دليل التداول الاجتماعي (Social Trading) في الدول العربية

Trading can sometimes seem like a separate activity, but it doesn’t have to be. With social trading, you can interact with fellow traders from all over the world. Social trading has gained popularity in Arab countries in recent years.

Social trading has benefits beyond just making trading fun. It can also be a great way to learn new trading strategies and gauge market enthusiasm for a particular asset.

If you’re considering trying social trading in the Arab world, this guide is for you. We’ll explain everything you need to know about social trading and review the social trading platforms you can start using today.

How to Start Social Trading

61٪ من حسابات العقود مقابل الفروقات تخسر أموالاً.

What is Social Trading ?

Social trading is a type of trading where you interact with and learn from other traders. These traders can be your peers or highly profitable professionals who serve as role models.

The idea behind social trading in Arab countries is that you can learn from others. Through a social trading platform, you can share updates on your trades, explain your decision-making process, ask other traders about their trades, comment on a trade to support it, or start a discussion.

How does social trading work ?

Social trading in Arab countries works like any other popular social network. With the exception of sharing photos or status updates, individuals on the social trading network share trading data.

Follow other traders

To get started on a social trading network, the first thing you need to do is find other traders to follow. The best social trading platforms have an explore feature that lets you browse traders you might want to follow based on the sectors or assets they trade. You may also see the highest-earning traders on the network who have the best track records.

Each trader has their own profile page, so you can easily follow along to learn more about any trader you’re considering following. The profile page may provide some basic information about the trader, such as whether they’re an amateur, part-time, or professional trader, the types of assets they prefer, and the trading strategies they use.

Most importantly, you’ll also be able to see their current portfolio, trades, and history. You can’t see how much money any particular trader has, but you can see their return as a percentage, and the percentage of a single trade compared to their total portfolio.

News and Comments

Once you follow a few traders, updates from those traders will appear in your personalized news feed. These are typically news clips about new trades, comments, and other activity occurring on the social trading network. It’s a useful way to stay informed about what other traders are buying and selling, which may give you ideas for your own trades.

Another key aspect of social trading apps is their interactive nature. Other traders can follow you once you create your profile. You can also comment on other traders’ activity. For example, you might want to congratulate another trader on a winning trade or ask them how they decided to enter that trade.

Social trading in Arab countries can be a great way to learn more about trading strategies or hear other traders’ thoughts about a company. Comments are public, so you’ll find plenty of feedback from other traders. It’s relatively easy to start a thoughtful discussion about the merits of a particular asset or trading strategy.

Measuring market sentiment

An added advantage is that the best social trading platforms allow you to quickly gauge market sentiment for an asset. On some social trading platforms, data on traders’ open positions is collected through the platform. This means you can easily see the percentage of traders buying or selling an asset and use this information to inform your trading decisions.

Copy trading

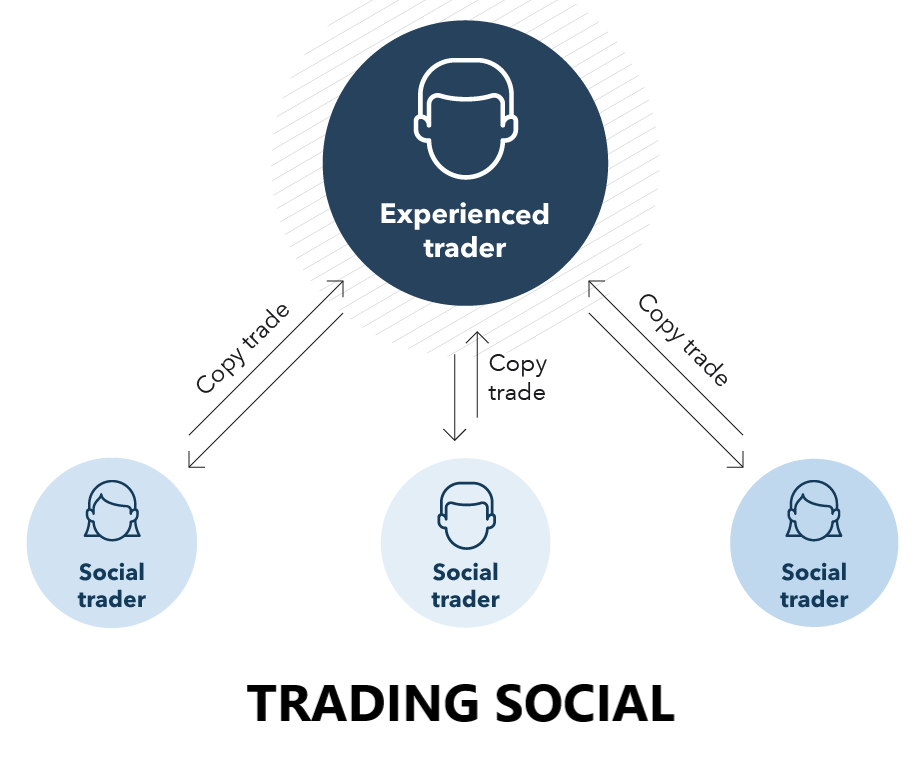

Another key component of many social trading platforms is copy trading. When copy trading, you can go beyond simply looking at another trader’s portfolio. You can actually mimic that in your own portfolio so that you can profit when that trader makes profits.

Copy trading can be extremely beneficial for beginner traders in particular. Simply find a more experienced trader with a proven track record and a risk tolerance similar to yours. Then set up the copy trading and sit back while the more experienced trader does the hard work of finding trading opportunities and interpreting market signals.

Even better, you can commit as much or as little of your portfolio to copy trading as you like. For example, let’s say you have £5,000 in your account. You can use copy trading to create a £2,500 forex social trading portfolio that works automatically. You can then manually trade the remaining £2,500, such as in stocks, to diversify your account.

Examples of Social Trading in Arab countries

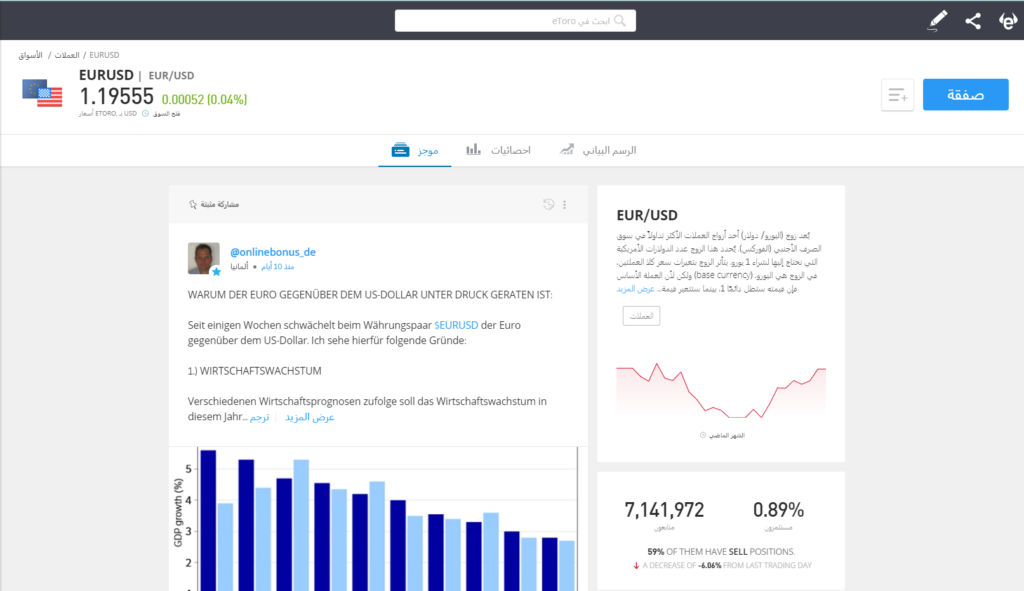

To show you how social trading works, let’s take a look at an example of social trading in Forex with eToro. We’ll focus on Forex currency pairs.

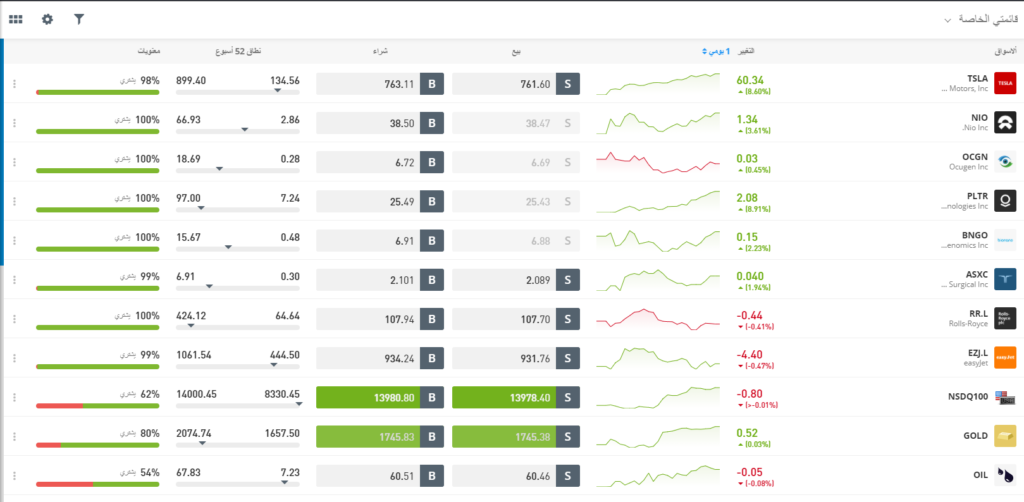

eToro will begin analyzing various prices and compile a list of good opportunities for you. If the program believes the EUR/UDS forex pair could be profitable, it will be included in the list.

On other social trading networks, the EUR/USD forex pair has its own news feed. You can quickly browse it to see what other traders are saying about the pair. Additionally, some platforms display the number of traders who have the pair on their watchlists, the percentage of traders on the network who currently have open positions on it, and the ratio of buyers to sellers.

Based on all this information, you can decide whether the EUR/USD offers you a good trading opportunity and whether to buy or sell this currency pair. If you’re not convinced that the EUR/USD is a suitable trade for you, you’ll also be shown the assets other traders are buying and selling.

Advantages of Social Trading

Social trading has become incredibly popular in Arab countries in recent years. This is largely due to the fact that this trading style offers several advantages over traditional trading. Let’s take a closer look at some of the most important benefits of social trading.

Learn from other traders

The best thing about trading on a social network is that it offers an opportunity to learn. Because you can see other traders’ portfolios, you’ll gain a better understanding of how to diversify your assets and how to determine how much money to bet on a single trade. You can also see when traders entered and exited trades, giving you insight into trading strategies and risk management techniques.

Furthermore, gathering ideas isn’t just about looking at someone else’s portfolio. If you don’t understand why an experienced trader did something, you can simply ask them! Social trading platforms make it easy to start discussions about everything from individual trades to broad strategies.

Know the market

Another important benefit of social trading in Arab countries is that trading on a social network provides additional market information. Trading data on a social network is public, so you can see whether investors are buying or selling a particular asset before opening your trade. This is a great help, as it’s often difficult to know how other traders feel about a company, currency, or commodity.

Additionally, it’s possible to use other people’s research on an asset to improve your trading decisions. You may analyze a trade one way, but another trader may post a different analysis of the same trade. Accessing this additional information enables you to make better decisions and increase your profitability.

Check out the latest news

Social trading platforms also provide a way to stay informed about market news. Events and announcements that can move the market are likely to appear quickly in your news feed. The sooner you learn about the news, the sooner you can act on it and potentially profit from it.

Automate your trading

The advantage of copy trading cannot be underestimated. With this type of trading, you place your portfolio in the hands of experienced traders with proven track records. It’s like having a dedicated portfolio manager for free or at minimal cost.

Additionally, because copy trading is automated, it makes trading much easier and less time-consuming. This alone is a huge advantage for part-time traders who need to balance work, home, and trading time.

You can build a trading community.

For many traders, the primary benefit of social trading in Arab countries has nothing to do with additional information or automated trading. Rather, the value of social trading platforms lies in their ability to bring traders together.

Social trading apps and platforms can foster communities among traders. Traders can congratulate each other on winning trades and express regret over losing ones. This sense of community makes trading more enjoyable in the long run.

Social Trading Risks

The main risk of social trading is that it’s too easy to rely too heavily on other traders. While it’s tempting to believe that more experienced traders with winning records are right in many cases, a winning record doesn’t guarantee they’ll be right about future trades. Following what other traders say without conducting your own analysis can get you into trouble.

Likewise, it’s important to remember that you don’t know everything about other traders on the social network. Many people have multiple brokerage accounts, so it’s possible that the portfolio you see represents only a small portion of the trader’s total portfolio.

Social trading can be a useful tool, but it’s important not to use it as a substitute for trading. Always do your research. While other traders can be helpful, you are ultimately responsible for your own trading decisions.

Best Social Trading Platforms

Choosing the right social trading platform makes a huge difference in your performance. While many social trading platforms in the Arab world share a similar set of features, they can vary significantly in how they deliver these features. Additionally, different brokers offer different trading assets and have different pricing structures.

With that in mind, let’s dive into a social trading review of four of the best platforms in the Arab world today:

1. eToro — An Effective Social Trading Platform

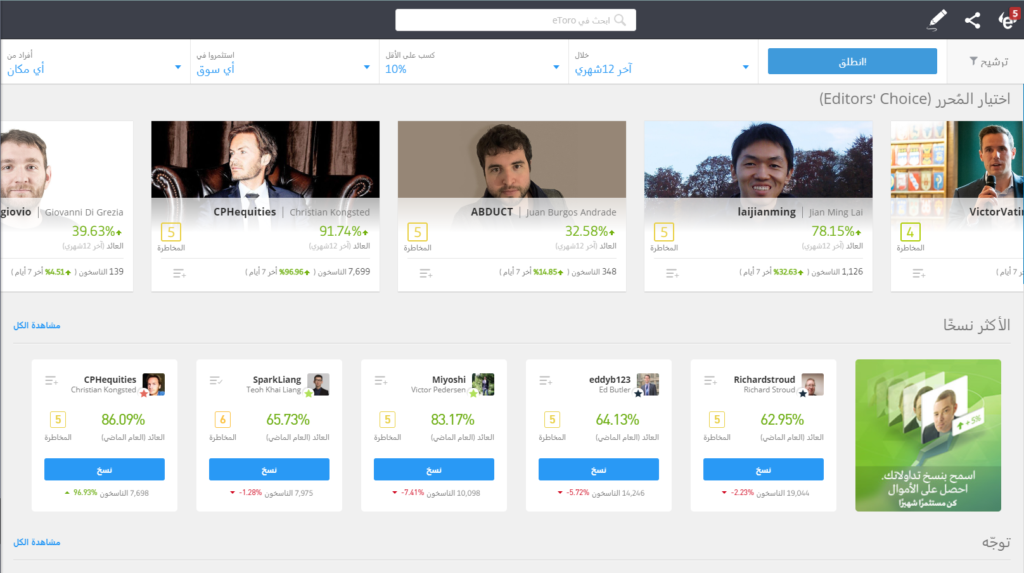

eToro offers the best social trading platform in the Arab world. When trading socially

eToro’s social trading network also supports copy trading. You can easily browse expert traders who have proven their ability to consistently profit. If you’re good enough to be imitated, eToro’s Popular Investor program offers the opportunity to earn money based on the number of traders who follow you.

Another great thing about eToro is that it offers an incredibly wide range of assets. You can buy stocks and participate in ETFs either outright or through CFDs. CFD trading is also available for forex, cryptocurrencies, commodities, and bonds. All trades are conducted with 0% commission.

Advantages:

Disadvantages:

61٪ من حسابات العقود مقابل الفروقات تخسر أموالاً.

2. AvaTrade — Social Trading via the FCA-licensed AvaSocial app

AvaTrade is a globally licensed broker, tightly regulated by the Central Bank of Ireland, the Australian Securities and Investments Commission, the Japanese Financial Services Agency, and many others.

This broker offers trading in over 1,250 global markets, including stocks, bonds, forex, cryptocurrencies, indices, and more, through CFD accounts, spread betting, and swap-free Islamic accounts.

With AvaTrade, you can access the copy trading service on the MetaTrader market from the MetaTrader 4 and MetaTrader 5 platforms offered by the broker.

The broker also offers access to AvaSocial, a social trading app where you can connect with other traders.

You can also copy their trades through the app, which is a partnership with an FCA-regulated fintech company.

Advantages:

Disadvantages:

71% of retail investors lose money when trading CFDs on this site.

3. Libertex — Social Trading Using MetaTrader Signals

Libertex is one of the world's leading CFD brokers with 23 years of experience and over 2.9 million clients from

The broker is registered and licensed by the Cyprus Securities and Exchange Commission, giving traders peace of mind.

With Libertex you can trade with 0 spreads across 200 markets including Forex, Indices, Commodities, Currencies, Cryptocurrencies and more.

Libertex also offers the MetaTrader 4 trading platform, where you can access MetaTrader signals. This allows you to see the performance of other traders using the platform and copy their trades on your account.

You can also contact them on each signal provider's forum page. This is a great way to educate yourself, too!

Advantages:

Disadvantages:

83% of retail investors lose money when trading CFDs on this site.

Advantages and disadvantages of social trading

Advantages:

Disadvantages:

Learn how to start copy trading ( social trading ) on eToro.

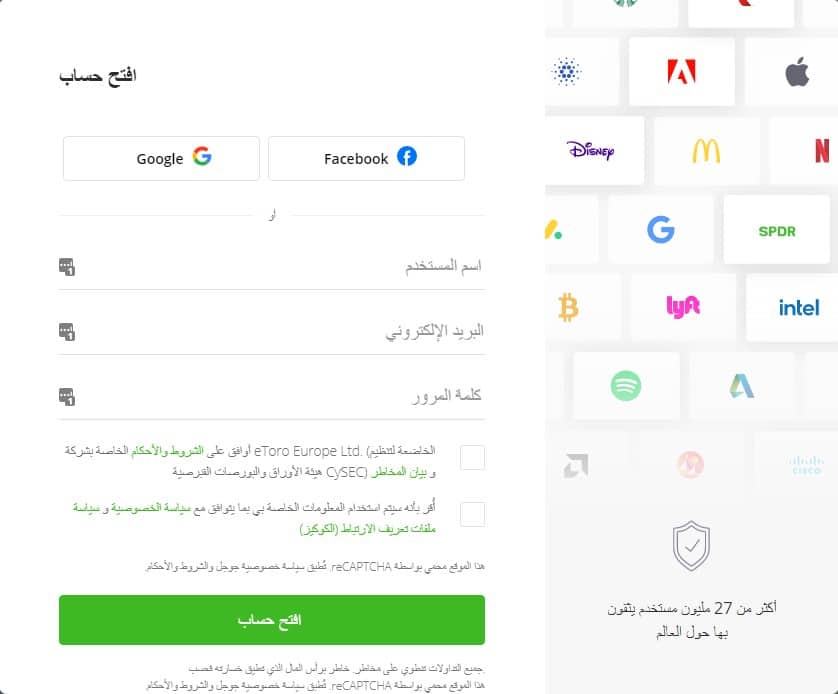

Are you ready to enter the world of social trading? We'll show you how to get started with eToro, which we consider the best social trading platform in the Arab world. eToro offers a vibrant social trading app and allows trading on a wide range of assets commission-free.

To get started with eToro, go to the broker’s website and click “Open Account” to open a new account. You’ll need to enter some personal information, such as your name, email address, and phone number. Since eToro partners are licensed, you must verify your identity, in accordance with government regulations. You can complete the authentication step by uploading a copy of your passport or driver’s license and a copy of a recent utility bill or bank statement. Before you can trade, you need to fund your account. eToro requires a minimum deposit of €220, which you can transfer via debit or credit card, or bank wire transfer. Now you’re ready to start exploring eToro’s trading opportunities and the platform itself. It will begin analyzing the market and giving you recommendations on profitable trades. All you have to do is select the ones you like and place the trade. eToro can be fully automated so that the platform handles trades itself. You can also use features like stop loss, take profit, and limits on the amount you can spend on each trade.Step 1: Open an account with eToro

Step 2: Deposit funds into your account

Step 3: Explore the social network and trade

Conclusion

Social trading in the Arab world is an excellent way to learn more about the markets and improve your trading strategy. When you trade socially, you gain access to an entire community of traders, including professionals with a long history of profitability. Whether you trade yourself using social data as a guide or take advantage of copy trading, social trading can help you become a better trader.

Are you ready to enter the world of social trading? Get started today with eTorof.

61٪ من حسابات العقود مقابل الفروقات تخسر أموالاً.