Πώς να επενδύσετε σε μετοχές στην Ελλάδα — Διαδικτυακός οδηγός για αρχάριους

Are you living in Greece and looking for financial advice on how to invest in stocks for the first time?

In this beginner’s guide, we will give you all the advice you need on how to invest in stocks in Greece. We’ll discuss how to choose a licensed and regulated stock broker, what fees you should expect to pay, how to place your first stock trading order, and finally, we’ll give you tips on picking the right stocks.

INVEST IN STOCKS

INVEST IN SHARES[ /button]

Your capital is at risk. Other charges apply. For more information, visit etoro.com/trading/fees.

How to invest in stocks — Choose the right broker

In order to buy stocks, you need to choose a top stock broker. To help you make your decision, we have listed the best brokers in Greece below, with a full breakdown of their fees and features. You can even enter the amount you plan to invest and the number of trades to calculate the cost you will incur with each broker!

How to invest in stocks — Detailed guide 2026

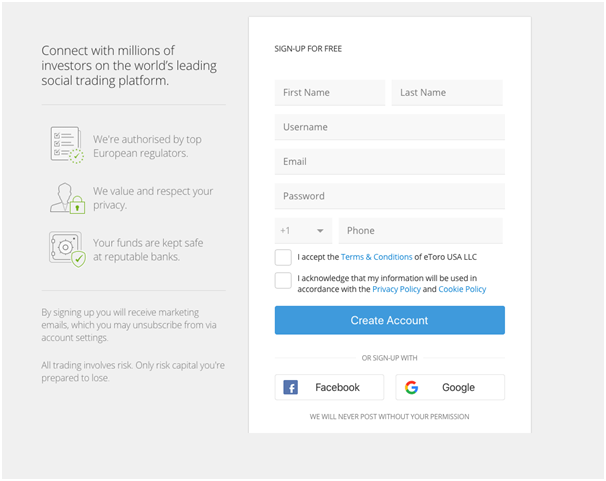

This walkthrough on how to buy stocks is based on our recommended, regulated broker eToro , although the process is similar across most brokers. You can register using the form below, after reading all the information on this page.

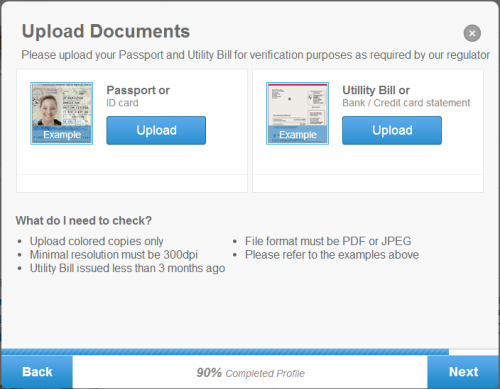

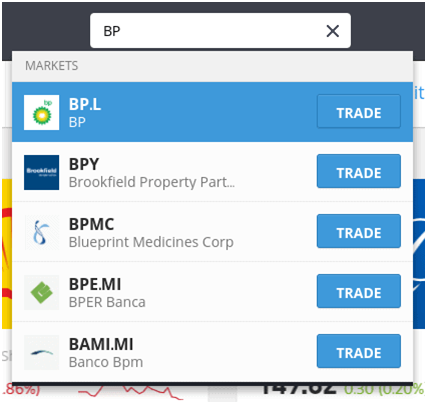

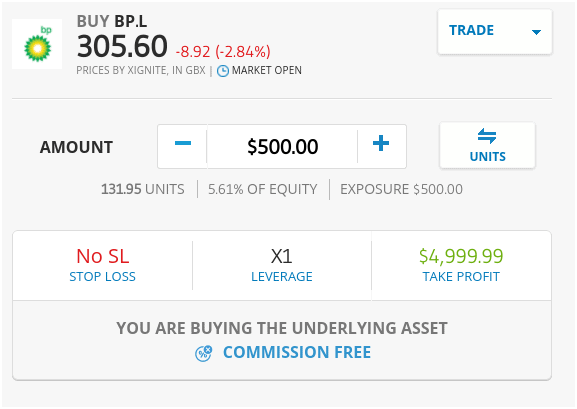

To open an account, eToro will ask you to submit a series of personal information, including: You will also need to choose a username and a strong password. You can deposit up to $2,000 without uploading identification to eToro, but if you want to deposit more you will need to verify your account, as this is required by the Financial Conduct Authority, eToro’s regulator. You will simply need to upload a copy of your passport/driving license and proof of your residential address. The latter can be either a recent bank statement or a recent utility bill. Once you upload the documents, eToro will validate them within minutes. You will need to make a minimum deposit of $50 on eToro. Supported payment methods include debit/credit cards, bank transfer Όπως αναφέρθηκε εν συντομία νωρίτερα, όλες οι καταθέσεις στην eToro μετατρέπονται σε δολάρια ΗΠΑ με χρέωση 0,5%. Αυτό στη συνέχεια θα σας δώσει άμεση πρόσβαση σε πάνω από δώδεκα χρηματοπιστωτικές αγορές — τόσο στην Ελλάδα όσο και στο εξωτερικό. Μόλις χρηματοδοτήσετε τον eToro λογαριασμό σας, μπορείτε να αγοράσετε την πρώτη σας μετοχή. Στο παράδειγμά μας, θέλουμε να αγοράσουμε μετοχές της BP. Εισάγουμε επομένως τον όρο BP στο πλαίσιο αναζήτησης που βρίσκεται επάνω μέρος της οθόνης και κατόπιν πατάμε TRADE. Εάν δεν έχετε ακόμη αποφασίσει ποιες μετοχές θέλετε να αγοράσετε, πατήστε το κουμπί TRADE MARKETS και περιηγηθείτε στη συλλογή μετοχών της eToro. Πριν μπορέσουμε να αγοράσουμε μετοχές στην εταιρεία που επιλέξαμε, πρέπει να δημιουργήσουμε μια εντολή αγοράς. Όπως μπορείτε να δείτε από το παρακάτω στιγμιότυπο οθόνης, η τρέχουσα τιμή αγοράς της BP είναι 305,60 p και αυτό θα αλλάζει σχεδόν από δευτερόλεπτο σε δευτερόλεπτο. Παρ’ όλα αυτά, πρέπει να εισαγάγουμε το χρηματικό ποσό που θέλουμε να επενδύσουμε, σε δολάρια ΗΠΑ. Στο παράδειγμά μας, αγοράζουμε μετοχές της BP αξίας $500. Σημείωση — αγοράζουμε το υποκείμενο περιουσιακό στοιχείο, σε αντίθεση με την επιλογή μόχλευσης και τη διαπραγμάτευση της μετοχής υπό τη μορφή CFD. Για να ολοκληρώσουμε την επενδυτική διαδικασία, θα πρέπει απλώς να πατήσουμε στην ένδειξη «OPEN TRADE». Μέσα σε λίγα δευτερόλεπτα η εντολή μας θα εκτελεστεί, πράγμα που σημαίνει ότι μόλις αγοράσαμε μετοχές της BP χωρίς προμήθεια. Αυτό ήταν — τώρα έχετε μάθει πώς να επενδύετε σε μετοχές, ακολουθώντας μόνο τέσσερα απλά βήματα! Χάρη στον τρόπο με τον οποίο λειτουργεί σήμερα η διαπραγμάτευση μετοχών στην Ελλάδα, μπορείτε να αγοράσετε χιλιάδες παγκόσμιες μετοχές με το πάτημα ενός κουμπιού. Το μόνο που χρειάζεστε είναι ένας λογαριασμός σε έναν αξιόπιστο διαδικτυακό χρηματιστή. Το καλό είναι ότι καθώς σήμερα δραστηριοποιούνται στην Ελλάδα εκατοντάδες χρηματιστές που σας διεκδικούν για πελάτη τους, τα τέλη και οι προμήθειες δεν ήταν ποτέ τόσο ανταγωνιστικά. Στην πραγματικότητα, υπάρχουν ακόμη και πλατφόρμες διαπραγμάτευσης μετοχών στην Ελλάδα που σας επιτρέπουν να αγοράζετε μετοχές χωρίς να πληρώνετε καθόλου έξοδα συναλλαγών. Ωστόσο, εκτός από το να μάθετε το how to invest in stocks (πώς να επενδύσετε σε μετοχές) στην Ελλάδα, είναι επίσης πολύ σημαντικό να μάθετε βασικά πράγματα για τη λειτουργία των μετοχών, το επενδυτικό ταξίδι και τους οποιουσδήποτε φορολογικούς κανόνες έναντι φορολογικών ελαφρύνσεων. Εφόσον εξοικειωθείτε με τις βασικές αρχές, θα έχετε καλύτερες πιθανότητες να αποφύγετε λάθη που θα σας κοστίσουν. Κορυφαία συμβουλή για τις μετοχές: αφότου αγοράσετε μετοχές σε μια εταιρεία, πρέπει να σας στείλουν ένα πιστοποιητικό μετοχής εντός δύο μηνών. Όταν μια εταιρεία αποφασίσει να βγάλει μετοχές, αυτό σημαίνει ότι θα εισαχθεί στο χρηματιστήριο. Αυτό είναι κάτι που επιτρέπει στους επενδυτές να αγοράζουν «μερίδια» της επιχείρησης. Όπως υποδηλώνει το όνομα, θα κατέχετε ένα «μερίδιο» της εταιρείας στην οποία επενδύετε — ανάλογα με τον αριθμό των μετοχών που κατέχετε. Η αξία των μετοχών καθορίζεται από τις δυνάμεις της αγοράς. Με άλλα λόγια, εάν υπάρχουν περισσότεροι αγοραστές από πωλητές στην αγορά, η τιμή της μετοχής θα αυξηθεί. Κατά συνέπεια, θα αυξηθεί και η αξία της επένδυσής σας. Εάν οι πωλητές είναι περισσότεροι από τους αγοραστές, θα συμβεί το αντίθετο — η αξία των μετοχών σας θα μειωθεί. Ως μέτοχος μιας εταιρείας, θα δικαιούστε μια σειρά από προνόμια. The most important are the right to dividends and the ability to vote at the annual general meetings (AGM). You can sell shares at any time during market hours. The amount you will get back in cash is calculated based on the number of shares you own and the company’s current share price. We recommend that you bookmark the Stock Terminology page while buying your first stock. If you want to calculate how much money you can potentially make by investing in shares in Greece, try our handy investment calculator. Remember that based on historical data, stocks tend to return 6%-7% annually. This can be achieved in three ways – capital gains, dividends and compounding growth. If the value of your shares is higher than the price you originally paid, you have ‘capital gains’. For example: This £1,000 gain is your capital gains. You will also have the opportunity to earn money from the shares in the form of dividend payments. In their most basic form, dividends allow large companies to share profits with shareholders. If and when they do, you will be entitled to your share of the proceeds. The specific dividend income you receive varies depending on how well the company is doing. Not all stocks pay dividends, but if they do, they are usually distributed every 3 or 6 months. Let’s see how stock dividends work: The good thing about dividends is that you get them out of your capital gains. In an ideal world, you’d be investing in stocks that are growing in value while also paying regular dividend payments! Bearing in mind that past returns are never an indication of future results, below is the average annual return of the FTSE 100 for each of the past 25 years. If you wanted to mirror these returns, you would need to invest in an ETF or fund that tracks the FTSE 100. Rather than simply cashing out their capital gains or waiting for dividend income, many investors reinvest an asset’s earnings to generate more earnings over time. This is called compound interest. By holding a stock for a long time and continuously reinvesting capital gains, you can achieve a compounding effect and earn profits on top of your profits. Let’s look at an example of how compounding works: The reason your investment grows this way is because you earn the profits you reinvest alongside the profits from your original investment. This means that each year you earn more interest on both your initial investment and your cumulative earnings. Compounding requires patience as the initial gains are small, but in the long run it can be highly profitable. Of course, you have to factor in stock fluctuations, inflation and fees, but if done right, it can be one of the best ways to grow your money through stocks. Although stock markets have historically performed well, this is not the case for all companies. In contrast, many businesses – both in Greece and abroad, are now worth only a fraction of their previous all-time highs. This is particularly the case in the UK banking space, with banks such as HSBC and Natwest not fully recovered from the 2008 financial crisis. With that in mind, below are some useful stock tips to help you mitigate your risks when investing in Greek stocks for the first time. In short, diversification is simply the opposite of putting all your eggs in one basket. That is, instead of investing in one or two companies, to have a diversified portfolio you would invest in dozens, if not hundreds of different stocks. Not only that, but you would be investing in businesses from various sectors, thereby ensuring that you are not over-exposed to a single sector. For example, let’s say you have £5,000 to invest in the stock markets. If you have never dealt with investing in shares in Greece before, it may be better to start with low stakes. On the one hand, most regulated brokers in Greece ask for a minimum investment of around £100-200. On the other hand, you are not obliged to use the entire balance in a single transaction. In contrast, platforms like eToro allow a minimum stock investment of $50. So by starting with small amounts, you will be able to gain confidence without blowing the bank. When you learn how to invest in stocks, it’s also important to learn how to research stocks. By this, we don’t mean something overly complicated like technical analysis or chart reading. Instead, simply make sure you are aware of any critical market developments that may affect the value of your investment. As an additional tip, it may be worth subscribing to news alerts on a third-party platform. For example, the Yahoo! Finance allows you to add the companies you’ve invested in to its portfolio, and then you can choose to receive real-time news when a relevant development occurs. For more information and advice on selling stocks, see our guide to the best stocks to invest. Below you can see some examples of popular stock analysis methods: There are many other methods of fundamental analysis that experienced investors use. You can read more about how to pick stocks yourself, here. If you have little or no knowledge of how stocks work, it may be worth considering the merits of a copy trading portfolio. Beginner-friendly platforms like eToro allow you to mirror the trades of experienced investors. This includes not only their current portfolio but every subsequent investment. The best thing is that you can review the credentials of the investor before you invest money. Copy trading essentially allows you to invest in stocks without doing any preliminary work, which is why it is very popular with new investors. Now, you know how to invest in stocks, but do you have a reliable broker that meets your investment preferences? There are many brokers and they all differ in terms of assets to trade, fees and features, so you should spend some time researching different platforms before signing up with one. Some of the most important factors to look out for are: The first and most important factor to consider before signing up with a stockbroker is whether or not they are regulated by the Financial Conduct Authority (FCA) or some other regulatory authority such as CySEC, ASIC etc. Thanks to this you will be sure that you will be able to buy and sell shares in a safe environment. For example: In general, never join a stock trading platform if it is not regulated! Once you’ve assessed the broker’s regulatory environment, you should then look at what payment methods they accept. In the vast majority of cases, stock trading platforms in Greece accept debit/credit card and bank transfer. The latter is more suitable for larger deposits of over £10,000. Depending on the broker, it can take 1 to 3 business days for the funds to reach your account if you deposit via bank transfer, but if you make a direct bank transfer, they can be credited in two hours. As we noted earlier, there are tens of thousands listed on dozens of exchanges. The specific markets you will have access to will depend on the broker you sign up with. For example, with eToro you will be able to buy and sell over 10,000 different companies. This includes businesses listed on: It is best to choose a broker that covers both the Greek and international markets, as this will give you the best possible opportunity to diversify your risk. eToro, for example, offers you stocks to invest on 17 different exchanges. There are a number of fees and charges to consider when looking for a broker, including trading fees, annual account fees and withdrawal fees. The good news is that some share trading platforms in Greece allow you to buy shares without paying trading fees or annual fees. Instead, they make money from the spread or a one-time conversion fee when you make your first deposit (eToro, for example, charges 0.5%). Researching the pros and cons of an online broker can be time-consuming. Below you will find a selection of the best stock trading accounts that meet a number of minimum requirements and can act as investment managers for your stocks. This includes the all-important regulatory approval, support for Greek debit/credit cards and bank accounts, and the ability to buy and sell shares in domestic and international companies. On the AvaTrade platform, in addition to trading stock CFDs, you can also access more than 1,250 global markets. In fact, your trades are 100% commission-free, with a broker regulated in six different jurisdictions! AvaTrade Fees: Advantages: Disadvantages: View AvaTrade[ /button] 71% of retail investors lose money when trading CFDs on this site. At eToro, you can invest in high-value British stocks such as Tesco, BT and Rolls Royce, as well as the best technology ETFs in Greece such as Amazon, Apple and Tesla. If you’re interested in trading stock CFDs—where leverage of up to 1:5 is offered—then you’ll need to pay a small fee, known as a spread. You can learn more about the difference between buying a physical share and trading shares via CFDs here. When it comes to getting started, you can open a trading account in just a few minutes. The platform allows you to deposit money via Greek debit/credit card, Greek bank account or e-wallet and you will need to cover a minimum amount of $50. Once your deposit is processed by the broker, it will be converted to USD with a small fee of 0.5%. This allows you to access international markets without having to worry about exchange rates. If you want to deposit more than $2,000, then eToro will ask you to submit identification documents. The platform supports large investments — up to $40,000 per card transaction and no limit via bank transfer. This would make you eligible for a VIP account manager and give you the opportunity to meet face-to-face with executives at the company’s headquarters in London. Another perk in eToro is the copy trade feature, which gives you the opportunity to copy successful stock investors and create exactly the same portfolios. For a more detailed overview, read our eToro review. Advantages: Disadvantages: Visit eToro[ /button] Your capital is at risk. Other charges apply. For more information, visit etoro.com/trading/fees. With Libertex, you can trade CFDs on global stocks, currencies, commodities, cryptocurrencies, indices and more. In fact, it offers stocks to invest in sought-after markets like cannabis stocks, which some brokers still don’t offer. When trading stocks, the commission ranges from 0% to 0.5%, but with certain types of accounts you can get 50% off and all with zero spreads! Fees at Libertex: Advantages: Disadvantages: Visit Libertex[ /button] 85% of retail investor accounts lose money when trading CFDs with this provider. Advantages: Disadvantages: The process of buying shares in Greece has changed significantly in the last decade. You no longer need to speak to a traditional broker over the phone to place your buy and sell orders. Instead, you simply need to choose a regulated online stock trading platform, deposit some money via your Greek debit/credit card, and then select stocks to invest. Buy shares now[ /button] Disclaimer: Investing in shares involves a significant risk of loss and is not suitable for all investors. You should carefully consider your investment objectives, level of experience and appetite for risk before deciding to buy stocks. Most importantly, don’t invest money you can’t afford to lose.1. Open an account with eToro today

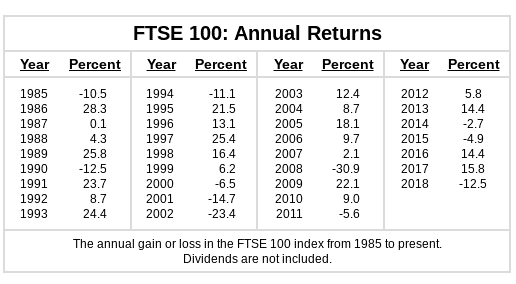

2. Upload identification documents

3. Deposit funds

4. Αγοράστε μετοχές

Μάθετε τα βασικά για την αγορά μετοχών στην Ελλάδα

Τι είναι οι μετοχές?

Πώληση μετοχών

How much money can you make from investing in stocks?

How to make money from stocks :

1. Capital gains

2. Dividends

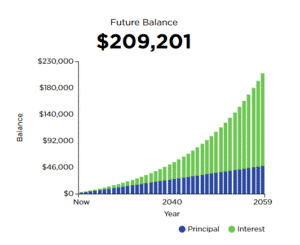

3. Compound interest

What to consider before buying shares in a company

Tip 1: Diversify as much as you can

Tip 2: Start with low stakes

Tip 3: Learn how to research stocks

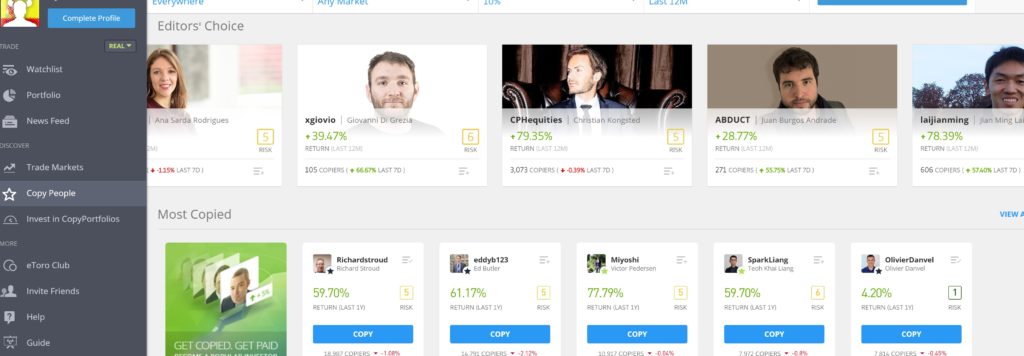

Tip 4: Consider a copy trading portfolio

How to choose a broker in Greece to invest in shares

Supervision by the Financial Conduct Authority

Greek payment methods

What stocks can you buy in Greece?

Fees and commissions

Where to buy stocks — the best stock trading platforms in Greece for 2026

1. AvaTrade — wide range of stock trading accounts

With AvaTrade, users can access a wide range of different trading platforms and account types. This includes spread betting accounts, options trading, CFD trading and swap-free Islamic accounts on MetaTrader 4 and MetaTrader 5 trading platforms.

Supply

0%

Deposit fees

Free

Withdrawal fees

Free

inactivity fees

Yes, $50 after 3 consecutive months of non-use

2. eToro — Top stock broker in Greece

3. Libertex— Best CFD stock broker with zero spreads

Supply

0%-0.5% for stocks

Deposit fees

Free

Withdrawal fees

1 EUR to withdraw via credit/debit card, 1% via Neteller, free via Skrill

inactivity fees

EUR 10 after 180 days

What are the advantages and disadvantages of investing in shares?

How to invest in stocks — Conclusion

Frequently asked questions

Can I invest in foreign companies?

Which Greek payment methods can I use to buy shares online?

What fees will I pay when I invest in stocks?

How do I buy shares listed on AIM?