Tesla akcijos ir investavimas – kaip investuoti į TSLA 2026 metais?

In this guide, we will examine Tesla’s price and success story, discuss how to buy TSLA shares in 2026, and identify the best trading platforms that offer the lowest fees and the most convenient share purchase for investors of all levels.

[to]

[stocks_table id=”25″]

How to buy Tesla shares in 2026 – a quick guide

Step 1: Choose an online broker and create an investment account.

Step 2: Verify your account – Many brokers ask for ID, email, and phone number verification.

Step 3: Fund your account using a debit/credit card or bank transfer – many brokers have no minimum deposit amount or it can be as low as $10.

Step 4: Once you have created an account, search for the Tesla (TSLA) stock symbol. Click on the symbol to see key information and price movements.

Step 5: Place an order to buy TSLA shares – enter the amount or number of shares you want to issue and click “buy”.

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

What is Tesla?

Founded in 2003 by Martin Eberhard and Marc Tarpenning, Tesla is an innovative force in the automotive and clean energy industries. Later, with the addition of Elon Musk in 2004, Tesla Inc. has become synonymous with electric vehicles, renewable energy, and cutting-edge technology worldwide. The company is currently headquartered in Palo Alto, California.

Tesla gained widespread acclaim for the Tesla Roadster, followed by other popular models such as the Model S, Model 3, Model X, and Model Y. In addition to cars, Tesla has expanded into energy storage solutions with products such as the Powerwall, Powerpack, and SolarCity.

Tesla (TSLA) share price in 2022-2023

Tesla shares are traded on NASDAQ under the symbol TSLA. In recent years, the company has experienced significant volatility and attracted significant investor attention.

Tesla posted record revenue in 2022, with profits more than doubling to $12.6 billion for the year. However, with increased competition in the market and challenging economic conditions, 2023 was a different story, with the electric car maker’s third-quarter results falling short of expectations.

Tesla’s value fluctuations in recent years, source Nasdaq.com

According to CNBC , the company’s revenue was $700.00 below expectations at $23.4 billion, and earnings per share were 66 cents, compared to the forecast of 73 cents.

Also, vehicle deliveries decreased by 6% in the third quarter of the year and car prices were reduced.

These shortcomings have hit Tesla shares hard, with the company’s share price falling about 21% in the four weeks following the release of its third-quarter financials.

Is Tesla (TSLA) a good investment in 2026?

Those looking to buy Tesla shares in 2023 should be cautious, as the company’s rapid growth of the past decade is unlikely to be repeated.

But others remain optimistic, believing that Elon Musk has big plans for the company. Despite missing its third-quarter financial targets, the automaker’s market cap is still more than double that of Toyota, Ford, and General Motors combined. And while big swings have occurred regularly, Tesla’s stock price has continued to rise impressively.

Tesla’s ambitions and future prospects are also a key factor in this equation: a pickup truck, a semi-truck, a supercar, and fully autonomous cars (including taxis) are in development and already planned for release in the future.

Most importantly, the long-delayed Tesla Cybertruck will soon enter mass production, with first deliveries expected to begin in late November.

This year it’s Cyber Thursday

11.30.23 | 2pm CT pic.twitter.com/nFhbIJMoXi

— Cybertruck (@cybertruck) November 27, 2023

However, many have expressed concerns about rapidly rising global inflation and its impact on Tesla. While the automaker’s third-quarter revenue rose 9% year-over-year, its gross profit, operating and EBITDA margins fell more than 7%.

In conclusion, it can be said that investing in Tesla in 2023 can potentially bring profit, however, before making a final decision, it is worth carefully considering the company’s achievements and future challenges. While Tesla’s rapid growth may not be repeated in the coming years, the company’s market capitalization, ambitious projects and imminent product releases provide the basis for a profitable future.

Where can I buy Tesla (TSLA) shares?

Investors can buy Tesla shares on a variety of brokerage platforms, with eToro being one of the most popular choices. The low minimum deposit and support for fractional trading are particularly appealing to new buyers in the market.

Other popular choices include Pepperstone, XTB, and Webull, which are also well-known for their extensive trading options, user-friendly interface, and fee structure.

1. eToro – the best place to invest in Tesla (TSLA) shares

eToro is a social trading platform that offers access to a wide range of financial markets and asset classes. The broker offers competitive trading fees, with the option to trade ETFs for free.

The social trading platform means that users can interact with other investors on the eToro platform , similar to social networking sites.

Another unique advantage is the copy tool, which allows newly registered members to copy successful investors who generate profits. You only need to set the desired parameters and the platform can automatically perform the same trading and selling actions. Of course, the amount of money is optional and you do not have to invest as much as a person who has been trading for many years.

You can learn more here: eToro Reviews and Review 2023 – Is It Worth a Try?

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

2. Pepperstone – a platform that provides great security and convenience

Pepperstone is known for its reliability and user-friendly features suitable for trading across a variety of asset classes, including Forex, stocks, and cryptocurrencies. The broker boasts a global reach, although access is limited in the United States.

Pepperstone has extensive experience in the market and is noteworthy solely for its registration with the FCA and ASIC, which ensure a high level of protection for money transactions and the storage of personal data.

One of the most frequently mentioned benefits is Pepperstone’s customer service, available by phone five days a week, 24 hours a day, complemented by an extensive FAQ section for quick reference (although this service is only available on weekdays).

This trading platform also has MT4, MT5, and cTrader functionality, making it a great choice for traders seeking cost-effectiveness, convenience, and top-notch service.

Your capital is at risk. Additional fees may apply.

3. XTB – a long-time favorite in the stock market

XTB is a global CFD broker that has been a leader in international trading since its founding in 2002.

With extensive experience and offering high levels of client data protection and insurance, XTB is a safe choice for both beginners and experienced traders.

Providing access to a wide range of assets, XTB boasts over 3,900 stocks, numerous ETFs, 22 commodities, 42 indices and 49 forex pairs. Cryptocurrency trading is also popular here (around 30 are offered), including Bitcoin.

For users in specific regions, XTB allows direct purchase of shares, providing access to a wide selection of over 7,800 individual stocks and 150 ETFs covering prominent regional markets, including the Baltics.

Fees for regular transactions usually do not exceed 0.50%, making it a very affordable platform for everyone.

Your capital is at risk. Additional fees may apply.

4. Admiral Markets – Lithuanian-language trading platform with educational resources

Admiral Markets is a trading platform designed for those looking to improve their trading skills. It offers Forex trading, CFDs, and the buying and selling of stocks.

Admiral Markets, known for its user-friendly interface and variety of trading accounts, is particularly praised for its extensive educational resources. The platform offers unique features such as MetaTrader and StereoTrader, as well as well-known analytical tools such as Dow Jones News or Acuity Trading Sentiment Analysis. You will also have access to Forex signals on the platform .

The platform is regulated by ASIC, CySEC, FCA, New SRO, FSCA and JSC, which ensures a high level of trading and investment insurance.

In addition, Admiral Markets is one of the few platforms in Lithuanian, making it a great choice for those who want to start investing and fully understand every feature and step.

Your capital is at risk. Additional fees may apply.

5. Webull – a modern and affordable brokerage platform

Webull is a dynamic, commission-free trading platform that has become popular due to its intuitive design and advanced features. Launched in 2018, the platform offers a user-friendly interface, real-time market updates, and exceptional analytical tools.

With a focus on stocks and options, it is more geared towards experienced traders, although beginners can quickly learn to navigate the site. Webull stands out by offering free trades across a variety of asset classes, including stocks and ETFs. The platform supports extended trading hours, giving flexibility to active traders.

Webull is available as a mobile app and a browser-based website , making it an attractive option for those looking for a modern and accessible trading experience.

Tesla shares and buying them – how can you invest in TSLA?

If you want to buy Tesla shares, then follow these steps (we will use eToro in the example) and you will be able to start investing soon:

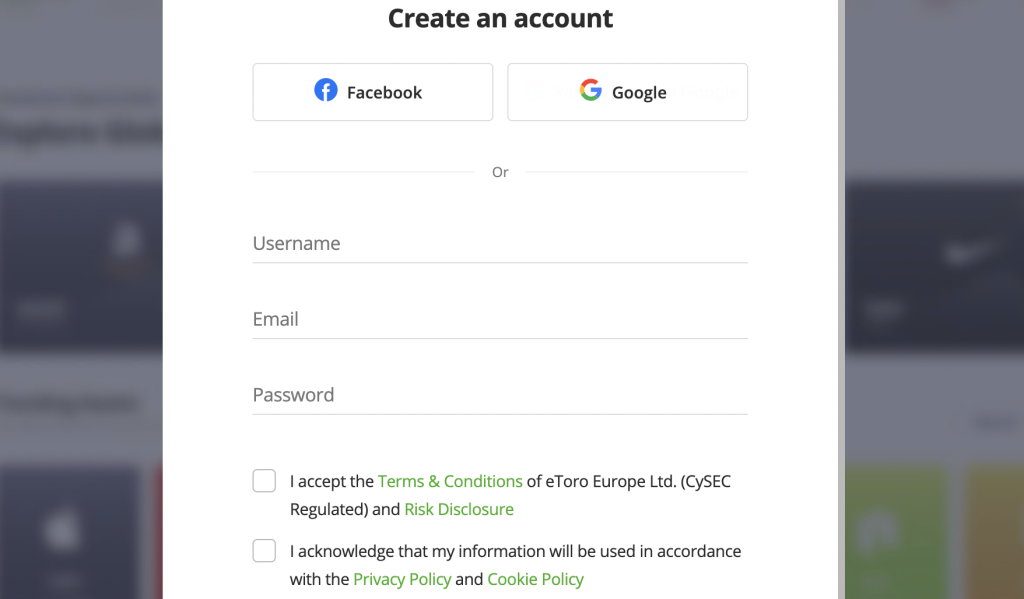

Step 1: Create an eToro account

Visit eToro and create a free account. Follow the on-screen instructions to activate your account. You may be asked to provide ID, email, and a phone number that you will need to verify.

Step 2: Fund your account

Once your newly created user account has been approved, you should now make a deposit, which will allow you to start investing. The minimum deposit amount (in Lithuania) is $50. Click on the “Add Funds” button in the left drop-down menu to open the deposit page. Several payment methods are available, including debit and credit cards, bank transfers and e-wallets , such as PayPal.

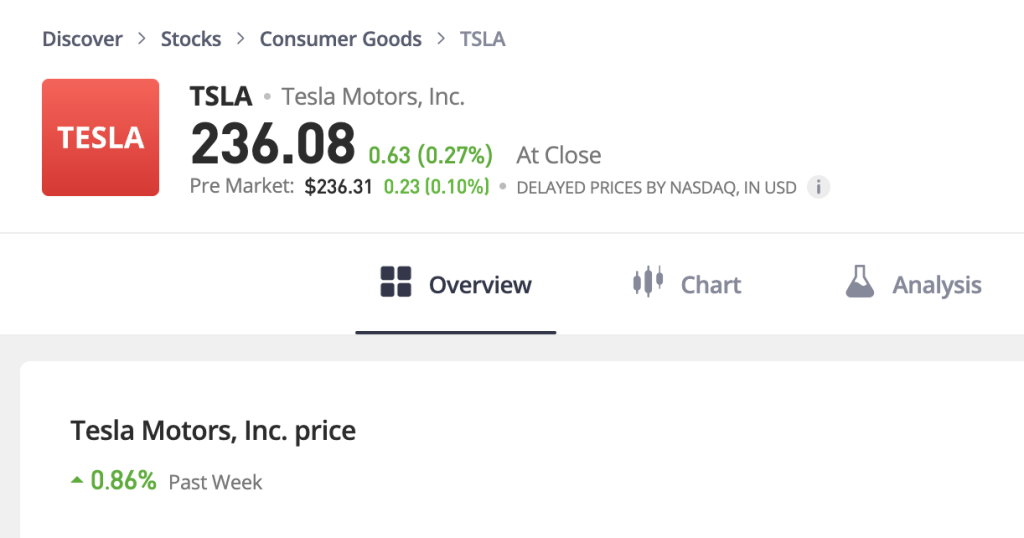

Step 3: Search for Tesla (TSLA) shares

Once you have deposited funds, you can search for the asset you are interested in, which in this case is Tesla shares. If you type Tesla or TSLA in the search bar, you will see a stock option, click on it. Here you can find the latest news related to Tesla, statistics, recent results and more.

Step 4: Start investing in Tesla shares

Select Tesla and click on the blue button labeled “Trade” to place your order. Then, fill out the order form and your Tesla position will be added. The shares you purchase will be automatically added to your eToro wallet – you can transfer them to another storage location if needed.

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

Tesla Stocks and Investing – Summary

To decide whether to invest in Tesla shares, you need to understand the company’s dynamic history and recent results. Despite the setbacks in the third quarter of 2023, Tesla’s survival success is clear – with a market cap exceeding $700 billion.

So, when assessing Tesla’s future potential, one must weigh the company’s market dominance, ambitious projects, and new product releases. Interested investors can buy TSLA shares on various trading platforms, including eToro, Pepperstone, XTB, and Webull.

FAQ

SourcesCan you buy Tesla shares directly?

How much does Tesla stock cost?

Is it worth buying TSLA now?

How to buy TSLA shares online?