Forex trading Ελλάδα Οδηγός 2026

The forex market is one of the largest financial markets in the world. The total value of currencies changing hands every day exceeds $5 trillion.

If you are thinking about getting into currency trading, this Forex trading guide for beginners will cover everything you need to know.

We will explain how forex trading works in Greece, highlight the benefits of forex trading, and offer you strategies and tips to help you get started. In addition, we will review five of the best forex brokers in Greece with whom you can trade currency today.

How to start forex trading in Greece — educational presentation on forex trading on eToro

Are you ready to start trading forex? We’ll show you how to place your first trade using eToro:

Το 51% των λογαριασμών ιδιωτών επενδυτών χάνουν χρήματα όταν διαπραγματεύονται CFD με αυτόν τον πάροχο. Θα πρέπει να σκεφτείτε εάν έχετε την οικονομική δυνατότητα να αναλάβετε τον υψηλό κίνδυνο να χάσετε τα χρήματά σας.

What is forex trading?

One of the most exciting things about forex trading is that the market is global. It is very different from stock trading, where each stock exchange usually hosts shares of companies from only one country. When you trade forex, you are participating in a market that is used by governments, banks and traders all over the world.

The forex market is also huge, with over $5 trillion in transactions every day. The size of this market is due to the fact that it is crucial not only to forex traders, but also to the flow of the global economy. For example, if you want to buy clothes made in England, you will pay an importing company in euros, which in turn pays the English manufacturer in pounds. Currency exchanges are also carried out all the time by major banks.

Forex trading hours are 24 hours a day, five days a week: from 9 p.m. Sunday to 9 p.m. Friday. In forex trading, there is no central exchange like in the stock market. Instead, a forex order is placed on a global computer network and can be executed by a forex broker, a bank, or anyone else who transacts on the global network. Since electronic forex trading takes place all over the world, the market can be very active at any time of the day.

Forex trading pairs

One of the key things that beginner Greek investors need to know about forex trading is that each currency is valued in relation to another. Here, therefore, we have another key difference compared to the stock market.

The lira does not have a fixed value on its own. Instead, the lira is valued in relation to, for example, the dollar or the euro. The value of the lira can increase against the dollar and the euro by different ratios, or it can increase against the dollar and decrease against the euro at the same time.

Therefore, forex trading in Greece, as in the rest of the world, is carried out through currency pairs. There are three types of currency pairs in forex trading:

Major pairs

The main currency pairs in forex trading are seven and all of them involve the US dollar:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

These seven pairs make up the majority of daily forex trading volume in Greece and around the world. Beginner forex traders should start trading in the major currency pairs because they are always available for buying and selling and usually have lower fees than the less common currency pairs.

Secondary pairs

There are over 20 different minor currency pairs. These are currency pairs that do not include the USD or that combine the USD with other world currencies. For example, JPY/AUD and GBP/EUR are considered minor currency pairs.

Exotic

Exotic pairs include currency combinations that are not traded frequently. For example, JPY/ZAR and EUR/HUF are considered exotic forex pairs. Exotic pairs can be highly illiquid — meaning, there aren’t many people buying or selling them at any given time — so they are more suitable for more advanced forex traders.

Why get involved in forex trading?

The forex market brings together many features that make forex trading online particularly suitable for beginners. Let’s look at some of the most important reasons to get involved in forex trading in Greece.

Accessibility

For many traders, the most attractive feature of the forex market is that it is extremely accessible. Few other markets allow you to turn on your computer and start trading at any time. But since the forex markets operate 24 hours a day, this is possible. There are also very few restrictions on the currencies you can trade, unlike the stock market where most stock brokers offer stocks from one or two countries.

Moreover, you don’t need a lot of money to start trading forex in Greece. At many leading forex brokers the minimum trade amount is just £50. So you can start buying and selling currency pairs with a very small initial investment.

Liquidity

Since the daily trading volume is very high, it is almost guaranteed that you will find a buyer for the currency you want to sell at any time. This is called liquidity: there is a constant flow of currency pairs around the world.

Liquidity is a good thing, as it means that the chance of you getting stuck in a trade because you can’t sell your position when you want to is small. Having high liquidity is also important because it helps keep the price you pay for your trades low. Below, we’ll go into more detail about the fees you incur when trading forex and the factors that affect them.

Transactions in one direction or the other

Another positive aspect of forex trading is that you can bet on the value of one currency against another to go down or up. When you short a currency, you profit as its value goes down. This gives you more flexibility to hedge your forex trading positions and design more complex trading strategies.

Leverage

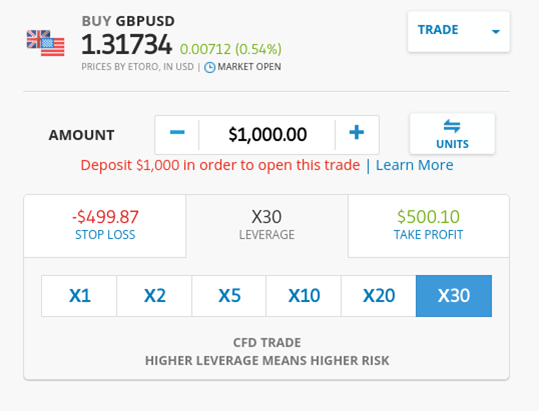

A key feature of forex trading available in Greece is the use of leverage in your trades. Leverage essentially allows you to borrow money from your forex broker to increase the size of your position. For example, if you open a position with 10:1 leverage, you can buy a currency worth £1,000 with just £100 in your trading account.

The benefit of using leverage is that it multiplies the amount of your return. Let’s say you buy GBP/USD with 10:1 leverage. If the value of the dollar increases by 1% against the pound, the value of your position will increase by 10%.

With leverage, you can make significant profits from even small changes in the value of currency pairs. In addition, you can invest in many different forex pairs to hedge your positions, as only a small investment is enough to open large positions.

What are the fees in forex trading?

One of the best things about forex trading in Greece is that it is almost always commission-free. Instead of charging a flat fee per trade, most forex brokers charge a fee known as a spread.

The spread is the difference between the price at which you can buy a currency pair and the price at which you can sell it at the same time. Spreads vary depending on the currency pair and the broker and can range from as little as 0.05% to 1% or more. Generally, the lowest spreads are found on major currency pairs, while the highest spreads are found on exotic ones.

Another important thing to remember is that when you trade with leverage, you will likely have to pay additional fees. Most forex brokers charge an interest rate on overnight positions — i.e. if you hold a leveraged forex position after 10pm GMT — even though the forex market never sleeps. Therefore, if you use leverage in your forex trading, it is best to only keep your positions open for a few hours at a time.

Forex trading in Greece — Risks

It is important to note that using leverage significantly increases your risk when trading forex in Greece. First, any loss is magnified. Just as a 1% gain in the value of a currency pair translates into a 10% return when using 10:1 leverage, a 1% loss in its value translates into a 10% decrease in the value of your position.

Additionally, when you trade using leverage, you are borrowing money from your broker. Most forex brokers, when the value of your position starts to decrease, will ask you to deposit cash into your account to cover a larger portion of its value. So, you may be forced to add money to your account quickly, or your broker will sell your position at a loss.

Because of these additional risks, novice forex traders should be very careful with the use of leverage.

Forex trading strategies

To have a chance of getting rich from forex trading, it is crucial to implement a reliable forex trading strategy.

There are as many forex trading strategies as there are forex traders. Each trader must develop their own, personalized strategy that meets their goals, risk tolerance, and investment style. It is a process that takes time and practice, so we recommend that you start by trading on a demo account to test which strategy works best for you.

So let’s take a closer look at three forex day trading strategies you can try.

Scalping (short-term speculation)

Scalping is an extremely short-term trading strategy that involves buying and selling a currency pair throughout the day. The goal of a scalping strategy is to profit from very small price movements that occur within a few seconds or minutes. Scalpers closely monitor technical indicators to identify potential entry and exit points.

The price movements taken into account when implementing a scalping strategy are small, so the returns from any single trade can be very small. However, if you make several profitable trades in a day, these small returns accumulate.

Swing trading

Swing trading is a medium-term forex trading strategy. Typically, swing trading takes into account the momentum in the price of a currency pair. Ideally, you enter a forex trade after a strong reversal, as the price begins to rise or fall with high trading volume. You stay in the trade for as long as the currency pair continues to trend in a particular direction, and then sell as soon as the trend begins to weaken. Aggressive swing traders can then speculate on a countertrend, should it occur.

News-based trading

Much of the volatility in the forex market is caused by news releases. World events, politics, weather, trade agreements, and economic reports can cause a currency to rise or fall in value. A strong forex trading strategy is to monitor market news to assess whether a country’s currency is poised to move up or down in the short or long term. You then open a forex trade based on the news and your analysis.

Forex trading automation

Many intermediate or advanced traders choose to automate their forex trading. Automating your trading not only reduces your workload during the trading day, but it also removes the psychological factor from your trading, which often leads to wrong decisions.

There are two main methods by which you can automate your forex trading: forex signals and forex robots.

Forex trading signals

Forex signals are combinations of technical indicators and news scanners. With forex signals, you receive an alert on your computer or mobile phone when a specific set of parameters is met. For example, when certain indicators align, you can receive an alert on your phone with information about the currency pair, the current price, and potential entry and exit points.

Forex signals can either be generated manually or through the use of artificial intelligence. You can also purchase forex signals from professionals through your broker or another online forex trading platform.

Forex trading robots

Forex robots use signals to fully automate your trading. These bots not only identify and alert you to potential forex trading opportunities, but also execute trades on your behalf. Trading robots can operate 24/7, which makes them particularly suitable for automated forex trading.

Forex trading tips

Forex trading is easily accessible in Greece, but before you get started, it’s important to know a few things. So let’s look at five tips that will help you prepare for the forex market.

1. Take forex courses

Our guide is a great resource for getting your first forex trading knowledge. Before committing any money to your trading, it would be a good idea to take a full forex trading course. You can find a quality course through your broker or by searching for professional trading services online.

2. Read the best books on forex trading.

Professional traders have spent years perfecting their forex trading strategies and techniques. By choosing a book, you can learn some of their most useful tricks. We recommend Forex for Beginners: What You Need to Know to Get Started and Everything in Between, by Anna Coulling, and How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life, by Courtney Smith.

3. Try a forex demo account

Another way to get familiar with forex trading is to start with a demo forex account. With a demo account, you can practice on your broker’s forex trading platform, access real-time price data, and track the performance of your trades over time, without risking real money.

4. Start with small amounts

When you start trading on a live account, it’s a good idea to start with a small investment. Focus on one or two currency pairs rather than trying to trade multiple pairs right from the start. Also, try trading with no leverage or only low leverage to limit your risk.

5. Use stop loss limits

One of the best things you can do to limit your risk when trading forex is to set stop loss limits. With a stop loss, your broker will automatically sell your position if its value falls below a pre-set level. Stop loss limits are especially important in forex trading, as the market is active 24/7 and you cannot constantly monitor your trades.

Best platforms for forex trading

To start trading forex in Greece, you will need a top-notch forex trading platform. Look for one that offers low spreads, high leverage, and access to a wide range of currency pairs. Check out our five favorites below:

1. AvaTrade — Forex broker with a wide variety of account types

AvaTrade is a forex broker that offers a wide range of account types. This includes CFD trading accounts, options trading accounts, and swap-free accounts. Choosing a broker that offers such a variety of accounts allows you to move with flexibility in the market.

The broker also offers a full suite of trading platforms including MetaTrader 4, MetaTrader 5, AvaOptions, AvaSocial, and AvaTradeGO. Through these platforms, you can perform algorithmic trading, options trading, social trading, and copy trading—from your computer, mobile, or online platform.

You can trade commission-free on over 1,250 global markets including all major, minor and exotic currency pairs. Plus, you can rest easy knowing that AvaTrade is regulated in six jurisdictions, including the CBI, ASIC, FSA, FSCA, FRSE and BVI FSC.

Advantages:

Disadvantages:

Your capital is at risk.

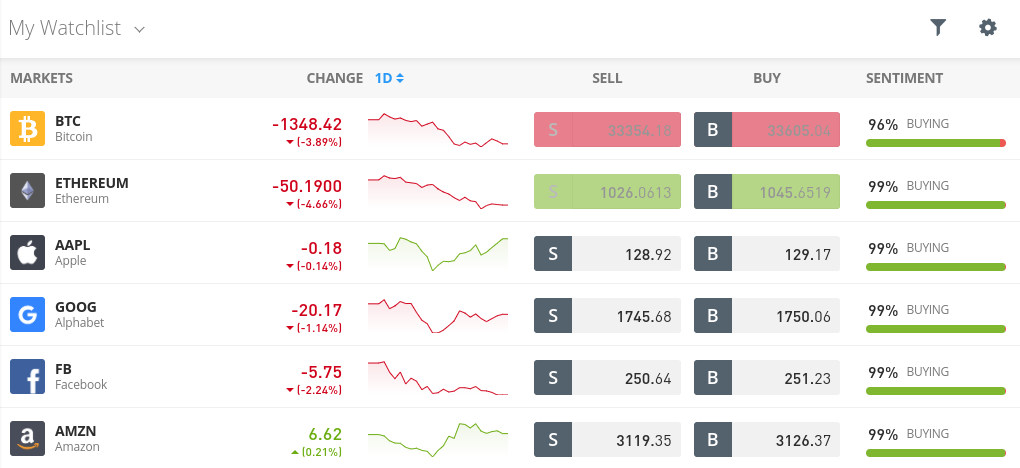

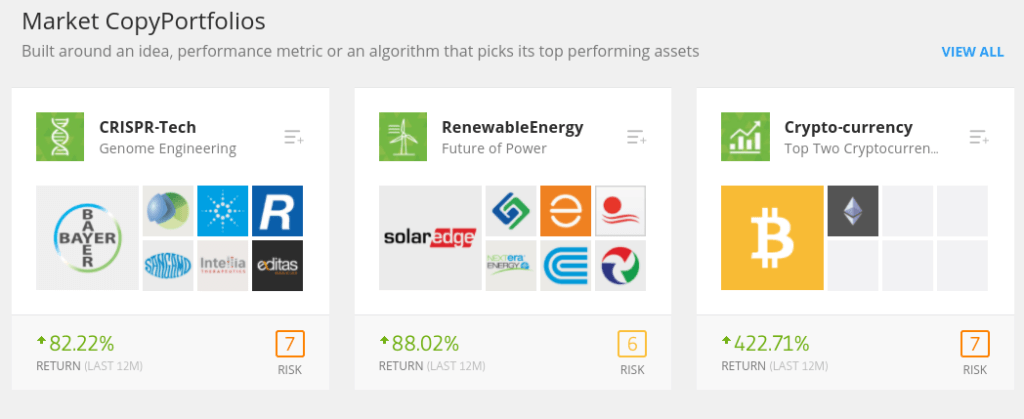

2. eToro — One of the best forex trading platforms in Greece

eToro also has a powerful charting platform with dozens of built-in technical studies. Additionally, you can follow market news through the platform, making it easy to stay up to date with the latest developments. The only downside is that you can’t use forex signals through the eToro platform.

All forex trading on eToro is commission-free and you’ll find spreads starting from just 0.008% on major currency pairs. eToro does charge account fees and withdrawal fees, but they’re relatively low and can easily be avoided. We also liked that you can trade major currency pairs, with leverage of up to 30:1.

Advantages:

Disadvantages:

Το 51% των λογαριασμών ιδιωτών επενδυτών χάνουν χρήματα όταν διαπραγματεύονται CFD με αυτόν τον πάροχο. Θα πρέπει να σκεφτείτε εάν έχετε την οικονομική δυνατότητα να αναλάβετε τον υψηλό κίνδυνο να χάσετε τα χρήματά σας.

3. Libertex— Forex broker with zero spreads

With Libertex you pay a small commission on every buy and sell and have zero spreads. Plus, you can trade forex via CFDs, so you have the ability to profit from both rising and falling markets.

It offers a wide range of account types, with a VIP+ account offering a 50% commission discount and many other additional features. The broker also has a proprietary, feature-rich online platform with a host of investment sentiment indicators, live news, and more.

Advantages:

Disadvantages:

85% of retail investor accounts lose money when trading CFDs with this provider.

How to start forex trading in Greece — educational presentation on forex trading on eToro

Are you ready to start trading forex? We’ll show you how to place your first trade using eToro.

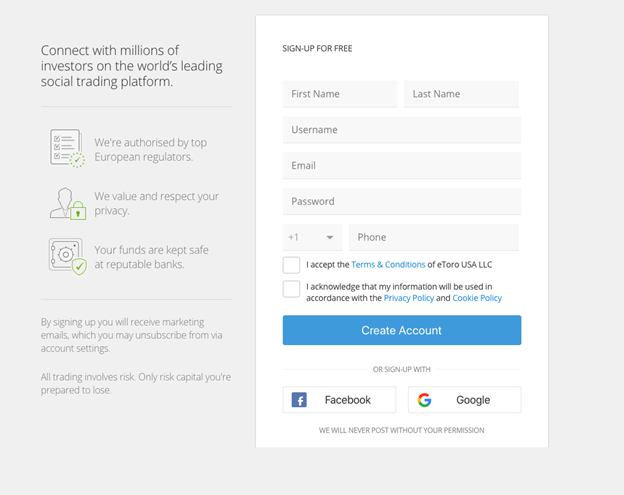

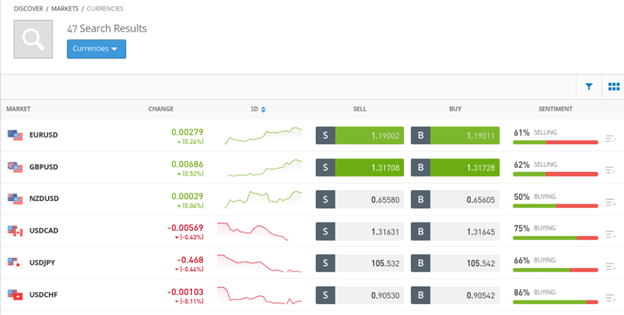

Go to the eToro homepage and click on the “Join Now” option to open a new account. You will need to enter a new username and password, along with information such as your name, date of birth, email, and phone number. To comply with government regulations, eToro also requires you to verify your identity. Upload a copy of your driver’s license or passport, as well as a copy of a recent utility bill or bank statement to confirm your address. Now it’s time to fund your account. eToro accepts a wide range of payment options, including debit or credit card, e-wallet or bank transfer. The first time you deposit money into your account, you will need to deposit at least £140. Αφού χρηματοδοτήσετε τον λογαριασμό σας, είστε έτοιμοι να ανοίξετε την πρώτη σας συναλλαγή forex. Αναζητήστε ένα ζεύγος νομισμάτων όπως το GBP/USD στον πίνακα ελέγχου της eToro και στη συνέχεια, πατήστε στο Trade όταν εμφανιστεί στο μενού, για να ανοίξετε μια φόρμα νέας εντολής. Στη φόρμα εντολής, καθορίστε πόσα χρήματα θέλετε να επενδύσετε (το ελάχιστο όριο είναι $50) και επιλέξετε αν θα αγοράσετε ή θα πουλήσετε το ζεύγος νομισμάτων. Μόλις η συναλλαγή σας είναι έτοιμη, πατήστε «Trade» για να την ολοκληρώσετε. Το forex trading σας δίνει πρόσβαση σε μια ταχύτατα κινούμενη, παγκόσμια αγορά που λειτουργεί όλο το 24ωρο. Με το forex trading, μπορείτε να κερδοσκοπείτε επί της κίνησης της τιμής ενός νομίσματος σε σχέση με ένα άλλο. Η αγορά forex είναι ευρέως προσβάσιμη, δεδομένου ότι είναι παγκόσμιας φύσης και απαιτεί μόνο μια μικρή αρχική επένδυση. Αν είστε έτοιμοι ξεκινήσετε συναλλαγές forex στην Ελλάδα, ανοίξτε λογαριασμό eToro σήμερα. Απλά πατήστε στον παρακάτω σύνδεσμο για να ξεκινήσετε! Το 51% των λογαριασμών ιδιωτών επενδυτών χάνουν χρήματα όταν διαπραγματεύονται CFD με αυτόν τον πάροχο. Θα πρέπει να σκεφτείτε εάν έχετε την οικονομική δυνατότητα να αναλάβετε τον υψηλό κίνδυνο να χάσετε τα χρήματά σας.Step 1: Open a forex trading account

Step 2: Deposit funds

Step 3: Place a forex trade

Συμπέρασμα

eToro — Καλύτερη πλατφόρμα για forex trading στην Ελλάδα

Συχνές ερωτήσεις

How does Forex trading work?

What are pips in forex trading?

How does margin work in forex trading?

Is forex trading considered halal?

What is the best app for forex trading?

Is forex trading profitable?