Amazon akcijos ir investavimas – kaip investuoti į AMZN 2026 metais?

Despite its setbacks in the early 2000s, Amazon surpassed the $1.49 trillion valuation in 2007 and is now one of the most attractive investments on the market. With that in mind, the question of how to buy Amazon stock in 2024 is a constant in the novice community. In this guide, we’ll examine Amazon’s price history, list the best trusted brokers, and show you how you can buy Amazon stock.

[to]

What is Amazon?

Amazon.com, an online bookstore founded by Jeff Bezos in 1994, has grown into a global e-commerce and technology giant. Headquartered in Seattle, Washington, Amazon has expanded its business far beyond its original plans to become the world’s largest online retailer.

Amazon’s e-commerce platform serves millions of customers worldwide , offering a wide selection of products and facilitating the activities of third-party sellers. The company’s range of products and services spans e-commerce, music, artificial intelligence and other industries.

The company’s cloud computing division, Amazon Web Services (AWS), is a major player in the cloud services industry, providing infrastructure and services to businesses and organizations.

Amazon’s success is determined not only by its wide product offering, but also by its commitment to customers, innovation, and investment in new technologies.

Amazon (AMZN) stock price in 2026

The company’s shares, which trade on NASDAQ under the symbol AMZN, have historically been one of the most sought-after investments in the market.

Despite the unprecedented disruption caused by COVID-19, the company’s stock value reached an all-time high of $186.12 in July 2021 (preceded by a decline in 2020).

However, in 2022, stocks lost as much as 50% of their value – their worst annual performance since 2000.

While Amazon shares have failed to return to their pandemic-era record highs, investors who acted during the 2020 market downturn are now rewarded, with share prices up nearly 65% over the past year.

Is Amazon a good investment in 2026?

A $1,000 investment in Amazon shares 10 years ago would be worth almost $12,000 today. But does that mean that novice investors should still be buying Amazon shares in 2024? Is it still possible to make such profits?

Experts say prospective investors should be wary of potential fees from Amazon’s platform and competition, which also remains a major threat to Amazon’s business. The company’s success in recent years has led to fundamental changes in the world of e-commerce, and competitors such as Wal-Mart, Best Buy and Home Depot have been forced to improve their online offerings.

The same goes for Amazon’s cloud infrastructure business, Amazon Web Services (AWS), which is facing increasing pressure from Microsoft Azure and Alphabet’s Google Cloud Platform. According to CNBC, both players saw revenue growth of 29% and 22%, respectively, in the third quarter of 2023. This was reflected in Amazon’s slightly slower growth from 2021.

Despite these potential threats, Amazon still remains one of the world’s most productive companies, and its net income more than tripled in the third quarter this year.

Amazon is also poised to capitalize on the current AI boom. The company not only offers machine learning and generative AI technology as part of its cloud computing business, but is also integrating AI into its e-commerce offerings.

Where can I buy Amazon shares?

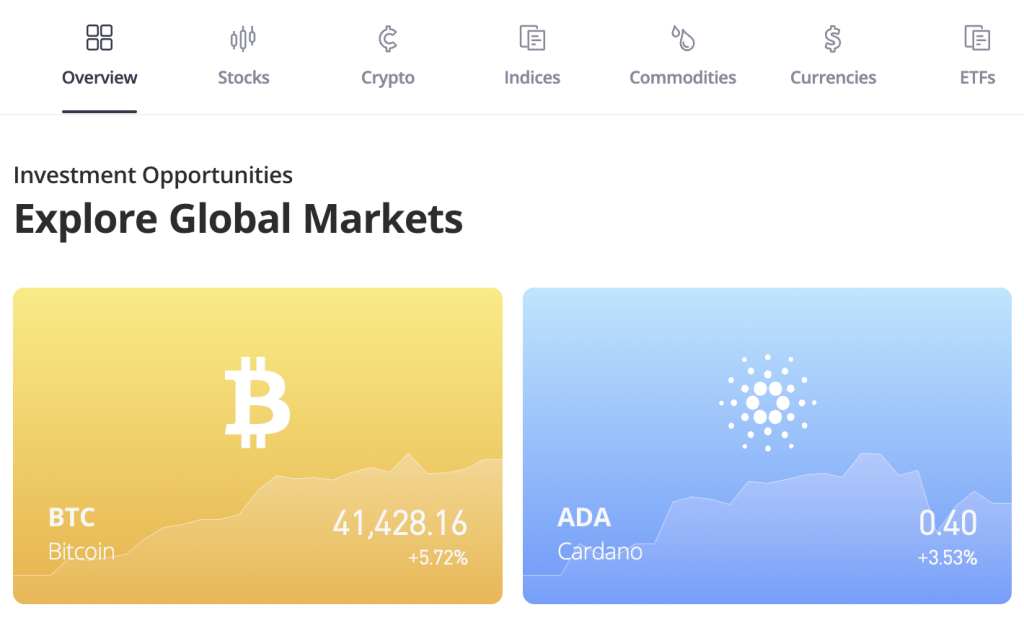

Investors can buy Amazon shares using a variety of brokers .

eToro is one of the most popular options, offering a user-friendly interface, low minimum deposits, and fractional trading. These factors also contribute to the platform’s accessibility for beginners.

1. eToro – stock investments

eToro , a widely recognized trading platform, is renowned for its intuitive user interface, which has attracted millions of users since its inception.

The platform also goes beyond traditional trading, encouraging social trading and offering a Copy Trading tool that creates a community-oriented atmosphere reminiscent of social media.

With a low minimum deposit, affordable share trading, and no account fees, eToro is an economical entry point for investors. The beginner-friendly broker is especially suitable for those who are just starting out in investing and want to have like-minded people around.

Advantages

Disadvantages

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

2. Pepperstone – stock trading for investors of all levels

Founded in 2010, Pepperstone Group has become a leading trading platform specializing in Forex, stocks, indices, metals, commodities and cryptocurrencies. It is an exclusive online brokerage platform known for its wide range of investment options and a wide range of services. Known for its reliability, this platform is suitable for traders of all levels.

Recognized for its exemplary customer service, Pepperstone is regulated in the United Kingdom and is registered with the FCA (No. 684312) and ASIC (No. 147055703). The firm provides additional protection for client accounts through segregation, and customer support is available 24 hours a day, 5 days a week, by phone or through the FAQ section.

It is noteworthy that Pepperstone does not accept traders from the United States.

Pepperstone outperforms most Forex brokers worldwide with its customization across MT4, MT5 and cTrader. In conclusion, Pepperstone is a good choice for traders looking for cost-effective trading, a variety of account options and efficient customer service.

Advantages

Disadvantages

Your capital is at risk. Additional fees may apply.

3. XTB – a modern and affordable brokerage platform

XTB is a dynamic trading platform known for its intuitive design and advanced features, with no commissions. Since its launch in 2002, the platform has grown in popularity and continues to serve thousands of clients.

XTB is considered a reputable global CFD broker as it is regulated by various agencies around the world, ensuring the safety and insurance of any capital invested in businesses or digital assets.

With a long and successful track record combined with regulatory compliance, XTB has become a favorite choice for both beginners and experienced traders. XTB's extensive offering includes over 3,900 stocks, numerous ETFs, commodities, indices, cryptocurrencies and Forex pairs.

The advantages of choosing XTB include a user-friendly interface, no commissions, very low fees, a variety of asset classes, and the company's extensive experience in this field.

Advantages

Disadvantages

Your capital is at risk. Additional fees may apply.

How to buy Amazon shares?

Below are the main factors for buying Amazon shares (we use eToro in the example):

Step 1: Create a new account

To invest in Amazon shares, log in to the eToro website and create a free account. Click "Sign Up" and follow the on-screen instructions.

Step 2: Verify your identity

Submit a document for verification. A driver's license or passport is proof of identity, and a utility bill or bank statement is proof of address. eToro typically verifies these documents within minutes of submission.

Step 3: Fund your account

After successfully verifying your account, deposit funds into your account. The minimum deposit for users in Lithuania is $50. Access the deposit page by clicking on “Add Funds” or “Add Money” in the left drop-down menu. eToro supports a variety of payment methods, including debit and credit cards, bank transfers, and e-wallets such as PayPal.

Step 4: Buy shares

Search for Amazon stock by typing Amazon or AMZN in the search box and pressing "Enter." Select the option you're interested in, usually the first one. Click the green "Trade" button to open the trading page.

On the trading page you will find the latest news, statistics, charts and other information. Log in (if you are not already logged in) and fill out the share purchase order form. After purchasing shares, you will be able to find them in your account wallet.

Our verdict on Amazon (AMZN) shares

In conclusion, investing in Amazon shares should be successful, but it is important to remain critical and cautious and to conduct personal market research. For those looking to buy Amazon shares, eToro is probably the best option - with competitive fees and a low minimum deposit, it is an ideal environment for beginners.

FAQ

SourcesCan I buy AMZN shares directly?

How much will one share of AMZN be worth in 5 years?

Is it worth buying a single share?

Does Amazon pay dividends?