أفضل منصات التداول للمبتدئين 2026

استخدم أداة البحث التفاعلية الخاصة بنا للحصول على أفضل منصة تداول العربية للأسهم أو الفوركس أو العقود مقابل الفروقات أو العملات الرقمية أو التداول الاجتماعي أو اليومي التي تلبي احتياجاتك.

- نقدم وسطاء منظمين فقط

- نكشف عن التكاليف الخفية و العمولات و السبريد

- اكتشف الوسطاء الذين حصلوا على تصنيف عالي لخدمة العملاء

منظمة بالكامل

مراجعة من خبراء

مراجعة من خبراء

رسوم شفافة

مناسب للمحمول

Trading platforms are the bridge that connects you to the financial market you want to invest in. For this reason, you will have to choose a trading platform that is completely free and suits your needs. The best trading platforms , whether you are interested in stock markets, forex, commodities or even cryptocurrencies.

We strive to bring you the best trading platforms in 2026 and beyond. This research includes trading platforms that offer the best fees and commissions, the most diverse asset classes, and of course, platforms with a strong regulatory stance.

[forex_table id=”18″ ]

We invite you to continue reading to learn about the trading platforms that have succeeded in outperforming their competitors.

List of the best trading platforms

Below you will find a list of the best trading platforms that caught our attention in 2026 . Please scroll down to read the full review of each of the five free trading platforms!

Review of the best trading platforms

For example, it is not enough for the platform to have a good reputation in the market or just choose it to support the financial market you intend to trade in – it must also offer competitive fees and excellent customer support. You will also need to check some other information such as its trading tools, features, educational resources, indicators, and chart reading.

Click the button below to trade with the best trading platforms.

Capital at risk

To help guide you in making the right choice, below you will find a selection of the best trading platforms in 2026 .

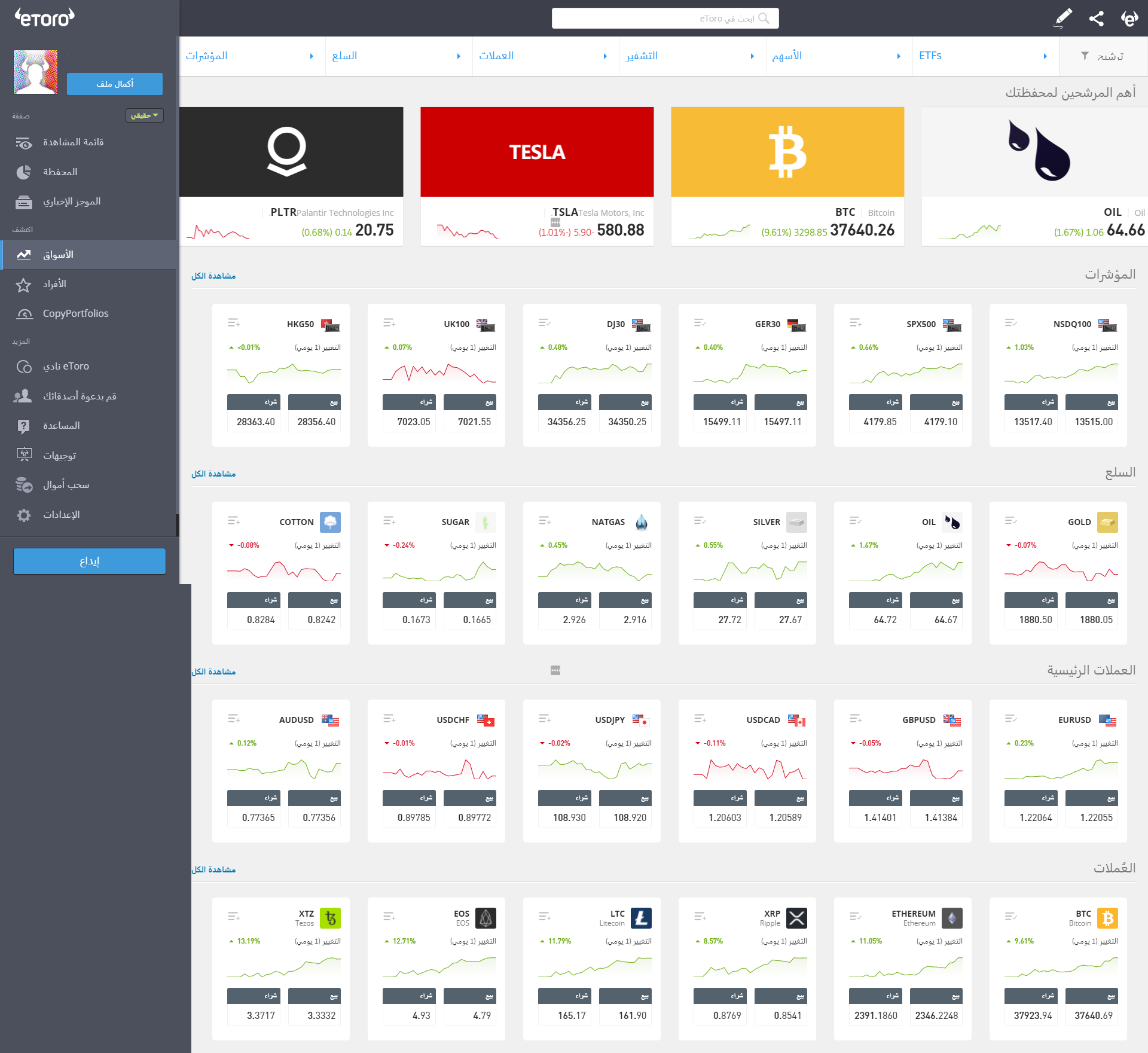

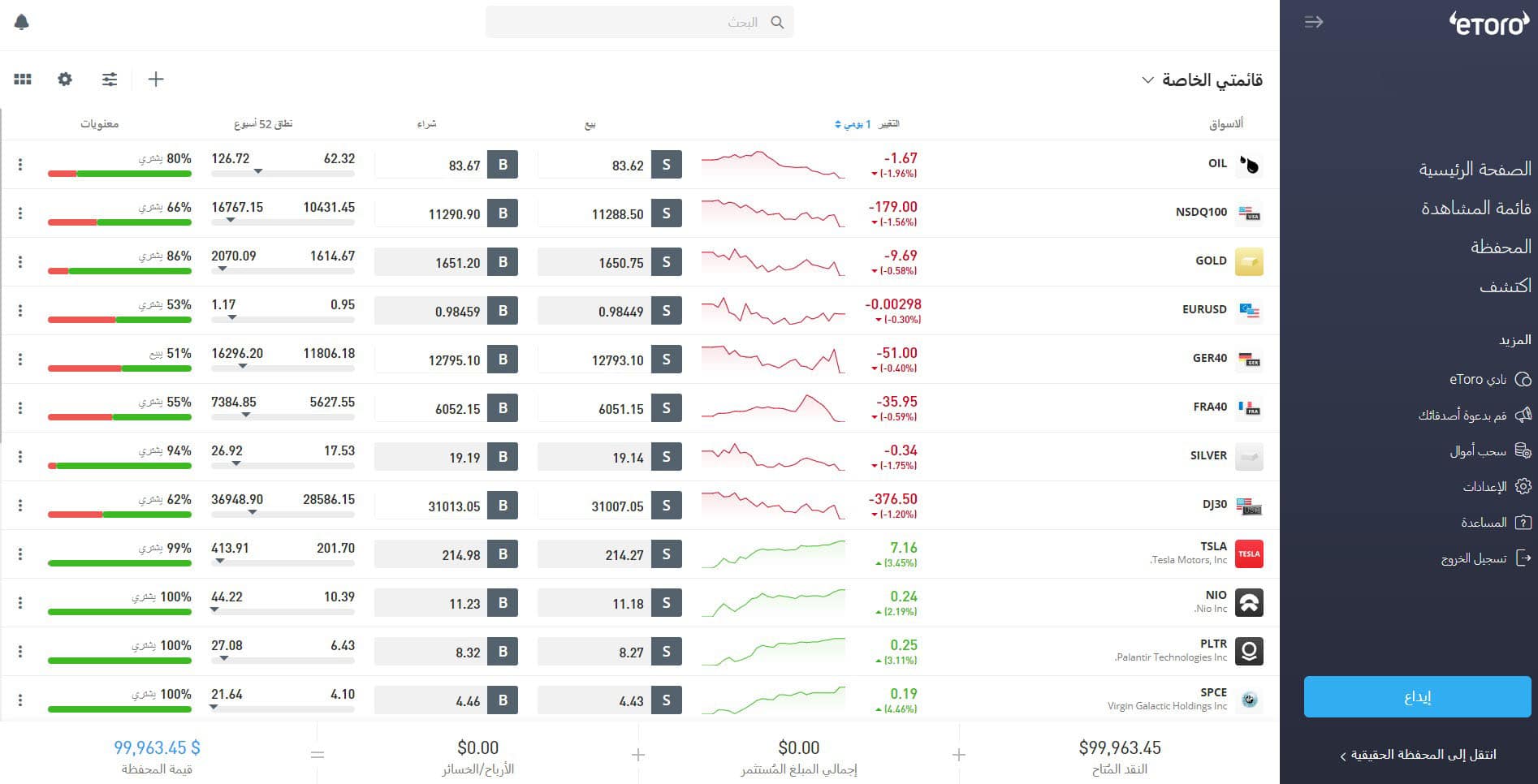

eToro – 1 – Best Trading Platform for Beginners in 2026 :

After searching through hundreds of online investment providers, we found eToro to be one of the best trading platforms for beginners that caught our attention in 2026 . First and foremost, it’s an ideal choice if you’re just starting out in the world of trading. This is because it offers a very easy-to-use platform and supports small-scale trades.

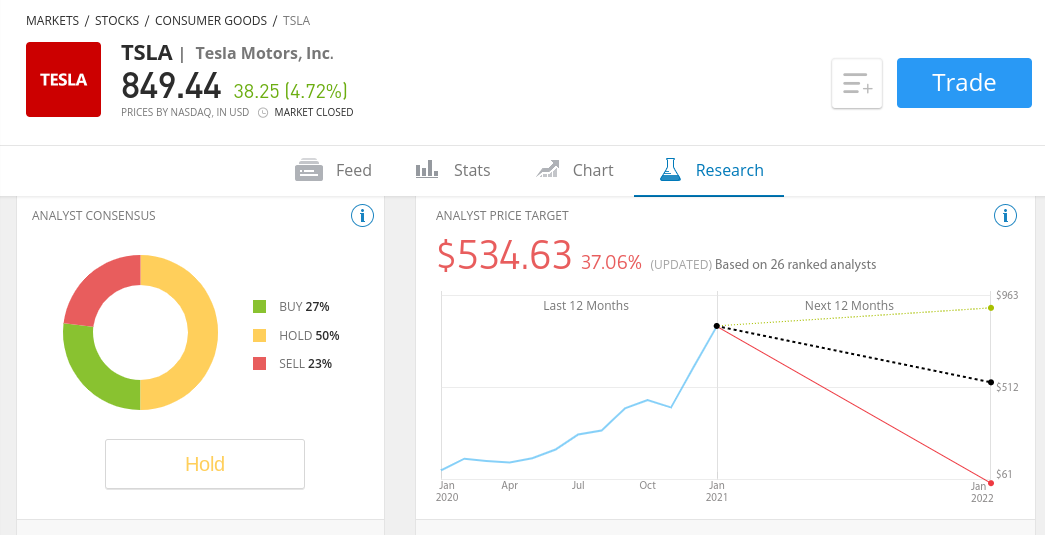

For example, the minimum deposit is just $200, and you can open trades starting from $25. Speaking of assets that you can trade with eToro, the platform supports a wide range of asset classes, covering 2,400 stocks traded on 17 different exchanges. For example, you can buy shares of companies traded on the US, Canadian, UK, and Hong Kong markets , as well as countless European exchanges.

Markets

The eToro trading platform also allows you to trade 13 global indices such as the Dow Jones and 20 cryptocurrencies such as Bitcoin . If you are interested in trading commodities , the platform supports most major commodities from gold and silver to oil and natural gas. Of course, it also offers the opportunity to trade a huge number of forex pairs.

You also won’t have to incur recurring account maintenance fees, which makes the eToro trading platform ideal for those looking for a low-cost broker.

eToro offers the best cryptocurrency and forex trading platforms. Trading cryptocurrencies and forex with eToro is simple and easy, with its ideal platform for beginner traders. It is also among the best CFD trading platforms. eToro also offers investing in stocks and ETFs through the same trading platform. Traders can do everything from these top trading platforms.

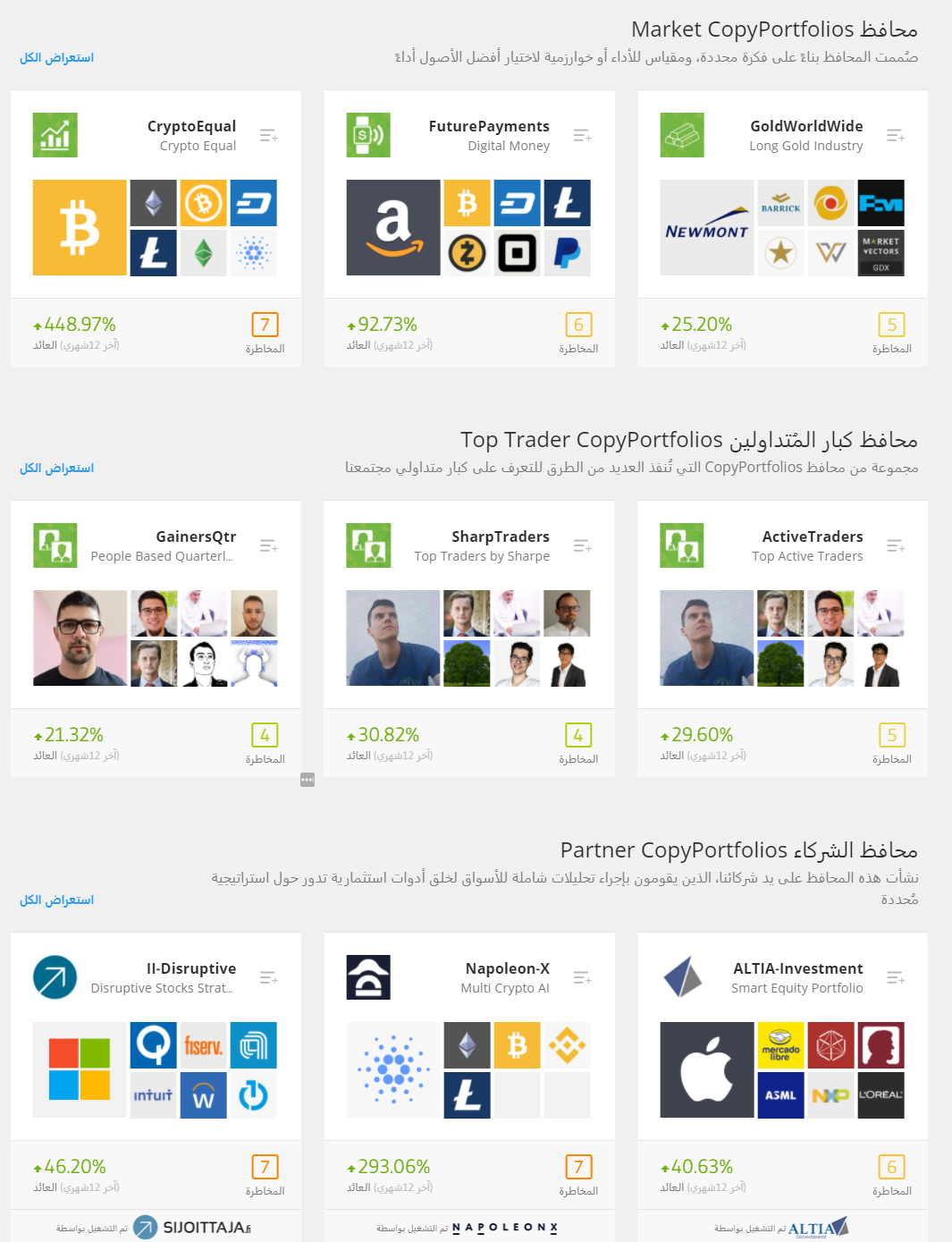

Passive investing

Another reason eToro tops our list of the best trading platforms for beginners is that it offers a range of passive investment tools (ones that traders don’t need to manage themselves). For example, funds allow you to leverage a diversified investment strategy and portfolio managed by a group of experienced traders. This means that the investment team will buy and sell assets on your behalf.

This way, you can trade cryptocurrencies, CFDs, or stock markets with the best cryptocurrency trading platforms, but also the best investors .

There are also numerous strategies to choose from, such as those focused on technology stocks, cryptocurrency trading, and even some that specialize in the renewable energy sector. There’s also a copy trading tool, which gives you the opportunity to select a veteran trader whose performance you like, and then copy all of their trades on an ongoing basis. For example, if a trader allocates 3% of their portfolio to Apple stocks and 2% to Tesla stocks, your portfolio will follow suit. This applies to any stock market or CFD.

financial transactions

Moving on to financial transactions, top trading platforms like eToro allow deposits using debit and credit cards, bank transfers, and e-wallets like PayPal and Skrill . The eToro trading platform is licensed by the UK (FCA), Cyprus (CySEC), and Australia (ASIC), reflecting its strong regulatory commitment and the fact that it takes client safety seriously.

These features strengthen its position among the best cryptocurrency and CFD trading platforms.

Advantages:

Disadvantages:

Capital at risk

2- Alvexo - An innovative trading platform in the Arab world

The company offers a full range of investment services tailored to client needs, with flexible leverage, a comprehensive suite of analytical tools and academic trading resources, and direct client support through the latest software innovations.

organization

Alvexo is regulated and supervised by the Cyprus Securities and Exchange Commission (CySEC). Additionally, another Alvexo entity, operating under HSN Capital Group Ltd, is regulated and supervised as a securities dealer by the Financial Services Authority (FSA) of Seychelles.

Types of trading accounts

Alvexo offers five accounts, each offering investment options tailored to its requirements and configuration. Alvexo's range of trading instruments includes CFDs, stocks, indices, commodities, and currencies, along with the newly launched Alvexo cryptocurrency trading feature.

A variety of additional services depend on the account type, while the VIP account offers more services, dedicated support, and, of course, better rates. It is also an Islamic account, free of commissions and interest, for clients who operate according to Islamic law.

Payment methods and minimum

There are several payment methods that are enabled as an option to transfer to real trading accounts, and these funding methods include popular credit and debit cards, a choice of electronic payments, and bank transfers.

The minimum deposit at Alvexo is $500, which is determined by the terms of the Classic account. However, the amount is also determined by the type of account you choose.

Advantages:

Disadvantages:

76.22% of CFD accounts lose money.

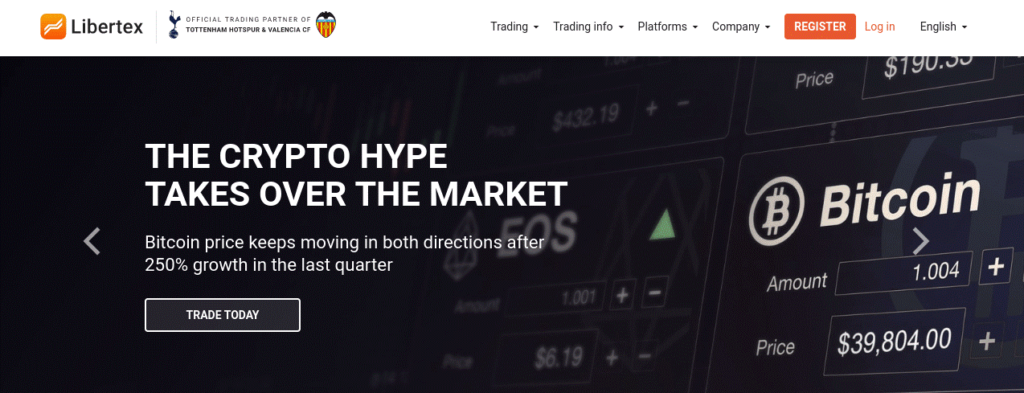

Libertex - 3 - Low-cost CFD trading platform with zero spreads:

This offer allows you to benefit from some of the best quotes available in the industry. Although a commission is charged on both sides of the trade, it is extremely low, at less than 0.1% per order. That's why we offer the best platforms for trading cryptocurrencies and CFDs. Libertex is one of the few brokers that offer zero-spread trading .

A prime example is that you can trade forex with a commission as low as 0.012%. Moving on to the markets it supports, the platform offers CFDs on stocks, commodities, and cryptocurrencies. When trading CFDs, you can use leverage on all trades you want to open.

However, it should be noted that the available leverage ratios adhere to the limits imposed by regulatory authorities in Europe, with a maximum of 1:30 on major forex pairs, and this ratio is lower for trading other assets. The platform also allows for long or short positions on all CFD markets offered by the platform. This feature gives users the opportunity to profit during both rising and falling markets.

Two trading platforms

It offers two trading platforms to choose from: MetaTrader 4 and the company's in-house developed platform. Both platforms can be accessed via the mobile app. For example, you can download trading robots to your desktop—this is the path you'll need to use when installing automated trading robots.

If you like this trading platform, you can open an account in just a few minutes. The minimum deposit is $100 , and you can use credit/debit cards, bank transfer, or an e-wallet to deposit funds. Once you make your initial deposit, the minimum for subsequent deposits drops to just $10.

In terms of regulatory status, this trading platform is licensed by the Cyprus Securities and Exchange Commission, one of the leading regulatory bodies in Europe. Furthermore, it has been offering trading services in various financial markets since 1997. Therefore, it can be said that the company enjoys a solid reputation and a long history of presence in the markets, spanning over two decades.

Advantages:

Disadvantages:

How to choose the best trading platform for you

With so many trading platforms on the market, finding the right one can be a daunting task that takes a lot of time and effort.

Ultimately, you are investing your hard-earned money, so you should be 100% confident that the trading platform you choose is right for your personal circumstances and financial goals.

The best way to make the selection process easier is to list the key criteria that your chosen trading platform should have, which will greatly ease your burden in choosing the best trading platform for the year 2026

Below is a list of the most important factors to consider when choosing a trading platform.

Organizational status

While some tend to choose a trading platform based on criteria such as fees or supported markets, the reality is that making a wise choice should start with prioritizing the safety of your funds.

Again, you should always remember that you will be placing your trust in the platform you choose to protect your capital, so you should check the regulatory bodies that have granted it operating licenses and the supervisory bodies that supervise its business.

According to this criterion, the best trading platforms will be those licensed by reputable bodies, such as the United States. There are also many other recognized regulatory bodies, such as the Cyprus Securities and Exchange Commission in Cyprus and others in the United Kingdom and Australia.

Available financial markets

The online trading industry attracts investors of all backgrounds, interests, and capital sizes. For example, while some focus on stock trading, others are more interested in cryptocurrency or forex trading. For this reason, it's essential to ensure that the platform you intend to trade with offers the market you're interested in investing in.

As mentioned earlier, the best trading platforms for beginners we've discussed today offer the opportunity to invest in a wide range of markets. We can list the asset classes available through these platforms as follows:

- stocks

- Exchange-traded funds, index funds, mutual funds

- Bonds

- Forex and Commodities

- Bitcoin and other cryptocurrencies

You can easily find out if a trading platform supports your preferred markets by checking the list of available assets on its website.

Capital at risk

Trading Platforms: Fees

Charging competitive fees and charges to users is undoubtedly one of the key criteria when choosing the best trading platforms. In many cases, the platform offers a simple and transparent pricing structure. However, some deliberately offer confusing and complex fee systems, making it difficult for traders to know exactly what they will be paying.

To help decipher this, below we review the main types of fees charged by trading platforms.

Trading commission

The commission the platform charges on your trades is the most important fee you should check. These commissions often come in two main forms: For example, some trading platforms charge a fixed fee, such as $15 to buy a stock and another $15 to sell it.

In other cases, you may pay variable fees depending on the platform's policies. For example, a trading platform may charge a 1% fee on all buy and sell positions. Therefore, if you buy $500 worth of stocks, you will pay a $5 commission. Then, when you close the stock trade, assuming its value is $600, you will pay a $6 commission when you sell.

With that in mind, you'll notice that in our list of cryptocurrency trading platforms for beginners, many of the platforms selected, allow you to invest commission-free. This means you can buy stocks, funds, and other asset classes without worrying about commissions or fees.

Spread

If you're a long-term investor and plan to hold your purchased stocks for many years, you don't need to worry about spreads. It's a different story if you're a short-term trader and intend to buy and sell forex, commodities, or cryptocurrencies frequently—in this case, the spread is a critical cost factor.

For starters, the spread is the difference between the buy and sell prices on the asset you're trading. Sometimes the spread is calculated as a percentage, but when trading forex, the spread is displayed in pips.

Transaction fees

You may be surprised to learn that many brokers in the trading industry charge fees for depositing and/or withdrawing funds. Again, the costs you will pay—if any—will vary from platform to platform. Furthermore, you may pay a fixed fee or a percentage based on the deposit amount.

Best trading tools and features

If your primary focus is on a trading platform that allows you to buy and sell various assets, you may not be paying attention to the additional tools and features that this platform offers beyond its primary function. The truth is, this important aspect should not be overlooked, as ignoring it could mean missing out on many useful trading tools.

Examples of these features include:

Fractional shares

The ability to buy and sell fractional shares is a significant advantage if you're an individual trader or have a limited trading budget. Naturally, you wouldn't want to pay $3,000 for a single Amazon share or $1,700 for a single Google share. Fractional shares overcome these obstacles by allowing you to purchase a portion of a stock—in other words, without having to purchase the entire stock.

Some platforms allow you to invest as little as $20. This means that if you invest $20 in a company's stock priced at $200, you will purchase 10% of the stock in question. This option is great not only for investing small amounts but also allows you to build a diversified portfolio.

Capital at risk

Types of commands

Placing an order to execute trades is a standard procedure you'll follow regardless of the trading platform you decide to sign up with. Simply put, the broker needs to know exactly what you want from your trade. While all trading platforms offer standard buy and sell orders, there are other types of orders that may be useful for your trading.

For example, the best online trading platforms offer orders called 'stop loss' and 'take profit.' Both types of orders are essential for limiting loss risk or securing profits. Another type of order is called 'trailing stop loss.' Some trading platforms offer this type of order, which allows you to keep your winning trade open until the market begins to reverse by a certain percentage.

Copy trading

If you want to actively trade in the financial markets but don't have the necessary experience or knowledge, the ideal solution is to look for a platform that offers a 'copy trading' feature. At its simplest, this platform allows you to copy the trades of other traders without any intervention from your side.

بعض المنصات تستضيف آلاف المستثمرين المعتمدين الذين قاموا بالتسجيل في برنامجها يمكنك تصفح الملف التعريفي لكل متداول والاطلاع على إحصاءات رئيسية مثل الأداء السابق، متوسط العائد الشهري، تصنيف المخاطر، فئات الأصول المفضلة، ومتوسط مدة التداول.

إذا وجدت متداولا تريد نسخ تداولاته ، فسيتعين عليك دفع الحد الأدنى المشار إليه من قبل معايير الإيداع الخاصة بكل وسيط. وبمجرد تأكيد اشتراكك، سيتم نسخ جميع الصفقات التي يفتحها هذا المتداول في حسابك مباشرة. وبالطبع، يمكنك إيقاف نسخ الصفقات من المتداول في أي وقت تريده

MT4/MT5

إذا كنت تمارس التداول منذ فترة طويلة، فأنت على دراية بالتأكيد بمدى الشعبية التي تحظى بها سلسلة منصات الميتاتريدر. وبالنسبة للمتداولين المبتدئين، فإن منصتي MT4 وMT5 هي منصات تطورها شركة روسية وتلعب دور الجسر الذي يربط بينك وبين شركة الوساطة التي تعمل معها. يفضل كثير من المتداولين اختيار وسيط يقدم كلا المنصتين، وهو ما يعزى إلى الكم الهائل من أدوات التداول المتطورة التي توفرها.

على سبيل المثال، توفر كلاً من MT4 وMT5 الميزات التالية

- مئات المؤشرات الفنية

- أدوات الرسم البياني وتخصيص المنصة

- عروض الأسعار في الوقت الحقيقي

- نسخ التداولات

- القدرة على استخدام روبوتات التداول الآلي

- إصدارات للأجهزة المحمولة للتداول أثناء التنقل

لا يدعم جميع الوسطاء منصات MT4 و/أو MT5، ولهذا سيتعين عليك التحقق من هذا الأمر إذا كان ضروريًا من وجهة نظرك

التنبيهات

ستظل الأسواق المالية تتحرك بخطى سريعة وتشهد في أحيان كثيرة قفزات لا تصدق، ولهذا يجب أن تكون على اطلاع بأهم وأخر التطورات على مدار الساعة. ستكون فكرة جيدة اختيار منصة توفر خاصية تنبيهات الأسعار. على سبيل المثال، فإن أفضل منصات التداول تسمح لك بتعيين إشعارات سعرية يتم إرسالها عبر تطبيق المنصة أو البريد الإلكتروني.

يمنحك ذلك ميزة إضافية حيث يتم تنبيهك فور وصول السعر إلى أهداف معينة أو مستويات هامة. وبالإضافة لذلك، تسمح لك أفضل منصات التداول بتعيين تنبيهات متعلقة بمؤشرات التذبذب. يعني ذلك أنك ستحصل على إشعارات إذا شهدت حركة الأصول المحددة تقلبات حادة سواء صعودًا أو هبوطًا

رأس المال في خطر

التعليم، الأبحاث والتحليلات

من واقع تجربتنا، فإن أفضل منصات التداول عبر الإنترنت قادرة على أن ترتقي بتجربة التداول إلى مستوى جيد كليًا من خلال منح عملائها موارد تعليمية شاملة. توفر هذه المصادر التثقيفية فرصة تعلم أساسيات البيع والشراء دون الحاجة للاستعانة بخدمات مزود خارجي.

من بين الموارد التعليمية الأكثر فائدة التي تقدمها منصات التداول الأعلى تقييمًا ما يلي:

- أدلة ومدونات حول شروط التداول الرئيسية

- ندوات عبر الإنترنت (ويبينارات)

- البودكاست

- كتب إلكترونية

- دورات مصغرة

وبالإضافة إلى الموارد التعليمية، اكتشفنا أيضًا أن أفضل منصات التداول تقدم كم هائل من أدوات البحث والتحليل. قد يشمل ذلك البث الحي للأخبار المالية، نشر رؤى وتحليلات عن التداول، وبيانات عن اتجاهات السوق. وإذا تحدثنا عن الجانب التحليلي، توفر أفضل منصات التداول أدوات لقراءة الرسم البياني - مثل المؤشرات الفنية.

تجربة المستخدم

If you're taking your first steps into the world of online trading, you'll want to make sure you choose a provider that offers a seamless, uncomplicated user experience. While you won't have to worry about this when using the desktop version of your broker's trading platform, ensuring a smooth trading experience requires that the trading app be just as efficient.

This aspect is especially important if you prefer investing via your mobile phone, as you'll be forced to enter buy and sell trades on a small screen. Therefore, it's essential to ensure the ease of use and navigation of the trading software. This should not only facilitate finding assets and generating performance reports, but also facilitate opening and closing orders, viewing the value of your investment portfolio, and depositing and withdrawing funds.

The good news here is that most trading platforms already design apps compatible with devices running Apple and Android operating systems. In other words, the app the company provides you with will be specifically designed to work on your preferred operating system. If the trading platform you're examining offers demo accounts, this will give you the opportunity to test all of these features for yourself without risking real money.

Capital at risk

Payment methods

You'll need to deposit some funds into your trading account before you can start buying and selling assets from the comfort of your home. This makes it essential to check which payment methods your brokerage firm accepts.

In most cases, you'll be able to transfer funds from your personal bank account. While some platforms credit the deposit amount to your account immediately, other platforms may take one to two business days for the payment to be processed. This may make it necessary to consider whether the trading platform offers additional payment options, such as credit/debit cards—the most important advantage of which is that the deposited funds appear in your account immediately.

If you decide to use our top-rated trading platform, eToro, not only is it easy to deposit using Visa and Mastercard, but you can also use bank transfers, as well as e-cards like PayPal, Neteller, and Skrill.

Customer Service

There is a significant variation in the level of customer service provided by different trading platforms. For example, some companies may only allow you to receive assistance via email or by opening an online support ticket. In this case, we recommend avoiding these platforms, as a response to your requests may take several days.

That's why it's best to choose trading platforms that offer real-time customer support. The best way to contact the company in this case is through live chat, although phone support is also a good option.

You'll also need to know the days and hours during which the customer support team is available. Some platforms don't offer support on weekends when most financial markets are closed. In most cases, support services are available on trading platforms 24 hours a day, 7 days a week, such as eToro's customer service !

How to get started with the best trading platform

So far, in this guide, we've reviewed a selection of the best online trading platforms. We've also explained the important criteria you should consider before choosing a specific broker.

Finally, in the following lines, we will explain the steps to start working with the trading platform in a practical way. For further clarification, we chose to show the steps required to open an account with the top-rated platform eToro . Please follow these three easy steps so you can get started today !

Capital at risk

Step 1: Open an account

First, visit the official website of the eToro platform, then enter your email and password as shown below, then click on the “Continue” button.

Step 2: Fill out the profile

At this stage, as shown below, you will be asked to enter a set of personal information related to you: starting with your country of residence, your nationality, place and date of birth, as well as your address and phone number. Finally, you will be asked to select the currency you have chosen to trade in from among four available currencies, the most important of which are the US dollar and the euro.

Step 3: Deposit funds into your account

Now it's time to find your new trading account with eToro, you can choose from several convenient payment methods, such as:

- Direct Debit Cards

- credit cards

- Bank transfer

- One of the electronic wallets.

The minimum deposit with eToro is just $20.

After choosing the payment method and the amount you want to deposit, click on “Deposit”.

Step 4: Start trading with the best trading platform

Now that you have completed the account opening process in just minutes, you can trade on the eToro platform in many commodities, assets and stocks...

You will also benefit from the demo account feature to practice adequately before starting direct investment.

Capital at risk

Summary: Best Trading Platforms

In short, there are hundreds of trading platforms to choose from. With this in mind, you need to do some research to make sure you find a broker that matches your needs.

In the end, eToro has all the positive aspects of what you would look for in an online trading platform. You pay no fees on your trades, and it only takes a few minutes to get started!