Ako kúpiť akcie Amazonu v roku 2026

In this article, we will look at how to buy Amazon stock using a highly rated, regulated online trading platform.

Despite this year’s bear market, where most stocks have seen their prices fall, Amazon has shown resilience. Amazon shares are up 70.48% to $143.20, while the S&P 500 continues its upward trajectory. Analysts have pointed to Amazon’s latest deal with Comcast, which appears to support the current price performance.

How to buy Amazon shares – a quick guide

- Setting up a trading account on eToro – eToro is a copy trading platform that offers stock trading and is fully regulated by the UK FCA, ASIC and CySEC. Simply go to their website and create a new brokerage account using your personal details

- Upload ID – In line with strict KYC regulations, you will need to verify your identity and address by uploading a copy of your passport or a current bank statement or utility bill.

- Depositing Funds – Funding your account is quick and easy as eToro supports a wide range of payment methods including credit/debit cards, PayPal, Neteller, Skrill, bank transfers and more. Simply log in, click Deposit Funds , enter the amount and fiat currency, then choose the deposit method that suits you.

- Buy Amazon Stock – Type AMZN into the search bar. Clicking on Amazon will bring up a trading window where you can click the “Trade” button. Once you have entered your total stake, click Open Trade to buy Amazon stock.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

How to Buy Amazon Stock on eToro – Step by Step

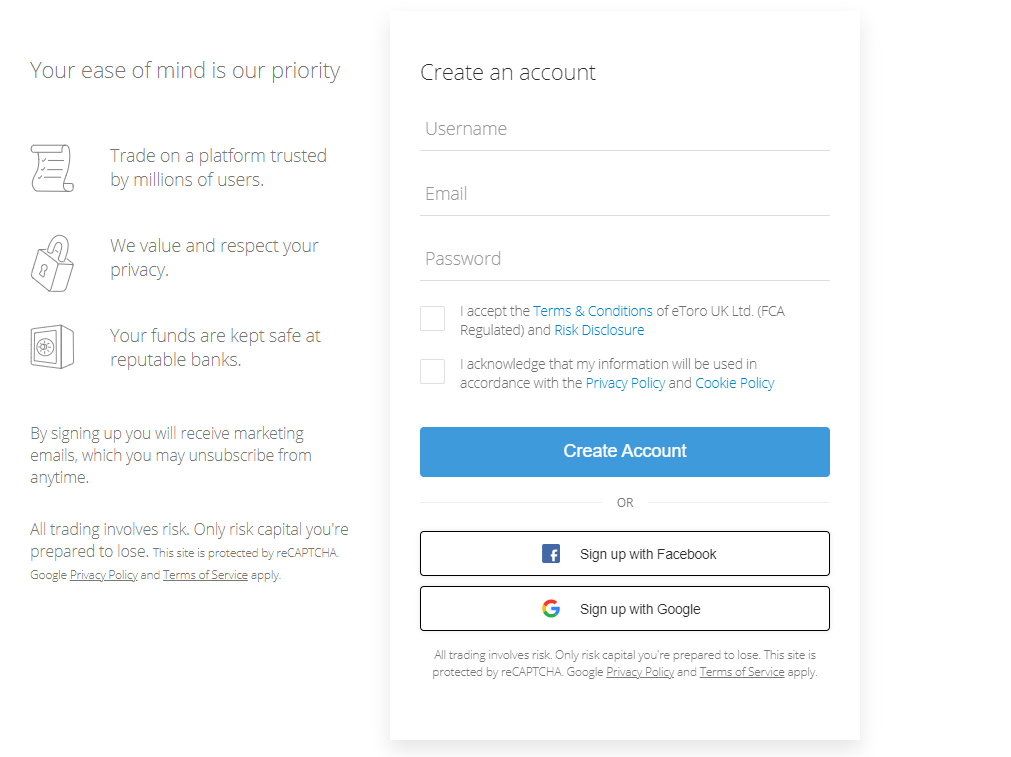

Step 1: Create a live trading account

To set up a live trading account on eToro, you will need to go to the eToro.com website and click on the “Start investing” link. You will then be presented with an online form where you will need to enter all of your personal information in order to set up a new trading account.

You need to fill in all the relevant details as requested by eToro, or you can log in using your Google or Facebook accounts. You need to accept the terms and conditions and privacy policy before submitting the information you have provided. Then simply click on the “Create account” button.

Step 2: Verification

In line with KYC processes, eToro requires all new traders to provide proof of identity , such as a valid passport photo, and proof of residence in the form of a valid bank statement from the last six months.

As part of KYC regulations, new users must also answer a series of questions to help the platform better determine what type of service is a perfect fit for each trader’s profile and experience level.

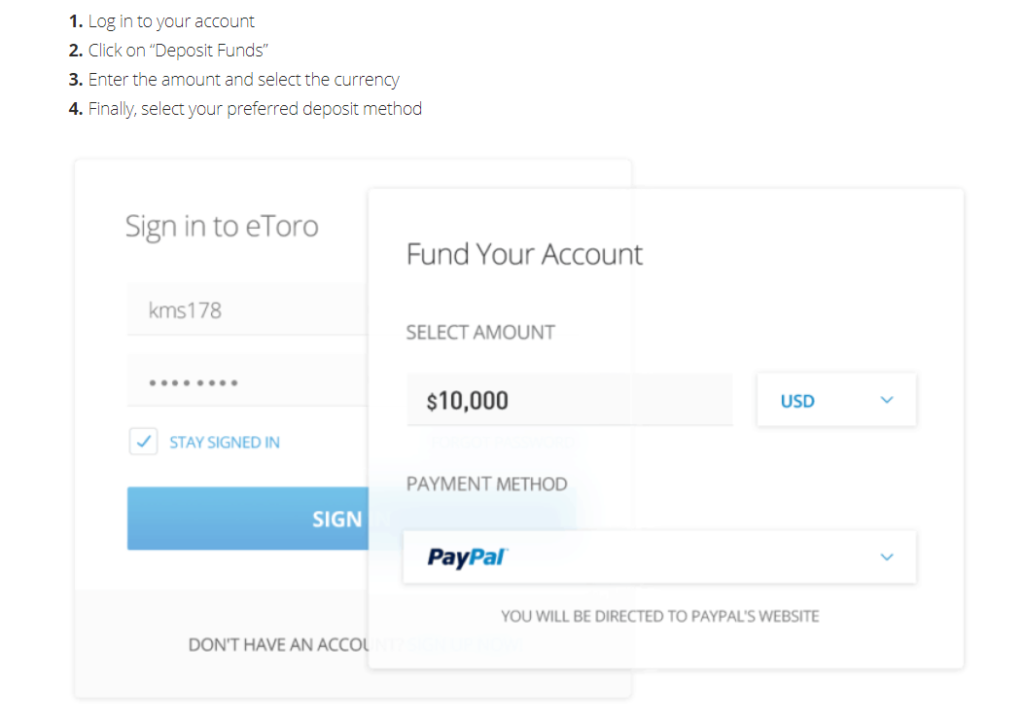

Step 3: Deposit funds

Depositing funds into your new eToro account is an efficient and fully digital process. A wide range of payment methods are available, including debit cards, credit cards, bank transfers and a number of e-wallets such as PayPal and Neteller.

Depositing can be done in four simple steps, as shown in the image above.

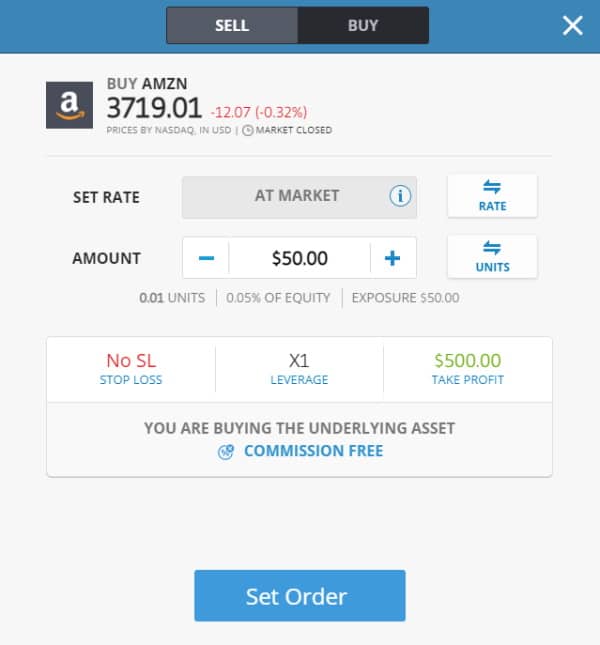

Step 4: Buy Amazon shares

There are two ways to trade stocks or invest in Amazon:

- You can speculate on stock price movements through CFD derivative instruments , which allow you to use leverage to increase your purchasing power and trade in both directions.

- You can trade stocks through traditional investment methods, such as buying and selling actual shares .

The key difference between the two approaches is that with CFDs you do not take ownership of the underlying shares.

To buy Amazon shares via CFDs, simply type “Amazon” into the search bar and click on the relevant result. Then click on the “Trade” button and select either BUY or SELL based on your trading objectives. Next, enter your deposit amount, select the leverage level and select your preferred order type. Finally, click on “Open Trade” to make your investment.

Top Rated Online Brokers for Buying Amazon Stock

Since Amazon forms one of the four most popular FANG stocks (Meta – originally Facebook , Amazon , Netflix and Alphabet – originally Google ) on the Nasdaq stock market and boasts a market capitalization of $1.88 trillion, it is common practice for trading platforms to allow their clients to invest in Amazon.

With so many online brokers to choose from, how can you know which one best suits your trading needs? In this section, we’ll review some of the top-rated online stock trading platforms, paying close attention to key metrics like fees and regulations.

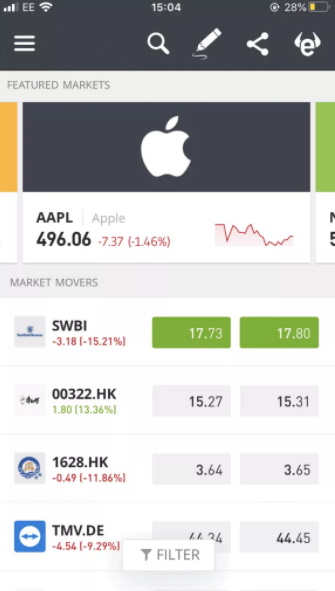

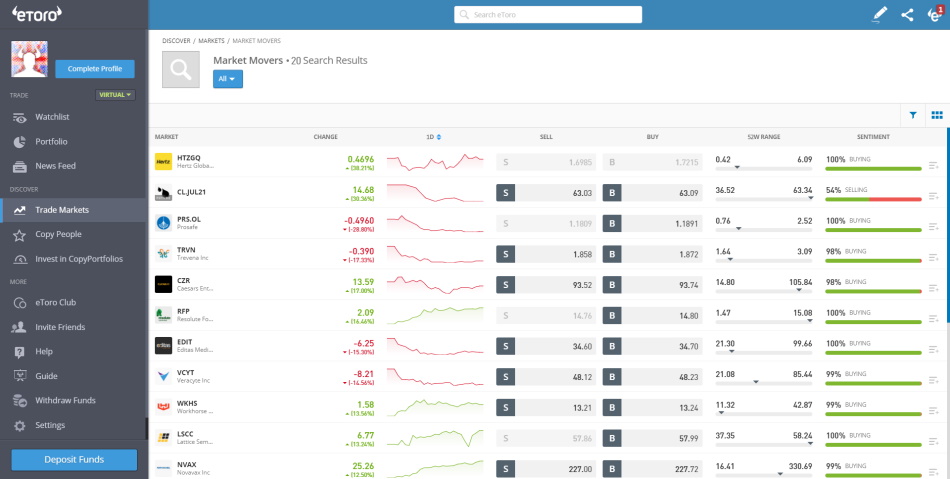

1. eToro – Top copy trading platform where you can buy Amazon shares

One of the main advantages of eToro is that it allows you to buy hundreds of stocks, including Amazon, both traditionally and through CFDs . By trading CFD derivatives, you can trade on a speculative basis, as well as using leverage of up to 5:1 . Traders who hold a CFD stock position do not take ownership of the underlying asset or acquire shareholder rights.

Social trading means that you can communicate and interact with the rest of the trading community on the eToro platform in a similar way to popular social networks, but in an environment of other online traders.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

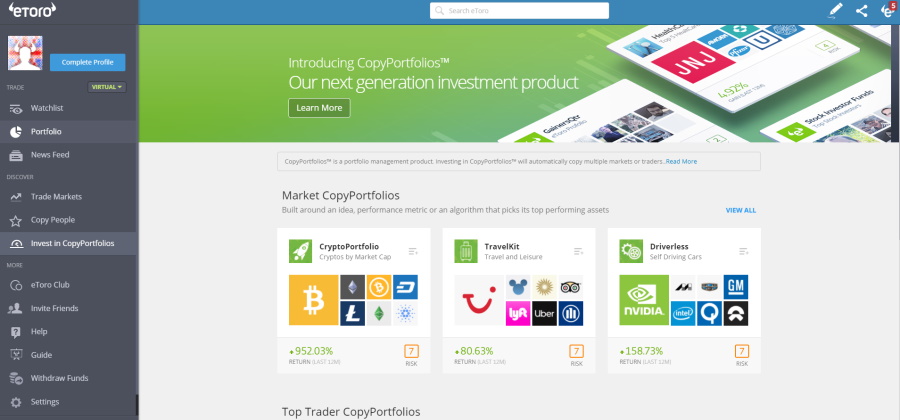

eToro also makes it easy to trade with copy trading features like CopyTrader and CopyPortfolios. This way, you can browse the public profiles of hundreds of experienced eToro investors and copy the trades of your favorites based on metrics like past performance and risk ratings. You can also invest in investor themes or portfolios with the click of a button.

The minimum deposit for EU-based investors is just $50 , and there are no deposits, account opening or maintenance fees. All in all, traders can buy fractional shares of Amazon on eToro for as little as $50, which is ideal for beginners as Amazon shares are priced at over $3,700 per share. This is possible because eToro supports fractional share trading, meaning you can invest as little as $50 to buy a fraction of a share.

Is eToro safe?

When it comes to the protection and regulation of client funds, eToro is regulated and authorized by several top financial authorities, including the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Additionally, depending on your country of residence, you may be covered by government regulator investor protection schemes and negative balance protection.

eToro: advantages and disadvantages

What we like:

What we don’t like:

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

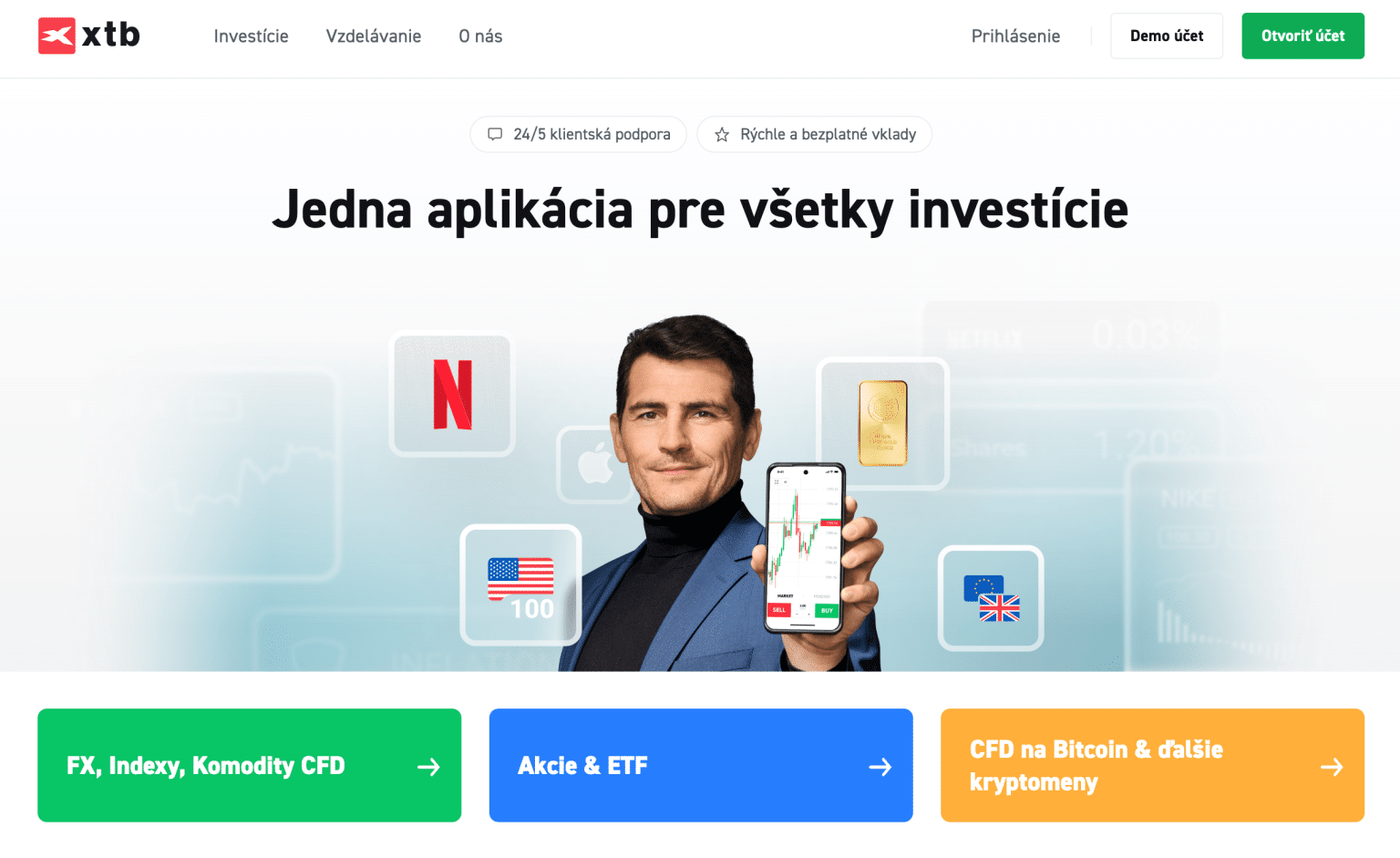

2. XTB – a reputable broker offering traditional stocks and leveraged CFDs

XTB is a global stock broker that supports thousands of markets. This includes over 3,000 stocks from 16 exchanges. In Slovakia, you can invest in other US stocks besides Amazon shares, such as Apple, Netflix, Palantir and Alphabet. You can also invest in shares of large-cap British companies, including HSBC and AstraZeneca. In addition, the XTB platform also supports over a dozen European exchanges, including France, Sweden, Germany, Norway and Portugal.

The main disadvantage is that XTB does not support Asian markets such as Singapore and Japan. However, you can invest in the available stocks from as little as €10. In addition, you do not pay any commission for trading stocks. So whether you want to invest in Swiss ABB shares or British Aston Martin shares, you are only charged the spread.

Supported CFD markets include stocks, ETFs, indices, forex and commodities. XTB is also one of the best day trading platforms for novice investors. There is no minimum deposit and you can try out the platform via a free demo account. In addition, XTB offers a number of educational guides. XTB is a secure online broker regulated by the FCA (United Kingdom), CySEC (Cyprus) and other licensing authorities. XTB is publicly listed on the Warsaw Stock Exchange.

Benefits:

Disadvantages:

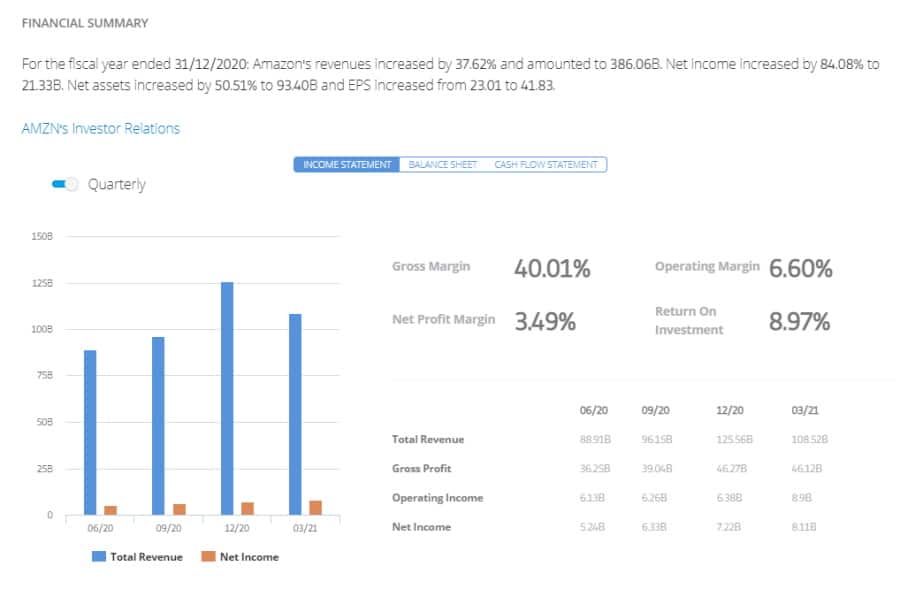

Basic data about Amazon

| Market Cap | $1.88T |

| Price-to-Earnings (P/E) Ratio | 71.01 |

| Revenue | $419.13B |

| Earnings Per Share | 52.5469 |

| Dividend (Yield) | 0 (0%) |

| Previous Close | 3731.41 |

| Day's Range | 3690.35 - 3755.11 |

| 52 Week Range | 2869.32 - 3755.11 |

| 1-Year Return | 17.47% |

Amazon Stock Price History and Forecast

Amazon.com, Inc., founded by Jeff Bezos in 1994, began as an online bookstore. In 1997, Amazon shares were offered to the public through an IPO (initial public offering).

Since Amazon was listed on the NASDAQ exchange under the ticker AMZN, it has continued on an upward trajectory that now represents one of the largest market capacities on a major US stock exchange.

During the IPO, Amazon shares were priced at just $18 , while now, at the time of writing this article in November 2023, Amazon shares are priced at $143.20 . In other words, this is a 795% increase in the share price . If we compare the current AMZN share price with the same period last year, we find that there has been an increase of 70.45%.

What is the Amazon stock price forecast for the rest of Q3 and Q4?

According to CNN Business, Amazon's stock price forecast for the next 12 months suggests an upward trajectory, with more than 40 financial analysts predicting a median target of $422.95, a high estimate of $550.00, and a low estimate of $375.00. The median forecast of $424.95 suggests a potential upside of 297% from the previous price. What is Amazon's stock price forecast for the rest of Q4? Or should you buy Amazon stock now?

Most investment analysts agree that investors and traders should buy Amazon stock .

Does Amazon pay dividends?

The telltale sign of a good dividend stock is the sustainability of the payout. When the percentage of a company's income that is distributed to stakeholders as dividends becomes too high over a prolonged period, it is cause for concern. Payout ratios that have reached the 100% mark signal that the company is using either cash reserves or borrowings to pay dividends to its shareholders. The company will usually have no choice but to minimize or defer dividends.

Another way to identify profitable dividend stocks is to see if the company is expanding its network of regular customers. This indicates that consumers value the company's goods and services. This then helps to increase revenues and net income in the long run. A strong group of loyal customers acts as a catalyst for sustainable growth and dividend payments.

With that in mind, it may come as a surprise that Amazon currently doesn't pay a dividend . However, based on the two metrics we discussed above, Amazon certainly has what it takes to become one of the best dividend stocks .

Amazon's main focus now appears to be reinvesting its net profits into expanding its business, which saw a dramatic increase in sales during the height of the Covid-19 pandemic. Partly due to social distancing and global restrictions, consumers have opted for online shopping rather than traditional brick-and-mortar shopping.

Over the past three years, Amazon has spent nearly $60 billion on assets, hiring new employees, and other projects.

Should I buy Amazon shares?

Investors are watching Amazon shares very closely, especially after its streaming deal with Comcast was announced last week.

As mentioned earlier, under the terms of the deal, new movie releases will debut on Amazon Prime Video after they premiere on Comcast's Peacock app. Amazon shares have a strong Buy rating because the company has a strong presence in both the cloud computing and e-commerce sectors .

The all-time high closing price for Amazon stock was $3,731.41 on July 8, 2021.

Amazon shares have risen about 18% over the past 52 weeks, making it one of the best-performing stocks in the Nasdaq 100 and S&P 500 indexes . In the first quarter of 2021, revenue grew more than 40% compared to the same period a year earlier, the fastest growth rate in the business's decade. With continued demand, Amazon hired more than half a million employees last year, bringing the company's total headcount to more than 1.29 million.

The recent recovery and positive market movements have increased Amazon's market capitalization by over $60 billion, as it currently stands at $1.88 trillion.

How will Amazon continue to expand its business?

"We will measure ourselves based on the rate at which our customers purchase from us repeatedly and the strength of our brand. We have invested and will continue to invest aggressively to expand and leverage our customer base, brand and infrastructure as we strive to build an enduring franchise."

This is a section taken from a letter sent to Amazon shareholders in 1997, and 24 years later, it still holds true.

Amazon could further expand in the following ways:

- The e-commerce giant will focus on India because there is huge potential for expansion there. Online sales accounted for just 1.6% of all retail sales in India, compared to 15% in China.

- In 2018, Amazon bought online pharmacy PillPack , and with the e-pharmacy market expected to grow by more than $100 billion, Amazon could benefit from this new venture.

- Amazon Prime subscribers continue to renew their memberships, and the e-commerce giant now boasts a 150 million-strong customer base. With added benefits including next-day delivery, unlimited music streaming, Prime Video, and access to Amazon Fresh and Whole Foods, Amazon Prime continues to grow year after year.

- Cloud computing with Amazon Web Services (AWS) is used by millions of customers worldwide to minimize costs, increase productivity and flexibility, and accelerate development.

Should you sell or buy Amazon shares?

So should you sell or buy Amazon stock? According to leading equity research firms including JP Morgan and Morgan Stanley, there is a general consensus among the investment community that Amazon stock has a strong buy recommendation because the e-commerce giant has a wide range of opportunities to expand its business in the foreseeable future.

The coronavirus pandemic has brought new challenges to how we interact with each other and how our core infrastructures operate. Amazon is thriving in these difficult times, with new ventures like PillPack and e-pharmacy services offering new conveniences.

Amazon also has a chance to win the $10 billion JEDI contract from the US Department of Defense, which officials expect to close by the second quarter of 2026.

In short, we believe Amazon is a great buying opportunity . Amazon's long-term business plans are very feasible. Amazon is constantly creating innovative services and products that help maintain its upward momentum.

Expert verdict

Investors who got into the stock early are now looking at 5-figure percentage gains. Market analysts and financial research firms expect Amazon's successful and impressive market performance to continue. With a market cap of $1.52 trillion, it's easy to see why Amazon is one of the best stocks to buy in 2026.

If you are interested in investing in Amazon shares with the top-rated online social trading platform, we recommend using eToro.

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

References:

- https://www.marketwatch.com/investing/stock/amzn

- https://www.wsj.com/market-data/quotes/AMZN

- https://www.fool.com/quote/nasdaq/amzn/

- https://www.tradingview.com/symbols/NASDAQ-AMZN/

- https://www.aboutamazon.com/

Frequently asked questions

[ms_fs_multi_faq headline-0="h2" question-0="How to buy Amazon shares?" answer-0="You can buy Amazon shares through eToro after opening a trading account and depositing funds. Then, you search for Amazon shares, choose your investment amount, and place an order." image-0="" headline-1="h2" question-1="How to invest in Amazon directly?" answer-1="When you invest in shares on eToro. You can choose to invest in large or small amounts from as little as $50, using fractional share trading. With no management fees, no transfer fees and no hidden additional broker fees, the cost of buying AMZN shares through eToro is among the lowest in the online trading scene." " image-2="" headline-3="h2" question-3="Who owns Amazon?" answer-3="Amazon was founded in 1994 by Jeff Bezos. Since then, he has helped the e-commerce company grow to new heights with a market capitalization of $1.88 trillion. Jeff Bezos stepped down as CEO on July 5, 2021.