Ako kúpiť akcie Tesla s 0 % províziou v roku 2026

Tesla management offered a cautious outlook for 2024. The company expects a significant decline in volume compared to 2023, which is well below its target compound annual growth rate (CAGR) of 50%. Nevertheless, Tesla is an excellent investment option because it is constantly inventing new technologies and a lot of innovation. For this reason, many investors have tried to buy Tesla shares. If you want to do the same but are not sure where and how to buy Tesla shares with 0% commission , we have a detailed guide for you.

How to buy Tesla shares – 4 quick steps:

If you already have some experience with stock trading and investing, and you just want to know where to get them — we recommend using the eToro broker , which is one of the best, if not THE BEST in the world. If you are wondering how to buy Tesla shares on eToro, you should do this:

- Create an account . The first step is to create an account on the eToro platform, which you can do via your email address, or simply log in via Facebook or Google.

- Verify your ID . After you create your account, you must verify it by providing official government-issued documents, such as a government-issued ID card, driver’s license, or passport.

- Deposit funds . To start trading, you must first make an initial deposit, which you will use to purchase Tesla shares. eToro allows you to start with a minimum deposit of €50.

- Buy shares. Now you are ready to search for Tesla shares on the eToro platform and start buying them.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Step 1 – choose a broker

When it comes to buying Tesla shares, your priority should be choosing the right broker . There are many available around the world, but no two are the same. This makes it difficult to know which ones are good and which ones to avoid. However, after thorough research, we have managed to narrow down the choices to two platforms that we can recommend as the best options for buying TSLA shares.

1. eToro — the best option to buy Tesla shares

Of course, this is no coincidence, as eToro provides the best services for both beginners and more experienced traders . If you are a beginner in investing and are not yet proficient in using expert tools, eToro is the ideal platform for you. It offers access to thousands of global markets and allows you to trade with leverage. You can also trade CFDs , stocks (such as Apple), cryptocurrencies , ETFs and other assets.

Investing in Tesla (TSLA) stock is now more accessible to more investors thanks to the option to buy fractional shares . This option is convenient for investors with a smaller budget who are interested in buying shares of large companies without having to invest in the entire stock.

One of the key factors that sets eToro apart from other trading platforms is their thorough regulation . eToro is overseen by some of the most respected regulatory authorities in the world, including CySEC, FCA, ASIC and FINRA, ensuring a high level of trust and security for traders.

In addition, eToro has another very important feature on its platform for every beginner, and that is Social trading . Social trading means trading using the rest of the trading community to help you, and its most popular feature is copying trades or the so-called copy trading .

Advantages:

Disadvantages:

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

2. XTB – Trade Tesla CFDs with leverage for 0% commission

XTB offers a unique way to gain exposure to Tesla shares in Slovakia. You will not invest directly in Tesla, but instead trade the price of its shares through a CFD (Contract for Difference). For example, if you invest €250 and Tesla shares rise to €270, you will receive a profit of €20.

The XTB platform allows clients from Slovakia to trade equity CFDs with leverage up to 1:5. This means that you can multiply your equity investments in Tesla shares by 5 times. So if you have €200 in your XTB account, you can make trades up to €1,000.

You can invest in Tesla shares without paying any commissions or international fees. The same rules apply to over 2,100 other stocks. XTB supports stock markets in the US, UK and Europe. In addition, XTB is also one of the best platforms for day trading commodities including gold, oil, silver and natural gas. The XTB platform also supports forex and indices.

As for the minimum deposit, you can start trading with any amount. Although there is no minimum deposit for Tesla shares, the minimum investment is €50. XTB is also a safe online broker as it is authorized and regulated by the FCA.

Benefits:

Disadvantages:

Step 2 – Research Tesla stock

It is important to remember that just because a recommendation or information about Tesla's stock price is rising does not automatically mean that you should buy it. Before investing, it is essential to thoroughly research the stocks you are interested in. Never invest blindly without knowing what you are investing in. In the next part of the article, we will bring you information about Tesla.

What is Tesla?

Tesla is an American electric vehicle and clean energy company . It is headquartered in Palo Alto, California, although there are plans to move its headquarters to Austin, Texas. The company designs and manufactures electric vehicles, solar panels and solar roofs, electric batteries, including those you can use at home, to massive grid-connected ones, and the like.

The company made headlines several times in 2021, first for accepting Bitcoin payments , and then for stopping accepting them on the grounds that Bitcoin is not environmentally friendly.

Tesla stock price history

Tesla forecast is important for knowing when to invest, when to buy and when to sell. However, if you want to make a Tesla stock forecast for the year 2026, you also need to know its past. Historical price performance, market cap and EPS are crucial for understanding price behavior and making a correct Tesla forecast.

Tesla's stock price has come a long way in a very short time. Over the past decade, starting in 2010, the stock has been rising, but extremely slowly. It took 10 years to reach $70, having originally started at $3 in 2010. In January 2021, it reached an ATH of $225, but was rejected by resistance levels as low as $300.

Then, in April, it attempted another sharp increase, but failed due to another sharp decline in price. However, since May 14, 2021, the price of TSLA has been steadily increasing, with a particularly sharp increase in October. Tesla reached its all-time price maximum on November 4, 2021, when its price rose to $407 per share .

Tesla Basics

Fundamental analysis of a company is very important when making predictions for Tesla stock. According to reports from the summer of 2021, Tesla's fundamentals have improved significantly over the past year and a half . The second quarter of this year gave investors plenty to be happy about. The company posted a record quarterly net profit of $1.1 billion, which significantly beat estimates. It was also up 813% compared to the second quarter of 2020.

The company is progressing rapidly and is striving to achieve its goal of increasing production by 50% every year .

In other words, Tesla is thriving as interest in electric cars and green energy production continues to explode, and it is now one of the most successful companies in the world, being the largest and most powerful automaker on a global scale.

Tesla Dividends

Tesla has never declared a dividend on its common stock, according to its own website. It intends to retain all future earnings to fund future growth , and therefore does not expect to pay cash dividends to its shareholders in the foreseeable future.

Tesla ESG Analysis

ESG is another thing that many investors – and especially institutional investors – always look at when evaluating stocks and trying to decide whether to invest in them or not. It can certainly help to know the ESG ratio and know what to expect when predicting Tesla. ESG stands for Environmental, Social, Governance: Tesla’s environmental risk score is 3, its social risk score is 17, while its governance risk score is 10.

This suggests that Tesla still has social and governance issues that have been present for some time and remain major obstacles for Tesla. The company is far from being an ESG leader, but it does not seem to be significantly affected.

Tesla stock forecast

Stock price predictions are also among the most important things that every analyst must look at. When it comes to Tesla stock forecast for 2026 , analysts have set a median target of $776, with a high estimate of $1,591 and a low estimate of $67. This is a significantly large difference between the three price estimates, indicating that Tesla's price is not stable and that analysts believe that anything can happen .

Elon Musk Biography

He also briefly surpassed Jeff Bezos as the world's richest man in January of this year , although Bezos has since reclaimed the title.

Musk dreamed of various inventions throughout his life, sometimes getting so lost in his thoughts that his parents decided to check his hearing one day. He became interested in computers at the age of 10 and sold his first software at the age of 12. It was a game called Blastar.

Since then, the brilliant inventor has been coming up with all sorts of ideas and solutions, and currently leads several companies including SpaceX, Tesla, and The Boring Company. He is also very concerned about the future, especially when it comes to the quality of human life, which is why he is working on clean energy projects .

Thanks to the reputation of Tesla Inc CEO Elon Musk, Tesla shares have risen higher than ever in the past few days, as Musk is a very charismatic and popular person.

Are Tesla shares a good buy?

Looking at price action, Tesla stock certainly looks like a great buy. Right now, the price is very close to its peak, so investors looking for opportunities will likely wait for Tesla stock to decline after a rejection from the nearest resistance. However, day traders can still profit from minor swings due to volatility.

As always in investment advice, investing and trading in stocks or any other asset is subject to significant risk, so do your research and only use money you can afford to lose, and don't give in to emotion whenever you trade.

Step 3: Create an eToro account and invest - how to buy Tesla shares on eToro

Now that you know everything you need to know about Tesla and its shares, let’s take a look at how to buy Tesla shares on eToro . The process is quite simple and only requires 4 short steps to complete. If you’re ready to get started, here’s what you need to do:

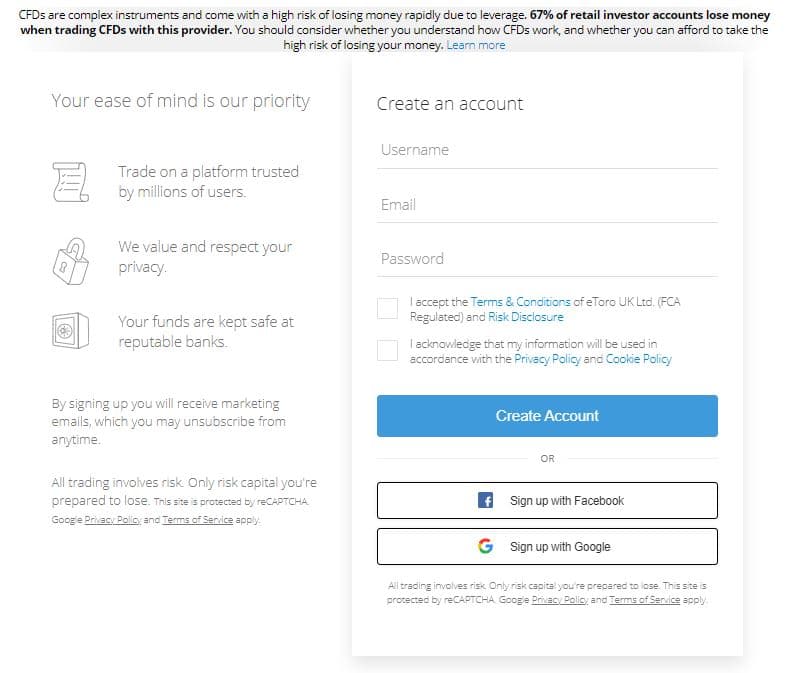

1. create an account

The first thing you need to do is create an account. This is a simple step and if you have ever created a brokerage account anywhere, you will know how to do it. eToro doesn’t force you to create a new account from scratch as it allows you to log in using Google and Facebook accounts.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

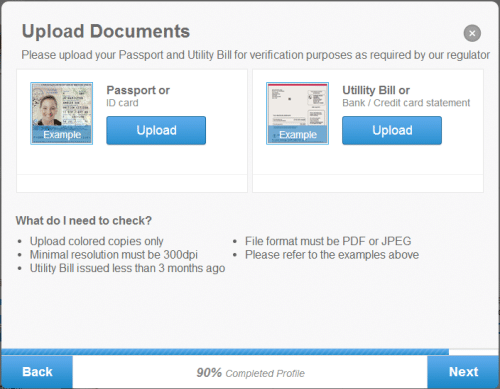

2. verify your ID

The next step will be to verify your identity. As a regulated company, eToro must comply with the laws of each country in which it operates. This means carrying out KYC procedures and verifying the identity of users before allowing them to trade. This is done for the protection of users, as it confirms that the person whose name is being used is actually the person behind the trading account.

It also helps authorities track down anyone who might be involved in shady activities. To complete the process, simply upload a photo of your ID, passport, or driver's license, as well as a bank statement that confirms your address.

3. deposit funds

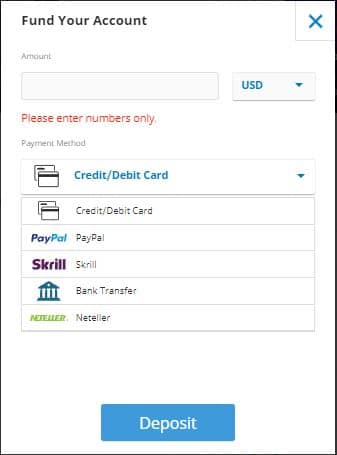

The third step comes after your account is verified and involves depositing funds. eToro offers a very decent range of payment methods, including credit and debit cards, PayPal, Skrill, bank transfers and more. Click on Deposit Funds in the bottom left corner of the dashboard and you will see a new deposit window open.

Select the amount you want to deposit (minimum €50), the payment method and enter your payment details. Depending on the method chosen, the delivery of the funds can take different times, even up to several business days in the case of bank transfers, which are the cheapest but also the slowest.

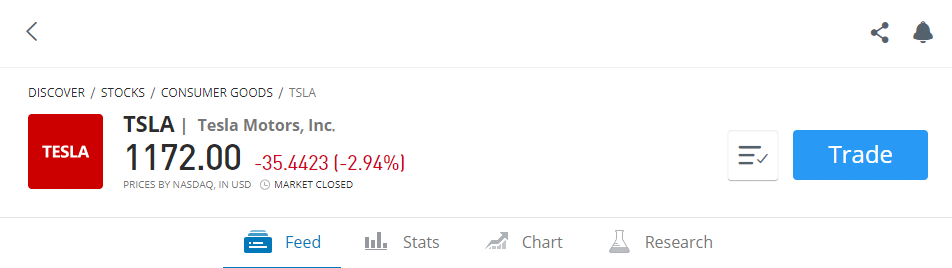

4. buy Tesla shares

Now all that remains is to go to the top of the main panel and use the search function to find the chosen stock and click on the "Trade" button. You will see a new window open again, but this time it will not be a window for deposits, but for trading. Fill in the necessary details and make your first trade.

67% of retail investor accounts lose money when trading CFDs with this provider.

Should you sell or buy Tesla shares?

Should you buy Tesla shares, or if you already own some, should you sell them? As always, the decision is up to each investor/trader. But based on the stock's historical performance, TSLA is a quality stock that has been growing at a faster or slower pace since the company went public.

There have been several Tesla price drops over the years, but they have only occurred during periods when the entire market has suffered a similar fate.

Conclusion

Tesla reported its fourth-quarter 2023 financial results on Wednesday, Jan. 24. Shares fell more than 12% on Thursday amid mixed results. In addition to revenue and profitability falling short of forecasts, the company warned of a slowdown in growth in 2024.

If you want to buy Tesla shares, the best place to do so is eToro – the world's most popular brokerage service.

eToro - the best broker and trading platform for buying Tesla shares

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Frequently asked questions

What is Tesla?

Who owns Tesla?

Where is Tesla based?

How much are Tesla shares worth?

Are Tesla shares a good buy?

How to buy Tesla shares?