Akcijų birža ir geriausios platformos 2026 metais

If you are wondering which stock exchange is most convenient to use at home, then we invite you to familiarize yourself with the best platforms that can offer low transaction fees, various asset classes, and smart tools and features that make your investments easier.

[to]

Stock Exchange in Lithuania – comparison

To compare the best platforms – take a look at the key features of each provider, including smart tools, fees, payment options, and more:

[stocks_table id=”17″]

[with_note]

Stock exchange and most popular platforms in 2026

Below you will find the most popular platforms for online stock trading as of 2026. You can scroll down and read a separate review of each provider to find out which one best meets your expectations:

- eToro is a trading platform that allows users to trade a variety of assets, including stocks, cryptocurrencies, Forex, gold , silver, and other commodities. It stands out for its smart features that allow users to follow and copy the trades of experienced investors, making eToro particularly attractive to beginners.

- Pepperstone is a smart broker offering MetaTrader. Here you can trade stocks, Forex, cryptocurrencies and other assets. There is no minimum deposit and the account is completely free (no inactivity fee).

- XTB is a trading broker known for its low fees and excellent offerings, including Forex, indices, stocks, commodities and cryptocurrencies. It provides a variety of trading tools and learning resources to help traders make informed decisions.

- Admiral Markets is a platform that offers access to a wide range of financial instruments. It emphasizes risk management and often provides traders with educational resources. It is important to note that Admiral Market has a trust score of 95 out of 99, which only proves its solid reputation in the market and ensures security when trading.

- Interactive Brokers is a well-known brokerage firm known for its advanced trading capabilities. This broker is recommended for experienced investors who have access to a wide range of asset classes, advanced trading tools, and research resources.

- TD Ameritrade is a platform that offers a wide range of investment products. TD Ameritrade is regulated in many countries, so you can access a wide variety of stock exchanges. It is important to note that the platform only supports bank account transfers, although the latter are very fast.

- IG is a world-class online trading platform that offers access to a variety of markets. You can trade with IG on the official platform (web) and MT4, which is available on mobile.

- Fidelity is a respected financial services company that offers a wide range of investment options. The platform is particularly well-known for its retirement planning and investment management services.

- Trading 212 is an online broker that offers commission-free trading in stocks, ETFs, and cryptocurrencies. It is popular for its accessibility and mobile trading app, making it attractive to both beginners and experienced traders.

[/su_note]

World Stock Exchange – Overview of the Best Platforms

We spent dozens of hours researching the most prominent stock brokers on the internet. Our research focused on the most important factors, from supported stock markets and trading commissions to licensing and customer service. So, let’s take a look at each platform individually:

1. eToro – Overall the best broker on the market

eToro is a popular global brokerage firm with over 26 million users. Using this platform, you can buy, sell, and trade over 2,400 stocks across 17 international markets.

In addition to major exchanges such as the NYSE and NASDAQ stock exchanges, you can also trade companies listed in Germany, France, Sweden, Hong Kong, and many others.

eToro’s minimum stock trade is also just $50 (eToro supports fractional ownership and allows you to buy shares in fractions).

eToro is also great for first-time stock traders. The platform is easy to use, it only takes a few minutes to open an account, and you’ll even find automated trading services.

At the forefront is the platform’s innovative copy trading feature. As the name suggests, it allows you to copy the portfolio of an experienced stock investor.

When it comes to funding, eToro supports debit cards, credit cards, bank transfers, and e-wallets such as Paypal and Neteller. Finally, eToro is licensed by the FCA, ASIC, and CySEC, and registered with FINRA in the US.

Learn more: eToro Reviews and Review 2023 – Is it worth a try?

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

2. Pepperstone – Most efficient customer service

Pepperstone is a well-known platform in the market for its reliability and convenience. It offers trading in various asset classes such as Forex, stocks and cryptocurrencies. Trading is allowed worldwide, except for the US.

Emphasizing consumer safety, Pepperstone is registered with the FCA and ASIC. It is worth noting that the company refrains from using client investments, which further strengthens overall client protection.

A key advantage of Pepperstone is its reliable customer service, available by phone. Consultants are available five days a week, 24 hours a day, and the FAQ section always has the most important answers.

In summary, Pepperstone offers a variety of account types, competitive pricing, and smart features (MT4, MT5, cTrader). This trading platform is a great choice for traders looking for cost-effectiveness and top-quality service.

Your capital is at risk. Additional fees may apply.

3. XTB – huge selection of cryptocurrencies

In second place is XTB , a great broker to consider if you want to trade CFDs. The broker has won numerous awards for its top-notch service and is considered one of the best choices for both beginners and advanced traders.

In addition to its highly rated trading features, XTB offers a range of impressive educational resources that help new traders learn about the market and can help experienced traders improve their existing skills. These resources include market news, articles and in-depth e-books. There is also access to a range of advanced technical analysis tools.

The most notable current brand ambassador is Connor McGregor. Such partnerships show that the broker is trustworthy and has an excellent reputation.

The broker offers two trading platforms: xStation 5 and xStation mobile. Both platforms are known for their speed, top-notch market analysis tools, and accurate indicators. For Forex trading, spreads start from just 0.1 pips and 48 currency pairs are available for trading.

Additionally, XTB offers fast deposits and withdrawals. This makes it easy to access your funds and start trading. The registration process can be completed in a few minutes and only requires personal details and a $250 deposit.

Your capital is at risk. Additional fees may apply.

4. Admiral Markets – a favorite platform for beginners to learn

Admiral Markets is a long-established online trading platform offering the most popular asset classes – Forex, CFDs, stocks, cryptocurrencies and more. Admiral Markets is extremely popular among beginners because the platform is simple and easy to use.

You can also find learning resources here, so you can start trading with detailed and reliable information.

Admiral Markets offers MetaTrader, StereoTrader and Supreme, as well as other premium analysis tools such as Dow Jones News, sentiment analysis and instant trading signals.

The internal investment system is highly secure and carries regulatory oversight in several countries, including Australia (ASIC), Cyprus (CySEC), UK (FCA), Canada (New SRO), South Africa (FSCA) and Jordan (UAB).

It is important to mention that Admiral Market has a trust score of 95 out of 99, which only proves its strong reputation in the market and ensures safety and fairness in all trading accounts.

Your capital is at risk. Additional fees may apply.

5. Interactive Brokers – the most suitable platform for long-term investments

Interactive Brokers provides users with a platform that includes a wide range of supported markets and trading tools.

Interactive Brokers provides access to over 135 markets in 33 countries. This means you can trade stocks listed in the US, Canada, Europe, Asia and more.

In other words, if there’s a small-cap global stock market, there’s a good chance you’ll find it on this popular platform. In addition to corporate stocks, Interactive Brokers also lets you trade ETFs, mutual funds, and other asset classes. As for stock trading fees, you can start investing in U.S.-listed stocks without any commissions.

If your chosen market is overseas, you will pay a commission fee that varies depending on the market. When it comes to security, Interactive Brokers has a solid reputation. The platform is strictly regulated by several US authorities.

6. TD Ameritrade – Leader in ETFs and Mutual Funds

Similar to International Brokers, TD Ameritrade is an online company that has been around since 1970. The platform is now a home for every asset class imaginable.

In addition to its massive stock trading library, it also covers thousands of ETFs and mutual funds, as well as bond and digital currency markets. In terms of what stocks you can trade, TD Ameritrade supports tens of thousands of stocks across dozens of marketplaces.

In fact, this popular trading platform also provides access to initial public offerings (IPOs) both in the U.S. and abroad. If you choose to trade stocks listed on the NYSE or NASDAQ, TD Ameritrade will not charge you a commission.

International corporate stock exchanges have different commissions depending on the exchange. TD Ameritrade is also a good choice if you are looking for a wide range of research and analysis tools. This includes real-time quotes, third-party stock reports, and a highly advanced trading platform that includes technical indicators.

TD Ameritrade only supports bank account transfers – so no debit/credit cards or e-wallets. That said, bank transfers on this free stock trading platform are usually processed very quickly, so you won’t have to wait long before you can start placing orders.

7. IG – a convenient platform for trading using various devices

IG is a UK-based trading platform and online broker that was first launched in 1974. This popular platform accepts account registrations from most countries, resulting in a global customer base of over 239,000 traders.

In addition to Forex, Cryptocurrencies , and ETFs, IG lets you trade stocks with the click of a button. This includes markets in the US, UK, Australia, New Zealand, South Africa, Asia, and a number of European exchanges.

When it comes to trading commissions, this will depend on your location. For example, some countries benefit from commission-free trading on US and UK stock CFDs, while others will pay a small commission, averaging 0.10%. Each specific marketplace usually has a variable commission rate.

IG also offers two trading platforms. These include their proprietary platform and MT4, where you can also trade on your mobile phone.

The latter is suitable for advanced traders who want access to technical indicators and charting tools, as well as the ability to deploy an automated robot. Depending on your location, you will likely be offered leverage on your stock trades. Finally, IG is regulated in several jurisdictions, so you should be concerned about security.

8. Trading 212 – simple and reliable platform

With Trading 212, opening an account takes just a few minutes, and you don’t need any prior experience to navigate the trading arena.

This popular broker lets you invest in over 10,000 global stocks and ETFs, all commission-free. Plus, because Trading 212 supports fractional ownership, the minimum investment is just £1 (or currency equivalent).

In terms of supported exchanges, Trading 212 focuses mainly on the UK, US and a few European markets. We also like Trading 212 because you also have the option to trade CFDs, Forex pairs and commodities.

When it comes to funding your account, you can make an instant deposit using a debit/credit card or e-wallet. There are no fees for depositing or withdrawing funds. The main downside to Trading 212 is that you will be charged a 0.5% FX fee on CFDs.

9. Fidelity – a broad global stock market

Fidelity is a popular, US-based trading platform that covers stock exchanges in over 25 countries, giving you plenty of diversification. You can also invest in newly listed US IPOs, which is ideal if you want to buy shares in a company that is just starting out on its business journey.

Fidelity also allows you to invest in mutual funds and ETFs, with thousands of instruments supported. When it comes to pricing, Fidelity charges no commissions. This is the case with all US-listed stocks, ETFs, and options.

There is a fee for trading international stocks, which will vary depending on the exchange. Fidelity also offers margin trading and requires no minimum deposit to get started.

This means you can start with a few dollars and test the waters before making a larger financial commitment.

What is a stock exchange?

A stock exchange is a centralized financial market where individuals/institutions can buy and sell various financial products, such as stocks and securities. In short, it is a safe intermediary between the buyer and the product provider.

A stock exchange facilitates the buying and selling of shares, allowing investors to trade these assets with each other. This also facilitates pricing and capital formation.

These exchanges act as centralized trading platforms where buyers and sellers come together to trade the shares of companies listed on the exchange. When an investor wants to buy shares, he places an order through a broker, specifying the quantity and price at which he wants to buy. Conversely, when an investor wants to sell, he does the same.

Lithuanian Stock Exchange for Beginners: What Should You Pay Attention to When Choosing?

Before you begin the investment process, you can compare and review popular platforms to make sure the provider is right for you and your stock trading goals.

To point you in the right direction, below are the key features of the platforms that will help you decide if the platform you choose is right for you:

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

1. Regulation

You would be surprised how many unregulated stock trading platforms operate in the online arena.

Many popular stock trading regulators include the FCA (UK), FINRA (US), CySEC (Cyprus), and ASIC (Australia). Although these financial institutions are based in different jurisdictions, they have much in common.

Some of the requirements they place on their regulated online stock trading platforms are:

Ensure that the stock trading platform identifies all account users. This keeps financial crimes out of the platform.

Client funds must be held in separate bank accounts. This ensures that the platform will not use your money to fund its own obligations.

The leverage must comply with the regulations of the country in which the trader resides.

Regular platform audits ensure that traders can buy and sell assets in a safe environment.

Most importantly, all of the popular trading platforms we reviewed on this page are strictly regulated by reputable financial institutions.

2. Property

Once you have confirmed that your trading funds are safe on the relevant platform, it is time to investigate what assets are supported. In most cases, popular stock trading platforms include the NYSE and NASDAQ OMX in the US. This means that you can trade stocks such as Facebook, Amazon, Visa, Virgin Galactic, Johnson & Johnson, Amazon, and Tesla.

The London Stock Exchange, as well as several European markets, are also commonly offered on popular stock trading platforms.

3. Shares or traditional CFDs

Many stock platforms allow users to invest in stocks and CFDs. While a stock investment platform allows you to buy and hold an asset, a CFD platform will also allow you to leverage and trade on future asset movements.

Stock CFD sites are also known to offer really competitive spreads. Depending on your investment goals, you can choose a platform that allows you to trade stocks, CFDs, or even both.

4. Taxes

Stock trading platforms, even though they offer a commission-free service, will always charge a fee. However, their goal is to make money.

The main fees you may want to review are:

- Capital Gains Tax: This tax is usually levied when an investor sells shares or securities at a profit. The rate can vary depending on factors such as the holding period and the country’s tax laws.

- Dividend tax: Investors may be subject to taxes on dividends they receive from holding shares. The rate may vary depending on the country and the individual’s tax status.

- Transaction tax: Some countries charge a tax on the purchase and sale of shares , called a transaction tax or financial transaction tax. This is usually a small percentage of the transaction value.

- Stamp Duty: In certain regions, a stamp duty fee is charged on share transactions. It is a fixed amount or a percentage of the transaction value that is paid by the buyer.

- Income tax: Income tax may be levied on profits made from trading stocks for a living, and the rate is based on the person’s total income and tax bracket.

- Inheritance tax : When shares are inherited, they may be subject to inheritance or estate taxes, depending on the jurisdiction.

Most stock trading platforms charge a commission when you enter and exit the market. Typically, this is a variable commission amount that is multiplied by your amount.

Example:

Let’s say your chosen stock trading platform charges a 0.15% commission;

You bet $1,000 per trade;

Your commission is $1.50;

When you decide to exit the trade, your position is worth $1,400;

You pay a 0.15% commission again. Only this time your commission is $2.10;

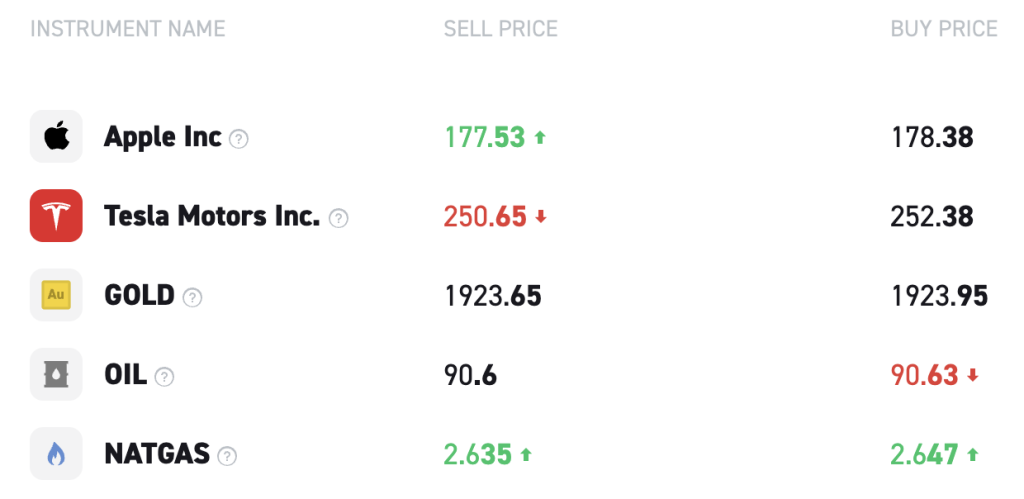

5. Stock trading spreads

This is the difference between the “bid” and “ask” price.

The bid price is the highest price a new buyer will pay for the stock, while the offer price is the lowest amount the seller will agree to sell for. While it may seem insignificant at first glance, this price difference is how stock trading platforms secure their profits.

6. Other fees

In addition to commissions, there are several other fees that may be charged by your chosen stock exchange and trading platform.

This includes:

- Transaction fees: Most of the stock trading platforms we’ve talked about today allow you to deposit and withdraw funds without any fees. However, some do charge transaction fees, so check this before opening an account.

- FX fees: You may have to pay an FX fee when you trade shares priced in a different currency than your own. FX fees are sometimes also charged on deposits.

- Inactivity fees: If you fail to make a transaction for a certain period of time (usually 12 months), your account may be flagged.

7. Trading tools and features

There can be huge differences between the trading tools offered by online platforms. For example, some platforms offer a wealth of features that can enhance your trading experience, while others provide a bare-bones service.

Nevertheless, some of the most important features offered by popular stock trading platforms include:

Fractional Shares: Fractional shares allow users to purchase a percentage of a stock rather than a full share. This can be beneficial for users who want to diversify their investments and invest on a limited budget.

Time to sell. The market is always volatile. The good thing is that some trading platforms allow you to choose a long or short investment period in stock exchanges according to your needs.

Education, Research, and Analysis: Many platforms may provide users with educational and research tools to help them with the investing process. This is a complete set of educational materials that can take your stock trading efforts to the next level.

8. Mobile app

Many popular platforms allow users to access their investments via a mobile app. The convenience of mobile trading will allow users to access trades from the comfort of their own home – which can be important if you want to invest when the market opens or closes in a convenient way.

9. Payments

Some of the online stock trading platforms discussed on this page allow users to deposit currency in a variety of ways. Depending on your preferred payment option, you can start trading using one or more of the options listed below:

- Credit/debit card

- Online bank transfers

- Orders

- Electronic wallets such as PayPal, Neteller, etc.

10. Customer support

Popular platforms that conduct online stock trading often provide customer support 24 hours a day, 7 days a week.

Online stock trading: how to get started?

We present a quick and clear guide on how to use the stock exchange for beginners. Below we will discuss how to start the trading process with your chosen broker:

Step 1: Create an account

Go to the homepage of your chosen broker and start the account setup process. You will need to fill in your personal details including your name, surname, email address and mobile phone number. Create a username and password to continue using the platform.

Step 2: Complete the verification process

Most of the most popular brokers are regulated, so users may need to verify their accounts. To do this, simply upload your ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents are uploaded, your broker should verify them within a few minutes.

Step 3: Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support one or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- Electronic wallet

Select your preferred payment method and transfer funds to your account.

Step 4: Invest

Once your account is funded, search for any stocks or other assets you wish to purchase. Search for the asset name in your platform’s navigation bar and press “Enter.” Enter the amount you wish to deposit into the trade and confirm your transaction.

Baltic Stock Exchange – which platform is the cheapest?

When looking for the cheapest stock trading platform, there are several different types of fees to consider.

Most stock trading platforms are free, but charge a commission for each trade you make to make a profit. Others may charge zero commission for stock trading, but may charge a platform subscription fee, an account management fee, or a withdrawal fee.

eToro , our recommended platform, is considered one of the cheapest platforms on the market. You can also use a free demo trading account to decide if the platform is right for you.

Stock Exchange and Best Platforms – Summary

Stock trading is available on many different platforms, so before choosing just one, users should compare and review which platform can best meet their expectations and preferences. In this guide, we have reviewed some of the factors that users can use to analyze, as well as popular brokerage options that you can analyze.

Your capital is at risk. Additional fees may apply. For more information, visit etoro.com/trading/fees.

FAQ

SourcesWhat is a stock exchange?

How do stock trading platforms make money?

How to buy shares online quickly?

Which online stock trading platform is best for beginners?

When does the stock exchange open?