Ako investovať do kryptomien v roku 2026 – kompletný návod v slovenčine

The popularity of cryptocurrency trading has increased significantly over the past year, with the market often showing sharp movements. With this new asset class gaining popularity, more and more people have become interested in how to invest in cryptocurrencies in Slovakia.

In this article, we will walk you through the process and teach you how to invest in cryptocurrencies – we will introduce you to all the available options and discuss some of the main strategies. We will also discuss the pros and cons of investing in cryptocurrencies and evaluate the daily progress of the cryptocurrency market through new technologies, which makes this period an ideal time to enter the market.

How to invest in cryptocurrencies in 4 steps

We will break down this new world of trading and explain how to invest in cryptocurrencies to anyone interested in the entire process of investing in cryptocurrencies. The best part is that the entire process is relatively quick and easy:

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

[fin_table id=”15″]

Cryptocurrencies as investments – choosing the best platform

Having provided an overview of how to invest in cryptocurrencies online, let’s take a closer look at this market. To start, let’s talk about choosing the most suitable platform. As with trading in any asset class or financial market, it is extremely important to thoroughly research all the available offers and make the right decision. However, with the wide range of platforms, this task can become very difficult.

So, let’s make it simple and go through a short list of some of the best trading platforms currently available on the market.

1. eToro – The best cryptocurrency trading platform

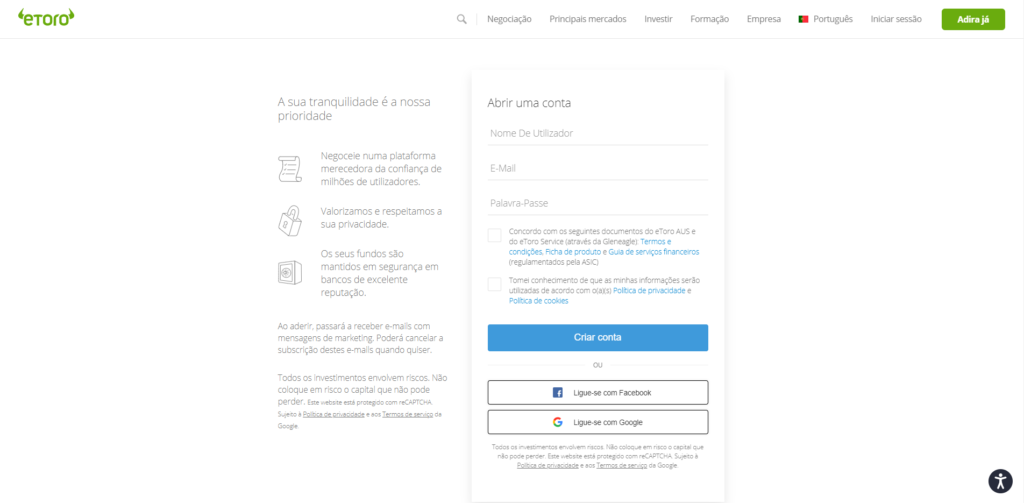

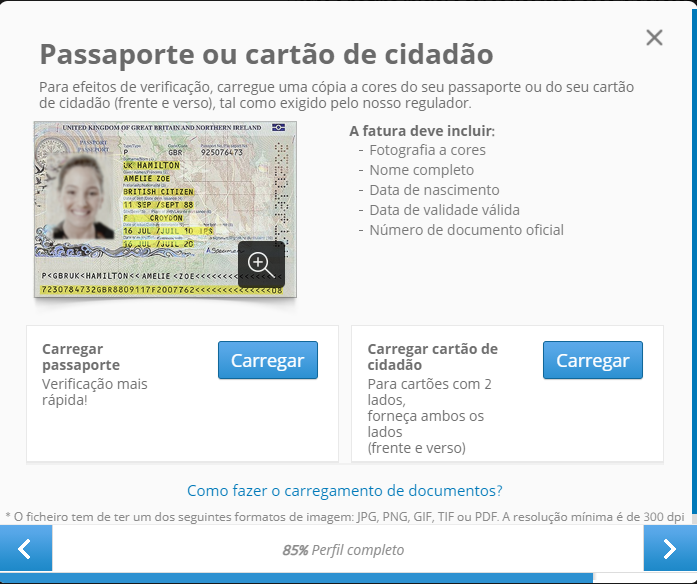

With this in mind, you should always choose a regulated brokerage firm to ensure your protection. With eToro, you can invest in cryptocurrencies with ease and peace of mind knowing that the broker is licensed by the FCA , CySEC, and ASIC.

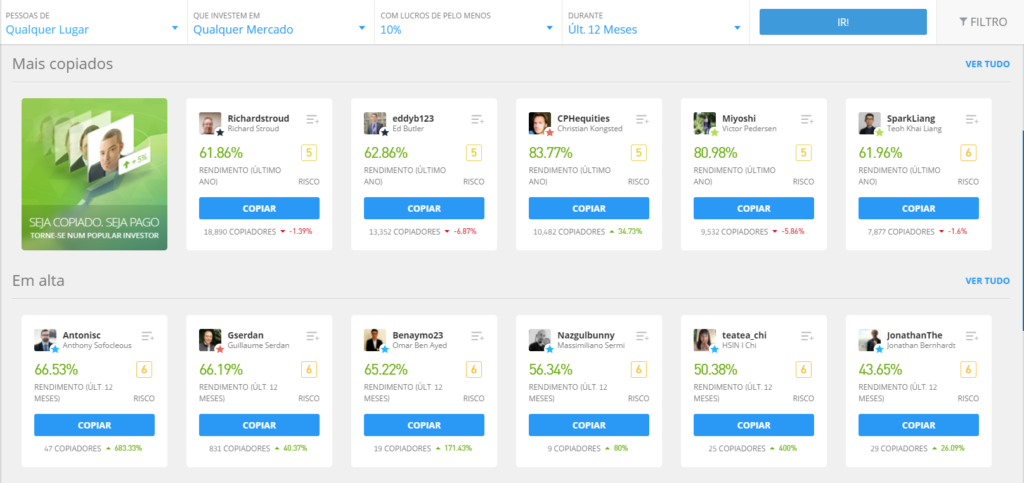

eToro boasts a trusted track record among investors and provides its users with all the benefits associated with one of the most powerful tools currently available in the world of financial investing: social trading. Social trading combines the world of financial analysis with the power of knowledge sharing present in social networks, allowing users to share their trades and success stories.

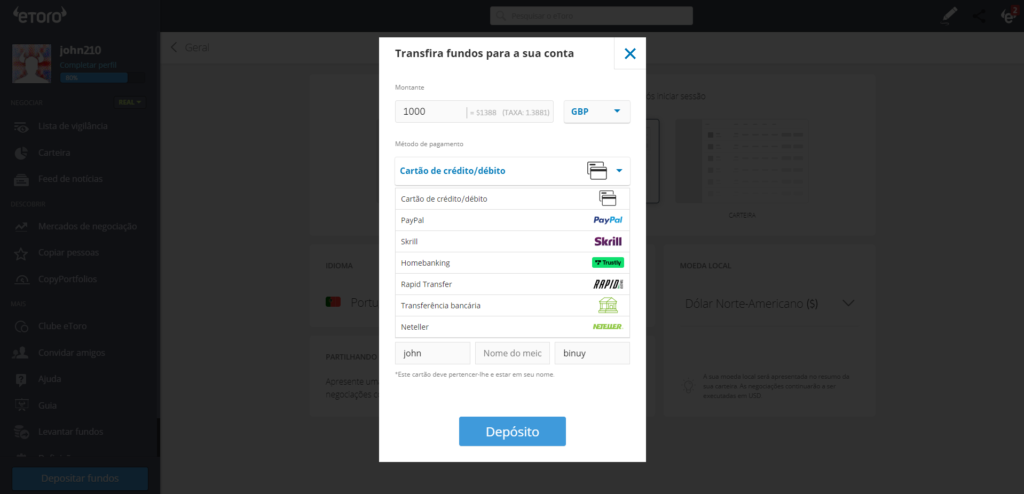

Users can choose to copy trades from other traders, allowing them to profit from market movements effortlessly. This is an extraordinary tool that allows anyone to invest in the cryptocurrency markets, even without experience and knowledge. eToro also offers very low fees and many benefits for investors from Slovakia. You can start trading and investing with just €100.

Advantages:

Disadvantages:

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

2. OKX - a platform ideal for buying, selling or trading cryptocurrencies

OKX is one of the cryptocurrency exchange platforms with the longest history and experience in the market. Without a doubt, it is one of the main platforms in the trading market for Bitcoin , Ethereum and other cryptocurrencies.

The platform has a presence in over 130 countries and is headquartered in Malta. Originally from China, it later changed its headquarters, but ties to the original Hong Kong office still prevail.

OKX is one of the most important exchanges on the market, belonging to Tier 1 because it has one of the highest trading levels. It is a reliable and secure platform because it meets all the important standards.

The main tasks of the platform include trading in cryptocurrencies and derivatives. Unlike other platforms, it is not regulated by the FCA, but it is considered a safe and reliable platform. They use TradingView technology, which provides great graphic quality. The maximum leverage level is 5:1, which is ideal for speculation in the short and medium term. One of the most prominent services is the wallet, something that is not widespread on all platforms.

This platform offers a wide range of cryptocurrencies, converting around 30 local currencies to USDT, ETH, BTC or other cryptocurrencies. You have a variety of payment methods available to make your transactions.

Benefits:

Disadvantages:

3. Libertex - investing in cryptocurrencies with zero spreads

One of the most popular platforms among crypto investors is Libertex. The platform has a fantastic reputation, built over its 23-year history, with around 3 million active customers worldwide. The feature that really sets Libertex apart is its zero spreads policy on cryptocurrencies, as well as other asset classes and financial markets.

Another big advantage of using Libertex that makes this broker so popular is that it allows investors to trade on margin. This means that investors are able to open larger positions than their trading account balance.

For individual and non-professional investors, Libertex offers margins of up to 1:10, meaning that it is possible to control trades on the market worth $10,000 with a deposit of just $1,000, thus enabling significantly higher profits. Libertex also offers minimum deposits of just $100.

Advantages and disadvantages of Libertex

Advantages:

Disadvantages:

85% retailových investorov prichádza o peniaze pri obchodovaní s CFD s týmto sprostredkovateľom.

How to invest in cryptocurrencies - analysis and research

Since you have just chosen your favorite platform, opened your account, and made your initial deposit – you are ready to invest! What is the next step? The most experienced and astute investors always start their journey with analysis and research.

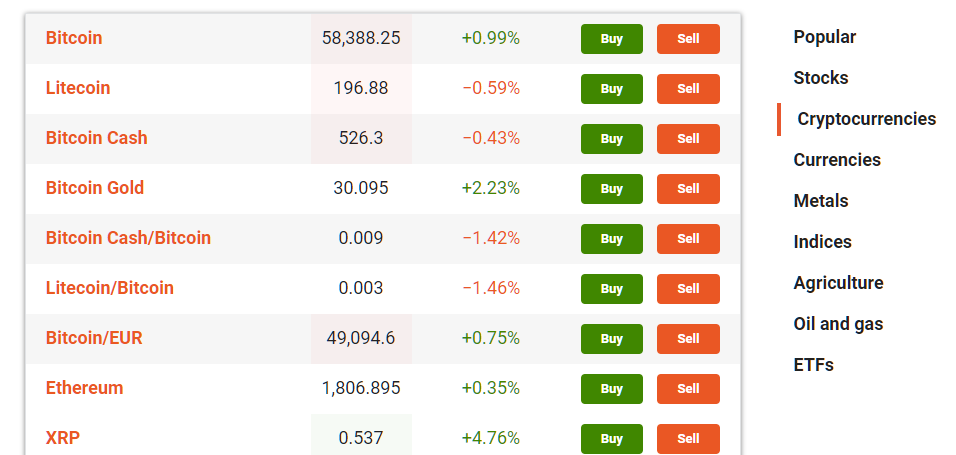

Investors should understand the basics of how to invest in cryptocurrencies online. For this reason, we will now look at some of the main aspects to consider. There are different ways to access the markets, so you first need to decide which market is best suited to your needs and goals. The following list contains the three best ways to invest in cryptocurrencies – to make your decision process easier.

1. Buying Cryptocurrencies – Best Cryptocurrencies to Invest in

If you want to invest in cryptocurrencies in Slovakia, one of the best ways to invest is to buy cryptocurrencies directly through a crypto exchange. Just like you can buy stocks or buy gold or silver in physical form, owning a unit (or units) of any cryptocurrency is one of the easiest ways to enter this investment space.

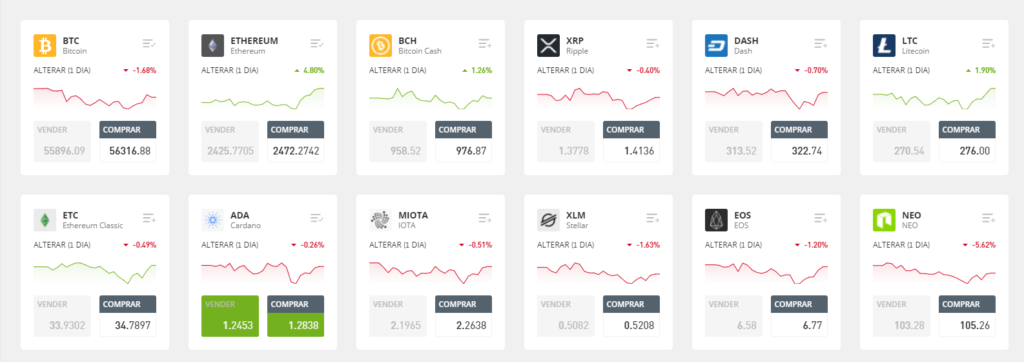

The main advantage is that you can fully benefit from the appreciation of the currency in question, and since the currency is digital, unlike buying gold or silver in physical form, it is stored virtually. The disadvantage, however, is that depending on the currency in question, the unit can be extremely expensive. Bitcoin is currently worth around $43,000 per token . This means that if you are just starting out, investing in Bitcoin may not be the most ideal decision, unless you only want to buy a fraction of it.

2. Investing in cryptocurrencies through ETFs

When it comes to how to invest in cryptocurrencies, ETFs provide another excellent option. Exchange Traded Funds (ETFs) are essentially an investment vehicle provided by banks and other institutions that provide access to the world of cryptocurrencies by investing in the fund.

The fund is essentially made up of various crypto assets, meaning that as the value of these securities increases, the value of the fund increases proportionally, which in turn means that your holding in the ETF appreciates. The beauty of this option is the ability to benefit from the price increases of several different cryptocurrencies, eliminating any expenses associated with directly and individually purchasing all of these assets, and knowing that your fund is managed by a team of professional investors. You will benefit from their experience and knowledge, creating a fantastic opportunity to profit from large market movements.

eToro’s CryptoPortfolio is a great example of one of these ETFs. This investment vehicle is managed and balanced by eToro’s investment committee and is a diversified product that tracks the value of the major cryptocurrencies on the market. Investors using this option also benefit from zero management fees on the fund, making it an excellent and cost-effective long-term investment.

Trading CFDs, Futures and Options on Cryptocurrencies

In addition to directly purchasing digital currencies and investing in cryptocurrency ETFs, investment methods involving CFDs , futures, and options are also extremely popular among cryptocurrency enthusiasts.

For those unfamiliar with these products, we will provide an overview of their structure and explain their potential usefulness for investing in cryptocurrencies.

1. Cryptocurrency CFDs for investing

Contracts for Difference (CFDs) are extremely popular products in the financial markets, used across many different asset classes. CFDs essentially allow an investor to speculate on the future price direction of a particular cryptocurrency, eliminating the need to actually purchase the underlying asset.

So, for example, you can buy a Bitcoin CFD and determine the amount you want to invest based on your budget. If the value of Bitcoin increases, you can sell your CFD and profit from the difference between the buy and sell price.

The most advantageous feature of CFDs is that using CFDs allows you to open short positions, which allows you to profit from a falling price. Therefore, if you were to assume that the value of Ethereum would fall, for example, you could decide to sell your CFD on your broker's platform and buy it back at a lower price. In this case, you would profit from the difference between the initial price and the final price. With CFDs, the only way you can lose your money is if the price moves in the opposite direction to what you expected.

2. Futures

Futures trading works similarly to CFDs, where the trader speculates on the direction of the price and profits from the difference between the entry and exit prices.

Options trading is a bit more complicated, but it can be a very profitable way to invest in cryptocurrencies.

3. Cryptocurrency options

When trading options, an investor essentially buys a contract labeled "call" if they believe the price of an asset will rise. The trader specifies the amount they want to invest in the contract and specifies a price level.

If the price of the asset exceeds this level during a certain period of time (referred to as "expiration"), the trader will make money if the contract is terminated at that time. The higher the price increase, the greater the profit.

Alternatively, if a trader is speculating on a decline in the price of an asset, it is possible to buy a contract called a "put". Again, you must specify the amount you want to invest as well as the price level ("strike"). If the price falls below this level at the time of contract expiration, the trader makes a profit. The greater the decline, the greater the profit.

Reasons to invest in cryptocurrencies in Slovakia

As we delve deeper into the world of cryptocurrency investing, and as you gain a little more knowledge, it is important to consider the reasons why you should consider investing in cryptocurrencies.

The most common answer is undoubtedly to make a profit. However, with so many different markets and assets available to trade today, why choose cryptocurrencies?

1. Sudden and continuous market growth

One of the main reasons why you should consider investing in cryptocurrencies is the sudden rise of this market. Demand and trading volumes for cryptocurrencies have broken all records in recent years. Interest from individual investors has exploded, as has interest from professional investors (banks, institutions, and even governments).

High volume means huge liquidity and plenty of movement, which creates huge opportunities. With eToro, you can copy the trades of investors with a history of making profits in the world of crypto, which means you can also profit from every successful trade made by the traders you choose to follow, without any action on your part.

2. Wide selection of available cryptocurrencies

One of the main advantages of investing in the world of digital currencies is the wide selection of different cryptocurrencies. Unlike gold and silver, which are limited markets, the cryptocurrency space is huge and constantly growing, making it possible to trade several different digital currencies.

eToro provides a full range of cryptocurrencies, allowing you to trade everything from smaller coins like Tron to market leaders like Bitcoin and Ethereum.

3. Digital currencies are becoming increasingly important in today's world

One of the most exciting aspects of investing in cryptocurrencies is that you are essentially investing in the future!

Over the past decade, various experts have debated whether cryptocurrencies will replace traditional currencies in the future and whether they will ever be accepted in our traditional way of life. This transition is already underway, with more and more companies allowing payments in cryptocurrencies and even creating their own digital currencies.

Major players like Tesla and Amazon are major players and pioneers in accepting cryptocurrencies. In addition, more and more investment banks are starting to trade cryptocurrencies as the market continues to grow, with several central banks now present in the digital currency world.

The movements observed in this market at the moment are strong indicators of its popularity among investors and the opportunities available to anyone who decides to enter this market. As more and more companies and institutions adopt cryptocurrencies, demand is constantly growing, which means that prices are likely to continue to rise and reach unprecedented proportions.

As central banks continue to invest more in developing their own cryptocurrencies, the future is bright for the industry and the opportunities are immense.

Best cryptocurrency to invest in 2026

The beginning of the article focused on how to learn to invest in cryptocurrencies, we mentioned the best options available and emphasized the importance of analysis and research, as well as reviewed the benefits of investing in cryptocurrencies with some platforms suitable for investing.

In the following sections, we will take a step forward and consider the best ways to invest in cryptocurrencies in 2021. The best way to invest in cryptocurrencies really depends on your motivation, your capital, and your experience.

If you want to own your own cryptocurrencies, you can buy units of any digital currency through a cryptocurrency exchange.

If you want to speculate and profit from market value trends, you can buy CFDs or even use options to profit from price fluctuations without actually owning any digital currency.

One of the safest ways to invest in cryptocurrencies is to use eToro's CryptoWallet, an all-in-one platform that allows you to store your virtual assets and trade on digital platforms.

A crypto wallet provides you with a private security key to access your assets and allows you to trade over 500 digital currency pairs without having to move or transfer funds, simplifying the process of investing and managing your cryptocurrencies.

Should I invest in cryptocurrencies now?

Before investing in any financial asset, all traders should evaluate their position and weigh all the pros and cons. You must consider your own budget and capital, time frames, and level of experience to ensure that investing in the financial markets is the right choice for your lifestyle.

If you decide to start your investment journey, you need to choose the most suitable asset and the best platform. The main advantage of cryptocurrencies is that they belong to a new and exciting space that is constantly growing rapidly thanks to innovative new technologies. With the growing popularity of cryptocurrencies, the markets have shown unprecedented returns.

Regardless of your level of experience, the existence of tools such as eToro's social trading means that you can copy the trades of more experienced traders with proven records of profitability.

This means that even if you have no experience or knowledge of the market, you have the opportunity to profit while you learn to trade.

Since the account opening process is extremely simple, with low deposit requirements, the world of cryptocurrency investing is accessible to everyone.

Cryptocurrency trading strategies

When it comes to choosing a strategy for investing in cryptocurrency online, traders have a few main options. The first consists of the traditional approach of fundamental or technical market analysis.

1. Fundamental analysis

Using this form of analysis, investors study the factors and connections that affect the big picture markets and potentially affect the price of cryptocurrencies.

This includes: movements in the value of the US dollar and global interest rates, any changes in regulatory standards, any impact reports associated with digital currencies, and any significant changes in the supply and demand environment.

These types of factors include Tesla's recent press release, where the company announced a $1.5 billion investment in Bitcoin. This type of analysis is typically used in long-term investments.

2. Technical analysis

This form of analysis involves studying price charts, making decisions based on price movements and technical indicator data.

This form of analysis is popular among day traders and is mainly used for short-term investments. It can also be used in conjunction with fundamental analysis.

Another, more modern strategy involves using the eToro social trading tool. This simple tool allows you to select another eToro member who has a profitable trading history and copy their trades in the future. This feature allows you to make money whenever these traders make a profit in the market, and offers the option to copy several different traders to easily diversify your portfolio and start making money in different currencies. The process of registering and setting up an account on the eToro platform is extremely quick and easy. It is possible to start trading within minutes by following these four simple steps. 4. Finally, simply choose a cryptocurrency and start your investment journey. You can choose the amount you want to invest, choose a currency or currency pair, or even search for another trader to copy their trades through the social trading tool. As you can see in the image above, simply select the amount you want to invest and set the leverage to get started. Opening your first market position could not be easier. Welcome to the cryptocurrency market.eToro Social Trading

Cryptocurrency trading on eToro

Conclusion

Now you know exactly how to invest in cryptocurrencies and you may have already wondered about the best cryptocurrency to invest in.

In this guide, we've evaluated the best brokers available, discussed the pros and cons of the market, the different strategies you can use, and shown you how easy it is to open an account and trade with eToro – the best cryptocurrency broker in Slovakia.

The digital currency market provides a wealth of opportunities. You have the opportunity to benefit from Copy Trading. Manage your portfolio without having to constantly watch the markets.

Copy Trading is designed for users to save time and learn from expert traders. Trades are replicated to your portfolio in real time.

No additional charges for using the CopyTrader feature. You can start or stop copying and add or remove funds at any time.

eToro - The best brokerage firm for cryptocurrency trading in Slovakia

Investície do kryptomien nemusia byť vhodné pre retailových investorov a môžete prísť o celú investovanú sumu. Je dôležité prečítať si a porozumieť rizikám tejto investície, ktoré sú podrobne vysvetlené v tomto odkaze

Frequently asked questions

Should I invest in cryptocurrency?

Is it too late to invest in cryptocurrency?

What is the best way to invest in cryptocurrency?

Can I make money while learning about the market?

Is it difficult to invest in cryptocurrencies?