الكشف عن أفضل وسطاء الفوركس في الدول العربية لسنة 2026

If you want to trade currencies from the comfort of your home, you must open an account with a forex broker in the Arab world. There are hundreds of active platforms in this field, so you should take the time to evaluate the broker that best suits your needs.

This includes a set of minimum requirements, such as low fees and commissions, a wide range of trading pairs, and a good number of chart-reading tools. Of course, we must also ensure that the broker is regulated.

In this guide, we’ll point you in the right direction by discussing the best forex brokers in Arab countries in 2026 . We’ll also review some indicators you should consider when comparing forex brokers.

How to start trading with a Forex broker in Arab countries

To get started with a Forex broker, you need to follow these steps:

Top 5 Forex Brokers in Arab Countries 2026

If you’d like to learn more about the best Forex brokers in Arab countries, continue reading this guide. If you’d like a quick summary of the best brokers currently on the market, check out the list below.

- eToro – The Best Forex Broker in Arab Countries

- Alvexo – A Safe and Reliable Forex Broker

- AvaTrade – Forex broker offering a huge range of trading accounts

What is a forex broker?

After that, you can trade forex pairs with the click of a button. When you place an order, it must be matched with an order from another user on the platform.

This is because a forex broker is there simply to match the orders of buyers and sellers.

For example:

- Suppose you want to place a sell order on GBP/USD.

- You want to place 1000 GBP at 1.2760 to buy.

- For your trade to be executed, someone else must create a sell order.

- Not only does this transaction have to cover the full £1,000, but it also has to be done at the same price of 1.2760.

Once the Forex broker executes the order, there will be both winners and losers. In other words, if you make £100 on the trade, then someone else must, in theory, lose £100.

But regardless of which direction the market takes, the forex broker will make money because brokers charge what is known as the “spread,” which is the difference between the buy and sell prices of a forex pair.

In addition to facilitating buy and sell orders, the best forex brokers in Arab countries do the following:

- Verify the identity of all traders to ensure continued compliance with anti-money laundering laws.

- Processing deposits and withdrawals

- Ensure that trading conditions reflect real-world Forex trading conditions.

- Providing trading tools of leverage and margin.

- Providing technical analysis tools and features.

- Providing educational resources.

- Providing the highest level of customer service.

However, with so many forex brokers operating in the Arab world, it’s important to understand which platforms can be challenging to join. Therefore, you should spend some time researching the broker that best suits your needs.

Best Forex Brokers in Arab Countries in 2026

As we mentioned earlier, there are hundreds of forex brokers in Arab countries competing for your business. This is great for you as a trader, as brokers are forced to become more competitive. This not only involves lowering their commissions and fees, but also includes offering more comprehensive products for tradable currency pairs.

To save you hours of research, we present to you below a selection of the best Forex brokers in Arab countries in 2026.

1. eToro – A Trusted Forex Broker in Arab Countries

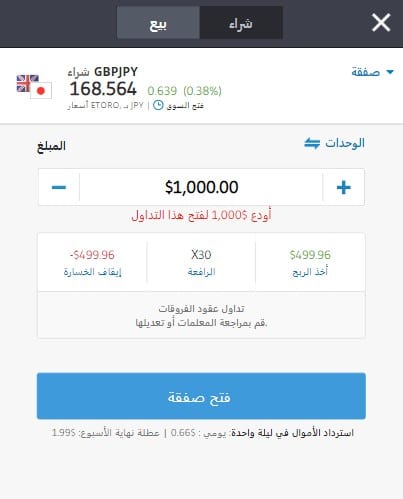

Getting started with eToro is easy, and the platform is helpful for new traders, as the broker is geared toward those with little or no experience in forex trading. When it comes to commissions, you pay $1 when buying or selling stocks, but you should consider the spread and overnight financing fees when holding a position after market hours; This is standard market practice.

eToro also doesn’t charge any monthly or annual account maintenance fees. Deposits are subject to a small currency conversion fee of 0.5%, as the entire platform is denominated in US dollars. Withdrawals cost only $5, which is great. In terms of features, eToro is packed with chart reading tools and educational resources. You can also take advantage of the copy trading feature, which allows you to copy buy and sell orders created by professional forex traders.

It’s also worth noting that eToro offers leverage. If you’re a retail trader from an Arab country, this allows you to use leverage of up to 1:30 on major pairs and 1:20 on minor and exotic pairs. If you’d like to start trading with eToro now, creating an account will only take a few minutes. You’ll need to meet a minimum deposit of $200, which you can complete with a UAE credit/debit card, bank account, or e-wallet. The platform is regulated by the Financial Conduct Authority ( FCA ), operates in partnership with the Financial Sector Conduct Authority ( FSCA ), and is licensed by the Cyprus Securities and Exchange Commission ( CySEC ) and the Australian Securities and Markets Commission ( ASIC ).

eToro Commissions:

| commission | 0% on ETFs |

| Deposit commission | Currency conversion fee of 0.5% |

| Withdrawal commission | $5 |

| Inactivity fee | $10 per month after 12 months of inactivity |

Advantages:

Disadvantages:

Your capital is at risk.

2. Alvexo - A safe and reliable Forex broker

Alvexo has its headquarters in France, in Paris, to serve its clients' needs, but its main office is located in Limassol, Cyprus, where it is regulated by CySEC.

The Alvexo platform is simple and easy to use, making it accessible to everyone. All types of traders will be able to easily familiarize themselves with the system. With its two platforms, MT4 and Web Trader, Alvexo caters to all types of traders, from beginners to the most experienced.

On the Alvexo platform, you can create:

- Free demo account

- Standard account

- Golden Account

- Premium account

- Or Elite account.

To deposit to Alvexo, you can use methods such as:

- Credit/Debit Card (Visa and MasterCard)

- PayPal

- Skrill

- paysafecard

Note that at Alvexo, only USD and EUR are used.

One of the great advantages Alfxo has over other brokers is its customer service. In fact, it has responsive customer support available at all times via phone, chat, or email.

Advantages:

Disadvantages:

76.57% of CFD accounts lose money.

3. AvaTrade – A Forex broker that offers a huge range of account types

AvaTrade offers traders a wide range of different account types for forex trading. These include CFD trading accounts that allow users to profit from both rising and falling markets, and leverage, which means they can control a large position with a small deposit .

This broker also offers options trading accounts, social trading accounts, and swap-free accounts, in addition to a comprehensive range of currency pairs, including major, minor, and exotic currency pairs.

Since AvaTrade is regulated in six jurisdictions, it offers peace of mind and security for your funds. You can also benefit from the fastest and most secure trading platforms, MetaTrader 4 and MetaTrader 5, for desktop, web, and mobile trading.

Trading is commission-free, and there are some unique tools you can take advantage of, such as AvaProtect and AvaSocial . Opening an account is easy, requiring only a small deposit of $100.

AvaTrade Commissions

| commission | 0% |

| Deposit commission | Free |

| Withdrawal commission | Free |

| Inactivity fee | $50 after 3 consecutive months of non-use |

Advantages:

Disadvantages:

Your capital is at risk.

How to Compare Forex Brokers and Choose the Right One for You

Now that you've had a chance to review the best forex brokers in the Arab market, we'll show you what you should look for when choosing a platform for yourself.

Ultimately, it's always best to thoroughly vet a broker before opening an account with them. Alternatively, you may come across a forex broker we haven't reviewed and want to investigate further.

Therefore, in the following lines, we will review the most important indicators that you should check when choosing a Forex broker that meets your needs.

organization

As with stock trading, your first stop will be to ensure that the forex broker has a sound regulatory position. Depending on the regulator – such as the Financial Services Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Markets Commission (ASIC), the Financial Services Authority (FSA), and others – this will ensure that you:

- Keeping all client funds in segregated bank accounts, which means keeping your money separate from the broker's working capital.

- Verify the identity of all new account registrants to ensure the platform complies with anti-money laundering laws.

- The broker is subject to regular audits.

- Keep your data safe and out of the hands of malicious users.

- Explaining the risks of Forex trading to all clients.

In the vast majority of cases, if a forex broker is licensed, you'll find its registration number at the bottom of its website. If not, it may be worth checking the regulatory body's register to be 100% sure.

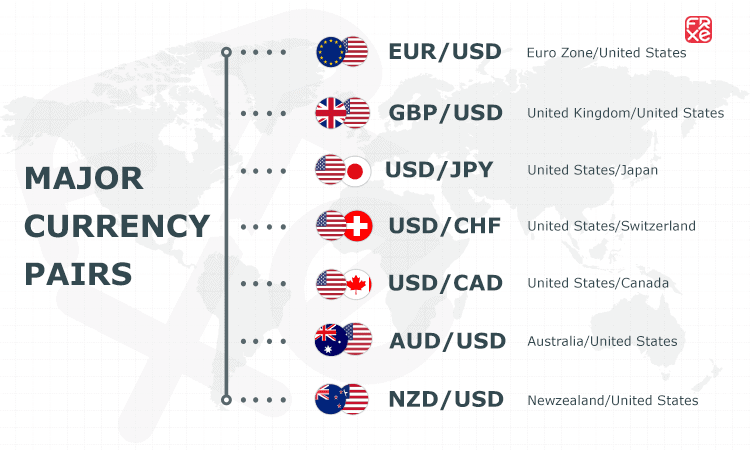

Forex pairs

Next, you need to familiarize yourself with the forex pairs the broker allows trading, which can range from dozens to hundreds or more. In most cases, you'll find that the forex broker offers most of the major and minor currency pairs.

This is because these pairs are the most widely traded and highly liquid in the forex arena. They also have the highest spreads and lowest volatility, making them ideal for new forex traders.

On the other hand, exotic pairs are much more volatile and have wider spreads. Despite the higher risks, you can still capture the opportunity to achieve greater profit margins.

However, it's still best to avoid exotic pairs if you're completely new to trading. However, if you want to trade a specific currency pair, you should first ensure that the broker supports it before opening an account.

Commissions

Of course, commissions play a major role in your search for the best forex brokers in Arab countries. Commissions will ultimately be deducted from your potential trading profits, so you'll want to keep them to a minimum.

Below we review the most common expenses you may need to be aware of before opening an account, taking into account the complexity of forex broker commission structures.

Forex trading commission

This is the most important commission you should pay attention to. If you choose an Emirati broker that charges a trading commission, you will have to pay it every time you place an order.

For example:

- If you are supposed to pay 0.5% on each “side” of a trade, this means that you will pay 0.5% when you enter the trade, and the same percentage again when you exit it.

- If the initial transaction value is 1000 pounds, the transaction entry commission will be 5 pounds.

- If you decide to exit the trade after the order value reaches 1,200 pounds, then you will pay a commission of 6 pounds.

The good news is that all of the best forex brokers in Arab countries that we recommend on this page do not charge commissions. However, this is not the case with all platforms on the market, so you should check this before opening an account.

Price differences

The spread is simply the difference between the buy and sell prices of a currency pair. This way, as we mentioned before, the Forex broker in question ensures that they make money in all cases.

When evaluating a broker's competitiveness in this sector, you'll likely stick with platforms that offer spreads of less than 1 pip on major and minor pairs, but anything more than that means you're paying more than you should.

Non-trading commissions

You should also check the commissions charged for not trading.

These commissions include:

- Deposit and Withdrawal Commissions: Some online forex brokers charge a commission when you deposit and/or withdraw, sometimes a lump sum or a percentage.

- Currency conversion commission: Some forex brokers in Arab countries charge a currency conversion commission. You may be trading forex pairs denominated in a currency other than the one you deposited.

- Inactivity Fee: This fee is charged when your forex trading account remains inactive for a number of months. For example, if you don't place a trade within 12 months, you may be charged $10. Your account will continue to be deducted $10 each month until you place a trade or your account balance reaches zero.

As you can see from the above, there are many commissions that you should take into account when choosing a Forex broker, so research is very important.

The crane

Leverage allows you to trade with an amount greater than the money in your account, and the vast majority of the best

This is due to the commitment of all platforms to comply with the laws implemented by the European Securities and Markets Authority ( ESMA ).

In short, this means that you can trade major forex pairs (such as EUR/USD ) with leverage limits as low as 1:30; thus, with £100, you can open a trade with a maximum size of £3,000. If you're trading minor pairs (such as EUR/GBP ) or exotic pairs (such as EUR/TRY ), the maximum leverage is 1:20.

The only way to get higher leverage limits is to prove to your Forex broker that you are a professional trader, then you can usually get limits in excess of 1:200.

Trading Tools

If you think you can make money in the forex markets without the help of trading tools, you need to think again. Without them, how can you determine the likely direction a forex pair is headed? Otherwise, you're relying on nothing but luck. That's why professional forex traders use technical indicators.

This includes 50-day and 200-day moving averages, Bollinger Bands, MACD, RSI, and dozens more.

In addition to technical indicators, you should also ensure that your forex broker in Arab countries offers chart reading tools.

User experience

If you're completely new to online forex trading, you need to ensure that your broker offers a smooth and easy-to-navigate experience. This should start from the very beginning, when you open an account and deposit, as well as finding your preferred trading pair. The process of placing orders and analyzing charts should also be seamless.

Research and Education

The best forex brokers in the Arab world have a comprehensive research department, whose activities include holding webinars, providing market insights, real-time news, and in-depth expert analysis.

As for educational resources, it's very useful for a forex broker to have easy-to-understand manuals and explanations of key forex terms. For example, a broker might provide manuals on how to create a forex trading strategy or establish a risk management system.

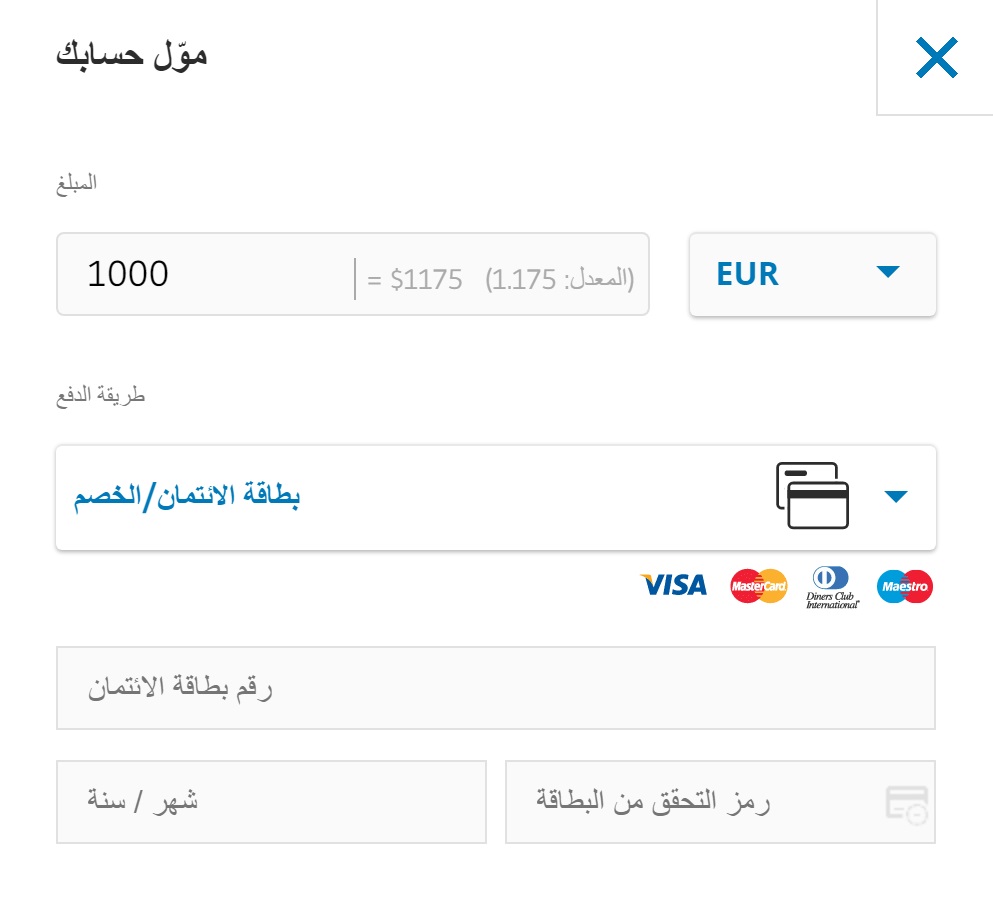

Payment methods

If you plan to trade forex with real money, you'll definitely need to deposit and withdraw funds using a payment method that suits you. Most of the best forex brokers in Arab countries we've reviewed on this page support deposits using credit and debit cards, in addition to bank transfers. E-wallets are also available, including PayPal, Skrill, and Neteller.

Customer Service

New forex traders often overlook the importance of customer service. However, the best forex brokers in Arab countries offer 24/7 customer support. This way, you can always access support day and night. As for support channels, the easiest way to communicate is through live chat.

Email is also an option, but responses won't be immediate. Alternatively, your chosen forex broker may offer a dedicated phone support line, in which case we prefer toll-free numbers. This way, you can receive immediate support without incurring call costs.

Best Forex Brokers for Beginners

If you're looking for the best forex brokers for beginners, you should choose a platform that allows you to trade with ease and convenience. It shouldn't have overly exaggerated features, and navigating the broker's website shouldn't be difficult. In light of this, we believe the most user-friendly forex broker serving Arab clients is eToro.

This platform tailors its services to suit new traders, meaning you don't need any experience to get started. Best of all, eToro provides analytical tools on forex pairs to help you decide whether to buy or sell them, and when!

Forex Options Brokers

Some online brokers allow you to trade forex "options." For those who don't know, these are highly complex financial derivatives that allow you to speculate on the future value of a particular asset by paying a small sum of money. If your predictions are correct, you make money.

There is no maximum amount you can earn, as your profits depend on the gap between the "buy/sell" price of the options contract and the price at which the contract is settled. If your predictions are wrong, you will only lose the amount you paid to establish the contract.

If you are a new Forex trader, we advise you to stay away from options, as they are more suitable for those who understand complex financial products.

How to start trading with a Forex broker in Arab countries

Now that you've had a chance to understand the best active forex brokers in the Arab world, as well as the considerations you should take into account when choosing a platform, we'll show you how to prepare for a trading account today.

Although the registration process is similar across most of the top forex brokers, we've relied on eToro for the following guidelines, as it represents our choice as the best forex trading platform in the Arab world.

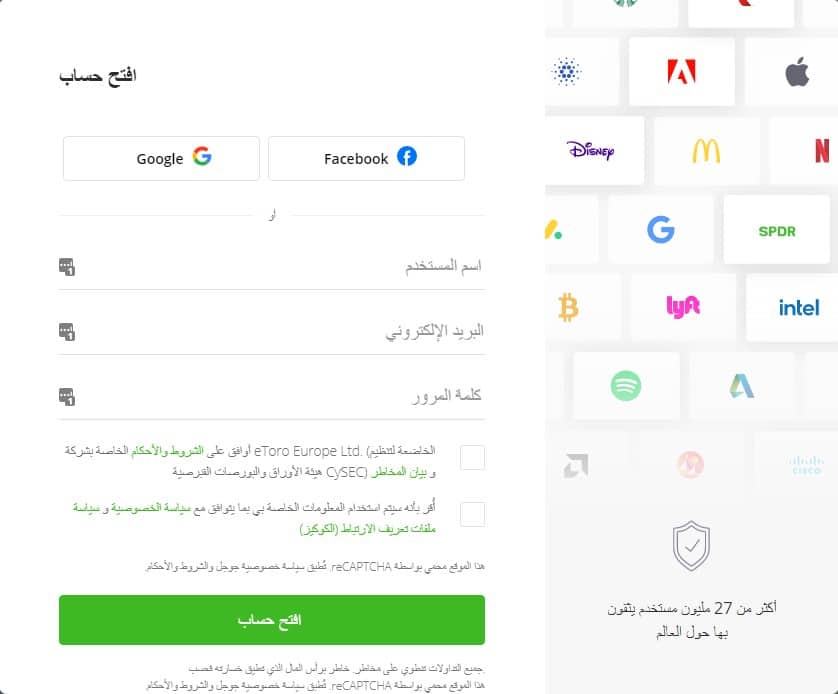

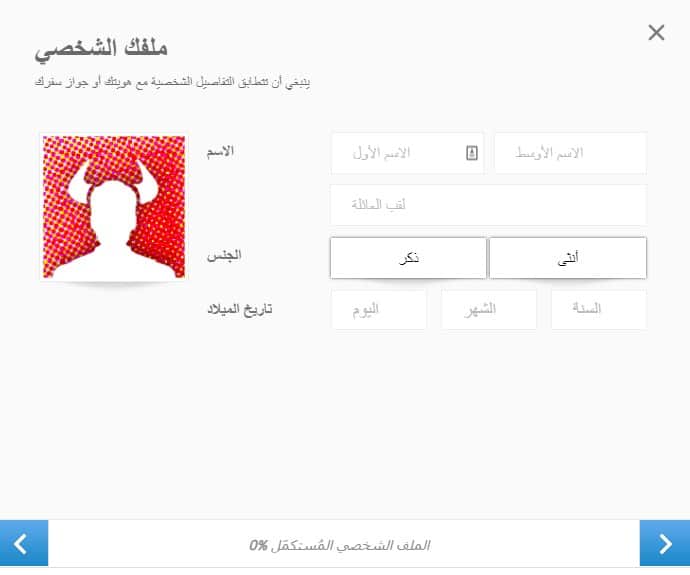

All forex brokers in Arab countries require you to provide some personal information when opening an account. To begin, go to the eToro website . You will then be asked to enter your email address and choose a password. After registering, you will have to enter the rest of the information in the following order: You will now be asked to deposit funds into your account. The minimum deposit with eToro is between $50 and $200. Supported payment methods include credit and debit cards, as well as bank transfers and e-wallets. Deposits made by all methods except bank transfers are credited to your account instantly. Once you’ve created and funded your account on the eToro platform, you’ll access the forex trading market. Choose the currency pairs you want to buy or sell, and determine when to do so according to your strategy. All you have to do is complete the trade. You also have the opportunity to use features like Stop Loss to better manage your purchases.Step 1: Open an account and fill out your profile.

Step 2: Deposit funds

Step 3: Forex Trading

Online currency trading must be done through a forex broker. There are many brokers active in this sector of the financial market, so you’ll find a platform to suit almost any need. Now, after completing this entire guide, you have a solid overview of the best forex brokers in Arab countries for the year 2026. The platforms we’ve discussed all offer low commission trading, include a wide range of tradable currency pairs, and offer a decent selection of payment methods. Most importantly, they’re all regulated. In conclusion, eToro is our recommended forex broker. All trades are conducted with $1 commissions on stocks, and you can choose from a variety of different forex pairs offered by the platform. The platform provides important educational tools that enable you to make a profit. All you have to do is execute the trade!

CFDs are complex instruments and come with a high risk of losing money rapidly Conclusion

eToro – The Best Comprehensive Forex Broker in the Arab World

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.

Frequently Asked Questions

How do Forex brokers make money?

How do Forex brokers work?

Are Forex brokers regulated?

What are the most traded forex pairs?