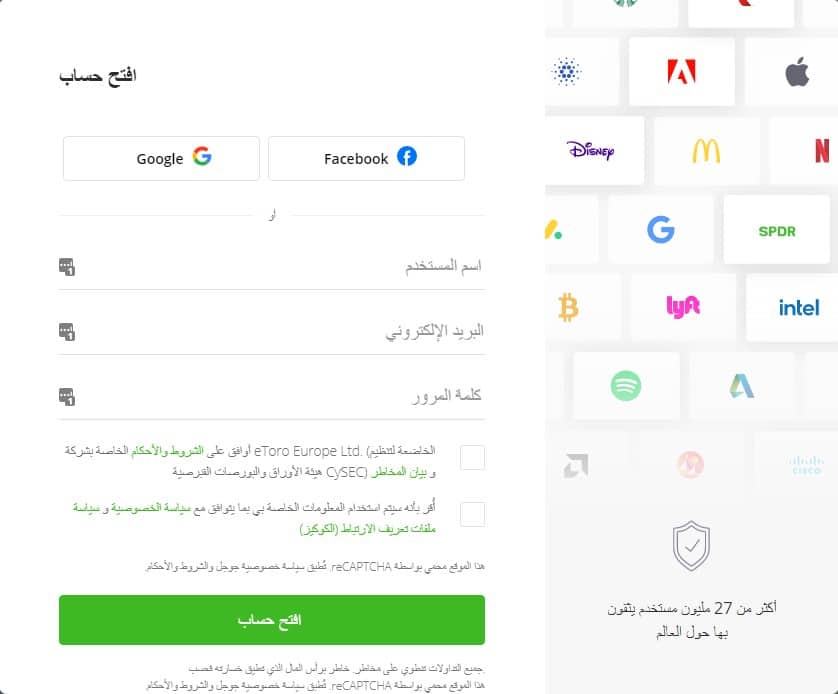

If you’re ready to start trading with a high-leverage broker and fully understand the risks involved, we’ll now walk you through the process with eToro. This FCA-regulated broker will offer you leverage of up to 1:30 the moment you set up your account—which takes less than 10 minutes.

To begin the process, visit the eToro website , where the window below will appear. You’ll now need to enter some personal information, including your username and password, and click the “Continue” button.

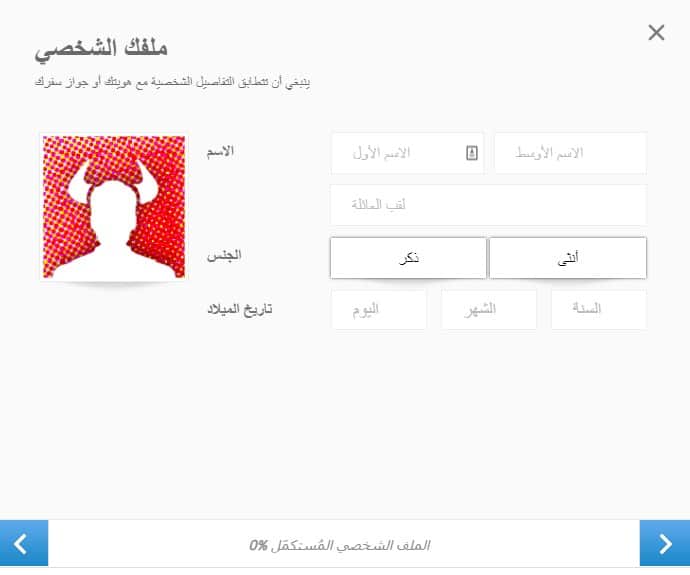

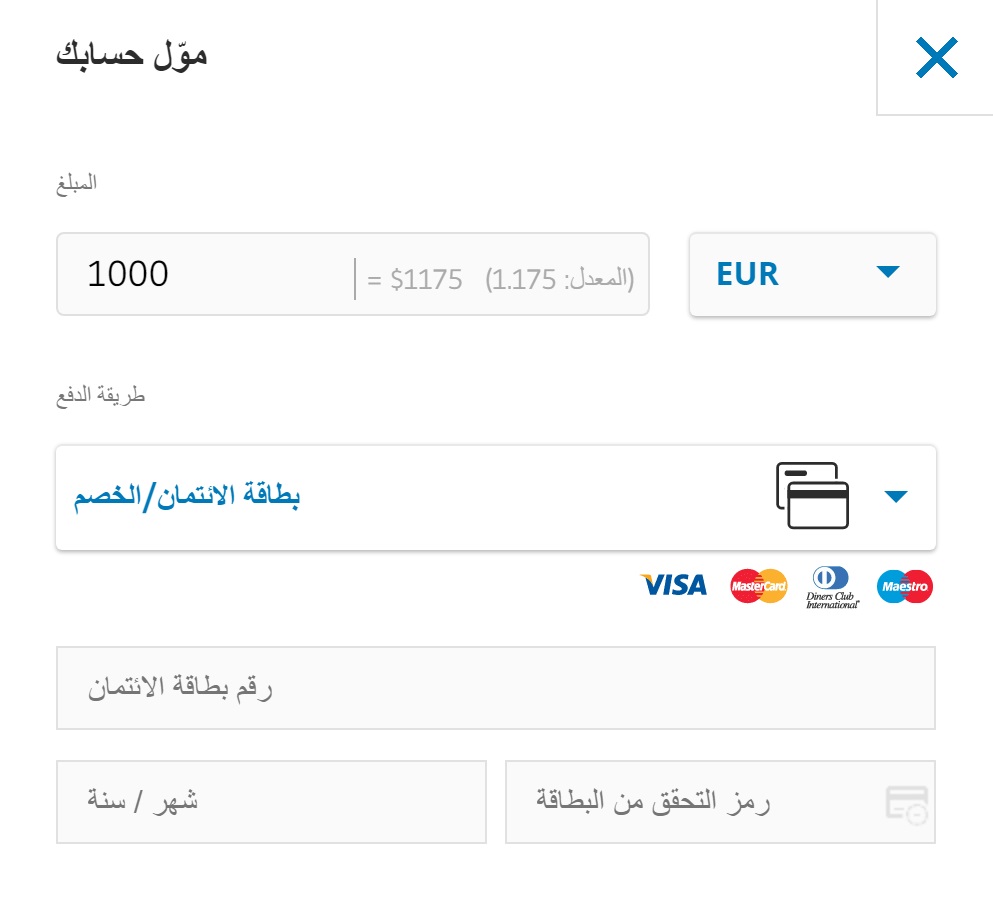

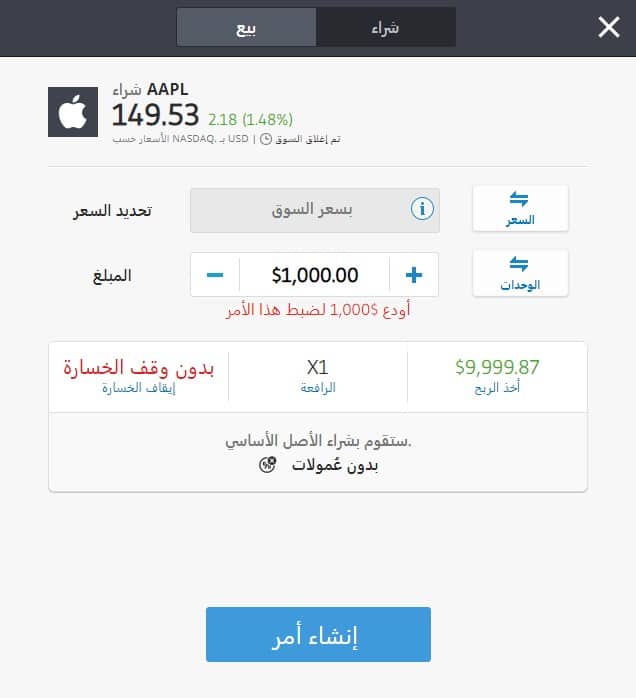

73.81% of CFD accounts lose money. As we’ve discussed throughout this guide, online trading is widely regulated in Arab countries. Since eToro is registered and authorized by the Financial Conduct Authority, it is imperative that it first request the following personal information: Next, to verify your identity, you will need to upload some documents, including: You will now need to add some funds to your eToro account. The minimum deposit is between $50 and $200 depending on the country, and you can choose from the following payment types: You can now search for the asset you wish to trade using leverage. In our example, we will invest in Apple stock, which is leveraged at 1:5. All that remains for you is to choose “Buy” or “Sell” and then press the Create Order button.Step 1: Open an account and upload your ID

Step 2: Fill out the profile

Step 3: Add funds to your trading account

Step 4: Find an asset and trade it.

If you’re in the Arab world and looking for the best brokers with high leverage, you’re bound to stumble at some point. This means that if you’re an individual client seeking higher leverage limits than the Financial Conduct Authority allows, you’re out of luck. Well, unless you can prove you’re a professional trader or decide to use a high-leverage broker abroad. Taking all of this into consideration, we found eToro to be the best option out there. Individual clients in Arab countries can’t access leverage up to 1:30. Getting started on this popular FCA-regulated platform takes minutes, and you can deposit funds instantly using an Arab debit/credit card or e-wallet!

CFDs are complex instruments and come with a high risk of losing money rapidly Conclusion

eToro — The Best Comprehensive High Leverage Broker in the Arab World

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.

Frequently Asked Questions

How much leverage do traders in Arab countries get?