دليل تداول الذهب في الدول العربية – أفضل الاستراتيجيات للمبتدئين

Gold is the world’s most traded commodity, alongside oil, natural gas, and food grains. Not only that, but this precious metal is also one of the most sought-after assets due to its use as an inflation hedge and a top destination for those seeking safe havens worldwide. Furthermore, gold is widely used in numerous industries, such as jewelry, dentistry, some medical products, mobile phones, and many others.

Trading gold several decades ago was extremely difficult, as you had to buy and sell the metal itself and then bear the expense of storing it. Today, however, everyone can buy and sell gold without worrying about these difficulties.

In this guide, we’ll explain everything you need to know about gold trading in Arab countries, including Kuwait, the Arab states, Bahrain, and Qatar. We’ll also cover in detail the fundamentals associated with investing in gold, including the advantages, risks, and trading strategies. We’ll also recommend the best gold trading platforms in Arab countries and other Arab countries.

How to Buy Gold Stocks – 2021 Step by Step

To start buying gold shares, you need to follow these steps:

73.81% of CFD accounts lose money.

What is gold trading?

Gold trading is simply a popular investment method that involves gold as an investment asset from a financial market perspective. Just like with other financial assets, gold trading in Arab countries involves buying and selling the commodity to generate profits in the short or long term, as well as adding it to an investment portfolio as a hedge against the risks of inflation or other market declines.

Gold is considered one of the most important assets in the modern economic and monetary system, and its relative global scarcity enhances its intrinsic value. Many investors turn to gold during times of inflationary pressures, political instability, and economic recession. There are many ways to trade gold, perhaps the most common of which is the traditional method of purchasing physical gold in the form of bullion, coins, or jewelry. However, with the current technological advancement, numerous methods have emerged that allow investors to buy and sell gold for speculation and profit, such as futures contracts, gold investment funds, exchange-traded funds (ETFs), options, and contracts for difference.

Gold trading price

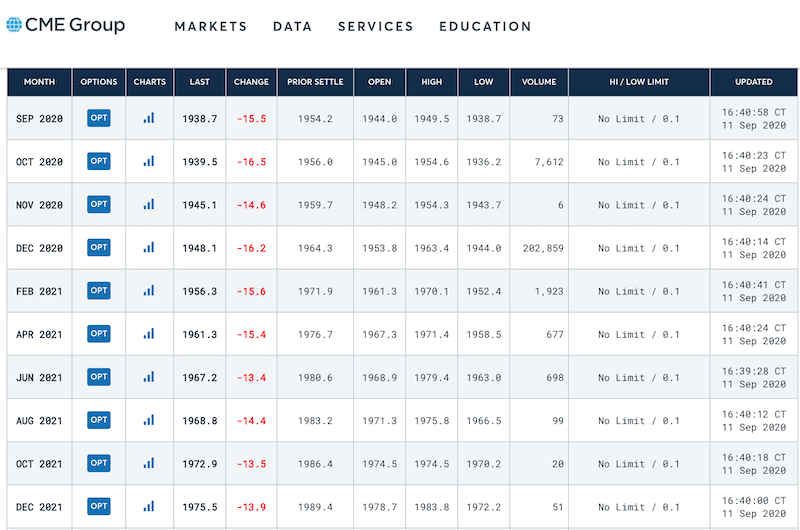

Gold is traded in a variety of ways and across multiple markets, which requires understanding the differences between spot and futures trading. The primary difference between the two markets is that when trading spot gold, the prices quoted represent the current market value of the asset—in other words, the price you would use to buy and sell gold at the current moment. Spot gold is traded 24/7 on interbank markets, which are derived directly from the global over-the-counter (OTC) gold markets.

The spot gold price is the benchmark for pricing an ounce of gold worldwide and plays a pivotal role as a pricing indicator in the gold bullion industry.

On the other hand, gold futures contracts have different expiration dates, typically covering the next 12 months. In other words, gold futures contracts allow investors to buy and sell the precious metal at a future date at a predetermined price. Gold futures prices typically tend to be higher than the spot price of gold due to the costs involved, including storage, insurance, and interest rate calculations.

A gold contract includes a standard quantity of the precious metal, equivalent to 100 ounces, and is traded in US dollars and fractions of a cent per ounce. For example, if gold is trading at $1,940 per ounce, the contract value is equivalent to $194,000. It’s worth noting that most CFD brokers offer trading in gold contracts that track spot prices, not futures.

There are also several other differences between the two markets, including:

- Minimum transaction size: There is a minimum transaction size for gold futures contracts of 0.01 lots (1,000 units), while the minimum transaction size for gold in the spot market is 0.10 lots (10,000 units).

- Swap Fees: You will pay a fee for rolling over gold trades, but this only applies to spot contracts.

- Minimum Tick Size and Value: The minimum tick size and distance in gold futures is $10.00/tick, while in the spot market it is $10.00/pip.

Gold trading hours

Trading in global gold markets (spot gold) takes place 24 hours a day, 5 days a week, so investors can trade the yellow metal at any time and from anywhere in the world. However, the global gold market closes daily between 10:00 PM and 11:00 PM GMT.

Gold trading methods

As mentioned earlier, there are four main ways to trade gold beyond the traditional method of buying and selling physical gold. Below, we review the other three methods investors can use to buy and sell gold on electronic platforms without having to physically hold or store the precious metal.

CFDs on gold

Contracts for difference (CFDs) represent an alternative way to trade commodities, such as gold and crude oil. Simply put, CFDs are a form of financial derivatives that give you the ability to invest in a specific asset without actually owning it. In other words, you enter into a contractual agreement with another investor to speculate on the price of the commodity, rather than owning it physically. For this reason, trading gold in the form of CFDs is one of the easiest and least expensive investment methods, as it doesn’t require large investments as long as you have sufficient funds to meet margin requirements.

Also, when buying and selling gold through a CFD broker, you won’t have to pay any commissions. You can also trade using leverage, allowing you to open trades in sizes as small as fractions of a standard contract (lot). This means you won’t need as much capital to open a gold trading position, compared to purchasing futures directly from a formal exchange.

gold futures contracts

Futures are the most popular way to trade gold, although they are more complex and expensive than trading the precious metal through CFDs. For centuries, futures contracts have been used as an insurance tool to mitigate the risks faced by farmers, producers, and large corporations. Today, futures contracts are used not only to hedge against future risks but also to speculate on asset prices.

More specifically, when you purchase a futures contract, you don’t pay the future settlement price—that is, the price at the contract’s expiration date. Rather, you are entering into a contractual agreement to buy or sell the commodity at a specific price on a specific date and place. Although trading futures contracts on a formal exchange offers investors advantages such as deep liquidity and the ability to build multiple trading strategies, it is highly complex and requires lengthy registration procedures and significant capital investment.

In any case, there are many gold futures trading exchanges worldwide, including but not limited to:

- Chicago Mercantile Exchange (CME)

- U.S. Commodity Futures Exchange (COMEX)

- Tokyo Commodity Exchange (TOCOM)

- Euronext

- Shanghai Gold Exchange

- Multi Commodity Exchange/National Commodity and Derivatives Exchange of India

- Intercontinental Exchange

COMEX is the largest gold futures market, as well as the largest derivatives exchange in the world.

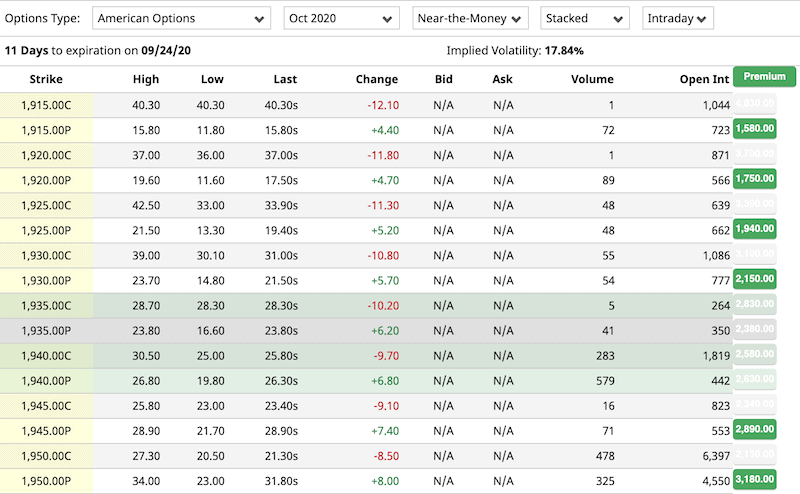

Gold Options

Options are a popular way to trade gold. Call and put options give the holder the right to buy or sell gold at a specific price and on a predetermined date. These options are typically traded on futures exchanges.

Gold options offer some advantages over futures, such as greater leverage, the ability to control the size of potential losses, and the application of hedging strategies.

For example, at the time of writing, gold futures for December 2021 delivery are trading at $1,947.9. If you believe gold prices will rise in the future, you can purchase call options. Let’s assume you choose a strike price of $1,950 for the October 2020 contracts. Remember that the expiration date affects the option price, so the December contract price will be higher than the October contract price.

Source: Barchart

Each gold option contract controls 100 ounces, so if the cost of the option contract at the strike price of 1950 is $20.50, the premium you will pay for that option is $20.50 x 100 = $2050.

Here are the possible scenarios that may occur upon expiration of the option: Assuming the price of gold reaches $2,000 by the expiration date, the investor can exercise the option to buy gold at $1,950 per ounce and immediately sell it on the market at the spot price of $2,000 per ounce. In this case, the trader will make a total profit of $5,000.

Advantages of gold trading in Arab countries

If you’re still wondering whether or not to trade gold, let us help you decide by listing some of the benefits you’ll reap from trading gold in Arab countries.

Gold is considered an ideal asset for hedging financial market risks.

Gold is primarily classified as a safe haven asset, due to its ability to preserve

Gold has deep liquidity.

Deep liquidity is a top priority for traders, both individuals and major financial institutions. Gold is the most widely traded precious metal and one of the most liquid commodities in the world. This means it’s easy to access all the news and analysis related to the gold markets. You can also use the Gold COT Report, which includes important data on the activities of active day traders and is published once a week by the Commodity Futures Trading Commission (CFTC), to help the public understand the dynamics of the gold market.

Tax benefits

Last but not least, if you are a UK resident, you can trade gold through spread betting, which allows traders to exempt profits from capital gains tax. Many of the most popular brokers operating in the Arab region, such as FXCM and IG Markets, allow you to open spread betting accounts.

How to make profits from gold trading

Unlike stock and bond markets, gold doesn’t pay dividends or any other form of passive income to its holders. This means you only profit from speculating on the price movement of gold. It’s important to remember that you can buy or sell gold short, giving you the opportunity to profit whether the price rises or falls. For example:

- Let’s assume you place a sell order on a gold CFD worth 1,000 SAR with a leverage of 1:10, which means you only need to invest 100 SAR.

- Let’s assume that the price of gold has fallen by 10% after several days.

- In this case, the value of your CFD on gold will rise to 1,100 riyals.

- If you think the downtrend is about to end, you can place an order to close the trading position.

- In this case, the deal generated a profit of 1,100 riyals after investing only 100 riyals.

Despite this optimistic scenario, you must consider the risks involved in this type of trading. For example, if the market moves against you by 10%, you could lose your entire capital. Therefore, you must monitor margin requirements for all open contracts and ensure you maintain sufficient funds in your trading account.

Gold trading risks

Online gold trading can be used to hedge against economic risks, but there are still high risks involved in trading the precious metal for the purpose of speculating on price fluctuations.

First and foremost, gold differs from other assets traded in financial markets due to its weak correlation with other assets. Second, gold price trends are determined by a complex equation in which market news intertwines with the forces of supply and demand. This is why gold can experience sudden movements and unexpected fluctuations, regardless of the prevailing original trend.

Finally, you are exposed to the risk of losing your capital rapidly, especially when using high levels of leverage when trading CFDs.

Taking these factors into account, you’ll need to develop a solid risk management plan before you start trading gold. Examples of risk management strategies commonly used by day traders include risk/reward ratios, stop-loss and take-profit orders, and the ‘one percent rule.’

Gold trading strategies

As with all other forms of investment, you’ll need to develop an effective gold trading strategy that can predict market trends. Here are some suggestions to help you create a solid trading plan:

gold/silver ratio

The gold/silver ratio represents the amount of silver needed to purchase one ounce of gold. This ratio is widely popular among precious metals traders due to the strong correlation between gold and silver trends. The high correlation between the two commodities allows the gold/silver ratio to be used as a tool to determine the right time to buy or sell gold or buy and sell silver.

Monitoring other precious metals

Precious metals, regardless of their names, tend to move in the same direction, as investors generally view this asset class as a hedge against market risk. However, from time to time, a precious metal may deviate from the trend and move in a direction different from that of its peers. To better understand correlations, we recommend placing all precious metals (gold, silver, platinum, and palladium) on a single watchlist and closely monitoring their price movements for some time.

Market news and economic data

Gold reacts strongly to market news and economic data, exhibiting a high degree of sensitivity in this regard, perhaps more than other asset classes. This was evident since the beginning of the COVID-19 pandemic, when gold rose by 25% due to the turmoil in financial markets. This means it is essential to follow relevant news and important economic data issued by major central banks. For this reason, we advise you to seek a reliable source of financial information and monitor the economic calendar for dates of important events and reports. Among the most influential economic data on gold trends are gross domestic product (GDP) growth reports issued in the United States, Europe, the United Kingdom, China, Japan, Australia, and many others, in addition to the consumer price index, non-farm payrolls, unemployment data, and interest rate decisions.

Gold Trading Tips

Here are some tips to keep in mind before you start trading, as well as some recommendations specifically related to gold trading.

Tip 1: Use the risk/reward ratio.

Using the risk-reward ratio is a simple yet effective investment tool. This ratio allows you to evaluate the potential return and risk of any trade, as well as compare it across different time frames (day, week, month). For example, most day traders use a risk-reward ratio that typically ranges between 1.0 and 0.25%. If you plan to trade for the long term, you should use a higher risk-reward ratio, ranging from 1:3 to 1:5. This translates to a potential profit of at least 3 riyals for every 1 riyal you risk.

Step 2: Practice trading gold on a demo account.

The vast majority of CFD brokers allow you to open a demo trading account, which gives you the opportunity to master the trading platform and test your strategies with virtual money. While this step isn’t mandatory, it’s extremely useful in honing your skills and testing the ability of your strategy to achieve your desired goals.

Tip 3: Learn technical analysis.

Technical analysis is an essential tool in the arsenal of both long- and short-term traders. This type of analysis focuses on predicting price movement based on historical data. Technical analysis is widely popular and important in modern online trading markets. Mastering technical analysis requires reading relevant investment books, reviewing articles and guides on day trading topics, and familiarizing yourself with the most common technical analysis terms and indicators. To begin your journey, we recommend using the following indicators: Moving Average Line (MA 26, MA 12), Relative Strength Index (RSI), Bollinger Bands, Fibonacci Retracement Levels, and volume indicators.

Step 4: Follow the US Dollar Index

The US dollar is the pricing standard and settlement currency for gold contracts worldwide. This means it’s essential to be familiar with the factors driving currency markets, particularly those related to the US dollar’s trends. Although supply and demand play a pivotal role in determining gold prices, they don’t necessarily fluctuate significantly throughout the day. Therefore, the strength or weakness of the US dollar can significantly impact gold price movements.

Step 5: Try Gold Trading Signal Services

One useful way to get ideas for gold trading is to look for a reputable trading signal provider. Trading signals and recommendations rely on complex algorithms, which alert you via email or text message when trading opportunities appear in the market, provided certain conditions are met.

Best trading platforms

Given the overwhelming popularity of gold as one of the most widely traded assets globally, you’ll notice that almost all brokerage firms allow the buying and selling of this important commodity. Consequently, there are hundreds of gold trading platforms in Arab countries and beyond. However, gold trading can be quite expensive if you invest through a bank or brokerage firm that connects you directly to futures exchanges like the CBOE. To make things easier for you, we recommend the following list of the safest and most affordable gold trading platforms for investors from Arab countries, according to our latest review for 2021.

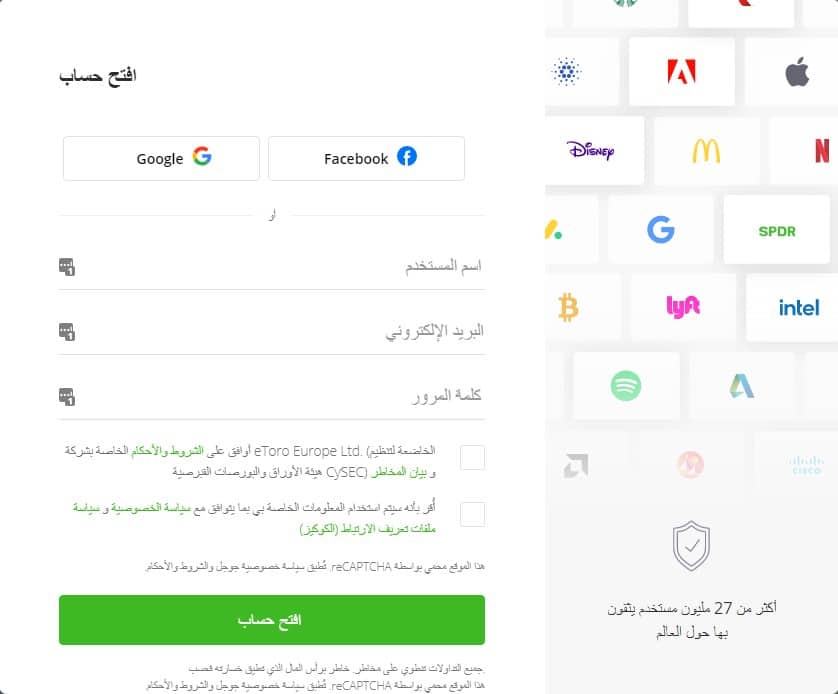

1. eToro – An efficient and secure social trading platform in Arab countries

eToro is a licensed, secure online trading platform that allows users

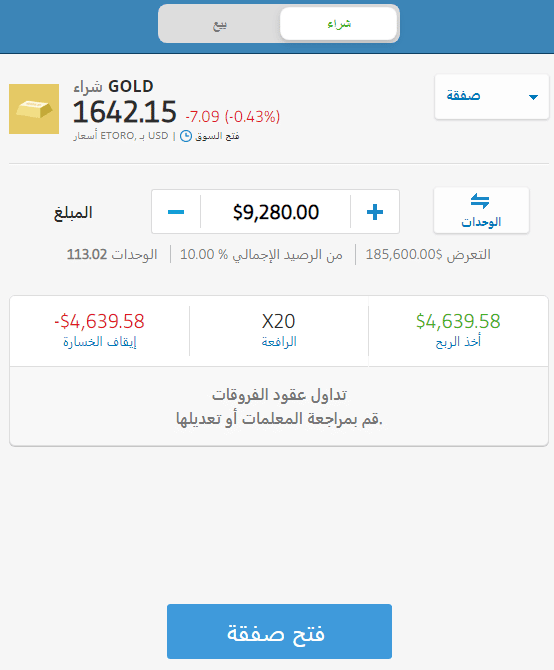

You can trade CFDs on the eToro platform, which allows you to use leverage of up to 1:10 when buying or selling the precious metal. In addition, eToro allows trading on a range of popular gold exchange-traded funds (ETFs), such as SPDR Gold (GLD), iShares Gold Trust (IAU), Gold Miners ETF VanEck Vectors, and many others. You can use leverage of up to 1:5 when trading ETFs.

It’s worth noting that eToro is licensed by the UK’s Financial Conduct Authority (FCA), making it one of the most reliable and secure trading platforms in the world. You can start investing with eToro with an initial deposit of SAR 750, which you can deposit via PayPal, credit/debit cards, or bank transfer. Alternatively, you can start by opening a demo account, which gives you $100,000 in virtual funds.

eToro is also one of the most popular stock trading platforms.

eToro Fees:

| Commission | 0% on ETFs |

| Deposit fees | Free |

| Withdrawal fees | $5 |

| inactivity fees | $10 per month after 12 months of inactivity |

Advantages:

Disadvantages:

67% of retail investor accounts lose money when trading CFDs with this provider.

2. Alvexo - Trade gold with a safe and reliable broker

The platform offers a diverse catalog of financial instruments; our research shows that traders will be able to trade forex, stocks, commodities, indices, and cryptocurrencies there.

To execute your trading operations, you will have the option of using the MetaTrader 4 platform or the web or mobile application developed by Alvexo.

Alvexo offers different spreads depending on the type of account you open. Thus, the Standard account offers higher spreads, unlike the Gold or Premium accounts, which have very competitive spreads.

Advantages:

Disadvantages:

76.57% of CFD accounts lose money.

3. AvaTrade - The Best Gold Trading Platform for Professional Traders

AvaTrade is also one of the most reliable CFD trading platforms you should consider, especially if you are an experienced investor. AvaTrade offers a wide variety of assets across several trading platforms, including MetaTrader 4, MetaTrader 5, AvaTradeGo, and AvaOptions. AvaTrade is also among the best platforms for automated trading tools, allowing users to copy the trades of other traders.

As for the gold trading conditions on the AvaTrade platform, it offers leverage of 1:5 for individual traders and 1:200 for professional traders. The platform charges a highly competitive spread of 0.28 and allows gold trading in contract increments as small as 0.01 lots. Furthermore, the platform charges no commissions other than the difference between the buy and sell prices (the spread).

You can start trading gold with AvaTrade with a deposit of as little as $100, with instant funding options available using credit or debit cards. It's worth noting that AvaTrade is licensed in numerous countries worldwide.

AvaTrade Fees:

| Commission | 0% |

| Deposit fees | Free |

| Withdrawal fees | Free |

| inactivity fees | £50 per quarter after 3 months of no account activity |

Advantages:

Disadvantages:

79% of individual investors incur financial losses when trading CFDs on this site.

4. Libertex - Broker for CFD trading on gold without spreads

Libertex offers a unique trading proposition: instead of charging a spread

The zero spread offer applies to many asset classes, including metals, commodities, forex, indices, stocks, and cryptocurrencies. This commission ranges from 0% to 0.5%, but some account types benefit from a 50% discount.

You can trade CFDs on gold with Libertex with a low commission of 0.004%! The Libertex platform boasts a wealth of functional capabilities, along with ease and intuitive user experience, as well as numerous excellent research and educational resources.

Furthermore, Libertex offers its clients peace of mind and reassurance regarding the safety of their funds. The company is licensed by CySEC, segregates client funds in segregated bank accounts, and implements a negative balance protection policy for individual traders.

Libertex fees:

| Commission | 0% - 0.5% |

| Deposit fees | Free |

| Withdrawal fees | 1 EUR on credit/debit cards, 1% on Neteller, free with Skrill |

| inactivity fees | 10 euros after 180 days |

Advantages:

Disadvantages:

83% of individual investors incur financial losses when trading CFDs on this site.

Pros and cons of gold trading in Arab countries

Advantages:

Disadvantages:

How to start gold trading in Arab countries

If you've landed on this page, you're likely looking for how to get started trading gold. If our prediction is correct, we'll take this opportunity to explain how to open an online trading account and start trading gold on the eToro platform, which allows you to trade gold with access. The process of opening an online trading account is largely similar for all CFD brokers.

The first step you need to take is to go to the eToro homepage and register for an online trading account. Once you’re on the broker’s homepage, enter your email address, choose a password, and click the ‘Open Account’ button. At this stage, eToro requires you to enter your country, nationality, place and date of birth, personal address, mobile phone number, and finally the currency you have chosen to trade in from four available currencies. After completing the registration process, you’ll be able to fund your eToro account. The company accepts payments via credit/debit cards in Arab countries, bank transfers, and e-wallets. eToro requires a minimum deposit of $20. On the “Trading” interface, find the asset you want to trade, then complete the trade by clicking Buy or Sell. eToro also allows you to use features like stop loss so you can have complete control over your trades.Step 1: Open an online trading account

Step 2: Enter personal information

Step 3: Deposit funds

Step 4: Start trading gold

Many traders attempt to capitalize on short- and long-term gold price fluctuations to generate profits. The profit opportunities don’t stop with speculating on gold prices; the precious metal can also be used as a hedge against inflation and market uncertainty. For this reason, gold traders focus on monitoring macroeconomic indicators such as unemployment data and consumer prices, as well as potential scenarios of market turmoil, political instability, and inflationary pressures. If you’re a novice trader, gold is definitely an asset to consider at the beginning of your journey. As we’ve explained in this guide, CFD brokers like eToro offer the easiest way to enter the gold markets. All you need to do is register on one of these platforms, master its handling, and then find a successful trading strategy. Want to get started with eToro today? Simply click the link below to create your account and start trading gold!

CFDs are complex instruments and come with a high risk of losing money rapidly conclusion

due to leverage. 73.81% of retail investor accounts lose money when trading

CFDs with this provider. You should consider whether you understand how

CFDs work and whether you can afford to take the high risk of losing

money.

Frequently Asked Questions

What are the best gold ETFs??

What is the minimum investment amount required to trade gold?

Can I short sell gold?