ETF Trading Ελλάδα Οδηγός 2026 – Συναλλαγές ETFs

Exchange-traded funds (ETFs) have become increasingly popular among UK investors. However, ETFs are also rich targets for active trading.

So, what is ETF trading? With ETF trading, you can speculate on an entire industry or market sector in one place. ETF trading in Greece is a great alternative to trading individual stocks, currencies or commodities.

Want to get into ETF trading in Greece? In this guide, we’ll explain how ETF trading works and highlight some top ETF trading strategies. We’ll also look at three of the top brokers you can use to start trading ETFs in Greece today.

How to start ETF trading

Are you ready to get into ETF trading in Greece? We’ll show you how to get started with eToro, which offers full-stack or CFD trading on over 450 popular ETFs:

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

What are ETFs?

ETFs are baskets of assets that are traded on a stock exchange. A single ETF can give you financial exposure to, for example, hundreds of different stocks or more than a dozen different commodities. ETFs have become very popular alternatives to mutual funds and investment trusts because they trade like stocks and can be purchased through most brokers in Greece.

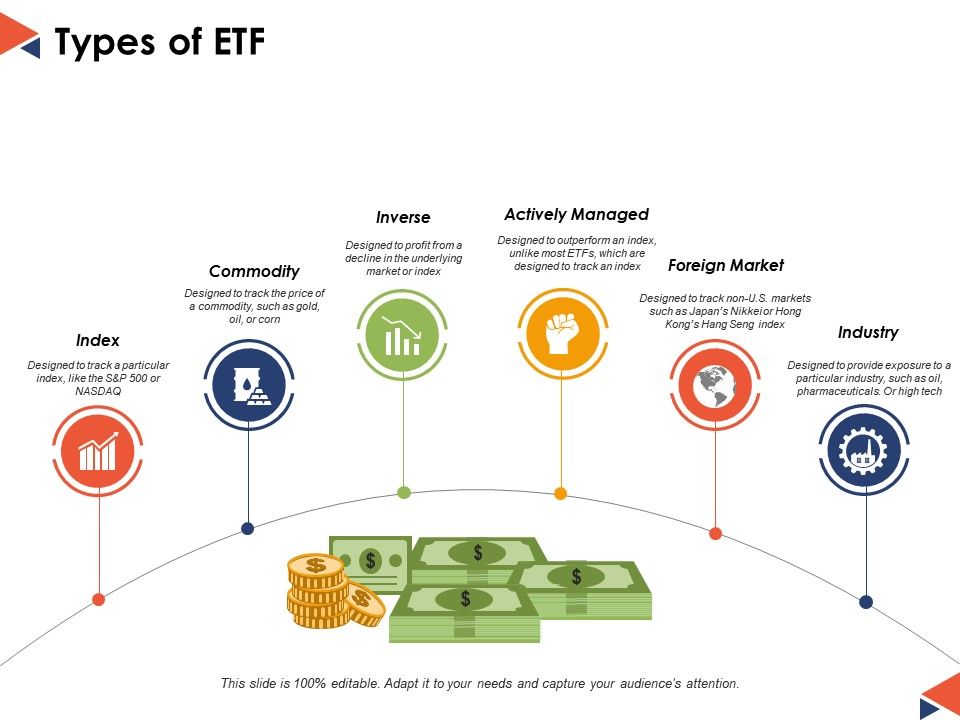

Different types of ETFs

ETFs can contain many different types of assets, in a wide variety of combinations. Let’s take a closer look at some of the most popular types of ETFs in Greece.

Stock ETFs

Stock ETFs, as the name suggests, are baskets of stocks. When you buy stock ETFs, it’s pretty much the same as buying stocks – except you’re buying many different stocks at once.

There are many different styles of stock ETFs.

Index ETFs are designed to mirror major stock market indices, such as the FTSE 100 or AIM 50. They contain all the same blue chip stocks so that changes in the value of the ETF mirror changes in the broader market.

Dividend ETFs invest primarily in dividend stocks. The value of these ETFs may not change much over time, but you can make a return from the dividends paid by all the companies the fund owns.

Sector ETFs give you exposure to a selection of stocks from a specific market sector. For example, you can use a sector ETF to trade pharmaceutical stocks, oil stocks, or cannabis stocks.

There are many other styles of ETFs. Some focus on growth stocks, while others look for undervalued stocks. If you want to trade small-cap stocks, there are ETFs for that too.

Bond ETFs

Bond ETFs are bundles of bonds. Often, these ETFs offer returns through distributions from the bonds they contain. However, the value of bond ETFs can rise or fall as interest rates and bond prices change.

Commodity ETFs

Commodity ETFs give you exposure to a wide variety of commodities – such as sugar, coffee and oil – at the same time. Trading commodity ETFs is a good way to get into commodities trading if you want to make predictions about agriculture or energy in general, rather than the price of a specific commodity.

Forex ETFs

Forex ETFs typically contain currency futures contracts, giving you exposure to a bunch of different forex pairs. Trading these ETFs is a way to get into forex trading while avoiding costly currency conversion fees.

What is ETF Trading and how does it work?

ETF trading in Greece is a form of trading that focuses on buying and selling ETFs for profit. This is distinctly different from ETF investing, in which it is much more typical to buy a mutual fund and hold it for months or years at a time. Many ETF investors engage in daily or weekly swing trading.

ETF trading relies on the fact that ETF prices change throughout the trading day. However, the way ETF prices move is slightly different from the way stock prices move.

While stock prices are driven primarily by buying and selling activity, ETF prices are driven primarily by price changes in the assets they hold. Let’s look at an example of a technology sector ETF that holds shares of Amazon, Apple, and Facebook. If the stock prices of all three companies increase by 5%, then the value of the ETF will also increase by 5%.

Importantly, since ETFs hold many assets, the change in the value of the ETF reflects the average change in the prices of its underlying assets. So, if Amazon increases by 5%, Apple decreases by 2%, and Facebook increases by 1%, the value of the ETF will only increase by 1.33%. So, when trading ETFs in Greece, it is important to think about how news or market events will affect all of the assets an ETF holds.

ETF trading fees

Since ETFs are traded on major exchanges like stocks, ETF trading in Greece is usually subject to the same commissions and fees as trading stocks. Many UK brokers offer commission-free trading in ETFs, although some charge a fee of several pounds each time you buy and sell. If you trade ETFs using contracts for difference (CFDs), you may pay a spread of around 0.1% per trade or more.

ETF trading comes with an additional cost that stock investors don’t have to bear. ETFs typically have management fees that range from as little as 0.01% of your investment annually to 0.5% per year or more. ETF investors usually don’t need to worry about these fees, as they are very small when you only hold an ETF for a couple of days at a time.

Benefits of ETF Trading Greek

Are you wondering why you should trade ETFs? There are many benefits to ETFs that have helped ETF trading explode in popularity in Greece.

ETFs reduce risk

Perhaps the number one reason to trade ETFs is that they give you financial exposure to a wide range of assets in a single trade. This is a big deal because it dramatically reduces the risk of any single trade. For example, if you were to trade shares of AstraZeneca, your trade could be a rollercoaster in response to news about the company. However, if you were trading a biotechnology ETF, any bad news about AstraZeneca would only have a limited impact on the value of your trade.

Of course, this works both ways. Good news about the company could send AstraZeneca’s stock soaring. However, a biotech ETF in which AstraZeneca is just one of dozens of companies represented could hardly be considered a response to the news. ETF trading allows you to greatly reduce your risk in exchange for potentially limiting your profits.

Wide exposure

Another major advantage of ETF trading in Greece is that, by giving you exposure to a wide range of assets, you can speculate on entire sectors or markets at once. For example, with ETF trading, you can speculate on the energy market as a whole without making multiple, potentially costly trades for multiple commodities.

Easy entry

Unlike mutual funds or investment trusts, you don’t need a specific broker or connection to funds that manage ETFs. ETFs are traded on an exchange and do not require a minimum investment. Additionally, some ETF trading platforms allow you to buy fractional shares of an ETF, so the amount of money you need to start trading is very low.

High liquidity

Since ETFs are traded on exchanges like the London Stock Exchange, they tend to have very high liquidity. This is important for ETF trading in Greece as it means you will have no problem buying and selling ETFs quickly. Even for some of the less popular ETFs, it is easy for your broker to match your trade with someone else who is buying or selling that fund.

Risks of ETF trading

ETF trading may be relatively less risky than other types of trading, but that doesn’t mean it’s risk-free. As with any type of trading, there’s always the possibility that the value of your position could drop. In that case, you may need to close your trade for a loss.

Please note that if you buy and sell ETFs through leveraged CFD trading, the risk is higher. Leveraged trading multiplies your losses as well as your profits.

ETF Trading Strategies

It is important to approach UK ETF trading with a clear strategy in mind. The better your ETF trading strategy, the more likely you are to return consistent profits from your trades. Let’s take a look at three of the most popular ETF trading strategies that you can start using today:

Momentum ETF Trading

The goal of momentum trading is simply to ride the wave. Instead of trying to perfectly limit the market, exit your position as soon as momentum shows signs of weakening. These signs could come in the form of lower trading volume or a trade signal from a momentum indicator such as the moving average convergence divergence (MACD).

ETF Overbought and Oversold Trading

Another simple yet effective ETF trading strategy is to monitor overbought and oversold levels. These levels can be determined using a technical indicator such as the relative strength index (RSI).

The key to this type of trading is timing. Don’t buy an ETF as soon as it’s oversold. Instead, wait until a strong reversal occurs to open a long position. It’s better to lose a small long position than to risk the ETF continuing to fall without a reversal.

ETF trading with limited reach

Sometimes, ETFs will bounce between support and resistance price levels. This presents an opportunity for ETF trading, as you can buy and sell on the moves between these price levels. Be cautious about trading around support and resistance levels, as a breakout is likely to eventually occur. When this happens, the price movement can be rapid and powerful.

ETF Trading Tips Greek

Getting started with ETF trading in Greece is easy, but getting the hang of it takes time and practice. To help you get better, here are five of our favorite tips:

#1. Take an ETF Trading Course

This guide is a great place to start learning about ETF trading in Greece. However, if you want practical help and ETF trading strategy advice, we recommend taking an ETF trading course. There are tons of courses online offered by professional ETF investors and even some of the best ETF brokers.

#2. Choose an ETF trading book

Reading an ETF trading book is another way to learn more about the ins and outs of ETF trading in Greece. Two of our favorites are “Trading ETFs: Gaining the Edge with Technical Analysis” by Deron Wagner and “A Practical Guide to ETF Trading Systems” by Anthony Garner.

#3. Studying a single sector

When you are just starting out with ETF trading, it is a good idea to focus on a single sector or market segment. The more you know about that market, the better you will be able to design an ETF trading strategy and understand how prices move in that market. Only after you have mastered that market should you move on to trading in another sector.

#4. Learn to use Stop Losses

Stop Losses play a key role in ETF trading. They prevent your losses from increasing when a trade goes badly, protecting your profits from other trades. We recommend that you place a stop loss on every ETF trade.

#5. Be patient.

ETF trading requires considerable patience. When there is no good trading opportunity that fits your strategy, don’t force it. It is better not to trade for a day than to rush into a trade and lose money.

Best ETF Trading Platforms

Choosing the best ETF trading platform plays a big role in your trading. Your ETF broker determines which ETFs you can trade and how much each trade will cost. Additionally, your ETF trading platform is your primary source of analysis tools and research to guide your trading.

Let’s take a closer look at three of the top UK ETF brokers that you can use to start trading today:

1. AvaTrade – Wide range of ETF trading platforms

AvaTrade offers users a wide range of different ETF trading platforms and account types such as CFD Trading, Spread Betting, Options Trading and Islamic Swap Free accounts. All of these accounts also offer commission-free trading.

With AvaTrade, you can trade a full range of different ETFs, as well as over 1,250+ other markets covering stocks, currencies, indices, commodities and more. All of this can be done from the popular MetaTrader 4 and MetaTrader 5 trading platforms as well as the broker’s feature-rich web platform.

Opening an account is a simple process and can be done in a matter of minutes. You can also deposit and withdraw funds with zero fees. The broker offers strong peace of mind as they are regulated in six different jurisdictions around the world.

Advantages:

Disadvantages:

71% of retail investors lose money trading CFDs on this site

2. eToro – Fractional ETF Trading

This broker stands out for offering a comprehensive social trading network with its ETF trading platform. You can follow other ETF investors and see which funds they are buying and selling. You can also take advantage of the copy portfolio feature, which allows you to automatically mimic the trades of professional ETF investors.

eToro’s proprietary charting software interface isn’t the most advanced we’ve seen, but it’s easy to use and comes with over a hundred built-in indicators and drawing tools. The main limitation is that you can’t create your own technical studies.

Advantages:

Disadvantages:

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

3. Libertex – ETF CFD provider with zero spreads

The spread is the difference between the buy and sell price and is often indicated by the broker. With Libertex, you pay a small commission for buying and selling. You can also get 50% commission discounts for certain account types.

Additionally, you can trade CFDs ETFs as well as a variety of other markets, including currencies, stocks, and an extensive list of cryptocurrencies. The broker’s trading platform is web-based and simple to use.

Advantages:

Disadvantages:

85% of retail investor accounts lose money when trading CFDs with this provider.

Advantages and disadvantages of ETF trading

Advantages:

Disadvantages:

How to start ETF trading

Are you ready to get into ETF trading in Greece? We’ll show you how to get started with eToro, which offers full-stack or CFD trading on over 450 popular ETFs.

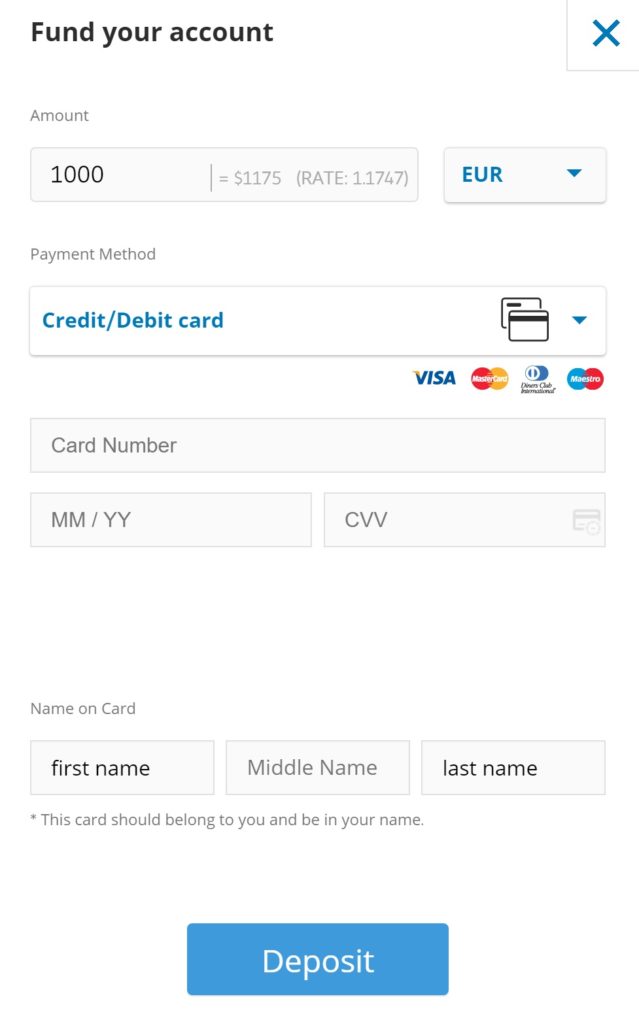

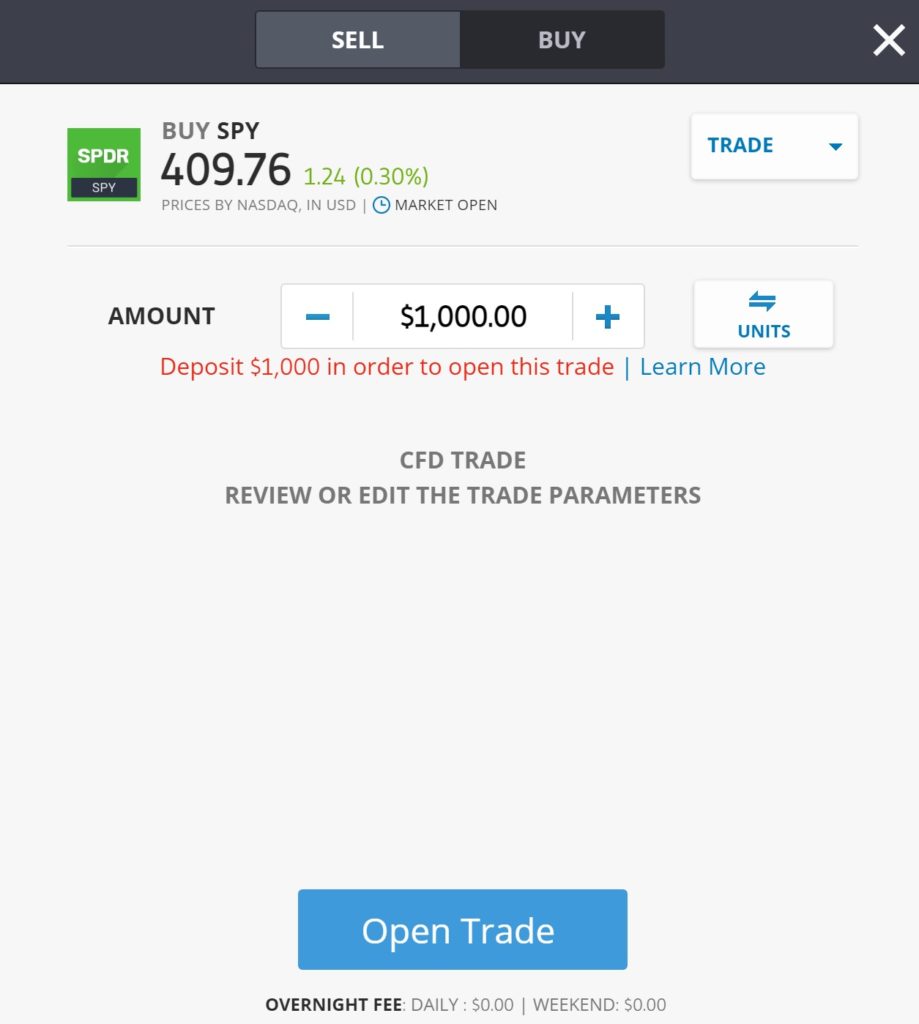

Get started with eToro by opening a new trading account. On the broker’s website, click “Register Now” and then enter a new username and password along with your name and email. eToro requires you to verify your identity in order to comply with UK government regulations. You can complete this step online by uploading a copy of your passport or driving license along with a copy of a recent financial statement or utility bill. Add funds to your eToro trading account using a debit or credit card or bank transfer. Please note that eToro requires a minimum deposit of $50 when opening a new account. Go to the eToro ETF dashboard to browse the top ETFs or search for a specific fund by name. When you find an ETF to trade, click the “Trade” button to open a new order form. In the order form, specify how much money you want to trade and how much leverage you will apply, if any. You can also enter a stop loss or take profit level here, according to your ETF trading strategy. When you are ready, click “Trade” to open your first ETF trade.Step 1: Open an ETF trading account

Step 2: Fund your account

Step 3: Place your first ETF trade

ETF trading allows you to speculate on entire market sectors or industries in a single trade. By giving you exposure to a wide range of assets, ETF trading in Greece can partially reduce trading risk compared to trading individual assets. Additionally, ETFs are easy to enter and exit and do not require a large amount of money to trade. Are you ready to get started with ETF trading in Greece? Sign up for an eToro account to make your first ETF trade today!

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.Conclusion

eToro – The best ETF trading platform in Greece

Frequently asked questions

What is ETF options trading?

What are the rules for ETF trading?

Can I trade international stocks through ETFs?

Does ETF trading require a minimum investment?