Akcijų pirkimas Lietuvoje 2026 – kaip investuoti į akcijas?

Buying shares is a simple and easy-to-understand process, where one of the most important components for success is the right trading platform. In this guide, we will show you how you can start investing in shares and review the most popular brokers that offer the best conditions and the lowest fees.

[to]

Buying shares in Lithuania – the best trading platforms

Let’s compare some of the best investment platforms on the market based on the tools offered, asset classes, and, of course, fees:

[stocks_table id=”21″]

[with_note]

A brief guide to buying and selling stocks

Let’s quickly review the process of buying and selling shares:

- Create your account – start by creating a trading account on your chosen platform and complete the registration process.

- Verify your ID – Then, verify your identity by presenting your driver’s license, passport, or other ID.

- Deposit Funds – Deposit funds to use as your initial investment using one of the many supported payment methods.

- Invest in stocks — finally, find the stocks you want to buy on your chosen platform, then enter the amount you want to trade and confirm your transaction.

Below you will find a detailed explanation and tips for each step.

[/su_note]

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

Step 1 – Buying shares and a broker

To start investing in the stock market, users often need to choose a broker. Below we will provide brief reviews that discuss the features, fees, and digital assets offered by the best platforms on the market:

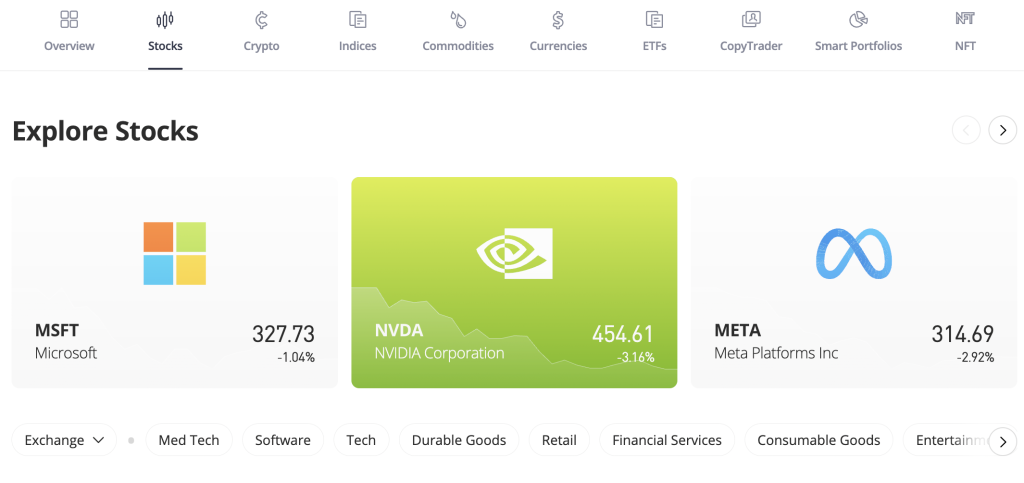

1. eToro – buying stocks on the best market platform

The first investment platform on our list is eToro , a trading platform available in over 140 countries and serving over 26 million users.

eToro offers access to over 2,400 global markets and buying company stocks is available (including Apple and Tesla shares ). The platform does charge spreads, but they are very small and quite affordable.

eToro also offers a wide range of services, including automated trading, where you can set specific parameters and let the software do the trading for you, as well as social trading. Another feature it offers is copying, or the ability to find a professional trader who is trading the stock you are interested in and then copy their actions.

eToro is also regulated by CySEC (Securities Authority), FCA, ASIC, ensuring safe buying and selling. Additionally, if you want to further diversify your portfolio, it also offers a range of other assets including cryptocurrency trading, ETFs (such as the S&P 500), indices and more.

Learn more: eToro Reviews and Review 2023 – Is it worth a try?

| Buying shares | 1$ |

| Buying cryptocurrency | Spread, 0.75% for Bitcoin purchases |

| Inactivity fee | $10 per month after one year |

| Cash withdrawal | $5 |

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

2. Pepperstone – a smart broker with many years of experience

Pepperstone is known for its reliability and user-friendly features. It makes it easy to trade across a variety of asset classes, including Forex, stocks, and cryptocurrencies. The site can be accessed from anywhere in the world except the United States.

It is important to note that Pepperstone is FCA and ASIC registered. The company also refrains from using client investments for its own purposes, adding an additional layer of client protection.

A big advantage of Pepperstone is its reliable customer service by phone, which is available five days a week, 24 hours a day. You can also find essential answers in the FAQ section at any time.

In summary, Pepperstone offers a variety of account types, competitive pricing, and smart platforms (MT4, MT5, cTrader). This trading platform is a great choice for traders looking for cost-effectiveness and top-quality service.

Learn how to buy Amazon shares using the Pepperstone platform.

| Buying shares | Tax-free |

| Buying cryptocurrency | Up to 0.50% |

| Inactivity fee | None |

| Cash withdrawal | Free |

Your capital is at risk. Additional fees may apply.

3. XTB – a stock exchange with many years of experience

XTB , a global CFD broker with main locations in London and Warsaw, has been serving the international trading community for almost two decades since its founding in 2002.

XTB’s long-standing experience and commitment to regulatory compliance prove it is a safe choice for both beginners and experienced traders. Any capital invested in XTB is protected and insured due to its regulatory status.

The platform offers access to a variety of assets, including over 3,900 stocks, numerous ETFs, commodities, precious metals (gold, silver, and others), indices, cryptocurrencies, and forex pairs.

Direct share purchases are allowed for users in certain regions. In such accounts, XTB provides access to a wide selection of over 7,800 individual stock exchanges and 150 ETFs covering the major markets of the Baltics and other regions.

| Buying shares | Tax-free |

| Buying cryptocurrency | Up to 0.50% |

| Inactivity fee | $10 per month after one year |

| Cash withdrawal | Free withdrawals over $100 |

Your capital is at risk. Additional fees may apply.

4. Admiral Markets – Smart Online Broker

Admiral Markets is an online trading platform with many years of experience, based in Estonia. The platform allows you to trade Forex , CFDs and stocks. The broker is famous for its user-friendly interface, various trading accounts and a wide range of educational resources.

Distinguishing itself in a competitive market, Admiral Markets offers smart features such as MetaTrader, StereoTrader and Supreme suite. These features are complemented by premium analysis tools including Dow Jones News, sentiment analysis from Acuity Trading and trading signals.

It is worth noting that Admiral Markets can be used as an educational platform, making it an ideal choice for those who are eager to learn the basics of investing.

The platform is regulated by authorities such as Australia’s ASIC, Cyprus’ CySEC, UK’s FCA, Canada’s New SRO and South Africa’s FSCA. In addition, Admiral Markets offers innovative risk management tools and competitive pricing.

| Buying shares | 0.15% |

| Buying cryptocurrency | 0.5% |

| Inactivity fee | $10 per month after two years |

| Cash withdrawal | Up to 3.50% |

Your capital is at risk. Additional fees may apply.

5. Skilling – many asset classes in one place

The platform’s minimum investment is $100, which may be a bit too much for beginners.

The great thing is that you can practice trading as much as you want on the demo account, and when you’re ready, you can even trade with leverage. In total, this platform has over 800 financial instruments and also has a copy tool.

| Buying shares | 0.05% |

| Buying cryptocurrency | 0.1% + administrative fee |

| Inactivity fee | $10 per month after one year |

| Cash withdrawal | Up to 2.9% |

56% no patēriņa investoriem zaudē naudu tirgojot CFD šajā vietnē.

Step 2 – Buying and researching stocks

If you have already chosen a trading platform, then let’s take a closer look at what buying shares is and what you should know before you start?

First, determine your investment goals. Determine whether you are looking for long-term growth, income, or a combination of both. Your goals will guide your stock selection.

Then, familiarize yourself with basic financial concepts such as price-to-earnings (P/E) ratio, earnings per share (EPS), and dividend yield. These ratios help you evaluate the value of a stock.

Company analysis is also very important. Examine the company’s financial health, business model, and industry. Examine annual reports, financial statements, and press releases. Pay attention to revenue, earnings, debt levels, and competitive advantages. Analyze competitors and market trends to assess growth potential.

Review reports and recommendations from financial analysts. These reports can provide valuable insights into a company’s performance and future prospects.

Income-oriented investors should consider a company’s dividend history, payout ratio, and dividend growth potential. Also, be sure to consider the risks associated with the stock, including economic, industry-specific, and company-specific risks. Make sure the stock you’re buying fits your risk tolerance, capital, and investment goals.

Remember that stock research is an ongoing process, so it’s important to stay informed about your investments . Diversification and disciplined decision-making are the foundation of successful stock investing.

Step 3: Buying stocks for beginners

Now you have the foundation to successfully start trading stocks. Below are the steps to help you create an account and invest:

Step 1: Open your trading account

Go to the homepage of your chosen broker (we are using eToro in our example) and start the account setup process. You will need to fill in your personal details, including your name, email address, and mobile phone number.

Step 2: Verify your identity

Most of the most popular brokers are regulated, so users may need to verify their accounts. To do this, simply upload your ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents are uploaded, your broker should verify them within a few minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support one or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- Electronic wallet

Select your preferred payment method and transfer funds to your account.

Step 4: Buying shares

Kai jūsų sąskaita bus apmokėta, ieškokite akcijų, kurias norite įsigyti. Radus tinkamą variantą, įveskite operacijos sumą ir patvirtinkite pirkimą.

Sveikiname – jūs investavote!

Greitieji investavimo mokymai pradedantiesiems

Žemiau pateikti greitieji investavimo mokymai pradedantiesiems paruoš pagrindus, kurie užtikrins, kad akcijų pirkimas būtų sėkmingas ir rezultatyvus. Sužinokite daugiau apie rinką, dividendus, akcijų biržą, CFD ir dažniausiai daromas investavimo klaidas.

Kas yra akcijos?

Pirmiausia atsakykime, kas yra akcijos. Akcijos yra vertybinis popierius, kuris sudaro dalį korporacijos. Įsigijęs akcijų prekybininkas tampa daliniu įmonės, kurios akcijas įsigijo, savininku.

Akcijų pirkimas suteikia pirkėjui teisę į dalį įmonės turto, taip pat į pelną, lygų akcijų vertei. Akcijų vienetai vadinami “akcijomis” ir perkami biržose, keityklose arba privačiai parduodant.

Kodėl svarbu atlikti tyrimą prieš pradedant?

Nors akcijų rinka nėra tokia nepastovi kaip kriptovaliutų pramonė, visada yra tikimybė, kad kai kurios įmonės pralenks daugelį kitų. Žinoma, yra ir priešingai – neigiamų pokyčių atveju įmonių akcijų vertė gali pradėti kristi. Štai kodėl esminė analizė yra labai svarbi ilgalaikei prekybai akcijomis.

Kas yra akcijų dividendai?

Kai kurios bendrovės nori atlyginti savo akcininkams už tai, kad jie išlaiko savo akcijas. Tai padeda sukurti teigiamą įvaizdį įmonės įvaizdį rinkoje – tai parodo, kad akcininkai tiki įmonės sėkme. Tuo tarpu akcininkai gauna pasyvias pajamas ir gauna papildomų grynųjų pinigų tiesiog mainais už akcijų laikymą.

Žinoma, ne visos įmonės tai daro, todėl investuotojai turi patikrinti, ar įmonė, kurios akcijomis jie domisi, moka dividendus.

Akcijos ir CFD – panašumai ir skirtumai

Neretai akcijos kartu su CFD yra maišomos, ir pradedantiesiems yra sunku suvokti pagrindinius kiekvieno investavimo būdo privalumus ir trūkumus. Greitai aptarkime šias dvi investavimo strategijas.

CFD yra investicija, kuri naudojama pirkti/parduoti akcijas ir vertybinius popierius neprisiimant teisių į realų turtą.

Prekyba CFD (dar žinoma kaip “sutartis dėl skirtumo”) ir akcijų pirkimas yra panašūs tuo, kad abu leidžia investuotojams pasipelnyti iš turto kainų pokyčių.

Abu susiję su galimu pelnu ir nuostoliais bei abu gali būti naudojami ilgalaikiam investavimui arba trumpalaikei prekybai. Be to, tiek CFD, tiek akcijos pasiekiami per internetinės prekybos platformas.

Pagrindiniai skirtumai tarp akcijų ir CFD yra šie:

- Nuosavybė: akcijos atspindi faktinę nuosavybės teisę įmonėje, o CFD yra sutartys, kurios seka pagrindinio turto kainą.

- Svertas: CFD dažnai apima finansinį svertą, leidžiantį prekiautojams kontroliuoti didesnes pozicijas su mažesniu kapitalu, o akcijos paprastai neapima sverto.

- Dividendai: Akcininkai gali gauti dividendus (papildomą uždarbį), kurie yra bendrovės pelno dalis, o CFD prekiautojai negauna dividendų, nes jiems nepriklauso pagrindinės akcijos.

Ką geriau pasirinkti – akcijas ar CFD?

Daugelio specialistų nuomone, akcijos yra tinkamesnis pasirinkimas naujiems investuotojams dėl savo paprastumo, nuosavybės teikiamos naudos ir ilgalaikio potencialo. CFD dažnai reikalauja daugiau laiko ir išsamesnio tyrimo, tad norintieji išmėginti turėtų atidžiai atlikti rinkos analizę.

Kokių savybių reikia norint tapti sėkmingu prekybininku?

Be žinių ir patirties, svarbiausi treideriui būdingi bruožai yra disciplina ir emocinis tvirtumas. Drausmė yra būtina norint laikytis savo prekybos strategijos kasdienių iššūkių akivaizdoje; be prekybos drausmės maži nuostoliai gali virsti didžiuliais.

Charakterio tvirtumas yra reikalingas norint atsigauti po neišvengiamų nesėkmių ir blogų prekybos dienų, kurios pasitaikys kiekvieno prekybininko karjeroje. Prekybos sumanumas yra dar vienas būtinas prekybos sėkmės bruožas, tačiau jis gali būti tobulinamas augant žinioms ir patirčiai.

Dažniausiai daromos investavimo klaidos

Pradedantieji investuotojai dažnai daro keletą įprastų klaidų pirkdami akcijas, kurios gali turėti įtakos jų investavimo rezultatams. Žemiau pateikiamos dažniausios klaidos padės suprasti, į ką verta atkreipti dėmesį, ir tokiu būdu iš anksto apsisaugoti nuo ateityje tykančių pavojų:

1. Tyrimų trūkumas: nesugebėjimas ištirti ir suprasti perkamų akcijų yra dažna klaida. Labai svarbu ištirti įmonės finansinę būklę, jos pramonę ir platesnes rinkos tendencijas.

2. Nėra diversifikacijos: visus savo pinigus investuoti į vienas akcijas arba nedidelį akcijų skaičių gali būti rizikinga. Diversifikavimas arba investicijų paskirstymas įvairiems turtams gali padėti valdyti riziką.

3. Rizikos tolerancijos ignoravimas: kai kurie pradedantieji investuoja per daug agresyviai, neatsižvelgdami į savo rizikos toleranciją. Labai svarbu suderinti savo investicijas su savo gebėjimu ir noru valdyti riziką.

4. Emocinis sprendimų priėmimas: leidimas emocijoms, tokioms kaip baimė ar godumas, paskatinti investicinius sprendimus, gali sukelti impulsyvius veiksmus. Svarbu išlaikyti racionalų protą, jei siekiate ilgalaikių tikslų.

5. Sekti populiarumą: dažna klaida yra sutelkti dėmesį į akcijas, kurios šiuo metu yra populiarios arba patenkančios į antraštes, o ne atsižvelgti į jų ilgalaikį potencialą. Dažnai geriau investuoti į įmones, turinčias tvirtus pagrindus.

6. Išlaidų nepaisymas: neatsižvelgus į sandorio išlaidas ir mokesčius, gali sumažėti investicijų grąža. Svarbu suprasti ir sumažinti šias išlaidas.

7. Lack of a clear strategy: Buying stocks without a clearly defined strategy or financial goals can lead to aimless decisions. A clear plan helps investors stay the course.

8. Impatience : A common mistake is to expect quick profits. Successful and profitable investing usually requires a long-term perspective.

9. Lack of continuous learning: Failure to continuously learn about the stock market and the general economy can be a hindrance. The financial environment is constantly evolving, so investors should constantly update their knowledge and adapt a new strategy (if necessary).

How to manage risk?

When you are dealing with real money, you need to consider position and risk management. Typically, risk management methods vary in complexity and depend on your specific strategy, but there are some general trading principles.

Know your entry and exit points and stick to them unless you have a good and objective reason to change them. Set your stop loss and take profit alerts accordingly (this is very useful when using a mobile app). Cut your losses early and avoid the emotional urge to take on more and more risk in the hope of “eating out” your losses. Most importantly, don’t panic.

If you are building a long-term buy/hold portfolio, buying different stocks or cryptocurrencies (diversification) can reduce overall risk without sacrificing expected returns. Also, consider when you should rebalance your portfolio.

What are the main differences between trading and investing?

The main differences between trading and investing are:

- Investment period : This can span years or decades, as the goal is long-term wealth accumulation, while trading covers a much shorter period – often from less than a day to a few months;

- Number of transactions : Since investing typically involves buying and holding, the number of transactions is typically much lower than in trading, where frequent transactions are the norm;

- Type of Transactions : Investing typically involves only long positions, while trading can involve both long and short positions to benefit from larger and smaller market movements.

In short, investing is a long-term option that often requires a lower time investment, while stock trading, while more time-consuming, can be a more profitable and faster short-term investment.

Buying shares in Lithuania – summary

Buying stocks is one way to invest your money for the short and long term. It can be done very simply – choose an investment platform (our experts recommend eToro ), create an account, do research on the product you are interested in and buy stocks. Over time, watch the growth, use the investment training above and, when the time comes, sell at a higher price.

Before you start investing, it is important to familiarize yourself with the market characteristics on the stock exchange, comparing not only the US and European markets, but also other foreign markets. Remember that risk always remains, so invest only what you can afford to lose.

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

FAQ

SourcesWhat is a stock?

How can I earn dividends from stocks?

With what amount can I start investing in stocks?

What is the best strategy for investing in stocks?