Najlepšia platforma na obchodovanie s akciami roku 2026

If you want to trade stocks from the comfort of your home, you need to find a trading platform with the best ratings.

The most important metrics you need to consider are the markets that a given stock trading platform offers and the associated fees, commissions, payments, and regulation.

In this guide, we’ve prepared an overview of selected platforms and will tell you which one we think is the best platform for trading stocks in 2026 . We’ll also cover some basic risk management principles and walk you through the process of getting started with trading.

Stock Trading Platforms of the Year 2026 – Quick Overview

In the list below you can find the stock trading platforms that made it into our selection. Below you can read a review of each platform to see which one suits your personal trading goals.

- eToro – The world’s best stock trading platform

- XTB – Trade over 2,200 markets via the xStation 5 platform

- Robinhood – An innovative platform for trading stocks on US exchanges

- TD Ameritrade – Best Stock Trading Platform for Asset Diversity

- Trading 212 – Commission-Free Stock Trading Platform for Beginners

- Fidelity – The Best Trading Platform for Long-Term Investors

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Best Stock Trading Platforms – Brief Reviews

We spent a lot of time thoroughly researching the leading online stock trading platforms. Our research focused on a wide range of factors – from the variety of stock markets offered, to trading commissions and fees, to licensing issues and the quality of customer support.

Below you will find an overview of the best stock market trading platforms that you should consider in 2026 and in the coming years.

1. eToro – the world’s best stock trading platform in 2026

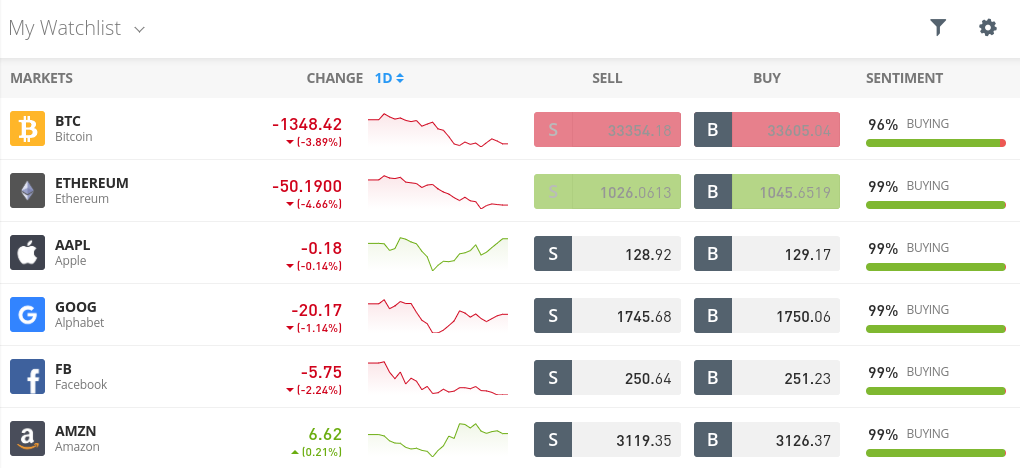

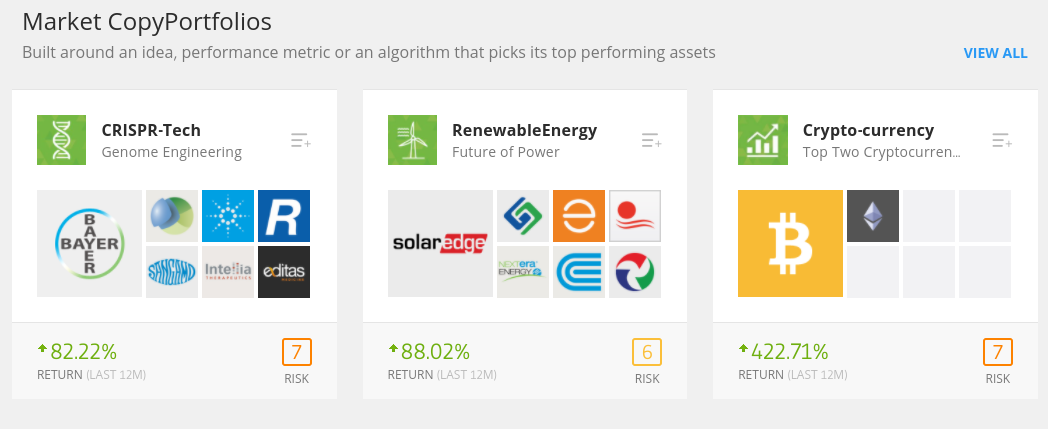

We selected eToro as the number one stock trading platform for 2026. eToro is a broker that offers a wide range of markets, a user-friendly interface, and the guarantees of official regulation, and is currently home to over 17 million active traders .

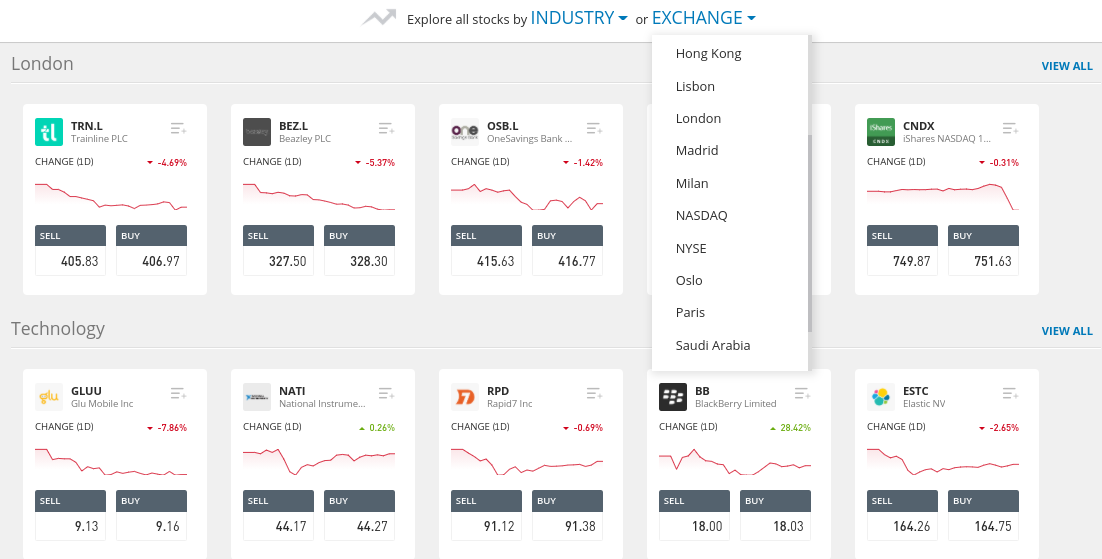

On eToro, you can buy, sell and trade over 2,400 stocks from 17 international markets. In addition to major exchanges like the NYSE, NASDAQ and the London Stock Exchange, you can also trade companies listed in Germany, France, Sweden, Hong Kong and many other countries.

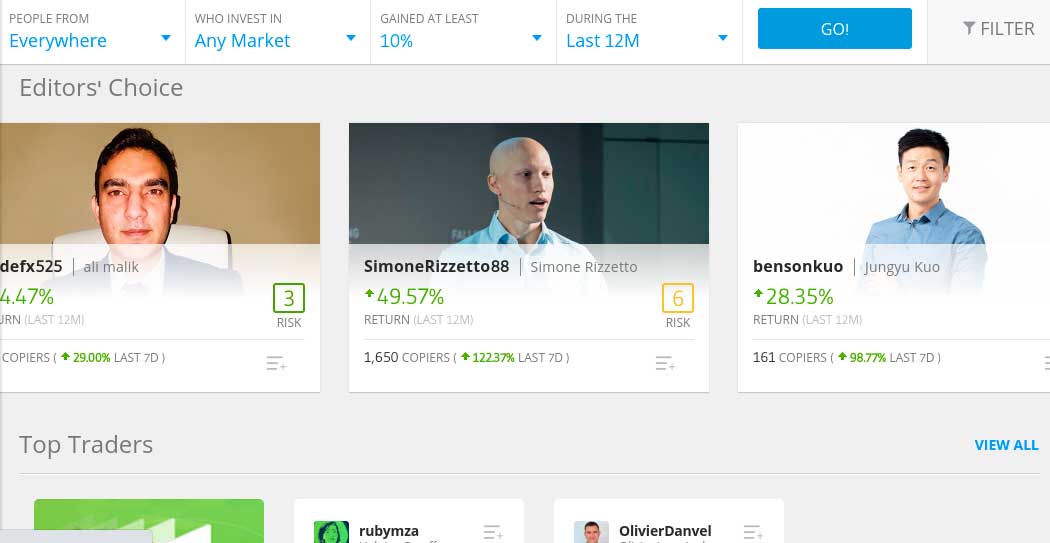

eToro is also our number one because it is perfect for novice stock traders. The platform is easy to use, takes just a few minutes to set up an account, and even offers automated trading services. This is ensured by the innovative Copy Trading feature. As the name suggests, the feature allows you to copy the portfolio of an experienced stock investor of your choice.

You can access the Copy Trading feature with a minimum deposit of €200 and you can use it without any additional trading fees. When it comes to funding your account, eToro supports deposits via debit cards, credit cards, bank transfers and e-wallets such as PayPal and Neteller. Finally, when it comes to regulation, eToro is licensed by the FCA, ASIC and CySEC and is registered with FINRA in the USA.

To learn more about eToro, read our comprehensive review .

Rating:

What we like:

What we don’t like:

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

2. XTB – Trade over 2,200 markets via the xStation 5 platform

XTB offers investors a wide range of markets, including stocks and CFDs. You can find indices and ETFs from the US, UK and Europe. You can also trade commodities, currency pairs and digital currencies, including some of the best cryptocurrencies, on the XTB platform.

There are two account types to choose from on the XTB platform. The Standard account may be more suitable for day traders, as spreads start at 0.5 pips. The Swap-Free account comes with minimum spreads of 0.7 pips, but you don't pay any fees for overnight investments. Both account types offer leverage of up to 1:500 and commission-free trading.

XTB is also one of the best day trading brokers for experienced traders. XTB's native platform, xStation 5, features a wide range of analytical tools, including technical indicators and custom chart screens. In addition, the platform is available on mobile and all computer devices. If you want to practice trading without any risk first, you also have a free demo account available for 28 days. In the demo account, you can trade with a fictitious €100,000 in virtual funds.

The main drawback of XTB is the lack of passive trading tools. However, XTB offers daily market information and educational guides that allow day traders to make informed decisions. You can also check out the economic calendar with upcoming events that are likely to affect the financial markets.

To start using the XTB platform, it only takes a few minutes to create an account. There is no minimum deposit and the platform accepts payments via debit/credit cards, bank transfers and the Skrill e-wallet. Most importantly, XTB is a regulated broker, authorized and licensed by the FCA. In addition, XTB is listed on the Warsaw Stock Exchange.

Rating:

What we like:

What we don’t like:

You risk losing your capital.

3. Robinhood – an innovative platform for trading stocks on US exchanges

Robinhood supports fractional ownership , which means you can invest as little as a few dollars in stocks of your choosing, such as GameStop . In addition to its core stock trading department, Robinhood also offers other financial products like ETFs, cryptocurrencies, and options. Many Robinhood users trade through a browser , although the platform also offers a full-fledged mobile app .

This app is great for trading stocks on the go, for example. We also like the fact that Robinhood has no minimum deposit , which again will appeal to those of you who only want to trade small amounts.

The main downside to Robinhood is that it doesn't support debit/credit cards or e-wallets . Instead, you'll need to wire funds from a US bank account . It also goes without saying that as a US-based brokerage firm, Robinhood is heavily regulated.

What we like:

What we don’t like:

4. TD Ameritrade – Best Stock Trading Platform for Asset Diversity

In addition to a huge library of tradable stocks, this includes thousands of ETFs and mutual funds, as well as bonds and digital currencies. When it comes to stocks you can trade, TD Ameritrade supports tens of thousands of stocks across dozens of markets .

In fact, this popular trading platform also gives you access to initial public offerings ( IPOs ) – both in the US and overseas. If you choose to trade stocks listed on the NYSE or NASDAQ, TD Ameritrade will not charge you any commission.

This is also the case for ETFs and options listed in the US. International stock markets come with different commission rates depending on the exchange. TD Ameritrade is also useful if you are looking for a variety of research and analysis tools . This includes real-time quotes, third-party stock reports, and a super advanced trading platform that is equipped with technical indicators.

TD Ameritrade only supports bank account transfers – no debit/credit cards or e-wallets. As a result, bank transfers on this free stock trading platform are usually processed very quickly – so you won't have to wait long before you can place orders.

What we like:

What we don’t like:

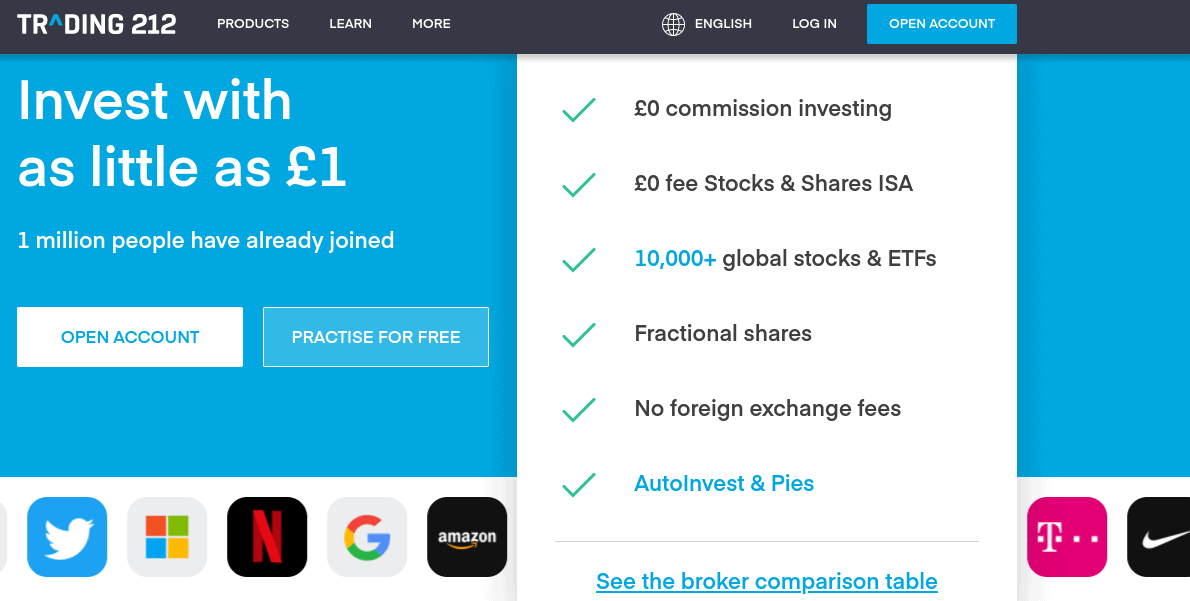

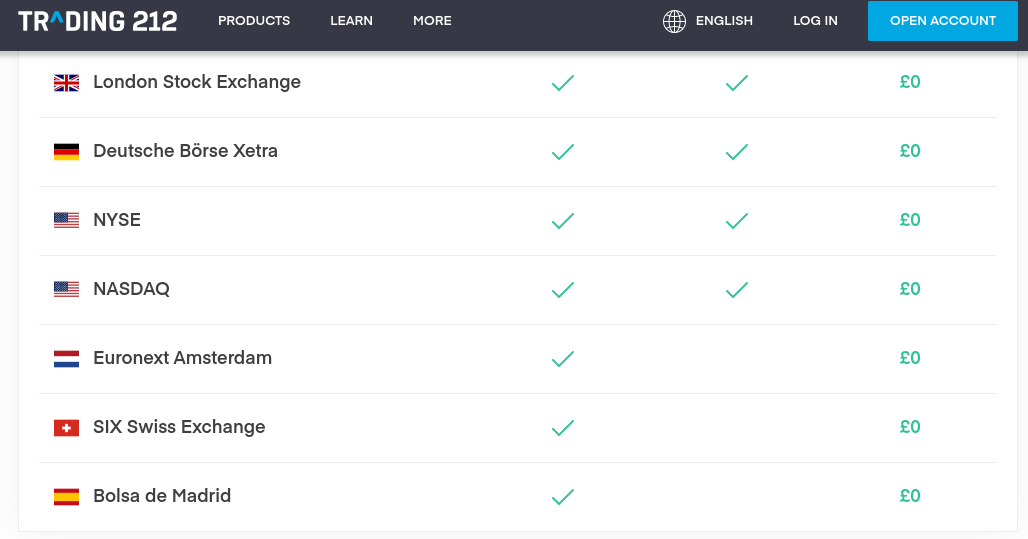

5. Trading 212 – a commission-free stock trading platform for beginners

This highly rated broker lets you invest in over 10,000 global stocks and ETFs – all commission-free. Trading 212 supports fractional ownership and the minimum investment is just €1 (or currency equivalent).

This makes it ideal if you want to trade stocks for the first time without risking too much money. In terms of supported exchanges, Trading 212 focuses on the UK, US and a few European markets . We also like that you can trade stock CFDs with Trading 212.

This comes with other benefits such as the ability to short stocks as well as the use of leverage. Stock CFD leverage is typically capped at 1:5 on Trading 212, meaning you can trade with five times your current account balance. In addition to stock CFDs, you can also trade forex and commodities.

When it comes to funding your account, you can make an instant deposit using a debit/credit card or e-wallet. There are no fees for deposits or withdrawals. The main downside to Trading 212 is that you will be charged a 0.5% FX fee for CFD instruments that are not in your primary account currency .

What we like:

What we don’t like:

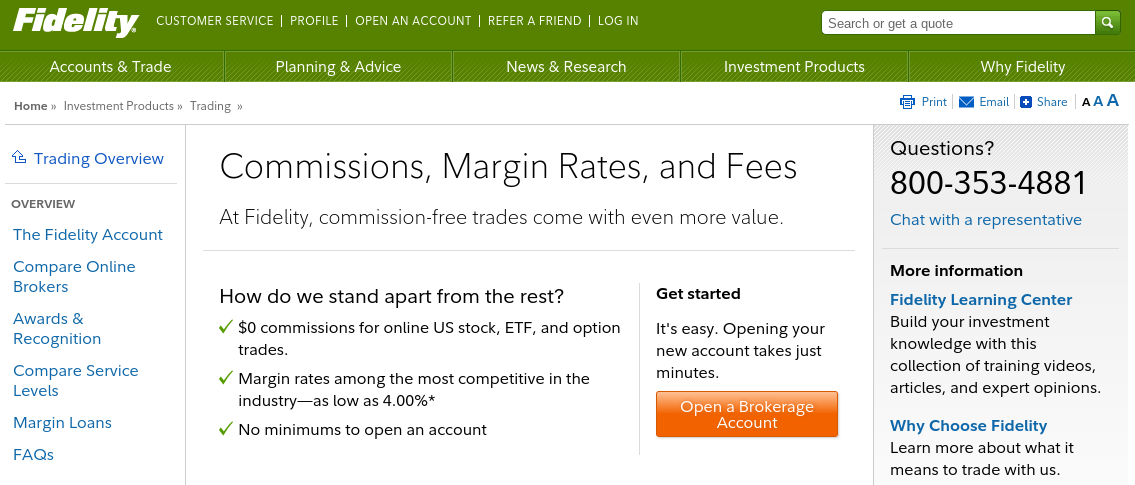

6. Fidelity – The best stock trading platform for long-term investors

While most stock traders will look to buy and sell stocks over the short term, some of you might be more interested in a long-term investment strategy . This means you will buy stocks and hold them in your portfolio for several years.

If so, Fidelity is a great option for you. The popular US-based trading platform covers stock markets in over 25 countries , giving you plenty of diversification opportunities. You can also invest in newly listed US IPOs, which is ideal if you want to buy shares in a company that is just starting its corporate journey.

Fidelity is also a great trading platform if you want to invest in mutual funds and ETFs . When it comes to fees, Fidelity offers commission-free trading .

International stocks will be subject to a trading fee , which will vary from exchange to exchange. Fidelity is also a good option if you want to trade stocks on margin. While most investors using Fidelity have more experience in the stock trading scene, the platform does not have a minimum deposit. This means you can start with just a few dollars and test the investing waters before making a larger financial commitment.

What we like:

What we don’t like:

Which stock trading platform is best for me?

In this guide, we've introduced you to some of the best online stock trading platforms available today. However, there's a chance you'll come across a trading platform we haven't discussed on this page.

If so, you should study all the details about its offerings and fees to make sure the platform is right for you and your trading goals, for example, if you want to invest in Amazon .

In the next section of this article, we will provide you with a list of key things to consider before choosing the right stock trading platform for your needs.

Regulation

You would be surprised how many unregulated stock trading platforms are active in the online world, even in 2026. The key problem is that unsuspecting traders are lured in by the offer of low fees and commissions – so they often forget the need to check whether the platform in question is safe.

You should never use a stock trading platform that is not licensed by at least one reputable financial authority.

The key word here is reputable because it doesn’t protect you much if the broker is licensed offshore. Some of the top stock trading regulators include the FCA (UK), FINRA (US), CySEC (Cyprus), and ASIC (Australia). These financial authorities – although located in different jurisdictions – have a lot in common.

Some of the requirements they have for online stock trading platforms they regulate include:

- Ensuring that the stock trading platform verifies the identity of all users.

- Client funds must be held in segregated bank accounts. This ensures that the platform does not use your money to fund its own liabilities.

- Leverage must be maintained in accordance with the regulations imposed in the trader's country of residence.

- Regular platform audits ensure that traders can buy and sell assets in a safe environment.

All trading platforms we write about on this site are strictly regulated by reputable financial authorities.

Assets

Once you’ve made sure your trading funds are safe on the platform, it’s time to look into what assets are supported on it. In most cases, the best stock trading platforms cover the NYSE and NASDAQ in the US. This means you can trade stocks like Facebook/Meta, Amazon, Visa, Johnson & Johnson, Amazon, and Tesla .

The London Stock Exchange, as well as several European markets, are also typically offered by the best stock trading platforms. eToro, for example, allows you to trade over 2,400 stocks from 17 international markets, which is great for building a diversified portfolio.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Stocks or traditional CFDs

You should also check whether the platform offers traditional shares or stock CFDs . If it is traditional shares , this means that you are buying the shares outright and you retain full ownership of them until you decide to redeem them. It also means that when the company in question makes a quarterly distribution, you will receive dividends .

However, if your chosen stock trading platform specializes in CFDs, this means that you will not own the shares . On the other hand, this allows you to use leverage as well as engage in shorting stocks . Stock CFD sites are also known for offering really tight spreads . This makes them ideal for short-term day traders who are looking for smaller profit margins.

Fees

Stock trading platforms – even if they offer a commission-free service – will always charge some kind of fee.

The main fees you need to consider are as follows:

Securities trading commission

Most stock trading platforms charge a commission when you enter and exit the market. This is usually a variable commission that is multiplied by your deposit.

For example:

- Let's assume that your chosen trading platform charges a commission of 0.15%.

- You make a trade of €1,000.

- The commission is therefore €1.50.

- When you decide to exit the trade, your position is worth €1,400.

- You pay a commission of 0.15% again. This time the commission is €2.10

Spreads when trading on the stock exchange

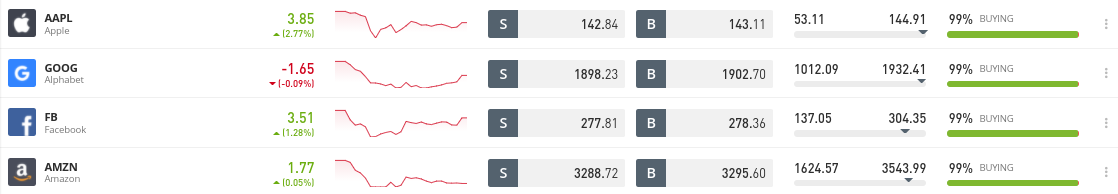

When trading stocks online, you need to have a good understanding of how spreads work. In its most basic form, it is the difference between the "bid" and "ask" price of the stock you are trading.

The bid price is the highest price a new buyer will pay for the stock, while the ask price is the lowest amount the seller will accept. While it may seem insignificant at first glance, this price difference is how stock trading platforms ensure their profit.

The best way to calculate the spread when trading stocks is to find out what the difference is between the bid and ask price as a percentage.

For example:

- At the time of writing, eToro is offering an offer price for Facebook shares of €278.36.

- The asking price is €277.81

- The spread is therefore 0.19%.

Simply put, if the spread reaches 0.19%, it means that you need to make trading profits of more than 0.19% to actually make a profit.

Leverage fees

If you want to trade stocks with leverage, you will need to do so through a CFD instrument . It is important to note that leveraged CFD instruments often charge overnight trading fees . As the name suggests, this is a few cents for each night that your trade remains open.

The amount you pay for night trading when trading stock CFDs can vary depending on:

- Specific actions

- Leverage sizes

- Your deposit sizes

- Will your store stay open over the weekend?

This is why leveraged CFD trading is more suitable for a short-term strategy . This is because paying out leverage for a few days will cost a negligible amount, but a leveraged position that remains open for months will be very costly.

Other fees

In addition to commissions, spreads, and night trading, there are several other fees that your chosen stock trading platform may charge.

This includes:

- Transaction fees: Most of the trading platforms we’ve covered allow you to deposit and withdraw funds without charging a fee. However, some do charge transaction fees, so check before opening an account.

- FX Fees: You may have to pay an FX fee when trading stocks whose native currency is different from your own. FX fees are sometimes also charged on deposits.

- Inactivity Fees: If you don’t make a trade for a certain period of time (usually 12 months), the platform may start charging you an inactivity fee. This is usually deducted from your account until you make a trade or your balance reaches zero.

As mentioned above, a full overview of what fees your chosen stock trading platform charges is key information for determining your trading strategy.

Business tools and features

There can be huge differences in what trading tools online platforms offer. For example, while some platforms offer a wealth of study materials to help you make better decisions, others only provide basic tools.

Anyway, some of the main features offered by higher-quality stock trading platforms include:

Fractional shares

Unless you have a significant amount of capital available, it is probably best to opt for trading platforms that offer fractional ownership. As we briefly mentioned, this allows you to trade a “fraction” of a single share.

This is especially important when trading stocks of technology companies like Amazon, Tesla, and Apple, which can cost you hundreds, if not thousands, of dollars to enter the market.

The solution is to choose a platform that allows you to invest small amounts. For example, the minimum stock trade on eToro is just €50 across all of its 2,400+ stock markets.

Automated trading

The idea of making a full-time living trading stocks online is a tempting proposition. Unfortunately, it’s not that easy. After all, you need to have a good understanding of trading strategies, technical analysis, risk management, fundamental research, and more. It can take many years to fully master these metrics – which is why so many inexperienced stock traders end up losing money.

The good news is that there is a simple solution to this lack of knowledge about stock trading – Copy Trading .

- This is an innovative feature offered by eToro. It allows you to choose a successful stock investor and then automatically copy their trades.

- For example, if this person invests 15% of their portfolio in Twitter shares, then 15% of your portfolio will be allocated there as well.

- In other words, if you invested €100, you will automatically buy €15 worth of Twitter shares.

The best thing about eToro Copy Trading is that you still have full control over your portfolio . For example, while you might be happy with a trader's performance, you can also decide to add a few other stocks that you like.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Shorting stocks

Stock markets will always be influenced by different trends. The best stock trading platforms will provide you with options not only for long-term investing, but also for shorting.

You take long trades when you believe that the price of a stock will increase over the long term. As such, it is no different from buying a stock in the traditional sense. Shorting, however, is the opposite, and is used when you expect the price to decrease.

Shorting allows you to profit from markets whether prices are rising or falling. As we mentioned earlier, to take advantage of the shorting option, you will need to use a stock trading platform that supports CFDs .

Education, research and analysis

Stock trading platforms don’t care whether you make or lose money – as they generate profits from commissions and spreads. However, the best platforms in this space will provide you with all the educational materials you could need to make bigger profits.

A range of educational materials are at the forefront that can take your business endeavors to the next level.

This may include:

- Trading guides

- Explainer videos

- Blogs and articles

- Market statistics

- Business tips

- Webinars

- Courses

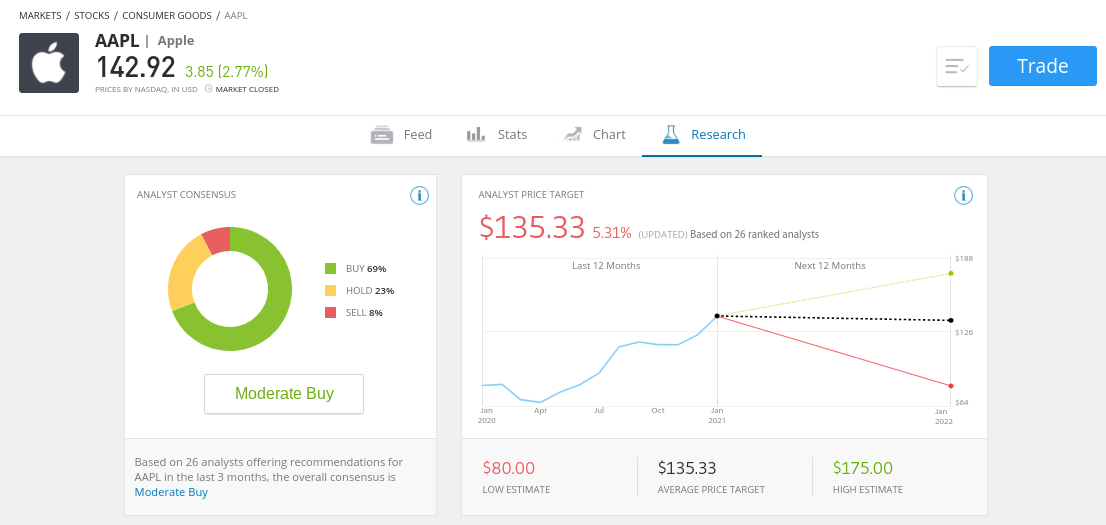

In addition to educational tools, the best stock trading platforms are packed with research and analysis tools .

If you are a day trader you will want to choose a trading platform that offers chart reading features. This should include a good selection of technical indicators and drawing tools. If the platform is compatible with MT4, you will have all the technical analysis tools you will need.

Payments

Some of the best online stock trading platforms we cover in this guide only support deposits and withdrawals via bank transfer. While this may be convenient for some of you, it won't be the case if you want to start trading immediately, as bank transfers can take a few days for the funds to reach your trading account.

Your capital is at risk.

That's why we recommend eToro – this platform allows you to deposit funds using a debit card, credit card, and even e-wallets like PayPal, Skrill, and Neteller.

In addition to which payment methods your chosen platform supports, you also need to find out:

- What fees are associated with the selected payment method?

- How long does it take for deposits to be credited to your account?

- How long does it take for the platform to process withdrawals?

- Minimum deposit amount

- Minimum withdrawal amount

You can usually check the metrics above by visiting the website of your chosen platform before signing up.

Customer support

The best stock trading platforms operate smoothly and without any issues, meaning there is little chance that you will need to access customer support. However, there may still be times when you need help – for example, to check the status of your deposit or verify a specific trading fee.

So be sure to research when the customer support team is open. It is usually 24/5, although some stock trading platforms offer support 7 days a week.

You should also check what support channels are offered. The best option in this regard is live chat - as it is free and instant. Some stock trading platforms also offer telephone support, although this is usually only true for traditional brokerage firms.

How to start trading stocks

If you've read this far in this guide to the best stock platforms of 2026, you're probably ready to start trading.

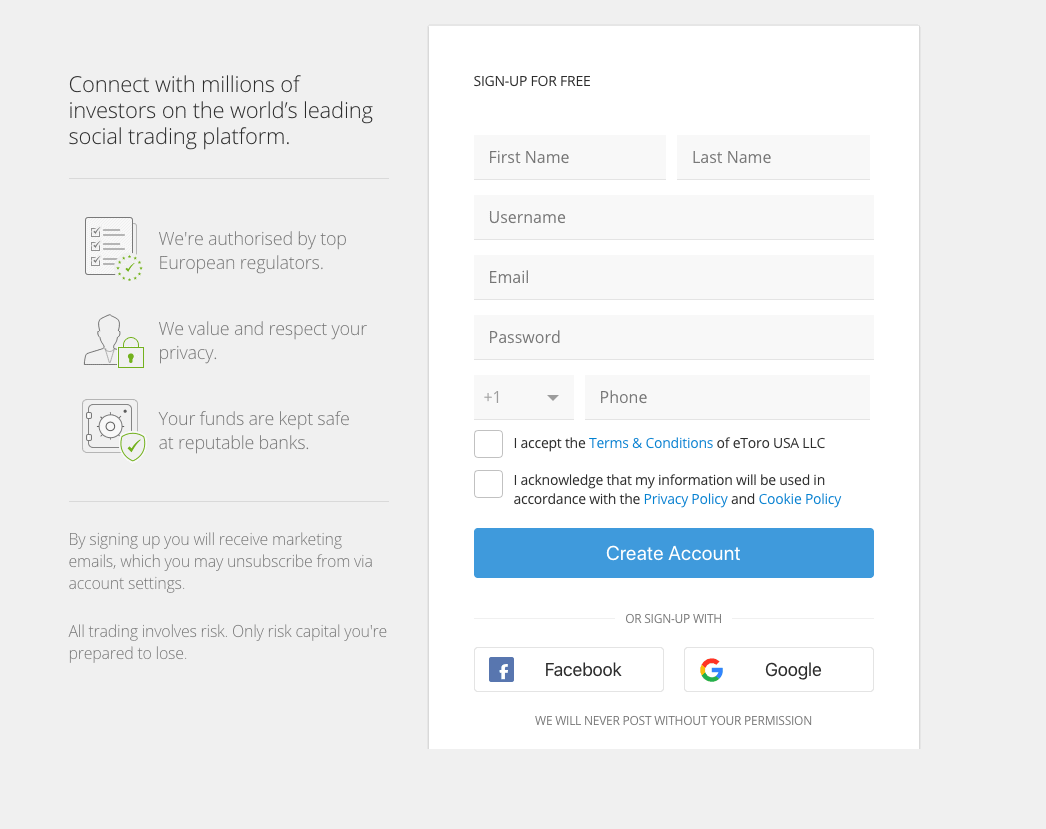

Step 1: Create an account and upload your ID

First, you will need to create an account on eToro. To do this, visit the platform's homepage and look for the “Join Now” button.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

You will then be asked to enter some personal information – such as your name, address and date of birth. eToro also needs to collect some contact information – including your mobile phone number and email address.

Step 2: Confirm your identity

eToro will ask you to upload a copy of:

- Passport or ID or driver's license

- Utility bill or bank statement (issued within the last 3 months)

This is because the platform is highly regulated and must comply with domestic and international anti-money laundering laws. Once you upload the above documents, your eToro account will be verified.

Note : You can upload the above documents later. However, you must do so before you can withdraw money or attempt to deposit more than €2,250.

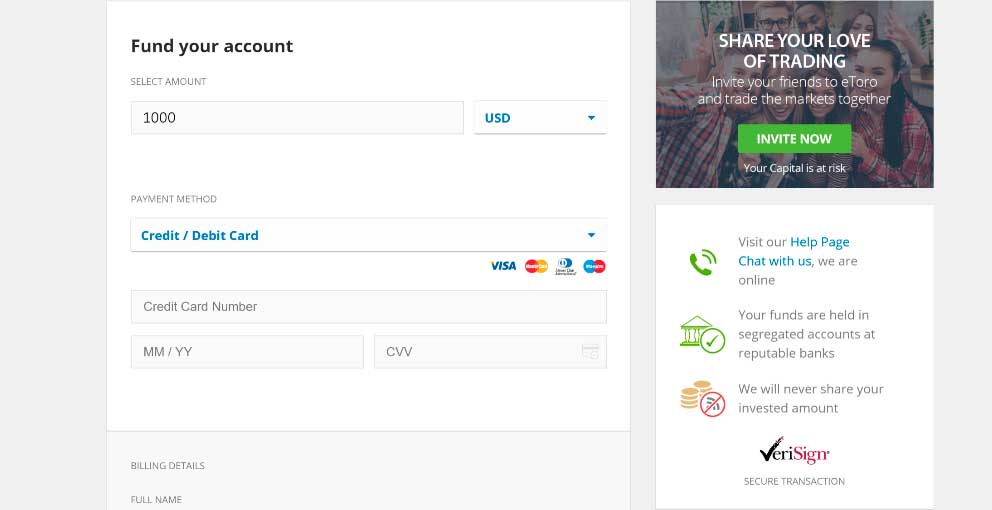

Step 3: Deposit funds

Once you have set up an account, you can practice your trading skills on the eToro demo account – which comes with a pre-loaded virtual €100,000.

However, if you are ready to start trading with real money - you will need to make a deposit first. You can choose from the following payment types:

- By debit card

- By credit card

- By e-wallet (PayPal, Skrill or Neteller)

- By bank transfer

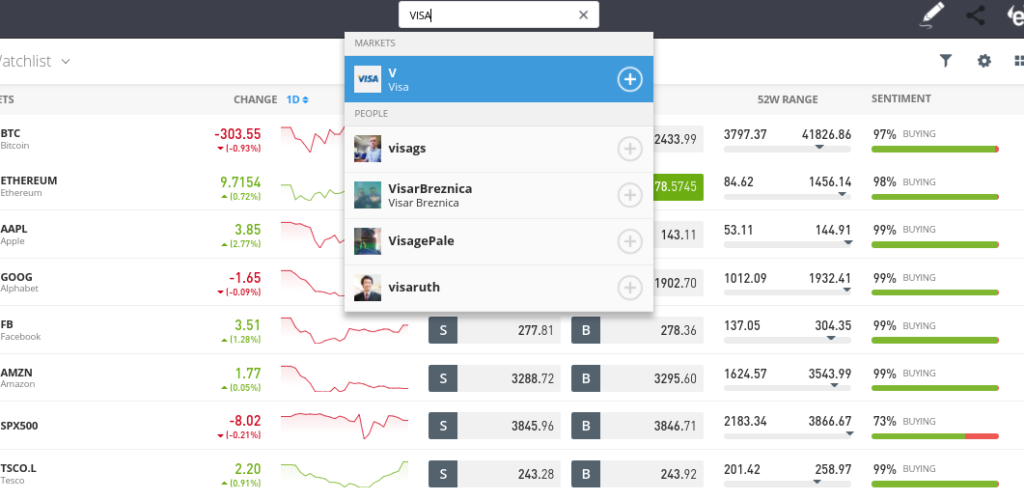

Step 4: Search for the desired actions

eToro offers over 2,400 stocks across 17 international markets, so if you know which stock you want to trade, it's best to search for it straight away . In the example below, we're searching for Visa shares.

Your capital is at risk.

Alternatively, if you don't know which stocks you want to trade, click on the "Trade Markets" button. This allows you to browse what stocks are on offer on the exchange or in specific sectors.

Step 5: Make the trade

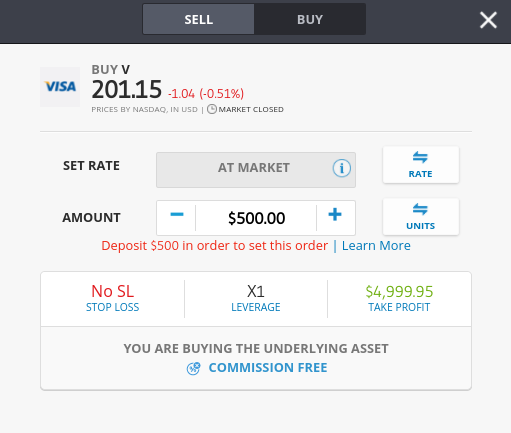

After clicking the "Trade" button next to the selected stock, you will see an order window as shown in the image below.

Here you need to enter and fill in the following fields:

- Buy/Sell: By default, you place a buy order – meaning you expect the stock price to increase. If you want to short the stock, change the order to sell.

- Amount: Enter an amount (minimum $50). In our example, we are depositing $500 to buy Visa shares.

- Stop-Loss: Although optional, we recommend that you enter a stop-loss price. This is the price at which your trade will be closed if it falls by a certain amount (eg 5%).

- Take-Profit: Although this is also optional, you should also consider entering a take-profit price. This is the price at which eToro will close your trade when it reaches a set profit target (eg 10%).

After reviewing the information entered, click the "Open Trade" button to place an order to trade stocks without commission.

Note : If the market you want to trade is closed, click the "Set Order" button. eToro will execute this trade when the market reopens.

Conclusion

With so many stock trading platforms vying for your attention, you don't have to sign up with the first provider that catches your eye. Instead, take the time to explore the many platforms active in the online space. Then you are sure to find a trading platform that is right for you and your needs.

However, if you don't have time to explore the hundreds of platforms on offer, we recommend considering eToro . The platform is also highly regulated and allows you to open an account and deposit funds in just a few minutes.

Best trading platform for stock trading

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Frequently asked questions

What is the best stock trading platform for beginners?

Which online stock brokers have the lowest fees?

Which stock trading markets are available online?

Are online stock trading platforms safe?

How do stock trading platforms make money?

Which stock trading platform accepts PayPal?

How to short stocks online?