كيف تشتري البيتكوين في الدول العربية – دليل المبتدئين

This step-by-step guide will explain how to buy Bitcoin in Arab countries and provide you with everything you need to know about this exciting topic. We’ll also discuss the brokers you can use to buy Bitcoin, how to invest in cryptocurrencies in general, and finally, the steps you need to take to start your purchase today.

How to Buy Bitcoin in Arab Countries Today – A Detailed Step-by-Step Guide

Do you want to buy Bitcoin in Arab countries now but don’t know where to start? If you’re already looking to buy Bitcoin, follow the step-by-step instructions below.

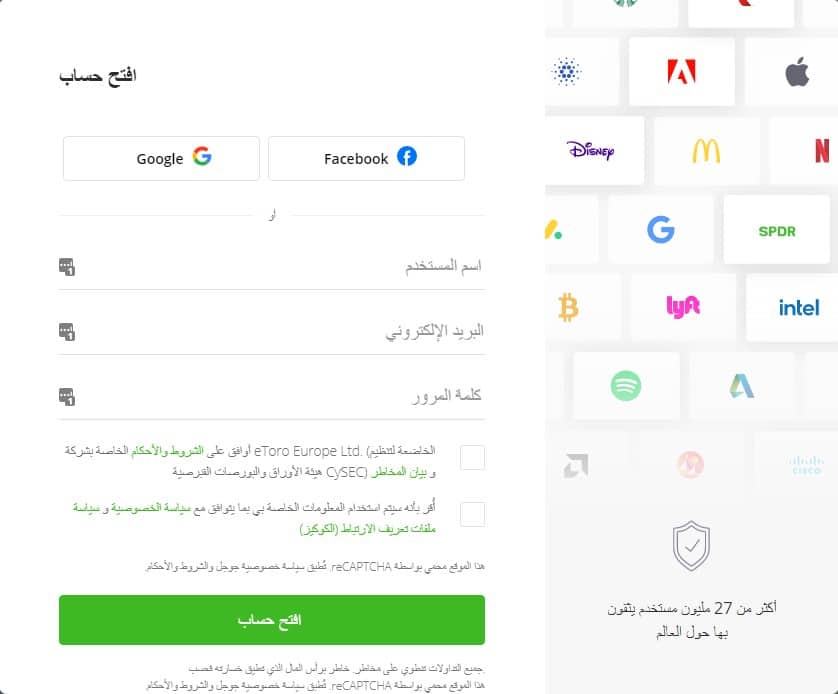

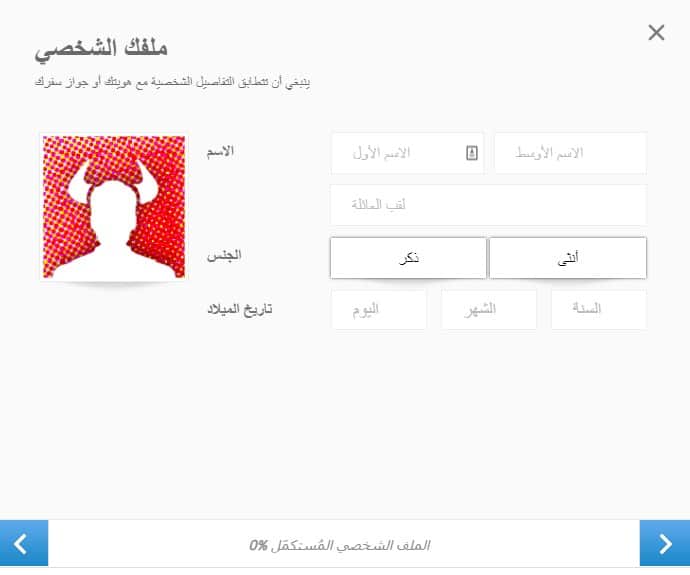

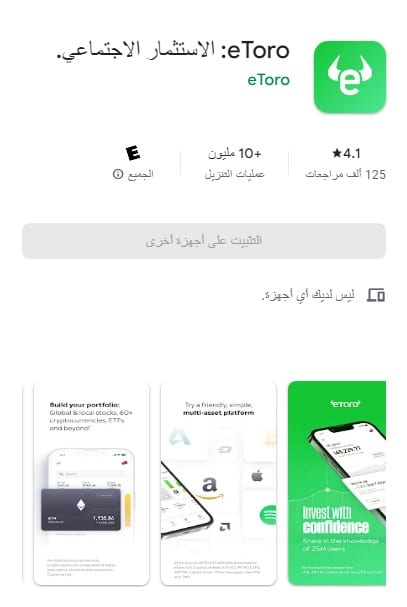

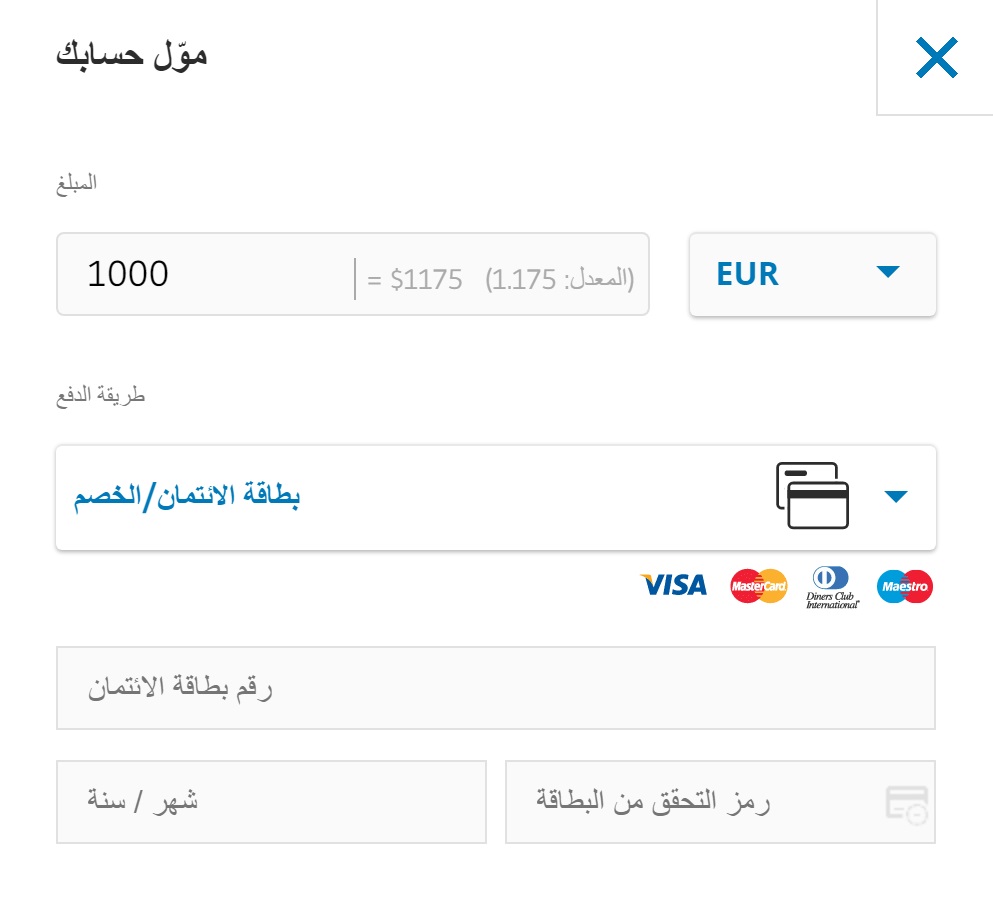

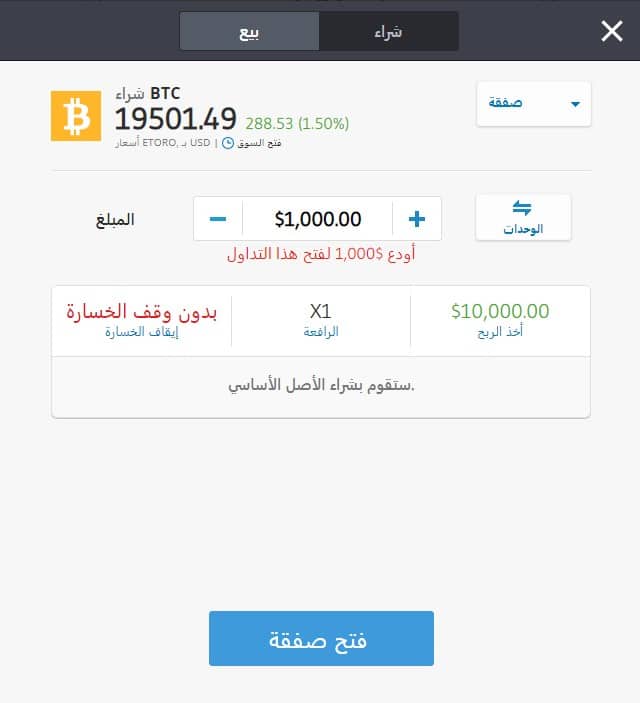

The first step you need to take is to visit the eToro website and open an account. The process will only take a few minutes, during which you’ll need to provide your email address and a password of your choice. Finally, click the “Open Account” button. You will then be directed to the profile filling window. Here you will have to enter some documents: Although this step isn’t mandatory, there are several advantages to downloading the eToro app . The app allows you to buy and sell Bitcoin from anywhere you are—as long as you have an internet connection. You can download the app for free from the Apple or Android app stores. You can go ahead and deposit funds. Note that the minimum deposit is between $50 and $200, depending on your country of residence. You can deposit using credit/debit cards, bank transfers, or an e-wallet of your choice. After setting up eToro , making your deposit, and completing all the steps above, you can now trade Bitcoin. Search for the term “Bitcoin.” All you have to do is select “Buy” and then click the “Open Trade” button, as shown below, to invest in Bitcoin.

73.81% of CFD accounts lose money.Step 1: Open a brokerage account with eToro

Step 2: Fill out the profile

Step 3: Download the eToro app

Step 3: Deposit funds

Step 4: Start trading Bitcoin

What is Bitcoin?

Bitcoin is a non-traditional asset class that experiences significant

- Bitcoin, in its simplest definition, is a digital currency that first appeared in 2009.

- The creation of this cryptocurrency and its supporting technology is attributed to an unknown developer with the pseudonym Satoshi Nakamoto.

- The main concept of cryptocurrency is that it is not owned or controlled by any person, organization, government, or even central banks.

- On the contrary, it is a decentralized currency.

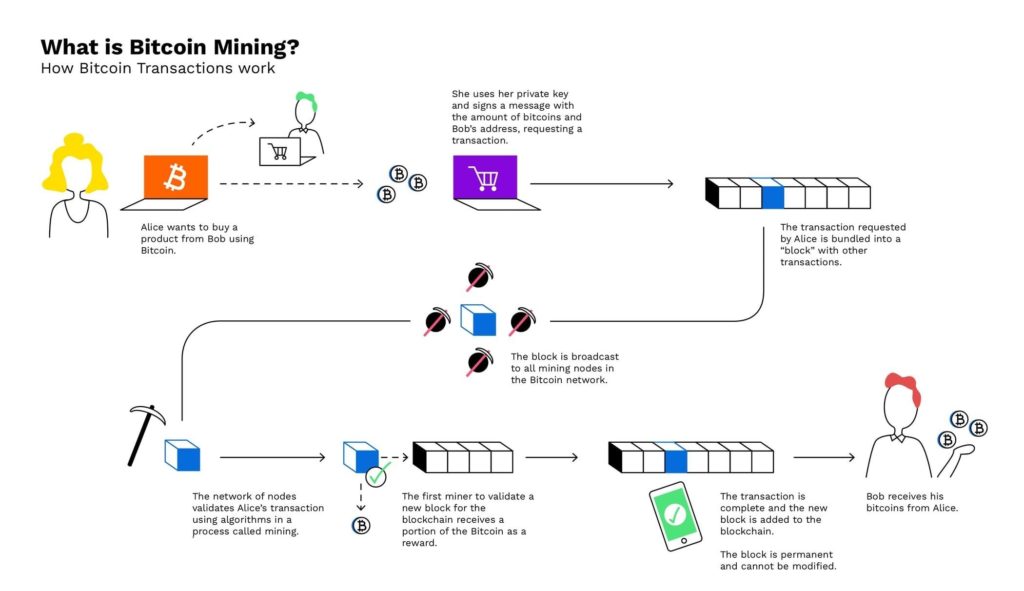

This unique nature makes Bitcoin immune to manipulation or increased supply through paper printing, as is the case with traditional currencies such as the Arab dirham or the US dollar. An alternative method for creating Bitcoin is mining, where one new coin is created every 10 minutes.

The digital currency will continue to be produced at the same rate until it reaches 25 million bitcoins—which is expected to happen in the year 2140. You can transfer your bitcoins to another user at any time, not to mention that a growing number of websites and online stores support bitcoin as an accepted payment method.

However, the vast majority of those who buy Bitcoin in Arab countries do so purely for investment purposes. In other words, they expect the value of Bitcoin to rise over time, allowing them to sell it later at a higher price and make a profit.

Why buy Bitcoin?

As we mentioned earlier, the vast majority of people buy Bitcoin as an investment. However, it’s important to note that cryptocurrencies in general, and Bitcoin in particular, are subject to extreme volatility, with their prices experiencing spikes and falls around the clock.

Despite these risks and the importance of keeping them in mind, there are still some reasons why you might consider buying Bitcoin in Arab countries now.

Note: Although you can easily buy Bitcoin with AED, cryptocurrency prices are usually discussed in US dollars.

Bitcoin is growing faster than all other asset classes.

First of all, you’ve likely landed on this page and are reading this guide because you’ve heard about the recent meteoric rise in Bitcoin’s price. But before you delve into that, it’s important to remember that the price of Bitcoin in 2009 was just $0.01.

Bitcoin continued to rise at varying rates until it reached its first record high of around $20,000 in 2017. Although the price of the digital currency collapsed in the following months, a trend that continued for several years until it reached its lowest levels of $4,000, Bitcoin succeeded in breaking above $19,500 again in November 2020 and then jumped to unprecedented levels above $60,000 during the first quarter of 2021.

To put this into perspective, if you invested AED 100 in Bitcoin in 2009, this small investment would be worth more than AED 195 million today! Although you may have missed out on buying Bitcoin when it was only a few cents, the cryptocurrency continues to record record gains unmatched by any other asset class.

For example, if you purchased Bitcoin in March 2020, you would have paid $5,000. This means that your investment increased by more than 290% over the next eight months until the end of the year, in addition to the strong gains that multiplied the price several times in 2021. For comparison, let me remind you that the FTSE 100 index is now trading below its levels of five years ago. This is the reason why many people in Arab countries and abroad are buying Bitcoin.

The supply of Bitcoin will remain limited and cannot be tampered with.

An additional factor that new investors in Arab countries may not realize is that the supply of Bitcoin is extremely limited, to the point that some compare it to gold. As previously noted, this is due to the fact that the maximum number of Bitcoin units is 21 million, which, at least in theory, ensures that Bitcoin’s value will continue to rise according to the law of relative scarcity.

Of course, this optimistic scenario is based on several fundamental assumptions—perhaps the most important of which is that the Bitcoin phenomenon will remain a topic of interest in the long term. If this scenario materializes, as it has in previous years, limited supply will remain a significant attraction for many investors.

This mechanism spares Bitcoin from the effects of fiat currencies, which depreciate when central banks decide to print more for various purposes, such as combating recessions and easing monetary policy. It’s worth noting that this characteristic—scarcity—will remain constant and cannot be changed in any way because it’s a fundamental component of the Bitcoin code, which considers itself a decentralized currency not subject to any party’s control.

Similarly, the stock market is prone to a decline in a company’s stock price if the board of directors decides to issue new shares without increasing capital. The equation is simple: the greater the supply of the instrument you invest in, the lower its value. Again, this scenario cannot be repeated with Bitcoin, given the impossibility of tampering with the blockchain network that hosts its transactions.

Bitcoin is divisible – so you can invest small amounts.

The price of a single Bitcoin currently stands at tens of thousands of dollars, recently touching $60,000, and is expected to rise. Naturally, you’re unlikely to have enough capital to purchase a full Bitcoin, and even if you do, you may not want to allocate such a large investment to a single digital currency. Don’t worry, you don’t have to invest such large sums.

This is because Bitcoin, as a digital currency, is divisible into smaller units. Simply put, you can buy a fraction of a Bitcoin without having to purchase a whole coin. In fact, Bitcoin can be divided into 0.00000001 units—meaning that a single $60,000 coin can be divided into units worth a few cents each.

With eToro , you can trade Bitcoin as a CFD. This means you speculate on future movements in the underlying asset’s market. Therefore, you don’t own Bitcoin, and the cost of trading CFDs is lower because you’re not purchasing the underlying asset.

You are in complete control of your Bitcoin investment.

We’ve also observed that many Bitcoin buyers enter the market for purely philosophical reasons. That is,

They justify this desire by saying that once you transfer Bitcoin to your own wallet, no one else will be able to access it.

Because you’re the only one who has the wallet’s private keys. Private keys act like a password, not only giving you access to your Bitcoin holdings, but also allowing you to transfer them to another wallet.

This scenario stands in stark contrast to the workings of traditional currencies—you’ll always need to use a bank to hold your funds. In this case, the bank has complete control over your funds, and they can restrict your access to them at any time. This is different with Bitcoin; as long as the currency is securely stored in your own wallet, no one can touch it without your permission.

How much does it cost to buy Bitcoin?

Like other assets, such as stocks, Bitcoin’s price is determined by free market forces. Simply put, the constant shift in supply and demand will cause the price to move up or down at any given moment.

For example, if positive news about Bitcoin is released and helps increase enthusiasm for the cryptocurrency’s future, more buyers will join the market, which will naturally increase demand and drive Bitcoin’s price higher. If the opposite scenario occurs and demand declines, Bitcoin’s price will also decline.

As for your question about the cost of purchasing Bitcoin, you can find out by checking the broker’s platform, which will often display it in US dollars. For example, the price of Bitcoin at the end of 2020 was approximately $19,447. Based on the exchange rates prevailing at that time, this amount would be equivalent to 75,000 UAE dirhams.

How to buy Bitcoin using PayPal

Many investors in Arab countries are looking to buy Bitcoin using PayPal. This is because PayPal is a simple and secure way to make online purchases, and it offers a faster payment alternative to Arab money transfers and debit cards. In fact, there are only a limited number of brokerage firms in Arab countries that allow the use of e-wallets to fund financial investments, with most focusing on credit cards and bank transfers.

However, many platforms like eToro nowadays not only support deposits and withdrawals using PayPal, but also other e-wallets like Skrill and Neteller.

How to buy Bitcoin stock

Bitcoin is a decentralized digital currency, which means it is very different from traditional stocks. However, the basic principles of investing remain the same. For example, Bitcoin is listed and available for trading on cryptocurrency exchanges—just like traditional stocks. Similarly, stock and Bitcoin prices remain dependent on the forces of supply and demand, rising or falling according to changing market trends.

Buy Bitcoin Safely

The past few years have witnessed numerous Bitcoin-related scandals. Not only have

Naturally, these scandals and scams have everyone wondering how to safely buy Bitcoin in Arab countries. In fact, we’ll go a step further by recommending that transactions be limited to regulated platforms.

eToro is a broker with a range of licenses that confirm its safety. This means you can rest assured when buying or selling Bitcoin on the platform, with complete security. For example, you can use credit/debit cards, bank transfers, or any other electronic wallet without worrying about your sensitive financial data being exposed to unauthorized parties.

The importance of this becomes even more apparent when you realize that most Bitcoin brokers and exchanges operate without official licenses. This naturally means you risk putting your hard-earned money in the wrong hands. Therefore, the only way to buy Bitcoin safely is to deal with a regulated platform.

Risks of buying Bitcoin

As with any type of investment, there are several risks involved in purchasing Bitcoin, so you should be aware of them.

This includes:

Risk of financial loss

When you buy Bitcoin in Arab countries, you’re making this decision because you believe the value of the digital currency will rise in the future. If your predictions prove true, you’ll make a profit or return on your investment. However, this isn’t always the case when investing in financial markets. As mentioned earlier, the FTSE 100 index is currently trading at lower levels than it was five years ago.

Bank stocks are also a clear example of the predicament your investments can face. A stock like HSBC is down 62% from its value 18 years ago! Moving on to Bitcoin, although this digital currency has achieved amazing gains over the past 10 years,

However, this does not guarantee that the upward trend will continue indefinitely. As experts point out, past performance can never be a 100% accurate indicator of future results. Therefore, it is still possible to sell Bitcoin for less than you paid to buy it, incurring a financial loss.

The uncertainty surrounding Bitcoin’s future regulatory status

With a few exceptions, Bitcoin remains unlicensed in most countries around the world—including Arab countries. Several regulatory bodies have already issued warnings against dealing with cryptocurrencies in general, including the Central Bank of Arab States.

However, if Arab countries eventually decide to enact cryptocurrency legislation, it remains unclear whether they will embrace Bitcoin or seek to ban it entirely.

Outside of Arab countries, we’ve seen regulatory bodies like the UK’s Financial Conduct Authority (FCA) announce that, starting January 2021, cryptocurrency CFDs will no longer be permitted in the country. The FCA justified its decision by stating that cryptocurrency trading involves significant risks due to its exposure to massive speculation, prompting it to intervene to protect investors.

Bitcoin theft or loss

We previously mentioned that most Bitcoin buyers in Arab countries like the idea of owning the currency outright without having to entrust it to a third party. Achieving this equation requires storing your cryptocurrencies in a private digital wallet.

However, there is still a risk that your wallet could be compromised by hackers. If this catastrophic scenario occurs, you will lose the Bitcoin stolen from your wallet forever. There is no recourse to this situation compared to, say, a hacked credit card, in which you can contact your bank and request that the card be blocked and the funds returned.

Another major risk is forgetting or losing your private keys or wallet password. In this case, it will be virtually impossible to access your funds. There are dozens of examples of people losing millions of dollars simply because they forgot their passwords. This would also mean you’d lose your Bitcoin forever.

Sell Bitcoin

When you decide to sell your Bitcoin, the transaction will depend on how you purchased the cryptocurrency and how you stored it.

If you choose a good broker, you’ll be able to choose your trading limits. This allows you to determine how much money is spent on each trade.

Profits can be withdrawn at any time.

It’s different if you used a traditional cryptocurrency exchange to buy Bitcoin, as the selling process would go as follows:

- Once you purchase Bitcoin, you can withdraw the coins you purchased to your own wallet.

- Assuming you choose a desktop wallet, this means you will store your Bitcoin on your computer.

- When you decide to sell your Bitcoin, you will need to send the coins back to the exchange.

- There you can convert Bitcoin to dirhams or any regular currency.

- The final step is to transfer the funds to your bank account.

Comparing the two methods above clearly shows that the easiest path is to deal with a safe and efficient broker like eToro . The educational tools features can help you make better, faster decisions about when to buy and when to sell.

Where to buy Bitcoin in Arab countries?

Now that we’ve covered the intricate details of how cryptocurrencies work, we’ll move on to explaining the places and sites where you can buy Bitcoin. We’ve narrowed down your search to the list of platforms we’ve provided below.

1. eToro – Trusted FCA Broker for Buying Bitcoin

eToro is the best option for buying Bitcoin for residents of Arab countries. First and foremost

When it comes to fees and costs, we can safely say that we haven’t found a Bitcoin broker that offers conditions as competitive as eToro. This is because you can buy Bitcoin in Arab countries. Instead, the broker generates its revenue by charging a small 0.5% fee for currency conversion when depositing funds. Before we go any further, let me remind you that eToro allows you to invest in Bitcoin starting from as little as $25.

This low minimum deposit offers numerous advantages, including the ability to invest small amounts on a regular basis, depending on your financial circumstances. If you’re looking to diversify your cryptocurrency portfolio, eToro offers 15 digital currencies. This includes major currencies such as Ethereum, Ripple, and Bitcoin Cash. Beyond cryptocurrencies, eToro offers the opportunity to invest in over 1,700 stocks and 150+ ETFs. The company also offers Bitcoin CFD trading.

It’s safe to say that eToro is the most suitable trading platform if you’re just starting out in the world of cryptocurrencies. This is primarily because it’s intuitive and easy to use, and doesn’t require any prior investment experience. All you need to do is search for Bitcoin and enter the amount you want to invest. Furthermore, eToro offers automated trading services that are particularly useful for newcomers. For example, the platform offers a Cryptocurrency CopyPortfolio, which is managed by eToro’s experienced experts.

You can also use the Copy Trading feature to copy the trades of successful Bitcoin investors. This way, you can copy the trades of these professionals head-to-head. Moving on to the terms of joining, eToro requires a minimum deposit of $200. You can deposit these funds using credit/debit cards, e-wallets, or an Arab bank account. Finally, you can buy Bitcoin from eToro via its website or mobile investment app.

Advantages:

Disadvantages:

Digital assets are highly volatile, and their investment products are unregulated. They will not enjoy the protections provided by EU investor laws.

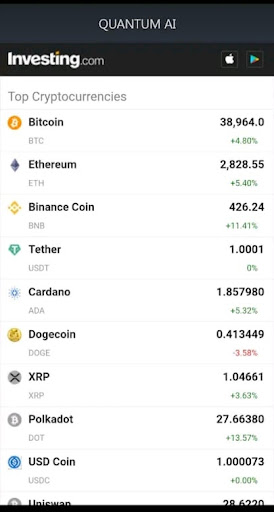

2. Quantum AI - A good automated trading broker for buying Bitcoin

It analyzes thousands of asset prices simultaneously to help you make better, faster decisions.

With Quantum AI, you can trade cryptocurrencies like Bitcoin, as well as many others. It also offers CFD trading for various instruments, such as forex, stocks, commodities, and more.

Quantum AI claims it has the potential to generate daily profits of up to 60%. We didn't find any figures to support this. However, we did some research and found several good reviews from private investors, as well as professionals.

Quantum AI is a software platform and is unregulated. However, it partners with 15 different brokers worldwide that are regulated in Australia or the UK. This makes Quantum AI a safe and reliable trading robot. All your personal information, as well as assets such as Bitcoin, your deposits, and more, are protected by Quantum AI's encryption.

Creating an account to start trading Bitcoin is very simple and only takes about 10 minutes. You will be asked to provide some personal information, verify your identity, and make your initial deposit of €220. Deposits and withdrawals can be made using credit or debit cards, or bank transfer.

If you have a question, or need any assistance, you can contact Quantum AIs customer support via email 24/7, but it is only available to registered users.

Advantages:

Disadvantages:

Cryptoassets are highly volatile, unregulated investment products. Your capital is at risk.

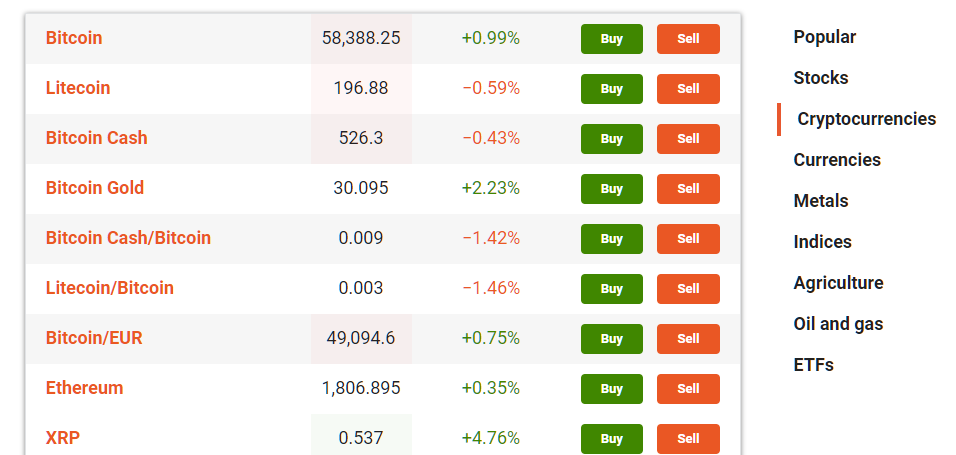

3. Libertex - Invest in Bitcoin CFDs with zero spreads

Libertex gives you the ability to buy Bitcoin using CFDs, which allow you to speculate

When trading CFDs, you can open buy or sell positions, giving you the opportunity to profit from both rising and falling markets. CFDs also allow for leverage, giving you the ability to control large trades with a small deposit.

Libertex offers a wide range of cryptocurrencies, including Bitcoin, Bitcoin Cash, Bitcoin Gold, Bitcoin/Euro, Monero/Bitcoin, Zcash/Bitcoin, and many more! You can trade all of these digital currencies with zero spreads!

The broker also offers a 50% discount on buy and sell commissions, which are already very low and competitive.

Moreover, opening an account with Libertex is very easy, as you can complete the registration process within a few minutes, with a minimum deposit of only €100.

Traders can invest their funds with Libertex without any concerns about their safety, as the company is licensed by the Cyprus Securities and Exchange Commission (CySEC).

Advantages:

Disadvantages:

Your capital is at risk.

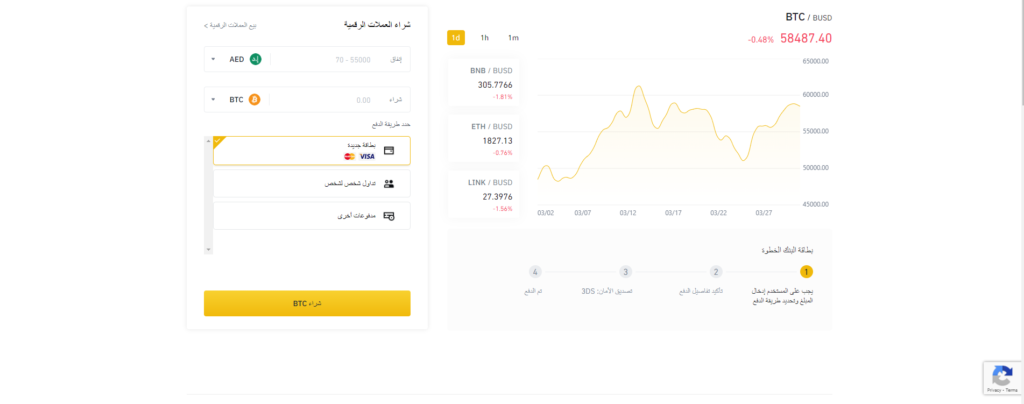

4. Binance - The popular Bitcoin exchange that supports credit/debit cards in Arab countries.

Binance is one of the world's largest cryptocurrency exchanges by

Binance has also expanded its operations to include traditional brokerage services. This means you can buy Bitcoin in Arab countries through its platform using credit/debit cards or wire transfers. All you need to do is open an account, upload some identification documents, and select the amount you want to deposit.

After completing your purchase, you can keep your cryptocurrencies on Binance or withdraw them to another location or wallet. Binance is known for its strict security controls and operates the Secure Asset Fund for Users (SAFU), an emergency reserve fund designed to protect and compensate users in the event of a platform hack. In other words, customers affected by any losses resulting from platform issues can receive compensation from this fund.

Speaking of fees, Binance's trading costs are very competitive, with only a 0.1% commission per transaction. If you decide to use credit/debit cards, you'll be charged a higher fee, typically 2% of the transaction value. However, Binance is currently offering a customer promotion that reduces the transaction fee to 1%. This offer covers all deposits made using Visa and Mastercard.

Advantages:

Disadvantages:

Your capital is at risk.

Although you may not be familiar with the technical intricacies of cryptocurrencies, buying Bitcoin in Arab countries has never been easier. In fact, opening an account with a brokerage firm, depositing funds using an Arab country’s credit/debit card, and then investing in Bitcoin will take no more than 10 minutes when trading with a company like eToro . Best of all, you can easily sell your investments at any time on the platform.

CFDs are complex instruments and come with a high risk of losing money rapidly a summary

eToro – The best broker for buying Bitcoin in Arab countries.

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.