Recenzia Libertex pre rok 2026 – odhalenie výhod a nevýhod

If you are interested in trading CFD derivatives and want to speculate on the underlying prices of assets such as forex, commodities, cryptocurrencies, ETFs and more, then you should explore the Libertex platform. But is Libertex really the right CFD broker for your trading needs?

For the purposes of this Libertex review for 2026, we have researched and tested all key aspects of Libertex – from fees and commissions to payment methods and mobile trading. Read on to find out if this CFD broker is right for you.

What is Libertex?

Libertex has been providing CFD trading services to its clients since its founding in 1997. This popular trading platform has over two decades of experience in the financial market and online trading and has amassed nearly 3 million clients worldwide, including both casual traders and active, experienced investors.

Libertex serves clients from over 100 countries and provides access to over 250 financial instruments. Unlike most of its competitors, Libertex keeps its brokerage offerings as simple and efficient as possible. After all, this CFD broker focuses mainly on trading CFD derivatives and covers just over 200 markets, which includes a wide range of stocks, cryptocurrencies , indices, ETFs and more.

Additionally, leveraged trading on the Libertex platform allows you to gain much greater exposure to the financial market you are trading in compared to the total amount you deposited to open a position. Leveraged CFDs therefore maximize both potential profits and losses .

Libertex allows retail traders based in the European Union to invest with leverage of up to 30:1 (on major currency pairs). This means that an account balance of €1,000 can give you access to €30,000 of trading capital. On the other hand, professional traders have access to a maximum leverage of up to 1:600.

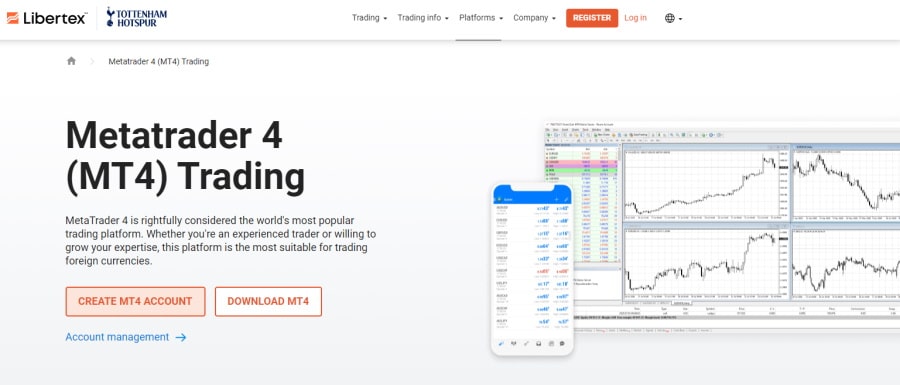

When it comes to available trading platforms, Libertex offers two options . The proprietary Libertex trading platform is ideal for novice traders looking for a user-friendly online trading platform without any complex and advanced technical features. On the other hand, advanced investors with a lot of trading experience can take advantage of technical indicators, fully customizable charts, drawing tools and robo-advisory services for automated trading through the popular MetaTrader trading application .

Libertex – advantages and disadvantages

What we like:

What we don’t like:

85% of retail investor accounts lose money when trading CFDs with this provider.

What can you trade on the Libertex platform?

First, it should be noted that trading on Libertex is not a traditional investment in the sense of taking ownership of the underlying asset . Instead, when trading CFDs, you speculate on the future price of assets such as forex , stocks, ETFs, options and more. As we mentioned earlier, a contract for difference, commonly referred to as a CFD , is a type of financial derivative that allows you to trade on price movements in the markets without owning the underlying asset.

CFD trading offers the option of long and short orders. This means that if you expect the price of the underlying asset to rise, you buy, and if you believe the price will fall, you sell.

Additionally, leveraged CFD trading allows you to gain full market exposure even with a small initial deposit, which in financial terms is known as margin. Simply put, to gain full market exposure, you only need to put up a portion of the cost of the position as margin.

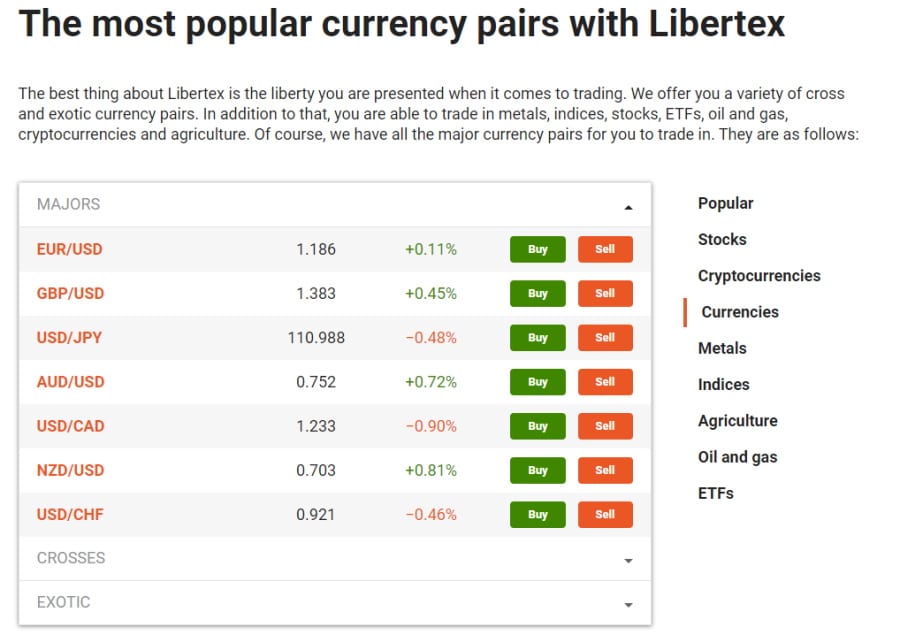

CFD Forex Trading

Libertex is a popular choice among forex traders because this trading platform provides a wide selection of major, minor and exotic currency pairs, such as:

- EUR/USD

- EUR/AUD

- GBP/JPY

- USD/CAD

- NZD/USD

- USD/CHF

- USD/JPY

- USD/ZAR

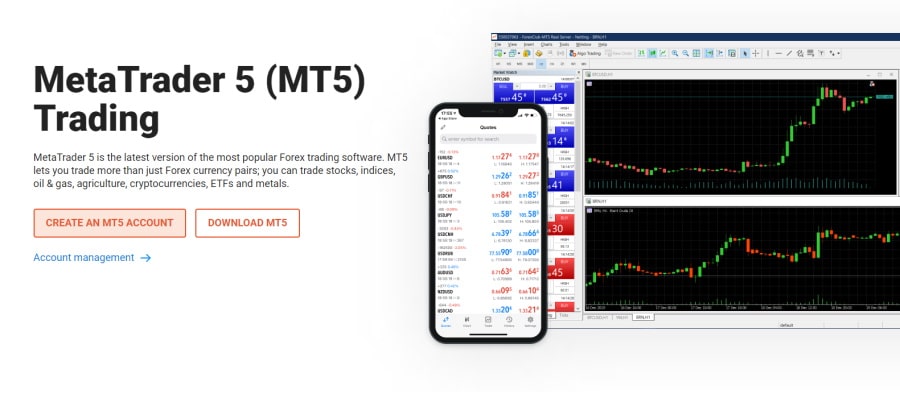

The minimum trading volume is €20 for all forex pairs and you can trade with leverage up to 1:30 or 1:20 depending on the FX pair you choose. In addition, you can link your Libertex live trading account to either MetaTrader 4 or MetaTrader 5. MT5 is a multi-asset trading platform that provides a range of trading features and is supported by MetaQuotes.

CFD trading with cryptocurrencies

On January 6, 2021, the FCA (Financial Conduct Authority - United Kingdom) passed new legislation that means that cryptocurrency instruments are not available to retailers in the United Kingdom. However, this is not the case in the European Union.

Professional traders have access to a wide range of cryptocurrencies from Bitcoin to crypto-to-fiat and cryptocurrency pairs. This means you can buy dogecoin (DOGE/USD) and other digital assets with 0% commission.

Another advantage of trading cryptocurrency CFDs is that you don’t take ownership of the underlying digital asset. This means you are speculating on the market price and don’t have to worry about storing the cryptocurrency in a wallet.

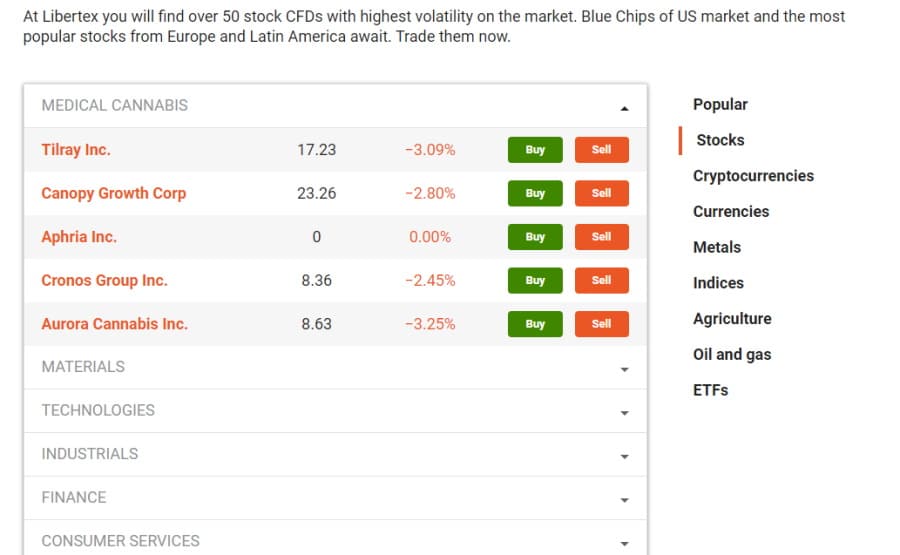

CFD trading on shares

With a Libertex trading account, you can find over 50 stock CFDs with the highest market liquidity. These include blue-chip stocks from US exchanges and major stocks of companies listed on European and Latin American markets.

As we mentioned earlier, when you trade stock CFDs, you are not buying actual shares . Instead, you are gaining exposure to the stock market on a speculative basis as you attempt to predict whether the price of the share will rise or fall.

On the Libertex platform, you can trade Apple (APPL) shares with leverage up to 1:5 and a commission of -0.207%. You can also get 0.2200 dividends per share. This means that if you have an open long position, capital will be credited to your account, but if you have an open short position, money will be written off.

Additionally, you can browse the entire range of stock CFDs or select stocks based on their industry, such as:

- MEDICINAL CANNABIS

- MATERIALS

- TECHNOLOGY

- INDUSTRY

- FINANCE

- CONSUMER SERVICES

- LUXURY GOODS

- TELECOMMUNICATIONS

- CONSUMER GOODS

- ENERGY

- HEALTH CARE

- AUTOMOTIVE INDUSTRY

CFD trading with commodities

Libertex also supports commodity trading , meaning you can gain exposure to three key commodity trading sectors: metals, agriculture, and oil and gas. Let’s take a look at a comprehensive list of the types of commodity CFDs you can access on this CFD and forex trading platform .

- Metals – copper, palladium, platinum, silver, gold.

- Oil and gas – Brent crude oil, Brent Cash crude oil, heating oil, Henry Hub natural gas, WTI crude oil.

- Agriculture – cocoa, coffee, corn, soybeans, sugar and wheat.

As for trading commissions, they vary depending on the underlying asset, but generally range from 0.0% to -0.516%.

85% of retail investor accounts lose money when trading CFDs with this provider.

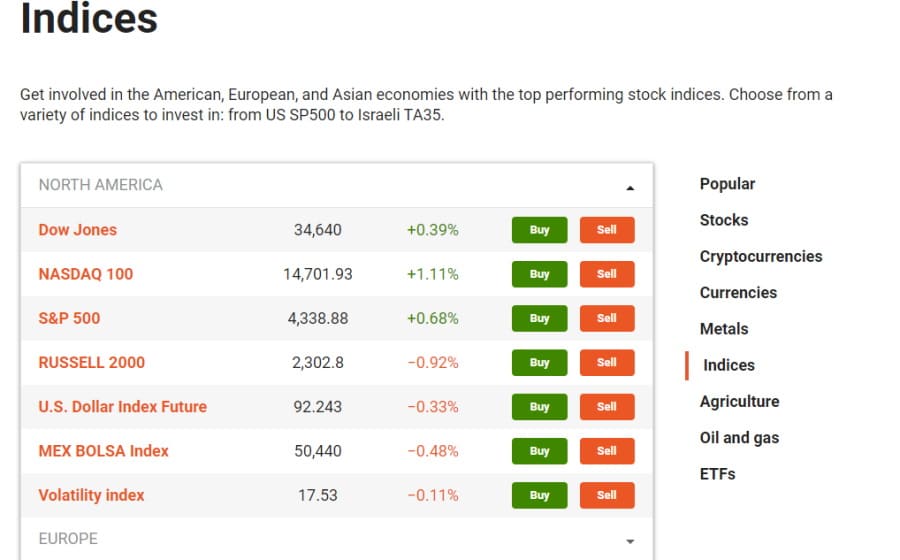

CFD trading with stock indices

Indices act as a measure of the price movements of a basket of stocks from a stock exchange, such as the London Stock Exchange and the New York Stock Exchange. For example, the FTSE 100 index is a measure of the price performance of the 100 largest companies that make up the LSE (London Stock Exchange). Trading indices gives investors complete exposure to a country's economy or sector in a single trade.

As with all CFDs, you can speculate on the price of an index without owning the underlying asset. Indices are popular with traders because they represent a highly liquid market to buy and sell. Stock index markets typically have longer trading hours compared to other markets, meaning you can gain greater exposure to unique trading opportunities.

With this in mind, Libertex covers the European, American and Asian markets with the most popular stock indices. You can choose from a wide range of indices such as:

- S&P 500 – measures the performance of the 500 largest companies by capitalization in the US

- NASDAQ 100 – tracks the value of the 100 largest technology companies in the US

- DAX – measures the price performance of the top 30 stocks listed on the Frankfurt Stock Exchange

- Hang Seng Index – monitors the price performance of leading companies listed on the Hong Kong stock exchange

- Nikkei 225 – tracks the value of 225 leading companies on the Tokyo Stock Exchange

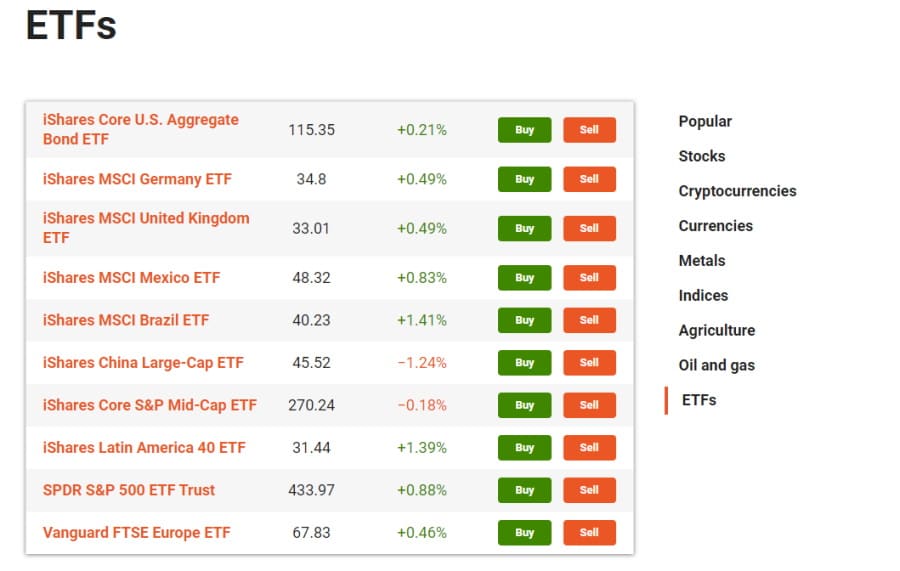

CFD trading with ETFs

Trading ETFs with derivatives is an effective way to gain exposure to short-term price movements within specific markets and sectors. When trading ETFs via CFDs and spread betting, you can use leverage, which is capped at 1:5 at Libertex , to gain full exposure to the ETF. You only need to deposit a fifth of the total trade value to open a trade.

This deposit is known as margin, and while it reduces the amount needed to open a position, it also increases potential losses. This is because CFDs calculate profits and losses based on the total size of the trade, not the initial deposit.

Libertex gives you access to the following ETFs with commissions starting from -0.08%:

- iShares Core US Aggregate Bond ETF

- iShares MSCI Germany ETF

- iShares MSCI United Kingdom ETF

- iShares MSCI Mexico ETF

- iShares MSCI Brazil ETF

- iShares China Large-Cap ETF

- iShares Core S&P Mid-Cap ETF

- iShares Latin America 40 ETF

- SPDR S&P 500 ETF Trust

- Vanguard FTSE Europe ETF

CFD options trading

Options trading is divided into two types called Puts and Calls. In CFD trading, the buyer of a call option predicts or speculates that the price of the underlying asset will increase, while the buyer of a put option predicts that the price will decrease.

Buying and selling options via CFDs typically provides greater exposure than other trading instruments. As a result, traders and investors can open larger positions at lower costs. For example, with leverage of up to 1:10, for every €1,000 you deposit, you can trade up to €10,000 worth of options.

Libertex offers the following options CFDs with leverage up to 1:5 and 0% commission:

- Bitcoin

- Oil

- DAX

- S&P 500

- Gold (XAU/USD)

Fees and commissions at Libertex

CFD trading with zero spreads

The most notable benefit when it comes to Libertex trading fees is that you don’t have to pay a spread . This is unique among CFD brokers because usually when commissions are low, spreads are charged. In other words, a spread is the difference between the buying and selling price of an asset.

This means that if the spread is 0.5%, you will need to make a profit of at least 0.5% to make a real profit. So, offering zero spread is good news for your potential trading returns.

Trading commissions

To offset the zero spreads when trading CFDs on Libertex, this trading platform charges a trading commission . It ranges from 0% to -1.623% depending on the underlying asset. All commissions can be found on the CFD specification page or in the trading terminal when you click on the asset.

For example, when it comes to forex trading, if you wanted to trade the EUR/USD forex pair, you would have to pay a commission of -0.011% and could use leverage of up to 1:20.

Most forex and CFD brokers offer commission-free trading but come with spreads. Libertex, on the other hand, facilitates trading with zero spreads, while some instruments, such as options CFDs, can be traded with zero commission and zero spreads.

85% of retail investor accounts lose money when trading CFDs with this provider.

Non-trading fees

An overnight trading fee , also known as a swap fee, is a fee for keeping your position open after standard trading hours. For example, the swap buy fee and swap sell fee for keeping trades open overnight for Apple CFDs are -0.0302% and -0.0254% respectively .

If the client's account is inactive for more than 180 calendar days (i.e. no trading, no open positions, no withdrawals or deposits), the company reserves the right to charge him an account maintenance fee of €10 per month . (Applies to clients with a total account balance of less than €5,000).

User experience on Libertex

If you are a beginner trader with little or no trading experience, Libertex is probably the right CFD broker for you . You can trade CFD derivatives via Libertex’s web and mobile trading platforms, or you can use the MetaTrader 4 and MetaTrader 5 platforms.

The account opening process is straightforward, making funding your account very easy. You can browse financial instruments based on the following criteria from the Libertex web trading platform:

- Popularity

- Indexes

- The biggest rise

- The biggest drop

- Highest volatility (1 day)

- 30-day uptrend

- Downtrend in 30 days

- Commodities

- Oil

- Metals

- Actions

- Currencies

- ETFs

You can also create a list of favorite assets . Alternatively, you can search for a tradable asset of your choice using the search bar at the top of the trading terminal.

Libertex boasts a user-friendly and intuitive interface that makes online trading easier, as all you have to do is click on your preferred asset, specify the trade amount and leverage, enter the order type and Stop Loss and Take Profit values, and click buy or sell to execute the trade.

Libertex provides an overall user-friendly trading platform and website for both novice and experienced investors .

Features, charts and analysis on the Libertex platform

Charts

As we mentioned earlier, Libertex gives you access to its own trading platform, as well as MetaTrader 4 and MetaTrader 5 .

Advanced traders and experienced investors will be very familiar with the MetaTrader application and the many trading tools you can use. MetaTrader is a third-party trading platform created by MetaQuotes Software Corp. that can be linked to your trading account with a CFD broker such as Libertex. MT4 and MT5 offer fully customizable trading terminals as well as automated forex robot services. MT4 and MT5 are compatible with both iOS and Apple devices and you can download the trading software to your computer.

85% of retail investor accounts lose money when trading CFDs with this provider.

Charts, features and analysis on the Libertex web trading platform

The Libertex web trading platform is user-friendly and you can start trading your favorite assets with just a few clicks of a few buttons.

When it comes to charts, you can fully customize each chart by choosing from bar, candlestick, line, area, and Heiken Ashi charts. You can set the time interval from 1 second to 1 month.

As for technical indicators, there are more than 40 of them and they are divided into three categories:

- Trend - such as Aroon, Choppiness Index, Ichimoku Cloud, MACD, Mass Index, Moving Average, Moving Average Exponential, Moving Average Weighted, Parabolic SAR, Price Oscillator, Triple EMA, Williams Alligator, ZigZag, Arnaud Legoux Moving Average, Coppock Curve, Directional Movement Index, Double Exponential Moving Average, Envelope, Hull MA, Least Squares Moving Average, and more.

- Oscillators – such as Awesome Oscillator, Balance of Power, Stochastic RSI, Williams %R, True Strength Indicator and many more.

- Volatility - including Bollinger Bands, Bollinger Bands Width, Donchian Channels, Keltner Channels, Relative Volatility Index, Chande Kroll Stop.

You can also compare different assets on the same chart by clicking the Compare button at the top of the screen and selecting assets. You can also use different drawing tools to make the charts fit your trading needs and goals.

Libertex charts are ideal for novice traders because each chart includes an Open Trade button in the top right corner, so you can execute trades without having to switch tabs or close the chart window.

Traders can also identify unique trading opportunities on Libertex through trading signals from top-rated third-party provider Trading Central.

85% of retail investor accounts lose money when trading CFDs with this provider.

Account types at Libertex broker

Libertex offers a live trading account and a demo account with a virtual balance of €50,000 in the account.

Demo accounts are ideal for new traders to practice CFD trading and become familiar with the trading platform in a risk-free simulated environment that mimics current market conditions.

You can switch between a live trading account and a demo account at will by simply clicking on the demo account and live account buttons in the top right corner of the trading platform.

Libertex mobile app review

As is common practice among trading platforms these days, Libertex offers a full-fledged mobile app that is compatible with iOS and Android mobile devices . This means you can buy and sell CFDs with zero spreads and identify the best trading opportunities from your mobile phone or tablet.

Alternatively, you can download the MT4 or MT5 mobile trading app and log in to your Libertex account using your personal details.

The mobile trading platform offers the same functionality as found on web trading platforms , so you can also trade financial instruments, manage your portfolio, access charts and forex signals directly from your mobile device.

Another useful and convenient feature is that you can set up price alerts and notifications via the MT4 and MT5 mobile trading apps. This means you never have to miss a trading opportunity again. Forex and stock trading strategies can become more flexible and reactions to these key events can be much faster because MetaTrader platforms offer the option to use trading alerts.

You can set alerts to alert you to key trading events, so important moments never go unnoticed. Price alerts eliminate the need to spend countless hours monitoring the markets, as the trading platform will notify you in real time via email or push message on your mobile device.

Payment methods on Libertex

Libertex supports a wide range of payment methods including credit cards, debit cards, PayPal, SEPA /international bank transfers, Skrill, Neteller and more. There are no deposit fees and your funds are credited to your account instantly, with the exception of bank transfers, which take 3 to 5 days to complete.

When it comes to withdrawals, you can use PayPal and Skrill, which have zero withdrawal fees, while credit/debit cards, SEPA bank transfer, and Neteller withdrawals require a small withdrawal fee.

Let's take a look at the full list of available options and their associated fees and processing times:

| Deposit payment method | Fee | Processing time |

| PayPal | None | Immediately |

| Credit/debit card | None | Immediately |

| Instant | None | Immediately |

| iDeal | None | Immediately |

| SEPA/International Bank Wire | None | 3-5 days |

| giropay | None | Immediately |

| Skrill | None | Immediately |

| Trustly | None | Immediately |

| Multibanco | None | Immediately |

| Transfers24 | None | Immediately |

| Rapid Transfer | None | Immediately |

| teleingresso | None | Immediately |

| Neteller | None | Immediately |

Selection methods

| Payment method | Fee | Processing time |

| PayPal | None | Immediately |

| Credit/debit card | €1 | 1-5 days |

| SEPA/International Bank Transfer | 0.5% min. €2, max. €10 | 3-5 days |

| Skrill | None | Within 24 hours |

| Neteller | 1% | Within 24 hours |

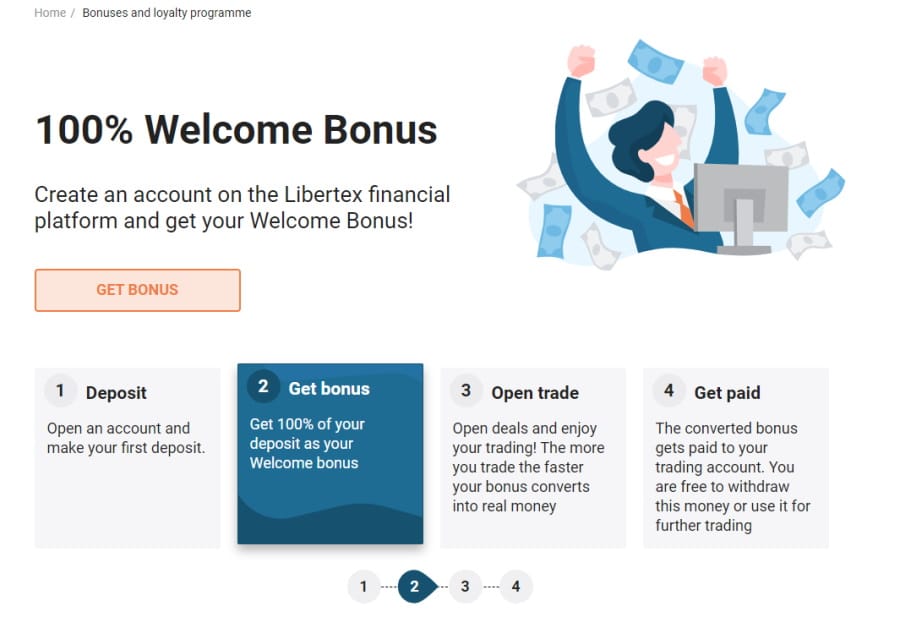

Libertex and 100% welcome bonus

When you open an account with CFD broker Libertex and deposit at least €100, you can get a welcome bonus of up to €10,000.

To be eligible for the welcome bonus, you must complete the registration process and make an initial deposit of at least €100 into your account. According to Libertex rules, you can get back 10% of all paid trading commissions as a bonus , which will be converted into real capital. The broker will then pay the transferred bonus directly to your trading account in 2% installments. You are then required to make sufficient trading volume within 90 days to convert the entire bonus.

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex contacts and customer support

You can contact customer support at Libertex via live chat, email, phone, WhatsApp, and Facebook Messenger.

In addition, you will find a useful page with FAQs, news, blogs, educational materials, CFD specifications and an economic calendar on the Trading Info tab at the top of the libertex.com website.

When you click on the trading education page, you can learn the basics of online investing with a three-hour trading course created by the award-winning Libertex Investment Academy.

Is Libertex safe?

Libertex is a trading platform operated by Indication Investments Ltd., which is regulated by CySEC (Cyprus Securities and Exchange Commission) with license number CIF 164/12.

Setting up two-factor authentication on your trading account is paramount to protecting your funds on the Libertex trading platform . Libertex supports two options for 2FA – via text message or the Google Authenticator app.

When it comes to protecting client funds, CySEC regulation requires brokers to hold all client funds in segregated bank accounts . In addition, you are covered by an investor protection scheme of up to €20,000 in the event that Libertex becomes insolvent.

How to start trading with CFD broker Libertex

When it comes to getting started with Libertex, all you need to do is follow the steps below.

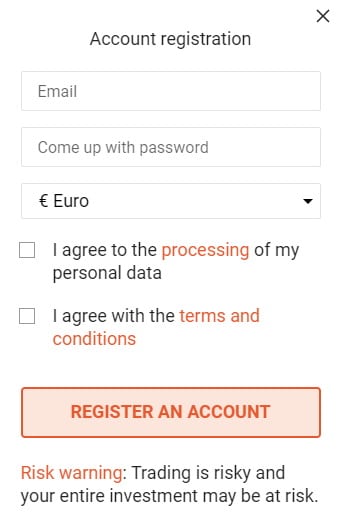

Step 1: Create a Libertex account

Go to the main website and click on the "Register" button at the top of the screen. To register for a live trading account, you will need to enter your email address and password via the login dialog of the mobile app or on the website. Alternatively, you can use your Facebook account to create a trading account.

Step 2: Deposit funds

After your first deposit, you will need to upload your documents such as ID and proof of address for identity verification purposes. New registered accounts usually take 3 business days to be approved.

Step 3: Start trading

To start trading, you can choose between the Libertex web trading platform or the mobile trading app, as well as MT4 or MT5 .

Simply find your preferred financial instrument on the platform and click on the sell or buy option. This will bring up a trading window where you can enter the trade volume, leverage, and place Take Profit and Stop Loss orders.

85% of retail investor accounts lose money when trading CFDs with this provider.

Libertex Review – Final Verdict

If you are new to the world of online trading , then Libertex is the ideal choice for you . As well as for anyone interested in trading CFDs with zero spreads and commissions from 0% on some assets.

The Libertex web trading platform is overall user-friendly and you can gradually work your way up to a real trading account via a demo account with a virtual balance of €50,000. To start your online trading journey with a top-rated CFD broker, simply click the link below and open an account with Libertex today.

Libertex – the best CFD and Forex trading platform with zero spreads and low commissions

85% of retail investor accounts lose money when trading CFDs with this provider.

References

- https://libertex.com/

- https://www.xtb.com/cz/vzdelavani/co-je-to-obchodovani-cfd

- https://www.investopedia.com/articles/stocks/09/trade-a-cfd.asp

Frequently asked questions

What is Libertex?

Can I trade with leverage on Libertex?

Does Libertex support MetaTrader 4 and MetaTrader 5 integration?

What is the minimum deposit on Libertex?

How much will it cost me to trade on Libertex?