Ako kúpiť akcie Gamestop bez provízie v roku 2026

Even if you’ve never traded any stocks before, there’s a good chance you’ve come across GameStop stock recently.

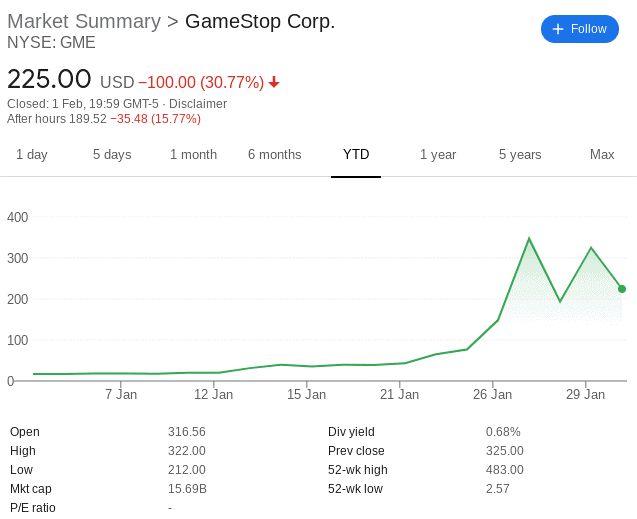

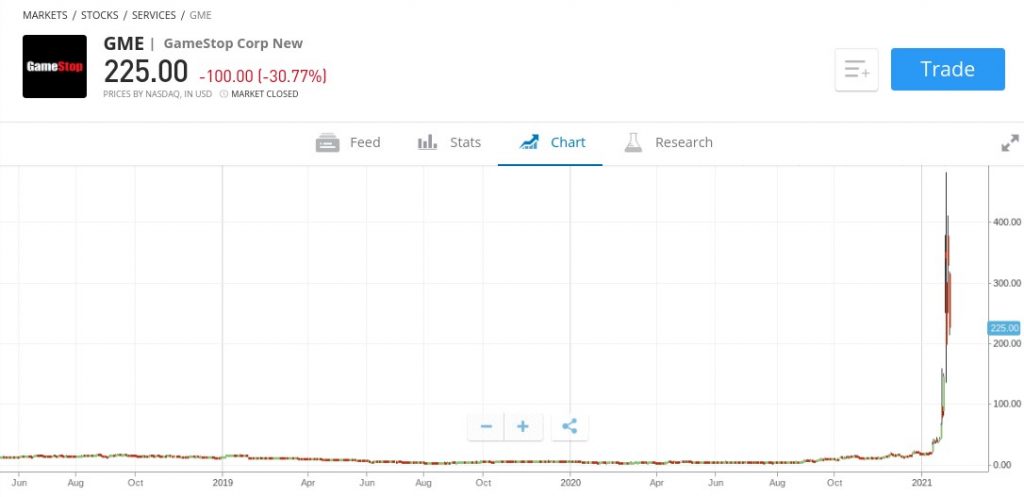

This US video game retailer saw its stock value rise from $17 to a high of $483 in less than a month.

It all started with a group of Reddit users who agreed to buy GameStop shares, which subsequently led to huge gains of over 2,700% in January 2021.

In this guide , we’ll show you where and how to buy GameStop shares in Slovakia. We’ll also provide you with a full breakdown of the risks to consider before investing in these shares, and which brokers in Slovakia make it the easiest and most efficient way to buy them.

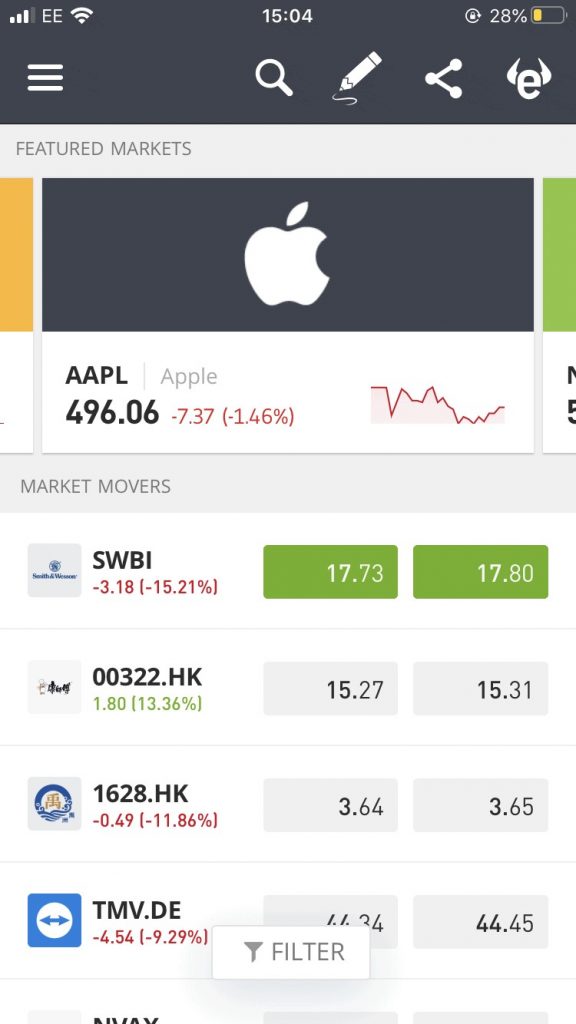

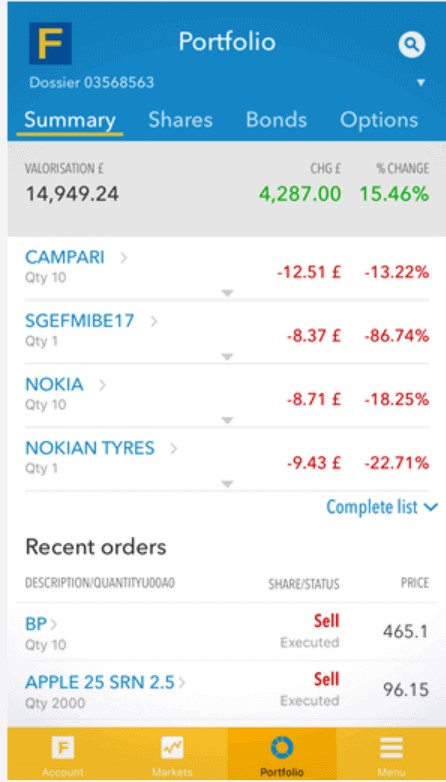

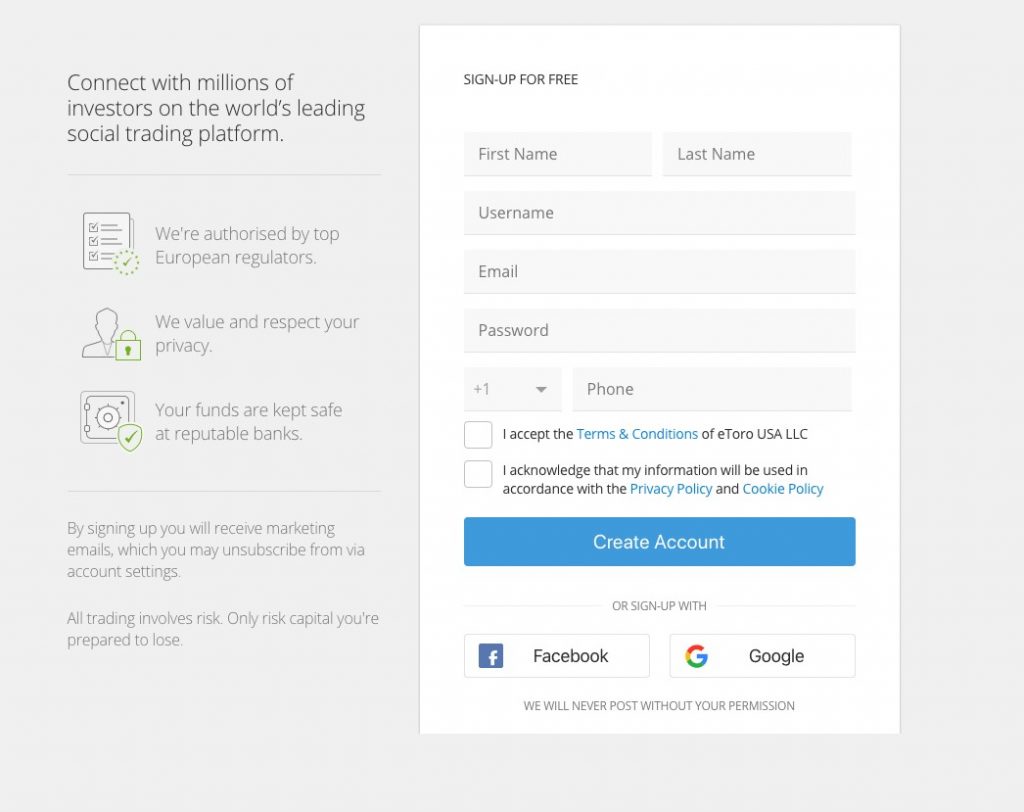

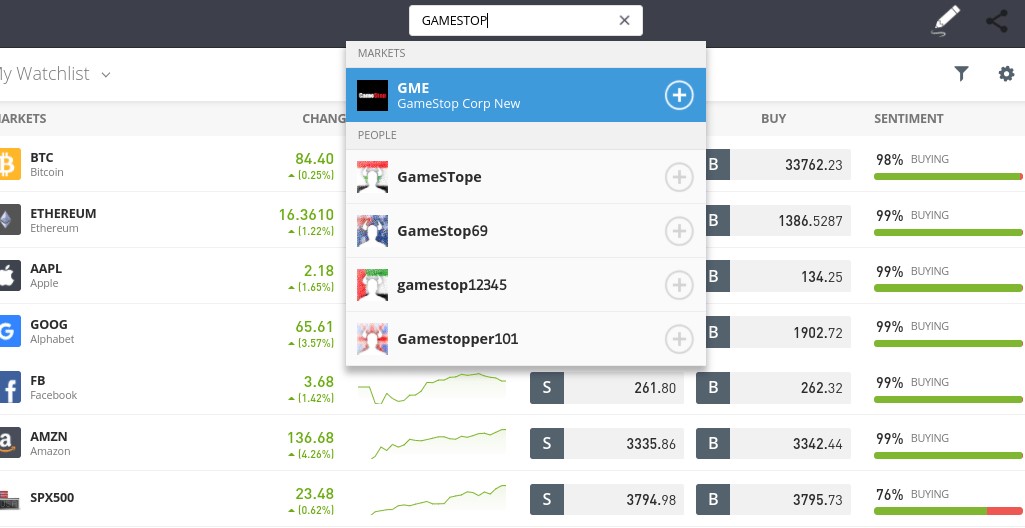

To purchase shares of this company, you need to find a stockbroker who gives you access to US stocks, but ideally, this broker should not charge high commissions. However, many local brokers and stock trading platforms charge both a commission and a foreign exchange surcharge when purchasing international assets. With this in mind, below we present a small selection of trading platforms available in Slovakia that allow you to buy GameStop shares with low or no fees. This includes the NYSE – meaning buying GameStop shares in Slovakia is no problem . Other available markets include NASDAQ (USA) as well as exchanges in Germany, France, Hong Kong and Saudi Arabia. You’ll also like that eToro allows you to buy fractional shares . This is especially important for high-risk stocks like GameStop. eToro offers not only ETFs, cryptocurrencies, forex and CFD markets – but also tools for automated trading . For example, you can choose a trader on eToro that you like (based on metrics such as monthly return on investment and risk assessment) and then copy their portfolio and movements. You can deposit funds using a Slovak debit/credit card (Visa, MasterCard, Maestro), bank transfer or e-wallets such as Paypal and Skrill. A small fee of 0.5% is charged on all deposits in euros. The process of opening an account, making a deposit and buying GameStop shares can be completed easily via the eToro website or mobile app . It is available on both iOS and Android devices. When it comes to security, eToro is not only authorised and regulated by the FCA, but your funds are also covered by the FSCS financial compensation scheme. Read our comprehensive eToro review to learn more about what this top-rated broker has to offer.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

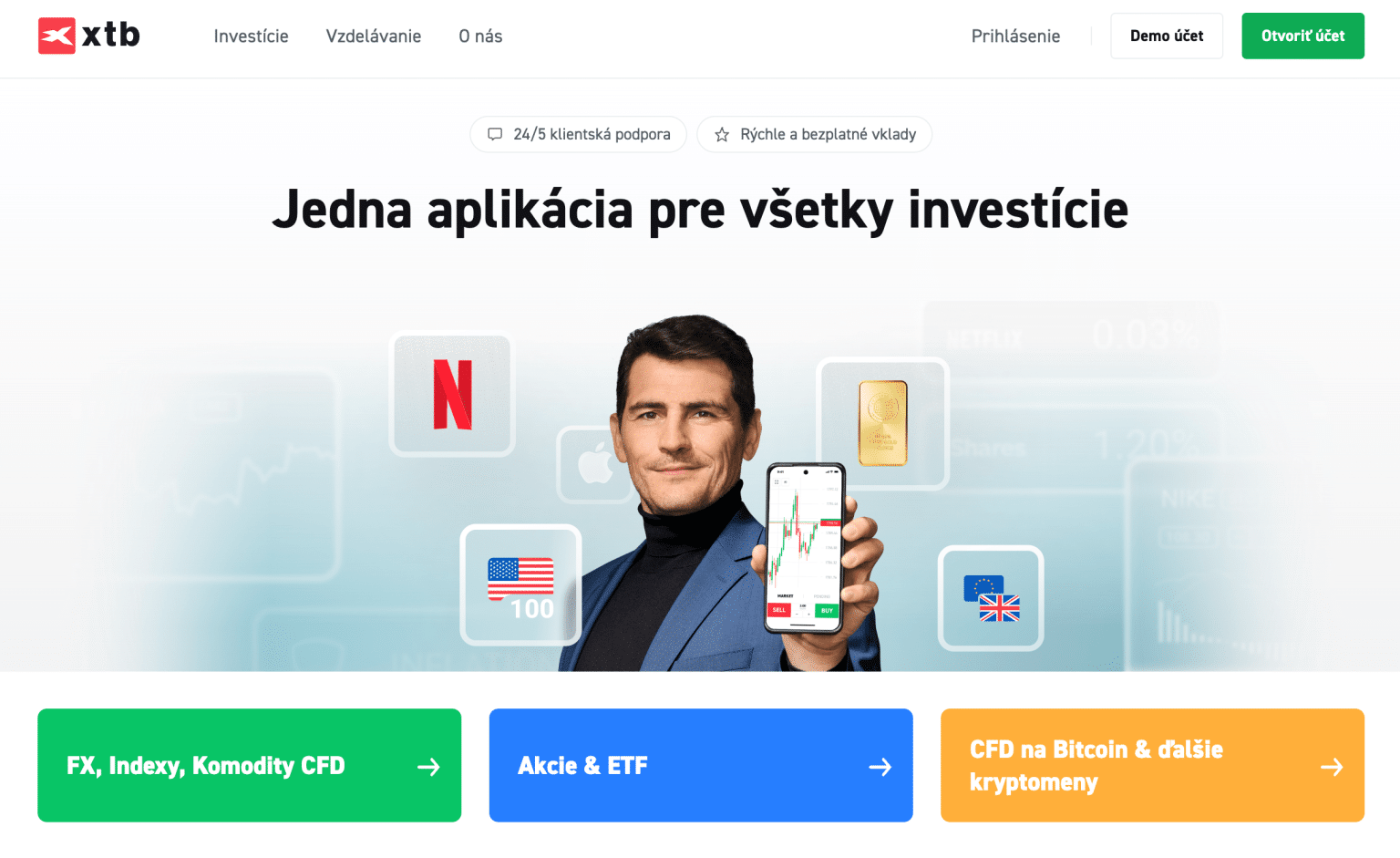

XTB is a global trading broker that supports thousands of markets. This includes over 3,000 stocks from 16 exchanges. Through XTB, you can invest in popular US stocks, in addition to Gamestop, you can trade stocks such as Apple, Netflix, Palantir, Amazon and Alphabet. You can also choose from some of the UK stocks from large-cap companies including HSBC and AstraZeneca. The XTB platform also supports over a dozen European exchanges including Portugal, France, Sweden, Germany and Norway. The only downside is that XTB does not support Asian markets such as Singapore and Japan. However, on the XTB platform you can invest in shares from as little as €10. In addition, you do not pay any commission for trading shares on this platform. So whether you want to invest in Swiss ABB shares or British Aston Martin shares, you only pay the spread. Supported CFD markets include stocks, ETFs, indices, forex and commodities. XTB is also one of the best day trading platforms for beginners. In addition, the XTB platform has a number of educational guides. XTB can be considered a safe online broker as it is regulated by the FCA (UK), CySEC (Cyprus) and other licensing authorities.

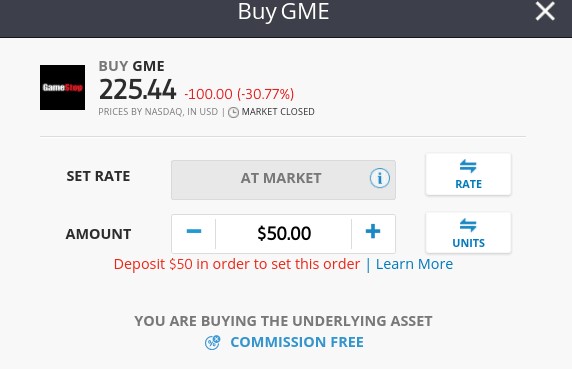

You risk losing your capital. This broker is also extremely cost-effective . It allows you to buy GameStop shares with the click of a button. All you have to do is create an account, upload your ID, and deposit funds. In terms of pricing, Fineco Bank charges a commission of just $4 when you buy US-listed stocks. However, note that all investments held at Fineco Bank are subject to an annual maintenance fee of 0.25%. In terms of account minimums, this highly rated broker requires a minimum deposit of just €100 . There are no fees for deposits or withdrawals, although the only supported payment method is bank transfer . So if you were hoping to use a debit/credit card or e-wallet, it would be best to opt for eToro. GameStop stock was struggling before the infamous WallStreetBets saga. So you have to ask yourself whether you are investing in this company because you think it represents a good long-term investment, or are you simply jumping on the Reddit bandwagon. In any case, we recommend that you read the following sections to evaluate whether or not GameStop is a good investment for you and your financial goals. GameStop Corp. (GME) first went public in 2012 — opting for the NYSE. Back then, a single share would have cost you around $10 . It's been a roller coaster ride since then, with GameStop stock going through several highs and lows. With that in mind, it's probably best to focus on recent stock price events that began in the first week of January 2021. When the market bells first rank for 2021, GameStop shares were trading at just over $15 . By the second week of the month, the stock had already hit highs of $35 . Fast forward to the last week of January, and the same shares had peaked at $426.73 . That's an increase of more than 2,700% in just one month of trading. Where the stock will go next remains to be seen. For example, GameStop shares fell 30% in the 24 hours prior to the writing of this guide. However, just a few days earlier, the stock had closed the day up more than 67%. Gamestop stock is arguably one of the most volatile stocks right now. GameStop is what the markets refer to as a "turnaround" company. Simply put, this means that the company has been going through tough times in recent years , and new management has been brought in to turn GameStop's fortunes around. With rapidly declining revenues and ever-increasing debt, it should come as no surprise that GameStop is not currently paying a dividend . Looking at the financial results, GameStop reported EPS (Earnings Per Share) of negative $5.38 and $6.59 in both 2019 and 2020. This once again confirms the video game retailer's recent troubles. From a P/E (Price to Earnings) perspective, this is an interesting read. At the time of writing, market estimates put the 2021 P/E ratio at -108 . A negative P/E ratio means the company is losing money . The estimates for 2023 are even more alarming, with a projected P/E ratio of -3750. Given the high level of volatility, you need to proceed with caution if you're considering buying GameStop shares. The bottom line is that the upside and downside potential is huge . Some of the main considerations you need to make regarding GameStop stock are outlined below: The fluctuations are usually associated with micro-cap stocks, which have a small total capitalization. After all, it is much easier to manipulate small stocks because there are such low levels of liquidity in the market. For those who don't know, a pump and dump scheme refers to the process of artificially influencing the value of a stock . It is achieved when a group of individuals come together, all agreeing to buy a specific stock at a specific time. In this scenario, it was GameStop stock, and the individuals involved were from a small investor group on Reddit known as WallStreetBets . The same thing happened with AMC Entertainment stock, causing some brokerages, such as Robinhood, to suspend retail trading in the stock. The key point is that GameStop's stock did not rise more than 2,700% due to strong earnings or growth of the company. Instead, the stock price was driven by a pump and dump scheme. The crucial point is that in such a practice, there is always one key denominator - the stock price eventually stabilizes - often below where it originally started. On the one hand, it's true that those behind the WallStreetBets pump were able to force a short-squeeze on hedge funds that shorted GameStop. For those who don't know, going short means you're trading on the assumption that the value of a stock or other asset will fall. In fact, this was one of the main motivations for the Reddit pump, as forum members do not consider short selling processes to be ethical. After all, short selling in the traditional sense – as opposed to placing a sell order via CFDs – can cause a stock price to fall. The only way to do this, instead of closing the position, is to buy the stock that is being shorted. This results in even more upward pressure. As a result, when the hedge funds were shorting, the price of GameStop stock increased at an even faster pace. It is important to note that there is a lot of capital behind the hedge funds. It's hard for the WallStreetBets traders to exert enough pressure on their own to oppose the hedge funds. In other words, there's a good chance that the hedge funds will successfully bring GameStop's stock price back to reality by continuing to push it down. It's worth noting that GameStop stock was in dire straits even before the Reddit community took action. It was hit hard by the coronavirus pandemic, for example. Just look at the decline in GameStop stock over the past five years. For example, in April 2016, GameStop shares were worth more than $32 . At the start of 2020 , the same shares were worth just $5 . That's a drop of more than 85%. The key issue for investors is that GameStop is calling itself another blockbuster. That means it's involved in an industry that was completely revolutionized and tied to the rise of the internet. This is evident in the financials, not least because GameStop is facing an ever-increasing debt load that was likely unpayable before the pump. Fortunately for the company, the rapid rise in its stock price has allowed GameStop management to pay off $600 million in debt through an equity conversion. But that will only help the company delay its downfall. With current price levels between $100-$400, it's hard to shake the belief that GameStop is severely overvalued . As we mentioned above, its upward price surge of over 2,700% in January is not because the company represents a fantastic long-term investment. Rather, it's simply the result of the WallStreetBets pump. Even if you think the new management team at GameStop can turn things around, you'll probably want to wait until the stock returns to pre-pump levels. Remember, not long ago you could buy GameStop shares for $17 . If you have read the above sections on the basics of GameStop and want to proceed with buying shares, the next step is to open an account with a broker that also provides services in Slovakia. First, visit the eToro website and click on the “Create Account” button. You will be asked to enter personal and contact information – including your social security number. You will also be asked to verify your identity in accordance with KYC - Know your customer rules. For this purpose, you will need to upload the following documents: Note : You can still buy GameStop shares right now without uploading the above documents . However, withdrawals will not be allowed and you will only be able to deposit up to €2,250. You will be prompted to deposit funds. In Slovakia, you can choose from the following payment types on eToro: Once you have created an eToro account and made a deposit, you can proceed to purchase GameStop shares. To start trading, type "GameStop" in the search box and then click the "Trade" button. Next, enter your deposit in dollars. In the past, the minimum deposit required for one share was $50, currently the trade amount is arbitrary. If the NYSE is open, click the "Open Trade" button to immediately complete your purchase of GameStop shares. If the markets are closed, click "Place Order." eToro will then complete your investment when the NYSE reopens. GameStop's stock price rose astronomically in January 2021 thanks to a WallStreetBets pump. Whether this upward trend will continue or not remains to be seen. That's why you should be very careful with this super-volatile stock . If you want to buy GameStop shares in Slovakia online, the easiest and most convenient way to do it is through eToro. This online broker allows you to invest any amount. So you don't have to risk a lot of money. Get started simply by clicking the link below!

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Štefan je copywriter a editor, ktorý sa zaujíma o investičné témy. Má niekoľkoročné skúsenosti s písaním a editingom na rôzne témy, ako napríklad technológia, akcie, financie, marketing, medicína, šport a ďalšie. Okrem toho je tiež skúseným trhovým analytikom a aktívnym obchodníkom, pričom investovaniu v oblasti kryptomien, ETF a akcií sa venuje už viac ako 7 rokov. Pre slovenskú verziu webovej stránky Tradingplatforms.com píše články z odvetvia kryptomien, obchodovania, športu, ako aj o iných ad hoc témach. Ďalej má tiež skúsenosti s písaním pre webové portály kryptomagazin.sk, kryptonovinky.sk a startitup.sk. Vo svojom voľnom čase sa rád vzdeláva v oblasti obchodovania na finančných trhoch. Primárne sa zaujíma o dlhodobé investície, ale venuje sa tiež dennému obchodovaniu. Aktuálne má sídlo v Berlíne, kde tiež v roku 2017 získal magisterský titul na Berlínskej univerzite ekonomie a práva, obor štúdia medzinárodný obchodný manažment. Investície do kryptomien sú rizikové a nemusia byť vhodné pre retailových investorov; môžete prísť o celú svoju investíciu. Tu si preštudujte riziká. Investície do kryptomien sú rizikové a nemusia byť vhodné pre retailových investorov; môžete prísť o celú svoju investíciu. Tu si preštudujte riziká. Upozornenie: Obsah na tejto stránke by sa nemal považovať za investičné poradenstvo a nie sme oprávnení poskytovať investičné poradenstvo. Nič na tejto webovej stránke nie je potvrdením alebo odporúčaním konkrétnej obchodnej stratégie alebo investičného rozhodnutia. Informácie na tejto webovej stránke majú všeobecnú povahu, takže musíte zvážiť informácie vzhľadom na vaše ciele, finančnú situáciu a potreby. Investovanie je riskantné. Pri investovaní je váš kapitál ohrozený. Táto stránka nie je určená na použitie v jurisdikciách, v ktorých sú opísané obchodovanie alebo investície zakázané, a mali by ju používať iba také osoby a tak, ako sú právne povolené. Vaša investícia nemusí byť kvalifikovaná na ochranu investorov vo vašej krajine alebo v štáte bydliska, preto vykonajte svoju vlastnú povinnú starostlivosť alebo v prípade potreby získajte radu. Táto webová stránka je pre vás bezplatná, ale môžeme dostať províziu od spoločností, ktoré sa nachádzajú na tejto stránke. Pokračovaním v používaní tejto webovej stránky súhlasíte s našimi zmluvnými podmienkami a zásadami ochrany osobných údajov. Registrované číslo spoločnosti: 103525 © tradingplatforms.com Všetky práva vyhradené 2024

Step 1: Choose a broker that allows you to buy GameStop shares

1. eToro – A platform where you can buy ETFs without commission

Our rating:

What we like:

What we don’t like:

2. XTB – a broker offering traditional leveraged stocks

Our rating:

What we like:

What we don’t like:

3. Fineco Bank – Trading in thousands of global stocks

What we like:

What we don’t like:

Step 2: Is GameStop stock a good investment?

GameStop stock price

Does GameStop pay dividends?

GameStop EPS and P/E ratios

So should I buy GameStop stock?

GameStop's stock price surge is actually just a Pump and Dump

WallStreetBets competes with multi-billion dollar hedge funds

Risks associated with investing in GameStop stock

Should you sell or buy GameStop stock?

Step 3: How to buy GameStop shares in Slovakia

Open a brokerage account and deposit funds

Step 4: Invest in GameStop

How to Buy GameStop Stock – Conclusion and Recap

Frequently asked questions

Can I buy GameStop shares in Slovakia?

Does GameStop pay dividends?

Where and how is the best way to buy GameStop shares in Slovakia?

What caused the sharp increase in the price of GameStop shares?

Stefan Nagy

Redaktor

Stefan Nagy

Redaktor

eToro : Najlepšia obchodná platforma - provízia pri obchodovaní s akciami a ETF