Apple akcijos ir investavimas 2026 m. – gidas pradedantiesiems

In this guide, we’ll look at why Apple is the world’s leading company, what this year’s earnings were like, and why it’s (not) worth investing in AAPL. We’ll also show you how you can buy a lot or just a fraction of Apple stock by following a few important steps.

[to]

[stocks_table id=”25″]

[with_note]

How to buy Apple (AAPL) shares – a quick guide

Step 1: Choose an online broker and open an investment account

Step 2: Verify your account – Most brokers will require a government-issued ID, phone number, and email to complete the account creation process.

Step 3: Fund your account using a debit/credit card or bank transfer. Most often, the minimum deposit is up to $50.

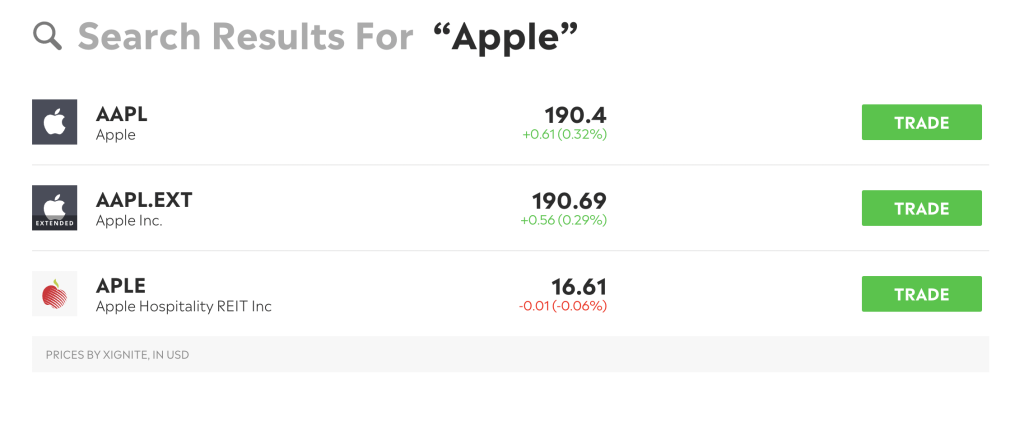

Step 4: Enter Apple or AAPL in the search box and click on the option – here you will find the most important information about the stock.

Step 5: Start your order – Once your account is funded, you can start shopping.

[/su_note]

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

What is Apple?

Apple is one of the most influential and valuable technology companies in the world. Headquartered in Cupertino, California, Apple is known for its innovation in electronics, software, and services.

The company’s iconic products include the iPhone, iPad, Macintosh computers, Apple Watch, and a host of software applications and services, such as the App Store, iTunes, and iCloud.

Apple’s success is often attributed to the company’s commitment to cutting-edge design, user-friendly interfaces, and a seamless ecosystem that integrates software.

The company consistently delivers strong annual results and boasts a large global customer base. The company’s shares, which trade on NASDAQ under the ticker symbol AAPL, are widely viewed as a blue-chip investment, attracting both individual and institutional investors.

Also read: Tesla shares and investing – how to invest in TSLA in 2023?

Apple (AAPL) stock price in 2023

The price of one Apple share in 2023 was impressive – at the beginning of the year it increased by 45%, and on June 25 it reached a record high of $ 195.38.

While Mac and iPad revenue fell 34% and 10% year-over-year, respectively, iPhone sales grew by about 3%, helping Apple avoid a decline in its overall annual profit.

Apple stock price this year, source Nasdaq.com

But Apple’s services business line (including Apple Music, Apple TV+, and the Apple Store) has been particularly profitable this year, generating record revenue of $85.2 billion, up 7.1% year-over-year. Apple’s services growth now outpaces both iPhone and the company as a whole.

Are Apple shares a good investment in 2023?

Despite a relatively slow growth period following the pandemic, Apple remains the largest company in the world by market capitalization ($2.976 trillion) and arguably the most influential player in the consumer technology industry.

Statistics for 2023 show that there are over 1.46 billion active iPhone users worldwide, and Apple Macs hold a rapidly growing share of the computer market (about one-fifth).

As one of the greatest commercial forces of the modern age, Apple has also expanded its influence in many key markets. The company is primarily growing in the audio (headphones and speakers), wearables, streaming, and cloud solutions markets.

Additionally, Apple is poised to become a major player in the virtual reality market, with the Apple Vision Pro set to be released in 2024. Talk of Apple entering the electric car market has also picked up steam in recent years, with the first model currently scheduled to be released in 2026.

While Apple’s market dominance and expansion into various sectors offer promising investment indicators, slower growth and increasing competition are concerns. The imminent foray into virtual reality and electric vehicles shows innovation, but other circumstances could pose risks.

Before making a decision on Apple stock, investors should carefully weigh these factors, considering the potential rewards and challenges.

Where can I buy APPL shares?

Investors can buy Apple shares through various online brokerage platforms, such as eToro, Pepperstone, XTB, and Robinhood. We will discuss each of them in more detail below:

1. eToro – the best platform to buy Apple (AAPL) shares

eToro is a popular trading platform that offers access to a wide range of markets and asset classes. The broker offers competitive trading fees with free trading on ETFs, and no account or deposit fees.

Source etoro.com

Since its launch, eToro has become the primary choice of over 20 million traders due to these and other important advantages,

Social trading is also available here, allowing users to interact with the community on the eToro platform, similar to social networking sites.

The minimum deposit for investors based in Lithuania is just $50 and there are no deposit or account fees, meaning Apple shares are easily accessible and suitable for beginners.

It is important to mention that eToro supports fractional trading in shares, which means that you can buy a fraction of a share according to the amount you want to invest.

Learn more: eToro Reviews and Review 2023 – Is it worth a try?

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

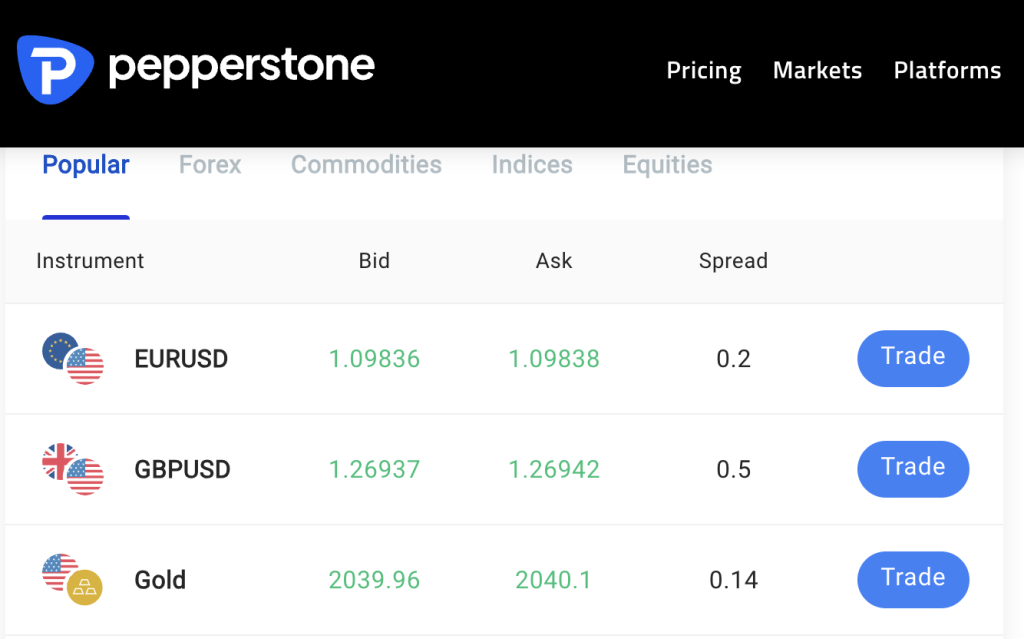

2. Pepperstone – a trading portal for those looking for versatility

The trading platform boasts advanced technology, competitive pricing and excellent customer service, and Pepperstone is regulated by the Australian Securities and Investments Commission (ASIC) and the UK Financial Conduct Authority (FCA).

Also, the broker’s suite of trading platforms includes cTrader, a specialized tool for Forex and CFD trading.

Pepperstone offers a variety of account options, including a demo account for beginners and a professional account tailored for experienced traders perfecting their strategies.

Traders can also take advantage of the broker’s educational resources, which include video tutorials, webinars, and detailed trading guides.

It is important to note that you cannot buy pure AAPL shares here. You can trade them as ETFs or CFDs.

Your capital is at risk. Additional fees may apply.

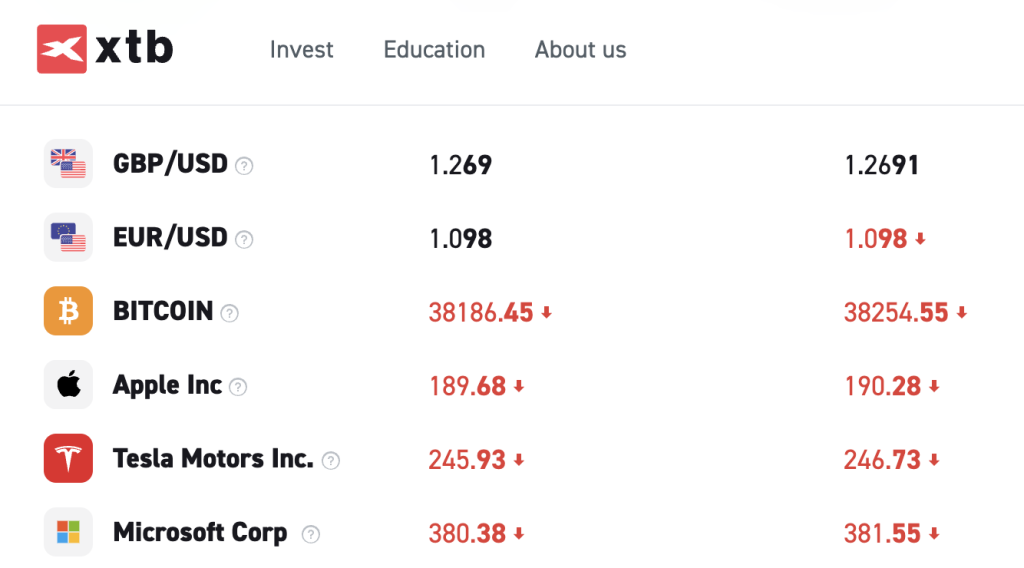

3. XTB – a market leader that offers a wide variety of asset types

XTB is a global CFD broker that has been a market leader for almost two decades.

Regulated by various global regulatory agencies, including the UK’s Financial Conduct Authority, and listed on the Warsaw Stock Exchange, XTB stands out as a reliable and safe choice for both new and experienced traders. The combination of regulatory compliance and successful results increases its appeal as a reliable trading platform .

The XTB platform offers a wide range of assets from cryptocurrencies to commodities, making it highly sought after in the trading space. The wide range of trading tools, research capabilities, and advanced charting features are suitable for traders of all levels.

The platform’s research capabilities are especially useful for novice traders who may lack the resources or experience to conduct in-depth analysis.

XTB customer service adds another advantage, and accessibility and quick response are key advantages. Effective customer service sets XTB apart from other platforms, ensuring users get quick resolution to their issues.

While offering the flexibility to trade stocks in certain regions, XTB emphasizes responsible trading by not allowing leverage in these transactions and not guaranteeing order execution.

Your capital is at risk. Additional fees may apply.

4. Admiral Markets – stock investments for beginners in Lithuanian

Admiral Markets stands out as a trading platform tailored for those looking to expand their knowledge. As an established company, it offers a variety of financial products, including Forex trading, CFDs and shares.

Known for its user-friendly interface and variety of trading accounts, Admiral Markets is particularly praised for its extensive educational resources. The platform also offers unique features such as MetaTrader, StereoTrader and Supreme, along with top-quality analytical tools such as Dow Jones News, Acuity Trading Sentiment Analysis and Forex Signals .

It is important to mention that the platform is regulated by institutions such as ASIC, CySEC, FCA, New SRO, FSCA and JSC, so Admiral Markets ensures a safe trading environment with insured investments.

Also, this portal is one of the few that is available in Lithuanian.

Your capital is at risk. Additional fees may apply.

How to invest in Apple (AAPL) shares?

Investing in stocks often consists of four main steps: opening a trading account, verifying your identity, depositing funds, and purchasing shares .

Here is a quick guide on how you can buy Apple shares (we are using eToro in the example):

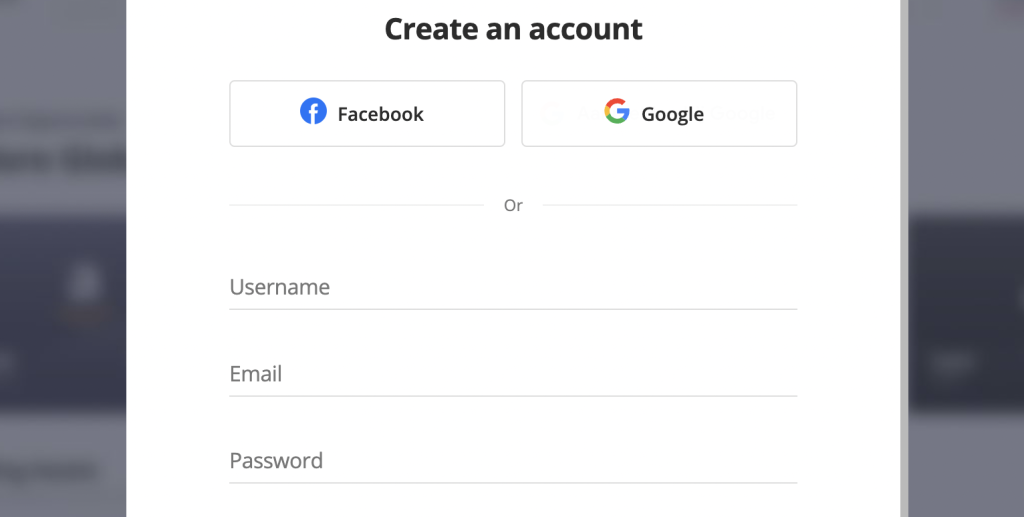

Step 1: Create a new account

First, you need to visit the eToro website and create a free account. Click the “Sign Up” button and follow the on-screen instructions. Here you will be asked to provide minimal personal and contact details.

Step 2: Verify your account

Now that you have created your account, you need to verify it before you can add funds. To complete this process, you will need to provide a document. A driver’s license or passport is a form of ID, while a utility bill or bank statement is a form of proof of address. eToro usually verifies these documents within minutes of receiving them.

Step 3: Fund your account

Once your account is successfully verified, you will be able to deposit money. The minimum deposit amount for users in Lithuania is 50 USD.

Click on the “Add Funds” or “Add Money” button in the left drop-down menu to open the deposit page. Several payment methods are available at eToro, including debit and credit cards, bank transfers, and e-wallets such as PayPal.

Step 4: Buy shares

Search for the Apple stock page using the search box (type Apple or AAPL and press “Enter”).

Once you open the page, you will find the latest news, statistics, charts with stock performance and more. To purchase shares, log in (if you haven’t already) and fill out the order form. Your AAPL long position will be added (you will purchase shares).

Apple Stocks and Investing in 2026 – Summary

APPL shares currently remain the most popular and profitable choice for both new and experienced investors. However, before making investment decisions, we recommend carefully evaluating the company’s price history, future goals, and familiarizing yourself with the forecasts made by specialists.

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

FAQ

SourcesCan I buy shares directly?

How can I buy shares?

Does Apple pay dividends?

Is it better to invest in Apple Inc or Tesla Inc?