Čo je obchodovanie s CFD a ako sa stať obchodníkom s CFD v roku 2026

You’re probably familiar with the term CFD Trading – and maybe you’re even thinking about becoming a CFD trader right now!

Although many beginning investors first learn to buy shares of companies , contracts for difference (CFDs) are an increasingly popular type of investment.

With online CFDs, investors do not buy shares directly. Instead, they buy a contract with their broker that allows them to speculate on fluctuations in the value of a company, just like with stocks.

There are several advantages to trading CFDs in Slovakia compared to buying shares outright. In this guide, we will cover everything you need to know about online CFD trading in Slovakia and reveal the best CFD trading platform of 2022.

Slovak guide to CFD trading – Step by step guide

Do you want to trade CFDs on the financial markets? Let us explain how to start trading on eToro :

[fin_table id=”15″]

What is CFD trading and what are CFDs in practice?

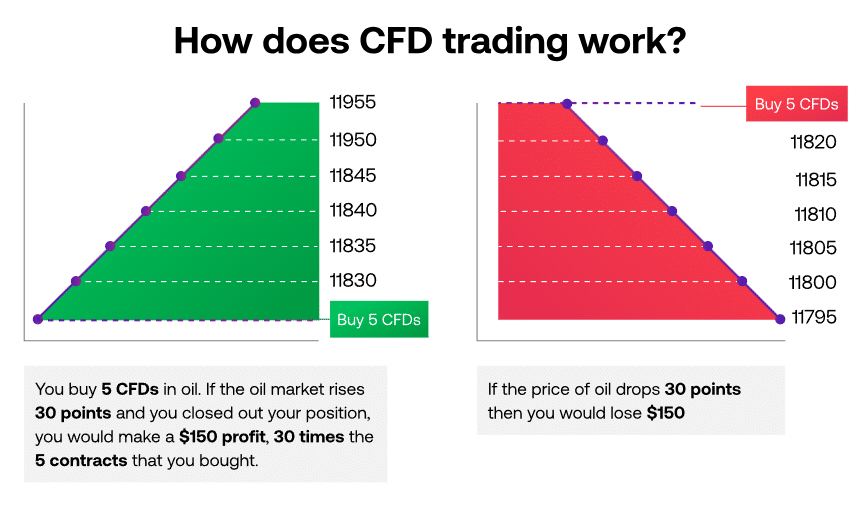

CFD trading is a form of derivative trading (CFD). This means that instead of investing directly in a financial asset, you trade through a contract based on the value of the underlying asset.

For example, instead of buying or selling stocks directly, you buy and sell a contract whose value depends on the underlying price of the stock.

CFD trading may seem complicated to beginners, but it is actually quite simple. In most cases, CFD trading works the same as buying shares outright. If the price of the share increases by 5%, the value of your CFD contract will also increase by 5%.

However, online CFD trading has some specific advantages. We will go over these advantages in this article, but one of the most important aspects is the ability to trade almost every financial instrument available.

For example, you can trade stocks, as well as Forex , commodities, cryptocurrencies, exchange-traded funds (ETFs), bonds, and more.

CFD Trading Example – CFD Simulation

Let’s look at an example to understand how CFD trading works in Slovakia. Let’s say you want to buy Royal Mail shares which are trading at 181 pence per share. You can visit your CFD broker and buy Royal Mail shares CFDs worth 181 pence per contract.

If the price of Royal Mail shares rises to 190 pence, the value of your CFD contracts will also rise to 190 pence. If you decided to sell your contracts at this price, you would make a profit of 9.5% – exactly the same profit as you would have made if you had bought Royal Mail shares outright.

What can a CFD trader trade?

As already mentioned, in addition to shares, various financial instruments can be traded in CFDs.

CFDs are extremely flexible, so they can be used to trade any type of financial instrument. Some popular types of CFDs in Slovakia include:

- Stock CFDs

- Forex CFDs

- CFDs on commodities (such as gold, silver and oil)

- Cryptocurrency CFDs

- CFDs on ETFs

- CFDs on bonds

While these are the most common types of CFDs available from major brokers in Slovakia , you can also trade CFDs on less common types of financial assets.

For example, CFDs that track the value of real estate or even works of art.

In each of these assets, the value of the CFD is directly driven by the price of the underlying asset. For example, imagine you start trading Bitcoin CFDs. If the value of Bitcoin increases by 2%, the value of your Bitcoin CFD will also increase by 2%.

The same goes for Forex, commodities, indices and any other asset that trades CFDs.

Reasons to be a CFD trader

Since it is possible to buy shares and other assets directly, what are the reasons that should lead you to use CFDs? There are several specific advantages that make CFD trading so popular.

Indirect ownership

The main advantage of CFDs is that you don’t have to take ownership of the underlying asset. This may not seem like a big deal if you only trade stocks – in most cases, the stock certificates are stored digitally in a stock trading account, requiring no effort on your part to buy or sell.

But what if you want to trade currency pairs or underlying commodities like oil? If you want to buy oil directly, you need to find transportation for the physical barrels of oil and storage facilities.

Forex trading, for example, requires converting from one currency to another, which often involves navigating the complex legal and tax regulations associated with foreign currencies.

When you trade CFDs, you don’t have to worry about any of these issues.

You only buy one contract, not a barrel of oil or a foreign currency – but the potential to profit from the price movement of the underlying asset is the same.

Leverage in CFDs

Perhaps the main reason why CFDs are so popular with stock traders is the ability to trade with leverage. With leverage, a trader essentially uses money borrowed from their broker to increase the size of their position.

Let’s say you want to buy shares in AstraZeneca, which are currently selling for €8.60. If you have €100 in your trading account, you can only buy 11 CFD contracts.

However, with leverage, you can invest more money than you have available in your trading account.

For example, if you use 1:10 leverage when trading, you can suddenly buy 110 contracts of AstraZeneca shares (total cost $946) for just $100 in your account.

The advantage of using leverage is the potential multiplication of your profits if the value of Astra Zeneca shares increases.

For every 1% increase in the price of the underlying asset, the price of your CFD position with a leverage of 1:10 increases by 10%. Therefore, you can use leverage to multiply your returns from successful trades.

Plus, since you need less money to invest in each position, you can diversify your trades without adding more money to your account.

Making money trading CFDs in both directions

Another great advantage of trading CFDs in Slovakia is the ability to profit even when asset prices fall. Instead of buying, you can open a short sell order for your CFD contracts.

For example, if the price of Facebook shares falls by 5%, the value of your CFD position will increase by 5%.

Fractional investing

Fractional investing is another advantage of trading stocks via CFDs, especially if you are investing in expensive stocks like Amazon . With stock CFDs, you can invest any amount you want – you are not forced to buy whole shares.

So while the value of one Amazon share is over $3,400, most CFD brokers allow you to invest any amount, for example as little as $50.

CFD trading rates in Slovakia

Although charging commissions is common practice among stock brokers, most of the best CFD brokers in Slovakia are completely commission-free.

This means that when trading CFDs in Slovakia, you do not have to pay a fixed fee of several euros for each open trade.

However, CFD trading is not completely free. CFD trading platforms typically charge spreads that can range from less than 0.1% to more than 0.5%.

The spread is the difference between the bid and ask price of each contract for difference (CFD), so it is built into your trades. The good news is that for most traders, spreads of around 0.1% per share are still much more economical when trading CFDs compared to commissions.

Risks of online CFD trading

Online CFD trading carries many of the same risks as other types of trading. There is always the possibility of the underlying asset being traded falling in value, which would result in the loss of your invested CFD contracts.

In this situation, you can decide to sell your contracts and take the loss, or leave your position open in the hope that the value will rise again.

If you trade with leverage, CFD trading is no riskier than trading the asset directly. However, when trading leveraged CFD trading in Slovakia, the risks of loss increase significantly.

We should point out that leverage also multiplies your losses. If you are trading a CFD with 1:10 leverage and the value of the underlying asset falls by 1%, the value of your CFD position will fall by 10%.

Most brokers require a minimum account balance equivalent to the value of your positions, so you may need to add money to your CFD trading account to keep your leveraged position open. For example, other brokers automatically sell any losing position.

Another thing to keep in mind is that since leverage requires borrowing money from a broker, it also means interest charges. You will have to pay the broker for each day that your leveraged CFD position remains open – these are called swap fees.

If the price increase doesn’t happen as quickly as you expected, interest rates may end up being higher than your profit.

Best CFD Trading Strategies for 2022

There are a number of different approaches you can take when trading CFDs, but regardless of your goals or trading style, it is important to approach each trade with a clear plan.

To help you get started, let’s explore some of the most popular CFD day trading strategies:

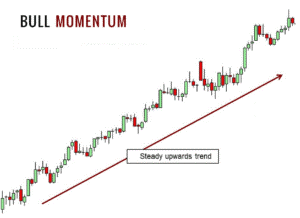

Momentum trading

Momentum trading is one of the simplest CFD trading strategies for beginners. Simply identify a stock or other asset that is experiencing a rapid increase in value with high volume. As long as more traders are trading the asset, its price will continue to rise for some time.

Once the momentum starts to fade, sell your position and cash in your profits. Remember, it is better to sell too early and make some profit than to sell too late and end up losing what you could have gained.

Value dynamics are often driven by company news and announcements, so you can identify potential opportunities by monitoring market news.

Breakout trading

Breakouts are another popular target for traders. To find these breakout points, you first need to identify areas of resistance that the stock has yet to break through.

When the stock price finally breaks through this resistance level, it is likely to continue to rise.

The key to this type of strategy is to avoid being fooled by false breakouts. A true breakout should break through the resistance level with strong trading volume.

It is also possible to use technical analysis tools to identify other factors, such as momentum, that indicate continued growth in the value of an asset.

Scalping

Scalping is a CFD trading strategy that requires a great deal of concentration and patience. The goal of scalping is to profit from small, short-term movements in the price of an asset that commonly occur throughout the day.

You can look for small bursts of momentum or increases in trading volume. Typically, scalping trades are opened and closed within minutes.

Scalping is particularly suitable for CFD traders because leverage can be applied to trades. The price movements involved in this strategy are typically only a fraction of a percentage point.

However, with a leverage of 1:10, the same price swing represents a profit equivalent to several percentage points.

Tips on how to be a successful CFD trader

CFD trading can be very profitable, but it is important to remember the risks associated with this type of trading.

Let’s explore five CFD trading tips that you can use to reduce your risk exposure and increase your profits.

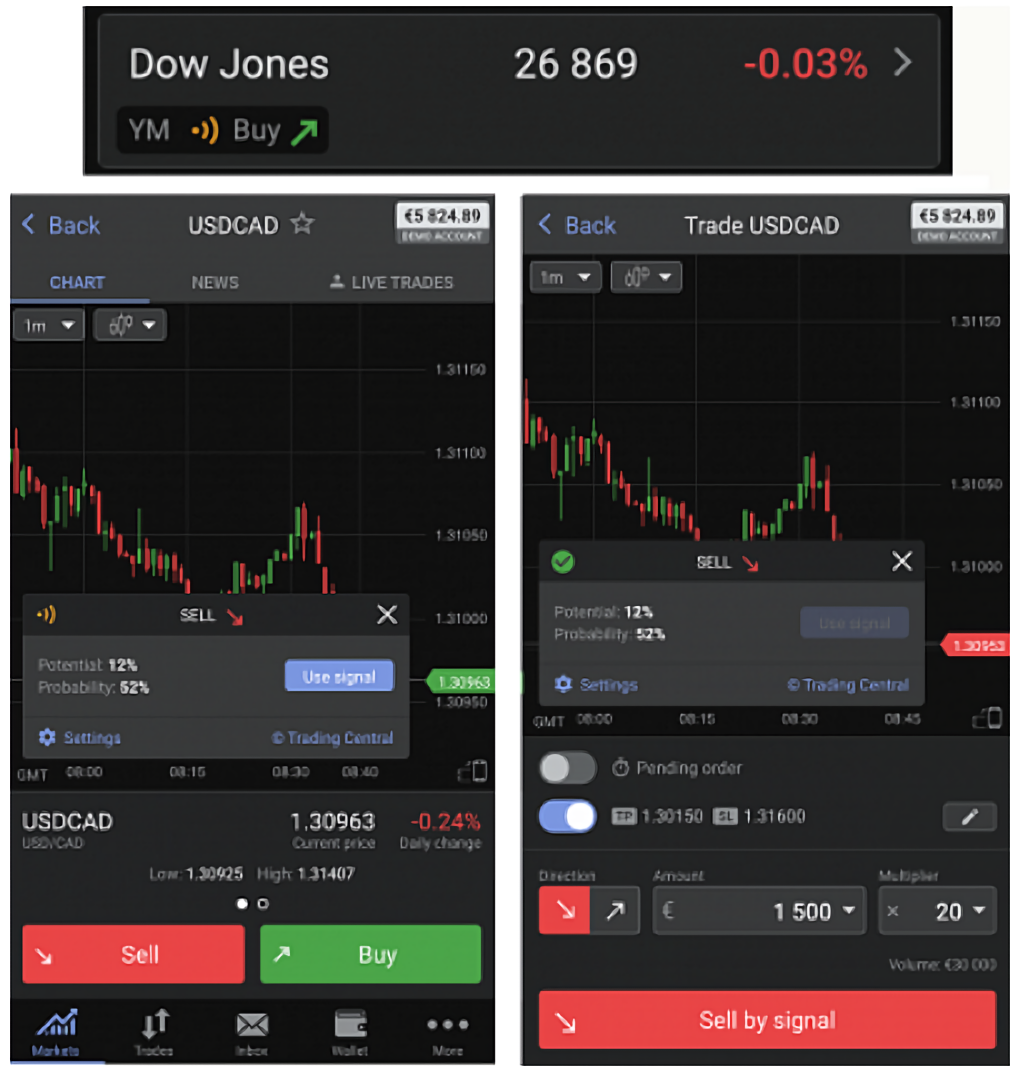

Start with a demo account for CFD trading

One of the best things you can do at the beginning of your journey into the world of CFD trading is to open a free demo account.

Most brokers in Slovakia offer this type of CFD trading platform, which allows you to buy and sell CFDs just like you would on any real CFD trading account – but without tying your real money to your trades.

A demo account is a fantastic tool to get familiar with CFD trading and learn how to create a strategy for your future real CFD trading account.

It is important to look at a demo account as if it were a real trading account with real money so that you can effectively practice best risk management practices.

Multiple positions

Since most CFD brokers do not charge commissions on their trades, placing multiple buy and sell orders is quite advantageous. Instead of executing your trade with one large order, you can mitigate your risk by buying and selling with multiple orders.

The advantage of cautiously entering multiple positions is that if the price of the asset falls after your initial purchase, you can buy more at a lower price. You can make some profits by selling by leaving your position open in some CFD contracts to earn a higher return if the price continues to rise.

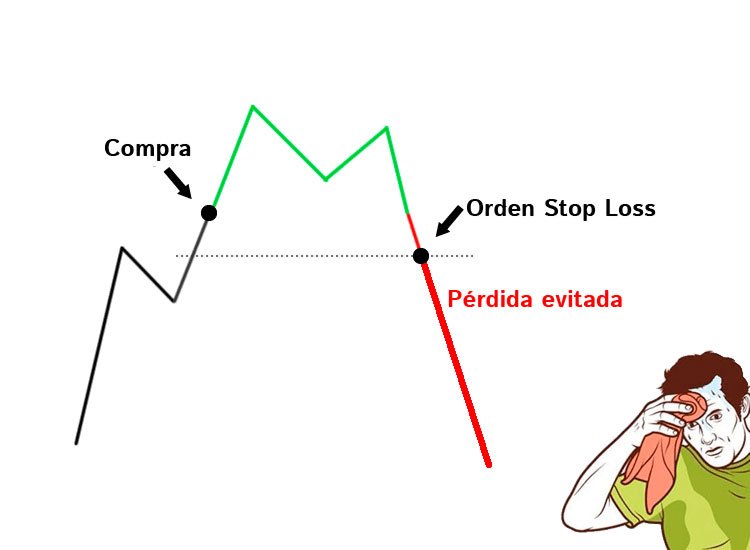

Use Stop Loss orders

A stop loss order is a price below the current market price of your CFD contract at which the broker must sell your position. Stop loss orders are the basis for proper risk management. Even if you set a stop loss, nothing will happen immediately.

If the value of your position decreases significantly, your broker will automatically sell your position to limit your loss.

On the other hand, you can also use stop loss orders to secure a certain profit. Simply set your stop loss to a value higher than the purchase price of your CFD. This limit will be called the take profit.

Use CFD technical analysis tools

Technical analysis is a fundamental tool for analyzing the value of stocks, Forex currency pairs, and other assets. This type of analysis takes into account the past price history of an asset in order to predict its future movements.

While you shouldn’t rely on just one technical indicator, using multiple indicators and price charts together can help you develop trading strategies and identify potentially profitable CFD trades.

Diversify your CFD portfolio

One of the main advantages of CFD trading is the ability to open multiple positions without adding more money to your account.

Regardless of whether you trade fractional shares or use leverage, CFD trading is not very expensive.

You can use this feature to your advantage by diversifying your portfolio. You can invest in CFDs on shares of companies in different market sectors – for example, buy oil stocks, blue chip stocks and shares in the pharmaceutical industry.

Or trade Stock CFDs and Forex CFDs to diversify your portfolio across different classes of financial instruments. The more diversified your portfolio is, the more protected you are in the event that the value of a particular company or market sector drops significantly.

The best CFD trading platforms in Slovakia

To start your journey into the world of CFD trading in Slovakia, you need to open an account on a CFD trading platform. There are many brokers to choose from and they all vary greatly in terms of costs, the number of CFDs available and the number of trading instruments included. So to make your choice easier, we have listed four of our favourite brokers operating in Slovakia below.

1. eToro – The best CFD trading platform in Slovakia

eToro is our favorite broker for CFD trading in Slovakia. This broker offers a selection of over 800 stocks from companies around the world as well as over 450 ETFs, and you can choose whether to buy the stocks directly or trade them with CFDs.

You can also trade CFDs on Forex, commodities, cryptocurrencies, indices and bonds. All trades on eToro are completely commission-free and the broker charges low spreads compared to the average.

But what really sets eToro apart is its CFD trading platform. eToro has its own social trading network where you can interact with other CFD traders, ask questions and also analyze market sentiment.

You can also enjoy copy trading, which uses a portion of your portfolio to automatically copy the positions of other experienced traders. In addition, eToro provides an integrated charting platform with dozens of technical studies. It does not include some of the more advanced features such as Forex signals. but it is capable enough for most intermediate traders. eToro also offers a mobile CFD trading app to help you follow the trading market on the go.

Advantages:

Weaknesses:

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

2. XTB – Invest in over 3,000 global stocks with 0% commission

XTB is one of the best brokers available in Slovakia. You can trade on this platform via the native desktop software or by downloading the XTB app for iOS/Android. The XTB platform has many features including chart analysis tools, technical indicators, and fast performance.

This broker offers two types of stock trading. The first option is investing in traditional stocks, which means you own the underlying shares. Over 3,000 traditional stocks are supported and you don’t pay any commissions for trading. For example, you can invest in big US companies such as Apple, Tesla, Amazon, IBM, Ford Motors, Microsoft and many more. You can also invest in UK-listed stocks such as AstraZeneca, GlaxoSmithKline, Lloyds Bank and BT.

The second option for trading stocks is CFDs (Contracts for Difference). These are financial derivatives that track real stock prices and allow you to trade stocks with leverage of up to 1:5, meaning you will have €50 available for every €10 you deposit. XTB supports thousands of stock CFDs and you can go short or long on selected companies’ stocks.

There are no commissions for trading stock CFDs or real shares. Regardless of which type of shares you choose, you can try trading risk-free with a free demo account. You can also choose to start trading with real money right away, with no minimum deposit required. You can fund your XTB account via the app, with accepted payment methods including debit/credit cards, bank transfer and e-wallets.

In addition, the XTB platform supports other asset types. For example, you can trade commodities such as oil, gold, silver, sugar, corn and natural gas. You can also trade popular forex pairs such as GBP/USD, USD/CAD and EUR/GBP on this platform. The XTB platform also allows you to invest in indices from all over the world, including Japan, China, Germany and the USA.

Rating

Advantages:

Weaknesses:

You risk losing your capital.

3. Libertex - CFD Broker with Zero Spreads

However, with Libertex, traders only pay a small commission on buying and selling and night trading fees.

This means that it is possible to trade with zero spreads on over 213 financial instruments with CFDs, from cryptocurrencies, stocks, currencies, indices, commodities and more! It is also possible to use the MetaTrader 4 trading platform, which allows for automated trading.

Managing your Libertex account is very easy. The broker is also regulated by CySEC, which provides security and peace of mind to its traders.

Advantages:

Disadvantages:

85% retailových investorov prichádza o peniaze pri obchodovaní s CFD s týmto sprostredkovateľom.

Slovak CFD Trading Tutorial – Step by Step Guide

Want to trade CFDs online? Let us explain how to get started trading on eToro.

To create an account with eToro, simply visit the homepage of the brokerage firm’s website and click on “Join Now.” The broker will ask you for a new username and password for your account. Next, you will need to enter some personal information, such as your name, date of birth, email address, and phone number. eToro also requires verification of your identity, in accordance with applicable regulations. You must upload a copy of your ID card, driver’s license or passport, along with a copy of a utility bill or bank statement issued within the last 3 months.2. After setting up your account, you need to deposit some funds into it. eToro requires a minimum deposit of $200, which you can make using the following payment methods: Teraz ste pripravení otvoriť svoj prvý CFD obchod. Zadajte názov akejkoľvek akcie, meny, ETF alebo kryptomeny do vyhľadávacieho panela na stránke eToro alebo si prezrite dostupné aktíva na svojom paneli. Keď nájdete aktívum, s ktorým chcete obchodovať, kliknite na „Obchodovať“ a otvorte nový objednávkový formulár. Do objednávkového formulára zadajte sumu, ktorú chcete investovať. Môžete tiež nastaviť stop loss alebo take profit príkaz, aby ste mali pod kontrolou riziko spojené s vaším obchodom. Ak chcete pri obchodovaní použiť pákový efekt, môžete túto možnosť nastaviť aj v tomto okne. Keď je váš obchodný príkaz nastavený, kliknite na „Obchodovať“, čím otvoríte svoju CFD pozíciu. Obchodovanie s CFD je čoraz populárnejším spôsobom obchodovania s akciami, Forexom, kryptomenami a rôznymi inými finančnými nástrojmi. Pri CFD nie ste povinní prevziať vlastníctvo podkladového aktíva a veľkosť svojej pozície môžete znásobiť pomocou pákového efektu. Navyše väčšina najlepších CFD brokerov na Slovensku si neúčtuje za obchodovanie žiadnu províziu. Založte si svoj účet na eToro ešte dnes a užite si obchodovanie na finančnom trhu bez provízií!

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Step 1: Open a Slovak CFD trading account

Step 2: Fund your account

Step 3: Open a CFD trade

Záver – Slovenský sprievodca obchodovaním s CFD

eToro - Najlepší CFD broker s nízkymi spreadmi

Často kladené otázky

Is there a difference between CFD trading and spread betting?

Is it possible to earn dividends from CFD trading?

Which CFD trading app is the best?

Can I take a CFD trading course to learn more?

What are the best books on CFD trading?