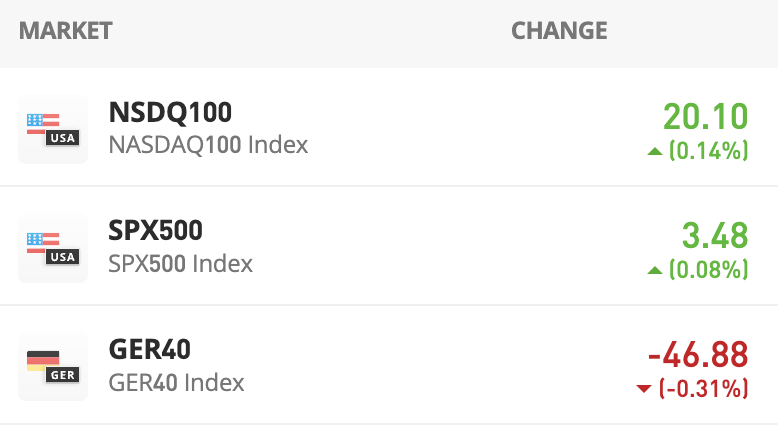

eToro atsiliepimai ir apžvalga 2026 m. – ar verta išmėginti?

eToro is now one of the largest brokers in the investment market, with over 20 million customers. Users are attracted not only by its low fees, but also by the exceptional convenience and customization of the platform for each buyer, but is eToro the right online broker for you?

2026 eToro reviews and review will tell you everything you need to know about this popular brokerage site and you will soon be able to decide if it is exactly what you are looking for.

[that]

[stocks_table id=”23″]

What is eToro?

eToro (eToro USA LLC) is an online broker that was first introduced in 2007 and now has over 20 million traders and investors on its platform.

The eToro trading platform allows you to interact with other members and post and reply to comments. This social trading allows you and your fellow investors to discuss trading ideas and share the best solutions in the daily market.

You will also find a Copy Trading tool here, which allows you to copy experienced eToro investors and their portfolios and existing positions. This is very useful (and profitable) if you are new to the market.

Finally, the eToro platform is really easy to use, making it ideal for new investors. Here you will find stocks , CFDs, indices, ETFs, cryptocurrencies, commodities and other popular markets.

eToro is also strictly regulated in several jurisdictions, so your capital always remains safe.

Advantages

Disadvantages

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

1. eToro shares

Let's start with the stock trading section of eToro . In short, this brokerage site gives you access to thousands of stocks, and the minimum investment in stocks is just $50.

This includes not only the two leading US exchanges - the New York Stock Exchange (NYSE) and NASDAQ - but also 15 other international markets.

There are a few key things to keep in mind if you want to invest in stocks. Firstly, when you buy shares, you own them. This means that you are officially a shareholder, which means you will be entitled to dividend payments when the company in question makes a distribution. Secondly, eToro supports fractional ownership, which opens up the possibility of small investments.

Partial ownership

Fractional ownership is a crucial aspect of modern stock trading - especially if you are interested in investing in companies that might be considered "expensive," such as Apple or Tesla shares.

Based on eToro reviews, here's how it works on eToro:

Let's say you're interested in buying shares of Alphabet (Google). The price is currently over $2,300 per share - you don't have the option to buy all the shares - but if you choose partial investing, you can invest a minimum of just $50 through eToro.

By purchasing shares for this amount, you will own 2.17% of one share of Alphabet (Google).

2. eToro Stock CFDs

A CFD is a financial contract that pays for the difference in settlement price between an opened and closed transaction.

We mentioned above that when you buy shares on eToro, you will own them, whereas when you invest in stock CFDs (contracts for differences), you do not buy shares, but you earn on the price difference.

Stock CFDs also allow you to benefit from additional perks such as leverage (you can use money you don't have) and short selling.

If you understand how CFDs work, you know that these investments are high-risk, so remain critical and always monitor the market.

Stock CFD example

An investor buys 100 shares of SPY for $250 per share (a $25,000 position), initially paying the broker only 5% or $1,250. Two months later, SPY is trading at $300 per share, and the trader exits the position with a profit of $50 per share, or a total profit of $5,000.

The example shows the advantage of leverage. The principle of leverage is that if 5:1 leverage is offered on eToro, then you can trade stocks with five times the amount you have in your eToro account.

3. eToro Cryptocurrencies

Let's take a look at cryptocurrency trading on the eToro cryptocurrency exchange . Here are some popular ways to trade cryptocurrency:

eToro reviews highlight that the platform offers cryptocurrency and fiat pairs. This means that you trade the exchange rate between a fiat currency and a cryptocurrency. The most popular coins can be traded against the US dollar, for example BTC/USD. In addition, many cryptocurrencies can also be traded against another fiat currency (GBP/EUR, AUD/USD, etc.).

eToro reviews and reviews have shown that it is also possible to trade cryptocurrency pairs, such as Bitcoin and Ripple (BTC/XRP) or EOS and Ethereum (EOS/ETH).

If you are a long-term investor in cryptocurrency, you will be happy to know that eToro allows you to buy and hold individual digital coins, including Bitcoin, Ethereum, Ripple, Cardano, Dogecoin, and other popular cryptocurrencies .

It is worth noting that eToro is increasingly adding new cryptocurrencies to its library in response to market demand. For example, the broker recently added Dogecoin.

In terms of ownership, you will acquire your chosen cryptocurrency immediately – meaning you can hold onto your investment for as long as you want. Of course, you should also consider whether you intend to store your new investments internally within eToro or in another wallet.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

Where is the most convenient place to store cryptocurrency?

The vast majority of retail investors often leave their coins on the eToro page, which is managed and stored on the main platform. This choice also means that you don’t need to have any knowledge or experience with how cryptocurrency wallets work .

Additionally, with this option, you can sell your cryptocurrencies with the click of a button and without having to make a transfer.

Your second option is to download the native eToro cryptocurrency wallet (pictured above), which is available for Android and iOS devices. This option will give you more control over your investments and independence from the trading platform. According to eToro reviews, this app is free and easy to use.

How to transfer cryptocurrency from eToro to MetaMask wallet?

If you want to move investments from your eToro wallet, then you can follow these simple instructions (we will use MetaMask in the example):

Open your eToro wallet

To send cryptocurrency from your eToro account to MetaMask, you will first need to make sure it is in your eToro Money wallet and not in your trading account.

Download eToro Money to your mobile device and create an account. Then log in using your trading account credentials.

Send cryptocurrency to your MetaMask address

To send cryptocurrency, simply click on the token you want to transfer and select “send.” You will then need to enter your MetaMask wallet address or scan a QR code.

It is important to enter the address correctly. If you enter the wrong wallet address, your funds may be lost forever. After a few minutes, your cryptocurrency should appear in MetaMask.

4. eToro Forex

At the time of writing, eToro offers 49 Forex trading pairs – all of which are available for trading 24/7.

Also, “exotic” Forex pairs are offered, such as USD/CZK, USD/RON, EUR/PLN and ZAR/JPY.

When it comes to leverage, most eToro traders are offered 30:1 for major currency pairs and 1:20. This is ideal if you want to trade (using Forex signals ) but only have access to a small amount of capital.

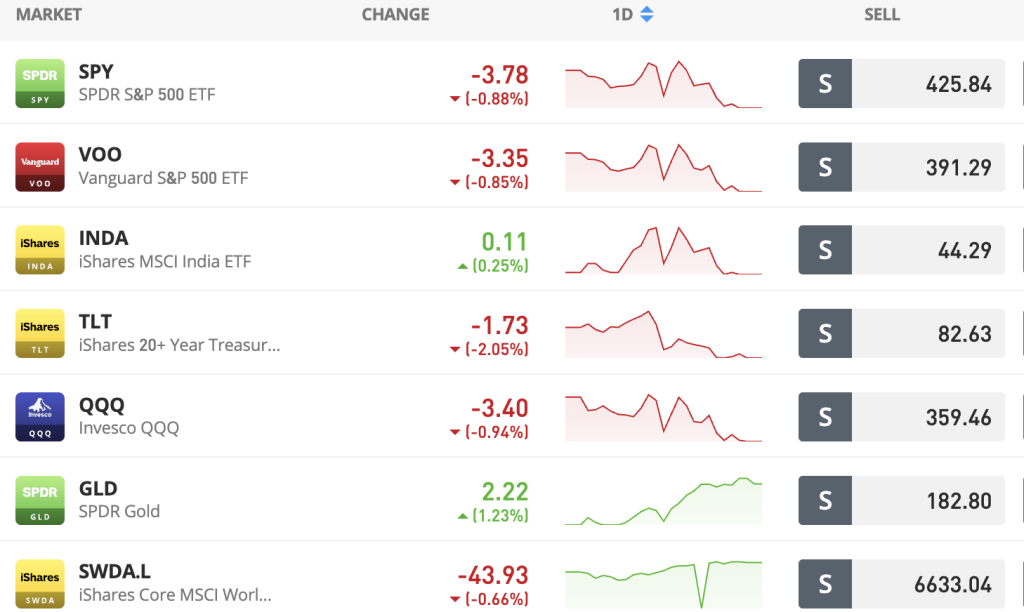

5. eToro ETFs

eToro currently offers over 250 ETFs and this includes index funds such as the Dow Jones, FTSE 100 and S&P 500, backed by providers such as Vanguard, iShares and SPDR.

You can also invest in ETFs that track commodities like gold and silver, as well as portfolios that track dividend stocks, growth stocks, blue-chip stocks, and others.

Regardless of the ETF you want to invest in, the minimum holding is only $50. It is important to note that you will also be able to receive dividends when the ETF provider makes a payment.

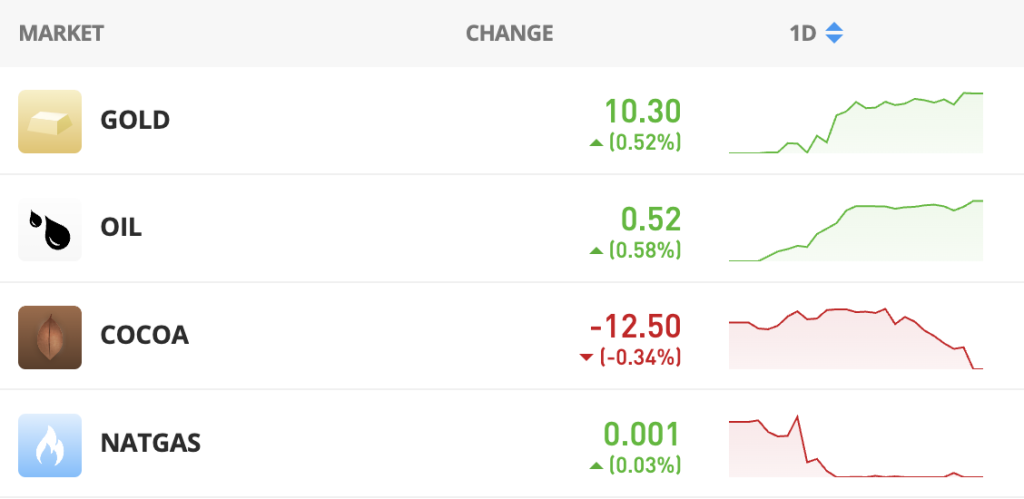

6. eToro Commodities

If you want to trade commodities from the comfort of your home, you can choose from 31 markets on the eToro platform.

The eToro commodities trading section consists of three main categories:

- Precious metals : gold, silver, platinum and others;

- Energy: crude oil, natural gas and others;

- Agricultural products: wheat, sugar, corn and others;

The minimum trade size for buying and selling in this market is $50.

7. eToro Indices

The final asset class, which eToro reviews also discussed, is indices (also known as “index funds”).

When you put money into an index fund, that money is used to invest in all of the companies that make up a particular index, giving you a more diversified portfolio than buying individual stocks.

The difference between ETH and indices

ETFs and index funds are often confused due to their similarities. Here are the key differences that can help you decide which option is better for you:

Index funds and exchange-traded funds (ETFs) have similarities in that they both track the performance of a specific index, such as the S&P 500 (stocks of the top U.S. companies). However, they differ in their structure and trading.

Index funds are investment funds, typically managed by investment companies, that are bought and sold at the end of the trading day at their net asset value (a set price for the entire day). ETFs, on the other hand, are traded on exchanges throughout the trading day, similar to individual stocks, and can be bought or sold at market prices (a floating price for the entire day).

Note: eToro is an investment platform that cannot control the market. The value of your investments may go up or down, so only invest what you can afford to lose.

eToro fees and commissions

In this review section, we will rely on eToro reviews and reviews to help determine the main fees when trading, buying, or simply holding an account.

1. Stamp duty

Typically, there is a 0.5% fee to buy shares on the London Stock Exchange.

2. Spreads (or “differences”)

eToro’s variable spread system – this means that the spread, which is the difference between the bid and ask price of an asset, will vary throughout the day. This will usually be a more competitive amount during busy market hours, such as when you are trading EUR/USD during the US-Europe cross. Of course, the spread will vary greatly depending on which market you wish to trade.

3. Deposit and withdrawal fees

eToro reviews and the official website state that the deposit service is free for US residents, while users from other countries are charged a 0.5% fee. While this isn’t ideal, keep in mind that you won’t have to pay any other ongoing fees when using eToro.

When it comes to withdrawals, eToro charges a flat fee of $5, which is charged regardless of how much you want to withdraw or the payment method you use.

4. Questionnaire inactivity fee

eToro's inactivity fee is $10 per month after 12 months of inactivity. Of course, if you buy or sell, then the inactivity fee will not be applied. Also, if your account balance is empty, then you don't need to worry about this fee (this fee is usually deducted from the account balance).

5. Nightly fee

If you decide to purchase assets like stocks or cryptocurrencies in the traditional sense, you don't have to worry about overnight financing. This fee only applies if:

- You are trading CFDs

- You keep your position “open” overnight

The amount you pay will depend on several variables, such as:

- Your bet

- The asset you are trading

- Amount of leverage applied (if any)

The good news is that you can view your overnight funding fee when you place an order on eToro, ensuring you always understand your trading costs.

eToro Fee Table

| Type | Tax amount |

| Opening an account | Free |

| Platform fee | Free |

| Inactivity fee | $10 per month after 12 months |

| Deposit | 0.5% for non-USD deposits |

| Withdrawal fee | $5 |

Overall, eToro has some of the lowest fees in the market. For example, there is no ongoing platform fee – meaning you can hold your investments for as long as you want without worrying about monthly or annual fees.

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

eToro Copy Tool

eToro reviews always mention this tool and its unique advantages - it is undoubtedly eToro's "flagship" product, as it paves the way for passive trading.

eToro Copy Tool - Example

- You invest $1,000 with an eToro trader who specializes in stocks;

- A trader allocates 10% of his portfolio to Microsoft shares and 15% to Facebook;

- This means that you automatically invest the appropriate proportion - $100 in Microsoft (10% of $1,000) and $150 (15% of $1,000) in Facebook;

- The trader exits his Facebook position and earns 50%;

- You also close the position – making a profit of $75 (50% of your $150 investment);

- A few days later, the trader also closes the Microsoft positions – this time the profit reaches 40%;

- You do the same thing – you make a profit of $40 (40% of your $100 investment);

So, this aspect of automated trading is very suitable for beginners. There is no need to spend extra time researching the financial markets and there is less risk of making mistakes.

It is important to note that with the eToro copy tool you always have full control over your portfolio, so you can add or remove assets according to your needs in real time. You can also stop copying a trader at any time. When you do this, all positions you have selected will be closed.

How to choose the right eToro trader to copy?

When you click on the “Copy People” button on the left side of your eToro account, you will have access to a large number of verified traders. As you can imagine, viewing each trader individually is beyond the scope of this article, so you will need to use the filter buttons.

To find a trader that meets your needs, financial goals and risk, you can use the following filters:

- Minimum ROI (return on investment) over a certain period of time, for example, 10% per year - usually, the higher the percentage, the better;

- Preferred asset class - select the asset class you are interested in, for example, stocks or cryptocurrencies;

- Risk score - “1” is the lowest risk and “6” is the highest risk;

- Average trading duration - if you want to have a long-term investment, then choose a trader who uses a similar strategy;

By setting filters, you will get the best matching profiles and you can take a closer look at the statistics.

For example, how much a trader has earned each month since joining the eToro website, what trades they are currently making, and the overall risk associated with the individual. You can also view how many eToro clients are copying a particular trader.

eToro's top traders 2026

Below are the three best traders to copy at the moment:

1. Jeppe Kirk Bonde – 30% average annual return since 2013.

This trader is based in the UK and has been using eToro since 2013. So, we have about 10 years of trading data to work with.

Jeppe Kirk Bonde earns an average annual return of 30%, meaning he has outperformed the broader financial markets.

Aside from a very small Bitcoin holding, Jeppe Kirk Bonde focuses on stocks. The trader increased his portfolio by 45% and 36% in 2019 and 2020, respectively.

2. Wesley Nolte – 650% return over the last 5 years

Similar to Jeppe Kirk Bonde, this eToro trader has excellent returns on the brokerage site. Simply put, Wesley Warren Nolte has earned over 650% in the last five years. It is important to mention that almost 20,000 clients copy this trader.

3. Viktor Pedersen – Successful eToro Swing Trader

Victor Pedersen, who goes by the username Miyoshi, is a trader based in Denmark. Although he only joined eToro in January 2018, he has already made over 103% in his first year of trading.

Viktor Pedersen is extremely active on eToro, averaging 48.45 trades each week. The average trading duration is just 1.5 weeks, and Victor Pedersen is aiming to “radically” outperform the popular S&P 500.

Note: For more information about the traders mentioned above, search for the username on the eToro website.

eToro Payments

The investment platform allows you to deposit funds via debit/credit card or e-wallet. The following payment methods are supported:

| Debit/credit cards | Visa Visa Electron MasterCard Maestro Local bank transfer (in certain countries) |

| E-wallets | Paypal Skrill Neteller |

Most deposits, except bank transfer, are processed instantly, meaning you can start trading straight away.

When it comes to withdrawals, eToro reviews state that you can withdraw funds using the same payment method you used to deposit money.

eToro Minimum Deposit - Can You Afford to Invest Today?

- The minimum deposit on eToro will depend on your place of residence;

- The minimum first deposit for most users is $200;

- If you are from the US or UK – it ranges from $10 to $50;

- Some countries have a minimum deposit of $1,000;

- Users from Algeria and Israel must deposit a minimum of $5,000 and $10,000 respectively;

- Corporate accounts require a minimum deposit of $10,000;

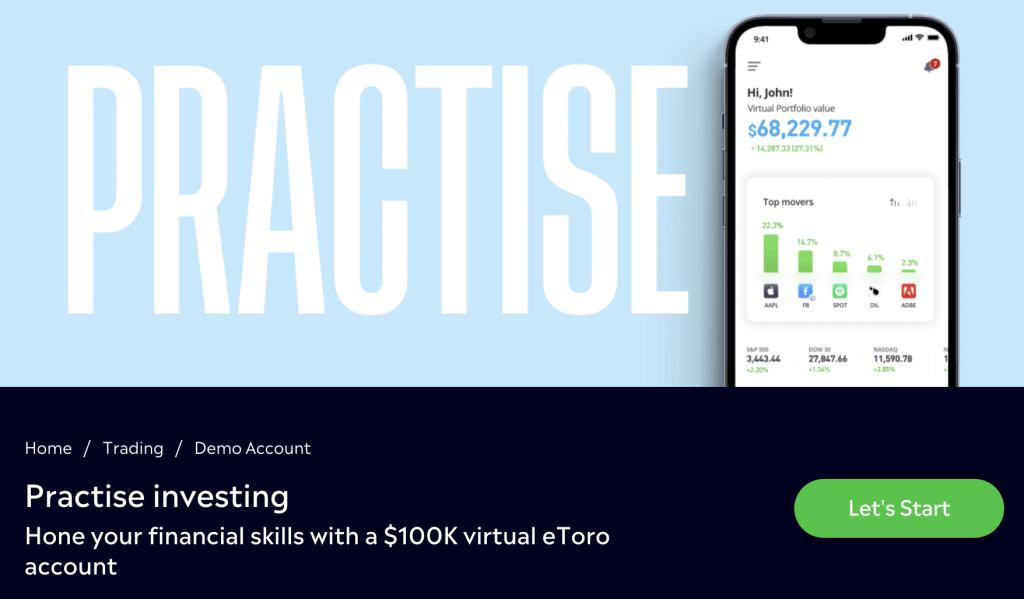

eToro Demo Account

- As soon as you sign up, you will have access to an eToro demo account (after switching from Real to Virtual).

- A demo account reflects real market conditions and you have access to all the same assets and order types.

- There are no time limits on the day trading demo account, so you can use it as long as you want.

- It is important to mention that you do not need to deposit funds or even upload an ID to use the demo account.

eToro Customer Service

According to eToro reviews, customer support is available 24/7. You can contact the team in real time via the live chat feature, which is accessible when you log in to your account.

eToro also accepts inquiries via email. Additionally, eToro is active on social media platforms like Twitter, which is another place you can look for help.

How to create an eToro account?

If you plan to join over 20 million traders, then follow the steps below to create an eToro account:

Step 1: Registration

Visit the eToro website and begin the account opening process. This will require you to enter some personal information - your name, home address, date of birth, national tax number and contact information.

Step 2: Verify your identity

As part of KYC, you will need to upload a copy of your government-issued ID. This can include a valid driver's license, passport, and in some cases, a national ID card.

You must also provide proof of residence, such as a recent bank statement or utility bill.

Step 3: Deposit funds and search for assets

Transfer funds to your eToro account.

If you know which asset you want to buy or trade, use the search box at the top of the page.

You can also manually view which markets are supported by clicking the 'Trade Markets' button.

Step 4: Invest

You will now need to fill out a simple order form to complete your investment purchase. Simply fill in the 'Amount' and 'Set Order' fields to complete the transaction.

Step 5 (optional): Sell

To sell your investments in the future, you need to go to your portfolio and find the relevant asset. Then, by clicking the "sell" button and confirming the order, you will execute the sale.

The funds will be transferred to your eToro cash account. You can use the funds to invest in other assets or withdraw them.

Our opinion on the eToro platform

eToro reviews and reviews have shown that this investment platform has many great features that will help investors of all levels trade. Already, over 20 million customers enjoy low fees and a wide range of asset classes - you can do the same by joining this platform for free and making your first deposit.

Note: eToro is an investment platform that cannot control the market. The value of your investments can go up or down, so only invest what you can afford to lose. Before you start trading, consider whether you understand how the market works and whether the type of investment you choose is in line with your strategy.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQ

Sources:What is eToro?

How does eToro make money?

What is the risk level of eToro?

Is eToro safe?