(eToro Arabic) تقييم منصة إيتورو : كيفية التداول مع ايتورو

Are you a resident of Saudi Arabia, the UAE, Bahrain, Kuwait, Qatar, or other Arab countries and would like to buy and trade stocks from the comfort of your home? If that’s what you’re looking for, then you’ve found your perfect match with the UK-based FCA-regulated broker eToro . The multi-asset platform is popular among novice traders, who can easily open an eToro account , deposit funds, and buy stocks commission-free in just a few minutes. But you may be wondering why eToro is the perfect choice for you? Read our eToro review to learn more.

In this comprehensive eToro review, we’ve covered everything you need to know about the popular eToro trading company . This includes the types of stocks you can buy, fees and commissions, trading tools, payment methods, platform ease of use , regulatory status, and much more. Let’s find out if eToro is the right broker for you.

How to start trading with eToro?

If you like the features of eToro’s review and decide to start investing with it by opening a commission-free stock account today, you’ll find below a detailed explanation of all the required registration steps:

eToro Company Review: Who is eToro ?

eToro is an online trading brokerage company launched by a group of fintech entrepreneurs in 2007. The platform offers a variety of asset classes, allowing eToro users to purchase assets in the traditional sense, as well as trade CFDs.

In the traditional ownership section, eToro allows you to buy stocks, exchange-traded funds (ETFs), and cryptocurrencies, while also offering CFDs on stocks, indices, bonds, hard metals, energy commodities, and many more, making CFD trading easy.

One of the most attractive aspects of eToro’s review is its leading pricing structure. This applies to cryptocurrencies , such as Bitcoin, as well as more than 153 ETFs. As a stock trading platform primarily targeting novice investors, eToro is an ideal choice for those taking their first steps into the world of online stock trading. CFD trading is also inexpensive with eToro.

This is because the entire registration process with eToro takes only a few minutes to set up a trading account , after which you can easily deposit via credit/debit cards, e-funds, or a bank account. All you need to do next is select the stocks you want to purchase, specify the amount you wish to invest, and finally confirm the transaction.

We also shouldn’t forget to mention the social trading and copy trading features offered by eToro , which are one of the main reasons for its immense popularity. This feature allows you to connect with other investors in a social networking format similar to Facebook, and it also allows you to copy the trades of premium users, adding a new dimension to the traditional concept of trading.

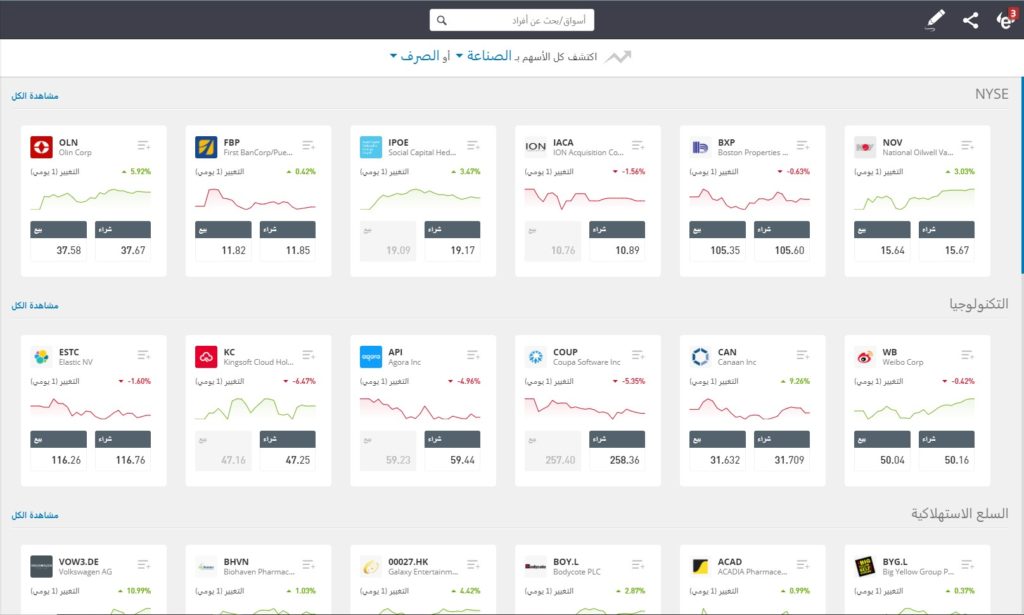

What stocks can you buy with eToro?

eToro offers the opportunity to trade shares in over 1,700 companies from various stock exchanges worldwide. You can choose from a large number of important company stocks, including those ranked among the best. For example, if you’re looking to invest in American companies like Tesla, Apple, or Amazon, eToro makes this easy.

Additionally, if you’re looking to add global stocks to your investment portfolio, eToro offers a wide range of options. Above all, eToro offers trading opportunities in US markets, including the New York Stock Exchange and NASDAQ, giving you access to hundreds of well-known US companies.

We can list the global stock exchanges offered by eToro as follows:

Available options include companies such as Apple, Amazon, Facebook, IBM, Ford Motors, Nike, Disney, and many more.

When it comes to the specific types of stocks you can buy, eToro’s offerings cover key sectors such as technology stocks, retail stocks, banking stocks, food and beverage stocks, and even cannabis stocks! The company also offers a good selection of stocks that pay regular dividends, which are suitable for investors seeking passive income.

You can track your favorite stocks through customizable watchlists on the eToro platform.

Fractional shares on eToro

eToro is one of the few brokers that allows you to take advantage of the ‘fractional stock ownership’ feature via CFDs. As the word ‘stock’ suggests, this feature allows you to purchase a ‘portion’ of a stock. Fractional shares are extremely useful for several reasons. For example, let’s assume you’re planning to add US stocks to your eToro portfolio.

Unlike on the London Stock Exchange, where shares of listed companies are priced in pence, US stocks are quoted in US dollars (not cents). For this reason, some heavily traded companies on the New York and Nasdaq exchanges can sometimes be worth hundreds, or even thousands, of dollars.

Taking Amazon stock as a prime example, at the time of writing this eToro review, the online retail giant’s stock is trading at $3,184. Converting this price to Saudi Riyals would equate to approximately 12,000 Saudi Riyals. For most of us, spending such a large sum just to purchase a single stock is unacceptable. Not only does this hinder our ability to build a diversified investment portfolio, but the stock price may exceed our entire investment budget.

However, when purchasing Amazon shares on eToro, you can invest as little as $50. In other words, if you invest $50 to purchase Amazon shares, you will be able to purchase 1.6% of each share. eToro offers fractional ownership of all 1,700 shares available on its platform.

ETFs on eToro

If you’re interested in using eToro to benefit from commission-free trading in global stock markets, but aren’t sure which companies to invest in, it might be worth considering purchasing exchange-traded funds (ETFs). ETFs allow you to invest in a basket of different stocks through a single investment vehicle.

Once you’ve allocated funds to purchase an ETF on eToro, you don’t need to take any further steps until you decide to sell your investment. This is because the fund’s management company handles the buying and selling of shares on your behalf. eToro offers a total of 153 ETFs operating in various economic sectors.

Specifically, eToro offers ETFs managed by three of the world’s largest providers of these investment vehicles—Vanguard, iShares, and SDPR. This diversity allows you to invest your money in a range of the world’s most popular exchange-traded funds. For example, all three companies offer ETFs that track the S&P 500 index.

This is because this index is the largest stock market index in the world, tracking the performance of the 500 largest companies listed on US stock exchanges. In other words, when you make a single investment in one of eToro’s S&P 500 ETFs, you will have, in effect, purchased shares in 500 different companies.

If you want to enhance your investment and risk diversification strategy, the ETFs offered by eToro also give you access to the bond markets. For example, the Vanguard Total International Bond ETF contains over 6,000 bonds traded across a variety of markets. Again, you can invest in the entire bond basket by purchasing shares in a single ETF.

Moving on to the minimum investment, eToro allows you to purchase ETFs with a minimum investment of just $50. This low figure is certainly good news for Arab investors, as most other brokerage firms impose high minimum investment limits for these types of assets. For comparison, if you decide to go directly with the company managing the ETF, a company like Vanguard requires a minimum investment of £500.

Other assets at eToro

If you want to diversify the asset classes you invest in, eToro has you covered.

Below is a breakdown of the asset classes you can trade on the eToro platform via CFDs:

- Indices: eToro offers three indices that you can buy or sell with the click of a button. These include the FTSE 100, Dow Jones 30, France 40, S&P 500, Nasdaq 100, Japan 225, and many more.

- Cryptocurrencies: You can buy 16 cryptocurrencies with eToro with a minimum investment of just $25. This includes Bitcoin, Ethereum, Ripple, Bitcoin Cash, and many more. You can also trade cryptocurrencies in pairs such as BTC/ETH. eToro offers the option to buy the cryptocurrencies themselves or trade them as CFDs.

- Commodities: You can trade many major commodities on eToro, covering oil, natural gas, gold, silver, copper, and many agricultural products.

- Foreign Exchange (Forex) : eToro also offers the opportunity to trade more than 40 currency pairs.

It’s worth noting that, with the exception of stocks, ETFs, and digital assets, all other asset classes available on the eToro platform are traded in the form of CFDs. This means you can trade the future value of the underlying asset without having to store or physically own it. This option is particularly useful when gaining exposure to hard assets such as gold, silver, or oil.

Although you won’t actually own the underlying asset, eToro’s CFDs provide you with two key advantages that you won’t get when buying assets traditionally – leverage and short selling.

However, it is important to remember that CFDs are complex financial products that carry high risks, so make sure you conduct thorough research and fully understand how to trade CFDs before risking real money.

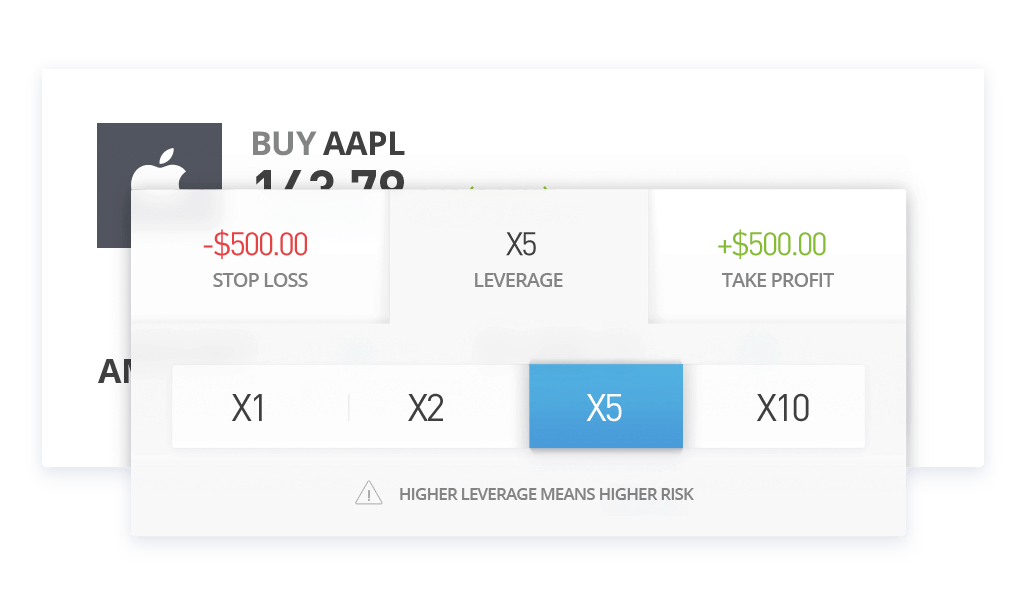

Leverage at eToro

CFDs allow you to leverage your trading with more funds than you already have in your account. It’s worth noting that eToro complies with all regulations imposed by the European Securities and Markets Authority (ESMA). Based on these regulations, traders located in the UK or across Europe will be subject to maximum leverage limits;

1:5 on stocks, 1:20 on gold, and 1:30 on major currency pairs. You’ll also get 1:2 leverage when trading cryptocurrencies and 1:10 on commodities other than gold.

If you’re unsure how leverage works on eToro, you should realize that you’re actually multiplying the value of the trade by the percentage you set. For example, let’s assume you decide to invest 100 Saudi riyals in gold. If the price of gold rises by 10% and you use the maximum leverage of 1:20, every profit you make of 10 riyals will be doubled to 200 riyals. Note that leverage also doubles the value of any loss.

Short selling at eToro

One of eToro’s most popular features is the ability to short sell CFDs. This feature simply means you can speculate on a decline in the price of the asset you’re trading.

For example, let’s assume you’ve conducted in-depth research on HSBC stock. Based on your findings, you believe the British bank’s stock price is overvalued. While most investors in this situation would avoid buying the stock, smart investors would seize the opportunity and short-sell HSBC stock to profit from the price decline.

Therefore, if you place a sell order worth SAR 500 on HSBC and the stock falls by 20%, your profit will be SAR 100. To open a short sale, all you need to do is trade your chosen asset as a CFD.

eToro Dividends

One of the questions many of us ask is whether eToro pays dividends on stocks. The simple answer is yes—when you invest in stocks or ETFs with eToro, you’re entitled to receive dividends distributed by the company.

If you trade stocks, the company you invested in will transfer your share of the profits to eToro, which will then add the collected dividends to your cash balance. You can then withdraw the funds or reinvest them in other assets, as you wish. This will give you the best possible opportunity to capitalize on the accumulation of profits and capital.

As for exchange-traded funds (ETFs), asset managers like Vanguard and iShares typically pay dividends quarterly. This is because the stocks comprising the fund’s asset basket pay dividends on different dates throughout the month—which would make paying dividends for each share extremely difficult and impractical.

For this reason, companies pay quarterly dividends to cover all the distributed profits collected by the fund management company over that period. Likewise, index fund dividends will appear in your eToro account and become available for immediate withdrawal.

One of the most important criteria you should consider before joining any stock broker is its fee policy. We don’t just mean stock trading fees; Other fees and costs may apply to your account. In the following lines, we will explain all the details of the fees you will pay with eToro. This applies to all types of stocks offered by eToro, both in the Arab region and abroad. This policy contrasts with the exorbitant fees charged by many stock trading platforms in the Arab region, and is one of the main reasons eToro has succeeded in attracting over 12 million clients. If you intend to buy shares with eToro, IG, or a traditional investment company like Hargreaves Lansdown, below is a list of the fees you can expect to pay at each company. If you intend to enter into a long position involving CFDs on shares with eToro, Plus500, or MarketsX, here are the fees you can expect to pay.

There are a few other types of fees you should be aware of when trading with eToro. In the world of stocks, the spread refers to the difference between the buying and selling prices of a company’s shares. It’s important for traders to understand what this term means, as it falls under the indirect trading fees that are deducted from the overall return on investment (ROI). eToro doesn’t offer a fixed spread structure, as its value fluctuates depending on market conditions. However, generally speaking, if you trade during normal market hours, you’ll benefit from the most competitive spreads. To give you an idea of the costs you might incur, assuming the buy and sell prices for Royal Mail shares at the time of writing (during normal exchange hours) are 174.24 pence and 174.80 pence, this translates to a spread cost of approximately 0.32%. This is very reasonable, considering there are no other fees associated with stock trading. eToro charges a so-called ‘inactivity fee’ of $10 per month after a year of inactivity in the account. eToro doesn’t charge a specific fee for depositing funds, but there are currency conversion fees you’ll need to consider. This is because all eToro account balances are denominated in US dollars. Therefore, when you deposit into your eToro account using a credit/debit card, eWallet, or bank transfer, you’ll incur a 0.5% conversion fee between the deposit currency and the account currency. In other words, if you deposit 1,000 Saudi riyals into your account, you’ll pay a 5 riyal fee. Moving on to withdrawals, eToro charges a flat fee of $5.

eToro Fees and Commissions

There are $1 fees on stock trades with eToro.

eToro vs. other brokers

Trading Company

eToro

IG

Hargreaves Lansdown

global stocks

$1

$0 or $10

$11.95 or 1% ($20 min / $50 max)

Open a position to trade CFDs on stocks with eToro for a week versus other brokers

eToro

Plus500

MarketsX

S&P 500

$1.20

$1.05

$1.30

Europe 50

$1.35

$0.65

$1.25

Apple

$3.15

$4.45

$3.20

Other fees

Spreads

inactivity fees

Deposit and withdrawal fees

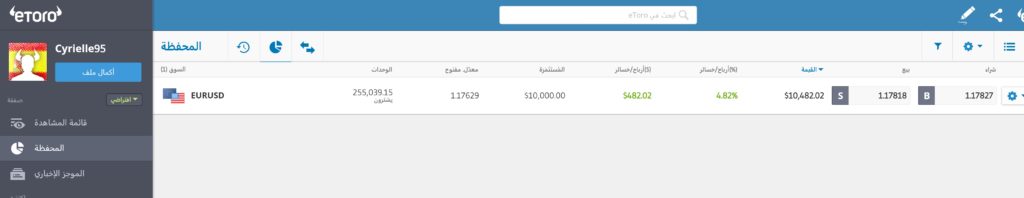

eToro stock trading platform

Buying and selling stocks on the eToro platform is extremely easy. To find the stock you want to invest in, you have two options:

- The first option is to search for a specific company by name and then go directly to the relevant investment page.

- The second option is to browse eToro’s stock library and then filter the available options by filtering the results according to the stock exchange or sector in which the company operates.

Stock Orders

Although eToro is primarily aimed at beginner investors, you will still be able to take advantage of multiple order types when placing your trade.

This includes:

- Market Order: This type of order allows a stock trade to be executed at the first available market price. If the relevant stock exchange is open, your trade will be executed within seconds.

- Limit Order : If you want to buy stocks at a specific price, eToro allows you to place a limit order. In this case, your order will only be executed when the market reaches the specified price. If the market price remains far from the order price, your trading order will remain pending until you cancel it.

- Stop-loss order: This type of order is particularly useful for traders who want to buy and sell stocks in the short term. Essentially, it automatically closes your trade if you incur losses of a certain amount.

- Take Profit Order: This order is also suitable for short-term traders, as it allows them to automatically close their trade when profits reach a certain level.

However, if you aim to buy stocks on the eToro platform and hold them for several years, a market order will be sufficient for you.

eToro Review: How to Buy Stocks on eToro, Social Trading, and Copy Trading

eToro is known as the world’s #1 ‘social trading platform’ – and there’s good reason for that. For those new to social trading, eToro operates much like a social media platform, except it’s a community focused on investing and trading. In other words, eToro offers the opportunity to discuss and share trading ideas, receive investment advice, and, most importantly, follow eToro members in a transparent and open environment.

For example, suppose a seasoned investor on eToro posts several trading ideas for the coming week, you’ll not only be able to view the posted ideas, but also respond to them and discuss the idea with the person who created them.

This is extremely useful if you’re just starting out in the world of investing and are still gathering information and gaining experience. You can also add eToro members whose performance and ideas you like to your ‘Friends List,’ which then allows you to monitor their activity on the platform.

eToro Copy Trading

As important as social trading is on the eToro trading platform, nothing compares to the copy trading feature, or what some call copy trading. As the name suggests, this feature allows you to select an eToro investor and copy their trades directly. You can copy all components of that trader’s current investment portfolio, as well as their future trades.

This simply means you invest in stocks without having to conduct any research yourself. Therefore, if you’re a novice trader learning how to invest in stocks but are in a hurry to start investing as soon as possible, CopyTrader is the perfect solution to your dilemma.

Another advantage of social trading is that you can set an investment amount you feel comfortable risking – but it must not fall below eToro’s minimum of $200.

- For example, let’s assume that the trader you follow has opened a trade with a total value of 100,000 riyals spread across 30 different stocks.

- This trader then allocated 5% of the total investment (i.e. 5,000 riyals) to buy Facebook shares,

- While the total amount I allocated to copy the trades of this investment portfolio was only 1,000 riyals.

- In this case, your investments will be allocated proportionally, meaning that your 5% share of the total portfolio in Facebook shares will translate into 50 riyals in your account!

There are no additional fees for using eToro’s copy trading feature, and you can close your trading position at any time. This feature gives you 100% control over your funds, including the ability to manually close specific orders while keeping the remaining positions in your portfolio.

Best Copy Traders on eToro

At the time of writing this review, there are approximately 710,000 traders you can copy on the eToro platform. Fortunately, the platform offers a wide range of search filters that you can use to filter through the top-rated traders, those most likely to meet your long-term financial goals, and those whose strategies align with your personal circumstances and preferences.

To give you an idea of the things you should consider when social trading and choosing the best traders on the eToro platform, we can list the following criteria:

- Total returns since the trader joined eToro

- Monthly returns

- Risk rating (1 is lowest and 10 is highest)

- Preferred asset class (stocks, ETFs, etc.)

- Average trade duration (determines whether the investor is trading short, medium, or long term)

- Number of copy traders and total assets under management

In social trading, finding a suitable trader to copy on eToro can take a lot of time and effort. Don’t forget that there are thousands of traders to choose from.

That’s why we’ve listed three of the best copy traders on eToro below to make it easier for you to choose and get started with social trading.

-

Jay Edward Smith – Jaynemesis – Top Rated Trader with 68% Returns Since 2020 Till Date

Just so you don’t get confused, Jay Edward Smith, who trades under the username Jaynemesis, is one of eToro’s top copy traders of 2021. To begin with, this trader made profits in 2020 of over 68% (by mid-October 2020).

This achievement is unprecedented, considering the uncertainty that has gripped financial markets due to the coronavirus pandemic—not to mention that many stocks are still trading at lower levels than before the pandemic began. Even more impressive is that, with the exception of a small loss of 0.57% in September 2020, Smith has achieved profits for 14 consecutive months. In 2018, the trader returned more than 52% to his investors—a remarkable achievement by any standard.

Taking a closer look at his investment portfolio, it can be seen that Jay Edward Smith manages a diversified basket of stocks, spanning a variety of sectors, from Microsoft to Etsy, UPS, Canadian Solar, and Beyond Meat. Although 95% of his portfolio is made up of stocks, he allocates a small portion of his investments to Bitcoin and ETFs.

Smith has also been involved in trading indices and commodities in the past. However, his risk rating on eToro is 5/10, up from 2/10 in April 2020. At the time of writing, Jay Edward Smith, a top-rated copy trader, has 26,000 followers and over $5 million in assets under management.

-

Shamsher Malik – Low-risk stock and forex trader (55% profit since 2020 to date)

If you’re uncomfortable following and copying a trader with a high risk rating like Jay Edward Smith (5/10), it might be worth checking out Shamsher Malik. This UK-based trader, who specializes in fundamental analysis, prefers a low-risk investment approach. Specifically, most of his trades focus on stocks and forex.

Shamsher Malik holds his trades open for an average of two weeks—reflecting his preference for following short-term trends. Despite his low risk profile (3/10), he has achieved impressive investment returns. For example, Shamsher achieved a return of 12.32% during the first ten months of 2020. Although this return on investment is significantly lower than what Jay Edward Smith achieved,

However, we must not forget to compare the return with the potential risk. Naturally, the higher the risk associated with the trader whose trades you are copying, the higher the expected profit and loss ratio. Also, let’s remember that Shamsher achieved profits of over 32% in 2019. Moreover, his strategy achieved an impressive level of drawdown percentage – which currently averages 10.45% annually.

-

Mantas Dabkevicius – Mantasdabk – Up and coming trader (55% profit since 2020 to date)

If you prefer short-term swing trading strategies, you might want to consider up-and-coming trader Mantas Dabkevicius. Based in Denmark, he trades on eToro under the username Mantasdabk, where he buys and sells several asset classes on a regular basis. His average holding period is 1.5 weeks.

Furthermore, Dabkevicius opens an average of around 20 trades per week—hence, he can be classified as a highly active trader. As for asset classes, the eToro trader’s exposure to stocks amounts to 60% of his total portfolio. The remaining percentage is distributed across a wide range of other assets, including commodities, forex, cryptocurrencies, and exchange-traded funds (ETFs).

This diversification gives you the ability to spread your risk and investments across multiple markets without any effort on your part. Speaking of performance, Mantas Dabkevicius joined the eToro platform in December 2019. Although he achieved a low return of 4.85% in his first month, his return rate since 2020 is approximately 55.62%.

This ratio was achieved by closing 58.70% of trading weeks in profit since joining eToro. While these significant returns might give the impression that Dabkevicius is a high-risk trader, his risk rating is actually only 4/10. This ratio has decreased from 6/10 Dabkevicius recorded in March 2020—a very good development.

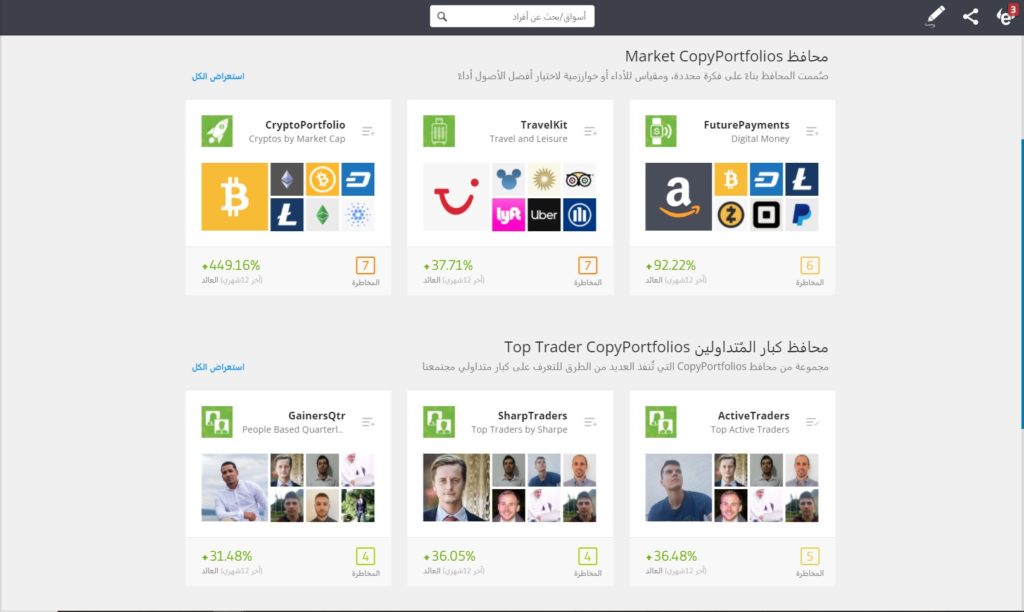

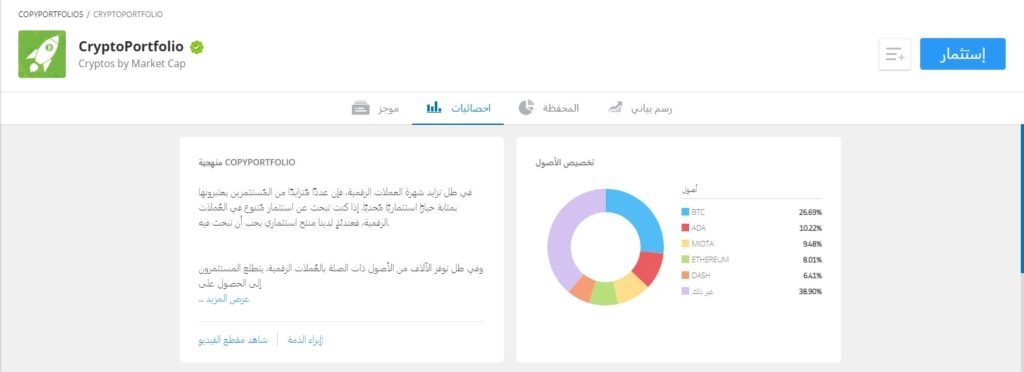

CopyPortfolios

eToro also offers more advanced copy trading and social trading tools called CopyPortfolios. These portfolios are professionally managed using artificial intelligence and automated trading tools and are divided into two types: Top Trader Portfolios, which include the best-performing traders on the eToro platform, and Market Portfolios, which combine a number of assets under a single strategy.

Top Trader Portfolio

Among the top investment portfolios on eToro’s Top Trader Portfolio is ‘GainerQtr.’ This portfolio achieved a return of just under 20% in 2020. In 2019, it returned just over 14%. The ‘GainerQtr’ portfolio is diversified, with the top 5 traders accounting for just over 25%, while the remaining percentage is distributed among a large number of traders investing in a variety of target markets.

Although CopyPortfolio is a more advanced investment tool than the standard CopyTrader, it requires a minimum investment of $5,000. On the other hand, it’s the best passive investment option on eToro, as it requires absolutely no effort from you, and the portfolio team manages everything for you. You don’t have to choose the investors whose trades will be copied, nor do you have to worry about constantly rebalancing your portfolio, as the CopyPortfolio managers take care of that as well.

Market Portfolios

Social trading portfolios allow you to target a specific segment of the financial markets. One example is the ‘RemoteWork’ portfolio. As the name suggests, this portfolio gives you exposure to companies associated with the work-from-home sector, including stocks like Twilio, Zoom, Shopify, Adobe, Salesforce, and many others.

This Market Portfolio has performed impressively since its inception in 2018, posting returns of 82% (2020 year-to-date), 41% (2019), and 49% (2018) over the past three years—truly impressive returns. Other specialized sectors covered by eToro’s Market Portfolios include renewable energy, self-driving cars, mobile payments, food, technology, and gaming.

You can start investing in Market Portfolios with as little as $1,000, compared to Top Trader Portfolios, which require a minimum investment of $5,000. The exact investment amount will depend on the portfolio you choose, so be sure to check these requirements.

eToro ‘s charts, research, and analytics

eToro’s trading platform loses some of its luster when it comes to its research and analysis services. Although eToro’s web platform integrates TipRanks stock research, it doesn’t provide enough information for advanced investors. For example, the platform doesn’t offer earnings reports, published financial results, or in-depth analysis from market experts.

However, you can still access a range of charting tools related to your chosen stock. This includes a large number of illustrative models and charts displaying historical stock prices, as well as general forecasts issued by leading hedge funds. eToro also lags behind when it comes to financial news availability, as news is only shared by users on the platform.

That’s why we recommend you look for research and news materials from external sources such as Yahoo Finance or Morningstar.

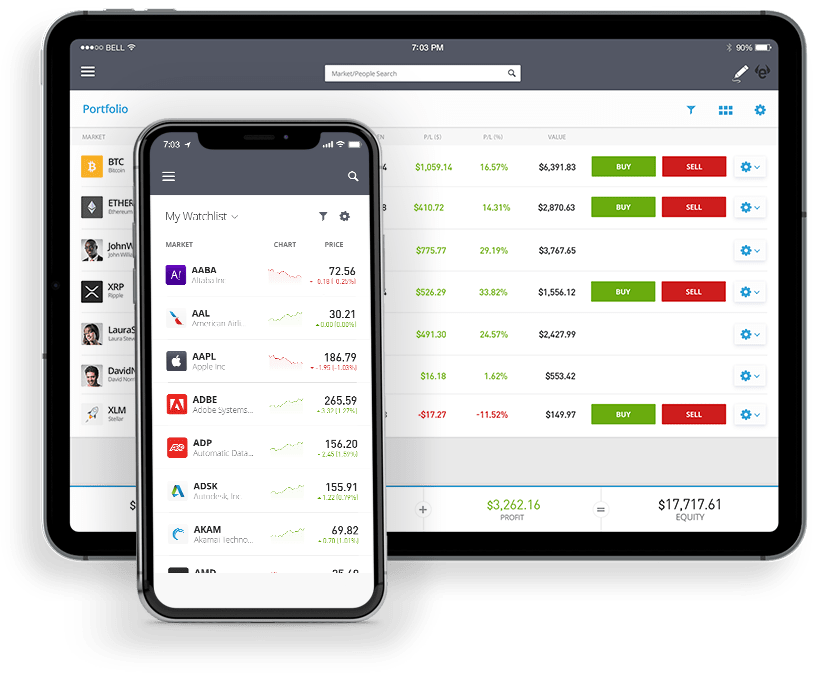

eToro Mobile App

Both the mobile app and the web browser-based platforms provide access to all account features, just like the desktop platform. It’s safe to say that the mobile app provides you with all the tools you need, whether you’re buying and selling stocks, viewing your investment portfolio data, or even depositing and withdrawing funds.

Another important aspect in this regard is that using the eToro mobile app won’t hinder your trading experience due to the small screen. It’s designed to be compatible with mobile device specifications, ensuring a seamless trading experience at all stages. If you’re planning to take your investment experience to a whole new level, we recommend taking full advantage of the eToro app’s capabilities.

For example, you can view the details and performance of all your trades with the click of a button from anywhere. You can also seize investment opportunities as soon as they arise without having to wait until you get home. The same applies when you want to close a losing trade. Under normal circumstances, you might have to wait several hours to access your account on your desktop, which can sometimes cost you significant losses.

eToro Demo Account

If you want to master the company’s platforms before risking real money, you can take advantage of an eToro demo account. The demo account gives you $100,000 in virtual funds while offering all of eToro’s functionalities, including copy trading tools, making it a great tool for getting familiar with the platform before moving on to real investing.

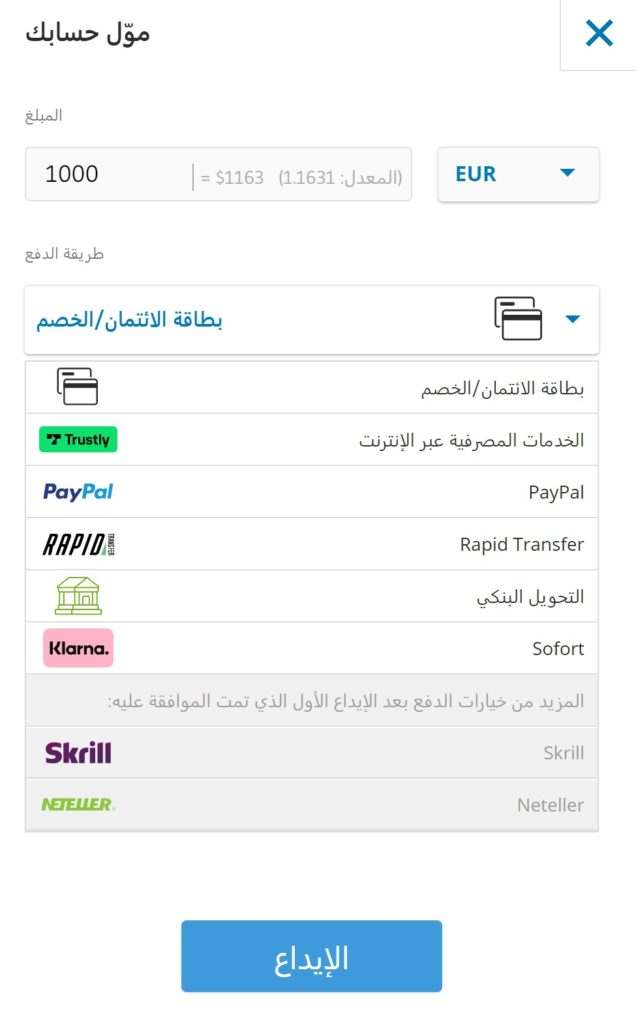

Payment methods on eToro

One of eToro’s best features is that it offers a wide variety of payment methods to choose from. These include:

These payment methods offer a great deal of flexibility, compared to traditional brokers in the Arab region, most of which only allow deposits via bank transfers. Degiro is one example of this—which prolongs the deposit process, which typically takes several days to reach your account. This can be extremely frustrating if you’re looking to capitalize on opportunities in a market that doesn’t have long waiting times.

This is different with eToro, where deposited funds appear in your account and become available for investment use immediately when you pay using credit/debit cards or e-wallets.

Moving on to deposit requirements, eToro requires a minimum deposit of $200. You may have noticed that all transactions on the eToro platform are denominated in US dollars, which is due to the platform offering more than 1,700 stocks from 17 international exchanges. This requires the use of a single currency, eliminating the need to worry about constant exchange rate fluctuations.

On the other hand, the fact that eToro is limited to using US dollars has led to a 0.5% currency conversion fee. Therefore, if you deposit in Saudi riyals, Emirati dirhams, Kuwaiti dinars, or any other currency other than US dollars, you will pay a small currency conversion fee. For example, if you deposit 1,000 Saudi riyals, you will incur a fee of 5 riyals.

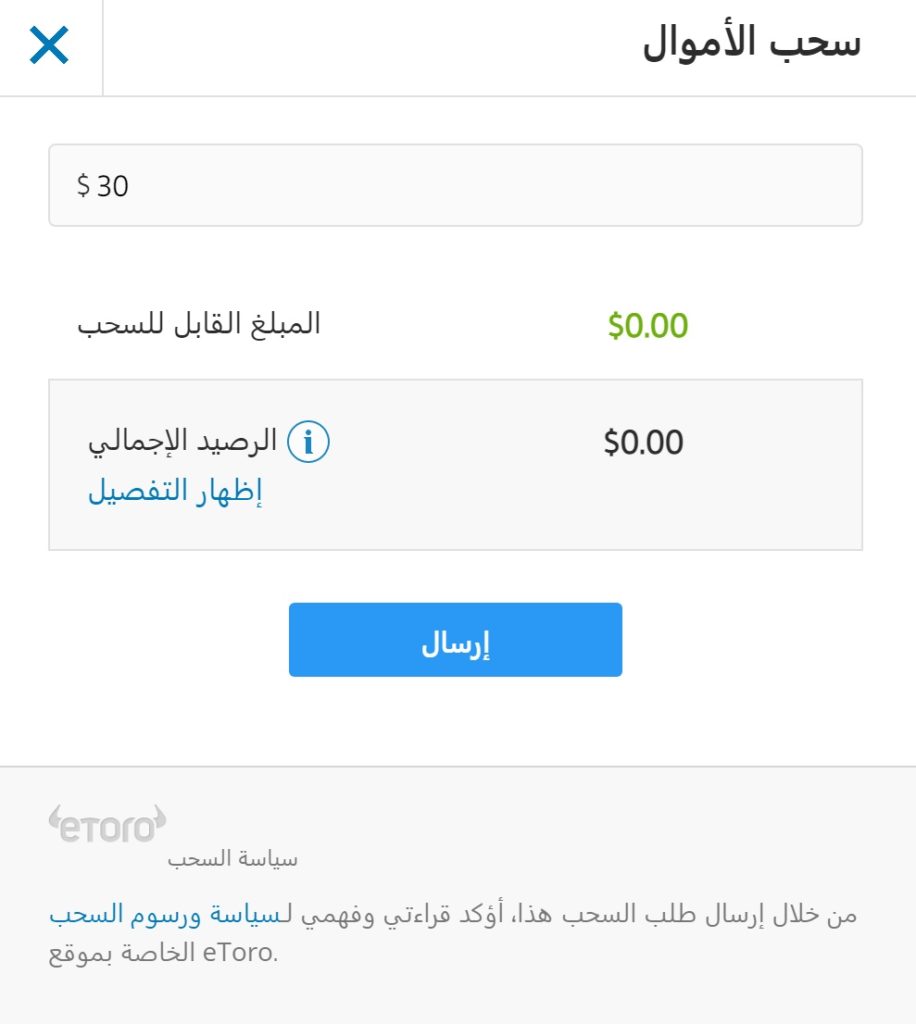

Withdraw funds from eToro

Withdrawing funds on eToro is easy and seamless. All you need to do is open your account page and submit a withdrawal request, including the amount you want to withdraw. Due to anti-money laundering requirements in some countries, you will be required to withdraw funds to the same deposit source, with an amount no less than the initial deposit amount, before using other payment methods.

For example, if you deposited SAR 500 with your credit card and later wanted to withdraw SAR 600, you would need to withdraw at least SAR 500 to the same credit card you used to make the deposit – after which you would be free to withdraw the remaining SAR 100 via any alternative payment method.

eToro’s minimum withdrawal amount is $30, and a flat fee of $5 is charged for each request, regardless of the amount withdrawn. Also note that eToro charges a 0.5% fee for currency conversions. The fee is determined based on the prevailing exchange rate at the time of the withdrawal request.

Is the eToro trading platform safe?

While available stocks for trading and transaction fees are crucial criteria when choosing a broker, it’s also important to check the regulatory status of the platform you’ll be trading on. This ensures you only choose reliable brokers and reputable platforms, ensuring your funds are kept safe at all times.

For eToro, the platform holds three regulatory licenses:

- Financial Conduct Authority ( FCA) – eToro (UK) Limited is a member of the UK Financial Services Compensation Scheme (FSCS). According to the FSCS advisory documents, under certain conditions, it covers investor losses of up to £85,000.

- Australian Securities and Investments Commission ( ASIC )

- Cyprus Securities and Exchange Commission (CySEC)

In addition to its strong regulatory licenses, it’s important to remember that eToro has been in the online stock trading market since 2007. This means the company has a long history spanning over 14 years, and we can therefore verify its practices throughout those years. As mentioned earlier, eToro’s client base exceeds 12 million investors, an unmistakable sign of its reliability. Overall, there’s no reason to worry about the safety of your funds when trading with eToro.

How to start trading with eToro ?

If you like eToro’s features and decide to start investing with it by opening a commission-free stock account today, you’ll find a detailed explanation of all the required registration steps below.

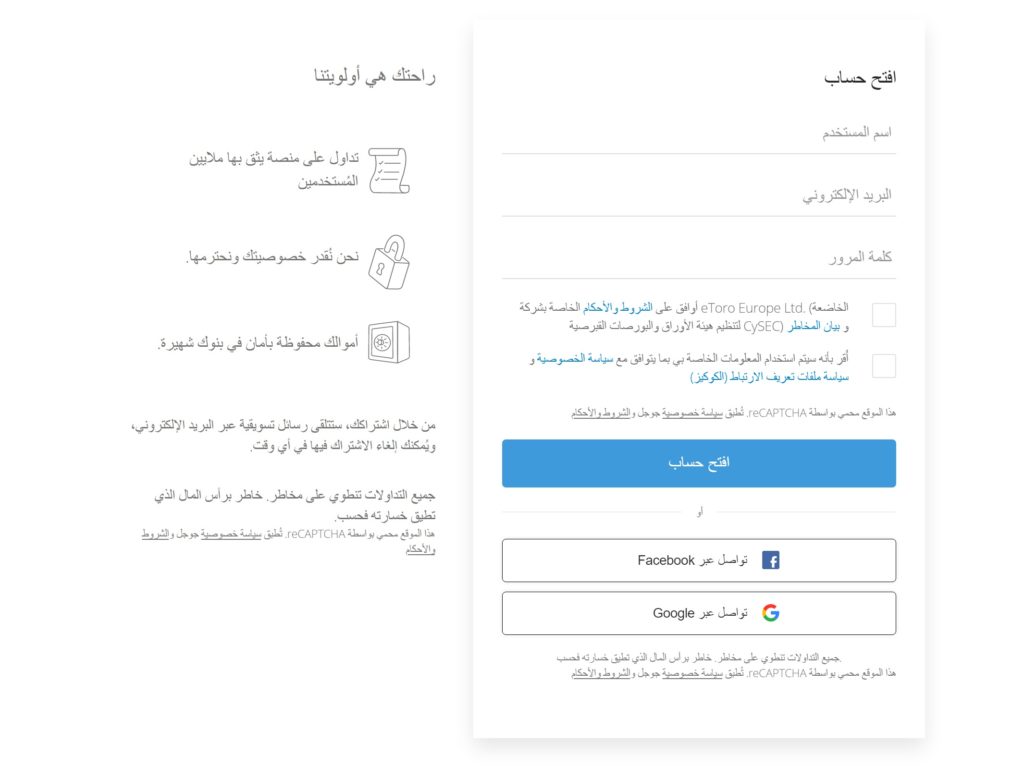

Step 1: Open an account

You’ll first need to visit the eToro website’s homepage and open an account. As an FCA-regulated platform, you’ll be asked to provide some personal details, such as your name, home address, date of birth, and contact information. You’ll also need to provide your national ID number.

Step 2: Verify your identity

eToro will ask you to confirm that you are the real owner of the trading account, so you will need to upload scans of some verification documents.

This includes:

- A government-issued ID card, such as a passport or driver’s license

- Proof of address, such as a recent utility bill or bank statement

The documents you submitted to eToro will be verified within approximately one hour. In the meantime, you can proceed to deposit funds into your account.

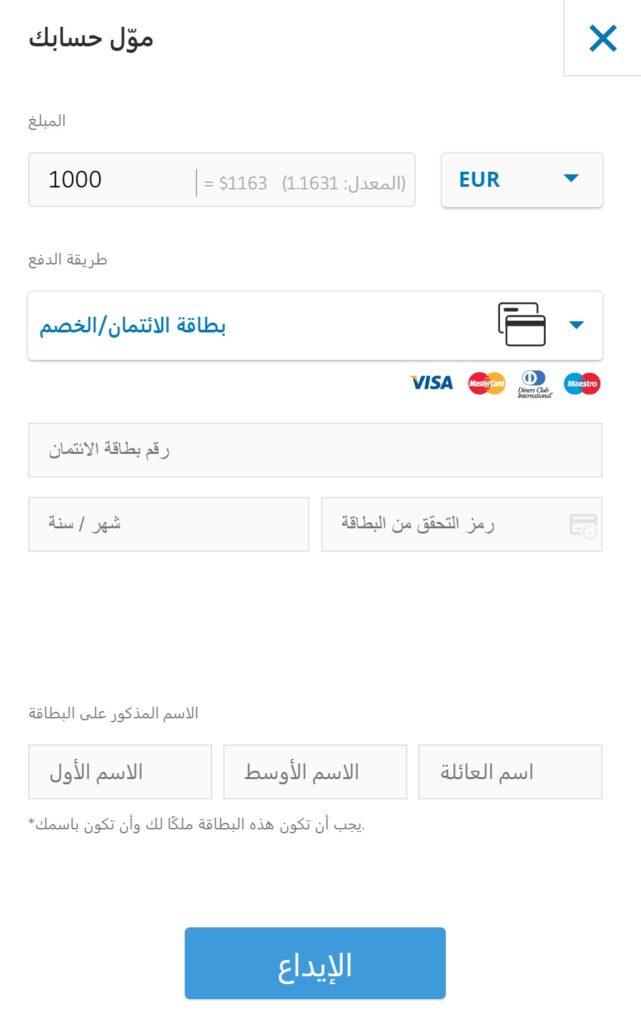

Step 3: Deposit funds

Depositing funds into your eToro account is easy. All you need to do is choose your preferred payment method (see above for available options) and then specify the amount you want to deposit. The minimum deposit is $200 (SAR 750). Deposited funds will appear in your account instantly unless you choose to deposit via bank transfer.

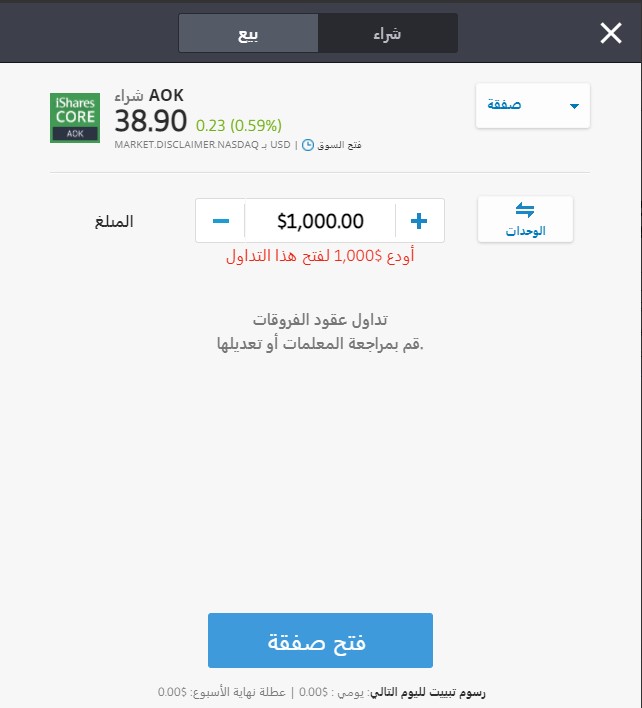

Step 4: Buy shares

Now that you’ve funded your eToro account, you can proceed to purchase some stocks or trade CFDs. If you want to invest in a specific company, enter its name or symbol in the search box at the top of the page. If you want to browse eToro’s stock list, click the ‘Trade Markets’ button and then ‘Stocks’. You can filter the results by exchange or the sector to which the stocks relate.

In this example, we were looking to buy shares in Nike, so we entered the name into the search box and then clicked ‘Trade’.

The only thing left to do is determine the amount you wish to invest. As mentioned above, you’ll need to specify this amount in US dollars. You can invest a minimum of $50 in the stock of your choice, which is equivalent to 190 Saudi riyals.

To complete a stock trading order, click the ‘Open Trade’ button during market hours, or the ‘Set Order’ button if the relevant stock exchange is closed at the time of submitting the order.

Advantages and Disadvantages of eToro

Advantages

Disadvantages

- A currency conversion fee of 0.5% of the deposit amount is charged.

- Limited resources for market research and analysis

eToro Company Review

Of course, we're not the only site to review eToro. As one of the most popular stock trading brokers in Saudi Arabia, Bahrain, the UAE, Kuwait, and Qatar, it has been reviewed by numerous websites online. If you look at some eToro reviews, you'll notice that most other sites offer similar ratings, leaving no doubt that eToro is a truly reliable platform for trading and investing.

Final Verdict eToro

It's easy to understand why over 12 million investors have chosen eToro. The platform's advantages are not limited to its ease of use and intuitiveness, but it also allows you to buy ETFs without paying any commissions or other fees. The platform has no annual account fees and supports multiple payment methods, including credit/debit cards, bank transfers, and e-wallets.

eToro also offers leverage and short selling for traders who want to employ more advanced strategies. These advanced features are available for over 1,700 stocks and can also be applied to trading indices, cryptocurrencies, bonds, forex, and commodities. Overall, eToro is the ideal choice if you're looking to invest in the stock markets in a simple, secure, and affordable way.

Like eToro's features? Simply click the button below to register your account today!

eToro - Our No. 1 Stock Broker

67% of retail investor accounts lose money when trading CFDs with this provider. Your capital is at risk.

Frequently Asked Questions

How much do eToro fees cost?

Is eToro regulated?

Which countries does eToro support?

Is eToro really free?

What is the minimum deposit with eToro?

Does eToro accept payments via PayPal?