Recenzia eToro pre rok 2026 – poplatky, funkcie, klady a zápory

eToro is one of the largest brokerage sites on the online investment scene – with over 20 million clients using the platform. Not only does this broker charge low commissions on thousands of assets and offer an easy-to-use trading platform, you can even invest passively with it through the Copy Trading feature.

But is eToro the right online broker for you?

In this 2026 review, we cover everything you need to know about the popular brokerage site.

eToro is an online platform that was first launched in 2007. The platform, which calls itself “the world’s leading social trading network,” is now home to over 20 million traders and investors. eToro’s rise to the top in such a short time is attributed to several exceptional features. eToro is ranked number one in our guide to buying cryptocurrencies . The platform also features social trading – the Facebook of the online investment world. eToro allows you to interact with other users of the platform, post and reply to individual discussions, and even add “Likes.” Ultimately, it allows investors to discuss trading ideas. You also have the equally innovative Copy Trading tool at your disposal, which allows you to choose an experienced investor on eToro and copy their portfolio and trading positions. Whether you are interested in buying stocks or trading forex – the door is open. Unlike many industry platforms, eToro is really easy to use, making it the ideal platform for beginners. And of course – eToro is strictly regulated in several jurisdictions, so your capital is safe.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Before we dive into the details of our eToro review – let us break down the key pros and cons we discovered with this platform.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

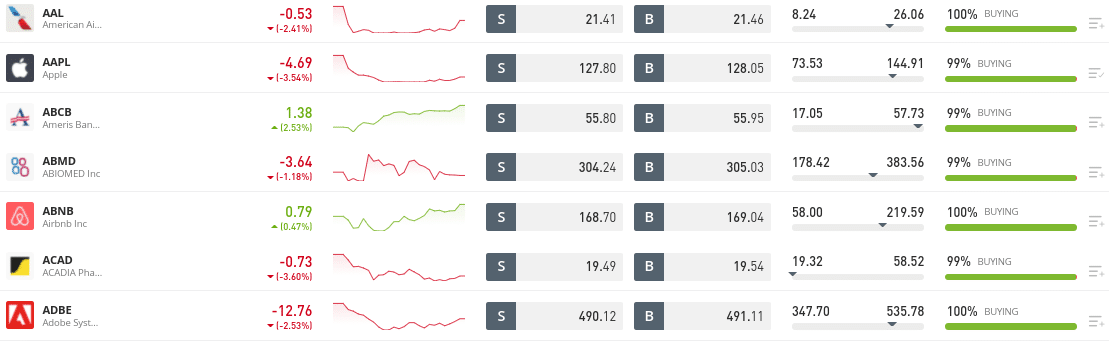

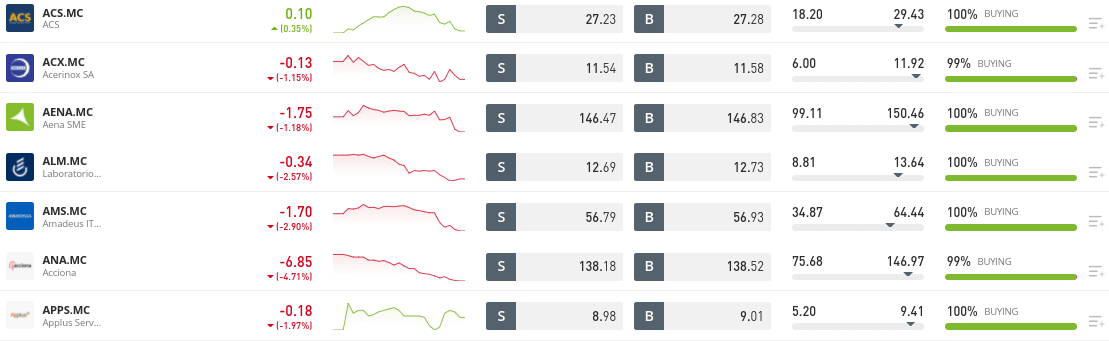

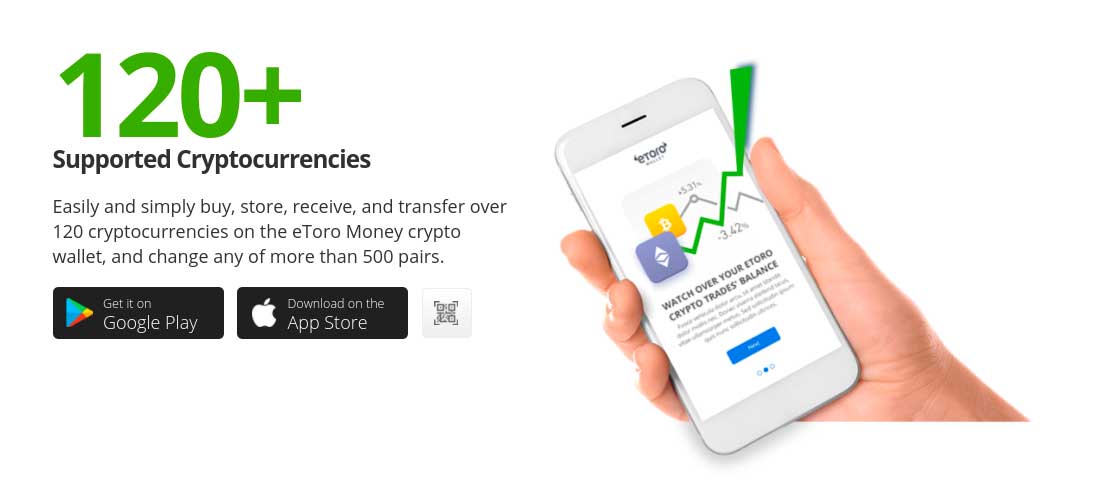

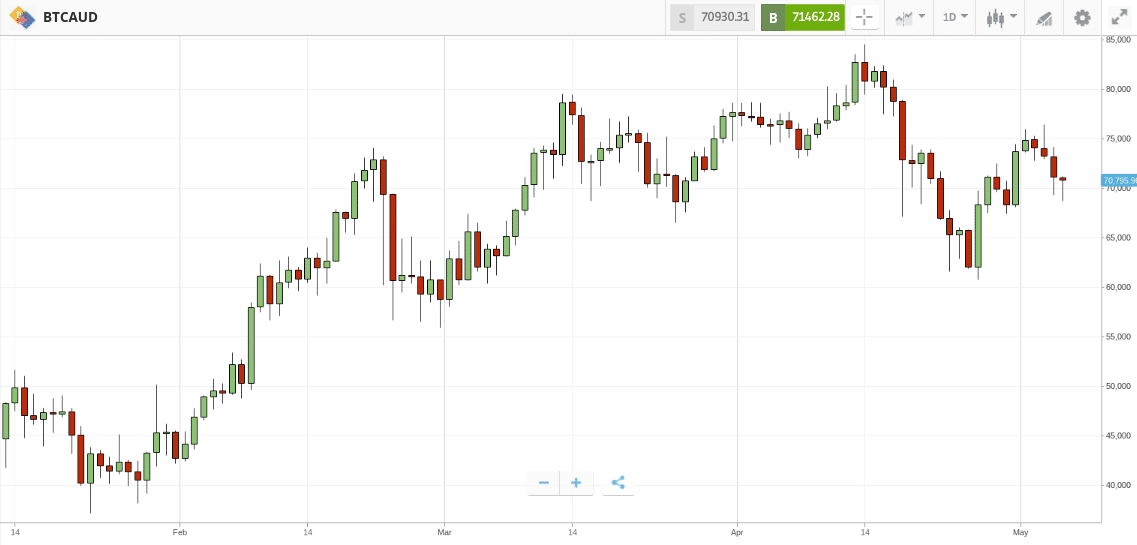

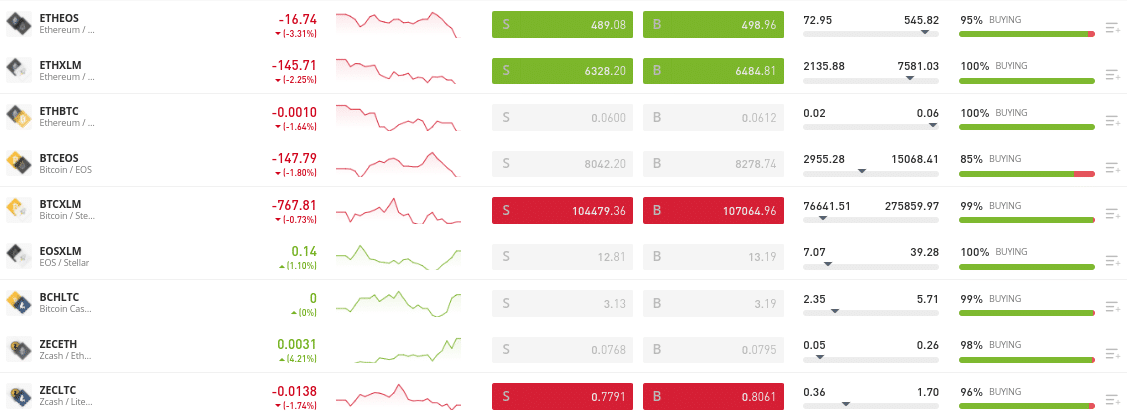

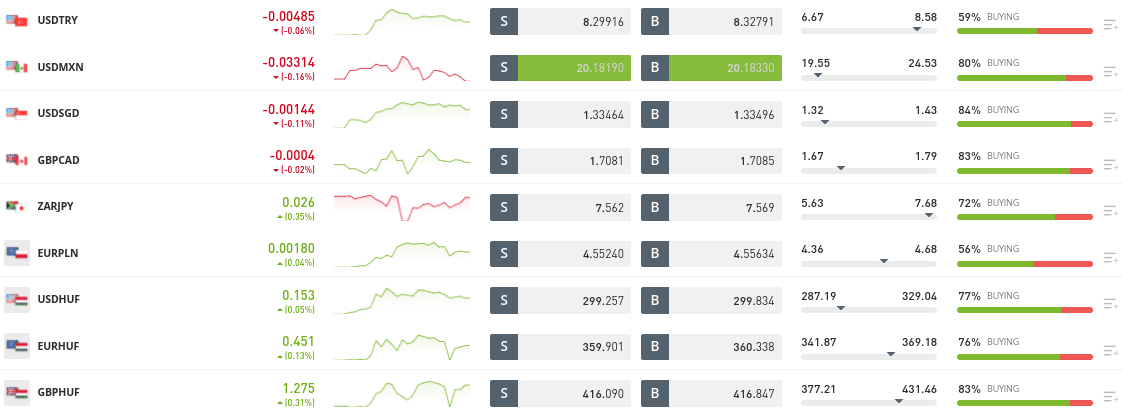

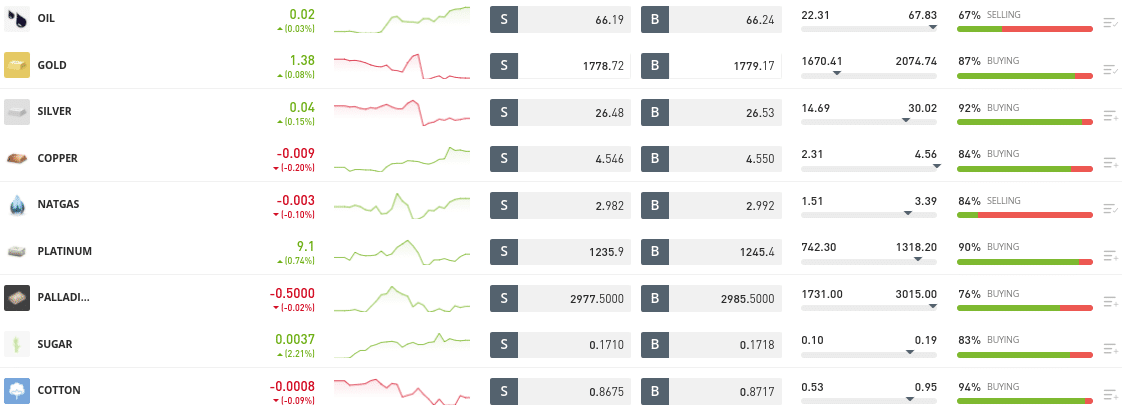

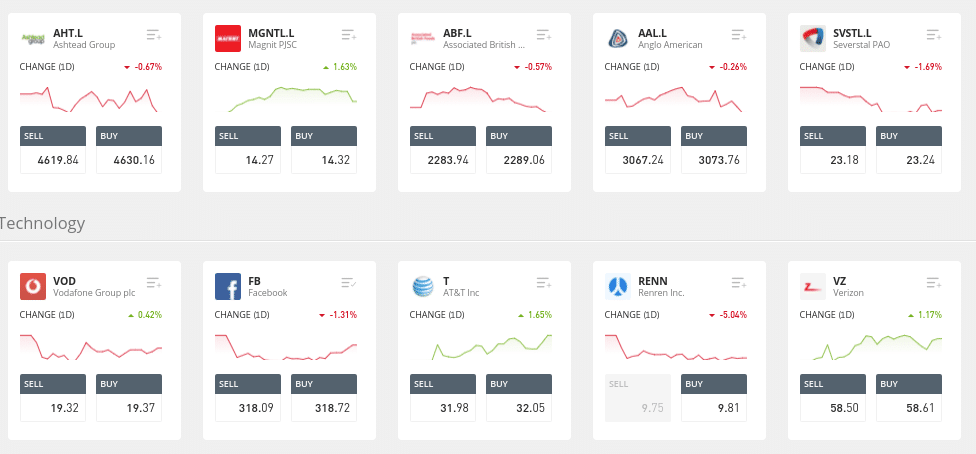

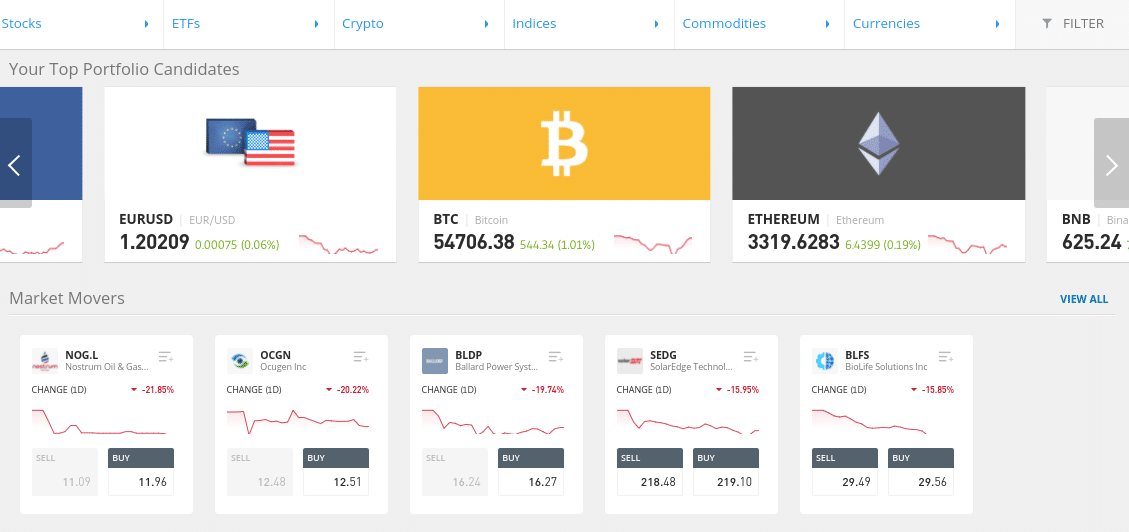

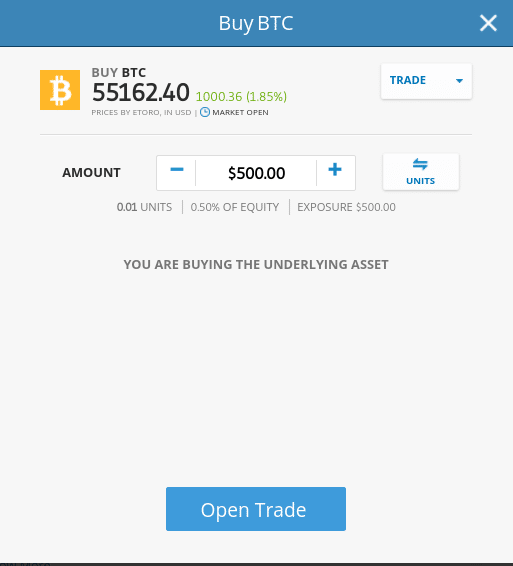

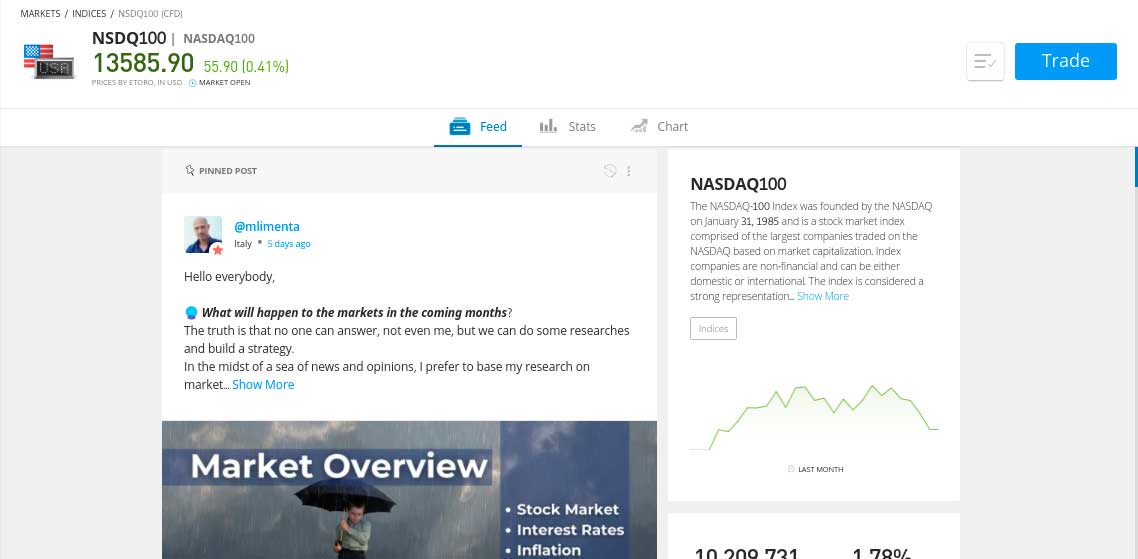

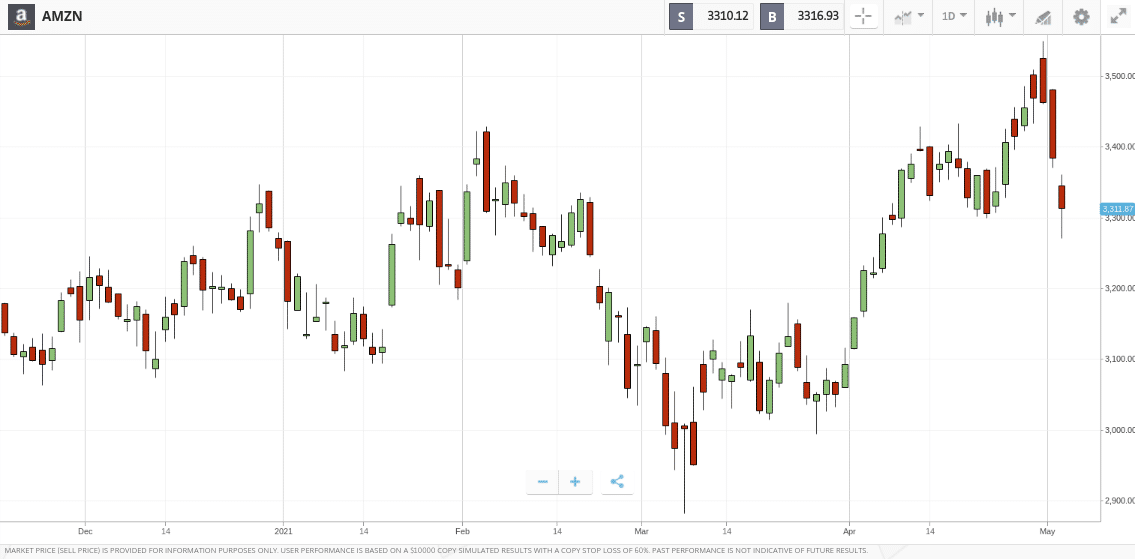

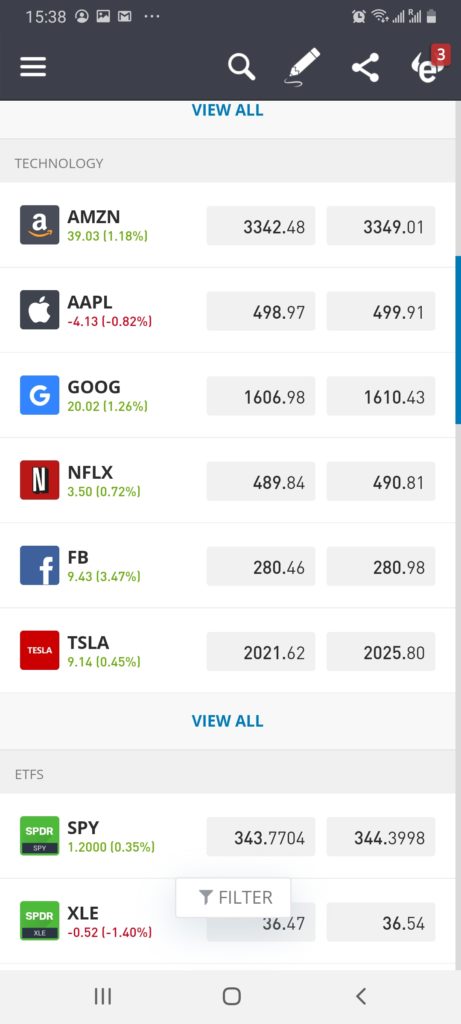

In the first part of our eToro review, we take a closer look at the markets and asset classes that eToro supports. Note : As discussed in more detail below, some assets (stocks, ETFs, cryptocurrencies) can be purchased and owned in the traditional sense, while others (forex, commodities, indices) are traded as leveraged CFDs. Let's start with the stock trading area. In short, this brokerage site gives you access to thousands of stocks. This includes not only the two leading US exchanges – NYSE and NASDAQ, but also 15 other international markets. These markets include: On the eToro platform, you will have access to stock markets in North America, Europe, Asia, the Middle East, and more. There are a few key points to note about trading stocks on eToro. Firstly, when you buy shares, you own them directly. This means you are officially a shareholder and therefore entitled to receive dividends when the company in question makes a split. Secondly, eToro also supports fractional ownership, which opens up the way for smaller investments. Fractional ownership is a key aspect of the modern stock trading scene, especially if you want to invest in US-listed companies that might be considered "expensive." For example, Amazon shares trade for over $3,300 and Tesla shares for over $700. On eToro, the minimum investment in shares is only €50 – regardless of the price of the desired shares. If you're new to fractional share investing - here's how it works on eToro: eToro’s fractional stock investing tool is not only great for those on a tight budget, but it’s also ideal for portfolio diversification purposes. For example, if you deposited €1,000 on eToro – you could buy 20 different stocks for €50. This allows you to easily build a portfolio with inverse risk. As we mentioned earlier, when you buy shares on eToro, you own them directly. This is why this popular online broker also allows you to trade shares via CFDs. This will be of interest to those of you who want to trade on a short-term basis. This is because share CFDs allow you to benefit from additional benefits such as leverage and shorting. For example: All stocks and exchanges that can be purchased in the traditional sense can also be traded via CFD instruments. Now that we've covered stocks, in this part of our eToro review we'll be looking at cryptocurrencies. These are divided into different digital currency markets and pair types, so we'll break down each segment, one by one. If you are a long-term investor in cryptocurrencies, you will be pleased to know that eToro allows you to buy and own over 40 different digital coins. This includes: eToro is constantly adding new cryptocurrencies to its list of supported coins, in line with market demand. For example, a few days before writing this review, the broker added Dogecoin. In terms of ownership, you will be purchasing your chosen cryptocurrency outright – meaning you can hold onto your investment for as long as you wish. Of course, you will also need to consider how you intend to store your newly purchased digital coins. Once you make a commission-free cryptocurrency purchase on the eToro website, you have two options when it comes to storing it. Additionally, if you choose this option, you can sell your coins with just the click of a button without having to make a transfer. The second option you have is to download the native eToro wallet – which is available via the mobile app for Android and iOS. This option will give you more control over your cryptocurrency investments – as you have the ability to transfer coins to and from the wallet. The eToro wallet supports over 120 digital currencies, and you can instantly convert one coin to another without leaving the app. In addition to buying digital coins on the eToro website , you can also trade cryptocurrencies. Again, this will appeal to those of you who want to adopt a cryptocurrency day trading strategy. Now, most digital currency trades on eToro are done through CFD instruments. As we mentioned above, not only does this allow you to use leverage, but you can also enter a short position. When it comes to leverage, most traders are limited to 1:2 leverage. This means that you can trade cryptocurrencies with twice the amount you have in your eToro account. When it comes to supported markets, there are two forms. First, you have crypto-to-fiat pairs. This means you are trading the exchange rate between a fiat currency and a cryptocurrency. All 19 coins we listed above can be traded against the US dollar. Additionally, many of the coins listed above can also be traded against other fiat currencies – such as the British pound, the euro, the Japanese yen, and the Australian dollar. Secondly, you have cryptocurrency pairs. As the name suggests, this means you will be trading between two digital currencies – say Bitcoin and Ripple (BTC/XRP) or EOS and Ethereum (EOS/ETH). Crucially, whether you are buying cryptocurrency or trading CFDs, the minimum deposit is just €25. Again, this is through eToro's fractional ownership tool. If you prefer the forex asset class – eToro is the place to go. At the time of writing, the broker offers 49 forex trading pairs, all of which are available for trading 24 hours a day. You will have access to all major and minor pairs – such as EUR/USD, GBP/USD and EUR/GBP. eToro is also a great choice if you are more risk-averse and want to trade exotic currencies. Some of the exotic currency pairs that eToro hosts include USD/CZK, USD/RON, EUR/PLN, and ZAR/JPY. When it comes to leverage, most traders on eToro will be offered 1:30 on major pairs and 1:20 on minor and exotic pairs. This is ideal if you want to trade forex but only have access to a small amount of capital. eToro currently offers over 250 ETFs – ideal if you want to invest in a diversified portfolio of assets. These include index funds like the Dow Jones, FTSE 100 and S&P 500 – backed by providers like Vanguard, iShares and SPDR. You can also invest in ETFs that track commodities like gold and silver, as well as portfolios that track dividend stocks, growth stocks, blue-chip stocks, and more. Regardless of the ETF you want to invest in, the minimum deposit is just €50. Of course, you will only be entitled to dividends once the ETF provider makes the payment. If you want to trade commodities from the comfort of your home – eToro offers you 31 markets. They can also be traded with leverage via CFDs – typically offering 1:20 on gold and 1:10 on other assets. Short selling is also available if you believe a commodity is overvalued. The commodities trading department on eToro consists of three basic categories: The minimum trade size when buying and selling commodity CFDs on eToro is just €50. The last type of asset we came across during the process of writing our review are indices. You can speculate on the future value of 13 different indices – covering the likes of FTSE 100, Dow Jones, S&P 500, Spain 35, Hong Kong 50 and more. Leverage of 1:20 and 1:10 will be offered on the major and minor indices. Now that we have introduced you to the financial instruments that the broker supports, in this section of our eToro review we will discuss the main fees that you will have to pay. Before we explain the platform's pricing structure in more detail, please see the eToro fee table below. As mentioned above, there are no platform fees on eToro, meaning you can keep your investments for as long as you want without having to worry about monthly/quarterly fees. If you want to buy shares listed on the London Stock Exchange - you pay a stamp duty of 0.5%. This is usually deducted by the brokerage you use to make the investment. eToro uses an industry-wide variable spread system. For those who don't know, this means that the spread – which is the difference between the buy and sell price of an asset – will change throughout the day. This will generally be more competitive during busy market hours – for example, when trading EUR/USD during the US-Europe cross-border exchange rate. The spread will vary greatly depending on which market you want to trade. For example, if you are trading major stocks listed on the NASDAQ or NYSE – you will probably pay an average of 0.2%. If you are trading gold or a major index like the Dow Jones, it will be even lower. For cryptocurrencies like Bitcoin, we found the spread to be an average of 0.75%, and for other digital assets, it was a bit higher. Ultimately, while it is beyond eToro's control to list every spread, we found the broker to be very competitive overall. First of all, if you are a US resident and deposit in US dollars – you can fund your account without paying any fees. Everyone else will pay a 0.5% foreign conversion fee – which is multiplied by the size of your deposit. You will also avoid paying FX fees when buying or selling assets listed on the international market. When it comes to withdrawals, eToro charges a flat fee of just €5 – which is payable regardless of how much you want to withdraw or what payment method you use. Like most brokers in the online space, eToro charges an inactivity fee. After 12 months of inactivity, it will cost you €10 per month. Of course, if you have assets in your portfolio – then the inactivity fee does not come into play. Moreover, if your account balance is empty, you do not have to worry about this fee. However, if you have funds in your account and no assets in your portfolio – the clock will start ticking towards the 12-month inactivity period. Simply start trading and the clock will reset. If you decide to buy an asset, such as stocks or cryptocurrencies in the traditional sense – you don't have to worry about overnight funding. This fee only applies if you are: All CFD trading platforms charge overnight funding fees. After all, CFDs are leveraged financial instruments. As always, the amount you pay on eToro will depend on several variables, such as: The good news is that you can see your daily overnight funding fee in dollars and cents when you place an order on eToro. When you make changes to your order – such as the stake size or leverage – the overnight funding fee will be updated. This ensures that you fully understand your trading costs before you enter a trade. We mentioned in our eToro review that the broker is particularly popular with inexperienced traders. This is because the eToro website is as simple as it gets in the world of online investing. You can see for yourself how clear and uncluttered the layout is once you get to the eToro homepage. You'll initially see a list of popular financial instruments – such as Facebook, Amazon and Apple stocks, gold and the S&P 500 index. However, you can view the full library of assets by clicking the "Trade Markets" button. You can then select a specific asset – such as stocks – for a further breakdown of what's on offer. You can also find your preferred market using the search box at the top of the page. Either way, once you find the asset you want to buy or trade, the process of placing an order is simple. It's really just a matter of entering your deposit and confirming your positions. This is in stark contrast to other online trading platforms that are crammed with overly complex tools and features. For example, if you're a beginner who simply wants to buy a few stocks, you probably won't be interested in technical indicators and detailed order books. If that describes you, you'll probably be very interested in eToro. When writing this review of the eToro trading platform, we were particularly interested in examining the platform's claim to be "the world's leading social trading network." For those new to the phenomenon, it works in a similar way to social media platforms like Facebook. You have the option to upload a photo to your profile and choose a username. You can share your thoughts via a post – which will then be seen by other eToro traders. Some traders may choose to "Like" or reply to your post. You can also add traders to your "watchlist" – this means you will be notified if and when they post a comment or "Like" on the eToro website. We really like the eToro social trading site – it allows you to interact with like-minded people. It also allows you to learn and grow while trading – as you see what the most successful investors are doing. You can also use the social trading tools to gauge what the broader market sentiment is at any given time. A direct offshoot of the social trading phenomenon is copy trading. In our opinion, this is probably the “flagship” product that eToro offers – as it paves the way for a 100% passive way of trading. The main concept is as follows: Keď investujete do profesionála za účelom kopírovania – vaše zrkadlové pozície budú úmerné sume, ktorú investujete. Minimum na obchodníka je len 500 € – bez akýchkoľvek ďalších poplatkov eToro.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

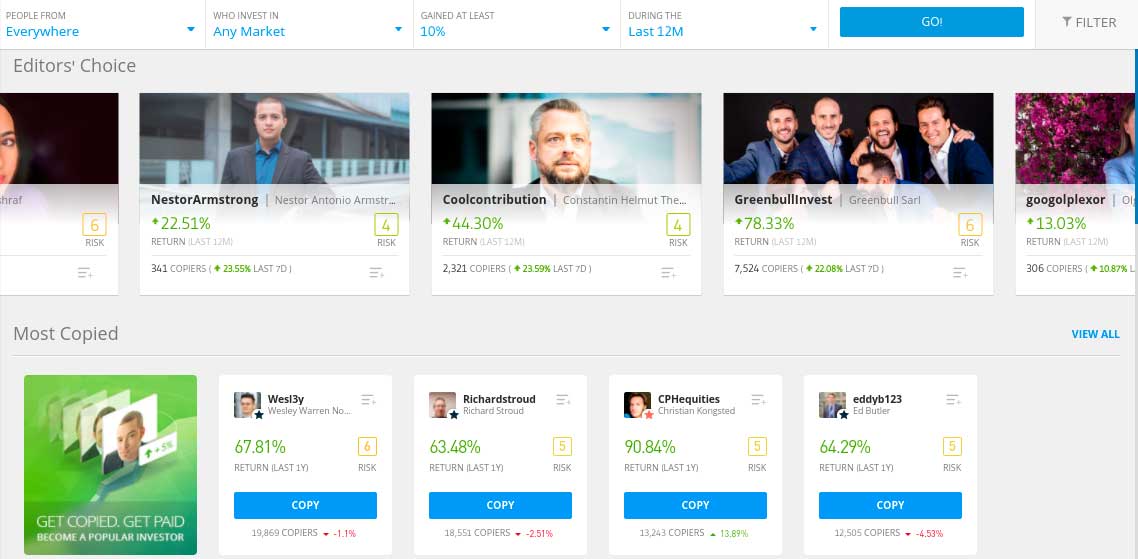

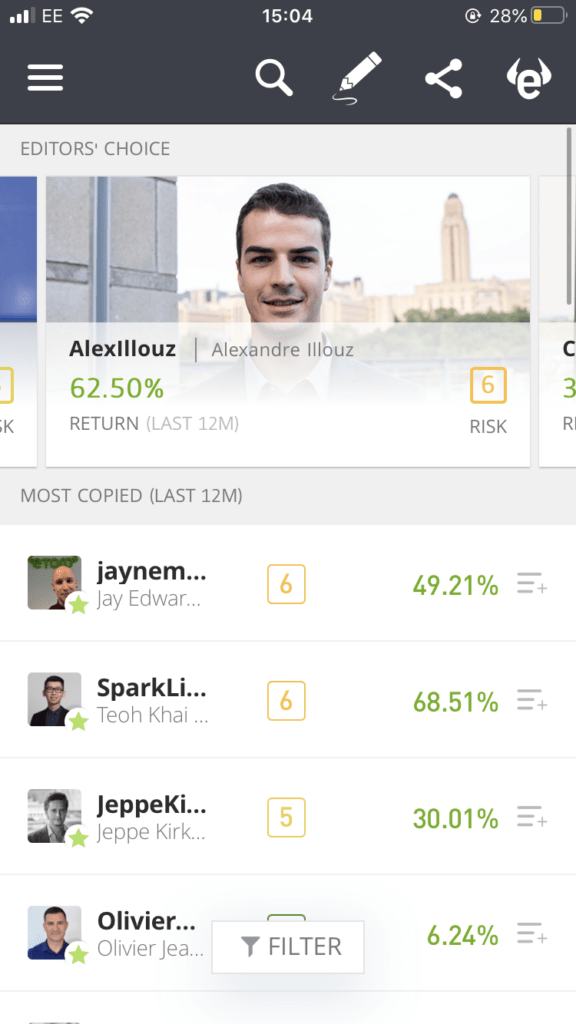

Tu je podrobnejší príklad toho, ako funguje nástroj na obchodovanie kopírovaním eToro: Ako môžete vidieť z vyššie uvedeného, aspekt automatického obchodovania tejto funkcie je veľmi vhodný pre nováčikov. Koniec koncov, nemusíte vôbec tráviť čas skúmaním finančných trhov. Namiesto toho je to len prípad výberu obchodníka, ktorého chcete kopírovať a ktorý mu umožní obchodovať vo vašom mene. Stále si ponechávate plnú kontrolu nad svojím portfóliom eToro – takže môžete pridávať alebo odstraňovať aktíva, ako chcete. Môžete sa tiež rozhodnúť kedykoľvek zastaviť kopírovanie obchodníka. Keď tak urobíte, všetky otvorené pozície, ktoré zrkadlíte, budú zatvorené. Po kliknutí na tlačidlo „Kopírovať“ na ľavej strane vášho účtu eToro budete mať prístup k tisíckam overených obchodníkov. Ako si viete predstaviť, kontrola poverení každého obchodníka je mimo možností, takže budete musieť použiť filter. To je však skvelé, pretože môžete nájsť obchodníka, ktorý konkrétne vyhovuje vašim potrebám, finančným cieľom a chuti riskovať. Aby ste mali predstavu o niektorých filtroch, ktoré môžete použiť na nájdenie obchodníka, patria sem: Po zúžení filtrov môžete kliknúť na obchodníka a pozrieť sa bližšie na jeho štatistiky. Môžete napríklad vidieť, koľko obchodník zarobil každý mesiac od vstupu na webovú stránku eToro. Môžete tiež preskúmať, aké obchody majú momentálne otvorené a celkové množstvo rizika spojeného s jednotlivcom. Okrem toho si môžete pozrieť, koľko zákazníkov eToro kopíruje konkrétneho obchodníka a s aký to má vplyv v súvislosti s financiami. Ak sa vám myšlienka preveriť tisíce investorov zdá ako skľučujúca úloha – nižšie uvádzame troch najlepších obchodníkov kopírovania na eToro, ktorí sú v súčasnosti na stránke aktívni. This trader is based in the UK and has been using eToro since 2013. We have quite a few years of trading data to work with. In short, Jeppe Kirk Bonde has generated average annual returns of 30% since joining in 2013, meaning he has outperformed the broader financial markets. Apart from a very small stake in Bitcoin, Jeppe Kirk Bonde focuses exclusively on stocks. In 2019 and 2020, the trader increased his portfolio by 45% and 36%. In the first four months of 2026 - Jeppe Kirk Bonde grew by 10%. Similar to Jeppe Kirk Bonde, this eToro trader has an excellent return on the brokerage side. Simply put, Wesley Warren Nolte has generated returns of over 650% over the past five years thanks to his large following. At the time of writing, the trader is being copied by almost 20,000 eToro clients. That represents millions of dollars in capital under management. All of Wesley Warren Nolte's assets come in the form of stocks - most of them based in the US. The trader's goal is to outperform the S&P 500 by at least 20% this year. Victor Pedersen – under the username Miyoshi – is a swing trader based in Denmark. Although the individual only joined eToro in January 2018 – he has been climbing higher and higher ever since. In fact, in his first year of trading – Victor Pedersen achieved financial returns of over 103%. The following year, the trade was 68% and for the first four months of 2026 - it's almost 8% in the green. Victor Pedersen is super active on eToro - with an average of 48.45 trades made each week. The average trade duration is just 1.5 weeks and Victor Pedersen's goal is to "radically" outperform the S&P 500. Note : If you want more information about one of the traders listed above, search for their username on the eToro website.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

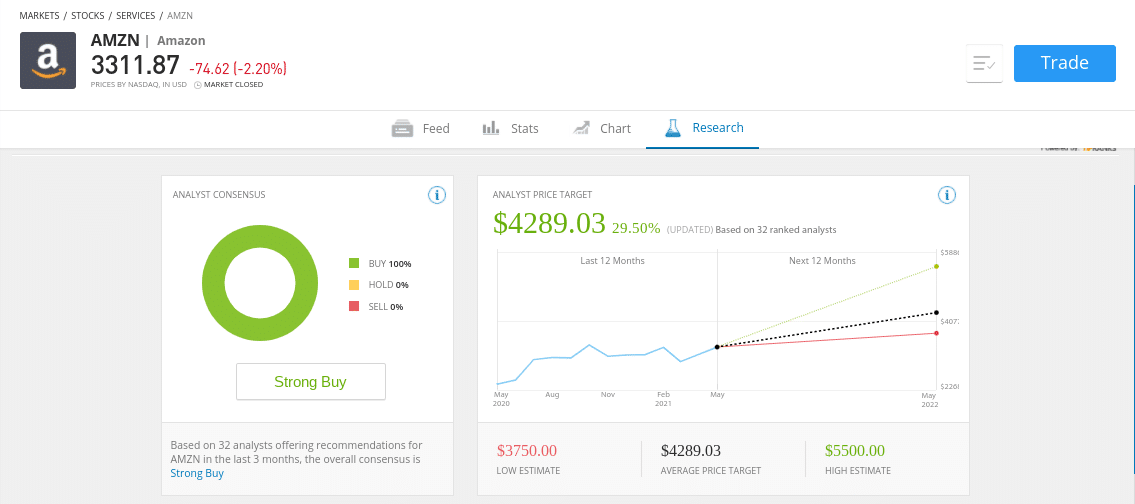

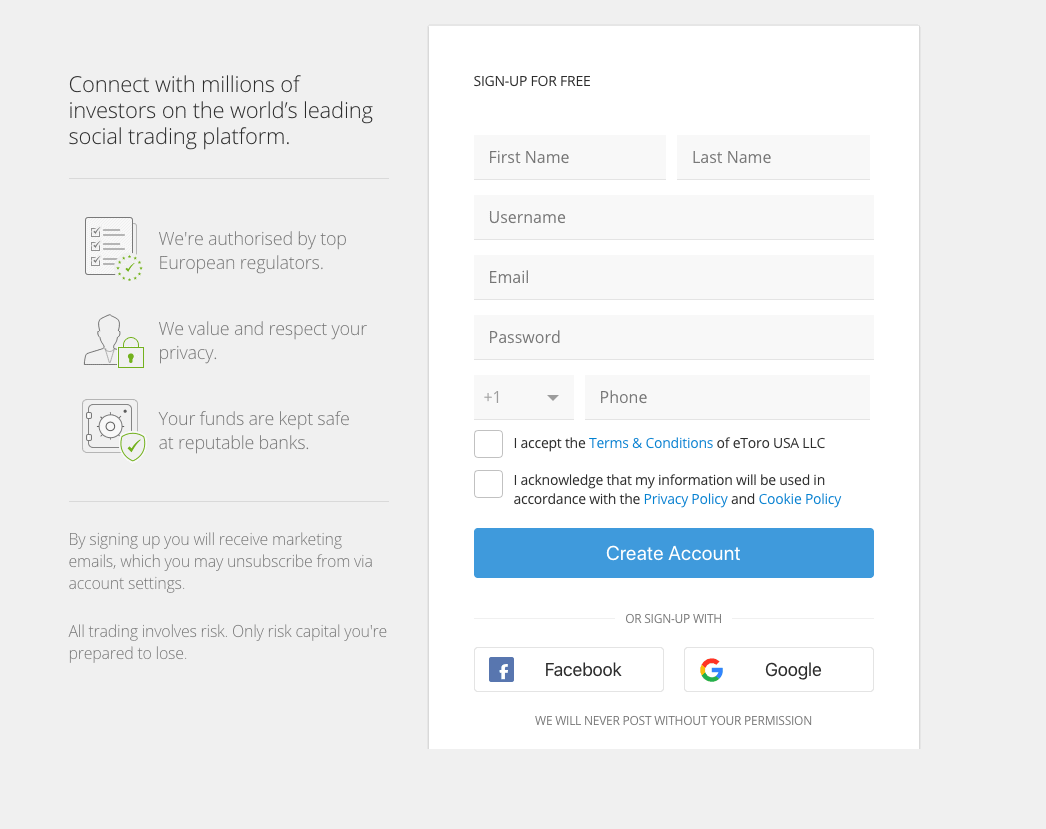

eToro is an excellent user-friendly trading platform that is usually preferred by inexperienced investors who have no knowledge of financial analysis. With this in mind, it will come as no surprise to find that the number of research and analysis tools is somewhat limited. eToro offers you the ability to view real-time price charts for all of eToro’s supported markets, but this will be too easy for an experienced technical trader. Therefore, those with experience in chart analysis will likely use a third-party platform – such as TradingView – for this purpose. On the other hand, eToro offers fairly comprehensive fundamental research on major stocks. For example, you can view key metrics related to market sentiment, with a breakdown of whether analysts believe the stock is a good buy, sell, or hold. You can also view price targets and hedge fund ratings. When you register on the eToro website – you will be assigned a standard account. This will give you access to all the markets, tools and features discussed so far in this eToro review. However, if you are of Islamic faith, eToro may offer you a special account. To open one, you will need to contact eToro and you will need to deposit at least €1,000 to be eligible to trade. In addition, eToro also offers corporate accounts. The minimum deposit for this account type is €10,000. More and more investors are turning to the eToro trading app – available for iOS and Android devices. The app is linked to your main eToro account, meaning you can switch between them as you see fit. More importantly, the eToro app comes with all the same features you'll find on the main website, meaning you can buy, sell, and trade your preferred financial market no matter where you are. The app – like the main website – provides a truly seamless user experience. It was built from the ground up, so it's designed specifically for your operating system, whether it's iOS or Android. You can easily deposit and withdraw funds through the app. Whether you want to find an asset or place an order – the smaller screen won't be a hindrance. Another great feature of eToro, whether it's online or mobile, is the ease with which you can deposit funds into your account. Unlike many brokers active in this space, eToro allows you to deposit funds instantly via debit/credit card or e-wallet. Supported payment types include: The main benefit is the fact that you can deposit and withdraw funds using PayPal, which is something that not many online brokers offer. That's why it's notable that eToro offers this option. All types of payments – except bank transfers – are processed instantly by eToro. This means you can start trading straight away. When it comes to withdrawals, you can get your funds back using the same payment method you used to deposit. The minimum deposit on eToro will depend on your country of residence. We are big fans of the eToro demo account for several reasons. There is no need to deposit any funds or upload any identification to use the demo account. Customer support is offered 24/5 on the eToro platform, mirroring traditional financial markets. You can contact the customer support team in real time via live chat, which is accessible after logging into your account. eToro does not offer phone support, but does accept questions via email. It is also heavily active on social media platforms like Twitter – another option you can use if you need help with your account. Wondering if eToro is safe? It's great to have access to trading, small deposits, Copy Trading tools, and a variety of supported payment types – but the most important metric when choosing an online broker is still security. The eToro platform is heavily regulated. There are three financial authorities that authorize and regulate eToro, namely: For traders based in the US, eToro is also registered with the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Such a strong regulatory position ensures that your capital is always protected. Client funds are held in segregated bank accounts, meaning that eToro cannot use them for its own operational purposes. All traders using eToro must also go through a Know Your Customer (KYC) process, which is why eToro requires you to upload a copy of your official ID. This comprehensive eToro review has covered everything you need to know about the broker – from supported assets and fees to payment types and regulation. If you're planning to join over 20 million traders by opening an eToro account right now – follow the steps below. Visit the eToro website and begin the account opening process. This requires you to enter some personal information – such as your name, residential address, date of birth, national tax number, and contact details.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

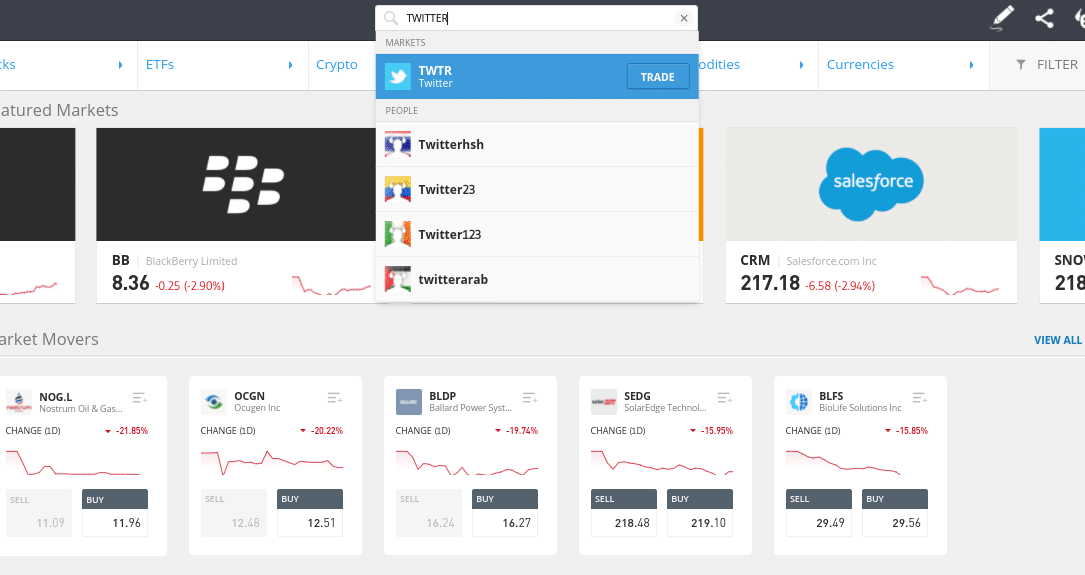

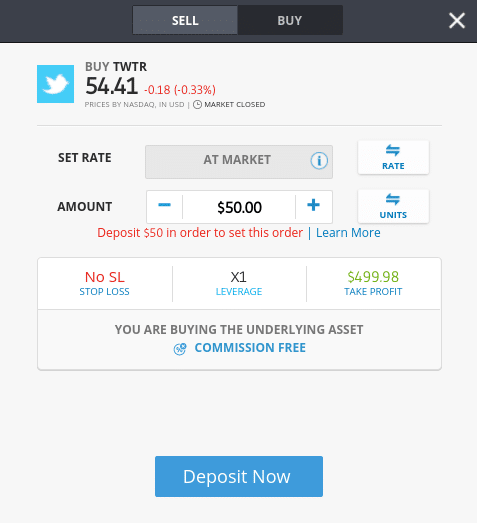

In accordance with KYC regulations, you will need to upload a copy of your government-issued ID. This can be a valid driver's license, passport, and in some cases, a national ID card. You will also need to provide proof of residency. This can be a recent bank statement or utility bill. You can instantly deposit funds into your eToro account using the following payment methods: Bank transfers are also accepted, but this may delay the deposit process by a few days. If you know which asset you want to buy or trade, use the search box at the top of the page. As you can see below, we are searching for "Twitter" stock. Alternatively, you can manually browse which instruments are supported by clicking on the 'Trading Markets' button. You will now need to fill out a simple order form to complete your investment or trade. Simply enter your deposit in the "Amount" field and click "Place Order" to complete your order. Your position will remain open until you decide to cash it out. When you are ready to sell on eToro, go to your portfolio and find the relevant asset. Then, when you click the "Sell" button and confirm the order - the position will be closed. Funds – at the current market value of the assets you sold, will be placed in your eToro cash account. You can use the funds to invest in other assets or for withdrawals. This highly comprehensive eToro review has covered everything this hugely popular brokerage has to offer. Investors of all shapes and sizes are also attracted to the social and copy trading features that eToro offers – as well as the broker's strong regulatory standing. All in all, eToro ticks all the right boxes that we would expect from a trading platform.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Toto oznámenie slúži len na informačné a vzdelávacie účely a nemá byť považované za investičné poradenstvo ani odporúčanie. Minulá výkonnosť nie je zárukou budúcich výsledkov. Copy Trading nepredstavuje investičné poradenstvo. Hodnota vašich investícií môže kolísať. Váš kapitál je ohrozený. Investície do kryptomien sú rizikové a veľmi volatilné. Môžu sa uplatňovať daňové povinnosti. Pochopte riziká tu. Štefan je copywriter a editor, ktorý sa zaujíma o investičné témy. Má niekoľkoročné skúsenosti s písaním a editingom na rôzne témy, ako napríklad technológia, akcie, financie, marketing, medicína, šport a ďalšie. Okrem toho je tiež skúseným trhovým analytikom a aktívnym obchodníkom, pričom investovaniu v oblasti kryptomien, ETF a akcií sa venuje už viac ako 7 rokov. Pre slovenskú verziu webovej stránky Tradingplatforms.com píše články z odvetvia kryptomien, obchodovania, športu, ako aj o iných ad hoc témach. Ďalej má tiež skúsenosti s písaním pre webové portály kryptomagazin.sk, kryptonovinky.sk a startitup.sk. Vo svojom voľnom čase sa rád vzdeláva v oblasti obchodovania na finančných trhoch. Primárne sa zaujíma o dlhodobé investície, ale venuje sa tiež dennému obchodovaniu. Aktuálne má sídlo v Berlíne, kde tiež v roku 2017 získal magisterský titul na Berlínskej univerzite ekonomie a práva, obor štúdia medzinárodný obchodný manažment. Upozornenie: Obsah na tejto stránke by sa nemal považovať za investičné poradenstvo a nie sme oprávnení poskytovať investičné poradenstvo. Nič na tejto webovej stránke nie je potvrdením alebo odporúčaním konkrétnej obchodnej stratégie alebo investičného rozhodnutia. Informácie na tejto webovej stránke majú všeobecnú povahu, takže musíte zvážiť informácie vzhľadom na vaše ciele, finančnú situáciu a potreby. Investovanie je riskantné. Pri investovaní je váš kapitál ohrozený. Táto stránka nie je určená na použitie v jurisdikciách, v ktorých sú opísané obchodovanie alebo investície zakázané, a mali by ju používať iba také osoby a tak, ako sú právne povolené. Vaša investícia nemusí byť kvalifikovaná na ochranu investorov vo vašej krajine alebo v štáte bydliska, preto vykonajte svoju vlastnú povinnú starostlivosť alebo v prípade potreby získajte radu. Táto webová stránka je pre vás bezplatná, ale môžeme dostať províziu od spoločností, ktoré sa nachádzajú na tejto stránke. Pokračovaním v používaní tejto webovej stránky súhlasíte s našimi zmluvnými podmienkami a zásadami ochrany osobných údajov. Registrované číslo spoločnosti: 103525 © tradingplatforms.com Všetky práva vyhradené 2024

What is eToro?

Pros and cons of eToro

Advantages:

Disadvantages:

What can you trade and invest in on eToro?

eToro Stock Overview

Fractional Ownership on eToro

Stock CFDs

Cryptocurrency overview on eToro

Buying cryptocurrency on eToro

eToro wallet

Cryptocurrency trading

Forex Overview on eToro

ETFs on eToro

Commodities on eToro

Indices on eToro

Fees and commissions on eToro

Overview of eToro fees (trading)

Asset

Commission

Actions

1$

Cryptocurrencies

variable

Forex

0%

ETFs

0%

Commodities

0%

Indexes

0%

eToro Fees Overview (Non-Trading)

Fee type

Fee

Opening an account

None

Platform fee

None

Inactivity fee

€10 per month after 12 months

Deposit fee

0.5% on deposits in a currency other than €

Withdrawal fee

€5

Stamp duty

Spreads

Deposit and withdrawal fees

Inactivity fee

Night trading

eToro User Experience

Social Trading with eToro

eToro Copy Trader Review

Ako vybrať vhodného obchodníka na kopírovanie

Najlepší eToro obchodník 2026

Jeppe Kirk Bonde - priemerný ročný výnos 30 % od roku 2013

Wesley Warren Nolte- 650% return over the last 5 years

Victor Pedersen - successful eToro swing trader

eToro Charts and Analysis

Account types on the eToro app

eToro App Review

Payments on eToro

Minimum deposit on eToro

eToro Demo Account

Contacting eToro and Customer Support

Is the eToro app safe?

How to start trading with eToro

Step 1: Create an account

Step 2: Confirm your identity

Step 3: Deposit funds

Step 4: Find the asset

Step 5: Purchase of the asset

Step 6: How to sell on eToro

eToro Review: Conclusion

eToro – the best trading platform

Frequently asked questions

What is eToro?

How does eToro work?

How does eToro make money?

Is eToro available in the US?

What cryptocurrencies does eToro support?

How can I make money on eToro?

How much does eToro cost?

Is eToro safe?

eToro je multi-asset platforma, ktorá ponúka investovanie do akcií a kryptoaktív, ako aj obchodovanie s CFD. CFD sú zložité nástroje a sú spojené s vysokým rizikom rýchlej straty peňazí v dôsledku pákového efektu. 61 % účtov retailových investorov prichádza o peniaze pri obchodovaní s CFD u tohto poskytovateľa. Mali by ste zvážiť, či rozumiete tomu, ako CFD fungujú a či si môžete dovoliť riskovať stratu svojich peňazí.

Stefan Nagy

Redaktor

Stefan Nagy

Redaktor