Geriausi Trading Apps pradedantiesiems naudoti 2026 metais

In this guide, we compare the best trading apps in Lithuania, tailored to different levels of investors. Read on to find out which are the best Trading Apps, offering low fees, different asset classes, and smart investment and analysis tools.

-

-

- [stocks_table id=”17″]

Most Popular Trading Apps to Use in Lithuania in 2024

Here is a list of the best e-commerce apps, suitable for both beginners and experienced traders:

- eToro is a quality e-trading platform for investors of all levels. The eToro iOS and Android app supports over 3,000 stocks from the UK, US, Hong Kong and many other international exchanges.

- Pepperstone – With the Pepperstone cTrader mobile app, investors can access premium and advanced trading options and a variety of money transfer types.

- XTB – XTB is a popular e-trading platform that offers access on the web and iOS/Android apps. This provider is ideal for short-term stock trading strategies, as it allows you to use leverage up to 1:5 and there are no commissions.

- Admiral Markets – With the Admirals app, users can access over 3,000 stock CFDs. The Admiral Markets app also offers a demo account, educational content, and charting tools, making it often the first choice for newbies to the market. The platform is available in Lithuanian.

Overview of the best trading programs in Lithuania

Below we will discuss different providers in more detail and list their main features to make it easier for you to choose the right one for you:

1. eToro – Overall Best Trading App for Beginners

If you are investing in the stock market for the first time, eToro will be the best stock trading platform for you.

You can use eToro on the web and on the iOS and Android apps on your phone. It’s really easy to use – all you need to do is open an account, deposit some funds and choose which stocks you want to trade. The registration process takes less than five minutes and you can instantly deposit money using a debit/credit card or e-wallet.

You will then get access to over 3,000 stocks from the different markets they offer. This includes popular stocks such as 888 Holdings, HSBC, easyJet, BP, Vodafone, Tesla and Apple.

If you want to invest in the broader UK stock market, eToro also supports FTSE 100, S&P 500, NASDAQ 100 and Dow Jones index funds, allowing you to invest in the world’s largest listed companies in a single trade.

In addition, you can also trade stocks from European countries, including France, the Netherlands, Sweden, Germany, Hong Kong, Saudi Arabia, and other third-party markets. All stocks listed on eToro can be traded in small lots – regardless of the stock price, you can invest any amount from 10 USD (about 9 EUR) or more.

It is important to note that eToro offers extremely low trading fees.

eToro is also suitable for beginners because of its copy function. If you find an investor you want to copy, you can easily do so by simply setting the system to “copy”. This feature eliminates the need to manually research the stock market, saves a lot of time and often allows you to generate higher profits.

eToro investment capital is held in segregated bank accounts. In addition, the FSCS covers your investments up to £85,000. eToro has been around since 2007 and over 30 million people use this trading platform.

Read more: eToro reviews and review

Supported markets

Minimum contribution TOP Features Promotions

Crypto

Forex

Indexes

Raw materials

ETF

$10, connecting from Lithuania – $50 Over 3,000 stocks.

Fractional equity investments. Global index funds. Copying other investors tool. FCA regulated and subject to FSCS.

Advantages

- FCA regulated and FSCS covered

- A convenient online store analogue for buying digital assets

- Trade over 3,000 global stocks

- Buy and sell fractional shares from just $10 (around £8) per trade

- Smart portfolios and copy trading allow you to invest passively

- Excellent customer service available 24/7 via live chat

Disadvantages

- UK deposits are taxed at 0.5%.

Your capital is at risk. Fees may apply. For more information, visit etoro.com/trading/fees.

2. Pepperstone – Advanced Trading Options and cTrader App

One of the most popular trading platforms, Pepperstone is used in over 174 countries. The platform is also regulated by several regulatory bodies such as the Financial Conduct Authority and the Australian Securities and Investments Commission (ASIC).

Pepperstone’s platform is smart and offers a TradingView account and Meta Trader 4 & 5. This provider also offers a separate cTrader mobile trading app for more experienced investors, which allows users to access features such as advanced risk management.

With cTrader, you also get regular access to trading statistics, price fluctuation alerts, and advanced order management settings. The app also offers advanced processing of expert advisors and indicators, which can be useful when performing technical analysis.

When trading stocks, the average commission fee is 0.10% per transaction. Payment methods

Supported markets

Minimum contribution

TOP Features

Promotions

Crypto

Forex

Indexes

Raw materials

$200 Spreads and commissions apply.

Advanced customization options. API and live price alerts.

Advantages

- Advanced customization options

- Advanced risk management

- Educational webinars

- Regulated by FCA and ASIC

Disadvantages

- High minimum deposit of $200

Your capital is at risk, additional fees may apply

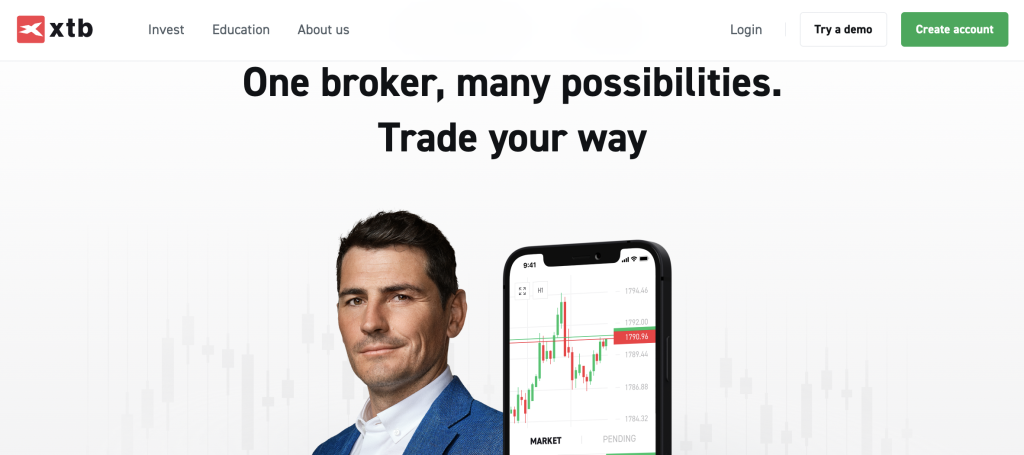

3. XTB – Invest in 3000 shares with 0% fees

XTB is one of the best stock brokers. You can trade online, using the native desktop software, or by downloading the XTB app for iOS/Android. All three options offer a wide range of features, including chart analysis tools, technical indicators, and fast speeds.

XTB offers two types of stock trading markets. In the first type, you can invest in traditional stocks, of which there are more than 3,000, and you will not pay any commissions for trading. This includes most US-listed stocks, so you can buy Tesla shares economically. You can also invest in Apple , Amazon, IBM, Ford Motors, Microsoft and many other popular US companies.

Your second option is to trade stock CFDs. These are derivative financial instruments that track real stock prices. XTB allows you to trade stocks with leverage up to 1:5 and, for example, you will have 50 EUR of trading capital with a deposit of only 10 EUR. It is important to note that there are no commissions for trading stock CFDs.

Before you start trading with real money, you can practice on a free demo account. This will allow you to trade stocks risk-free under live market conditions and understand the basic principles of trading and selling.

You can fund your XTB account through its app; payment types include debit/credit cards and e-wallets. There is no minimum deposit required.

Supported markets

Minimum contribution TOP Features

Promotions

Crypto

Forex

Indexes

Raw materials

None 3000+ stocks from UK, US and other markets

Trade stock CFDs with leverage up to 1:5.

Commission-free trading on all supported assets.

XTB mobile app, desktop software and web application.

Many analysis tools and technical indicators.

Advantages

- Invest in over 3,000 worldwide with 0% commission

- Or trade stock CFDs for leverage and short selling

- No commissions are charged on any markets

- No minimum deposit requirements

- Partial shares from just €10 (approx. £8.50)

Disadvantages

- Does not support cryptocurrencies

Your capital is at risk, additional fees may apply

4. Admiral Markets – start trading from just 1 EUR in Lithuanian

Admiral Markets is a popular stock trading platform that allows users to trade over 8,000 products. The trading app offered here allows you to trade CFDs on up to 3,000 stocks and access instant trading options.

The trading platform’s app offers a quick account opening process, so you can start trading in just a few minutes. The app includes a variety of charting tools and technical indicators that you can use before trading. The client app is available in 10+ languages (including Lithuanian) , and educational content such as webinars and informative articles are offered for novice investors.

Another important feature is fractional investing. Those with a limited budget do not need to buy the entire share - instead, you can purchase just a fraction of a share worth 1 EUR. However, the minimum contribution must be 25 EUR.

Along with stocks, Admirals users have access to multiple Forex pairs, indices, bonds, commodities, and ETFs. When trading stocks like Apple, users only have to pay a small commission of $0.02. It is important to mention that you get one free commission per day.

Deposits can be made using credit/debit cards and bank transfers. While you get one free bank transfer withdrawal each month, there is a $10 fee for each transaction.

Supported markets

Minimum contribution TOP Features

Promotions

Forex

Indexes

Raw materials

Bonds

$25 Spread betting and CFDs are supported.

Offers partial investment

Supports demo account.

Advantages

- Partial sharing options offered

- Supports spread betting and CFD trading

- Low commission fee

- FCA regulated

- Platform in Lithuanian

Disadvantages

- $10 fee for bank transfer withdrawals (one free withdrawal per month)

Your capital is at risk, additional fees may apply

How to choose the right trading program for you?

No two trading platforms are the same, so when choosing a provider, you need to know what to look for. Here are the key features of each platform that will enhance your trading experience:

1. Regulation and FSCS protection

The Financial Conduct Authority (FCA) oversees UK stock trading apps, so you should ensure that the trading app you choose is authorised and licensed by the FCA.

FCA-regulated trading apps must hold client funds in segregated bank accounts. As explained in the FCA guide, this simply means that trading apps cannot use your money to fund their own operations. Given the increasing number of online attacks, the authority also covers your investment capital up to €85,000 if the trading platform experiences problems.

That’s why we rate eToro and XTB so highly. Both platforms are regulated by the FCA. In addition, eToro and XTB are members of the FSCS. This means that as long as you invest no more than €85,000, you are fully protected.

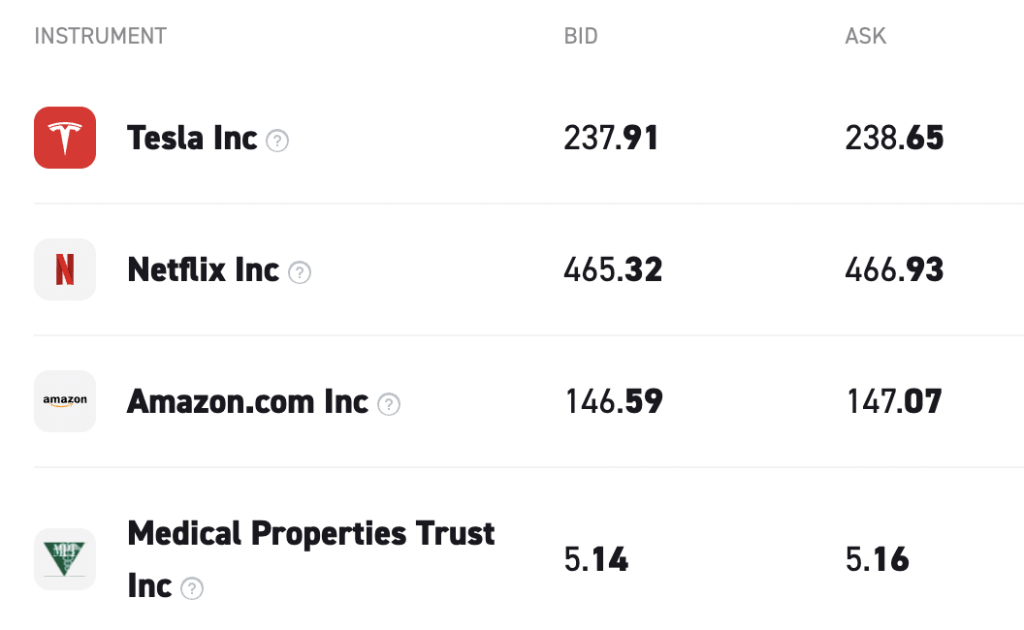

2. Supported stock markets

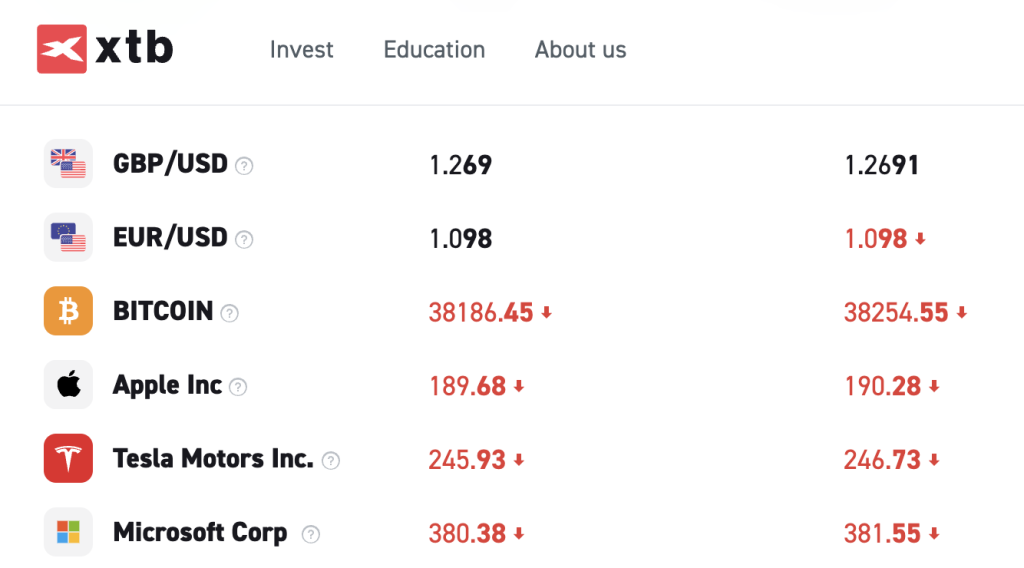

Source: xtb.com

When researching the best places to invest in stocks, you will need to evaluate what stock markets each one supports.

For example, if you want to invest in UK-listed stocks, look for trading apps that support the London Stock Exchange. Doing so will allow you to buy shares in BP, HSBC, 888 Holdings, Barclays, BT, GlaxoSmithKline and many other popular UK companies.

Also, if you want to invest in smaller companies, look for a trading app that supports the Alternative Investment Market (AIM). AIM lists small-cap stocks that are not large enough to be listed on the London Stock Exchange.

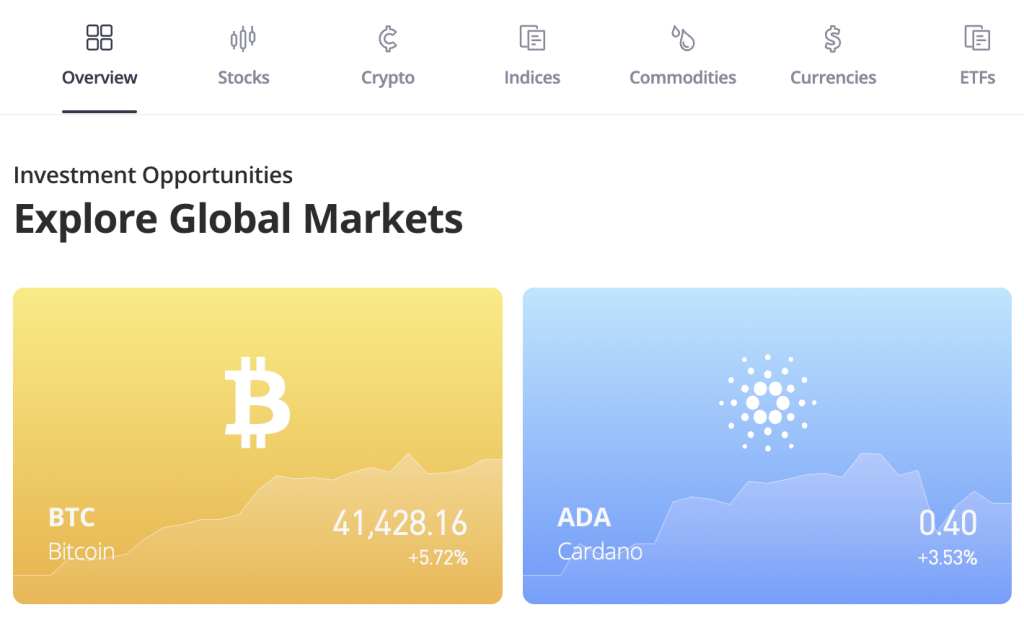

3. Other supported asset classes

Source: etoro.com

While you may initially want to trade stocks, you can also look into other asset classes that you are at least somewhat interested in. For example, you can check whether the chosen platform trades Forex pairs and whether it supports indices and commodities such as gold and oil.

4. Trading Apps and Fees

The best trading apps offer low fees. However, we have noticed that many providers have “hidden” fees that are not easy to find. So, let’s mention the main fees you can expect:

- Trading commissions. The first fee to look into is commissions. This is one of the main ways stock providers make money. Simply put, the program will take a commission when you buy and sell assets. Sometimes it can be 0%, sometimes around 0.5-1%.

- Spreads - Differences. A spread is an additional trading fee to look for when choosing a stock trading app. It is the difference between the buying and selling prices of the asset you are trading. The lower the spread, the better.

- Foreign Exchange Fees on International Stocks. One of the main drawbacks of trading international stocks is that you may have to pay FX fees. This is because you are investing in an asset that is traded in a different currency.

- Account fees. This is the fee charged to keep your account open. You may have to pay a fixed monthly fee or a percentage of the value of your portfolio.

5. Trading tools and analysis

Source: admiralsmarket.com

Most stock trading apps offer tools to help you analyze the markets. This often includes live price charts with drawing tools and technical indicators. However, these tools can be too complex if you are a beginner.

A better option would be market insights from expert analysts. This helps you make informed trading decisions as you get insights from experienced investors. You will find a wide range of research reports that are easy to understand.

6. Account minimums

Some platforms have a minimum deposit requirement. Sometimes there is also a minimum withdrawal requirement. Most often, the minimum deposit is around 10-30 EUR, but it can be higher.

7. Demo account

The most effective way to choose a stock trading app is to open a demo account. You won’t need to deposit funds or provide payment information.

Demo accounts come with pre-loaded virtual trading funds. This allows you to test the trading software without risk. If you like the software, you can then open a real money account.

8. Payment methods

It is worth choosing a supplier that supports a payment method that is convenient for you.

Many providers allow you to deposit funds directly into the app or using debit and credit cards. E-wallet deposits are also fast, especially with PayPal (and BestWallet in the future ).

If you want to transfer money from a bank, you will need to manually copy and paste your broker account number and sort code. Additionally, it may take 1-3 business days for the money to appear in your account balance.

9. Customer service

The best online investment sites offer high-quality customer service, and you can usually speak to an agent via live chat or email.

Also, pay attention to what days and hours the agents are open and make sure that the assistance is provided in a language you understand.

Best Trading Apps in Lithuania 2026

There is a huge selection of platforms on the market, however, not all of them can meet your expectations and investment goals. Above we have presented the best providers at the moment, which offer access from both a computer and a phone and are convenient for investors of all levels. Take advantage of the detailed review, useful tips and choose the trading platform that suits you best.

ALL

What is the best trading platform for beginners in Lithuania?

eToro is an FCA regulated broker offering the best stock platform in Lithuania. You can trade UK and international stocks from just $10 (around €9).

What is the best way to invest in shares?

The best way to invest in shares is to use an investment platform that is regulated by the FCA.

How do I choose a share investment platform?

You should make sure that the provider is regulated by the FCA and is a member of the FSCS. You should also research the stock markets they support and what fees you will have to pay for trading. We think the best share trading apps are eToro and Robinhood.

Are there any free Trading Apps?

Yes, the trading apps mentioned above allow you to buy and sell financial instruments. We also recommend trying the Binance trading app , which offers the same functionality in your browser and on your phone.

Are mobile trading apps safe?

Yes, all of the best trading apps discussed on this page are authorized and regulated by at least one reputable financial institution.

Sources

Raimondas Stonkus Rašytojas-analitikas

Peržiūrėti visus įrašus Raimondas StonkusRaimondas Stonkus yra rašytojas ir analitikas ekonomikos, verslo ir asmeninių finansų srityse. Savo karjeros kelią jis pradėjo prieš daugiau nei penkioliką metų sėkmingai užbaigus žurnalistikos studijas Vilniaus universitete, o po pastarųjų sekė žinių gilinimas rašant finansų, technologijų ir kriptovaliutų temomis.

Raimondo straipsniai buvo paskelbti populiariausiuose Lietuvos naujienų portaluose, įskaitant Delfi.lt, lrytas.lt ir vz.lt. Jau sukaupęs ilgametę patirtį rinkoje, jis atsidūrė sparčiai augančioje TradingPlatforms.com rašytojų komandoje. Šiandien su skaitytojais Raimondas dalinasi prekybos ypatumais, pateikia vertingų įžvalgų apie nuolat besikeičiančią verslo aplinką ir pataria, kaip geriausia elgtis skirtingose situacijose.

Raimondo misija yra išsklaidyti abejones apie finansų pasaulį ir sukurti galimybę kiekvienam užtikrintai ir apgalvotai priimti finansinius sprendimus. Jo išskirtinis gebėjimas aiškiai perteikti informaciją jau ne kartą buvo įvertintas mūsų svetainės skaitytojų ir yra naudingas tiek naujiems, tiek jau patyrusiems investuotojams bei verslo valdytojams.

Be pagrindinės rašytojo-redaktoriaus veiklos, Raimondo kasdienybė dažnai apima ir fotografiją, bėgimą bei muzikos kūrimą. Savaitgaliai neretai būna praleidžiami gamtoje Vilniaus užmiestyje arba namuose, skaitant klasikines knygas, naujienas bei apžvelgiant rinką.

- [stocks_table id=”17″]

ĮSPĖJIMAS: šios svetainės turinys neturėtų būti laikomas specialisto investavimo patarimu ir mes nesame įgalioti teikti specializuotų investavimo patarimų. Šioje svetainėje pateikti teiginiai nėra tam tikra prekybos strategija, investicinio sprendimo patvirtinimas ar rekomendacija. Informacija šioje svetainėje yra bendro pobūdžio, todėl turite kritiškai vertinti informaciją, apsvarstyti savo tikslus, finansinę padėtį ir poreikius. Investavimas yra spekuliatyvus ir čia nėra jokių garantijų. Kuomet investuojate savo kapitalą, visuomet išlieka rizika jį prarasti. Taipogi, ši svetainė nėra skirta naudoti jurisdikcijose, kuriose aprašyta prekyba ar investicijos yra uždraustos, ir ja turėtų naudotis tik tokie asmenys ir tokiais būdais, kurie yra teisiškai leistini. Atminkite, kad investicija gali neatitikti investavimo reikalavimų jūsų valstybėje, kurioje gyvenate, todėl atlikite deramus patikrinimus arba, jei reikia, pasikonsultuokite su tai išmanančiais specialistais. Šia svetaine galite naudotis nemokamai, tačiau informuojame, kad galime gauti komisinius iš įmonių, kurias pristatome šioje svetainėje. Toliau naudodamiesi šia svetaine sutinkate su mūsų sąlygomis ir privatumo politika.

Įmonės įregistravimo kodas: 103525

© tradingplatforms.com visos teisės saugomos 2024