How to Buy Tesla Shares كيف تشتري أسهم تسلا في الدول العربية

Tesla is no longer just a car company; it’s a brand that has grown to be much bigger. Based in Palo Alto, the company not only produces electric vehicles, but also is an energy storage company that seeks to integrate renewable energy solutions for homes and businesses.

Tesla is also one of the most talked-about companies in the world, so monitoring its stock has become more important, and investing in it has become even more important.

If you’re interested in buying Tesla shares but have no idea where or how to start, this guide is for you. We’ll explain how to buy Tesla shares in the UK and recommend top brokers that offer Tesla shares. We’ll also analyze Tesla’s history and outlook to help you decide whether it’s a good time to buy or sell Tesla shares.

How to Buy Tesla Stock – 2026 Step by Step

To start buying Tesla shares, you need to follow these steps:

Step 1: Find a stock broker in the Arab world that offers Tesla stock.

Tesla is listed on the NASDAQ stock exchange, and its stock symbol is TSLA, meaning you’ll need to find  a certified online broker that allows you to trade US stocks. As Tesla shares are one of the most widely monitored stocks in the markets these days, you’ll find several online stock brokers in Arab countries offering trading in its shares.

a certified online broker that allows you to trade US stocks. As Tesla shares are one of the most widely monitored stocks in the markets these days, you’ll find several online stock brokers in Arab countries offering trading in its shares.

With that in mind, you’ll need to find a licensed broker that not only allows you to buy Tesla stock but also offers low trading commissions and a reliable trading platform. To help you find the right broker for your needs, we’ve listed the best licensed stock brokers operating in Arab countries below.

Evest – Buy Tesla Stock Easily

Evest is a CFD trading platform operating in the GCC region and regulated by the Vanuatu Financial Commission (VFSC).

The registration process is simple, and within minutes, users can start investing in a wide range of instruments—from leading stocks to Bitcoin and even top altcoins. But that’s not all, Evest offers 0% commissions on stock investments!

Evest is a CFD trading platform. CFD stands for Contract for Difference, meaning you’re purchasing a contract that mimics the price of an underlying asset. In other words, you don’t actually own the underlying asset. However, there are several advantages to this, such as the ability to profit, additional security, and not having to manage the assets yourself.

Evest offers mobile and web app versions, and a desktop version compatible with MT5—the most powerful trading app on the market. With this in mind, Evest is a great choice if you’re looking for the best exchanges to buy Tesla stock.

Advantages: Disadvantages:

eToro – Buy Tesla stocks

eToro is one of the most popular online brokers in the Arab world and around the world. Founded

eToro offers investors access to over 800 global stocks from top exchanges, including the US market. You can trade shares of US companies like Amazon, Facebook, Google, and Tesla. One of eToro’s key benefits is that it allows you to buy stocks directly or using CFDs. Since eToro is also a CFD broker, you can use leverage on stock trades of up to 5:1, meaning you can buy a single Tesla share with a 20% margin requirement.

In terms of pricing, eToro is one of the best brokers. eToro also doesn’t charge any management fees or overnight fees when trading stocks.

To purchase Tesla shares on the eToro platform, you need to deposit at least $200. This broker supports several payment methods in Arab countries, including debit/credit cards, Arab bank accounts, and e-wallets such as PayPal. If you’d like to try the platform, you can do so for free with an eToro demo account, which gives you a $100,000 credit balance.

Advantages: Disadvantages:

67% of retail investors lose money trading CFDs on this site.

Alvexo – Invest in Tesla with a secure and comprehensive platform

Founded in 2014, Alvexo has established a reputation among investors seeking a safe, secure, and efficient broker. Alvexo is among

The platform offers a wide variety of stocks, including Tesla, Apple, Amazon, and others. It also offers up to 450 investment instruments across various categories, including 58 currency pairs. You’ll be able to invest in Tesla stocks without paying any commissions, as the platform is commission-free. This is only possible after making an initial deposit of at least $500. You can deposit your funds via bank transfer, e-wallet, or, if you prefer, credit or debit cards.

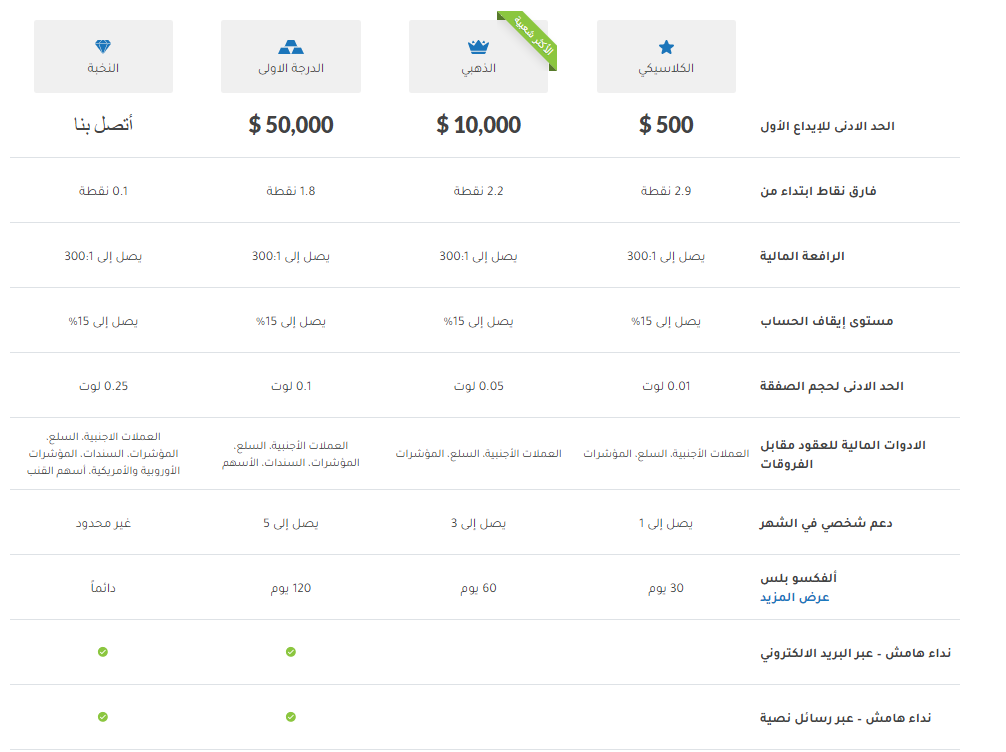

Once you register with the Alvexo platform or app, you’ll be able to choose the account that best suits your needs from four different account types. Starting with Classic, with a minimum deposit of $500, Gold with a minimum deposit of $10,000, First Class with $50,000, and finally Elite. Naturally, the higher the minimum deposit, the more benefits, features, and services Alvexo offers.

With Alvexo, you’ll have access to a valuable and useful set of formative tools. You won’t trade Tesla stocks until you feel fully prepared. The formative tools available will further assist you in this, including market news, blogs, and strategies recommended by experts and leading financial investors

.

Advantages:

Disadvantages:

76.57% of CFD accounts lose money.

AvaTrade – Wide range of trading platforms available

AvaTrade offers a wide range of different trading accounts and trading platforms. You can open a spread betting account, trade CFDs, trade options, and Islamic accounts with no swap fees, as well as trade via the MetaTrader 4 and MetaTrader 5 platforms.

Not only can you trade Tesla’s stock price, but you can also access over 1,250 markets worldwide, including global stocks, currencies, commodities, indices, and more. All of these markets are also available for commission-free trading!

Additionally, AvaTrade is licensed and registered in 6 different jurisdictions, which puts your mind at ease.

AvaTrade Fees:

| Commission | 0% |

| Deposit fees | Free |

| Withdrawal fees | Free |

| Inactivity Fee | Yes, $50 if there is no activity for 3 consecutive months. |

Advantages: Disadvantages:

71% of retail investors lose money trading CFDs on this site.

Libertex – Zero Spread CFD Broker

Libertex is a stock CFD broker with a unique offering. It charges

For stocks, the commission ranges from 0% to 0.5%, depending on the instrument you’re trading. Some account types also offer a 50% commission discount.

Libertex offers Tesla stocks and other popular stocks in the cannabis, electric vehicle, and other sectors. Additionally, they have a wide range of cryptocurrencies that you can trade.

This broker offers some useful educational tools, including courses, a blog, and several webinars. You can also trade via the globally recognized MetaTrader 4 platform, as well as the broker’s feature-rich web platform.

You can trade with Libertex with peace of mind as it is registered and licensed by the Cyprus Securities and Exchange Commission (CySEC).

Libertex fees:

| Commission | 0% – 0.5% on stocks |

| Deposit fees | Free |

| Withdrawal fees | 1 EUR on credit/debit card, 1% on Neteller, free on Skrill |

| Inactivity Fee | 10 euros after 180 days |

Advantages: Disadvantages:

Your capital is at risk.

Step 2: Research Tesla stock

Tesla shares have continued their meteoric rise over the past few years, which means you should buy Tesla shares now. Tesla is growing rapidly, but at the same time, some analysts and investors believe the stock is overvalued. To make an informed decision, it’s important to do thorough research before making any investment.

Below, we’ll explain all the basics you need to know about the company, including Tesla’s history, its stock price performance, and the company’s future prospects.

How much is Tesla stock worth? Tesla stock price history

Tesla was founded in 2003 by a group of engineers shortly after General Motors discontinued production of its first electric car. The company manufactures electric vehicles that use clean energy, produces battery energy storage from home to grid, and produces solar energy products such as solar panels.

Tesla CEO Elon Musk joined the company in 2004 after investing $6.3 million in Tesla shares during a Series A round. The company subsequently went public in June 2010, raising $226 million in the IPO when it offered 13.3 million shares at $17 each.

Since then, Tesla’s stock price has seen a dramatic increase, reaching an all-time high of $900 per share in early 2021. On August 11, 2020, Tesla announced a five-for-one stock split, which was implemented on August 31. For those unfamiliar with the term, a stock split is a decision by a company’s board of directors to increase the number of shares by issuing more shares at a lower price.

Between August 11 and August 31, Tesla’s stock price rose 81%, but on September 8, the stock pared some of its gains after Tesla fell 21%, marking the worst single-day loss in the company’s history. The stock then continued to rise, reaching a record high by the end of the year. Keep in mind that Tesla’s stock split doesn’t change much, but it can be somewhat confusing. The company’s earnings per share calculations change based on the new stock price, and you may need to adjust the new prices for pre-split figures. For example, looking at Tesla’s full-period chart, the stock price on IPO day was $3.84, which was adjusted for a 5-1 split.

Information about Tesla’s dividend distribution

Tesla has never announced dividend payments to shareholders. The company is transparent about its intentions, stating on its official website that it does not expect to pay any dividends in the near future due to its intention to continue the company’s growth momentum.

Should I buy Tesla shares?

Many people have high hopes for Tesla’s advanced technology and innovative vision. It’s clear that Tesla investors are looking beyond the immediate future, and some even see strong similarities between the company and Apple.

Whether or not it’s a bubble is still up for debate, but there are certainly some key factors that give Tesla the competitive advantage it has achieved so far.

First and foremost, the company is a major global producer of electric vehicles. Last year, Tesla became the world’s largest electric vehicle manufacturer in terms of sales, surpassing BYD in China. Globally, Tesla delivered between 367,000 and 368,000 electric vehicles in 2019.

Another huge factor to consider when analyzing Tesla is the data it collects. Tesla’s electric vehicles are constantly recording and collecting data, using cameras and other driving tools to store as much data as possible while driving. This data holds immense value when evaluated, and according to McKinsey & Company, it will be worth $750 billion annually by 2030.

Finally, Tesla doesn’t just sell electric cars. Tesla’s Supercharging stations are the fastest and most efficient way to charge electric vehicles on the market, and the new battery packs will last between 300,000 and 500,000 miles. Furthermore, Tesla produces solar roof products in addition to a wide range of solar panels.

Step 3: Open an account and deposit money

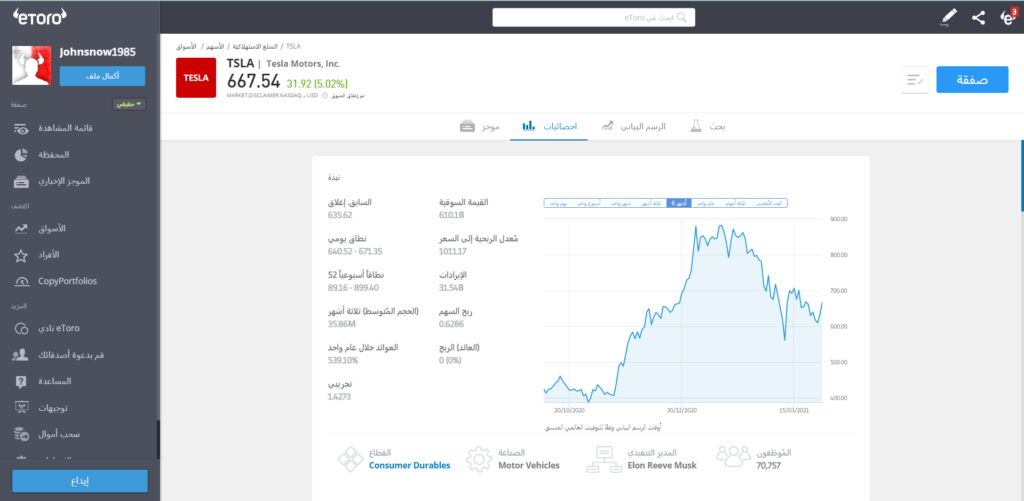

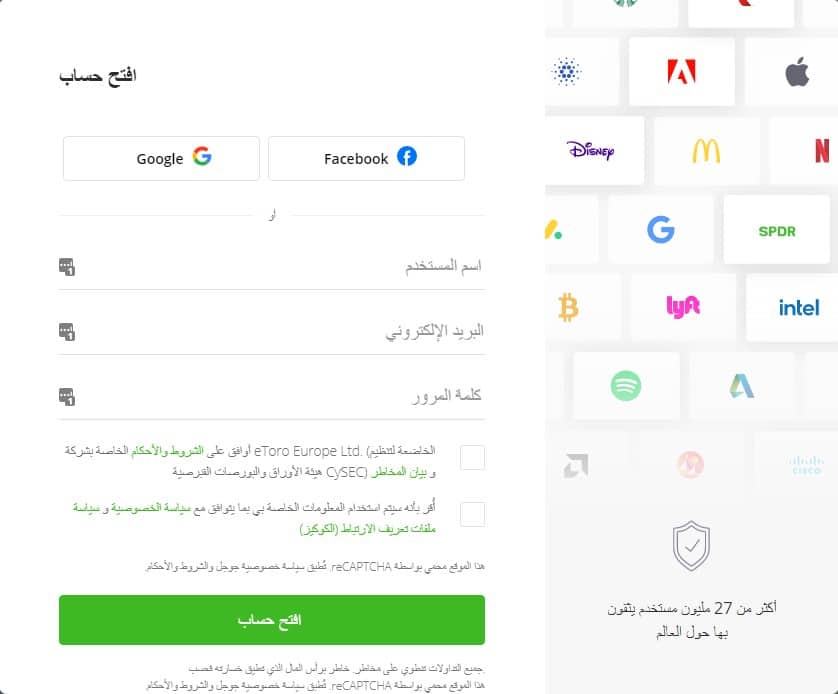

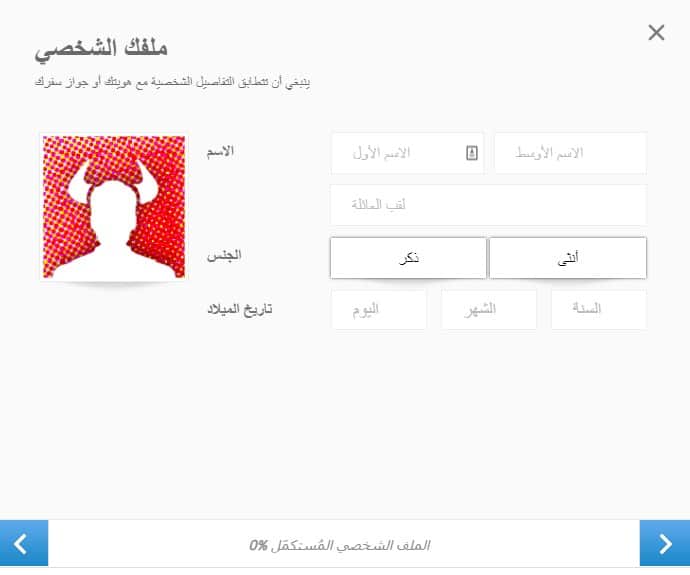

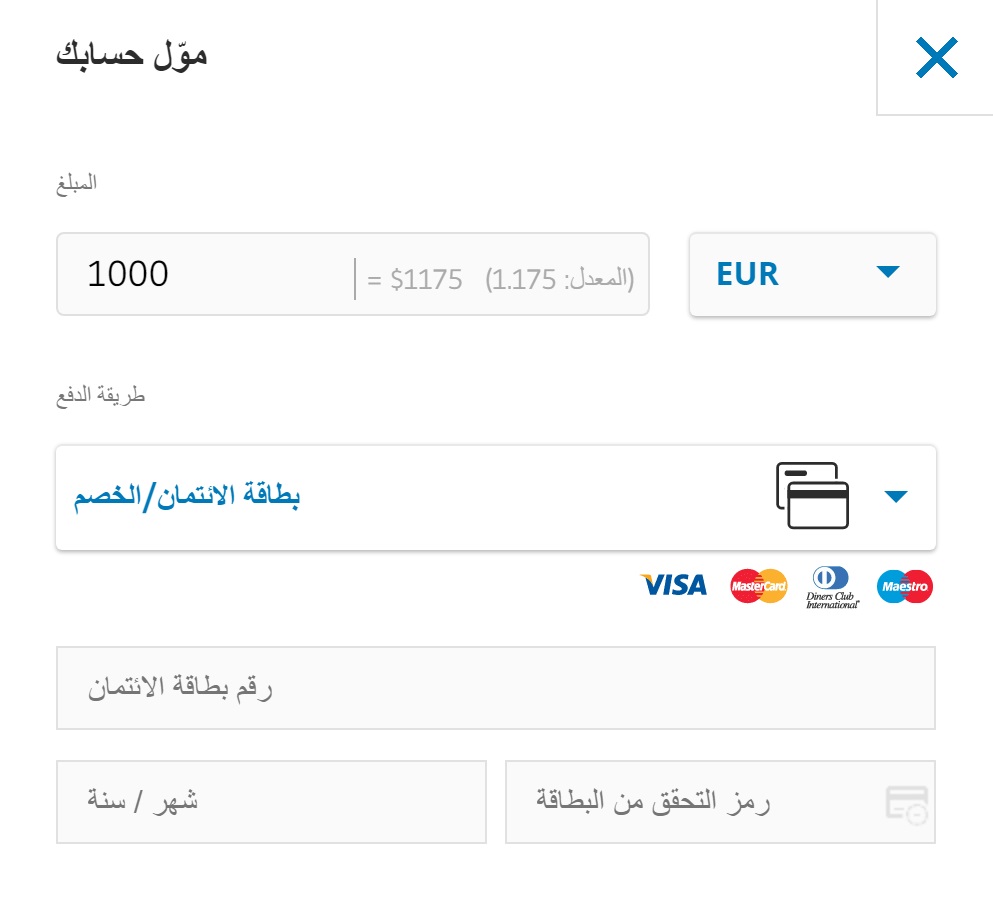

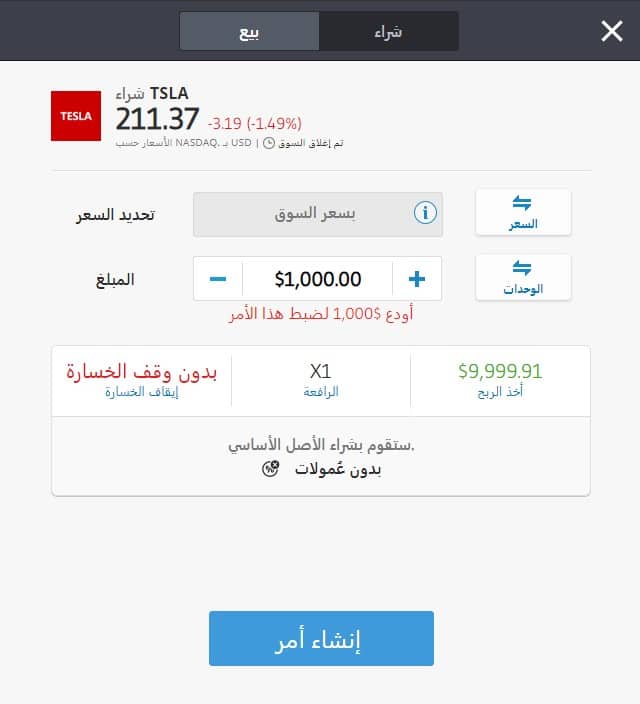

If you’re ready to buy Tesla shares in the Arab world, you’ll first need to open an online trading account with a brokerage firm. To help you get started, we’ll walk you through how to do this with our recommended broker, eToro . To create an online trading account with eToro , you will need to visit the broker’s homepage. This will show you the registration form above where you will need to enter your username, email address, and a valid password. In the next step, as shown below, you’ll be asked to verify your identity by entering some information and uploading a copy of your driver’s license or passport, as well as a utility bill or bank statement from an Arab country. You must do this because eToro is regulated by regulatory bodies, most notably the FCA. Once your account is approved, you can deposit funds into your account. As an Arab resident, you’ll meet the minimum deposit requirements, which range from $50 to $200 depending on the country you’re in, to get started with eToro . You can make a deposit using one of the payment methods eToro offers : Now that your account has been funded and approved, you’re ready to buy Tesla shares. In the eToro search box , enter Tesla in the search box at the top of the screen and click Trade on the first result that appears. eToro will take you to the Tesla stock page. On this page, you can find useful information about the stock and the company, including news, statistics, an interactive chart, and research tools. Once you’re ready to place a buy order, go to the “Invest” button and click it. You’ll then be asked to enter the amount you want to invest in Tesla stock. In 2020, Tesla’s stock rose more than 743%. However, even after this astonishing rise, analysts still believe Tesla’s bullish momentum remains despite the COVID-19 pandemic and market turmoil. However, Tesla’s short interest stands at 22% at the time of writing, making it the first company ever to have a $20 billion short bet against it. This phenomenon is called selling pressure, and refers to the total number of open short positions for a financial asset. As such, the battle between buyers and sellers can intensify, and a small correction can lead to a significant decline in value. Tesla is actually a risky stock, and perhaps overvalued at its current price of around $660.00. The split created a surge in demand for Tesla shares, as investors received a five-to-one equity ratio, and the stock improved in the S&P 500. So far this year, Tesla shares have fallen from their all-time high of $900.00 to around $660.00 by the end of the first quarter of 2021. Tesla is unlike any other company; it’s one of the most popular stocks among retail investors. While Tesla shares may fluctuate over the course of a few days, they are more of a buy than a sell in the long term. The easiest way to sell Tesla stock is to use a premium stock trading account that offers CFDs, such as eToro . To do so, you’ll need to sign up for a free online trading account, log in to your trading dashboard, select Tesla stock, and place a sell order. This means that when the market declines, you benefit from a drop in the share price. This is the great aspect of trading Tesla CFDs, which are derivatives of the Tesla share price. Fortunately, with eToro you can trade Tesla CFDs, all 100% commission-free!

Step 4: Buy Tesla Shares

Buy or sell Tesla shares?

How to sell Tesla shares

In short, Tesla investors’ expectations will become clearer in the coming days and weeks. Tesla has significant room for growth, both in terms of profitability and its stock price. Clearly, a number of analysts view the recent decline as an investment opportunity. One thing is for sure: Tesla is highly volatile and unpredictable, so if you don’t handle volatility very well, it’s probably not the right investment for you. On the other hand, some say that investing in Tesla is the most “buy it and forget it” investment currently on the market and one of the best stocks for long-term investors. Simply click the link below to get started!

CFDs are complex instruments and come with a high risk of losing money rapidly Final Opinion

eToro — Buy Tesla Shares The best broker to buy Tesla shares in the Arab countries

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.

Frequently Asked Questions

On which stock exchange is Tesla stock listed?

Does Tesla pay dividends?

What is the minimum purchase price for Tesla shares??

Is Tesla a constituent of a stock index?