كيف تشتري سهم أمازون في الدول العربية!

The vast majority of large-cap stocks suffered heavy losses during the COVID-19 crisis, but Amazon was one of the few to escape the pandemic’s negative effects. On the contrary, Amazon emerged stronger, with its shares posting record gains. If you want to buy Amazon shares as a personal investment, you’ll need to open a stock trading account with a broker in the Arab world, which will give you access to the NASDAQ stock exchange in the United States.

In this article, we explain how you can buy stocks online while residing in an Arab country. This guide covers the steps required to purchase Amazon stocks in the fastest, safest, and most cost-effective way possible. We also recommend the best stock brokers you can work with.

How to Buy Amazon Stock – 2026 Step by Step

To start buying Amazon shares, you need to follow these steps:

- 1 – ( eToro ) Find a Saudi stock broker that offers trading on Amazon stock

- 2- Conduct research on Amazon stocks.

- 3- Open an account and deposit money

- 4- Buy Amazon shares

73.81% of CFD accounts lose money.

Step 1: Find a stock broker in the Arab world that offers trading in Amazon stock.

Amazon is one of the largest companies in the world by market capitalization, so

On the contrary, you will need to spend some time considering the types of commissions and fees a trading platform charges, what local payment methods it supports, and most importantly, the strength of its regulatory status and operating licenses.

Taking all these factors into consideration, we can recommend a group of the best stock brokers you can work with to buy Amazon shares online.

1. eToro – A leading social trading broker

eToro is a market-leading brokerage firm offering clients the opportunity to trade over 800

eToro is known for being a social trading platform, which means you can engage with other members within the company’s supported trading community. eToro also offers innovative copy trading tools, allowing you to copy entire portfolio components of top-performing traders!

The minimum deposit starts at $200. However, eToro doesn’t require you to purchase the entire Amazon stock, as it’s currently priced at over $3,000 per share. Instead, you can invest any amount starting at $50, effectively purchasing a ‘fraction’ of Amazon stock.

Moving on to the safety of your funds, eToro is licensed by the UK FCA, as well as Australia’s ASIC and Cyprus’ CySEC, ensuring your funds are completely safe thanks to this three-pronged regulatory protection. Another advantage of eToro is that it offers a great stock trading app that you can use to buy Amazon stocks on your mobile device.

Advantages:

- An online stock broker offering an easy-to-use platform.

- +800 shares listed on Arab and international markets

- Buying stocks or trading CFDs

- Tools for social trading and copy trading

- PayPal accepted

- Mobile trading application

- Holds a UK FCA license

Disadvantages:

- Not suitable for advanced traders who prefer to conduct their own technical analysis.

67% of retail investor accounts lose money when trading CFDs with this provider.

2. Alvexo - Invest in Amazon with a good and secure comprehensive platform

Amazon, like other leading and large stocks, requires a set of unique conditions to be optimally invested in. Therefore, the first thing you should consider

Alvexo is regulated by two licenses: CySEC and the Financial Services Authority (FSA) under the Financial Services Authority Act of 2013. These licenses require the platform to comply with a set of provisions requiring it to segregate its own funds from those of its clients. This ensures a smooth and 100% secure investment in Amazon stocks.

If you want to invest in other assets and diversify your stock portfolio, you can do so with Alvexo, which offers more than 450 diverse investment instruments, ranging from stocks to forex pairs. Commission-free trading is available, with standard leverage of up to 300:1. You can also open any account you wish from four different account types.

For a successful investment in Amazon stocks, Alvexo offers you a platform. Its advanced technology gives you quick access to the markets, along with a comprehensive suite of daily signals, market news, and a trading academy. All this helps you make wiser and more intelligent decisions, avoiding mistakes caused by randomness and lack of training. The minimum deposit with the Alvexo platform or app is no less than $500. Deposit options are diverse, ranging from bank transfers, electronic cards, and e-wallets.

Advantages:

- Possibility to open a demo account for virtual training.

- Possibility of trading through the application at any time and place.

- Hundreds of stocks are available for trading with the app.

- Commission free and no fees related to deposit and withdrawal.

- Diverse investment categories (more than 450 investment instruments).

- Safe and licensed platform.

- Customer support is available to answer any questions.

Disadvantages:

- Large minimum deposit.

76.57% of CFD accounts lose money.

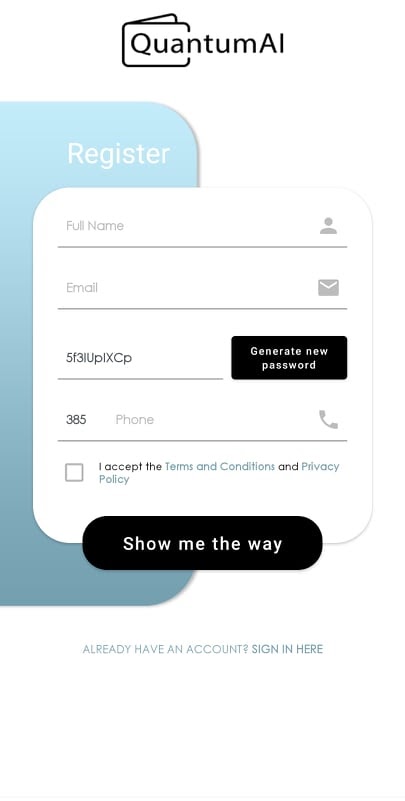

3. Quantum AI - Invest in Amazon with the world's first quantum computer

Quantum AI is a quantum machine powered by artificial intelligence. Its advanced software scans and analyzes the market to provide you with the best and most

Quantum AI is not a broker per se, but rather a highly advanced quantum machine, the world's leading provider of quantitative analysis. It partners with several regulated brokers, although all trading takes place directly on its platform or app. Quantum AI performs the necessary market price analysis for partner brokers. Since all of its partner brokers are regulated, your Amazon investment with Quantum AI is highly secure. You can also take advantage of features such as "stop loss," which allows you to automatically sell purchased Amazon shares when they reach a maximum price you set.

With Quantum AI, you won't be required to pay any withdrawal or deposit fees when investing in Amazon. It also doesn't impose any account inactivity fees. Furthermore, it's suitable for all types of clients, whether beginners or experts. If you have any questions or encounter a technical glitch at any time, simply contact the platform's customer support, which is available 24/7. We conducted a series of research to confirm the platform's effectiveness and found a number of positive reviews, which have led to a 96% rating on Coin Insider and a 4.3-star rating.

The Quantum AI software is available on your computer, accessible through any browser, and also on your iOS or Android smartphone. By downloading the Quantum AI app, you'll be able to trade Amazon stocks from the comfort of your home, at work, on the go, or anytime and anywhere you choose. You'll also be better informed about the constantly changing and unpredictable changes in market prices, which can be difficult to track conveniently when investing through the official website, which requires your computer to be with you at all times.

In addition to global stocks such as Amazon, Quantum AI offers a wide range of global stocks for trading, including forex, indices, cryptocurrencies, and commodities. Don't forget that you can use the demo account feature, which provides you with sufficient training to gain a deeper understanding of the markets, which may currently seem murky. This, of course, comes after conducting all the necessary research on Amazon stock and its value over the past days, weeks, months, and years.

Quantum AI requires a minimum deposit of €220, and deposits and withdrawals can be made via credit or debit card or bank transfer.

Advantages:

- Easy to use app and platform.

- Completely free commission and fees.

- It has received a number of positive reviews.

- Giving you recommendations on the best investment opportunities.

- Regulated partners.

- Free to use.

- Daily profit margin may reach up to 60%.

Disadvantages:

- CFDs only.

71% of retail investors lose money trading CFDs on this site

4. AvaTrade - A variety of trading platforms

AvaTrade offers its users access to a variety of account types and trading platforms, including spread betting, options trading, CFD trading, and swap-free Islamic accounts, all available on the MetaTrader 4 and MetaTrader 5 platforms.

In addition to the opportunity to trade CFDs on Amazon shares through AvaTrade, you also have access to over 1,250 global markets including stocks, indices, commodities, forex, and cryptocurrencies.

Best of all, you'll trade commission-free with a brokerage firm licensed in six different countries!

AvaTrade Festival:

| Commission | 0% |

| Deposit fees | Free |

| Withdrawal fees | Free |

| inactivity fees | Yes, $50 after 3 consecutive months without any activity. |

Advantages:

- Licensed in six different countries

- MetaTrader 4 and MetaTrader 5 platforms available

- Trade in over 1,250 markets from around the world

- 0% commissions, with costs limited to spread and swap.

- Access to over 1,250 markets from around the world

- There are no fees for deposit and withdrawal.

Disadvantages:

- inactivity fees

71% of individual investors incur financial losses when trading CFDs on this site.

5. Libertex - Best Stock CFD Broker with Zero Spreads

Libertex offers unique trading offers. Instead of charging a spread on trades, the company charges

You can also trade CFDs on Amazon stock with Libertex, as well as access many other stocks, as well as forex pairs, indices, and cryptocurrencies. Libertex's cryptocurrency products are also impressive, offering a wide range of these digital assets.

Furthermore, the company offers trading in shares of many major companies in highly popular sectors, such as medical cannabis stocks, especially since many other brokers prefer to avoid these emerging sectors. When trading stocks with Libertex, commissions range from 0% to 0.5%, but you can receive a discount of up to 50% on certain account types.

The Libertex platform boasts a wealth of functional capabilities, along with ease and intuitiveness, as well as numerous excellent research and educational resources. Traders can invest their funds with Libertex without any concerns about their safety, as the company is licensed by the Cyprus Securities and Exchange Commission (CySEC).

Libertex fees:

| Commission | 0% -0.5% for stocks |

| Deposit fees | Free |

| Withdrawal fees | 1 EUR on credit/debit cards, 1% on Neteller, free with Skrill |

| inactivity fees | 10 euros after 180 days |

Advantages:

- Zero-spread trading!

- Trade multiple asset classes

- Trade with a 50% discount on commissions

- Easy-to-use web browser trading platform

- MetaTrader 4 platform provides

- Distinctive educational resources

Disadvantages:

- Only offers CFD trading

Your capital is at risk.

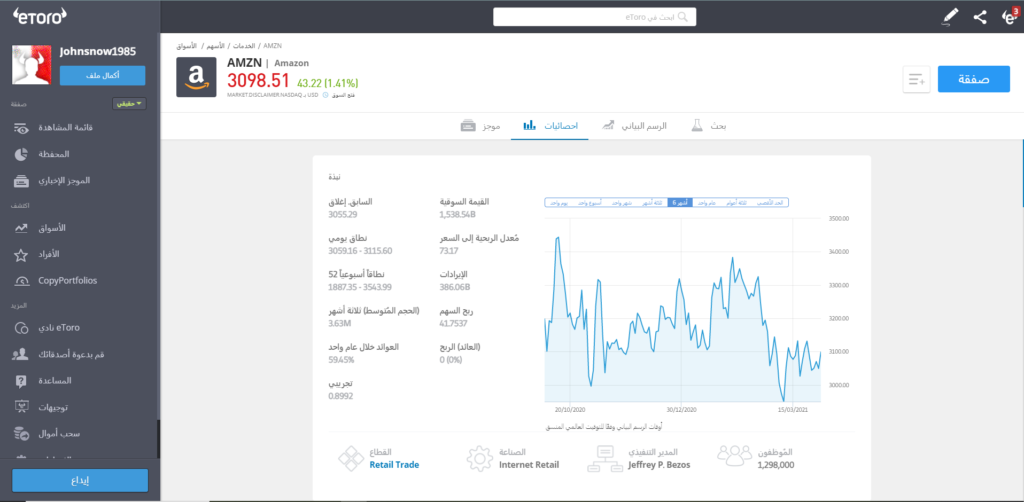

Step 2: Research Amazon stocks

Although Amazon has rewarded its shareholders with lucrative gains over the past decade, it's still essential to conduct your own research to determine the worth of your investment. In this part of our comprehensive guide, we outline some important factors to consider before purchasing Amazon stock.

Amazon stock price history

Amazon began its journey with Jeff Bezos in 1994 as an online bookstore. The company later expanded into other online retail sectors, such as CDs, consumer goods, and more. Just three years after its founding, Amazon made the strategic decision to go public. It chose to list on the NASDAQ stock exchange, which is heavily weighted toward technology stocks. The stock was priced at $18 during the initial public offering (IPO). At that price, Amazon's market capitalization was just under $500 million.

The company then embarked on an exciting and challenging journey in the following years, initially benefiting from the internet boom, known as the dot-com bubble. However, when the bubble burst, Amazon suffered, like other companies whose business model relied on the spread of the internet. In fact, it took Amazon nearly 14 years for its stock price to recover its losses and return to pre-crisis levels.

But since that moment, Amazon's stock has been on an upward trajectory that has not stopped, bringing enormous wealth to the company's shareholders. As of this writing, in early 2021, Amazon's stock price is trading above $3,100, which translates the stock's gains since its initial public offering price into a return on investment of more than 16,000%. What's more, this return may actually be even higher than that astonishing percentage, considering that Amazon's stock has been split several times during its more than quarter-century on the Nasdaq.

To simplify things, if we assume you invested 1,000 Saudi riyals in Amazon in 1997, your assets in the company would be worth more than 1.2 million riyals at today's prices. To put things in perspective, let me remind you that Amazon's current market capitalization exceeds $1.44 trillion. And it doesn't stop there, as its CEO, Jeff Bezos, currently ranks first on the list of the world's richest people with a fortune exceeding $ 177 billion .

Information about Amazon dividends

Despite this successful journey, as well as the fact that Amazon is now one of the largest, most successful, and most profitable companies in the world, you may be surprised to learn that the company has not distributed a single cent of its dividends since its inception. This seems somewhat strange, given the financial strength of a company of this size.

Despite its massive profits last year, Amazon reaffirmed its continued policy of reinvesting profits to grow the business. This strategy has already yielded significant results, diversifying the company's business portfolio and entering numerous sectors capable of generating significant cash flows. Examples of new areas Amazon has explored include artificial intelligence, cloud computing, and digital streaming.

Will I make a profit from buying Amazon stock?

Still unsure about investing in Amazon stock? Despite the remarkable success

The stock is trading below its all-time high.

Long-term traders are likely now chasing Amazon stock for several reasons, not least of which is the stock's continued upward trend. Most importantly, Amazon stock is currently trading below its all-time high reached in August 2020.

This is especially interesting when you consider the impact the COVID-19 pandemic has had on stock markets as a whole—many blue-chip companies have seen their market capitalizations drop by 30 to 50%. Ultimately, there's no reason to believe Amazon's success will stop anytime soon, so it will be interesting to see how far the stock goes over the next 6 to 12 months.

Retail sales continue to boom compared to last year.

When you think about Amazon's stock gains over the past few years, you might be tempted to compare it to the phenomenal rise of other stocks, such as Tesla, which has seen its value double in just a few months. However, it's important to remember that Amazon and its core business model, based on online retailing, have held a solid footing since 1994.

Despite this long history and the company's remarkable success, Amazon's retail sales continue to grow at rates typically seen only by successful startups. For example, Amazon's sales increased by 19% in 2020 compared to the previous year, and 2021 is expected to grow at a rate not far below that figure.

Amazon's customer loyalty is key to its success.

Customer loyalty is undoubtedly a crucial factor for Amazon if it wants to maintain its position at the top of the online retail industry. It's safe to say that Amazon has been successful in this endeavor so far, as evidenced by its Prime membership numbers. For example, a recent survey showed that 24% of Prime subscribers intend to increase their spending on Amazon this year.

A Bank of America study also showed that 67% of Prime members are either unlikely or extremely unlikely to cancel their premium membership plan. Although 6% said they plan to cancel their Prime membership this year, this number is actually 2% lower than in the same study conducted last year.

Unprecedented diversification

Despite Amazon's unprecedented online retail boom, it's important to remember that the company also has diverse revenue streams thanks to its involvement in numerous innovative projects. For example, Amazon recently entered the online grocery sector. Amazon intends to further strengthen its hold on this sector by expanding its ultra-fast half-hour delivery service to a greater number of Prime customers. Furthermore, it has also waived its $15 monthly fee for most Prime members. Analysts believe this move will increase the number of Prime subscribers.

We also have Amazon Web Services (AWS), which is expected to generate over $45 billion in revenue in 2021. This figure is significantly larger than the combined revenue generated by Google and Microsoft's cloud computing services. Amazon is also increasing its exposure to artificial intelligence and drone delivery, areas of interest that could generate a revenue boom in the coming years.

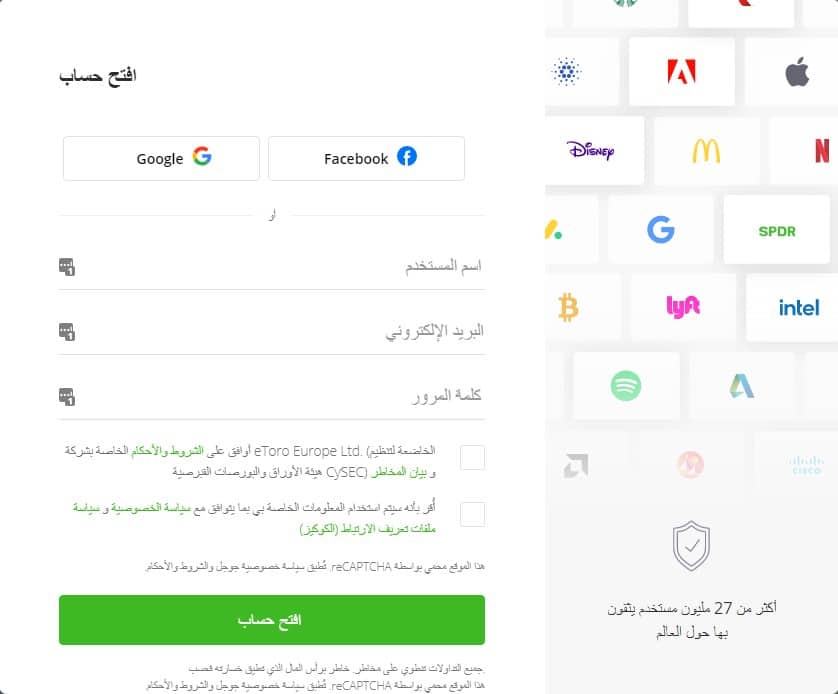

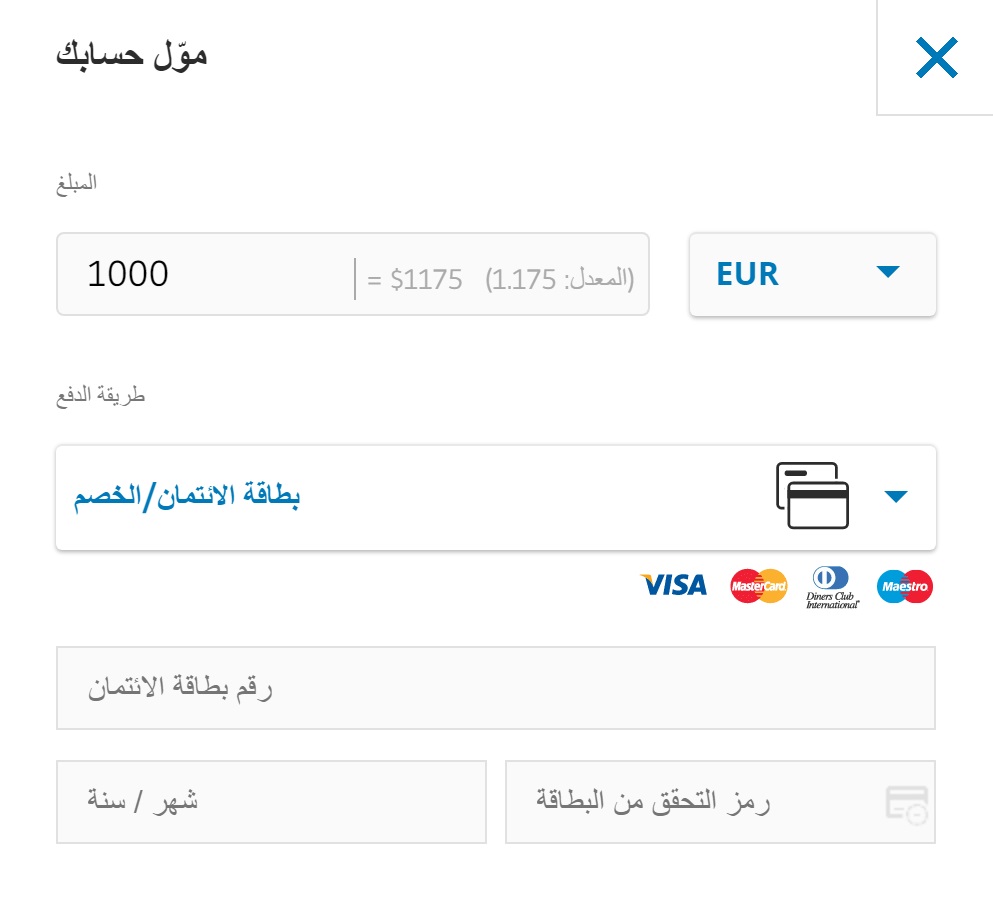

Step 3: Open an account and deposit funds.

Now that you have a solid background on Amazon, you’re ready to take the next step. Accordingly, the following lines will walk you through the steps for buying Amazon shares online as an Arab resident. Although there are a large number of brokers to choose from, we thought it would be helpful to explain how to invest in stocks via the eToro platform .

This is because eToro is licensed by the FCA and CySec: Cyprus Securities and Exchange Commission. The company also allows you to buy Amazon shares, as well as the ability to deposit funds instantly using credit/debit cards or bank transfer.

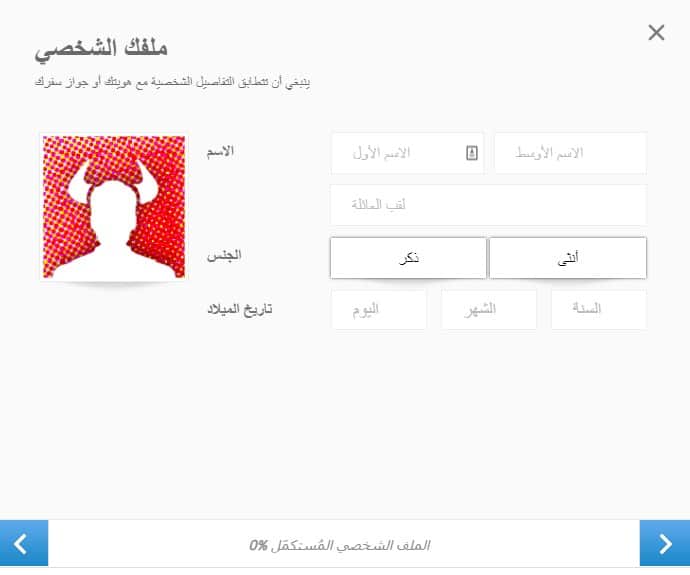

The first step you should take is to visit the eToro website or app and open an account.

Next, you will need to provide some personal information, such as your full name, email address, and a valid password.

You will also be required to complete the identity verification steps outlined below and verify your residential address. This process must be completed before any withdrawals can be made. Therefore, we recommend uploading the required documents now to avoid any delays if you wish to withdraw your funds.

This includes the following documents:

- Passport or driver’s license

- A recent utility bill or bank statement

eToro requires a minimum initial deposit of $20 (about 75 Saudi Riyals).

As for the supported payment methods, eToro accepts the following options:

- credit cards

- Debit cards

- Bank transfer

Once the deposit is confirmed, the funds will be added to your account immediately.

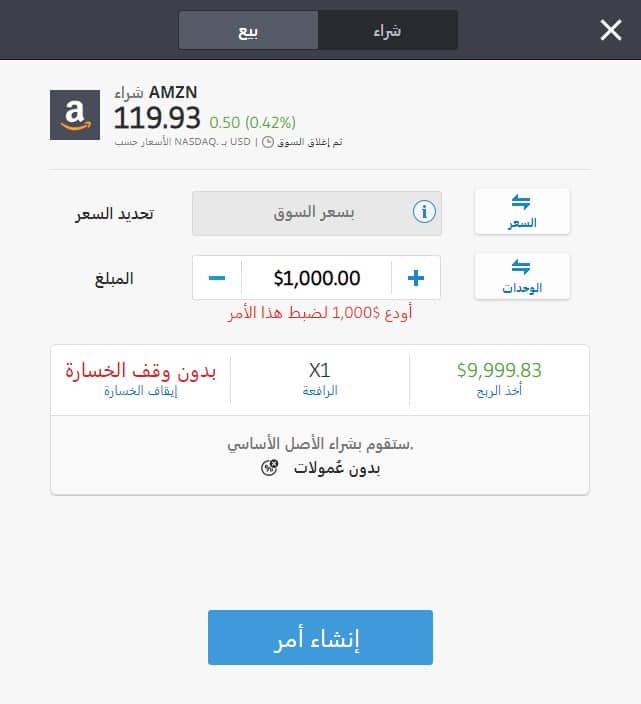

Step 4: Buy Amazon shares

Now that you’ve funded your account, you’re ready to start buying Amazon stock. If you’ve chosen the eToro platform, all you need to do is type ‘Amazon’ in the search box at the top of the page, then click the corresponding Amazon stock trade button that appears.

Then click on the Create Order button.

Final Verdict

To summarize the above in one sentence, those who supported Amazon in its early days have made tremendous gains and are now among the wealthy. You may feel discouraged after hearing these words because you missed out on this golden opportunity, but there’s no need to be sad because investment opportunities never end. Nothing speaks more true than the fact that Amazon’s stock price rose by more than 70% in 2020 alone. With the upward momentum continuing in 2021, no one can predict the extent of the gains this Nasdaq-listed stock can achieve, especially since Amazon consistently tops market analysts’ recommendations for the best stocks to buy.

Therefore, if you’re planning to invest some of your money in Amazon stocks, we recommend eToro as the fastest, safest, and most affordable platform. eToro is arguably the best among its peers, innovative copy trading tools, and FCA and CySec licensing.

Simply click the link below to begin your journey!

eToro – The Best Amazon Investment Broker in the Arab World

CFDs are complex instruments and come with a high risk of losing money rapidly

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.

Frequently Asked Questions

What was Amazon's stock price when it went public?

Will I need to pay a currency conversion fee to buy stocks on eToro because I live in the Arab world?