أفضل وسطاء العقود مقابل الفروقات CFD في الدول العربية لعام 2026

If you want to actively trade stocks to take advantage of tight spreads, low commissions, leverage, and short-selling capabilities, a specialized CFD broker may be suitable for you. In this guide, we discuss the best CFD brokers for trading stock CFDs. Essentially, each broker meets a set of minimum requirements to ensure you can trade stocks in a safe, convenient, and cost-effective manner.

Comparison of the best CFD brokers in Arab countries

We review the best CFD brokers in more detail further down this page, but if you’re just looking for a quick summary, here’s a list of the best CFD brokers for 2026.

73.81% of CFD accounts lose money.

What are CFDs?

Before we proceed, it’s important to quickly clarify what we mean by “contracts for difference”—not least because you’ll be trading more sophisticated financial products. In their simplest form, CFDs track the actual price of an asset.

This includes not only stocks and securities, but every investment category imaginable, whether it be gold, oil, natural gas, bonds, indices, cryptocurrencies if there is a market, as well as CFDs.

The ease with which CFDs can track the second-to-second price movement of a stock offers a number of benefits to the day trader. For example, you’ll often find that the best CFD brokers allow commission-free trading, as well as highly competitive margins.

Furthermore, and perhaps most relevant, CFDs on stocks can be traded with leverage, and you can also short-sell the company in question. This means you can speculate on the value of the stock falling, something that would not be possible when using traditional stock brokers.

Best CFD Brokers in Arab Countries for 2026

Choosing the right CFD broker for your trading needs is essential. For example, are you looking to trade stocks from a specific exchange or market, or are you more interested in low commissions and tight spreads? Similarly, you may be looking to deposit and withdraw funds using a specific payment method, or you may want access to an advanced trading platform such as MetaTrader 4.

Either way, these are some questions you should ask your CFD broker before signing up, and to help you along the way, we’ve listed the best CFD brokers currently serving Arab clients below.

1- eToro – Best CFD Broker for Arab Countries for Beginners

eToro actually covers both stock investment methods, offering both stock trading services

In terms of tradable markets, eToro’s stock CFD library covers the London Stock Exchange, as well as exchanges in the US, Germany, France, Japan, and many other countries. You can place buy and sell positions on stock CFDs, as well as apply leverage. According to the European Securities and Markets Authority’s limits, this is set at a ratio of 1:5. The trading platform itself is native to eToro and was created with the “novice investor” in mind. While this is ideal if you’re just starting out, it likely won’t be enough if you’re an experienced trader.

Beyond its library of securities, you can also trade CFDs on indices, cryptocurrencies, bonds, and commodities. An additional option you can consider for beginners is the platform’s copy trading feature. When you choose an experienced trader whose profile you like, you can mirror their trades like a byword. When it comes to safety, eToro is licensed by the FCA, CySEC, and ASIC, so you have regulatory oversight on three fronts.

Starting an account takes minutes and can be done online or through the eToro app. Minimum deposits start at $200 (approximately £160), which you can make using a debit/credit card, e-wallet, or bank account. Regardless of the payment method, all deposits come with a 0.5% conversion fee – as eToro is denominated in US dollars. Finally, eToro has a minimum withdrawal limit of $50, with all withdrawals costing $5.

Pros:

- Online broker is very easy to use.

- More than 800 stocks listed in Arab countries and global markets.

- Deposit funds using debit/credit card, e-wallet or bank account in Arab countries.

- Ability to copy other users’ trades.

Cons:

- Not suitable for advanced traders who want to perform technical analysis.

67% of retail investors lose money trading CFDs on this site.

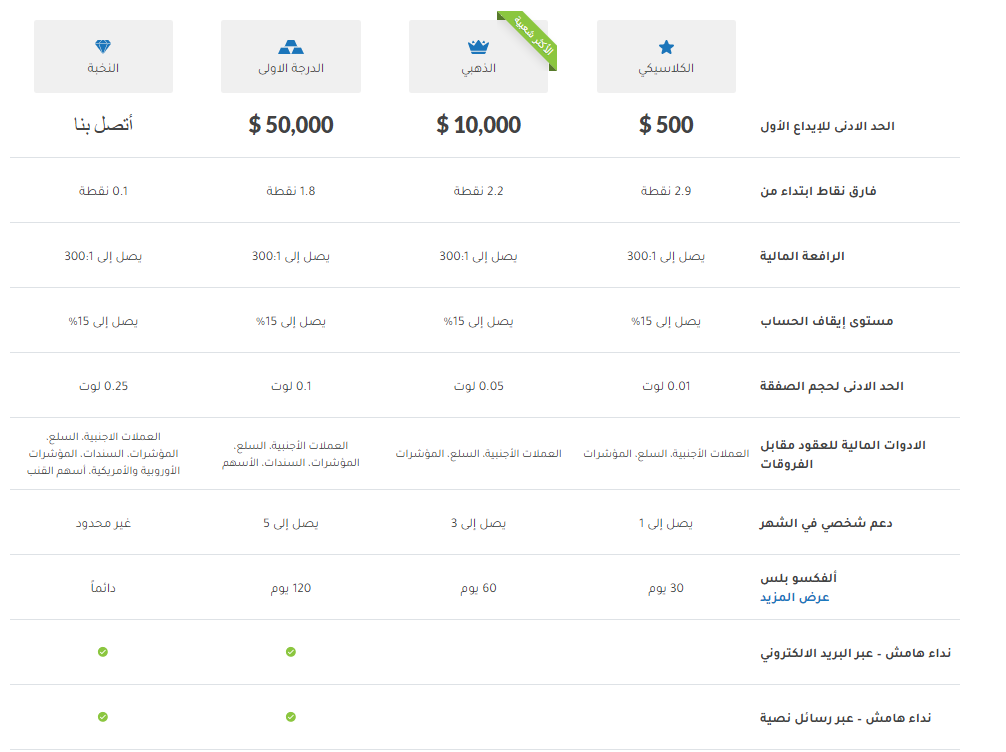

2 – Alvexo – A safe and comprehensive CFD broker in the Arab countries

The first thing that might come to mind after visiting the official Alvexo brokerage website is that it’s a very well-organized platform, and once you access it, you’ll be able to use it smoothly and

Alvexo is another broker that offers CFD trading. You can trade over 450 investment instruments using CFDs without paying any commissions and without any deposit or withdrawal fees. These assets range from a diverse range of stocks and commodities, to numerous other assets such as forex and others.

Don’t forget, before accessing Alvexo, that you can choose from five account types: Classic, Gold, First Class, and Elite. The minimum deposit increases as you move up the account ladder, and the features and services offered also vary. There is a different type of account, which we actually consider to be far superior to all of them in terms of the features it offers. The demo account, which can be opened for free, allows you to make virtual investments that mimic real ones, teaching you how to conduct real trades as if they were real.

To get started with Alvexo, you will be required to make an initial deposit of at least $500 via credit or debit card, bank transfer, or e-wallet.

Pros:

- Regulated by the FSA.

- Suitable for both new and experienced traders.

- Provides a variety of educational tools.

- Low fees and margins.

- Allows investing via mobile application.

- Easy to use.

- Customer support is efficient.

Cons:

- Fixed spread accounts are not available.

76.57% of CFD accounts lose money.

3 - AvaTrade - A popular online trading platform with tight spreads

AvaTrade is a good choice for those of you looking to trade CFD assets via a day trading strategy. This is because the platform offers some of the lowest spreads in the industry. For example, most major forex pairs hosted at AvaTrade can be traded with a spread of less than one pip.

In addition to its ultra-competitive spread structure, AvaTrade allows you to buy and sell CFD instruments on a commission-free basis. In terms of tradable markets, AvaTrade offers thousands of financial assets. In addition to Forex, this includes bonds, stocks, indices, commodities, cryptocurrencies, options, and futures. As such, if there is a market you are interested in, you will likely find it at AvaTrade.

What we also like about AvaTrade is that it offers multiple trading platforms. For example, you can use the AvaTrade platform via your web browser or through an Android/iOS mobile app. Furthermore, the platform also supports MetaTrader 4 and MetaTrader 5, which is great for advanced chart analysis and deploying automated robots, making it one of the best MetaTrader 5 brokers in the Arab world if you want to explore this option. We should also note that AvaTrade offers spread betting. If you are in the Arab world, this means that all profits are exempt from capital gains tax.

If you like the sound of AvaTrade but want to test the platform first, the CFD broker offers a demo account facility. You don't need to deposit any money to use this, which is great for getting a feel for the platform before a financial meltdown. The minimum deposit on the platform is $100, and you can deposit via debit/credit card or bank transfer. Finally, AvaTrade is heavily regulated and licensed in several countries.

Pros:

- Dedicated Forex options trading platform.

- Trade CFDs on stocks, forex and commodities.

- Includes paper trading with MetaTrader 4.

- Over 200 spread betting markets.

- ALL fees included in the spread.

- All trades are commission-free.

Cons:

- Very high inactivity fees.

73.05% of retail investors lose money when trading CFDs on this site.

4 - Libertex - Best CFD Broker for Trading on MT4 (MetaTrader 4 Platform)

Launched in 1997, Libertex is a CFD broker that allows you to trade over

Instead, you'll pay a small trading commission, which will be deducted from your order value. The platform now has over 2.2 million clients worldwide and is regulated by the Cyprus Securities and Exchange Commission. This particular regulatory body is a Tier 1 licensing body based in Cyprus, so you shouldn't have any problems regarding the safety of your funds.

In terms of leverage, this maximum is 1:30 for retail clients and 1:600 if you are considered a professional trader. When it comes to the trading arena, Libertex offers full support for the MetaTrader 4 platform, which means you can automate your CFD trading through a standalone robot or expert advisor. You will also have access to a wide range of technical indicators, and you can customize your trading screen to reflect your personal requirements.

Pros:

- Regulated by the Cyprus Securities and Exchange Commission (CySEC).

- Over two decades in CFD brokerage.

- Most asset classes covered.

- Not widespread.

- Support for debit/credit cards, e-wallets and bank transfers.

- Financial leverage up to 1:30 for retail clients.

Cons:

- Not regulated by the FCA.

- Limit the number of financial instruments to only 213.

83% of retail investors lose money trading CFDs on this site.

How to find the best CFD brokers in Arab countries?

Regardless of which Arab CFD broker you deal with, the end-to-end investment process is largely the same. In other words, you'll always be required to open an account, upload some IDs, deposit funds, and then place buy and sell orders on a do-it-yourself basis. With this in mind, your focus should be on key metrics such as fees, commissions, payment methods, security, and customer support.

Below we discuss these key factors in more detail to ensure you choose a CFD broker that closely matches your needs.

Rules

You will be depositing and trading real-world money, so it is essential to protect your funds. This is why you should only consider an Arab CFD broker if it is licensed and regulated.

Some of the most well-known financial regulatory bodies for the CFD industry include the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). These regulators provide rules that ensure retail clients are protected with segregated accounts and a negative balance protection policy.

Deposits, withdrawals, and payments

You should also visit a CFD broker's website to evaluate the payment methods they support, as this is crucial, as you will be depositing and withdrawing pounds and pence in the real world.

Although the specific payment methods available to you will vary from provider to provider, they may include:

- Debit cards

- credit cards

- Bank account transfer

- PayPal

- Skrill

- Neteller

Once you've evaluated the payment method you'd like to use, check to see if any transaction fees apply. You should also explore how long it typically takes for an Arab CFD broker to process withdrawals, and whether a minimum cashout requirement applies.

Fees, commissions, and spreads

You will need to pay fees to trade CFDs online, so this should also form part of your in-depth research process.

In particular, look for:

- Spread: The spread is the difference between the “bid” and “ask” price of a stock CFD. The best CFD brokers will usually display this as the “buy” and “sell” price, respectively. In either case, you will need to ensure that your chosen platform offers competitive spreads, not least because this will contribute to your overall trading costs. If you can get your stock CFD spreads to less than one pip, you are doing well.

- Trading Commissions : Some, but not all, CFD brokers will charge you a trading commission. For example, IG charges 0.10% when trading CFDs on Arab stocks with a minimum of £10. In other cases, eToro charges no commission at all.

- Overnight Financing : If you plan to trade leveraged stock CFDs, you may need to pay an overnight financing fee. As the name suggests, this is the case if you keep your CFD position open overnight. CFD brokers base this fee on an annual interest rate, which is compounded daily. In most cases, you can view the exact fee before you start your trade.

tradable markets

The best CFD brokers give you unrestricted access to a wealth of exchanges. While some of you may be happy to focus on Arab companies, others prefer a more diversified approach. As such, look to see which markets your CFD broker offers. The likes of eToro and IG cover exchanges from the US, Canada, Germany, France, South Africa, Saudi Arabia, Finland, and more!

Features and Tools

In addition to the basics, we also suggest exploring the trading features and tools offered by your CFD broker.

This may include:

Technical Indicators : If you want your CFD trading endeavors to be successful, you will need to know the ins and outs of how technical indicators work. This will ensure that you have the ability to read and interpret price trends. The best CFD brokers typically offer dozens of technical indicators, but be sure to check them out.

- Mobile Trading : CFDs are typically traded on a short-term basis, meaning that experienced investors often hold a position open for a number of minutes or hours, so they need to be "on their toes" when a new trend comes into fruition. As such, the best CFD brokers will offer a free stock trading app.

- Educational Resources : If you have little or no experience trading CFDs, it's best to stick with a broker that offers educational resources. This can be anything from a selection of how-to guides, video tutorials, and even live webinars.

- Financial Leverage : If you have a higher risk tolerance, the best CFD brokers will typically offer leverage of up to 1:30. This is reduced to 1:5 when trading stocks via CFDs.

- Negative Balance Protection : Although it has now become the norm with CFD brokers, it is best to ensure that the provider has negative balance protection. This means that an unsuccessful leveraged trade will not push your account balance into negative territory. Instead, your position will be closed when your balance reaches zero.

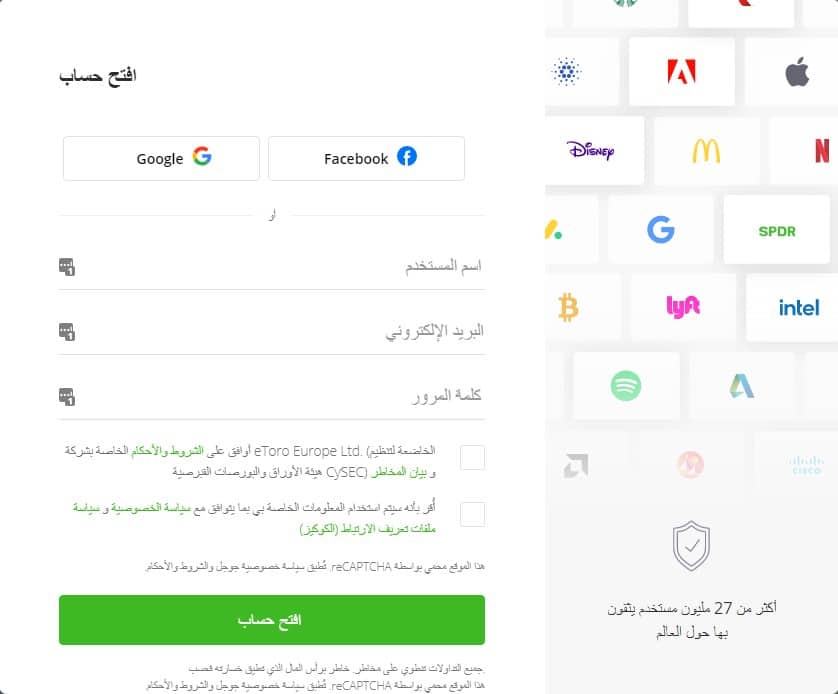

Get started with an Arab CFD broker today - eToro Tour

Are you based in the Arab world and looking to start trading CFDs today? If so, below is a quick step-by-step guide to get you started in minutes. We've based our demo on the popular CFD broker eToro—but feel free to use any platform of your choice!

Step 1: Open an account and upload your ID

First of all, head to the eToro website and choose to open an account. As with all CFD brokers regulated by the Financial Conduct Authority (FCA) or any other regulatory body, you will need to provide some personal information.

73.81% of CFD accounts lose money.

This includes:

- Full name

- home address

- date of birth

- National Insurance Number

- Email address

- Mobile phone number

You will also need to upload some ID in accordance with anti-money laundering laws in Arab countries, including a passport, driver’s license, and a recent utility bill or bank statement.

Step 2: Deposit funds

eToro accepts several payment methods in Arab countries for depositing funds. You can choose from debit/credit card or bank transfer. Minimum deposits start at $20, and all deposits are credited to eToro instantly (except for bank transfers, which take 1-3 business days).

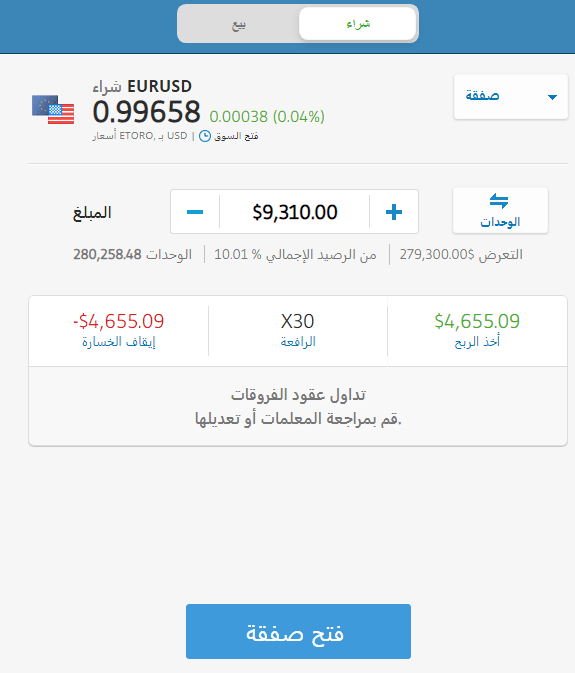

Step 3: Place a CFD trade

Now that your account is verified and funded, you can start trading CFDs immediately.

- Click the “Trade” button.

- Select your preferred CFD asset class (e.g., Forex).

- Click on the asset you wish to trade.

Next, you will be asked to place an order, in our example, we are looking to trade the EUR/USD pair.

- Choose from buy or sell order.

- Enter your class.

- Choose from market or limit order.

- Determine whether you want to apply leverage and at what rate.

- Enter your stop loss price.

- Enter your take profit price.

- Confirm the trade.

73.81% of CFD accounts lose money.

Once your CFD trade is executed on eToro, it will remain active until you manually close the position or your Take Profit/Stop Loss order is triggered.

Finding the best CFD broker for your individual trading needs is imperative, and you need to ensure that your research covers not only the broker’s regulatory standing and reputation, but other metrics such as tradable assets, fees, commissions, spreads, and payouts. If you’re keen to get started today, eToro is popular with Arab investors. You can open an account in minutes, deposit funds instantly using a debit/credit card, and then trade CFDs with the click of a button.

CFDs are complex instruments and come with a high risk of losing money rapidly decision

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.Questions and Answers

Is CFD trading legal in Arab countries?

Do I own the asset when I trade CFDs?

Can I transfer my CFD position to another broker?

Do CFD brokers in the Arab countries accept PayPal?