كيف تستثمر في النفط في الدول العربية – دليل المبتدئين

Did you know that oil prices have risen nearly 500% since the start of the COVID-19 pandemic?

This unprecedented volatility in the oil markets has encouraged institutional investors to increase their exposure to the market, helping to generate significant gains for the entire energy sector. This trend has been evident in the strong gains in oil company stocks and exchange-traded funds.

If you’re looking to get involved in this exciting market, read this article to learn how to invest in oil in Arab countries – our beginner’s guide will surely help you achieve your goal!

We’ll explain step-by-step how to invest in crude oil with a group of top brokerage firms, the most powerful trading strategies designed to take advantage of oil market fluctuations, and recommend the best oil companies you can invest in. We’ll also cover other important topics in the following sections.

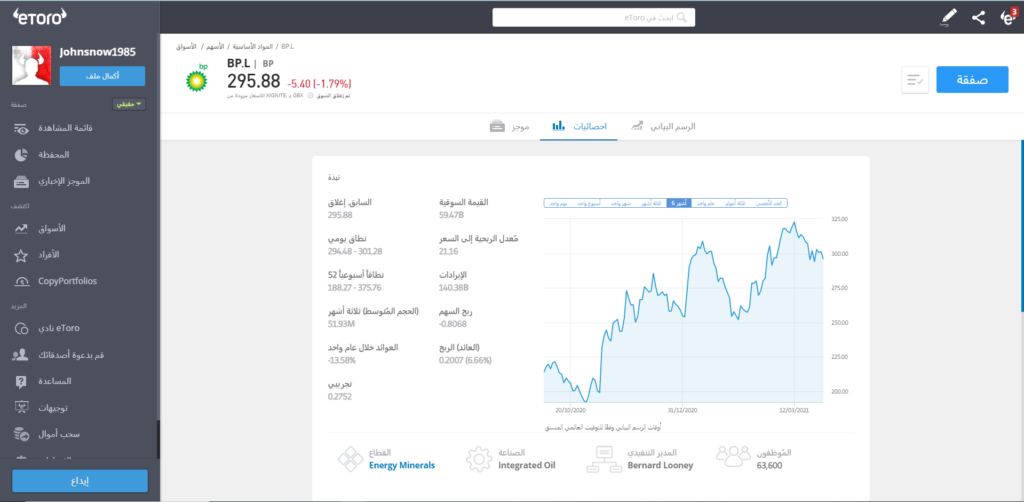

How to invest in oil with eToro

The section below explains step-by-step how to invest in oil on the eToro trading platform, which is our top choice for being comprehensive, regulated, and offering low fees and commissions.

73.81% of CFD accounts lose money.

A quick tutorial on how to invest in oil

If you’re wondering how to invest in oil in Arab countries with a small capital, follow these quick steps:

- Choose a broker to trade oil. We recommend eToro, which offers a wide range of products related to energy markets, including crude oil, oil company stocks, and exchange-traded funds.

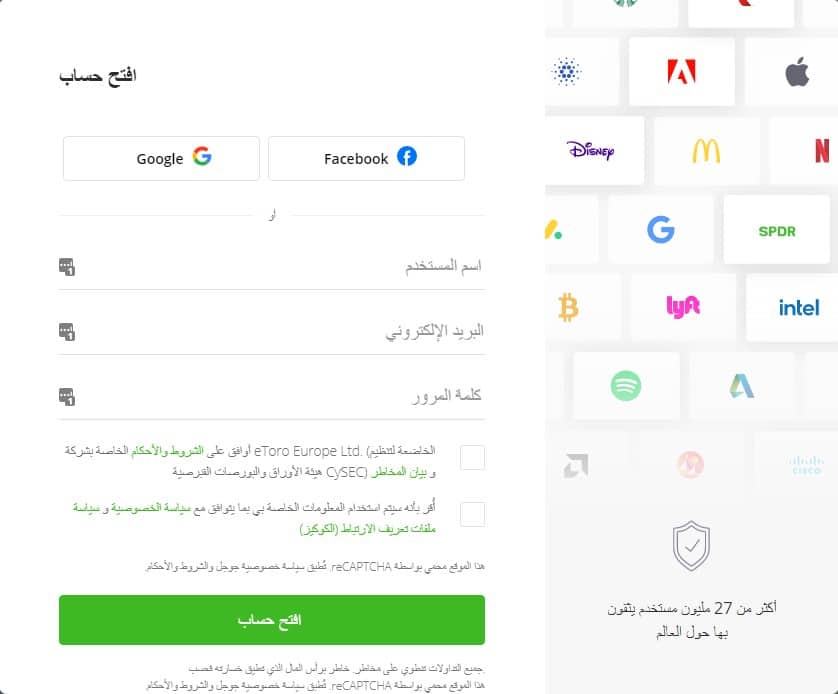

- Open an account. The steps to open an account with eToro are very simple and can be completed in just a few minutes. All you need to do is fill out some personal information, and you’re ready to go.

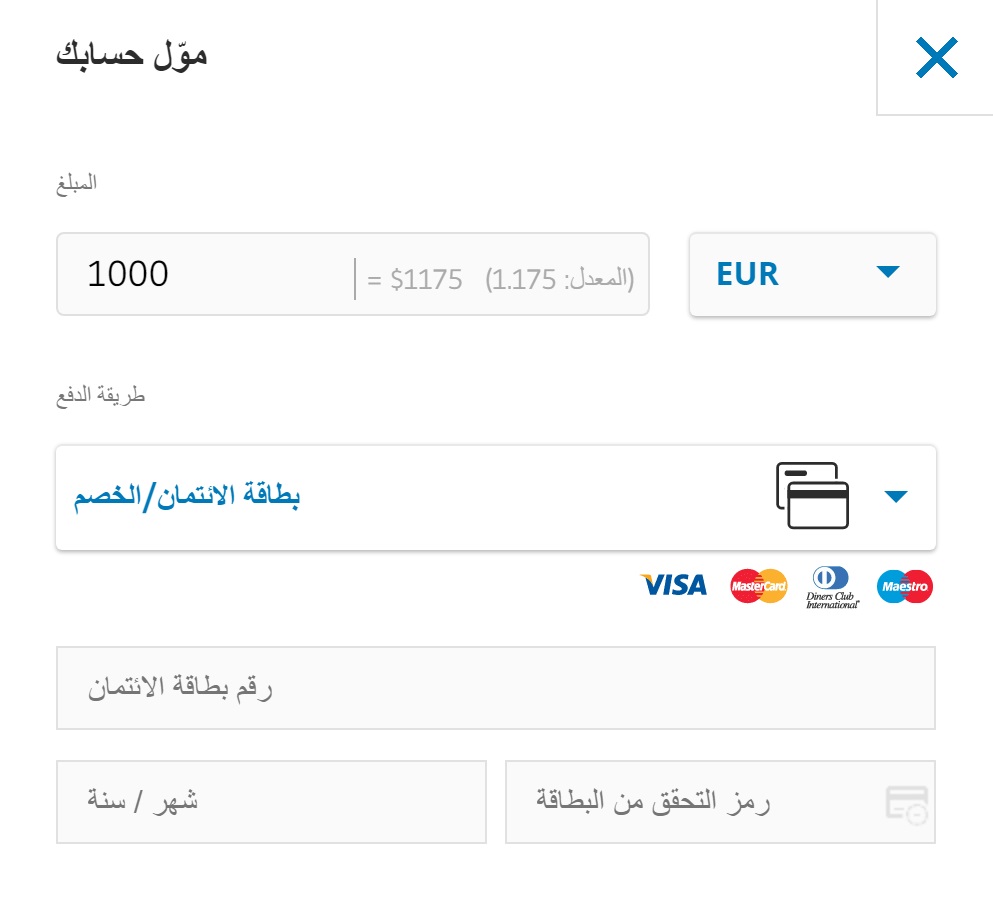

- Deposit Funds: The minimum deposit starts from just $20, which you can deposit via bank transfer or credit/debit cards.

- Invest in oil! You’re now ready to start investing in oil. Find the asset you want and click Trade!

That’s all! You’ve just invested in oil with the best oil investment broker in the Arab world.

Step 1: Choose an oil investment platform

One important factor to consider when investing in oil is to ensure you choose the right trading platform.

Ultimately, this platform is your gateway to the oil market, so it must be secure, seamless, and easy to use.

Below we discuss some of the best investment platform providers you can choose from.

1. eToro – An efficient and secure platform for investing in oil

eToro is the world’s largest social trading platform, with over 17 million users.

eToro gives you access to over 2,400 global markets, including crude oil, oil stocks, and oil ETFs, along with other asset classes like currencies, indices, and commodities.

However, while trading oil ETF prices involves no commissions, there are still some fees to consider, such as the spread, which is the difference between the buy and sell prices, and is applicable to almost all brokers. Also, if you hold your trade open overnight, swap (rollover) fees apply, which are also common across all CFD brokers.

However, eToro charges low spreads and swap fees, arguably very competitive compared to other brokers in the industry. This advantage is crucial because it helps you keep a significant portion of your profits in the long run, which would otherwise go to the broker!

Another one of the best features of the eToro platform is that it allows you to search for profitable traders and investors and copy their trades with the click of a button! The Copy People feature allows you to view and filter the performance of multiple traders, and if you like one or more traders, you can instantly copy their trades into your account.

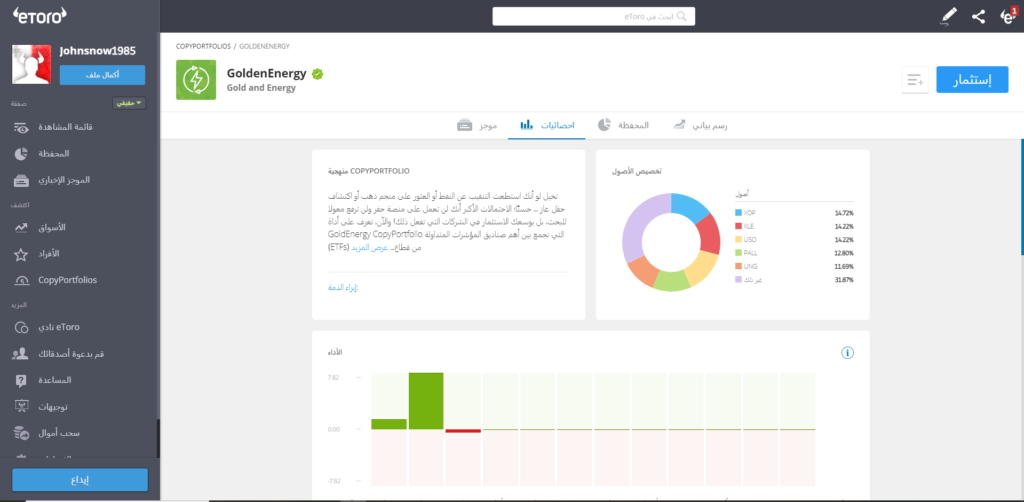

The CopyPortfolio section is also one of the great features on the eToro platform. Simply put, a CopyPortfolio is a ready-made investment portfolio, designed by experienced experts to allow you to invest and benefit from major movements in the financial markets effortlessly. For example, the CopyPortfolio includes portfolios specialized in various fields such as oil, drone technology, the 5G revolution, mobile payments, and many more.

With such a wide range of markets and product offerings, eToro offers a great platform for diversifying your portfolio when investing in the oil market. Another notable feature is that you can open your account in just a few minutes!

Features:

Disadvantages

67% of individual investors incur financial losses when trading CFDs on this site.

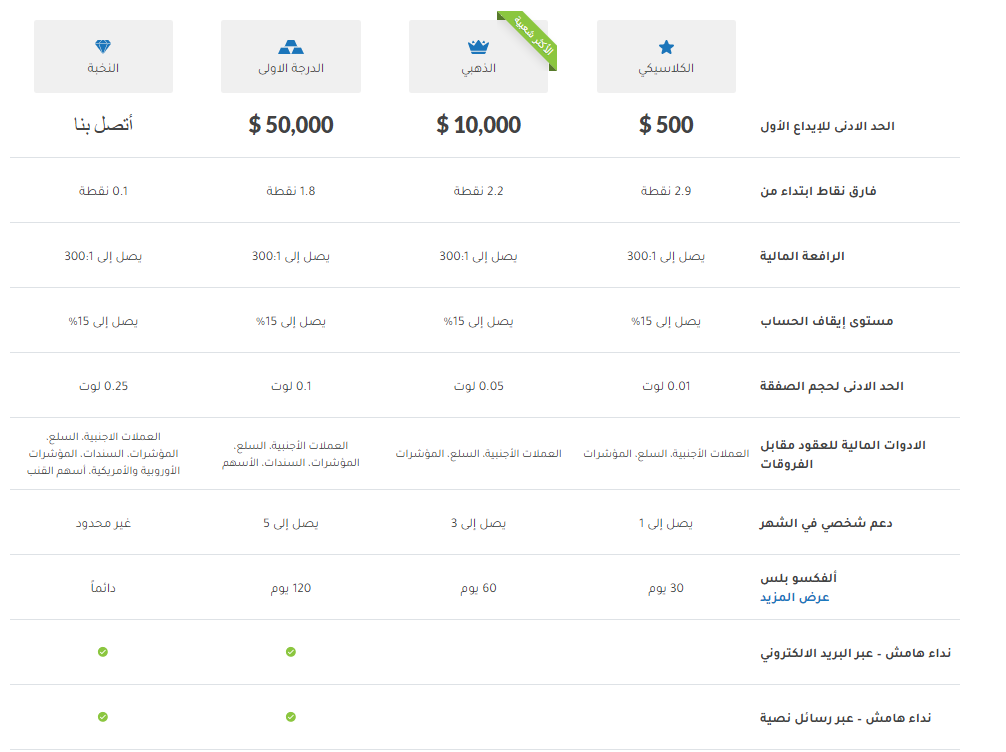

2. Alvexo – Investing in oil with the help of rich educational tools

If you’re looking for a good, timely, and comprehensive investment broker, while maintaining a safe and educational approach, Alvexo may be a

If you’re wondering whether Alvexo offers oil trading, the answer is yes. It offers trading in oil and a variety of commodities, in addition to numerous stocks and dozens of forex pairs. Not to mention indices, funds, and other assets. The number of investment instruments available for trading, both within the app and on the platform, exceeds 450. This ensures comprehensive diversity and covers the needs of all the platform’s more than one million clients.

You’ll be able to trade whatever you want with the Alvexo platform without paying any commissions or deposit or withdrawal fees. You’ll also be able to ask any questions or inquiries to the platform’s multilingual customer support. Don’t forget that just as you can invest in oil using any browser on your computer, you’ll also have the opportunity to invest simply by accessing the app.

With Alvexo, you can open any account you desire from four types of accounts. These include the Classic Basic Account, with a minimum deposit of $500; the Gold Account, with a minimum deposit of $10,000; the First Class Account, with a minimum deposit of $50,000; and the Elite Account. The benefits and advantages increase as you climb the account ladder.

With Alvexo, you can choose your deposit method, which includes bank transfer, major cards, or electronic funds transfer.

Advantages:

Disadvantages

76.57% of CFD accounts lose money.

3. Quantum AI – An oil investment platform with artificial intelligence

Trading is completely free of any fees, as Quantum AI does not charge transaction fees, commissions, or anything else.

Quantum AI is not a broker per se, but rather works in conjunction with several regulated brokers, with whom Quantum AI works as a market price analysis software.

Opening an oil trading account is very simple, requiring a minimum deposit of €220. You can pay using credit or debit cards, as well as bank transfers.

The Quantum AI platform is available on any browser on your computer and also as an app on your phone. It is compatible with iOS and Android smartphones and tablets. It is 100% free to download.

Features:

Disadvantages

71% of retail investors lose money trading CFDs on this site.

4. AvaTrade – The best broker offering various accounts for trading oil

AvaTrade is a global brokerage company licensed by prestigious regulatory bodies, including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), the Financial Services Agency of Japan, and many others. The company offers a variety of convenient ways to deposit and withdraw funds!

The AvaTrade platform gives you the opportunity to trade on over 1,250 global markets covering a wide range of asset classes, including commodities, such as oil, as well as currencies, indices, stocks, and cryptocurrencies.

AvaTrade users also benefit from a variety of trading accounts, including CFDs, options, spread betting, and Islamic accounts. The company also offers experienced traders the opportunity to open professional trading accounts.

AvaTrade offers a wide range of educational resources and research tools, including a blog, written articles, and videos. Users also have access to Trading Central, which provides actionable trading ideas in real time, as well as professional research covering thousands of financial markets.

AvaTrade offers customer support in over 14 languages, Monday through Friday, via live chat, phone, and email. Clients also benefit from access to the full range of trading features generally offered by MetaTrader 4 brokers, such as access to the MetaTrader Market and trading signals service.

Features:

Disadvantages

71% of individual investors incur financial losses when trading CFDs on this site.

5. Libertex – The best oil trading broker with zero spreads

Libertex is a CFD broker with over 23 years of experience. The company

Libertex is unique among its peers in that it charges no spread on trading pairs. The spread is the difference between the bid and ask price and represents a premium charged by the broker for facilitating trades. Libertex offers trading on over 213 CFDs covering commodity markets, such as oil, as well as stocks, indices, and currencies, all offered with zero spreads and low commissions!

Libertex also offers the ability to trade oil on margin using CFDs, which allow you to control large positions with a small deposit. Margin requirements vary depending on whether you are an individual trader or a professional client.

Libertex offers a powerful web-based trading platform. It also offers its clients the world’s most popular trading platform, MetaTrader 4. You can easily open an account with Libertex in just a few minutes.

The minimum deposit at Libertex is just $100, and can be made via bank transfer, credit/debit cards, and e-wallets such as Neteller and Skrill. You can also access premium customer support, Monday through Friday, between 8:00 AM and 8:00 PM CET, via live chat, WhatsApp, or Telegram.

Features:

Disadvantages

83% of individual investors incur financial losses when trading CFDs on this site.

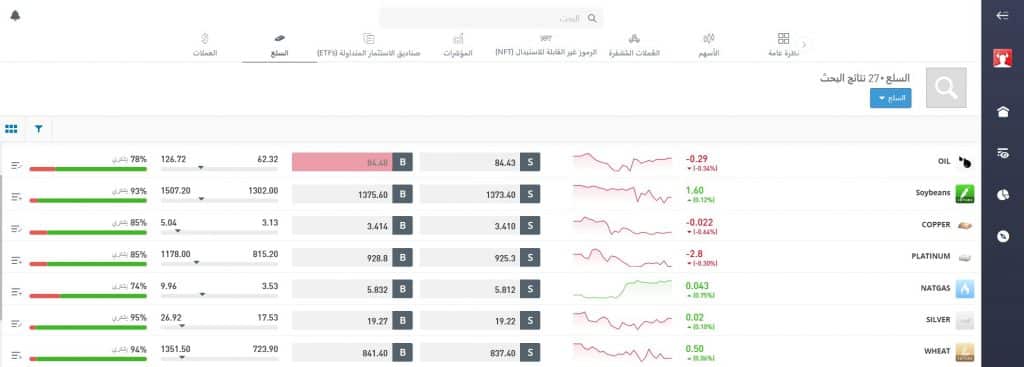

Step 2: Choose an oil investment

Now that you’ve chosen the right investment platform for oil trading, it’s time to decide what type of oil investment you’ll make. There are a number of investment options available to choose from!

Oil CFDs, Futures and Options

As we mentioned earlier, there are many ways to speculate on oil price movements. Some of these methods are simple, while others are extremely complex, which we will explain in the following lines.

CFDs on oil

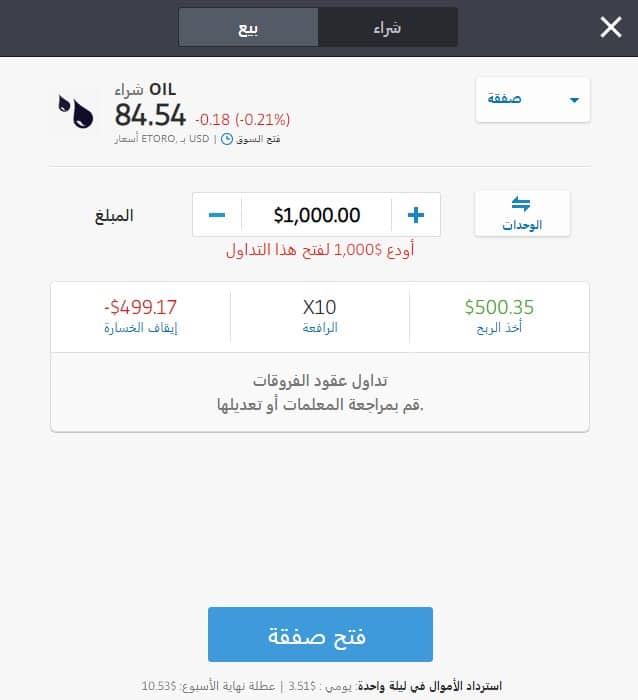

One of the easiest ways to trade oil is with a CFD broker, such as eToro. CFDs allow you to speculate on both rising and falling markets, without actually owning the underlying asset.

All you need to do is press the buy button if you believe the market will move upward, or click the sell button if you expect prices to fall. This is just one of the many advantages CFDs offer—allowing you to open buy or sell positions and profit from both rising and falling markets.

Another advantage of trading CFDs on oil is the ability to use leverage to control large positions with a small deposit. With some platforms, you can use leverage of up to 10 times your investment.

CFD brokers also offer the opportunity to use stop-loss orders to limit potential losses if the market moves against you, as well as take-profit orders to lock in any profits you may make when the trade goes in your favor.

Oil futures contracts

Oil futures are contracts to exchange a specific number of barrels of oil at a fixed price on a specific date in the future. When trading oil futures, you’ll notice that each contract expires, usually one month later, but can be as long as three months later.

Futures contracts are typically traded on major exchanges such as the New York Mercantile Exchange (NYMEX) and are primarily used by commercial companies to hedge against volatility in energy markets and secure the price of barrels of oil they wish to purchase in the future. However, futures exchanges do not offer the high levels of leverage found in CFD brokers.

Oil options

An oil option gives the holder the right, but not the obligation, to buy or sell a specified quantity of oil at a predetermined price and date in the future. There are two types of options contracts: calls and puts.

If you believe the price of oil will rise, you can buy a call option. If you believe the price of oil will fall, you can buy a put option. Oil options contracts are also affected by the expiration time and implied volatility pricing in the market, making them one of the most complex ways to invest in oil.

Oil stocks and ETFs

While many investors prefer to invest in oil directly using CFDs, futures, or options, others are more interested in investing in oil company stocks, exchange-traded funds (ETFs), or mutual funds. Ultimately, companies involved in oil exploration and extraction also move up and down with oil prices.

Companies operating in the energy sector generally offer investors exposure to the oil market with various advantages. For example, energy giants such as ExxonMobil, BP, and Shell typically pay generous dividends to shareholders.

This means that the investor will profit from capital gains in the share price, along with income from dividends, which are typically paid quarterly. When trading on the eToro platform, you will be able to buy oil company stocks with 1$ commissions, as explained above.

Oil ETFs also provide an alternative way to gain exposure to the oil market or even the entire energy sector. For example, the United States Oil Fund is one of the most popular oil ETFs. This fund aims to give investors exposure to the US oil market without having to purchase any futures contracts.

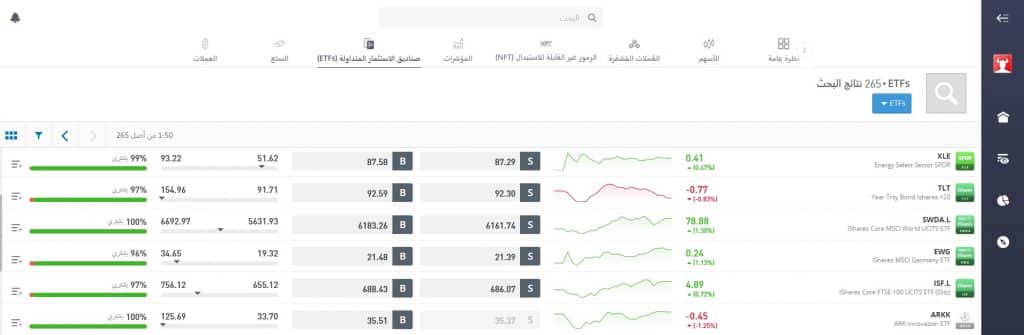

There are also several oil ETFs that operate similarly to mutual funds, giving you the opportunity to invest in a basket of stocks from various oil companies. For example, the Energy Select Sector SPDR provides investors with exposure to major companies operating in the US energy market. The fund directs the largest portion of its investments to ExxonMobil, Chevron, and ConocoPhillips, in addition to 23 other companies operating across various energy sectors.

eToro offers a comprehensive range of oil stocks available for investment.

73.81% of CFD accounts lose money.

Step 3: Research oil investments.

Now that you’re familiar with the various investment methods, you can begin trading oil, but only after learning as much as possible about this massive market. This step is essential for identifying opportunities and recognizing potential risks.

We recommend you review the sections below to build your knowledge of all aspects of the oil investment process!

Different types of oil

If you want to learn how to invest in crude oil, the first step is to understand the different types of oil and what distinguishes each blend from the others. The two most popular and widely traded oils are West Texas Intermediate (WTI) and Brent.

West Texas Intermediate (WTI) crude oil is a blend of crude oil processed in the United States and traded on the New York Mercantile Exchange (NYMEX). This type of oil is extracted from oil fields in Texas, Louisiana, and North Dakota and then piped to Oklahoma.

On the other hand, Brent crude is extracted from the North Sea and also transported via pipelines to Scotland. Brent is traded on the Intercontinental Exchange (ICE) and is used as a benchmark for oil pricing in Europe, Africa, and the Middle East.

oil price

Oils such as West Texas Intermediate (WTI) and Brent are priced in US dollars. Therefore, when you look at the price of oil, you are actually reading the price per barrel in US dollars. For example, the price of WTI crude oil is trading at $63.10 per barrel at the time of writing.

When learning how to invest in oil, it’s essential to acquire the skill of identifying future price fluctuations. The price of oil is influenced by many different factors, such as:

- OPEC production. The Organization of the Petroleum Exporting Countries (OPEC) consists of 14 oil-rich countries, led by Saudi Arabia. Member countries hold monthly meetings to discuss oil production levels and agree on the quantity each country will produce and sell on the open market. If member countries agree to reduce oil supply, prices typically rise, and vice versa.

- Geopolitical factors. The oil market is highly sensitive to geopolitical developments, especially in volatile regions such as the Middle East. Major events such as the COVID-19 pandemic have also significantly impacted oil prices, with economic lockdowns leading to inventory buildup and subsequent price collapses.

- US Dollar. As noted earlier, Brent and West Texas Intermediate crudes are priced in US dollars, so any significant movements in the greenback’s exchange rate affect the price per barrel.

Is oil a good investment? Oil investment analysis

An increasing number of investors have been asking this question recently, especially after oil prices collapsed by more than 90% at the height of the COVID-19 pandemic, then subsequently rose by nearly 500%.

According to JPMorgan analysts, commodity markets have entered a boom called a ” supercycle , “ evidenced by rising prices for food, metals, and energy. The world has experienced only four “supercycles” over the past 100 years, the last in 2008.

Many analysts are betting on higher oil prices in the long term, citing a variety of reasons, most notably the continued increase in demand for oil due to the following factors:

- The continued success of the rollout of new COVID-19 vaccines will eventually lead to the lifting of restrictions on domestic and international travel.

- Massive stimulus programs launched by central banks, including increased public spending on infrastructure and manufacturing.

- The growing trend among energy companies to shift to renewable energy generation could reduce oil exploration activities, thereby reducing supply and increasing prices.

If the price manages to approach the 2018 highs of around $77 per barrel, this would represent a 60% increase in oil prices since the start of 2021 trading. Similarly, a return to the 2008 highs of around $113 per barrel would represent a 130% increase.

Oil markets experience periodic sharp fluctuations due to their impact on global demand forecasts and geopolitical factors, which necessitates hedging oil investment risks.

73.81% of CFD accounts lose money.

Risks of investing in oil

When considering investing in oil in Arab countries, Arab states, or Kuwait, it’s also important to consider the risks involved due to the extreme volatility experienced by energy markets in general. Examples of these risks include:

- Economic risks. Oil markets are affected by demand and supply shocks, which arise from climate fluctuations, geopolitical tensions, and unforeseen events. For example, when oil demand suddenly collapsed during the COVID-19 crisis, oil prices plummeted to their lowest levels in 30 years.

- Corporate Risks. If you decide to invest in oil company stocks, news related to those companies will inevitably impact the stock price. For example, the revelation of financial scandals, accounting irregularities, or negative earnings reports will panic investors and cause them to rush to sell the company’s stock.

- Political risks. Geopolitical tensions cause sharp fluctuations in oil prices. The Middle East controls a significant portion of global oil production, and our Arab region is known to be rife with chronic conflicts and disputes, which constantly creates a risk premium to hedge against disruptions to supply lines.

- Climate change risks. A growing number of oil companies are moving away from underground fossil fuel exploration and instead seeking environmentally friendly energy sources. Many of these companies are also losing out on significant investment opportunities as investment funds actively seek to move away from sectors with large carbon footprints.

Oil investment strategies

There are a variety of strategies investors can use to take advantage of volatility in the oil markets. Many of these strategies depend on your preferred investment style, such as whether you’re more inclined to invest for the long term or the short term. Let’s take a look at some of these strategies:

Investing in oil using fundamental analysis

Long-term investors prefer to analyze the economic situation through what is called “fundamental analysis” to predict what might happen over the coming months or years. These investors focus on investing in oil companies rather than purchasing oil directly.

Given that energy companies tend to pay hefty dividends, they believe that combining diverse revenue streams would be a great strategy, capitalizing on both the share price appreciation and the income generated from quarterly dividends.

Trading oil using technical analysis

On the other hand, short-term investors, such as day traders, prefer to speculate on the direction of oil prices using CFDs, which offer the opportunity to profit in both rising and falling markets using leverage.

The latter category of traders studies price charts and technical analysis indicators to help them identify near-term reversal points and important technical levels in the market. Day trading in oil is widely popular because it offers the opportunity to capitalize on market fluctuations, although it is a highly specialized skill.

Investing in Oil Using CopyPortfolios

CopyPortfolios are a new way to facilitate investing in oil markets. CopyPortfolios are simply ready-made investment portfolios managed by a professional team on certain platforms. These portfolios are easy to invest in and offer a good opportunity for portfolio diversification.

A prominent example of this is the GoldenEnergy CopyPortfolio, which includes investments in the energy, oil, gold, and mining sectors.

You can view the different options in each portfolio and start investing with the click of a button!

Your capital is at risk.

Step 4: How to invest in oil with eToro

The section below explains step-by-step how to invest in oil on the eToro trading platform. This platform is our top recommendation because it’s highly secure and offers trading services!

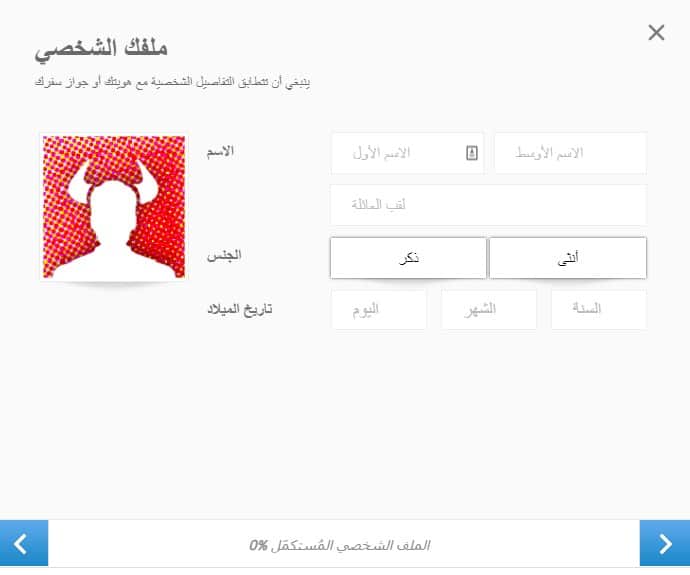

You can open an account with eToro in just a few minutes. To create an account, all you need to do is fill in your personal details, such as your full name, email address, phone number, and choose a password. Once you complete this step, you will be directed to the second step. As eToro is a globally regulated and licensed broker, you will be required to verify your identity and address according to Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. You can upload these documents via the platform, and they are specifically two types of documents: It’s very easy to deposit funds into your eToro account. You can choose between the following deposit options: You can easily search for the asset class you wish to trade on the eToro platform. Among the available options are oil stocks, oil ETFs, and you can also trade West Texas Intermediate crude directly via CFDs. According to your strategies, choose the asset you want to invest in, enter the amount and complete the deal!Step 1: Open an account

Step 2: Upload identity documents

Step 3: Deposit funds into your eToro account

Step 4: Choose your oil investment and start investing!

In this article, “How to Invest in Oil in Arab Countries,” we provide a beginner’s guide detailing a selection of the best oil investment platforms, outlining the different types of investment products available and how to do so. Whether you trade oil directly via CFDs, oil company stocks, or ETFs, let me tell you that many analysts are optimistic about the future of oil markets. As we noted earlier, investment bank JPMorgan believes we are currently experiencing a “supercycle” in commodity markets—and this boom will be the fifth in the past 100 years. To capitalize on this upward trend, you must have access to the right oil broker and trading platform. According to our review, eToro meets many of the criteria, as it is regulated and licensed by CySec and the FCA, and offers trading services. All that’s left is to open an account, which takes just a few minutes. Just try it for yourself!

CFDs are complex instruments and come with a high risk of losing money rapidly How to Invest in Oil in Arab Countries – Conclusion

eToro – The Best Broker for Oil Investment in Arab Countries

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.

Frequently Asked Questions

Is oil a good investment?

What are the risks involved in learning how to invest in oil?