أفضل وسطاء الأسهم ومنصات تداول الأسهم في الدول العربية

Are you based in an Arab country and looking to experience stock trading? There are hundreds of licensed stock brokers active in the online trading world, allowing you to buy company shares with the click of a button. The registration process typically takes only a few minutes—all you need to do is open an account, deposit some funds, and finally choose the stocks you want to purchase.

In this guide, we’ll discover the best stock brokers in Arab countries you can trade with. We’ll cover key aspects such as fees, trading costs, available stocks for trading, customer support, platform ease of use, and regulatory status.

Top 6 Stock Brokers in Arab Countries

If you don’t have time to read this entire guide, you can check out our list of the best stock brokers in the Arab world.

- eToro – Copy Trading and Social Trading Broker with $1 Commission

- Alvexo – Trade stocks with a safe and reliable broker

- Quantum AI – A good automated trading platform with no fees

- AvaTrade – A comprehensive suite of trading platforms

- Libertex – Spread-Free CFD Broker

73.81% of CFD accounts lose money.

Best Stock Brokers/Stock Trading Platforms of 2021

With hundreds of stock brokers currently operating in the Gulf and Arab world, finding the best platform among this crowd has become more challenging than ever. For example, a stock trading platform may excel in offering extremely low fees, but it may lag behind in providing access to global markets.

For this reason, we’ve narrowed down our list of recommendations below to the top 5 stock brokers in Arab countries for 2021. All of the platforms selected below are licensed, allow you to deposit into your account using local payment systems, and offer excellent customer service.

1. eToro – The best among all stock brokers in the Arab world

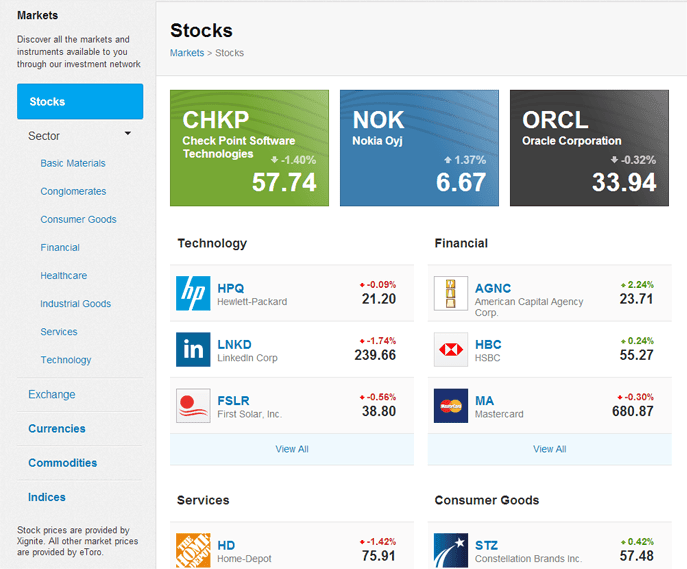

Moving on to trading markets, eToro offers over 2,000 financial markets. This includes stocks of major companies traded in the United States, Europe, and Asia. This diversity provides the ability to buy shares of giant companies, such as Apple, Facebook, and Microsoft, with paying $1 fees. There are also a large number of other stock markets (17 to be exact) covered by eToro—including, but not limited to, Australia, Canada, Sweden, and Germany. And if you plan to invest in financial instruments other than stocks, eToro offers access to investment funds and exchange-traded funds (ETFs).

One of the features we liked most about eToro is its social trading feature. For those unfamiliar with this feature, it allows you to copy the trades of experienced investors, thus earning passive income without any effort on your part. There are no additional fees for engaging in copy trading. Signing up with eToro only takes a few minutes, and you can start by opening an account and then depositing funds at no cost via credit/debit cards, e-wallets, or bank transfer.

The minimum deposit is $200. Given that all eToro funds are denominated in US dollars, you’ll pay a small 0.5% fee when depositing funds for currency conversion. However, the unified trading currency makes it easier to access global stocks without worrying about exchange rate fluctuations. It’s also worth noting that you can deposit up to €2,000 without immediately uploading your ID, so you can start buying your desired stocks in just a few moments.

Last but not least, eToro is regulated by the UK’s Financial Conduct Authority (FCA), which means your funds will remain safe at all times.

eToro Festival:

| Commission | $1 |

| Deposit fees | Free |

| Withdrawal fees | $5 |

| inactivity fees | $10 per month after 12 months of inactivity |

Advantages:

- An online stock broker offering an easy-to-use platform.

- Access to over 2,000 stocks from 17 different exchanges

- Deposit funds using credit/debit cards, e-wallets, or bank account

- Ability to copy other traders' trades

- FCA licensed

Disadvantages:

- Not suitable for advanced traders who prefer to conduct their own technical analysis.

67% of individual investors incur financial losses when trading CFDs on this site.

2. Alvexo - Trade stocks with a safe and reliable broker

Alvexo is registered with the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) in Seychelles. Alvexo offers two trading platforms: MetaTrader 4 and a web-based alternative. The downloadable MT4 platform is widely used among financial traders and is suitable for clients of all experience levels. Alvexo also offers the award-winning WebTrader platform, which requires no download. The web-based option is available on any device with an internet browser, and the interface is user-friendly and easy to navigate.

Alfxo clients can trade in multiple financial markets:

- Forex - Over 58 currency pairs including GBP/USD and EUR/GBP

- Indices - Trade the world's leading indices including the FTSE and DAX

- Stocks - Major stocks available from a range of global companies such as Alibaba, IBM, and Netflix

- Commodities - Brent Oil, Copper, and Natural Gas Trading

- Cryptocurrencies - Trade Bitcoin, Litecoin, Dash, and Ethereum.

Note that only ECN VIP account holders can trade European and US stocks.

Spreads vary depending on the account, but they are competitive compared to other brokers. EUR/USD spreads start at 3.3 pips for Classic accounts and drop to 0.4 pips with the ECN VIP option. Spreads on major indices such as the FTSE 100 start at 3.53 pips for Classic accounts and 0.88 pips for ECN VIP accounts.

Classic, Gold, and Prime members enjoy a commission-free structure. Other costs include an inactivity fee equal to 10 units of the base currency and swap fees on positions held overnight.

Clients can fund trading using credit cards, accepted ones include VISA, MasterCard, American Express, debit cards (VISA Electron, Maestro, CASH-U, V-Pay), e-wallets (QIWI Wallet) or bank transfer.

The minimum deposit depends on the type of account held. For a Classic account, the requirement is $500, for a Gold or ECN account it is $2,500, and for a Prime account it is $10,000. The broker does not charge any deposit or withdrawal fees.

Withdrawals take at least 3-5 business days, and wire transfers may take longer. Alvexo only accepts transactions in US dollars and euros.

Advantages:

- Regulated and reliable broker

- 5 different types of accounts

- Negative balance protection option

Disadvantages:

- Minimum deposit $500

76.57% of CFD accounts lose money.

3. Quantum AI - A good platform for automated online trading with no fees

The platform is software that integrates with a partner broker. This broker is usually the Meta4 trading platform, but it can also be another platform. Its model searches through thousands of different financial assets in just a second, compiling the best investment and trading opportunities for you into a list. From this list, you can choose the investments you want to make. Cool, right?

Quantum AI charges no commissions, nor does it charge any deposit or withdrawal fees. It's a free-to-use platform. The minimum deposit is €220 or more. Registration is very easy, and your account will be ready within minutes after completing registration and identity verification.

This may all sound too good to be true, but it has actually received many good reviews from many people and experts in the field.

Since Quantum AI Trading is available on smartphones and computers, you'll be able to trade anytime, anywhere, and even on the go. You can easily download its app from Google Play.

Your inquiries and questions can be answered by sending an email to the platform's email address. Customer service is available 24 hours a day, 7 days a week.

Is there anything you don't like about Quantum AI? Let's take a look at some of the platform's pros and cons:

Advantages:

- The world's first quantum computer.

- The platform will give you signals about what to invest.

- You can choose investments yourself from a list of all recommended investments.

- Suitable for beginners and investors who do not want to do a lot of research before trading.

- Daily profits up to 60%.

- Customer service is available 24/7.

Disadvantages:

- Disorganized

- Payment can only be made by bank transfer or credit/debit cards.

Your capital is at risk.

4. AvaTrade - Offering a variety of trading platforms

AvaTrade is a global brokerage company licensed in six different countries, providing maximum security and protection for its clients. Perhaps the most important feature of AvaTrade as a stock broker is that it offers a variety of account types and trading platforms.

AvaTrade users have access to spread betting, CFDs, and options, as well as Islamic accounts without interest, catering to a wide range of traders and investors worldwide. They also have access to a variety of trading platforms, including MetaTrader 4 and MetaTrader 5, as well as the company's in-house developed web platform.

AvaTrade offers trading on over 1,250 markets, including stocks from around the world. You can also trade commission-free, and all you pay is the spread and swap fees for overnight trades.

AvaTrade Fees:

| Commission | 0% |

| Deposit fees | Free |

| Withdrawal fees | Free |

| inactivity fees | Yes, $50 after 3 consecutive months without any activity. |

71% of individual investors incur financial losses when trading CFDs on this site. In addition to stocks, Libertex offers CFD trading on exchange-traded funds (ETFs), commodities, forex, and indices. The maximum leverage for stocks is 1:5, but you can get even higher leverage if you open a professional investor account. If you're interested in investing in cryptocurrencies, Libertex offers a wide selection as one of the best Bitcoin trading platforms. Libertex offers its users a range of useful educational tools, including a training course for beginners, detailed blog articles, and regular client webinars. You can also take advantage of a demo account to practice and familiarize yourself with the platform. This broker offers the MT4 platform. Founded in 1997, Libertex is a reliable, licensed broker with a global reputation. The company has won numerous prestigious awards, ensuring you're trading with a trustworthy and respected stock broker. Libertex fees:Advantages:

Disadvantages:

5. Libertex - Spread-Free CFD Broker

Commission

0% -0.5% for stocks

Deposit fees

Free

Withdrawal fees

1 EUR on credit/debit cards, 1% on Neteller, free with Skrill

inactivity fees

10 euros after 180 days

Advantages:

Disadvantages:

Your capital is at risk.

What is an online stock trading broker?

Once you find the stock you want to invest in, all you have to do is specify the number of shares you want to buy, and then the required funds will be deducted from your account balance.

After completing these steps, ownership of the purchased shares will be transferred to you and will remain yours until you decide to sell them. In addition to benefiting from the increase in the share price, you will also receive any dividends the companies you invest in decide to distribute, as the brokerage firm will add them to your account balance.

You can reinvest these dividends in other companies or withdraw them to your bank account, as you wish. With today's technological advancements, there's no longer a need to talk to your stock broker over the phone—all transactions can be completed online.

How do online stock trading platforms work?

Online stock brokers have made the entire investment process easier than ever. The first step is to open an account with your chosen broker to ensure the platform complies with local laws. This usually takes only a few minutes and often requires providing some personal information—such as your full name, home address, date of birth, and contact information.

You will then be asked to upload several pieces of personal identification to confirm your identity. This step is necessary to ensure that no one else is impersonating you. Once you pass the verification process, you will be able to begin depositing funds. Most of the stock trading platforms we recommend allow you to deposit into your account using a Saudi credit/debit card or bank account. Most of these companies also offer the option to deposit funds using an e-wallet such as PayPal.

Once you've funded your account with your stock broker, you can begin trading. With the exception of investing in index funds, you'll need to choose the stocks you want to buy. Once you've identified the companies you intend to invest in, the next step is to choose the number of shares you want to purchase. The good news is that you no longer have to buy 'whole shares'; fractional shares allow you to invest small amounts to purchase a portion of a stock, subject to the minimum trade size on the trading platform.

Stock Broker Fees in Arab Countries: Everything You Need to Know

Like any other company, stock brokers in the Arab world and beyond earn their revenue from the fees you pay. Therefore, regardless of their name, you will pay fees in one form or another. The exact details of the pricing model vary from broker to broker, so determining which broker is best for you will depend on your trading frequency and other personal preferences.

For example, if you plan to buy stocks and hold them for several years, your best option would be eToro as the platform does not charge any commissions.

Currency conversion fees

Most stock brokers in Arab countries charge a 'currency conversion' fee. This fee is typically incurred when attempting to purchase global stocks. For example, if your account is in US dollars, but you want to purchase European stocks traded in euros, this situation will require a conversion fee between different currencies. In this case, the broker will charge you a certain fee for enabling the currency conversion, which is multiplied by the value of the trade order.

Unlike some other brokers, the broker charges a currency conversion fee when you deposit funds into your account, rather than charging this percentage for each stock purchase. With eToro, you pay no fees at all.

Buying shares versus trading CFDs on shares

It is important to be aware of the difference between traditional stock buying platforms and stock trading sites - as there are differences between both types of asset classes.

buy stocks

When we refer to stock buying platforms, we're referring to online brokers that allow you to invest in companies in a traditional way. For example, if you buy 10 shares in Al Rajhi Bank, you actually own shares, and therefore an ownership stake, in the Saudi bank. Therefore, when Al Rajhi Bank decides to distribute dividends, you will receive your due as a shareholder in the company. Purchasing shares through traditional platforms also gives you the right to attend general assembly meetings and participate in other strategic decisions, such as selecting the company's management.

Trading stocks via CFDs

Trading stocks in the form of Contracts for Difference (CFDs) gives you the ability to speculate on the future value of the company you intend to invest in, but without the legal complications of actual ownership. This is ideal for traders seeking short-term gains. Additionally, you have the ability to use leverage in your trades, which multiplies your account balance used to trade stocks by up to 1:5 .

You can also short-sell companies—meaning you'll profit if the share price declines. Trading stock CFDs is also useful for generating profits from small price movements, as fees and commissions are typically minimal and don't impact your profits. However, you won't be entitled to dividends when trading stock CFDs, as you don't actually own the stock.

Will my money be safe with Arab stock trading platforms?

For example, licensed stock brokers in Europe and Asia are required to keep client funds in segregated bank accounts, meaning these firms cannot use your money for their operational activities. Separating your funds from the company's capital means you'll remain safe even if it goes bankrupt or becomes insolvent.

For our part, we assure you that the platforms included in our list of the best stock brokers are indeed licensed by a group of the world's most prestigious regulatory bodies. Reassuring yourself about the safety of your funds is, of course, our top priority!

How to invest in stocks today in Arab countries

After reading all the explanations we’ve provided, it may become somewhat clear to you how to invest in stocks. We’ll provide you with more explanations below regarding practical methods for investing in stocks.

No matter how complex and difficult the process may seem at first, it’s actually quite simple. We’ll explain these four easy steps below. Follow along to learn how to invest in stocks with eToro, the best stock investment platform in Arab countries.

73.81% of CFD accounts lose money.

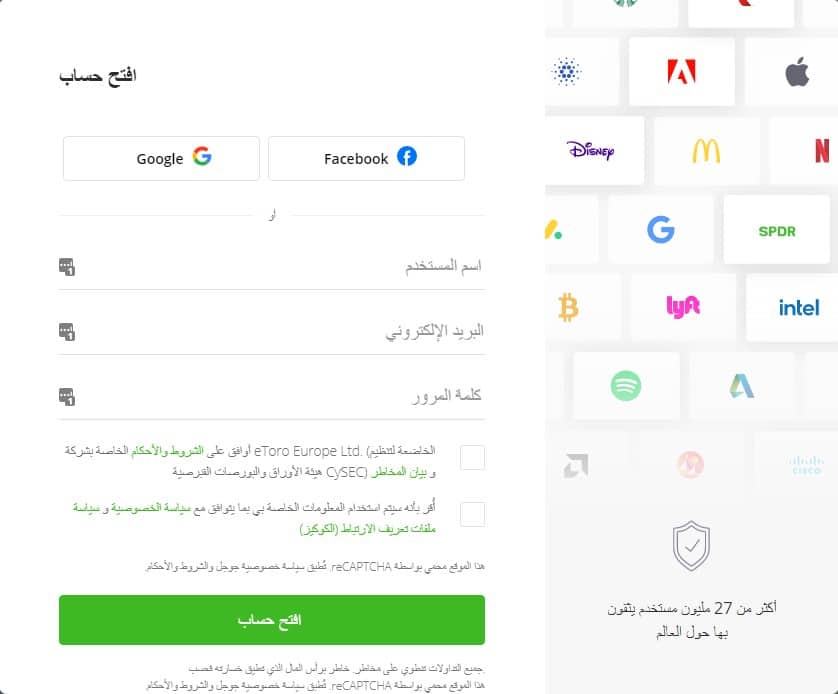

Step 1: Open an account on eToro

Visit the official eToro website to open an account. You’ll be asked to provide some initial personal information before proceeding to the next step: your email address and password, as shown below.

You’ll be able to open an account either on your smartphone by downloading the app, or through a browser on your computer.

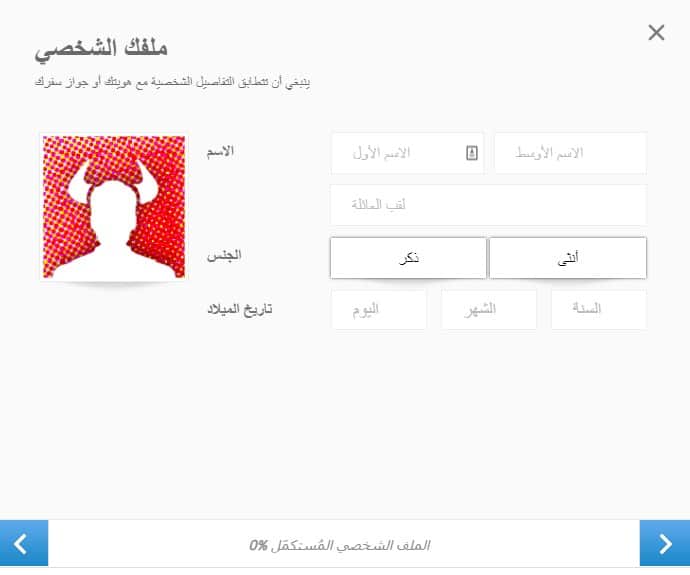

Step 2: Fill out the profile

At this stage, you will need to complete entering a set of information about yourself. This information should be entered in the following order:

- Country of Residence.

- Nationality.

- Date and place of birth.

- Your address and phone number.

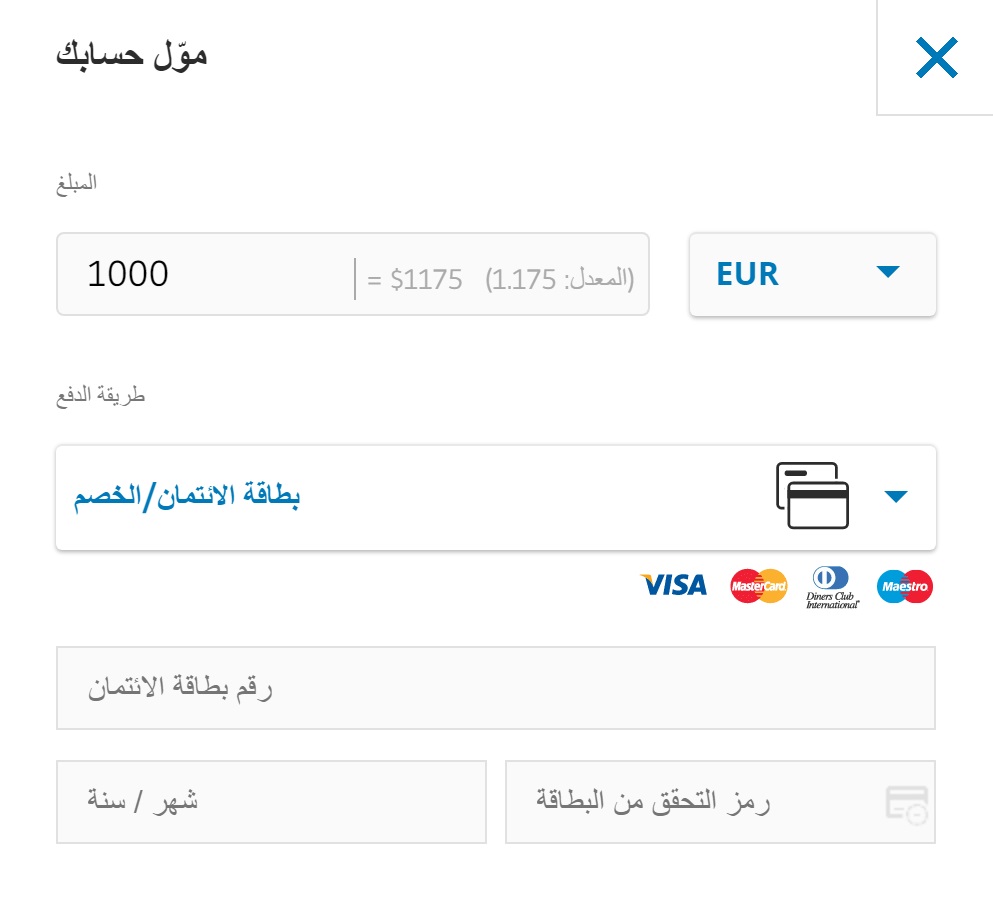

Step 3: Deposit funds

Now comes the stage of depositing funds. It is also worth noting that the minimum deposit is estimated at $50 to $200, depending on the country, and payments are made through

- Direct debit card.

- Credit Card

- Bank transfer

- E-wallets such as Neteller, Skrill, and PayPal.

All payments are made without any fees !

Step 4: Start investing in stocks

After registering with eToro, you’ll be able to invest in stocks seamlessly. All you have to do is search for the stock of the company you want to invest in and click the buy button.

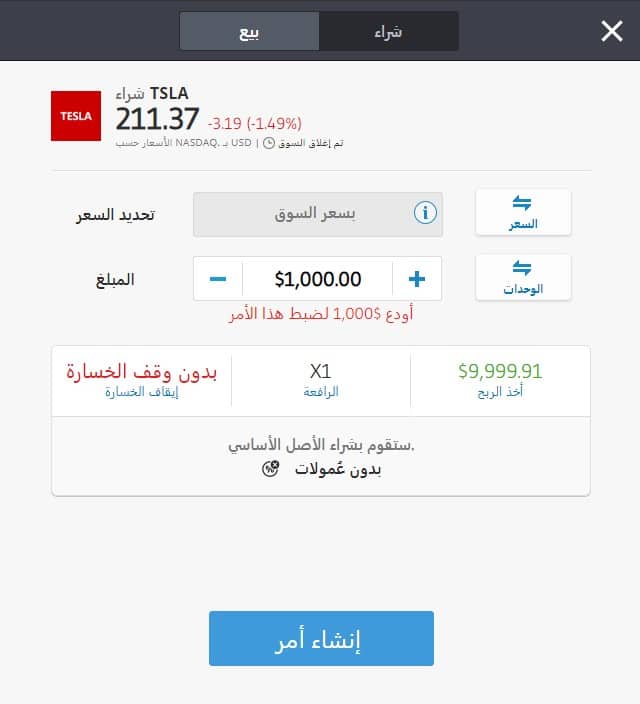

In the screenshot below, we have invested in Tesla shares.

conclusion

Buying and selling stocks in Arab countries, the UAE, Qatar, Bahrain, and Kuwait has never been easier, given the vast number of brokerage firms. The entire process requires simply opening an account, depositing funds, and finally selecting the companies in which to invest. The presence of this large number of stock trading platforms in Arab countries and the wider Arab world has contributed to increased competition, particularly in terms of lower fees.

For example, the top-rated broker on our list, eToro, allows you to buy and sell stocks commission-free. More importantly, you can easily deposit funds using debit/credit cards, bank transfers, or e-wallets like PayPal, meaning you can start buying your first stocks in just minutes.

eToro – The Best Stock Trading Platform in the Arab World

CFDs are complex instruments and come with a high risk of losing money rapidly

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.