Πώς να κάνετε αγορά Apple μετοχής το 2026

One of the most well-known and popular investments in the stock market is the Apple stock market. And that’s because Apple has a long history of achievement. Despite a notable drop in market capitalization in 2022, Apple was the first company to surpass market capitalizations of one, two, and three trillion euros.

The combined market capitalization of Apple and all of its companies is larger than many leading indices. For example, Apple’s market capitalization is currently around €2.95 trillion, while the European Deutsche Aktien index, which includes 40+ companies, has a market capitalization of €2.7 trillion.

Of course, many investors in the world’s most valuable company are debating whether to buy Apple stock right now or not. In addition, many beginners are wondering how they can buy Apple stock and how. That is the purpose of this guide, which also includes a detailed analysis of Apple stock.

In order to trade Apple shares in Greece, one must be registered with a broker who offers this option. For this registration, we provide brief steps on how to do it, while later, we will provide you with a more detailed guide.

Το 51% των λογαριασμών ιδιωτών επενδυτών χάνουν χρήματα όταν διαπραγματεύονται CFD με αυτόν τον πάροχο. Θα πρέπει να σκεφτείτε εάν έχετε την οικονομική δυνατότητα να αναλάβετε τον υψηλό κίνδυνο να χάσετε τα χρήματά σας. But who is the best broker in Greece to buy Apple shares? After research conducted by our team, we are able to confirm that eToro is the best available brokerage in Greece for stock purchases. We explain the reasons in more detail below. [stocks_table id=”17″] Millions of people use eToro , one of the world’s leading social trading brokers, as a multi-asset trading platform and to buy Apple stock. Investments in stocks , ETFs, commodities, currencies, cryptocurrencies (CFDs) and smart portfolios are supported by the Israel-based brokerage. The global eToro platform is regulated in the US, Australia, Europe and the UK. Retail investors interested in stock trading and social trading, copying the trades of other investors, are attracted to eToro. You can invest your money in a wide range of financial assets and buy Apple shares on eToro. Although real stocks, ETFs and a variety of cryptocurrencies (CFDs) can all be traded on the eToro platform, its main focus is as a CFD and Forex broker . CopyTrader, a social trading platform, and Smart Portfolios, formerly known as CopyPortfolios, are additional features. You will trade the actual asset if you open a position to buy Apple stock without leverage in stocks, ETFs. Buying Apple stock on eToro has the following advantages:

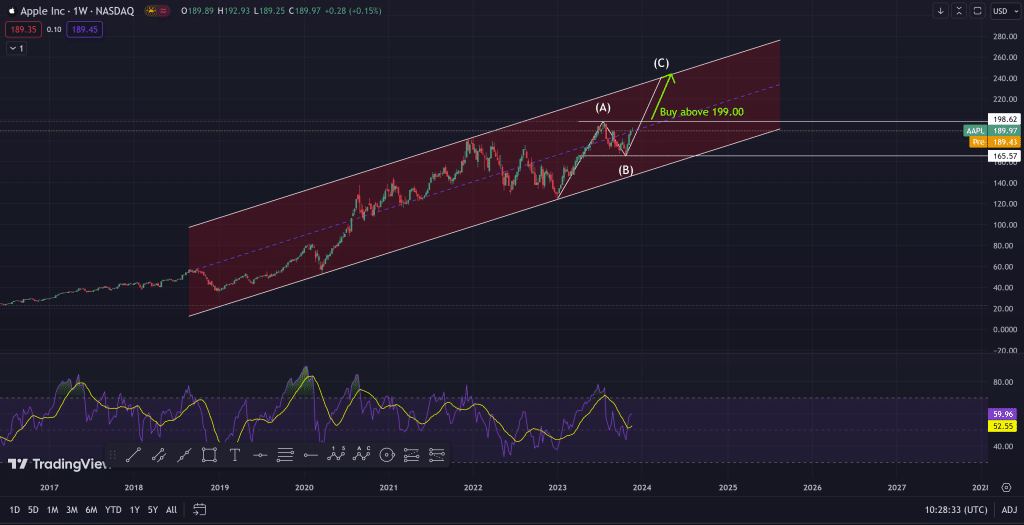

Το 51% των λογαριασμών ιδιωτών επενδυτών χάνουν χρήματα όταν διαπραγματεύονται CFD με αυτόν τον πάροχο. Θα πρέπει να σκεφτείτε εάν έχετε την οικονομική δυνατότητα να αναλάβετε τον υψηλό κίνδυνο να χάσετε τα χρήματά σας. It’s important to understand Apple’s company if you’re planning to buy Apple stock. The American technology company Apple Inc. was founded in 1976. Apple, which is headquartered in California, is currently the most valuable publicly traded company in the world. Apple depends on a distinctive user interface and strong branding. The emphasis is on an Apple product ecosystem where every gadget works seamlessly with every other device. Apple maintains a high-price strategy and is able to sell devices at higher than average prices because of the significant benefits to customers. It is also important to mention that renowned investor Warren Buffet is Apple’s largest shareholder. Since 2016, Warren Buffet has been aggressively buying Apple stock and currently owns more than 5% of the company. Buffet believes that Apple is more of a part of the consumer goods industry than a true technology company. Customers who buy Apple products will stay in the ecosystem. This creates recurring revenue from loyal customers who eagerly await Apple’s newest models. The table below includes general information about the company and Apple stock. A company’s past is not always indicative of its future. It is also a helpful guide to choosing whether to buy Apple stock. In addition, history allows for important conclusions to be drawn. We will look at some milestones in the next section that you should be aware of if you plan to buy Apple stock in 2026. 1976 – A garage was used to launch Apple. Here, Ron Wayne, Steve Wozniak, and Steve Jobs collaborated to create cutting-edge products. 1976–2001 – Apple’s early years were largely a failure. The company had periods of rapid expansion and periods of near bankruptcy. However, none of the visionaries gave up, and Steve Jobs in particular was committed to innovation. 2001 – The company’s first major achievement was the creation of the iPod. The music industry was evolving. Customers could then buy music online and listen to it whenever they wanted. 2007 – Apple popularizes smartphones with the release of the iPhone. Steve Jobs was initially chastised for his ingenuity. However, the smartphone gained popularity and changed modern life. 2011 – Apple CEO and founder Steve Jobs dies . Tim Cook takes over the company. The next few years will see the launch of AirPods and the rise of Apple services. Software and hardware work best together in a dedicated ecosystem. Apple has demonstrated its high level of innovation over the years. Investors who bought Apple stock at an early stage benefited from a smart price development. This was caused, in part, by numerous innovations, many of which had a negative impact on a specific technology sector. But let’s take a closer look at these innovations so that we can understand what a potential Apple stock purchase means in the future. Apple computer, which dramatically improved usability with an all-in-one design. From that point on, the screen and the computer were one and the same. The world’s best-selling portable music player is the iPod. Apple created one of the most popular devices that forever changed the way we listen to music, along with its own music service, iTunes. Apple managed to revolutionize the mobile phone industry with the iPhone. It was operated via a touch screen. Currently, there are about thirty different models on the market. The line of laptops offered by Apple consists of MacBook. The MacBook Air was specifically designed to be small and light. When portability is the main concern, many people still prefer to use MacBook Air. The American technology company’s tablet computer that can be used with a touchscreen is called the iPad. The way data is stored has been changed by iCloud. Apple device users could now store and back up data to external servers using an iCloud decorator. The recent lack of innovation has been criticized by those who have shorted Apple stock. The business model has seen a steady evolution that we will examine in more detail in the next section. However, the most significant innovations have been absent. In the coming years, topics such as Apple Glasses and its own electric vehicle will be discussed. It will be interesting to watch if and when Apple reveals more groundbreaking innovations to the public during its upcoming keynotes. This will be a hallmark of Apple stock buying. Does it make sense to buy Apple stock? To answer this question, we take a closer look at Apple’s business strategy. In its annual report, Apple neatly divides its operations into five distinct segments. Although the smartphone market in the Western Hemisphere is currently considered saturated, the iPhone is still the most important device. But let’s go look at the divisions of the company’s business model. It is the company’s most important industrial category. iPhone models are constantly improving and developing. Customers are reliable and consistent in their cash flow. The laptops and desktops made by Apple fall into the Mac category. Those who depend on Apple products tend to buy every new model. Here, sales growth is comparatively steady. In the future, tablets should be used more frequently in offices and classrooms. To a moderate extent, this could promote growth. Services sales are growing faster than average. For example, Apple Services includes the following features: All Apple products that fall under another hardware segment are referred to as “Other Services.” For example, the most popular smartwatch in the world is the Apple Watch, which is constantly changing. At the same time, a few years ago, AirPods were created as cutting-edge headphones. Additionally, it is important to mention that if you are thinking about buying Apple stock, you should not ignore the geographical distribution of the business model. America currently accounts for more than 40% of sales and the country has a much larger share of the smartphone market than other countries. Around 25% of sales come from Europe at the same time. Cross-border diversification is beneficial, but it is still dependent on the US market. In recent years, Apple’s stock price has risen impressively. From 2017 to mid-2022, it had a return of about 310%. But the 1st half of 2023 was not so profitable for Apple stock. In this case, shareholders had to deal with more than 17% in price losses. However, the fact that Apple shares were a legitimate source of long-term returns helped them outperform the market overall and stay on an upward trajectory. At the current valuation, the dividend yield is about 0.65%. Apple has increased its quarterly dividend payment for nearly a decade. Apple’s dividend is consistent, with an earnings ratio of less than 15%, allowing for regular dividend increases. Moreover, while maintaining sufficient capital for investment. Over the past five years, dividend growth has averaged 10%. Also, over the past ten years, it has exceeded 25%. Furthermore, for the coming years, dividend growth in the high single-digit range is also expected. The table below shows dividend earnings from 2018 to 2022. Since analysts trade the most valuable company on the stock market, you should consider their price targets when predicting Apple stock. This is before you decide to Buy Apple stock. According to the most recent price forecasts from analysts and rating agencies, there is significant price potential with the current price below €170 after the first half of 2023. As of early July 2023, five different analyst ratings indicated that Apple shares have significant upside potential. In the table below, we present the forecasts of some rating agencies. Just as we have done with Tesla stock, we are now doing the same with the Apple stock market. Our team of experts has analyzed the Apple stock chart, which you can see below. Contrary to what the above rating agencies predict, it is wiser to wait for the stock to break above the €198.00 barrier before buying Apple stock. If the €198.00 resistance is broken, then we will have an excellent upward trend with a target of €240.00 – €250.00. You shouldn’t just watch the price or charts if you want to buy Apple stock. Instead, the decision is also determined by the stock’s valuation, which ties into the company’s operational growth. Apple’s stock price fell by about 17% in the first half of 2023. Furthermore, since Apple’s stock price has declined, it is imperative to look at the company’s current valuation. Currently, Apple’s P/E ratio is valued at 31.04. This shows that Apple’s P/E ratio is higher than its historical average of the past five years, which was slightly less than 24. Also, the P/E ratio was consistently below 20 from 2010 to 2018. Furthermore, this shows that Apple’s price is higher now than it was 8 years ago. This is one reason why our experts do not recommend buying Apple stock at this time. Also, given the current market situation, the increasing nature of value and the growth potential, Apple shares seem to be valued overall. Apple’s KUV is around 6.1. This shows that the price-to-sales ratio has marginally decreased compared to the price-to-sales ratio of 8. However, over the past five years, the average P/S has been less than 6. Also, from 2009 to 2017, the P/S never went above 3.5. It has only recently seen an incredible rise. Additionally, while Apple shares may seem a bit pricey right now, the potential should still be apparent. Apple has the opportunity to take advantage of a challenging macroeconomic environment by operating from a strong market position and significant pricing power. So, should you buy Apple stock or sell it? We look at five arguments in this section for buying Apple stock in 2026. Every major metric at Apple has improved in recent years. Profits and sales have been growing consistently by double digits. In addition, the American technology company also increases its dividend annually at the same time, which is pushing the Apple stock market. Dividend growth has averaged 27% over a decade. You can buy Apple stock if you want to invest in a solid, fast-growing business. For the coming years, analysts predict sales and profits to grow as well. Apple is a powerful brand. Due to the fact that the company’s brand has become well-known and is associated with luxury. Buying an Apple product involves engaging with a huge ecosystem. Also, the Cupertino company’s other hardware works better with Apple products. This creates a huge moat. Moreover, customers have a stronger bond with the Apple brand the more hardware they own. Also, because the Apple brand is so addictive, consumers continue to buy even in low economic times. This always helps to increase the share price and is a reason to buy Apple stock. Furthermore, there is another moat that works in Apple’s favor at the same time. This is because iOS, the operating system created by Apple, is a perfect match for both hardware and software. Also, because iOS is the foundation for all Apple products, high compatibility is guaranteed. Furthermore, it is difficult to switch from Apple to other technology companies once you are used to it. Apple generates recurring revenue as a result of its customers’ increasingly predictable behavior. Apple generates a huge amount of cash flow and has managed to increase profitability in recent years. As a result, significant values are being generated for the Apple stock market. In addition, Tim Cook, for example, introduced the dividend to Apple shareholders. At the same time, an extensive buyback program was implemented, with which Apple shares worth over $ 300 billion were repurchased. This also guaranteed huge price increases for Apple in recent years and supported the company’s share price. Customer loyalty is the main pillar of Apple. Apple device owners know this. Anyone who currently uses a MacBook or an iPhone on a daily basis will recognize the quality of Apple products. Furthermore, the ecosystem is distinct if the Smart Watch and iPhone are paired at the same time. This, as AirPods automatically connect to the MacBook and the Apple TV knows the user’s preferences. Also, future additions to the ecosystem will likely include services and hardware that complement it perfectly and add value for all Apple customers. Over the past ten years, Apple has significantly increased its research and development spending. Less than two billion euros were invested annually in future innovations since 2010, but by 2019 this amount had already increased to over 16 billion and by 2021 it had exceeded 20 billion. Moreover, Apple and Tim Cook are investing all their money in the path of future development. Also, when it comes to large-scale investments, there are still some benchmarks that need to be met. New innovations are probably just a matter of time. It is fair to say, however, that the significant investment in research that has recently been made has not yielded much benefit. Despite the fact that billions of euros are spent annually, truly significant innovations will take some time to materialize. All investments, however, carry risks. Before buying Apple shares, investors should consider each one individually. For this reason, we will examine three risks in the following section that could reduce the value of an investment in Apple. Recession risk is more prevalent than ever in 2026. Given that Apple sells expensive hardware and software, this is a negative for the Apple stock market. Consumers often replace their electronics, even when they are in good working order. Apple’s sales may decline during tough economic times when consumers have to cut back on spending. There could be significant price losses as a result. However, if the economy improves, Apple’s growth story will likely continue, so this price development is likely to be temporary. Therefore, price declines are only a temporary risk. Technological change is another risk to Apple stock, which could be caused by breakthroughs or even disruptions by competitors. For the most part, Apple has been creative in releasing new technologies. Large sums of money are invested in research at the same time. This should ensure that it will remain competitive in the future, especially if Apple continues to attract the best scientists from prestigious universities. However, if you are buying Apple stock with the intention of holding it for the long term, you should keep an eye on the technology sector and the competition. Compared to other companies, Apple has a high valuation for its shares. Because investors who buy Apple stock benefit from both growth and quality. However, there can be an additional valuation discount if growth slows sharply or even stops. However, given Apple’s steady, decent cash flow, the chances of a downside are probably limited, as the company’s shares also look like a solid long-term value investment. Before we close with the epilogue of our article and our conclusions, let’s also look at the detailed guide to buying Apple shares in 2026. Visit the official website of the eToro broker and register by selecting the account form. For the safety of your money and personal data, proceed with KYC by comparing the information you provided in the registration form with the presence of official documents at the broker. Passport or ID and address confirmation are sufficient for account activation. For Greece, the minimum deposit amount is $50.00. Using a payment method that is convenient for you, proceed with your deposit. Bank cards and wire transfers are accepted. In the asset finder, type in the name of the stock. All the details will be displayed on your screen so that you can Buy Apple stock.

Το 51% των λογαριασμών ιδιωτών επενδυτών χάνουν χρήματα όταν διαπραγματεύονται CFD με αυτόν τον πάροχο. Θα πρέπει να σκεφτείτε εάν έχετε την οικονομική δυνατότητα να αναλάβετε τον υψηλό κίνδυνο να χάσετε τα χρήματά σας. The Apple stock market offers many opportunities for investors, especially those considering a long-term investment position. This is because Apple shares have the potential to outperform both the S&P500 and the broader market in the coming years due to their strong brand, technology strength, and growth potential. The current valuation seems somewhat expensive compared to the historical average. However, there are compelling arguments for the Apple stock market. Of course, you should choose a broker wisely in addition to considering the analysis and forecast for Apple Stock Market. For example, you can Buy Apple Stock on eToro safely and less expensively. Going forward, you should benefit from both strong dividend growth and potential price performance. Long-term value investors and dividend seekers may find Apple stock interesting given its significant earnings potential and strong cash flow.

Το 51% των λογαριασμών ιδιωτών επενδυτών χάνουν χρήματα όταν διαπραγματεύονται CFD με αυτόν τον πάροχο. Θα πρέπει να σκεφτείτε εάν έχετε την οικονομική δυνατότητα να αναλάβετε τον υψηλό κίνδυνο να χάσετε τα χρήματά σας. [/note] Ο Αντώνης Παπαγεωργίου είναι έμπειρος αναλυτής στον τομέα των επιχειρήσεων, των μετοχών και της αύξησης του πλούτου διαμέσου επενδύσεων. Επιπλέον, για περισσότερα από 13 χρόνια διαπραγματεύεται ενεργά στις χρηματοπιστωτικές αγορές, επενδύοντας μακροπρόθεσμα και μοιράζοντας την εμπειρία του μέσω πολλαπλών διαδικτυακών εκδοτικών οίκων. Αφού ολοκλήρωσε επιτυχώς τις σπουδές του στο Οικονομικό Πανεπιστήμιο Αθηνών, μετά από τις οποίες απέκτησε επίσης και μεταπτυχιακό στη δημοσιογραφία. Ο Αντώνης άρχισε ενεργά να ενδιαφέρεται και να γράφει για θέματα που σχετίζονται με τα οικονομικά, την τεχνολογία και τα κρυπτονομίσματα. Τα άρθρα του Αντώνης έχουν δημοσιευτεί σε μερικές από τις πιο δημοφιλείς εφημερίδες παγκοσμίως, συμπεριλαμβανομένων του Capital, Business Insider και Bloomberg. Ήδη αποδεδειγμένος ειδικός στον τομέα του, εντάχθηκε πολύ γρήγορα στην αυξανόμενη ομάδα δημοσιογράφων και συντακτών του TradingPlatforms.com. Σήμερα ο Αντώνης μοιράζεται με το κοινό του τα μυστικά του εμπορίου και παρέχει πολύτιμες πληροφορίες για το συνεχώς μεταβαλλόμενο οικονομικό και επιχειρηματικό περιβάλλον. Η αποστολή του Αντώνης είναι να διαλύσει τις αμφιβολίες σχετικά με τον οικονομικό κόσμο και να δώσει τη δυνατότητα στον αναγνώστη να λάβει σίγουρες και προσεκτικές οικονομικές αποφάσεις. Η εξαιρετική του ικανότητα να μεταφέρει με σαφήνεια πληροφορίες έχει επανειλημμένα εκτιμηθεί από το κοινό της ιστοσελίδας μας και είναι χρήσιμη τόσο για αρχάριους όσο και για έμπειρους εμπόρους. Εκτός από τις κύριες δραστηριότητες του δημοσιογράφου, του συντάκτη και του ενεργού εμπόρου, η καθημερινότητα του Αντώνης περιλαμβάνει και τη συνεχή προσωπική αυτοβελτίωση. Ο Αντώνης πιστεύει ότι οι επιτυχημένοι άνθρωποι μαθαίνουν και αναπτύσσουν νέες ιδιότητες καθ' όλη την διάρκεια της ζωής τους. ΠΡΟΕΙΔΟΠΟΙΗΣΗ: Το περιεχόμενο αυτού του ιστότοπου δεν πρέπει να θεωρείται επενδυτική συμβουλή και δεν είμαστε εξουσιοδοτημένοι να παρέχουμε επενδυτικές συμβουλές. Τίποτα σε αυτόν τον ιστότοπο δεν αποτελεί έγκριση ή σύσταση μιας συγκεκριμένης εμπορικής στρατηγικής ή επενδυτικής απόφασης. Οι πληροφορίες σε αυτόν τον ιστότοπο είναι γενικής φύσεως, επομένως πρέπει να λάβετε υπόψη τις πληροφορίες υπό το φως των στόχων, της οικονομικής κατάστασης και των αναγκών σας. Οι επενδύσεις πάντα έχουν ορισμένο βαθμό κινδύνου. Όταν επενδύετε το κεφάλαιό σας βρίσκεται σε κίνδυνο. Αυτός ο ιστότοπος δεν προορίζεται για χρήση σε δικαιοδοσίες στις οποίες απαγορεύονται οι συναλλαγές ή οι επενδύσεις που περιγράφονται και θα πρέπει να χρησιμοποιείται μόνο από τέτοια πρόσωπα και με τρόπους που επιτρέπονται νομικά. Η επένδυσή σας ενδέχεται να μην πληροί τις προϋποθέσεις για προστασία επενδυτών στη χώρα ή την πολιτεία διαμονής σας, επομένως, πραγματοποιήστε τη δική σας δέουσα ερευνα ή απευθηνθείτε σε οικονομικό σύμβουλο. Αυτός ο ιστότοπος είναι δωρεάν για εσάς, αλλά ενδέχεται να λάβουμε προμήθεια από τις εταιρείες που παρουσιάζουμε σε αυτόν τον ιστότοπο. Εγγεγραμμένος αριθμός εταιρείας: 103525 © tradeplatforms.com Με επιφύλαξη παντός δικαιώματος 2023

Simple steps to Buy Apple stock in 2026

The best online broker for buying Apple stock

eToro – Buy Apple shares

What is Apple?

Year of foundation

1976

Total capitalization

2.95 Trillion euros

Total amount of shares available

15,599,434,000

Stock symbol

AAPL

Seat

America – California

Industry

Technology

Stock market index

Nasdaq

The history of Apple

Apple’s key innovations

iMac in 1998

iPod in 2001

1st iPhone Release in 2007

MacBook Air model 2008

iPad model 2010

iCloud in 2011

Apple stock market and the company’s business plan

50% iPhone

10% Mac

10% iPad

20% Apple Services

10% Additional services

Apple stock market and prices

Apple stock market and dividends

Year

Dividend

Quota

2022

€0.88

0.71%

2021

€0.82

0.58%

2020

€0.77

0.71%

2019

€0.72

1.37%

2018

€0.65

1.20%

Apple stock market and price predictions from rating agencies

Goldman Sachs

€154.00

UBS

€182.00

Barclays

€164.00

J.P. Morgan

€197.00

Morgan Stanley

€192.00

Apple stock market and technical analysis from the experts at TradingPlatforms.com

Apple stock market and appreciation

P/E ratio

KUV Index

Reasons why you should buy Apple stock

Dividends, profits and sales all point in the same direction

Elegant brand and solid luxury

Huge free cash flow adds value for investors

Distinctive ecosystem and strong customer loyalty

Huge investments in and new discoveries are just around the corner.

The potential risks of buying Apple stock

Weak economy and recession

Innovations and disruptions based on competition

Lower valuation results from slower growth

Complete guide to Buying Apple stock in 2026 in Greece

Step 1 – Open an account on eToro

Step 2 – Secure and verify your eToro account

Step 3 – Deposit money into your eToro account

Step 4 – Buy Apple stock

Conclusion

eToro — Buy Apple shares

Frequently asked questions

What is the price of an Apple share right now?

How many Apple shares are there in total?

Who is the best broker to Buy Apple shares and why?

Bibliographic resources

Αντώνης Παπαγεωργίου

Αντώνης Παπαγεωργίου

Συνεχίζοντας τη χρήση αυτού του ιστότοπου, συμφωνείτε με τους όρους και τις προϋποθέσεις και την πολιτική απορρήτου μας.